Key Insights

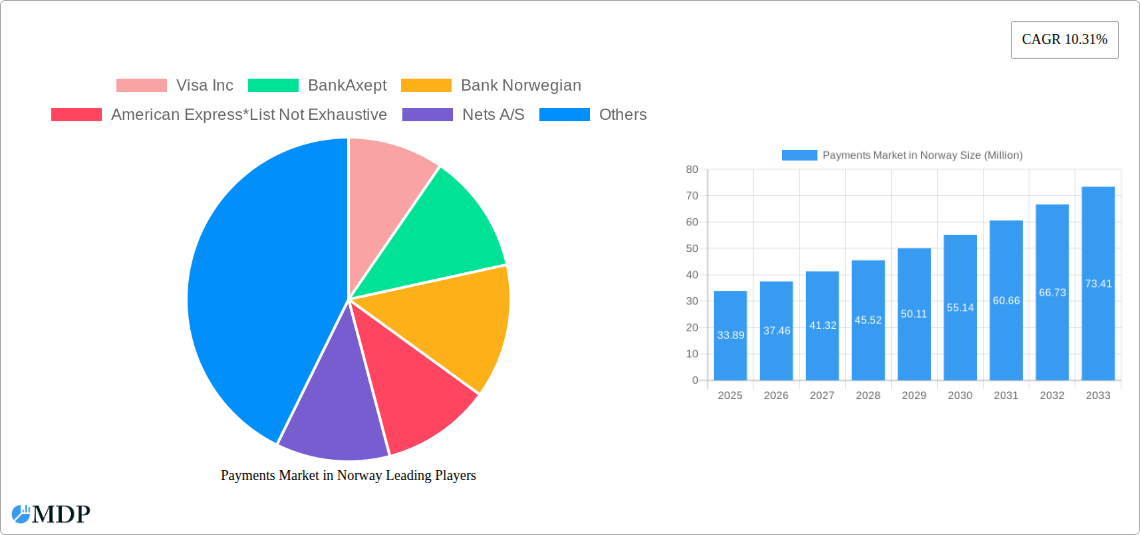

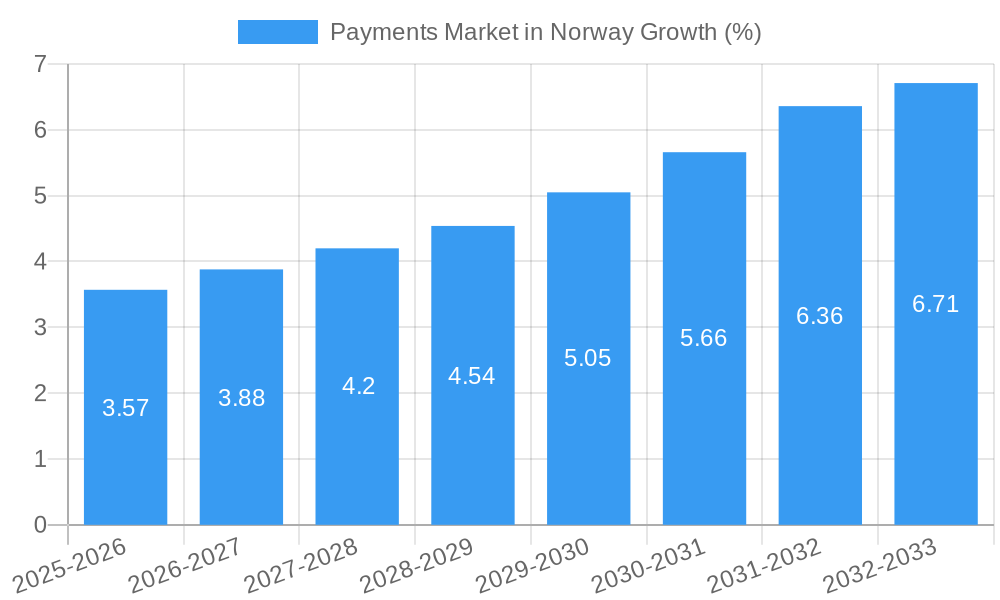

The Norwegian payments market, valued at €33.89 million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 10.31% from 2025 to 2033. This growth is fueled by several key factors. The increasing adoption of e-commerce and digital transactions is a significant driver, pushing consumers and businesses towards convenient online payment methods. Furthermore, the rising penetration of smartphones and the widespread availability of high-speed internet are facilitating seamless mobile payments. Innovation in the fintech sector, with the emergence of new payment platforms and digital wallets, is also contributing to market expansion. While the precise breakdown of market segments (online sales versus point-of-sale transactions) is unavailable, it's reasonable to assume that online sales contribute significantly to the growth trajectory, given the global trends in digital commerce. Key players like Visa, Mastercard, PayPal, and several Nordic-specific providers like Vipps and Klarna, compete intensely for market share, stimulating innovation and improving consumer experiences. The regulatory environment in Norway also plays a vital role, impacting security standards and the adoption of new payment technologies.

The forecast period (2025-2033) anticipates continued growth, driven by further digitalization of the economy and increasing consumer preference for cashless transactions. However, potential restraints include challenges in maintaining data security and combating fraud, along with the ongoing need to adapt to evolving consumer preferences and emerging payment technologies. The market is likely to witness further consolidation among payment providers, with larger players acquiring smaller companies to strengthen their market position. The increasing importance of embedded finance – the integration of financial services within non-financial platforms – is also likely to reshape the competitive landscape in the coming years. This integration will impact how consumers access and manage payments across different services, creating opportunities for innovation and partnership among payment providers and other businesses.

Payments Market in Norway: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic payments market in Norway, covering the period 2019-2033. It offers valuable insights into market trends, competitive landscapes, and future growth opportunities for industry stakeholders, including financial institutions, technology providers, and investors. With a focus on key players like Visa Inc, Mastercard Inc, PayPal Holdings Inc, and Vipps AS, this report is essential for anyone seeking to understand and navigate the complexities of the Norwegian payments ecosystem. The report utilizes data up to September 2023 and incorporates forecasts up to 2033, providing a complete picture of this evolving market.

Payments Market in Norway Market Dynamics & Concentration

The Norwegian payments market is characterized by a high level of digitalization and adoption of innovative payment technologies. Market concentration is moderate, with several key players holding significant market share, but also with room for smaller, specialized players to thrive. The market is driven by factors including increasing smartphone penetration, rising e-commerce activity, and government initiatives promoting digitalization. The regulatory framework, while robust, is also adapting to the evolving technological landscape, creating both opportunities and challenges for market participants. Product substitution, primarily from new mobile payment solutions, is a significant dynamic. End-user trends show a preference for convenient, secure, and contactless payment methods.

- Market Share: Visa and Mastercard hold a combined xx% market share in 2025, while domestic players like Vipps AS and BankAxept command significant shares in the domestic market. Smaller players collectively account for xx%.

- M&A Activity: The historical period (2019-2024) witnessed approximately xx M&A deals, driven by consolidation and expansion strategies. The forecast period is expected to see an increase to xx deals. The acquisition of Sphonic by Signicat in April 2022 exemplifies the ongoing consolidation in the identity verification and anti-fraud sector.

Payments Market in Norway Industry Trends & Analysis

The Norwegian payments market exhibits a robust growth trajectory, fueled by a confluence of factors. The CAGR for the forecast period (2025-2033) is estimated at xx%, driven by the increasing adoption of digital payment methods, particularly mobile wallets and contactless payments. Market penetration of mobile payments is expected to reach xx% by 2033, up from xx% in 2025. Technological disruptions, such as the rise of open banking and the increasing use of biometric authentication, are reshaping the competitive dynamics. Consumer preferences are shifting towards seamless, secure, and personalized payment experiences. The competitive landscape is characterized by both established players and emerging fintech companies vying for market share.

Leading Markets & Segments in Payments Market in Norway

The online sales segment dominates the Norwegian payments market, reflecting the country's high level of e-commerce adoption. Point-of-sale (POS) payments remain significant, with a continued shift towards contactless transactions.

- Key Drivers for Online Sales Dominance:

- High internet penetration and e-commerce adoption.

- Robust digital infrastructure.

- Government support for digitalization initiatives.

- Growing consumer preference for online shopping.

- Key Drivers for POS Payments:

- Strong retail sector and consumer spending.

- Increasing adoption of contactless and mobile POS solutions.

The dominance of online sales is primarily driven by the high internet penetration and e-commerce adoption rates in Norway, supported by a well-developed digital infrastructure and governmental initiatives promoting digital transactions. The relatively high levels of disposable income also contribute to the robust growth of both online and offline payment transactions.

Payments Market in Norway Product Developments

Recent innovations focus on enhancing security, convenience, and personalization of payment experiences. Biometric authentication, tokenization, and real-time fraud detection are key technological trends gaining traction. New payment solutions are increasingly integrating with other financial services, creating a more holistic customer experience. The market fit for these innovations is strong, given the Norwegian consumers' tech-savviness and preference for advanced digital solutions.

Key Drivers of Payments Market in Norway Growth

The Norwegian payments market's growth is propelled by several key factors:

- Technological Advancements: The adoption of innovative technologies like mobile wallets, contactless payments, and biometric authentication enhances convenience and security.

- Economic Growth: A stable economy and rising disposable incomes fuel consumer spending and digital transactions.

- Government Initiatives: Regulatory support for digitalization and open banking fosters innovation and competition.

Challenges in the Payments Market in Norway Market

Several challenges impede market growth:

- Regulatory Scrutiny: Maintaining compliance with evolving data privacy and security regulations presents ongoing hurdles.

- Security Concerns: The increasing reliance on digital payments necessitates robust security measures to mitigate fraud risks.

- Competition: Intense competition from both established players and new entrants necessitates continuous innovation and differentiation.

Emerging Opportunities in Payments Market in Norway

The integration of open banking APIs, the expansion of buy now, pay later (BNPL) services, and the increasing adoption of embedded finance present significant growth opportunities. Strategic partnerships between fintech companies and traditional financial institutions are further accelerating innovation and market expansion.

Leading Players in the Payments Market in Norway Sector

- Visa Inc

- BankAxept

- Bank Norwegian

- American Express

- Nets A/S

- PayPal Holdings Inc

- Vipps AS

- Klarna Bank AB

- Mastercard Inc

Key Milestones in Payments Market in Norway Industry

- September 2023: Tata Consultancy Services (TSC) partners with BankID BankAxept AS to establish an operations command center, enhancing the security and efficiency of Norway's national payment system.

- June 2022: Bulder Bank launches enriched data transaction services, improving the transparency and usability of payment information for customers.

- May 2022: The Norwegian government announces plans to modernize the BankID digital ID platform, further strengthening online security and payment authentication.

- April 2022: Signicat acquires Sphonic, strengthening its anti-fraud and identity verification capabilities, thus enhancing security within the Norwegian financial sector.

Strategic Outlook for Payments Market in Norway Market

The future of the Norwegian payments market is bright, with continued growth driven by technological innovation, expanding digital adoption, and supportive regulatory frameworks. Strategic partnerships, investments in cybersecurity, and the expansion of innovative payment solutions will be key success factors for market players. The focus on enhancing user experience and security will further drive market expansion.

Payments Market in Norway Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Other POS Payment Modes

-

1.2. Online Sale

- 1.2.1. Others (

-

1.1. Point of Sale

Payments Market in Norway Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Payments Market in Norway REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives; Adoption of online mode of Payments

- 3.3. Market Restrains

- 3.3.1. Too Much Competition Due to the Open Source; Network Congestion Due to Slow Network

- 3.4. Market Trends

- 3.4.1. Adoption of Online Mode of Payments Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Payments Market in Norway Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Other POS Payment Modes

- 5.1.2. Online Sale

- 5.1.2.1. Others (

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. North America Payments Market in Norway Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6.1.1. Point of Sale

- 6.1.1.1. Card Pay

- 6.1.1.2. Digital Wallet (includes Mobile Wallets)

- 6.1.1.3. Cash

- 6.1.1.4. Other POS Payment Modes

- 6.1.2. Online Sale

- 6.1.2.1. Others (

- 6.1.1. Point of Sale

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7. South America Payments Market in Norway Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7.1.1. Point of Sale

- 7.1.1.1. Card Pay

- 7.1.1.2. Digital Wallet (includes Mobile Wallets)

- 7.1.1.3. Cash

- 7.1.1.4. Other POS Payment Modes

- 7.1.2. Online Sale

- 7.1.2.1. Others (

- 7.1.1. Point of Sale

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8. Europe Payments Market in Norway Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8.1.1. Point of Sale

- 8.1.1.1. Card Pay

- 8.1.1.2. Digital Wallet (includes Mobile Wallets)

- 8.1.1.3. Cash

- 8.1.1.4. Other POS Payment Modes

- 8.1.2. Online Sale

- 8.1.2.1. Others (

- 8.1.1. Point of Sale

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9. Middle East & Africa Payments Market in Norway Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9.1.1. Point of Sale

- 9.1.1.1. Card Pay

- 9.1.1.2. Digital Wallet (includes Mobile Wallets)

- 9.1.1.3. Cash

- 9.1.1.4. Other POS Payment Modes

- 9.1.2. Online Sale

- 9.1.2.1. Others (

- 9.1.1. Point of Sale

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10. Asia Pacific Payments Market in Norway Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10.1.1. Point of Sale

- 10.1.1.1. Card Pay

- 10.1.1.2. Digital Wallet (includes Mobile Wallets)

- 10.1.1.3. Cash

- 10.1.1.4. Other POS Payment Modes

- 10.1.2. Online Sale

- 10.1.2.1. Others (

- 10.1.1. Point of Sale

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Visa Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BankAxept

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bank Norwegian

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 American Express*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nets A/S

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PayPal Holdings Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vipps AS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Klarna Bank AB

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mastercard Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Visa Inc

List of Figures

- Figure 1: Global Payments Market in Norway Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Norway Payments Market in Norway Revenue (Million), by Country 2024 & 2032

- Figure 3: Norway Payments Market in Norway Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Payments Market in Norway Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 5: North America Payments Market in Norway Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 6: North America Payments Market in Norway Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Payments Market in Norway Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Payments Market in Norway Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 9: South America Payments Market in Norway Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 10: South America Payments Market in Norway Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Payments Market in Norway Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Payments Market in Norway Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 13: Europe Payments Market in Norway Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 14: Europe Payments Market in Norway Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Payments Market in Norway Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Payments Market in Norway Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 17: Middle East & Africa Payments Market in Norway Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 18: Middle East & Africa Payments Market in Norway Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Payments Market in Norway Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Payments Market in Norway Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 21: Asia Pacific Payments Market in Norway Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 22: Asia Pacific Payments Market in Norway Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Payments Market in Norway Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Payments Market in Norway Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Payments Market in Norway Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 3: Global Payments Market in Norway Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Payments Market in Norway Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Payments Market in Norway Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 6: Global Payments Market in Norway Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Payments Market in Norway Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 11: Global Payments Market in Norway Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Payments Market in Norway Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 16: Global Payments Market in Norway Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Payments Market in Norway Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 27: Global Payments Market in Norway Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Payments Market in Norway Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 35: Global Payments Market in Norway Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Payments Market in Norway Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Payments Market in Norway?

The projected CAGR is approximately 10.31%.

2. Which companies are prominent players in the Payments Market in Norway?

Key companies in the market include Visa Inc, BankAxept, Bank Norwegian, American Express*List Not Exhaustive, Nets A/S, PayPal Holdings Inc, Vipps AS, Klarna Bank AB, Mastercard Inc.

3. What are the main segments of the Payments Market in Norway?

The market segments include Mode of Payment.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives; Adoption of online mode of Payments.

6. What are the notable trends driving market growth?

Adoption of Online Mode of Payments Drives the Market Growth.

7. Are there any restraints impacting market growth?

Too Much Competition Due to the Open Source; Network Congestion Due to Slow Network.

8. Can you provide examples of recent developments in the market?

September 2023 : Tata Consultancy Services (TSC) has partnered with BankID BankAxept AS, Norway’s national payment and electronic identity systems provider. This alliance aims to establish and manage an operations command center.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Payments Market in Norway," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Payments Market in Norway report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Payments Market in Norway?

To stay informed about further developments, trends, and reports in the Payments Market in Norway, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence