Key Insights

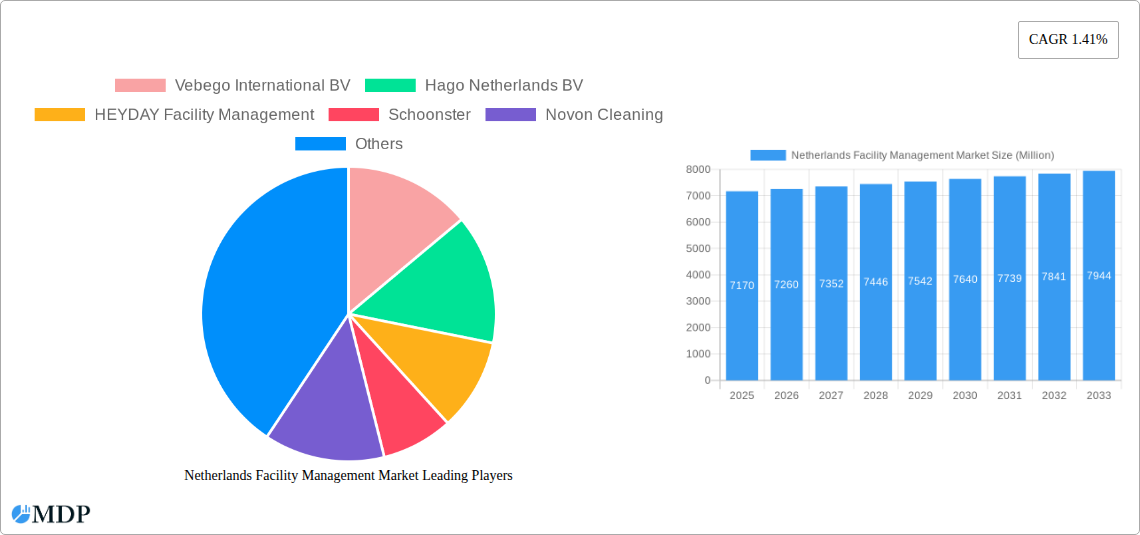

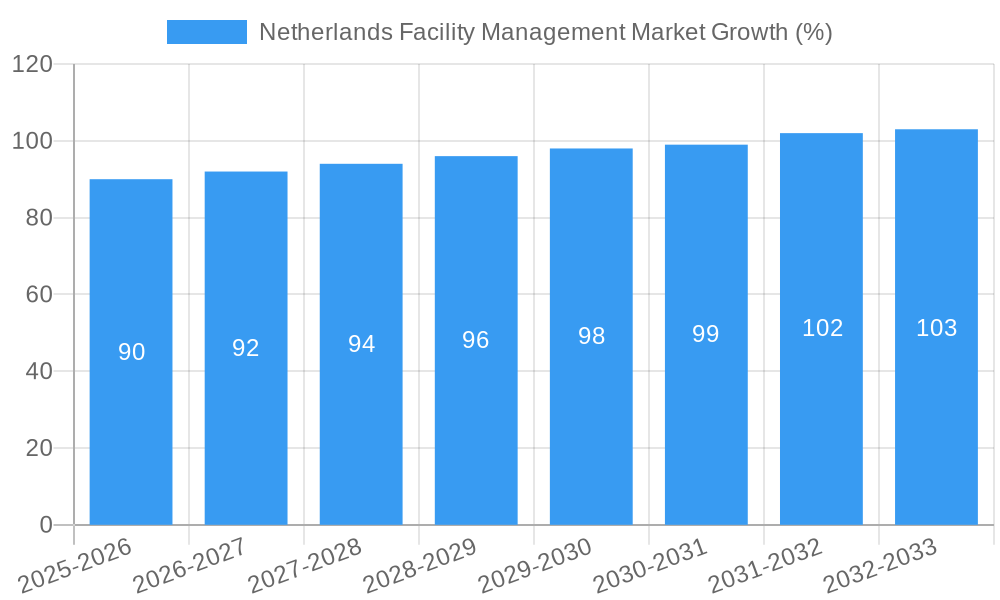

The Netherlands facility management market, valued at €7.17 billion in 2025, is projected to experience steady growth, driven by increasing urbanization, a robust economy, and the growing adoption of sustainable practices within commercial and industrial sectors. The market is segmented by facility management type (in-house versus outsourced), offering type (hard FM encompassing maintenance and repairs, and soft FM including cleaning and security services), and end-user (commercial, institutional, public/infrastructure, industrial, and others). The outsourced facility management segment is expected to dominate, fueled by cost efficiency and specialized expertise offered by external providers. Within offering types, the demand for integrated FM solutions combining hard and soft services is rising, reflecting a trend towards holistic facility management strategies. Key players like Vebego International BV, Hago Netherlands BV, and Apleona GmbH are leveraging technological advancements, such as smart building technologies and data analytics, to improve operational efficiency and enhance service delivery. Growth is further influenced by increasing government regulations related to sustainability and building codes, prompting businesses to prioritize energy efficiency and environmentally friendly facility management practices.

While the current CAGR of 1.41% suggests moderate growth, this figure may be influenced by the historical period (2019-2024) which may have included periods of economic uncertainty. Looking forward, factors such as potential economic fluctuations, competition among established and emerging players, and the availability of skilled workforce will influence the market's trajectory. The increasing focus on data-driven decision making and the integration of proptech solutions will likely contribute to a slight acceleration in the CAGR beyond the initial projection in the coming years. The strong presence of multinational corporations and a developed infrastructure in the Netherlands will continue to offer attractive opportunities for facility management providers. Competition is likely to intensify as companies strive to offer innovative and sustainable solutions to meet the evolving needs of clients.

Netherlands Facility Management Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Netherlands Facility Management market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, key players, emerging trends, and future growth potential. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Netherlands Facility Management Market Market Dynamics & Concentration

The Netherlands Facility Management market is characterized by a moderately concentrated landscape, with several large players dominating market share. Key drivers include increasing demand for outsourced services, stringent regulatory compliance needs, and a focus on operational efficiency across various sectors. Innovation, particularly in technology-driven solutions like integrated building management systems (IBMS) and smart building technologies, is significantly shaping market dynamics. Mergers and acquisitions (M&A) activity is moderate, with xx deals recorded between 2019 and 2024, primarily focused on expanding service offerings and geographic reach. Product substitution is influenced by the increasing adoption of sustainable and energy-efficient solutions. End-user trends indicate a growing preference for integrated facility management services.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Innovation Drivers: Smart building technologies, sustainable solutions, and integrated facility management platforms.

- Regulatory Framework: Stringent environmental regulations and building codes influence market practices.

- Product Substitutes: Limited direct substitutes, but competition exists from specialized service providers.

- End-User Trends: Increasing demand for outsourced FM services and customized solutions.

- M&A Activity: xx deals recorded between 2019 and 2024, resulting in consolidation and expansion.

Netherlands Facility Management Market Industry Trends & Analysis

The Netherlands Facility Management market is experiencing robust growth, driven by factors such as increasing urbanization, rising construction activity, and the growing adoption of sustainable building practices. Technological advancements, including the Internet of Things (IoT) and artificial intelligence (AI), are transforming the sector, enabling predictive maintenance, improved energy efficiency, and enhanced operational insights. Consumer preferences are shifting towards integrated, technologically advanced solutions that prioritize sustainability and cost-effectiveness. Competitive dynamics are characterized by intense competition among established players and the emergence of innovative startups. The market witnessed a CAGR of xx% from 2019-2024 and is projected to maintain a strong growth trajectory throughout the forecast period. Market penetration of outsourced FM services continues to increase, with approximately xx% of businesses currently utilizing such services.

Leading Markets & Segments in Netherlands Facility Management Market

The Commercial sector is the dominant end-user segment in the Netherlands Facility Management market, driven by the substantial office space and retail infrastructure. Outsourced Facility Management is the leading type of service, demonstrating significant growth potential. Hard FM, encompassing maintenance and repair services, holds the largest share of the offering type segment.

- Type of Facility Management:

- Outsourced Facility Management: Key driver is cost optimization and access to specialized expertise.

- Inhouse Facility Management: Driven by organizations prioritizing internal control and specific operational needs.

- Offering Type:

- Hard FM: Dominant due to the essential nature of maintenance and repairs across various facilities.

- Soft FM: Growing steadily, driven by increasing focus on employee well-being and workplace optimization.

- End-User:

- Commercial: Dominant due to high concentration of office buildings, retail spaces and commercial properties.

- Institutional: Significant growth potential driven by needs of educational institutions and healthcare facilities.

- Public/Infrastructure: Steady growth supported by government investments in infrastructure development and maintenance.

- Industrial: Moderate growth influenced by industry-specific requirements and maintenance schedules.

- Other End-Users: Includes smaller niche markets such as residential properties etc.

Netherlands Facility Management Market Product Developments

Recent product innovations focus on integrating smart technologies into facility management solutions, improving energy efficiency, optimizing resource allocation, and enhancing data-driven decision-making. This includes the development of integrated building management systems (IBMS) and the adoption of predictive maintenance tools leveraging IoT and AI. These advancements enhance efficiency and reduce operational costs, providing a significant competitive advantage in the market.

Key Drivers of Netherlands Facility Management Market Growth

Several factors contribute to the growth of the Netherlands Facility Management market. These include government initiatives promoting sustainable buildings, increasing urbanization leading to a higher demand for facility services, and the growing adoption of technological advancements such as IoT and AI. The robust economic growth of the Netherlands also positively impacts the demand for professional facility management services.

Challenges in the Netherlands Facility Management Market Market

The Netherlands Facility Management market faces challenges such as skilled labor shortages, increasing regulatory compliance costs, and intense competition from both established players and new entrants. These factors can limit market expansion if not effectively addressed. Supply chain disruptions and rising material costs also pose significant operational challenges.

Emerging Opportunities in Netherlands Facility Management Market

Long-term growth opportunities are presented by the increasing adoption of sustainable practices, the growing demand for integrated facility management solutions, and the development of innovative technologies. Strategic partnerships and expansion into new market segments, such as smart building technologies and specialized services, can unlock significant growth potential.

Leading Players in the Netherlands Facility Management Market Sector

- Vebego International BV

- Hago Netherlands BV

- HEYDAY Facility Management

- Schoonster

- Novon Cleaning

- SMB Willems

- ICS Group

- The Cleaning Cooperative

- VLS Group

- Fortrus

- Unica

- Apleona GmbH

- DW Facility Group BV

Key Milestones in Netherlands Facility Management Market Industry

- March 2022: SPIE Nederland launched PULSE Core, an integrated Building Operation Solution leveraging cutting-edge cloud technology. This innovation enhances building management capabilities.

- November 2022: Orion Group launched Alder, a tech-enabled facilities services provider, expanding access to services through a dynamic web-based platform. This significantly increases market reach and competition.

Strategic Outlook for Netherlands Facility Management Market Market

The Netherlands Facility Management market is poised for sustained growth, driven by technological innovation, increasing demand for outsourced services, and a focus on sustainability. Strategic investments in technology, talent development, and sustainable practices will be crucial for players seeking to capture significant market share in the coming years. The focus on integrated, data-driven solutions will continue to shape the market landscape.

Netherlands Facility Management Market Segmentation

-

1. Type of Facility Management

- 1.1. Inhouse Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offering Type

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End-User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Other End-Users

Netherlands Facility Management Market Segmentation By Geography

- 1. Netherlands

Netherlands Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend of Smart Buildings; Increasing Demand of Energy Management Services

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness About Intellectual Property Outsourcing

- 3.4. Market Trends

- 3.4.1. Growing Trend of Smart Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 5.1.1. Inhouse Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offering Type

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Vebego International BV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hago Netherlands BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HEYDAY Facility Management

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schoonster

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Novon Cleaning

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SMB Willems

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ICS Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Cleaning Cooperative

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 VLS Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fortrus

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Unica

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Apleona GmbH

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 DW Facility Group BV

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Vebego International BV

List of Figures

- Figure 1: Netherlands Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: Netherlands Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands Facility Management Market Revenue Million Forecast, by Type of Facility Management 2019 & 2032

- Table 3: Netherlands Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 4: Netherlands Facility Management Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Netherlands Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Netherlands Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Netherlands Facility Management Market Revenue Million Forecast, by Type of Facility Management 2019 & 2032

- Table 8: Netherlands Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 9: Netherlands Facility Management Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Netherlands Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Facility Management Market?

The projected CAGR is approximately 1.41%.

2. Which companies are prominent players in the Netherlands Facility Management Market?

Key companies in the market include Vebego International BV, Hago Netherlands BV, HEYDAY Facility Management, Schoonster, Novon Cleaning, SMB Willems, ICS Group, The Cleaning Cooperative, VLS Group, Fortrus, Unica, Apleona GmbH, DW Facility Group BV.

3. What are the main segments of the Netherlands Facility Management Market?

The market segments include Type of Facility Management, Offering Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend of Smart Buildings; Increasing Demand of Energy Management Services.

6. What are the notable trends driving market growth?

Growing Trend of Smart Buildings.

7. Are there any restraints impacting market growth?

Lack of Awareness About Intellectual Property Outsourcing.

8. Can you provide examples of recent developments in the market?

November 2022 - Orion Group ("Orion"), an Alpine Investors-backed commercial and industrial field services company, announced the launch of Alder, a tech-enabled facilities services provider. Alder is the second interior facility services provider to join Orion's Facilities Maintenance (FM) business and the fourth overall. Alder connects commercial customers looking for facility services through a dynamic, web-based platform to various vendors. The Alder network comprises hundreds of pre-vetted service providers across 70 distinct service lines in 40+ metro areas globally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Facility Management Market?

To stay informed about further developments, trends, and reports in the Netherlands Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence