Key Insights

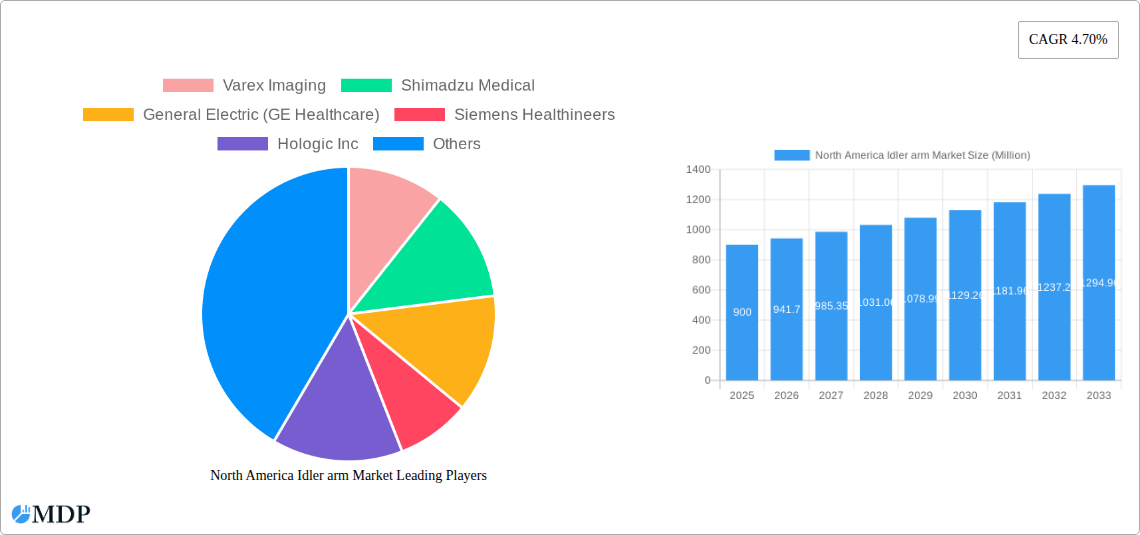

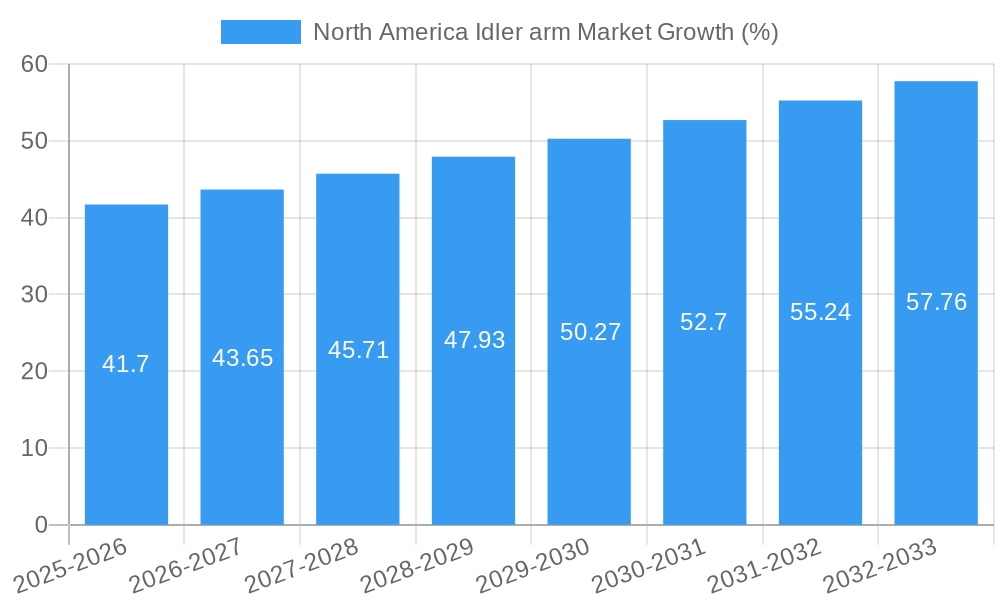

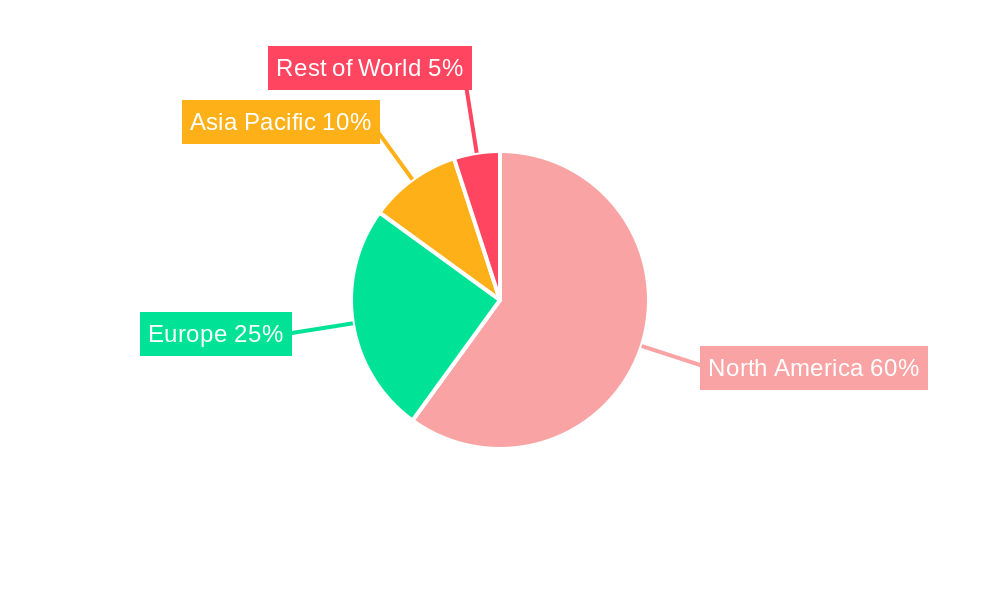

The North American C-arm market, valued at $0.90 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.70% from 2025 to 2033. This expansion is fueled by several key factors. Technological advancements leading to improved image quality, portability, and functionality of both fixed and mobile C-arms are significantly impacting adoption rates across various medical specializations. The increasing prevalence of minimally invasive surgeries, coupled with a rising geriatric population requiring more orthopedic and cardiovascular interventions, further stimulates demand. Furthermore, the growing emphasis on image-guided procedures and the integration of advanced imaging capabilities with surgical navigation systems contribute to market expansion. North America, particularly the United States, holds a dominant market share due to high healthcare expenditure, technological infrastructure, and the presence of key players like GE Healthcare, Siemens Healthineers, and Philips Healthcare. While regulatory hurdles and high initial investment costs might pose some challenges, the overall market outlook remains positive, with consistent growth anticipated throughout the forecast period.

The segmentation reveals that mobile C-arms are likely to witness higher growth compared to fixed C-arms due to their flexibility and suitability for various surgical settings. Among applications, cardiology, orthopedics and trauma, and radiology/oncology are the major revenue contributors. The competitive landscape is characterized by established players like Varex Imaging, Shimadzu Medical, and others, constantly striving for innovation and market share. Future growth is anticipated to be influenced by the integration of Artificial Intelligence (AI) and machine learning in image processing, enhancing diagnostic capabilities and streamlining workflows. Furthermore, the rising adoption of hybrid operating rooms, integrating advanced imaging technologies, will contribute to the continued expansion of the North American C-arm market. Strategic collaborations, mergers, and acquisitions are also expected to shape the competitive dynamics in the coming years.

North America Idler Arm Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America Idler Arm Market, offering invaluable insights for industry stakeholders, investors, and market entrants. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is presented in Millions. Discover key trends, growth drivers, challenges, and opportunities shaping this dynamic sector.

North America Idler Arm Market Dynamics & Concentration

The North America Idler Arm Market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. Market concentration is estimated at xx%, primarily driven by the presence of established multinational corporations with extensive distribution networks and a strong brand presence. However, smaller, specialized companies are also emerging, contributing to increased competition and innovation. Several factors drive market dynamics:

- Innovation: Ongoing advancements in idler arm technology, including materials science and design improvements, are key drivers of market growth. The development of lighter, more durable, and more efficient idler arms is continuously shaping market preferences.

- Regulatory Framework: Compliance with stringent safety and performance standards (e.g., those set by the NHTSA) significantly influences market dynamics. These regulations impact manufacturing processes and product design.

- Product Substitutes: While direct substitutes are limited, advancements in vehicle suspension systems might indirectly influence idler arm demand. The emergence of alternative suspension technologies could affect market growth.

- End-User Trends: Increasing vehicle production and sales, coupled with rising demand for advanced vehicle features, contribute to growth. The preference for higher quality and more durable components impacts market demand.

- M&A Activities: The market has seen a moderate level of merger and acquisition activity (xx deals in the past 5 years), indicating consolidation and expansion efforts by key players. Market share realignment resulting from M&A activities has been xx%.

North America Idler Arm Market Industry Trends & Analysis

The North America Idler Arm Market demonstrates robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors:

- Growth Drivers: The expanding automotive sector is the primary growth driver, with increasing vehicle production and replacement demand. Furthermore, the rising adoption of advanced driver-assistance systems (ADAS) and electric vehicles (EVs) is creating new opportunities. Market penetration of advanced idler arm technologies is currently at xx% and expected to reach xx% by 2033.

- Technological Disruptions: Advancements in materials science (e.g., lighter alloys, high-strength steel) are transforming idler arm design, leading to improved performance and efficiency. This technological advancement reduces vehicle weight while improving stability.

- Consumer Preferences: Consumers increasingly prefer vehicles with enhanced safety, durability, and reliability, boosting demand for high-quality components, including advanced idler arms.

- Competitive Dynamics: The market is characterized by both intense competition among established players and the emergence of new entrants, leading to price pressures and ongoing innovation.

Leading Markets & Segments in North America Idler Arm Market

The US dominates the North America Idler Arm Market, driven by high vehicle production volumes and a robust automotive aftermarket. Within the market segments:

- Type: The Mobile C-Arms segment is currently holding xx% market share and experiencing faster growth due to increasing demand for ease of use and portability in various applications. Fixed C-Arms still dominates the market at xx%.

- Application: The Cardiology application segment leads market share due to the high volume of cardiac procedures. Orthopedics and Trauma shows steady growth.

Key Drivers by Segment:

- US Market: Strong automotive manufacturing sector, extensive replacement market, and favorable government regulations.

- Cardiology Application: High volume of cardiac procedures, technological advancements in imaging, and increasing prevalence of cardiovascular diseases.

- Mobile C-Arms: Increased demand for portability, ease of use, and cost-effectiveness in various settings.

North America Idler Arm Market Product Developments

Recent product innovations focus on enhancing durability, precision, and efficiency. Manufacturers are increasingly incorporating advanced materials and manufacturing techniques to optimize idler arm performance. The market is witnessing a trend towards lighter weight designs and improved resistance to wear and tear, enhancing vehicle longevity and fuel efficiency. These improvements cater to the growing demand for high-quality and reliable automotive components in the evolving automotive landscape.

Key Drivers of North America Idler Arm Market Growth

The North America Idler Arm Market's growth is driven by several factors: the rising production of vehicles, especially in the US, increasing demand for improved vehicle safety and performance, and technological advancements leading to more efficient and durable idler arms. Government regulations promoting vehicle safety also contribute to market expansion.

Challenges in the North America Idler Arm Market Market

Major challenges include fluctuating raw material prices, increasing competition from low-cost manufacturers, and potential supply chain disruptions. These factors can impact profitability and market share. The industry faces pressure to continually innovate to meet evolving consumer and regulatory demands.

Emerging Opportunities in North America Idler Arm Market

Emerging opportunities include the growing adoption of advanced driver-assistance systems (ADAS) and the expansion of the electric vehicle (EV) market. The development of lightweight and durable idler arms specifically designed for EVs offers significant potential for growth. Strategic partnerships and collaborations between automotive manufacturers and idler arm suppliers will further drive market expansion.

Leading Players in the North America Idler Arm Market Sector

- Varex Imaging

- Shimadzu Medical

- General Electric (GE Healthcare) [GE Healthcare]

- Siemens Healthineers [Siemens Healthineers]

- Hologic Inc [Hologic Inc]

- Allengers

- Philips Healthcare [Philips Healthcare]

- AADCO Medical Inc

- DMS Imaging

- Ziehm Imaging GmbH

- Canon Medical Systems Corporation [Canon Medical Systems Corporation]

- Turner Imaging Systems

Key Milestones in North America Idler Arm Market Industry

- July 2022: Siemens Healthineers received FDA approval for the ARTIS icono ceiling, a ceiling-mounted c-arm angiography system. This enhances capabilities in interventional radiology and cardiology, impacting market competitiveness.

- January 2022: Philips integrated AI and 3D mapping into its Zenition mobile c-arm system, improving workflow efficiency and treatment outcomes, enhancing the appeal of mobile c-arm systems.

Strategic Outlook for North America Idler Arm Market Market

The North America Idler Arm Market is poised for continued growth, driven by technological advancements, increasing vehicle production, and the rising demand for higher-quality automotive components. Strategic partnerships, investment in R&D, and expansion into emerging markets will be key to maximizing future market potential. Focus on lightweighting and improved durability will be crucial for manufacturers seeking competitive advantages.

North America Idler arm Market Segmentation

-

1. Type

- 1.1. Fixed C-Arms

-

1.2. Mobile C-Arms

- 1.2.1. Full-Size C-Arms

- 1.2.2. Mini C-Arms

-

2. Application

- 2.1. Cardiology

- 2.2. Gastroenterology

- 2.3. Neurology

- 2.4. Orthopedics and Trauma

- 2.5. Radiology/Oncology

- 2.6. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Idler arm Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Idler arm Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Geriatric Population and Increasing Incidence of Chronic Diseases; Advancements in Maneuverability and Imaging Capabilities; Increasing Areas of Application of C-Arm

- 3.3. Market Restrains

- 3.3.1. High Procedural and Equipment Costs; Low Replacement Rates of C-Arm Systems

- 3.4. Market Trends

- 3.4.1. C-Arm Application in Cardiology is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed C-Arms

- 5.1.2. Mobile C-Arms

- 5.1.2.1. Full-Size C-Arms

- 5.1.2.2. Mini C-Arms

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Gastroenterology

- 5.2.3. Neurology

- 5.2.4. Orthopedics and Trauma

- 5.2.5. Radiology/Oncology

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed C-Arms

- 6.1.2. Mobile C-Arms

- 6.1.2.1. Full-Size C-Arms

- 6.1.2.2. Mini C-Arms

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cardiology

- 6.2.2. Gastroenterology

- 6.2.3. Neurology

- 6.2.4. Orthopedics and Trauma

- 6.2.5. Radiology/Oncology

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed C-Arms

- 7.1.2. Mobile C-Arms

- 7.1.2.1. Full-Size C-Arms

- 7.1.2.2. Mini C-Arms

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cardiology

- 7.2.2. Gastroenterology

- 7.2.3. Neurology

- 7.2.4. Orthopedics and Trauma

- 7.2.5. Radiology/Oncology

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed C-Arms

- 8.1.2. Mobile C-Arms

- 8.1.2.1. Full-Size C-Arms

- 8.1.2.2. Mini C-Arms

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cardiology

- 8.2.2. Gastroenterology

- 8.2.3. Neurology

- 8.2.4. Orthopedics and Trauma

- 8.2.5. Radiology/Oncology

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United States North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Varex Imaging

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Shimadzu Medical

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 General Electric (GE Healthcare)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Siemens Healthineers

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hologic Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Allengers

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Philips Healthcare

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 AADCO Medical Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 DMS Imaging

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Ziehm Imaging GmbH

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Canon Medical Systems Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Turner Imaging Systems

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Varex Imaging

List of Figures

- Figure 1: North America Idler arm Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Idler arm Market Share (%) by Company 2024

List of Tables

- Table 1: North America Idler arm Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Idler arm Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Idler arm Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America Idler arm Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Idler arm Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Idler arm Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Idler arm Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Idler arm Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Idler arm Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Idler arm Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Idler arm Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Idler arm Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: North America Idler arm Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Idler arm Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Idler arm Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: North America Idler arm Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: North America Idler arm Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Idler arm Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Idler arm Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: North America Idler arm Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: North America Idler arm Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Idler arm Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Idler arm Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the North America Idler arm Market?

Key companies in the market include Varex Imaging, Shimadzu Medical, General Electric (GE Healthcare), Siemens Healthineers, Hologic Inc, Allengers, Philips Healthcare, AADCO Medical Inc, DMS Imaging, Ziehm Imaging GmbH, Canon Medical Systems Corporation, Turner Imaging Systems.

3. What are the main segments of the North America Idler arm Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Geriatric Population and Increasing Incidence of Chronic Diseases; Advancements in Maneuverability and Imaging Capabilities; Increasing Areas of Application of C-Arm.

6. What are the notable trends driving market growth?

C-Arm Application in Cardiology is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Procedural and Equipment Costs; Low Replacement Rates of C-Arm Systems.

8. Can you provide examples of recent developments in the market?

July 2022: Siemens Healthineers received approval from the Food and Drug Administration (FDA) for the ARTIS icono ceiling, a ceiling-mounted c-arm angiography system designed for a wide range of routine and advanced procedures in interventional radiology (IR) and cardiology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Idler arm Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Idler arm Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Idler arm Market?

To stay informed about further developments, trends, and reports in the North America Idler arm Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence