Key Insights

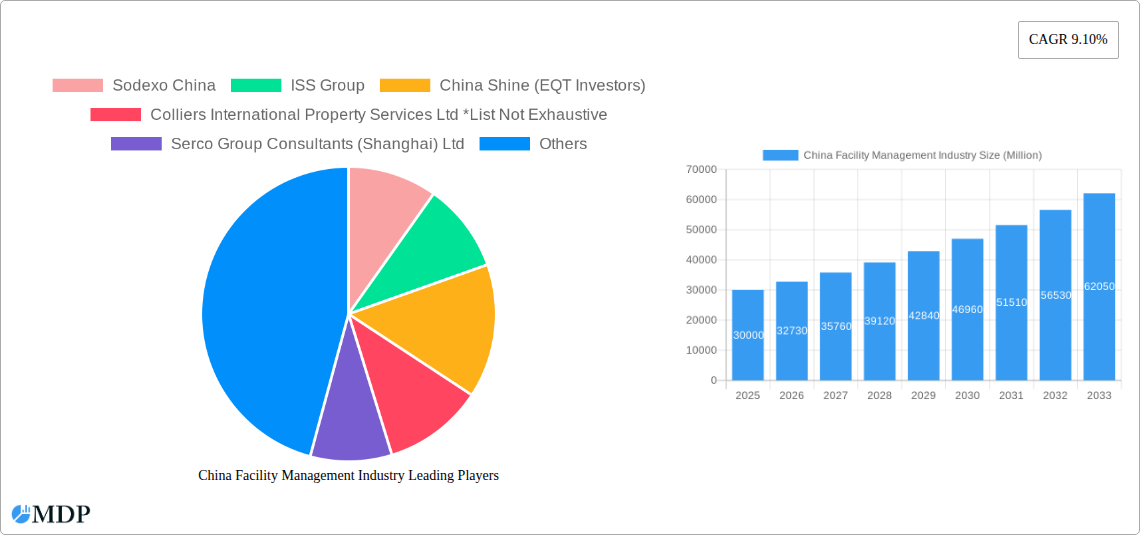

The China facility management (FM) industry is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 9.10% from 2025 to 2033. This expansion is driven by several key factors. Firstly, rapid urbanization and economic development in China are fueling increased demand for efficient and high-quality facility management services across commercial, institutional, and industrial sectors. The rising adoption of smart building technologies and a growing focus on sustainability are further propelling market growth. Outsourced facility management is gaining significant traction, reflecting a trend towards specialization and cost optimization among businesses. Within the offerings, both Hard FM (covering infrastructure and maintenance) and Soft FM ( encompassing services like cleaning and catering) are experiencing parallel growth, indicating a holistic approach to facility management. The increasing complexity of modern buildings and the need for specialized expertise are pushing companies to increasingly outsource these functions. This trend is particularly evident in larger commercial and industrial facilities.

However, the market faces some restraints. Competition among established players and new entrants is intense, creating pricing pressures. The availability of skilled labor remains a challenge in certain areas, impacting service delivery and potentially causing cost escalation. Regulatory changes and evolving industry standards also present challenges for FM providers, requiring continuous adaptation and investment. Despite these challenges, the long-term outlook for the China FM industry remains positive, fueled by sustained economic growth, urbanization trends, and the increasing recognition of the crucial role that efficient facility management plays in enhancing operational efficiency and asset value for businesses across all sectors. While precise market sizing for 2025 is not provided, a reasonable estimation based on the CAGR, assuming a substantial 2019 base and considering industry growth trends, places the market value in the billions of US dollars.

China Facility Management Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the China Facility Management industry, covering market dynamics, leading players, emerging trends, and future growth opportunities. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This in-depth analysis is crucial for investors, industry stakeholders, and businesses seeking to understand and capitalize on the significant growth potential within this dynamic sector. The report leverages a robust data collection methodology, incorporating both primary and secondary research, to ensure accuracy and reliability.

China Facility Management Industry Market Dynamics & Concentration

The China facility management market, valued at xx Million in 2024, is characterized by a moderately concentrated landscape with key players vying for market share. Several factors contribute to this dynamic environment:

- Market Concentration: While precise market share figures for individual players are commercially sensitive, leading companies like Sodexo China, ISS Group, and CBRE Inc. hold substantial market presence. The overall market concentration ratio (CRx) is estimated at xx%, indicating a degree of consolidation, although a significant number of smaller players also operate within the sector.

- Innovation Drivers: Technological advancements, including smart building technologies, IoT integration, and data analytics, are driving innovation and enhancing operational efficiency. Demand for sustainable and green building practices is another significant driver pushing industry players to adopt innovative solutions.

- Regulatory Frameworks: Government regulations focusing on environmental protection, building safety, and energy efficiency are influencing industry practices and creating opportunities for specialized service providers. These regulations are increasingly stringent, creating both challenges and opportunities.

- Product Substitutes: While direct substitutes are limited, competition comes from in-house facility management teams and specialized contractors offering individual services. The rise of proptech solutions is also indirectly impacting the industry by offering alternative approaches to facility management.

- End-User Trends: The growing demand for high-quality facilities across various sectors, including commercial, industrial, and institutional, fuels market expansion. Increasing urbanization and the rise of modern workplaces are significant contributors to this demand.

- M&A Activities: The industry has witnessed a moderate level of merger and acquisition (M&A) activity in recent years, with approximately xx deals recorded between 2019 and 2024. These activities are driven by a desire for expansion, diversification, and access to new technologies and markets.

China Facility Management Industry Industry Trends & Analysis

The China facility management industry is experiencing robust growth, driven by several key factors. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching a value of xx Million by 2033. This growth is fueled by:

- Increased Outsourcing: Many businesses are outsourcing their facility management needs to specialized firms, driven by cost savings, improved efficiency, and access to expertise. Market penetration of outsourced facility management is currently at xx% and is expected to increase steadily.

- Technological Disruptions: Adoption of smart building technologies, including AI-powered systems, predictive maintenance tools, and energy management solutions, is transforming the industry, improving efficiency and reducing operational costs.

- Consumer Preferences: A growing focus on sustainability and employee well-being is impacting facility management practices. There is increasing demand for green buildings, healthy workspaces, and efficient energy management systems.

- Competitive Dynamics: Intense competition among both domestic and international players is driving innovation and pushing firms to offer specialized services and value-added solutions to maintain a competitive edge.

Leading Markets & Segments in China Facility Management Industry

The Chinese facility management market is geographically diverse, with strong growth across major metropolitan areas. However, the precise identification of the single dominant region requires further granular data analysis beyond the scope of this brief overview. Different segments exhibit varying growth trajectories:

By Facility Management Type:

- Outsourced Facility Management: This segment holds a larger market share compared to in-house management due to the increasing preference for specialized expertise and cost efficiency.

- In-House Facility Management: While this segment remains significant, its growth is relatively slower compared to outsourced facility management.

By Offerings:

- Hard FM: This segment, encompassing infrastructure maintenance and repairs, shows steady growth aligned with infrastructure development.

- Soft FM: This segment, including cleaning, security, and catering, experiences significant growth driven by rising demand for improved workplace experiences.

By End-User:

- Commercial: This segment is currently the dominant end-user, fueled by the continuous expansion of commercial real estate.

- Institutional: Growth in this segment is closely tied to government investment in education and healthcare infrastructure.

- Public/Infrastructure: Significant government investment in infrastructure projects continues to propel this sector’s growth.

- Industrial: Growth is influenced by industrial expansion and manufacturing activities.

- Others: This segment encompasses various smaller sectors and exhibits moderate growth.

Key drivers include ongoing urbanization, robust infrastructure development driven by government policies, and the rising importance of workplace efficiency and sustainability.

China Facility Management Industry Product Developments

Recent product innovations focus on enhancing efficiency, sustainability, and data-driven decision-making. Smart building technologies, integrated facility management software, and predictive maintenance solutions are gaining traction. These innovations offer competitive advantages by improving operational efficiency, reducing costs, and enhancing environmental sustainability.

Key Drivers of China Facility Management Industry Growth

The Chinese facility management market is propelled by several key growth drivers:

- Rapid Urbanization: The ongoing urbanization process creates a significant demand for modern infrastructure and efficient facility management services.

- Government Investment: Significant government investment in infrastructure development, including transportation, energy, and public buildings, fuels industry growth.

- Technological Advancements: The adoption of smart building technologies and digital solutions enhances operational efficiency and creates new service opportunities.

- Rising Disposable Incomes: Increased disposable incomes lead to higher demand for high-quality facilities and improved workplace environments.

Challenges in the China Facility Management Industry Market

The industry faces several challenges, including:

- Regulatory Hurdles: Navigating complex regulatory requirements and obtaining necessary permits can pose significant challenges. The impact is estimated to cost the industry xx Million annually in compliance-related expenses.

- Supply Chain Disruptions: Fluctuations in material prices and supply chain disruptions can impact project timelines and budgets. The estimated impact on project costs is xx%.

- Competitive Pressure: Intense competition among various players necessitates continuous innovation and operational efficiency. This translates to decreased profit margins for some industry players.

Emerging Opportunities in China Facility Management Industry

Emerging opportunities exist in several areas:

- Smart Building Technologies: Integration of IoT devices and AI-driven solutions provides opportunities for innovative service offerings.

- Green Building Practices: Growing demand for sustainable and environmentally friendly practices creates opportunities for specialized service providers.

- Strategic Partnerships: Collaborations between facility management companies and technology providers can lead to the development of innovative solutions.

- Market Expansion: Expanding into underserved regions and tapping into new market segments can offer significant growth potential.

Leading Players in the China Facility Management Industry Sector

- Sodexo China

- ISS Group

- China Shine (EQT Investors)

- Colliers International Property Services Ltd

- Serco Group Consultants (Shanghai) Ltd

- CBRE Inc

- ESG Holdings Limited

- Leadec Industrial Services (Shanghai) Co Ltd

- Aeon Delight Co Ltd

- Diversey Holdings LTD

Key Milestones in China Facility Management Industry Industry

- January 2022: Recon Technology Ltd.'s mainland China variable interest entity secured a three-year operation and maintenance services contract with Dalian West Pacific Petrochemical Company Limited, signifying the growing demand for specialized industrial facility management services.

- January 2022: China Everbright Water China won a CNY 3195 Million wastewater treatment project at the Ji'nan International Centre for Medical Sciences, highlighting the increasing focus on sustainable infrastructure and facility management solutions.

Strategic Outlook for China Facility Management Industry Market

The China facility management market presents significant long-term growth potential driven by urbanization, technological advancements, and increasing demand for efficient and sustainable facility management solutions. Strategic opportunities exist for companies that can leverage technological innovation, establish strategic partnerships, and effectively adapt to evolving regulatory landscapes. Companies focusing on sustainability and digital transformation are best positioned to capitalize on this substantial market expansion.

China Facility Management Industry Segmentation

-

1. Facility Management Type

- 1.1. In-House Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offerings

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End-User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Others

China Facility Management Industry Segmentation By Geography

- 1. China

China Facility Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid growth in Construction Activities Across Commercial and Industrial Sector; Increasing Investment in the Healthcare Sector

- 3.3. Market Restrains

- 3.3.1. Lower Outsourcing Rate

- 3.4. Market Trends

- 3.4.1. Increasing Construction Activities to Drive the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Facility Management Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 5.1.1. In-House Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offerings

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sodexo China

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ISS Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Shine (EQT Investors)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Colliers International Property Services Ltd *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Serco Group Consultants (Shanghai) Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CBRE Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ESG Holdings Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Leadec Industrial Services (Shanghai) Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Aeon Delight Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Diversey Holdings LTD

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sodexo China

List of Figures

- Figure 1: China Facility Management Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Facility Management Industry Share (%) by Company 2024

List of Tables

- Table 1: China Facility Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Facility Management Industry Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 3: China Facility Management Industry Revenue Million Forecast, by Offerings 2019 & 2032

- Table 4: China Facility Management Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: China Facility Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: China Facility Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Facility Management Industry Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 8: China Facility Management Industry Revenue Million Forecast, by Offerings 2019 & 2032

- Table 9: China Facility Management Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: China Facility Management Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Facility Management Industry?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the China Facility Management Industry?

Key companies in the market include Sodexo China, ISS Group, China Shine (EQT Investors), Colliers International Property Services Ltd *List Not Exhaustive, Serco Group Consultants (Shanghai) Ltd, CBRE Inc, ESG Holdings Limited, Leadec Industrial Services (Shanghai) Co Ltd, Aeon Delight Co Ltd, Diversey Holdings LTD.

3. What are the main segments of the China Facility Management Industry?

The market segments include Facility Management Type, Offerings, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid growth in Construction Activities Across Commercial and Industrial Sector; Increasing Investment in the Healthcare Sector.

6. What are the notable trends driving market growth?

Increasing Construction Activities to Drive the Growth.

7. Are there any restraints impacting market growth?

Lower Outsourcing Rate.

8. Can you provide examples of recent developments in the market?

January 2022 - Recon Technology Ltd's mainland China variable interest entity, entered into a technical service contract with Dalian West Pacific Petrochemical Company Limited to provide three years of operation and maintenance services on metering instruments such as flow meters and alarms that are used for the daily operation of production facilities within refineries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Facility Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Facility Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Facility Management Industry?

To stay informed about further developments, trends, and reports in the China Facility Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence