Key Insights

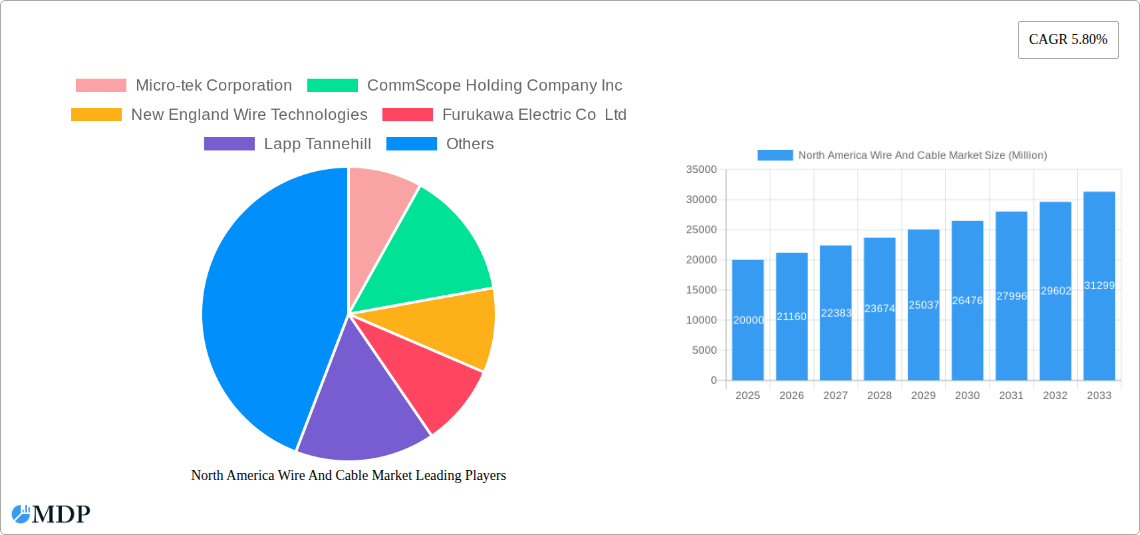

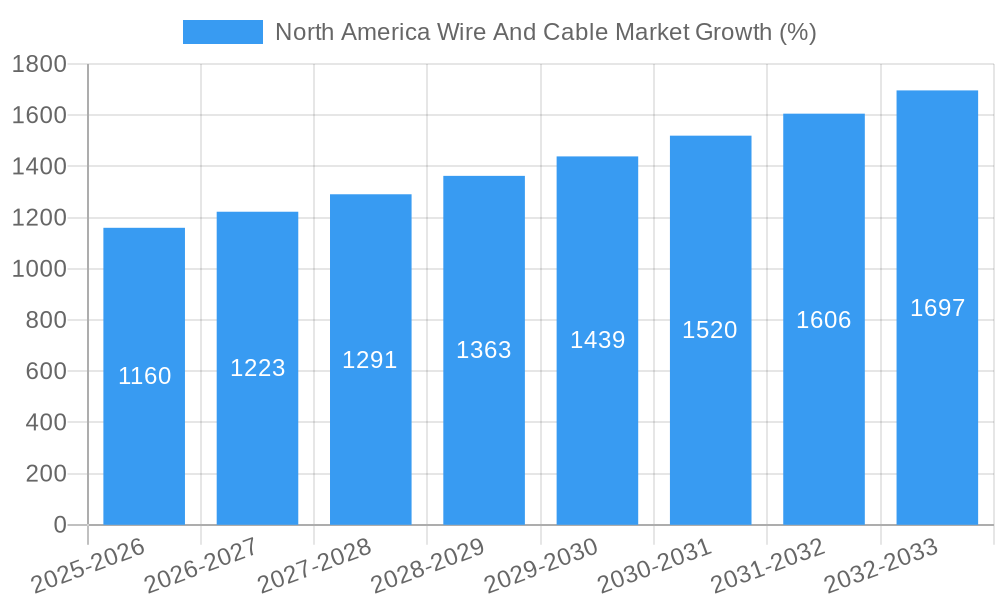

The North American wire and cable market, currently valued at approximately $XX million in 2025 (the exact figure is not provided but can be inferred from the CAGR and market size data), is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 5.80% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning construction sector, encompassing both residential and commercial projects, significantly contributes to demand for power cables and other wire types. Simultaneously, the continuous advancements in telecommunications infrastructure, coupled with the expanding IT and telecom industries, necessitate significant investments in fiber optic cables and signal and control cables. Furthermore, the growing need for reliable power infrastructure across energy, power, and automotive sectors further fuels the market's expansion. The increasing adoption of smart technologies and automation across various industries also contributes positively.

However, the market's growth is not without its challenges. Raw material price fluctuations, particularly for copper and aluminum, pose a significant restraint on profitability. Furthermore, the increasing adoption of wireless technologies in certain sectors could potentially moderate the growth trajectory of traditional wired communication systems in the long term. Nevertheless, the ongoing investments in smart city initiatives, the expansion of electric vehicle infrastructure, and the overall growth of industrial automation across various sectors are expected to outweigh these challenges, ensuring sustained growth for the North American wire and cable market throughout the forecast period. Significant players such as Prysmian Group, Southwire Company LLC, and TE Connectivity actively shape market competition and innovation within this dynamic landscape. The specific regional breakdowns for the United States and Canada within North America will exhibit similar trends, though potentially with variations in growth rates due to unique regional economic conditions and infrastructure investment cycles.

North America Wire and Cable Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America wire and cable market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils market dynamics, trends, and opportunities within the North American landscape. The market is segmented by cable type (Low Voltage Energy, Power Cable, Fiber Optic Cable, Signal and Control Cable, Other Cable Types), end-user industry (Construction, Telecommunications, Power Infrastructure, Other End-user Industries), and country (United States, Canada). Key players like CommScope, Southwire, Prysmian Group, and others are profiled, providing a 360-degree view of this dynamic sector.

North America Wire and Cable Market Market Dynamics & Concentration

The North American wire and cable market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. However, the presence of numerous smaller, specialized companies fosters competition and innovation. Market concentration is influenced by factors such as economies of scale, technological capabilities, and brand recognition. The market share of the top five players is estimated at xx% in 2025.

- Innovation Drivers: Advancements in materials science, miniaturization, and data transmission technologies are driving innovation. The demand for high-performance cables in various applications fuels this trend.

- Regulatory Frameworks: Regulations related to safety, environmental compliance, and energy efficiency impact market dynamics. Stringent standards necessitate compliance and drive investments in advanced cable technologies.

- Product Substitutes: The emergence of wireless technologies presents a partial substitute for wired solutions, especially in certain applications. However, wired connections maintain dominance in scenarios demanding high bandwidth or reliability.

- End-user Trends: The growing adoption of smart infrastructure, digitalization across sectors, and increasing automation are key end-user trends driving demand. Infrastructure projects and the expansion of 5G networks further fuel market growth.

- M&A Activities: The market has witnessed xx M&A deals in the last five years, reflecting consolidation and strategic expansion efforts by major players. These activities reshape market share and competitive dynamics. Deals frequently involve acquiring companies with specialized technologies or expanding geographic reach.

North America Wire and Cable Market Industry Trends & Analysis

The North American wire and cable market is projected to experience a CAGR of xx% during the forecast period (2025-2033). Market growth is primarily driven by robust infrastructure development initiatives, particularly in the telecommunications and power sectors. Increasing urbanization and the expansion of renewable energy sources further stimulate demand. Technological advancements, particularly in fiber optics and high-speed data transmission cables, are significant growth catalysts. The market penetration of fiber optic cables is expected to reach xx% by 2033.

- Market Growth Drivers: Increased investments in infrastructure projects, both public and private, are driving demand. Growing demand from the construction sector, especially for residential and commercial buildings, is also significant. Renewable energy initiatives are creating a substantial demand for specialized power cables.

- Technological Disruptions: The adoption of advanced materials, like high-temperature superconductors, presents opportunities for improved performance. This improvement in performance is expected to increase the market penetration. The continuous development of smart grid technologies is creating a substantial demand.

- Consumer Preferences: Demand for eco-friendly, sustainable cable solutions is increasing, and companies are responding with products using recycled materials and enhanced efficiency.

- Competitive Dynamics: The market features both large multinational corporations and smaller, specialized companies. Competition is intense, with players focusing on product innovation, cost optimization, and strategic partnerships to gain a competitive edge.

Leading Markets & Segments in North America Wire and Cable Market

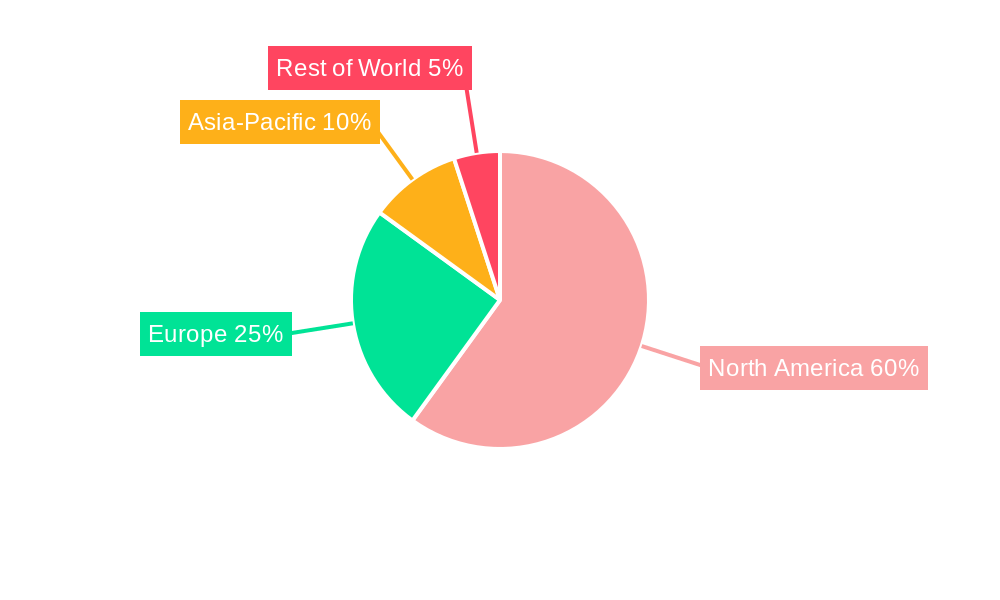

The United States constitutes the dominant market within North America, driven by its extensive infrastructure network and robust construction activity. Canada presents significant growth opportunities, particularly in energy and telecommunications sectors.

By Cable Type:

- Fiber Optic Cable: High growth is predicted due to increasing bandwidth demands for 5G networks and the expanding digital infrastructure.

- Power Cable: Steady growth is anticipated, driven by investments in the power infrastructure and the rise of renewable energy sources.

- Low Voltage Energy Cables: Demand is influenced by the adoption of smart home technologies and improvements in building efficiency.

By End-user Industry:

- Telecommunications: This sector drives substantial demand for high-speed data transmission cables, owing to the continued expansion of 5G networks and cloud computing infrastructure. Economic policies promoting broadband access significantly impact this segment.

- Construction: This segment is a major driver of overall market growth, with demand directly linked to building activity and infrastructure development projects. Governmental policies related to housing and infrastructure construction projects influence market dynamics.

- Power Infrastructure: This segment reflects substantial demand, tied to investments in both conventional and renewable energy sources. Government policies regarding electricity grids and renewable energy targets influence the segment’s growth.

Key Drivers (United States):

- High levels of construction activity, including residential and commercial building.

- Extensive infrastructure development projects.

- Governmental initiatives promoting broadband access and digital infrastructure.

Key Drivers (Canada):

- Governmental spending on infrastructure projects related to energy and transportation.

- Expansion of renewable energy resources requiring specialized cabling.

North America Wire and Cable Market Product Developments

Recent product innovations focus on enhancing performance characteristics, including higher bandwidth, improved durability, and increased resistance to environmental factors. Developments center around lighter, more flexible cables and the incorporation of advanced materials to enhance performance in harsh conditions. The market is also seeing the introduction of intelligent cables that incorporate sensors and data transmission capabilities. These new functionalities are designed to improve efficiency and enable remote monitoring and control systems, meeting market needs for improved reliability and operational efficiency.

Key Drivers of North America Wire and Cable Market Growth

Technological advancements, especially in fiber optics and high-speed data transmission, are key drivers. The increasing penetration of 5G networks and smart technologies fuels demand. Government initiatives promoting infrastructure development and renewable energy further accelerate growth. Economic growth and rising construction activity also significantly influence market expansion.

Challenges in the North America Wire and Cable Market Market

Regulatory compliance requirements can increase manufacturing costs. Supply chain disruptions and fluctuations in raw material prices create uncertainty and impact profitability. Intense competition from both established and emerging players pressures profit margins. These factors can collectively limit market growth or lead to price volatility, affecting market performance and profitability.

Emerging Opportunities in North America Wire and Cable Market

The integration of smart technologies within cables, creating self-monitoring and diagnostics capabilities, offers significant opportunities. Strategic collaborations between cable manufacturers and technology providers could lead to innovative solutions. Expansion into emerging applications, such as electric vehicles and robotics, present new growth avenues. The increasing demand for sustainable cable solutions and those incorporating recycled materials is presenting many lucrative growth opportunities.

Leading Players in the North America Wire and Cable Market Sector

- Micro-tek Corporation

- CommScope Holding Company Inc

- New England Wire Technologies

- Furukawa Electric Co Ltd

- Lapp Tannehill

- Prysmian Group

- Aba Industry Inc (Wonderful Hi-tech company)

- Encore Wire

- EIS Wire and Cable

- Daburn Electronics & Cable and Polytron Devices

- Dacon Systems Inc

- Fujikura Ltd

- TE Connectivity

- Southwire Company LLC

- Amphenol Corporation

- Leoni AG

- Belden Incorporated

- American Wire Group

- Coherent Corporatio

- Corning Incorporated

- Amercable Incorporated (Nexans)

Key Milestones in North America Wire and Cable Market Industry

- July 2023: CommScope announced a USD 60.3 Million investment to expand its fiber cable manufacturing in North Carolina, aiming to meet increased US demand driven by federal broadband initiatives. This expansion signals a significant boost to the fiber optic cable segment.

- August 2023: Southwire Company LLC partnered with the University of West Georgia to enhance sustainability initiatives, reflecting a growing industry focus on environmental responsibility and potentially influencing consumer preferences towards eco-friendly products.

Strategic Outlook for North America Wire and Cable Market Market

The North American wire and cable market is poised for sustained growth, driven by ongoing infrastructure development, technological innovation, and increasing demand from diverse end-user industries. Strategic opportunities lie in developing and adopting sustainable cable solutions, integrating advanced technologies like sensors and data analytics, and expanding into new and emerging applications. Companies focusing on innovation, strategic partnerships, and efficient supply chains will be best positioned to capitalize on future growth prospects.

North America Wire And Cable Market Segmentation

-

1. Cable Type

- 1.1. Low Voltage Energy

- 1.2. Power Cable

- 1.3. Fiber Optic Cable

- 1.4. Signal and Control Cable

- 1.5. Other

-

2. End-user Industry

- 2.1. Construction (Residential and Commercial)

- 2.2. Telecommunications (IT and Telecom)

- 2.3. Power In

- 2.4. Other

North America Wire And Cable Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Wire And Cable Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investments in Infrastructure; Deployment of Smart Grid Infrastructure

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Associated Complexities

- 3.4. Market Trends

- 3.4.1. Construction Industry to be the Largest End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 5.1.1. Low Voltage Energy

- 5.1.2. Power Cable

- 5.1.3. Fiber Optic Cable

- 5.1.4. Signal and Control Cable

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Construction (Residential and Commercial)

- 5.2.2. Telecommunications (IT and Telecom)

- 5.2.3. Power In

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 6. United States North America Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Wire And Cable Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Micro-tek Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CommScope Holding Company Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 New England Wire Technologies

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Furukawa Electric Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lapp Tannehill

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Prysmian Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Aba Industry Inc (Wonderful Hi-tech company)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Encore Wire

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 EIS Wire and Cable

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Daburn Electronics & Cable and Polytron Devices

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Dacon Systems Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Fujikura Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 TE Connectivity

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Southwire Company LLC

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Amphenol Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Leoni AG

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Belden Incorporated

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 American Wire Group

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 Coherent Corporatio

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Corning Incorporated

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.21 Amercable Incorporated (Nexans)

- 10.2.21.1. Overview

- 10.2.21.2. Products

- 10.2.21.3. SWOT Analysis

- 10.2.21.4. Recent Developments

- 10.2.21.5. Financials (Based on Availability)

- 10.2.1 Micro-tek Corporation

List of Figures

- Figure 1: North America Wire And Cable Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Wire And Cable Market Share (%) by Company 2024

List of Tables

- Table 1: North America Wire And Cable Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Wire And Cable Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Wire And Cable Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 4: North America Wire And Cable Market Volume K Unit Forecast, by Cable Type 2019 & 2032

- Table 5: North America Wire And Cable Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: North America Wire And Cable Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 7: North America Wire And Cable Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Wire And Cable Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America Wire And Cable Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Wire And Cable Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: North America Wire And Cable Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 20: North America Wire And Cable Market Volume K Unit Forecast, by Cable Type 2019 & 2032

- Table 21: North America Wire And Cable Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 22: North America Wire And Cable Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 23: North America Wire And Cable Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Wire And Cable Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: United States North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Canada North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Mexico North America Wire And Cable Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico North America Wire And Cable Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Wire And Cable Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the North America Wire And Cable Market?

Key companies in the market include Micro-tek Corporation, CommScope Holding Company Inc, New England Wire Technologies, Furukawa Electric Co Ltd, Lapp Tannehill, Prysmian Group, Aba Industry Inc (Wonderful Hi-tech company), Encore Wire, EIS Wire and Cable, Daburn Electronics & Cable and Polytron Devices, Dacon Systems Inc, Fujikura Ltd, TE Connectivity, Southwire Company LLC, Amphenol Corporation, Leoni AG, Belden Incorporated, American Wire Group, Coherent Corporatio, Corning Incorporated, Amercable Incorporated (Nexans).

3. What are the main segments of the North America Wire And Cable Market?

The market segments include Cable Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Investments in Infrastructure; Deployment of Smart Grid Infrastructure.

6. What are the notable trends driving market growth?

Construction Industry to be the Largest End User.

7. Are there any restraints impacting market growth?

High Cost of Installation and Associated Complexities.

8. Can you provide examples of recent developments in the market?

July 2023 - CommScope announced plans to invest USD 60.3 million to expand its fiber cable manufacturing in North Carolina. Through this facility, the aim was to meet US supply demands driven by federal initiatives to bring 'Internet for All' to underserved and rural broadband markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Wire And Cable Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Wire And Cable Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Wire And Cable Market?

To stay informed about further developments, trends, and reports in the North America Wire And Cable Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence