Key Insights

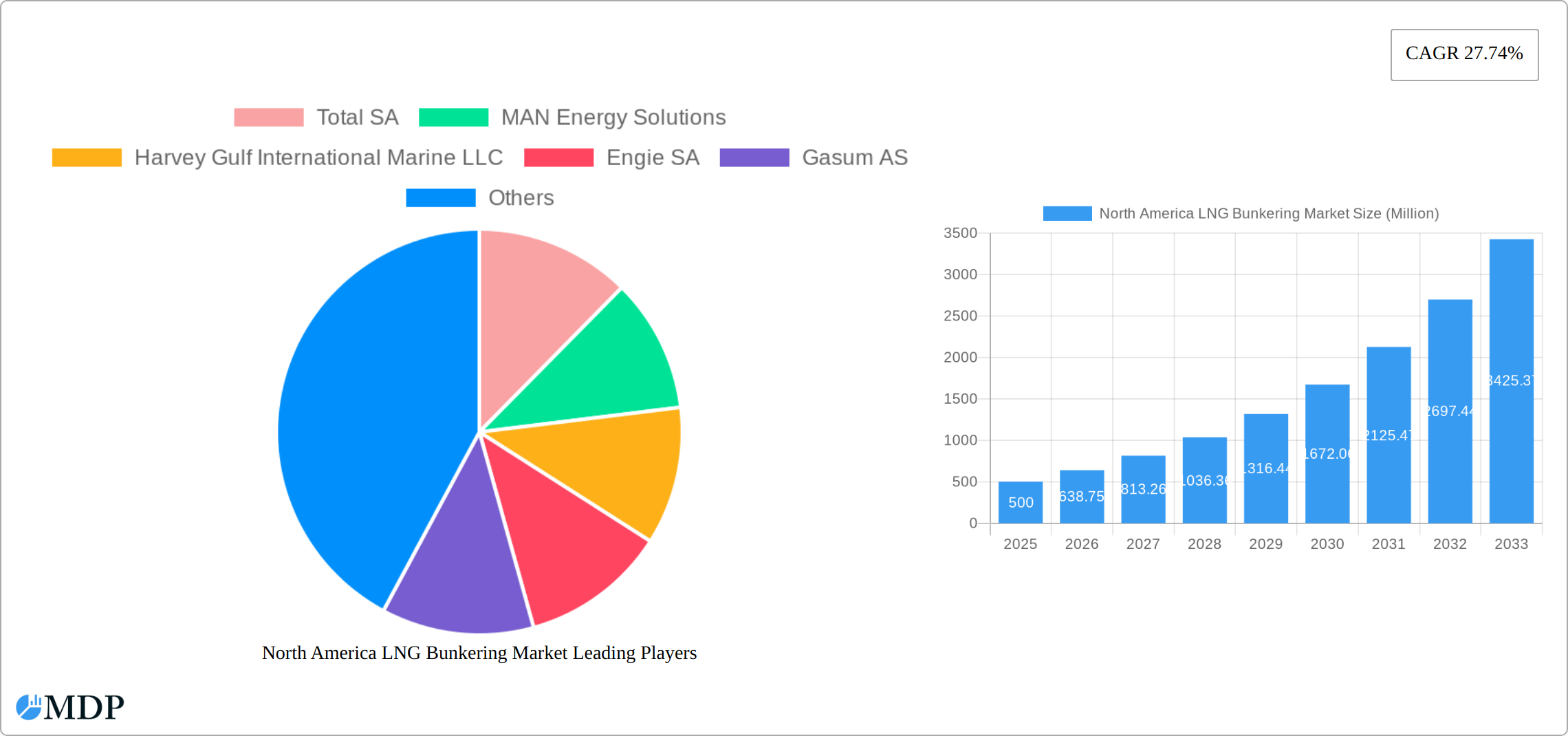

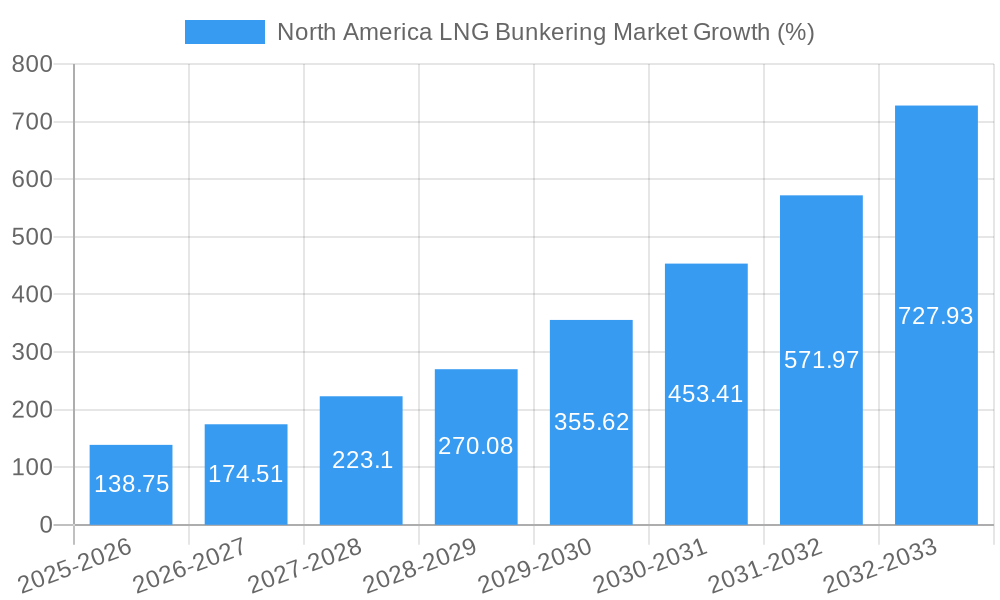

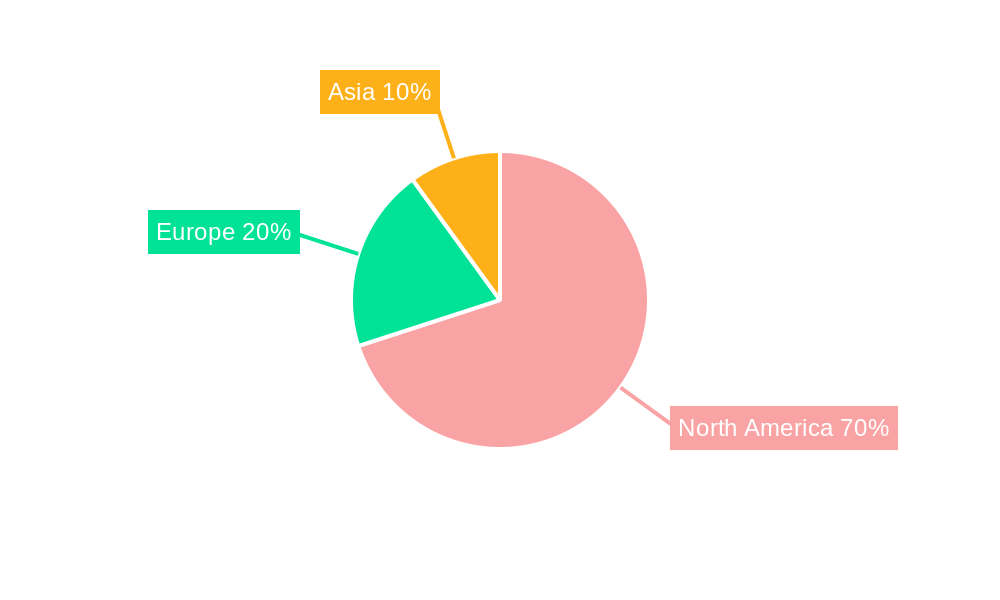

The North American LNG bunkering market is experiencing robust growth, driven by stringent environmental regulations aimed at reducing greenhouse gas emissions from maritime transport and the increasing adoption of LNG as a cleaner-burning fuel. The market's Compound Annual Growth Rate (CAGR) of 27.74% from 2019 to 2024 suggests a significant upward trajectory, indicating strong investor interest and industry expansion. Key drivers include the expansion of LNG infrastructure, including the development of dedicated LNG bunkering vessels and onshore LNG refueling facilities, along with supportive government policies promoting the use of alternative fuels. The growing tanker fleet, particularly in regions with stricter emission control areas (ECAs), is a significant end-user segment contributing to this growth. While the initial investment costs for LNG bunkering infrastructure present a restraint, the long-term cost savings and environmental benefits are outweighing this factor. Furthermore, technological advancements in LNG bunkering technologies, such as improved safety measures and efficient refueling systems, are accelerating market adoption. The increasing focus on reducing carbon emissions across the shipping industry, coupled with the readily available supply of LNG in North America, positions the region for continued market dominance in the coming years.

Considering the provided CAGR of 27.74% from 2019-2024 and a base year of 2025, we can reasonably estimate market size and future growth. While the exact 2025 market size (XX million) isn't specified, the projected growth rate suggests significant expansion. The market is segmented by end-user, with the tanker fleet, container fleet, and bulk/general cargo fleets driving the most significant demand. Major players like Total SA, MAN Energy Solutions, and others are actively investing in LNG bunkering infrastructure and services, further solidifying the market's competitive landscape and future growth. The North American market, particularly within the United States, Canada, and Mexico, benefits from its established LNG production and distribution network, positioning it favorably for continued expansion throughout the forecast period (2025-2033).

North America LNG Bunkering Market: A Comprehensive Report (2019-2033)

Unlocking the potential of the rapidly expanding North American LNG bunkering market with this in-depth analysis. This comprehensive report provides a detailed overview of the North America LNG bunkering market, covering market dynamics, industry trends, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, including key players like Total SA, MAN Energy Solutions, Harvey Gulf International Marine LLC, Engie SA, Gasum AS, Nauticor GmbH & Co KG, Gaztransport & Technigaz SA, Naturgy Energy Group SA, and Royal Dutch Shell PLC. This report is essential for businesses aiming to navigate this dynamic market and capitalize on emerging opportunities. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America LNG Bunkering Market Market Dynamics & Concentration

The North America LNG bunkering market is characterized by a moderate level of concentration, with key players vying for market share. The market share of the top five players is estimated to be approximately 60% in 2025. Innovation is a key driver, with companies continuously developing advanced technologies to improve efficiency and reduce emissions. Stringent environmental regulations are shaping market dynamics, pushing adoption of cleaner fuels. While LNG is a strong substitute for traditional marine fuels, competition from other alternative fuels like methanol and ammonia remains a factor. End-user trends, such as the growing adoption of LNG-fueled vessels, especially within the tanker fleet, are significantly impacting market growth. The historical period (2019-2024) witnessed xx M&A deals, indicating a consolidating market. The forecast period (2025-2033) anticipates a further xx M&A deals, driven by the desire for increased market share and access to technology.

- Market Concentration: Moderately concentrated, with top 5 players holding ~60% market share (2025).

- Innovation Drivers: Technological advancements in LNG bunkering infrastructure and vessel technology.

- Regulatory Frameworks: Stringent environmental regulations promoting LNG adoption.

- Product Substitutes: Methanol, ammonia, and other alternative fuels.

- End-User Trends: Growing adoption of LNG-fueled vessels across various segments.

- M&A Activities: xx deals during 2019-2024, with an anticipated xx deals in 2025-2033.

North America LNG Bunkering Market Industry Trends & Analysis

The North America LNG bunkering market is experiencing robust growth, driven by several key factors. Stringent environmental regulations, aiming to reduce greenhouse gas emissions from shipping, are compelling the adoption of LNG as a cleaner alternative to traditional marine fuels. This is further bolstered by the decreasing cost of LNG and improving bunkering infrastructure. Technological advancements in LNG storage and handling technologies are also enhancing market appeal. However, the market faces challenges, including the relatively high initial investment costs associated with LNG-fueled vessels and infrastructure development, and the limited availability of LNG bunkering facilities in certain regions. The competitive landscape is dynamic, with established players and new entrants vying for market share through technological innovation and strategic partnerships. The market is expected to witness significant growth, with a projected CAGR of xx% between 2025 and 2033, and market penetration expected to reach xx% by 2033. Consumer preference is shifting towards environmentally friendly options, further accelerating LNG adoption.

Leading Markets & Segments in North America LNG Bunkering Market

The tanker fleet segment is currently the dominant end-user in the North America LNG bunkering market, accounting for approximately xx% of total market share in 2025. This is largely attributed to the increasing number of LNG-fueled tankers being deployed, driven by the growing global demand for LNG.

- Key Drivers for Tanker Fleet Dominance:

- Growing global LNG trade.

- Increasing regulatory pressure to reduce emissions from shipping.

- Economic incentives for adopting LNG as a fuel.

- Availability of LNG-fueled tankers.

Other significant segments include the container fleet, bulk and general cargo fleet, and ferries and OSV. These segments are expected to experience significant growth during the forecast period, though at a slower pace than the tanker fleet segment. The growth of these segments will largely depend on the development of LNG bunkering infrastructure and the adoption of LNG-fueled vessels in respective segments. Specific regions like the US East Coast and West Coast are leading in infrastructure development, but expansion to other areas is crucial for broader market growth.

North America LNG Bunkering Market Product Developments

Recent product developments focus on improving the efficiency and safety of LNG bunkering operations. This includes advancements in bunkering technologies, such as the development of high-capacity bunkering vessels and automated bunkering systems. Innovations in LNG storage and handling technologies are also playing a crucial role. These advancements reduce the time and cost associated with LNG bunkering, making it a more attractive option for shipping companies. The development of smaller-scale LNG bunkering solutions is also expanding the market's reach to smaller ports and vessels. This enhances the market fit by catering to a broader range of end-users and enabling operations in more geographically diverse locations.

Key Drivers of North America LNG Bunkering Market Growth

Several factors are driving the growth of the North America LNG bunkering market. Stringent environmental regulations, particularly the IMO 2020 sulfur cap, are incentivizing the adoption of cleaner fuels like LNG. The decreasing cost of LNG, coupled with advancements in bunkering infrastructure, makes it an economically viable alternative to traditional marine fuels. Government support and policies promoting LNG adoption, including subsidies and tax incentives, are also accelerating market growth. Technological improvements in LNG storage and handling technologies, enhancing safety and efficiency of operations, play a crucial role.

Challenges in the North America LNG Bunkering Market Market

The North America LNG bunkering market faces several challenges. The high initial investment cost associated with LNG-fueled vessels and bunkering infrastructure can be a significant barrier to entry. Limited availability of LNG bunkering facilities in certain regions, particularly in smaller ports, restricts market penetration. Competition from other alternative fuels, such as methanol and ammonia, pose a threat to market growth. Regulatory hurdles and inconsistencies in environmental regulations across different jurisdictions create uncertainty for businesses. Supply chain issues, including the availability of LNG and the transportation of LNG to bunkering locations, could also hinder market expansion. These challenges collectively have a significant impact on market growth, limiting its expansion potential and influencing the overall profitability.

Emerging Opportunities in North America LNG Bunkering Market

The North America LNG bunkering market presents significant long-term growth opportunities. Technological breakthroughs in LNG storage and bunkering technologies are expected to further reduce costs and improve efficiency, enhancing market appeal. Strategic partnerships between LNG suppliers, bunkering operators, and shipping companies can accelerate infrastructure development and LNG adoption. Expanding LNG bunkering infrastructure to smaller ports and inland waterways will broaden market reach and attract more end-users. The continuous development of dual-fuel vessels that can operate on both LNG and traditional fuels reduces risks for early adopters, further boosting the market.

Leading Players in the North America LNG Bunkering Market Sector

- TotalEnergies SE

- MAN Energy Solutions

- Harvey Gulf International Marine LLC

- Engie SA

- Gasum AS

- Nauticor GmbH & Co KG

- Gaztransport & Technigaz SA

- Naturgy Energy Group SA

- Royal Dutch Shell PLC

Key Milestones in North America LNG Bunkering Market Industry

- 2020: IMO 2020 sulfur cap implemented, accelerating LNG adoption.

- 2021: Several major ports announce plans to develop LNG bunkering infrastructure.

- 2022: Significant investments made in LNG bunkering vessel construction.

- 2023: First commercial LNG bunkering operations commence in a new region.

- 2024: Launch of a new technology improving LNG bunkering efficiency.

- 2025: Several strategic partnerships formed between key players in the industry.

Strategic Outlook for North America LNG Bunkering Market Market

The North America LNG bunkering market is poised for substantial growth, driven by a combination of factors, including stringent environmental regulations, decreasing LNG costs, and ongoing technological advancements. Strategic investments in infrastructure development, coupled with innovative bunkering solutions, will be key to unlocking the market's full potential. Furthermore, collaborative efforts between industry stakeholders, including governments, regulatory bodies, and private companies, will be crucial for overcoming existing challenges and promoting wider adoption of LNG as a marine fuel. The market offers compelling opportunities for early movers and companies capable of adapting to evolving market dynamics.

North America LNG Bunkering Market Segmentation

-

1. End-User

- 1.1. Tanker Fleet

- 1.2. Container Fleet

- 1.3. Bulk and General Cargo Fleet

- 1.4. Ferries and OSV

- 1.5. Others

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America LNG Bunkering Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America LNG Bunkering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 27.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Ferries and OSV Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Tanker Fleet

- 5.1.2. Container Fleet

- 5.1.3. Bulk and General Cargo Fleet

- 5.1.4. Ferries and OSV

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. United States North America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Tanker Fleet

- 6.1.2. Container Fleet

- 6.1.3. Bulk and General Cargo Fleet

- 6.1.4. Ferries and OSV

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. Canada North America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Tanker Fleet

- 7.1.2. Container Fleet

- 7.1.3. Bulk and General Cargo Fleet

- 7.1.4. Ferries and OSV

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Rest of North America North America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Tanker Fleet

- 8.1.2. Container Fleet

- 8.1.3. Bulk and General Cargo Fleet

- 8.1.4. Ferries and OSV

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. United States North America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Total SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 MAN Energy Solutions

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Harvey Gulf International Marine LLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Engie SA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Gasum AS

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Nauticor GmbH & Co KG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Gaztransport & Technigaz SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Naturgy Energy Group SA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Royal Dutch Shell PLC

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Total SA

List of Figures

- Figure 1: North America LNG Bunkering Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America LNG Bunkering Market Share (%) by Company 2024

List of Tables

- Table 1: North America LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 3: North America LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 11: North America LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: North America LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 14: North America LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: North America LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: North America LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America LNG Bunkering Market?

The projected CAGR is approximately 27.74%.

2. Which companies are prominent players in the North America LNG Bunkering Market?

Key companies in the market include Total SA, MAN Energy Solutions, Harvey Gulf International Marine LLC, Engie SA, Gasum AS, Nauticor GmbH & Co KG, Gaztransport & Technigaz SA, Naturgy Energy Group SA, Royal Dutch Shell PLC.

3. What are the main segments of the North America LNG Bunkering Market?

The market segments include End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Ferries and OSV Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America LNG Bunkering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America LNG Bunkering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America LNG Bunkering Market?

To stay informed about further developments, trends, and reports in the North America LNG Bunkering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence