Key Insights

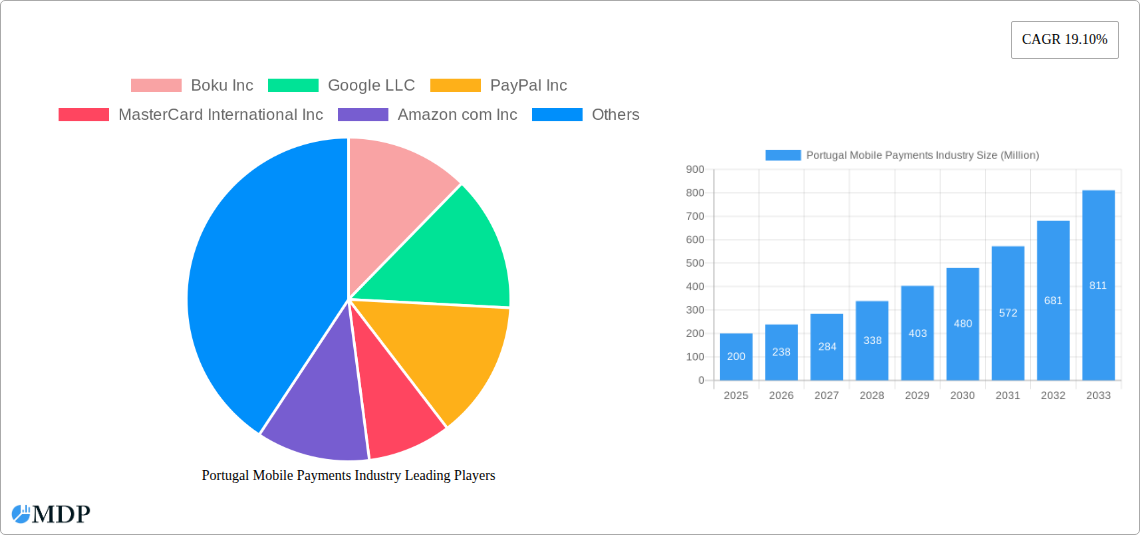

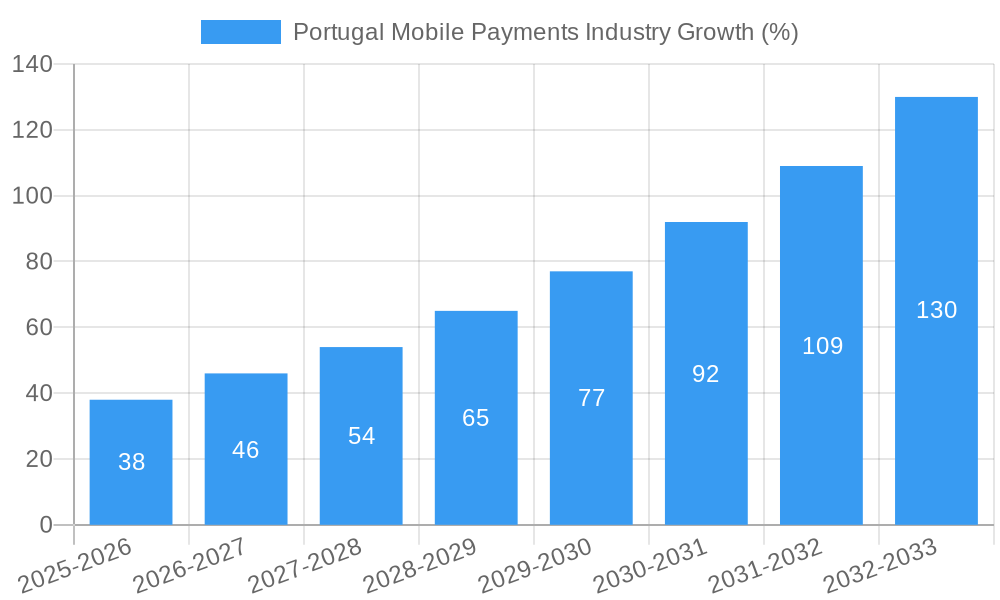

The Portuguese mobile payments market exhibits robust growth, projected to reach a substantial size driven by increasing smartphone penetration, rising e-commerce adoption, and a growing preference for contactless transactions. The 19.10% CAGR from 2019-2033 signifies significant expansion. The market is segmented by payment type, with proximity payments (e.g., NFC tap-and-go) and remote payments (e.g., online transactions via mobile apps) showing strong adoption. While precise market share figures for each segment are unavailable, it's reasonable to assume that proximity payments currently hold a larger market share, given the global trend towards contactless solutions. However, remote payments are expected to witness faster growth fueled by the expanding digital economy. Key players like PayPal, Google Pay, and Alipay are actively competing in this space, alongside domestic and international players. Regulatory support for digital financial inclusion and innovations in mobile banking infrastructure further bolster market expansion.

Looking ahead, several factors will influence market trajectory. Continued infrastructural development, including improved internet access and mobile network coverage, will be crucial for wider adoption, especially in rural areas. Growing consumer awareness and trust in mobile payment security measures will be paramount. Furthermore, the increasing integration of mobile payments into daily routines, such as utility bill payments and public transport fares, will significantly contribute to market expansion. Potential restraints include concerns regarding data security and privacy, and the need for addressing digital literacy gaps amongst certain demographics. Government initiatives promoting financial inclusion and encouraging the adoption of digital technologies will therefore play a crucial role in shaping the future of the Portuguese mobile payment landscape. The dominance of international players presents both opportunities and challenges for local businesses striving for market share.

Portugal Mobile Payments Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Portugal mobile payments industry, offering crucial insights for stakeholders seeking to navigate this rapidly evolving market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence based on rigorous data analysis and expert insights. Expect detailed coverage of market dynamics, leading players, technological advancements, and future opportunities. The report's findings are invaluable for investors, businesses, and policymakers looking to understand and capitalize on the growth potential within the Portuguese mobile payments landscape. The total market size is estimated at xx Million in 2025.

Portugal Mobile Payments Industry Market Dynamics & Concentration

The Portuguese mobile payments market exhibits a dynamic interplay of factors driving its evolution. Market concentration is moderate, with a few major players holding significant shares but leaving room for smaller companies to innovate. Innovation is primarily fueled by advancements in mobile technology, the increasing adoption of smartphones, and the growing demand for contactless payment solutions. Regulatory frameworks, while generally supportive, continue to evolve, impacting the operational landscape for payment providers. Product substitutes, such as traditional cash and card payments, still hold relevance, although mobile payments are gradually gaining traction. End-user trends reveal a strong preference for convenience, security, and ease of use, driving adoption across various demographics. M&A activity has been moderate in recent years, with xx deals recorded between 2019 and 2024, indicating consolidation and strategic expansion within the sector. Market share data indicates a fragmented landscape, with no single dominant player exceeding xx%.

Portugal Mobile Payments Industry Industry Trends & Analysis

The Portuguese mobile payments industry is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%, reflecting a significant increase in market penetration. Technological disruptions, including the rise of mobile wallets, NFC technology, and biometric authentication, are transforming the payment experience and boosting adoption rates. Consumer preferences are shifting towards seamless, secure, and rewarding digital payment methods. Competitive dynamics are characterized by intense rivalry among established players and the emergence of innovative fintech companies. Market growth is further propelled by increasing smartphone penetration, improved internet connectivity, and government initiatives promoting digital financial inclusion. These factors collectively contribute to a positive outlook for the Portuguese mobile payments market in the coming years.

Leading Markets & Segments in Portugal Mobile Payments Industry

While data on regional variations within Portugal is limited, the analysis suggests a relatively uniform adoption of mobile payments across the country. However, urban areas are likely to show higher penetration rates compared to rural areas due to greater infrastructure development and smartphone adoption.

By Payment Type:

Proximity Payment: This segment holds an estimated xx% market share, driven by the increasing availability of NFC-enabled devices and point-of-sale terminals. Key drivers include convenience and speed of transactions.

Remote Payment: This segment commands an estimated xx% market share. The growth is fueled by the rising popularity of online shopping and e-commerce platforms, coupled with the increasing trust in online payment security measures.

Portugal Mobile Payments Industry Product Developments

The Portuguese mobile payments landscape showcases continuous product innovation. New mobile wallets, enhanced security features (like tokenization and biometric authentication), and integration with various loyalty programs are key trends. These developments enhance user experience and address security concerns, attracting more users and broadening market adoption. The focus is on seamless integration with existing payment ecosystems and creating value-added services to stay ahead of the competition.

Key Drivers of Portugal Mobile Payments Industry Growth

Several factors fuel the expansion of the Portuguese mobile payments market. Technological advancements, specifically in mobile technology and secure payment solutions, play a central role. Economic growth and rising disposable incomes empower consumers to adopt digital payment options. Furthermore, supportive government regulations and policies, aimed at promoting digitalization and financial inclusion, accelerate market growth. These factors collectively create a favorable environment for the continued expansion of the mobile payments sector in Portugal.

Challenges in the Portugal Mobile Payments Industry Market

Despite the positive outlook, challenges persist. Regulatory uncertainties related to data privacy and security can hinder market growth. Supply chain disruptions affecting the availability of mobile devices and payment infrastructure can create bottlenecks. Intense competition among existing players and the emergence of new entrants necessitates ongoing innovation and adaptation. These issues, while manageable, need to be addressed to ensure sustainable growth. These factors could potentially reduce the market growth by xx% in the coming years.

Emerging Opportunities in Portugal Mobile Payments Industry

The long-term growth of the Portuguese mobile payments market is underpinned by several opportunities. Advancements in technologies like 5G and AI will pave the way for more innovative payment solutions. Strategic partnerships between established players and fintech startups will foster market expansion. Expanding mobile payment adoption into underserved segments like the elderly population presents significant growth potential. These opportunities, if effectively harnessed, can propel significant growth in the years to come.

Leading Players in the Portugal Mobile Payments Industry Sector

- Boku Inc

- Google LLC (Google)

- PayPal Inc (PayPal)

- MasterCard International Inc (Mastercard)

- Amazon com Inc (Amazon)

- Alipay com Co Ltd (Alipay)

- American Express Co (American Express)

Key Milestones in Portugal Mobile Payments Industry Industry

- May 2022: Ingenico's (a Worldline brand) PPaaS (Payments Platform as a Service) cloud-based solution enables seamless Alipay+ adoption across merchant networks in Portugal. This significantly expands the reach and acceptance of Alipay+ within the country.

Strategic Outlook for Portugal Mobile Payments Industry Market

The Portuguese mobile payments market is poised for significant growth. Strategic partnerships, technological innovation, and evolving consumer preferences will continue to drive market expansion. Focusing on enhancing security, user experience, and financial inclusion will be crucial for future success. The market's long-term potential is substantial, offering ample opportunities for both established players and new entrants.

Portugal Mobile Payments Industry Segmentation

-

1. Payment

- 1.1. Proximity Payment

- 1.2. Remote Payment

Portugal Mobile Payments Industry Segmentation By Geography

- 1. Portugal

Portugal Mobile Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Smartphone Penetration; Rise of E-commerce

- 3.3. Market Restrains

- 3.3.1. Internet Breakdown and Bandwidth Limitation

- 3.4. Market Trends

- 3.4.1. Smartphone and Internet Penetration to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Portugal Mobile Payments Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Payment

- 5.1.1. Proximity Payment

- 5.1.2. Remote Payment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Portugal

- 5.1. Market Analysis, Insights and Forecast - by Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Boku Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PayPal Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MasterCard International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amazon com Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alipay com Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 American Express Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Boku Inc

List of Figures

- Figure 1: Portugal Mobile Payments Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Portugal Mobile Payments Industry Share (%) by Company 2024

List of Tables

- Table 1: Portugal Mobile Payments Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Portugal Mobile Payments Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Portugal Mobile Payments Industry Revenue Million Forecast, by Payment 2019 & 2032

- Table 4: Portugal Mobile Payments Industry Volume K Unit Forecast, by Payment 2019 & 2032

- Table 5: Portugal Mobile Payments Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Portugal Mobile Payments Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Portugal Mobile Payments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Portugal Mobile Payments Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Portugal Mobile Payments Industry Revenue Million Forecast, by Payment 2019 & 2032

- Table 10: Portugal Mobile Payments Industry Volume K Unit Forecast, by Payment 2019 & 2032

- Table 11: Portugal Mobile Payments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Portugal Mobile Payments Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portugal Mobile Payments Industry?

The projected CAGR is approximately 19.10%.

2. Which companies are prominent players in the Portugal Mobile Payments Industry?

Key companies in the market include Boku Inc, Google LLC, PayPal Inc, MasterCard International Inc, Amazon com Inc, Alipay com Co Ltd, American Express Co.

3. What are the main segments of the Portugal Mobile Payments Industry?

The market segments include Payment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Smartphone Penetration; Rise of E-commerce.

6. What are the notable trends driving market growth?

Smartphone and Internet Penetration to drive the market.

7. Are there any restraints impacting market growth?

Internet Breakdown and Bandwidth Limitation.

8. Can you provide examples of recent developments in the market?

May 2022 - Using Ingenico's PPaaS (Payments Platform as a Service) cloud-based solution, acquirers and other payment service providers will be able to seamlessly adopt Alipay+ across their merchant networks. Ingenico is a Worldline trademark.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portugal Mobile Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portugal Mobile Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portugal Mobile Payments Industry?

To stay informed about further developments, trends, and reports in the Portugal Mobile Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence