Key Insights

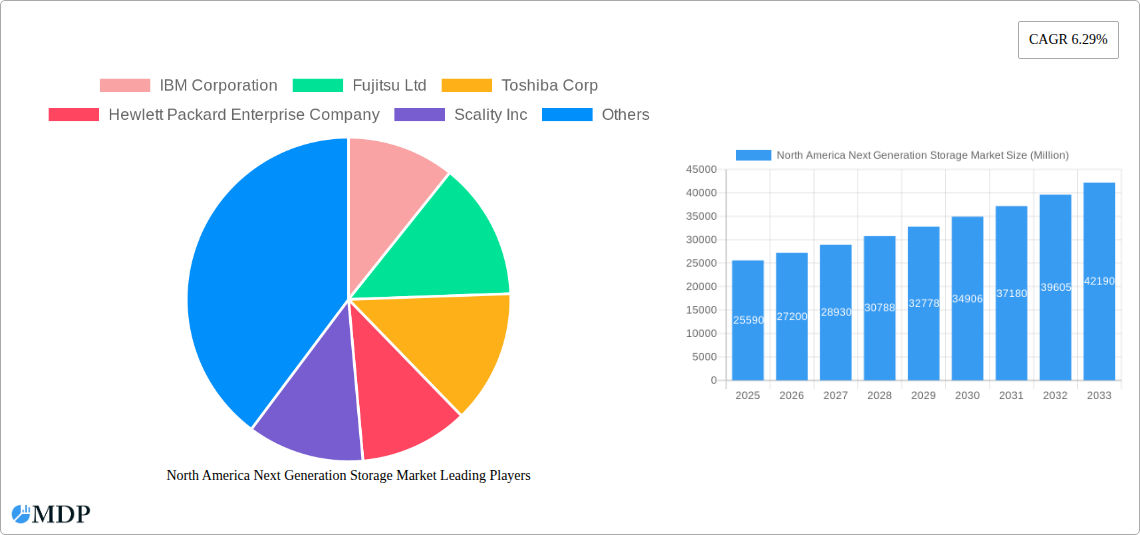

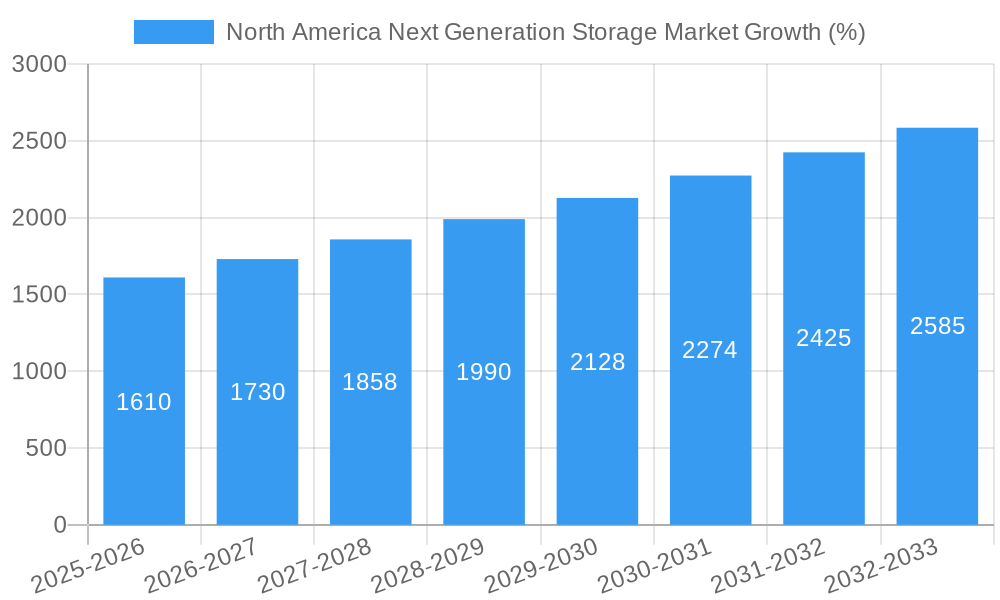

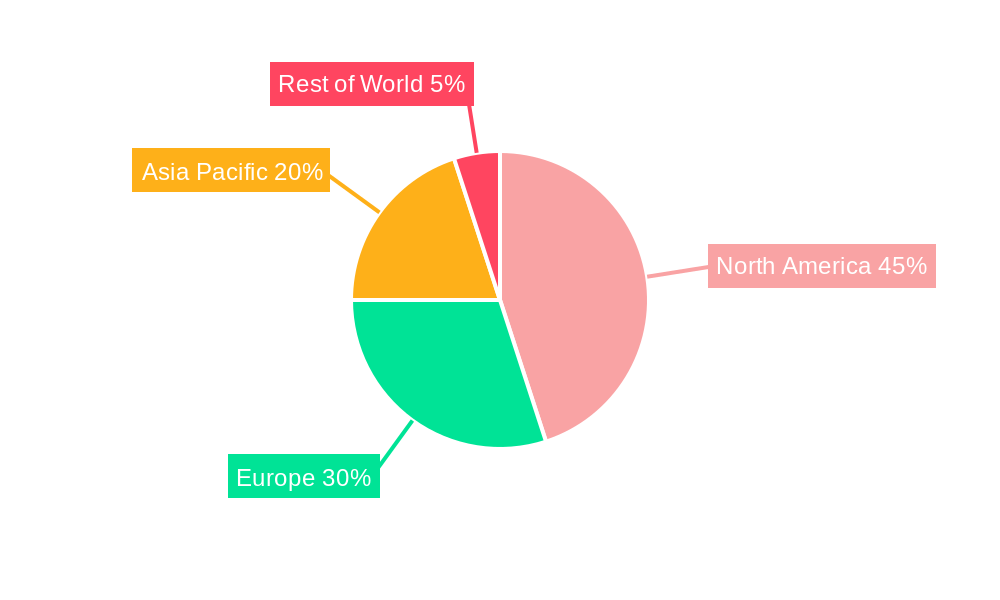

The North American Next Generation Storage market is experiencing robust growth, projected to reach \$25.59 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.29% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of cloud computing and big data analytics within BFSI, retail, IT and telecom, healthcare, and media & entertainment sectors is driving demand for advanced storage solutions offering scalability, performance, and security. Furthermore, the shift towards hybrid and multi-cloud environments necessitates robust and flexible storage architectures like File and Object-based Storage (FOBS), Block Storage, and Network Attached Storage (NAS), leading to significant market opportunities. Technological advancements, such as the development of faster and more efficient storage technologies, are also contributing to market growth. The prevalence of data breaches and the increasing importance of data security are bolstering the demand for secure and resilient storage systems, further fueling market expansion. Competition among major players like IBM, Dell, NetApp, and Pure Storage is intensifying, leading to innovation and competitive pricing, ultimately benefiting consumers.

The North American market segment, encompassing the United States, Canada, and Mexico, constitutes a significant portion of the global next-generation storage market. Its strong technological infrastructure, high adoption of advanced technologies, and the presence of major technology companies contribute to its dominance. However, the market also faces challenges. High initial investment costs associated with implementing next-generation storage solutions can act as a restraint, particularly for smaller businesses. Furthermore, the complexity of managing and maintaining these sophisticated systems requires specialized expertise, potentially creating an adoption barrier. Nevertheless, the long-term benefits of enhanced performance, scalability, and security outweigh these initial hurdles, driving sustained market growth throughout the forecast period. The continued advancements in technology, coupled with rising data volumes across various industries, promise sustained momentum in the North American Next Generation Storage market.

North America Next Generation Storage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Next Generation Storage Market, covering market dynamics, industry trends, leading segments, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry stakeholders, investors, and strategic decision-makers. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Next Generation Storage Market Market Dynamics & Concentration

The North American Next Generation Storage market is characterized by a moderately concentrated landscape with key players vying for market share. Market concentration is influenced by factors like technological advancements, regulatory compliance, and the increasing demand for scalable and secure storage solutions. The market is witnessing significant mergers and acquisitions (M&A) activity, with approximately xx M&A deals recorded between 2019 and 2024. This consolidation trend reflects the strategic moves of established players to expand their product portfolios and gain a competitive edge.

- Market Share: The top five players collectively hold approximately xx% of the market share in 2025, with IBM Corporation, NetApp Inc., and Dell Inc. among the leading players.

- Innovation Drivers: The increasing adoption of cloud computing, the proliferation of big data, and the growing need for data security are major drivers of innovation in the next-generation storage market.

- Regulatory Frameworks: Compliance with data privacy regulations like GDPR and CCPA significantly influences the demand for secure and compliant storage solutions.

- Product Substitutes: The availability of cloud-based storage solutions presents a degree of substitutability, however, the need for high-performance, low-latency storage in specific applications continues to drive the demand for on-premise solutions.

- End-User Trends: The growing adoption of digital technologies across various end-user industries, including BFSI, Retail, IT & Telecom, Healthcare, and Media & Entertainment, fuels the demand for advanced storage solutions.

North America Next Generation Storage Market Industry Trends & Analysis

The North American Next Generation Storage market is experiencing robust growth, driven by several key factors. The increasing volume of data generated across various sectors is a primary driver, necessitating efficient and scalable storage solutions. Technological advancements, such as the emergence of NVMe and the widespread adoption of cloud storage, are further propelling market expansion. Consumer preferences are shifting towards cloud-based solutions for their flexibility and scalability, while on-premise solutions remain crucial for specific applications demanding high performance and low latency.

The competitive dynamics are shaped by ongoing innovation, strategic partnerships, and M&A activities. The market is witnessing the emergence of new technologies like flash storage and software-defined storage, challenging traditional storage solutions. Market penetration of next-generation storage technologies is steadily increasing, with a projected xx% penetration rate by 2033. This growth is further fueled by a substantial increase in data centers and the evolving demands of various industry verticals. The overall market is expected to achieve a CAGR of xx% during the forecast period (2025-2033).

Leading Markets & Segments in North America Next Generation Storage Market

The United States dominates the North American Next Generation Storage market, driven by its advanced technological infrastructure, high data consumption rates, and substantial investments in IT infrastructure. Within storage systems, Network Attached Storage (NAS) currently holds the largest market share, followed by Storage Area Network (SAN) and Direct Attached Storage (DAS). File and Object-based Storage (FOBS) dominates the storage architecture segment due to its flexibility and scalability.

- Key Drivers for Leading Segments:

- NAS: Ease of use, scalability, and cost-effectiveness are key drivers of NAS adoption across various industries.

- SAN: High performance and reliability are driving the adoption of SAN in enterprise applications.

- FOBS: Scalability, flexibility, and cost-effectiveness of cloud storage are driving the adoption of FOBS.

- BFSI: Stringent regulatory compliance requirements and the need for secure data storage drive high adoption of next-generation storage solutions.

- IT and Telecom: The increasing demand for high-bandwidth applications and data analytics drives the use of high-performance storage solutions.

The dominance of these segments is primarily driven by factors such as increasing data volumes, rising adoption of cloud computing, and the requirement for advanced storage architectures that can cater to the growing demands of various applications. The US continues to lead due to its strong economy, advanced technology, and massive investments in digital infrastructure.

North America Next Generation Storage Market Product Developments

Recent product innovations in the North American next-generation storage market focus on increased storage capacity, improved performance, enhanced security features, and streamlined management tools. The market is witnessing a shift towards software-defined storage, NVMe technology, and hybrid cloud storage solutions. These innovations provide customers with greater flexibility, scalability, and cost-efficiency. The integration of AI and machine learning is also enhancing the capabilities of next-generation storage solutions, enabling intelligent data management and improved performance optimization. These developments are well-aligned with the market’s demand for secure, efficient, and scalable storage solutions across diverse industry verticals.

Key Drivers of North America Next Generation Storage Market Growth

Several factors contribute to the growth of the North America Next Generation Storage market. Technological advancements, like the development of faster and more efficient storage technologies (e.g., NVMe), are crucial drivers. The increasing adoption of cloud computing and big data analytics also fuel demand for robust storage solutions. Furthermore, robust economic growth and rising government investments in digital infrastructure contribute significantly to market expansion. Strong regulatory frameworks emphasizing data security and compliance are creating an environment favorable for the adoption of secure and compliant storage solutions.

Challenges in the North America Next Generation Storage Market Market

The North America Next Generation Storage market faces challenges such as stringent regulatory compliance requirements, potential supply chain disruptions impacting component availability, and intense competition from established and emerging players. High initial investment costs for implementing next-generation storage solutions can also hinder adoption in certain sectors. These factors can significantly impact market growth if not addressed effectively. For instance, supply chain disruptions in 2022 caused a xx% decrease in shipments of certain storage components, highlighting the vulnerability of the industry.

Emerging Opportunities in North America Next Generation Storage Market

Significant opportunities exist in the North American Next Generation Storage market. The increasing adoption of 5G technology and the Internet of Things (IoT) will generate massive amounts of data, necessitating advanced storage solutions. The growing adoption of Artificial Intelligence (AI) and machine learning will also drive demand for high-performance storage to support computationally intensive workloads. Strategic partnerships between storage providers and cloud service providers can unlock new market segments and accelerate growth. Expanding into emerging markets and offering customized solutions to cater to specific industry needs present substantial opportunities for growth.

Leading Players in the North America Next Generation Storage Market Sector

- IBM Corporation

- Fujitsu Ltd

- Toshiba Corp

- Hewlett Packard Enterprise Company

- Scality Inc

- Hitachi Ltd

- Netgear Inc

- Dell Inc

- DataDirect Networks

- NetApp Inc

- Pure Storage Inc

Key Milestones in North America Next Generation Storage Market Industry

- July 2022: QNAP Systems, Inc. launched an industrial 10GbE NAS (TS-i410X), targeting demanding environments like factories and warehouses. This launch expands the market for robust, industrial-grade storage solutions.

- June 2022: Nasuni Corporation acquired Storage Made Easy (SME), strengthening its position in cloud-based file data services and enhancing its portfolio of remote work and compliance solutions. This acquisition reflects the growing importance of cloud-based storage and data management.

Strategic Outlook for North America Next Generation Storage Market Market

The North America Next Generation Storage market presents significant growth potential. Continued innovation in storage technologies, coupled with increasing data volumes across various sectors, will drive market expansion. Strategic partnerships and acquisitions will further reshape the market landscape. Focusing on cloud-based solutions, hybrid cloud deployments, and enhanced data security measures will be critical for success. The market is expected to witness strong growth throughout the forecast period, driven by the ongoing digital transformation across various industries.

North America Next Generation Storage Market Segmentation

-

1. Storage System

- 1.1. Direct Attached Storage (DAS)

- 1.2. Network Attached Storage (NAS)

- 1.3. Storage Area Network (SAN)

-

2. Storage Architecture

- 2.1. File and Object-based Storage (FOBS)

- 2.2. Block Storage

-

3. End-User Industry

- 3.1. BFSI

- 3.2. Retail

- 3.3. IT and Telecom

- 3.4. Healthcare

- 3.5. Media and Entertainment

North America Next Generation Storage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Next Generation Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.29% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Volume of Digital Data; Rising Adoption of Solid-state Devices; Increasing Proliferation of Smartphones

- 3.2.2 Laptops

- 3.2.3 and Tablets

- 3.3. Market Restrains

- 3.3.1. Lack of Data Security in Cloud- and Server-based Services

- 3.4. Market Trends

- 3.4.1 Increasing Proliferation of Smartphones

- 3.4.2 connected devices and electronic devices will drive the market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage System

- 5.1.1. Direct Attached Storage (DAS)

- 5.1.2. Network Attached Storage (NAS)

- 5.1.3. Storage Area Network (SAN)

- 5.2. Market Analysis, Insights and Forecast - by Storage Architecture

- 5.2.1. File and Object-based Storage (FOBS)

- 5.2.2. Block Storage

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. IT and Telecom

- 5.3.4. Healthcare

- 5.3.5. Media and Entertainment

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Storage System

- 6. United States North America Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 IBM Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Fujitsu Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toshiba Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hewlett Packard Enterprise Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Scality Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hitachi Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Netgear Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Dell Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 DataDirect Networks

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 NetApp Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Pure Storage Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 IBM Corporation

List of Figures

- Figure 1: North America Next Generation Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Next Generation Storage Market Share (%) by Company 2024

List of Tables

- Table 1: North America Next Generation Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Next Generation Storage Market Revenue Million Forecast, by Storage System 2019 & 2032

- Table 3: North America Next Generation Storage Market Revenue Million Forecast, by Storage Architecture 2019 & 2032

- Table 4: North America Next Generation Storage Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: North America Next Generation Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Next Generation Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Next Generation Storage Market Revenue Million Forecast, by Storage System 2019 & 2032

- Table 12: North America Next Generation Storage Market Revenue Million Forecast, by Storage Architecture 2019 & 2032

- Table 13: North America Next Generation Storage Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 14: North America Next Generation Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Next Generation Storage Market?

The projected CAGR is approximately 6.29%.

2. Which companies are prominent players in the North America Next Generation Storage Market?

Key companies in the market include IBM Corporation, Fujitsu Ltd, Toshiba Corp, Hewlett Packard Enterprise Company, Scality Inc, Hitachi Ltd, Netgear Inc , Dell Inc, DataDirect Networks, NetApp Inc, Pure Storage Inc.

3. What are the main segments of the North America Next Generation Storage Market?

The market segments include Storage System, Storage Architecture, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volume of Digital Data; Rising Adoption of Solid-state Devices; Increasing Proliferation of Smartphones. Laptops. and Tablets.

6. What are the notable trends driving market growth?

Increasing Proliferation of Smartphones. connected devices and electronic devices will drive the market..

7. Are there any restraints impacting market growth?

Lack of Data Security in Cloud- and Server-based Services.

8. Can you provide examples of recent developments in the market?

July 2022: QNAP Systems, Inc., a computing, networking, and storage solutions provider, announced the launch of an industrial 10GbE NAS - TS-i410X. It is built with a fanless design, a rock-solid chassis, multiple flexible installation options, and a wide-range temperature and DC power support. The solution is suited for factories and warehouses, semi-outdoor environments, and transportation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Next Generation Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Next Generation Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Next Generation Storage Market?

To stay informed about further developments, trends, and reports in the North America Next Generation Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence