Key Insights

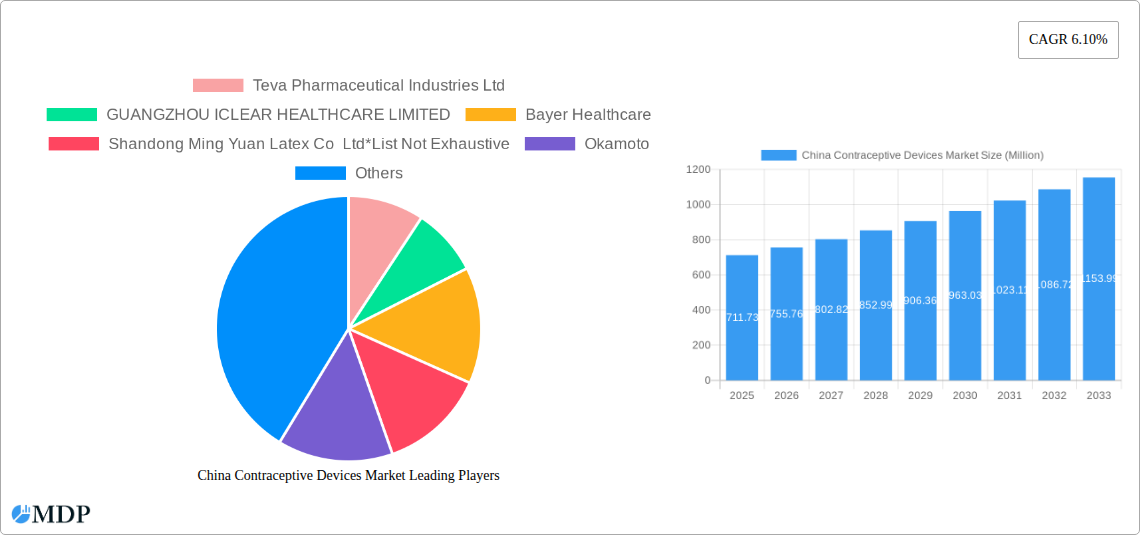

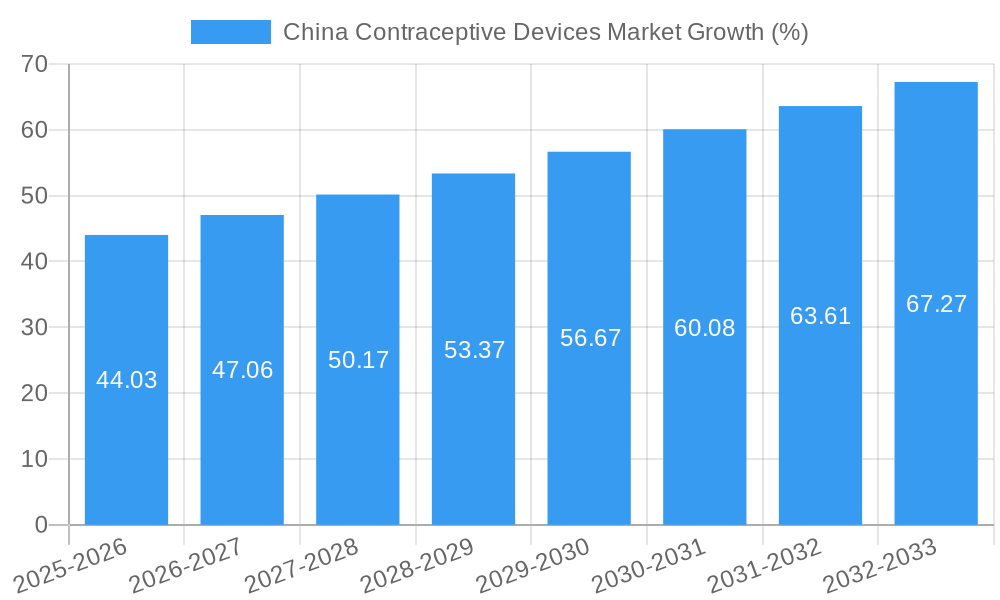

The China contraceptive devices market, valued at $711.73 million in 2025, is projected to experience robust growth, driven by increasing awareness of family planning, rising disposable incomes, and government initiatives promoting reproductive health. The market's Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033 signifies a significant expansion, with the market expected to surpass $1.2 billion by 2033. Key drivers include the growing urbanization leading to changing lifestyles and increased adoption of modern contraceptive methods, as well as a shift towards smaller family sizes. The market is segmented by product type (condoms, diaphragms, intrauterine devices (IUDs), and others) and end-user (male and female). Condoms currently dominate the market share due to their accessibility and affordability, followed by IUDs, which are gaining popularity due to their long-term effectiveness. However, the market faces restraints such as cultural stigma associated with contraceptives in certain regions and limited access to quality reproductive healthcare in rural areas. Major players such as Teva Pharmaceutical Industries, Bayer Healthcare, and Reckitt Benckiser are actively shaping the market through product innovation, strategic partnerships, and distribution network expansion. Increased competition and technological advancements, like the development of more effective and user-friendly contraceptive methods, are expected to further fuel market growth.

The growth trajectory of the China contraceptive devices market is influenced by several factors. Government policies promoting family planning and accessible healthcare play a crucial role, alongside the rising female literacy rate and increased access to information about reproductive health. While the market is currently dominated by established players, the entry of new companies and technological innovations will intensify competition. This competitive landscape will likely result in price reductions, improved product quality, and a wider variety of contraceptive options becoming available to consumers. Furthermore, the increasing focus on digital marketing and e-commerce channels offers promising opportunities for market expansion and improved reach, particularly in less-accessible regions. Future market projections will heavily depend on the success of these initiatives and continued government support for reproductive health programs.

China Contraceptive Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the China contraceptive devices market, offering invaluable insights for industry stakeholders, investors, and market researchers. The study period covers 2019-2033, with 2025 as the base and estimated year. The report projects robust growth, driven by several key factors explored in detail. Discover the market's size, segmentation, leading players, and future potential. This report is your essential guide to navigating the complexities and opportunities within this dynamic market.

The market is segmented by product type (condoms, diaphragms, intrauterine devices, other product types) and end-user (male, female). Key players include Teva Pharmaceutical Industries Ltd, GUANGZHOU ICLEAR HEALTHCARE LIMITED, Bayer Healthcare, Shandong Ming Yuan Latex Co Ltd, Okamoto, Reckitt Benckiser, Cooper Surgical Inc, and DKT International. The report utilizes data from the historical period (2019-2024) to forecast market trends until 2033.

China Contraceptive Devices Market Market Dynamics & Concentration

The China contraceptive devices market exhibits a moderate level of concentration, with a few dominant players holding significant market share. While precise figures are proprietary to the full report, we estimate that the top 5 players account for approximately xx% of the market in 2025. Market dynamics are shaped by several key factors:

- Innovation Drivers: Continuous innovation in contraceptive technology, including the development of more effective, user-friendly, and accessible devices, is a key driver.

- Regulatory Frameworks: Government regulations concerning contraceptive access and distribution significantly influence market growth. Changes in these regulations can create both opportunities and challenges.

- Product Substitutes: The availability of alternative family planning methods, such as sterilization procedures, can affect market demand for certain contraceptive devices.

- End-User Trends: Shifting demographic trends, including changes in age at first marriage and birth rates, impact the demand for contraceptive devices. Increasing awareness and education regarding sexual health also plays a role.

- M&A Activities: The number of mergers and acquisitions in the sector has been relatively low in recent years (xx deals between 2019-2024), suggesting a stable yet competitive landscape. Future consolidation is possible, particularly among smaller players seeking to enhance their market position.

China Contraceptive Devices Market Industry Trends & Analysis

The China contraceptive devices market is poised for significant growth during the forecast period (2025-2033). We project a Compound Annual Growth Rate (CAGR) of xx% during this time. This growth is attributed to several factors:

Increased government awareness campaigns, like the 2022 initiative promoting responsible childbearing, are expected to raise awareness of contraceptive options and improve access, thus boosting market penetration. The reduced price of Levoplant implants in 2021 also demonstrates an effort to improve affordability. Furthermore, technological advancements continually improve the safety and effectiveness of contraceptives, influencing consumer preference. However, these advancements bring along the need for greater investment in research and development by market players. The competitive landscape is characterized by established international players as well as domestic manufacturers, driving innovation and potentially leading to price competition. Market penetration across different regions of China also varies significantly and presents opportunities for growth for market players.

Leading Markets & Segments in China Contraceptive Devices Market

While data specific to regional breakdowns is part of the full report, the condom segment is projected to dominate the market by product type in 2025, driven by its high accessibility and relatively low cost. This segment is further supported by ongoing promotional activities and increased awareness of sexual health. The female end-user segment also holds significant market share, reflecting the increasing involvement of women in family planning decisions.

- Key Drivers for Condoms:

- Widespread availability and affordability.

- Strong marketing and promotional campaigns.

- Increasing awareness of sexually transmitted infections (STIs).

- Key Drivers for Female End-Users:

- Increased female participation in family planning decisions.

- Growing awareness of women's health and reproductive rights.

- Government initiatives promoting women's empowerment.

The dominance of condoms within the product type segment is anticipated to continue throughout the forecast period. The leading regions are likely to be major urban centers with higher levels of disposable income and awareness of contraceptive options. Further detailed regional analysis is available in the full report.

China Contraceptive Devices Market Product Developments

Recent years have witnessed several noteworthy product developments, including advancements in material science for condoms (e.g., thinner, more sensitive options) and more user-friendly designs for intrauterine devices (IUDs). These innovations aim to improve comfort and effectiveness while reducing side effects. Companies are also focusing on developing products tailored to specific demographics and needs, such as condoms with different textures or sizes. This focus on product differentiation is crucial to remaining competitive within a dynamic marketplace.

Key Drivers of China Contraceptive Devices Market Growth

The market's growth is propelled by several key factors:

- Technological Advancements: Continuous improvements in contraceptive technology lead to more effective and user-friendly products.

- Rising Disposable Incomes: Increased purchasing power allows more people to afford contraceptive devices.

- Government Initiatives: Policies supporting family planning and reproductive health contribute to market expansion. The 2022 propaganda campaign is a prime example.

- Increased Awareness: Growing public awareness about sexual health and family planning encourages greater adoption of contraceptive methods.

Challenges in the China Contraceptive Devices Market Market

Several factors pose challenges to market growth:

- Regulatory Hurdles: Stringent regulations governing the registration and distribution of contraceptive devices can create barriers to entry for new players.

- Supply Chain Issues: Disruptions in the supply chain, particularly during periods of heightened international trade tension, can impact the availability of products.

- Competitive Pressure: Intense competition among established and emerging players can result in price wars and reduced profit margins. The Daxiang-Durex lawsuit highlights the importance of intellectual property protection.

Emerging Opportunities in China Contraceptive Devices Market

Significant opportunities exist for market expansion through strategic partnerships between domestic and international companies, focusing on improved distribution networks and targeted marketing campaigns. Technological advancements in digital health offer prospects for the integration of telehealth platforms for providing contraceptive counseling and access. Expansion into underserved rural regions represents a significant untapped market potential.

Leading Players in the China Contraceptive Devices Market Sector

- Teva Pharmaceutical Industries Ltd

- GUANGZHOU ICLEAR HEALTHCARE LIMITED

- Bayer Healthcare

- Shandong Ming Yuan Latex Co Ltd

- Okamoto

- Reckitt Benckiser

- Cooper Surgical Inc

- DKT International

Key Milestones in China Contraceptive Devices Market Industry

- April 2021: Daxiang sues Durex for copyright infringement, highlighting the importance of intellectual property protection in the market.

- June 2021: DKT WomanCare and Shanghai Dahua Pharmaceutical reduce the price of Levoplant contraceptive implants, increasing affordability.

- February 2022: The Chinese government launches a campaign promoting responsible childbirth, potentially boosting awareness of contraceptive devices.

Strategic Outlook for China Contraceptive Devices Market Market

The China contraceptive devices market presents a compelling investment opportunity due to its significant growth potential and expanding target market. Future growth will depend on addressing existing challenges and leveraging emerging opportunities. Strategic partnerships, technological innovation, and targeted marketing are vital for companies seeking to achieve sustained success in this dynamic market. The focus on improving accessibility and affordability will be crucial for market expansion in the coming years.

China Contraceptive Devices Market Segmentation

-

1. Product Type

- 1.1. Condoms

- 1.2. Diaphragms

- 1.3. Intrauterine Devices

- 1.4. Other Product Types

-

2. End User

- 2.1. Male

- 2.2. Female

China Contraceptive Devices Market Segmentation By Geography

- 1. China

China Contraceptive Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Cases of Sexually Transmitted Diseases; Government Initiatives Regarding the Usage of Contraceptive Devices

- 3.3. Market Restrains

- 3.3.1. Side Effects Associated with Contraceptive Devices

- 3.4. Market Trends

- 3.4.1. Intrauterine Devices are Expected to Hold a Significant Share in the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Contraceptive Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Condoms

- 5.1.2. Diaphragms

- 5.1.3. Intrauterine Devices

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Teva Pharmaceutical Industries Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GUANGZHOU ICLEAR HEALTHCARE LIMITED

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shandong Ming Yuan Latex Co Ltd*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Okamoto

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Reckitt Benckiser

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cooper Surgical Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DKT International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Teva Pharmaceutical Industries Ltd

List of Figures

- Figure 1: China Contraceptive Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Contraceptive Devices Market Share (%) by Company 2024

List of Tables

- Table 1: China Contraceptive Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Contraceptive Devices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: China Contraceptive Devices Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: China Contraceptive Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Contraceptive Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Contraceptive Devices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: China Contraceptive Devices Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: China Contraceptive Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Contraceptive Devices Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the China Contraceptive Devices Market?

Key companies in the market include Teva Pharmaceutical Industries Ltd, GUANGZHOU ICLEAR HEALTHCARE LIMITED, Bayer Healthcare, Shandong Ming Yuan Latex Co Ltd*List Not Exhaustive, Okamoto, Reckitt Benckiser, Cooper Surgical Inc, DKT International.

3. What are the main segments of the China Contraceptive Devices Market?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 711.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Cases of Sexually Transmitted Diseases; Government Initiatives Regarding the Usage of Contraceptive Devices.

6. What are the notable trends driving market growth?

Intrauterine Devices are Expected to Hold a Significant Share in the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Side Effects Associated with Contraceptive Devices.

8. Can you provide examples of recent developments in the market?

In February 2022, the Government of China began an online propaganda campaign focused on how to respect the social value of childbirth and advocate age-appropriate marriage and childbearing, as well as optimal child-bearing and raising. This campaign is expected to increase awareness about contraceptive devices in the country, which may boost the market's growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Contraceptive Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Contraceptive Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Contraceptive Devices Market?

To stay informed about further developments, trends, and reports in the China Contraceptive Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence