Key Insights

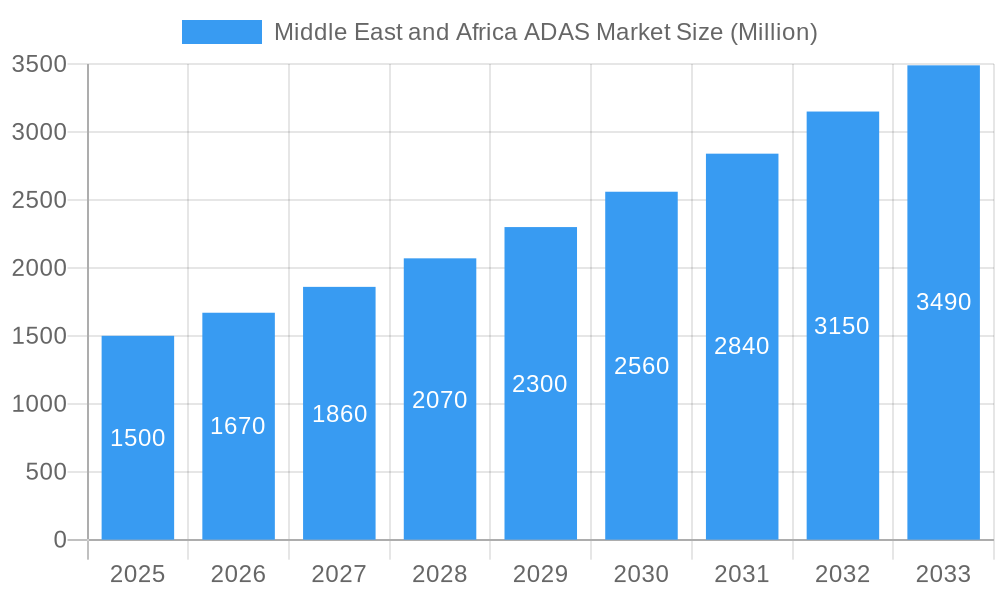

The Middle East and Africa (MEA) Advanced Driver-Assistance Systems (ADAS) market is experiencing robust growth, fueled by rising vehicle sales, increasing government investments in infrastructure development, and a growing focus on road safety. The market's Compound Annual Growth Rate (CAGR) exceeding 11.19% signifies significant potential. Key drivers include the expanding adoption of technologically advanced vehicles, particularly passenger cars, across major economies like the UAE, Saudi Arabia, and Qatar. Furthermore, the increasing prevalence of smart city initiatives and the rising demand for enhanced driver safety features, such as parking assist, lane departure warning, and adaptive front-lighting systems, are propelling market expansion. Segmentation reveals that radar and LiDAR technologies are gaining traction, while the passenger car segment dominates the vehicle type category. While challenges such as high initial investment costs and technological complexities exist, the long-term outlook for the MEA ADAS market remains positive. The market's expansion is likely to be driven by continued technological advancements, the introduction of more affordable ADAS features, and supportive government regulations promoting road safety. The market is expected to see substantial growth in the forecast period (2025-2033), with significant contributions from countries experiencing rapid economic development and urbanization.

Middle East and Africa ADAS Market Market Size (In Billion)

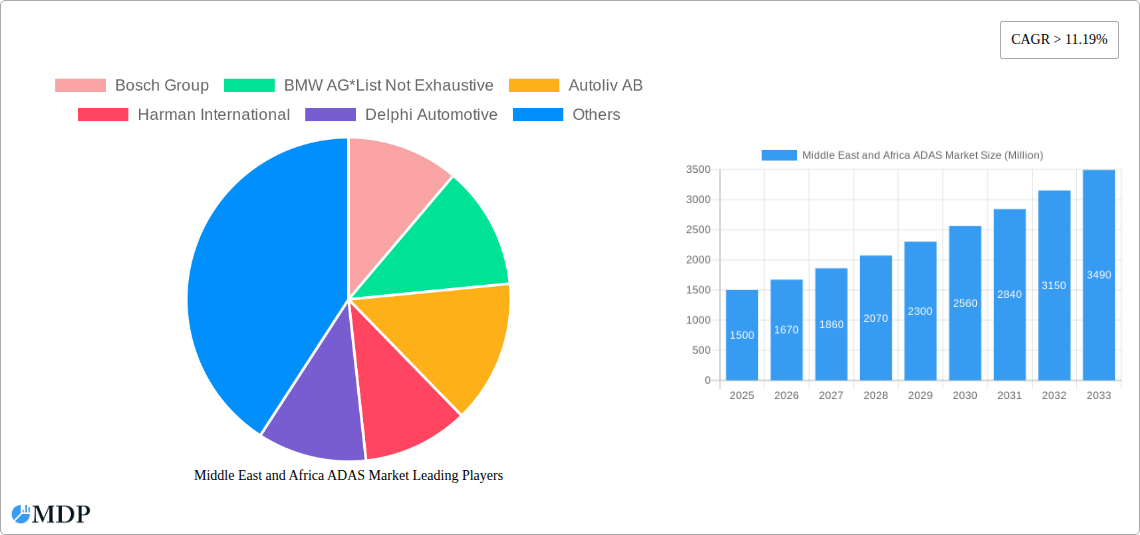

The competitive landscape is characterized by a mix of global automotive component manufacturers and Tier-1 suppliers, including Bosch, Autoliv, Continental, and Harman. These companies are actively investing in research and development to offer innovative and cost-effective ADAS solutions tailored to the specific needs of the MEA region. The increasing partnerships between these companies and local automotive players are further strengthening the market ecosystem. Future growth will hinge on the continued penetration of ADAS technologies into the commercial vehicle segment, expansion into less developed markets within the region, and adaptation of these systems to suit the unique driving conditions and infrastructural limitations across MEA countries. The market will likely see further diversification of ADAS offerings, with a focus on features addressing regional challenges like extreme weather conditions and diverse road types.

Middle East and Africa ADAS Market Company Market Share

Middle East & Africa ADAS Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Middle East and Africa Advanced Driver-Assistance Systems (ADAS) market, projecting substantial growth from 2025 to 2033. The study covers market dynamics, industry trends, leading segments, key players, and future opportunities, equipping stakeholders with actionable insights for strategic decision-making. The report analyzes the market across various segments, including technology (Radar, LiDAR, Camera), vehicle type (Passenger Cars, Commercial Vehicles), and country (Qatar, UAE, Saudi Arabia, Egypt, South Africa, Rest of MEA), with a focus on systems like Parking Assist, Adaptive Front-lighting, and more. The study period spans 2019-2033, with 2025 as the base and estimated year.

Middle East and Africa ADAS Market Market Dynamics & Concentration

The Middle East and Africa ADAS market is experiencing rapid expansion driven by increasing vehicle sales, rising road accidents, and government initiatives promoting road safety. Market concentration is moderately high, with key players like Bosch Group, Bosch Group, BMW AG, Autoliv AB, Harman International, Delphi Automotive, Continental AG, Hyundai Mobi, and Hella KGaA Hueck & Co. holding significant market share. However, the emergence of new technology providers and the entry of local players are increasing competition. Innovation drivers include advancements in sensor technology, AI, and machine learning. Stringent regulatory frameworks focusing on vehicle safety are pushing ADAS adoption. While there are no significant product substitutes at present, the market faces competition from other safety features. End-user trends show a preference for advanced features and increased safety consciousness. The number of M&A activities in the region is estimated at xx in the historical period, indicating a drive for consolidation and technological integration. The market share of the top five players is approximately xx%, while the remaining players make up the rest of the market share.

Middle East and Africa ADAS Market Industry Trends & Analysis

The MEA ADAS market exhibits a robust CAGR of xx% during the forecast period (2025-2033), driven by several key factors. Government regulations mandating advanced safety features in new vehicles are accelerating market growth. The rising affordability of ADAS technologies is widening consumer access. The increasing urbanization and consequent rise in traffic congestion are compelling drivers for enhanced road safety. Technological advancements in sensor fusion and AI are leading to more sophisticated and reliable ADAS solutions. A growing preference for connected and autonomous vehicles is fueling demand. The market penetration of ADAS in passenger cars is expected to reach xx% by 2033, while commercial vehicle penetration will reach xx%. The competitive landscape is dynamic, with established players focusing on innovation and expansion strategies alongside newer entrants seeking to carve out a market niche.

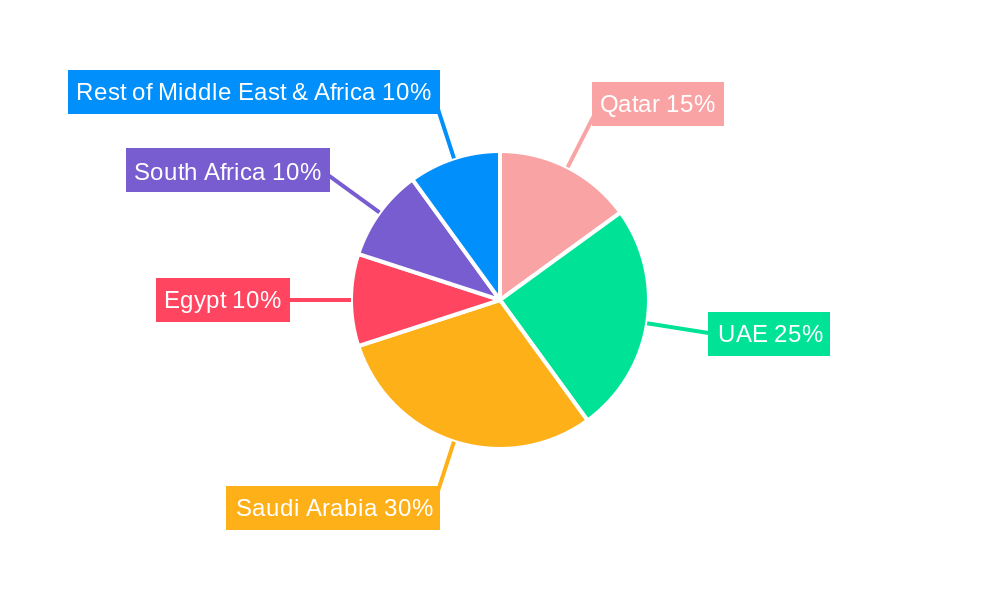

Leading Markets & Segments in Middle East and Africa ADAS Market

- Dominant Region: The UAE and Saudi Arabia are currently the leading markets due to high disposable income, advanced infrastructure, and supportive government policies promoting road safety.

- Dominant Country: The UAE leads in ADAS adoption due to its well-developed automotive industry and high vehicle ownership rate.

- Dominant Technology Segment: Radar technology currently holds the largest market share due to its maturity, cost-effectiveness, and reliability in various weather conditions.

- Dominant Vehicle Type: Passenger cars account for the largest segment due to higher vehicle sales and consumer preference for advanced safety features.

- Dominant ADAS Type: Parking assist systems are currently the most popular due to their relatively lower cost and high demand.

Key Drivers:

- Economic growth: Rising disposable incomes in several MEA countries are driving demand for vehicles equipped with ADAS.

- Government regulations: Stringent safety regulations are pushing manufacturers to integrate ADAS features.

- Infrastructure development: Investment in infrastructure and smart cities is indirectly boosting ADAS adoption.

Middle East and Africa ADAS Market Product Developments

Significant advancements are being made in sensor technology, particularly in LiDAR and camera systems, leading to enhanced object detection and recognition capabilities. Integration of AI and machine learning algorithms enables ADAS to better adapt to diverse driving conditions. The development of cost-effective solutions is expanding market access to a broader range of vehicles. Market focus is shifting towards more sophisticated systems with combined functionalities, reducing the need for multiple, independent systems. This streamlining of features improves system efficiency and optimizes cost.

Key Drivers of Middle East and Africa ADAS Market Growth

The MEA ADAS market's growth is fueled by several key factors: Firstly, the rising number of road accidents and a growing need for increased road safety are pushing governments to implement stricter safety regulations, thereby mandating ADAS features. Secondly, technological advancements, particularly in sensor technology and AI, are constantly improving the performance and reliability of ADAS systems. Thirdly, the rising affordability of ADAS technologies is making them accessible to a wider consumer base, driving increased adoption.

Challenges in the Middle East and Africa ADAS Market Market

Several challenges hinder the market's full potential. High initial costs associated with ADAS integration pose a barrier to widespread adoption, particularly in the commercial vehicle segment. The lack of skilled labor and specialized maintenance facilities in some regions restricts growth. Supply chain disruptions and the volatility of raw material prices can impact production costs and profitability. Furthermore, there is a need for better awareness among consumers about the benefits of ADAS. The lack of standardized testing protocols across the region also makes it difficult to compare products.

Emerging Opportunities in Middle East and Africa ADAS Market

The long-term growth of the MEA ADAS market is fueled by several emerging opportunities. The expansion of connected car technology and the increasing adoption of 5G networks provide opportunities for the development of more sophisticated, data-driven ADAS systems. Strategic partnerships between technology providers and automotive manufacturers can accelerate innovation and market penetration. The growing interest in autonomous driving technology presents a significant growth avenue for advanced ADAS systems. The government's push for smart city initiatives, creating a need for safe and efficient transportation solutions, presents strong market potential.

Leading Players in the Middle East and Africa ADAS Market Sector

- Bosch Group

- BMW AG

- Autoliv AB

- Harman International

- Delphi Automotive

- Continental AG

- Hyundai Mobi

- Hella KGaA Hueck & Co

Key Milestones in Middle East and Africa ADAS Market Industry

- 2021 Q4: Introduction of new safety regulations by the UAE government mandating ADAS in new vehicles.

- 2022 Q2: Launch of a new ADAS manufacturing plant by Bosch in South Africa.

- 2023 Q1: Strategic partnership between a major MEA automaker and a leading ADAS technology provider.

- 2024 Q3: Government grants announced to support the development and adoption of ADAS technologies in Egypt.

(Note: These are examples. Actual milestones should be researched and included.)

Strategic Outlook for Middle East and Africa ADAS Market Market

The MEA ADAS market holds significant future potential, fueled by continuous technological advancements and a growing focus on safety regulations and increased automotive production within the region. The market is poised for growth as prices of ADAS components continue to fall, making them more accessible to a broader customer base. Strategic partnerships and joint ventures will play a critical role in accelerating market development and penetration. A focus on developing cost-effective solutions tailored to the specific needs of the region will prove key for success. Investment in research and development and skilled workforce training are also essential to achieve sustainable growth.

Middle East and Africa ADAS Market Segmentation

-

1. Type

- 1.1. Parking Assist System

- 1.2. Adaptive Front-lighting

- 1.3. Night Vision System

- 1.4. Blind Spot Detection

- 1.5. Lane Departure Warning

- 1.6. Others

-

2. Technology

- 2.1. Radar

- 2.2. Li-Dar

- 2.3. Camera

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicle

Middle East and Africa ADAS Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa ADAS Market Regional Market Share

Geographic Coverage of Middle East and Africa ADAS Market

Middle East and Africa ADAS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 11.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Government Regulations And Stricter Policies For Safety Roads

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa ADAS Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Parking Assist System

- 5.1.2. Adaptive Front-lighting

- 5.1.3. Night Vision System

- 5.1.4. Blind Spot Detection

- 5.1.5. Lane Departure Warning

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Radar

- 5.2.2. Li-Dar

- 5.2.3. Camera

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bosch Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BMW AG*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Autoliv AB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Harman International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Delphi Automotive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hyundai Mobi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hella KGaA Hueck & Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Bosch Group

List of Figures

- Figure 1: Middle East and Africa ADAS Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa ADAS Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa ADAS Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa ADAS Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Middle East and Africa ADAS Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Middle East and Africa ADAS Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa ADAS Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Middle East and Africa ADAS Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Middle East and Africa ADAS Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Middle East and Africa ADAS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa ADAS Market?

The projected CAGR is approximately > 11.19%.

2. Which companies are prominent players in the Middle East and Africa ADAS Market?

Key companies in the market include Bosch Group, BMW AG*List Not Exhaustive, Autoliv AB, Harman International, Delphi Automotive, Continental AG, Hyundai Mobi, Hella KGaA Hueck & Co.

3. What are the main segments of the Middle East and Africa ADAS Market?

The market segments include Type, Technology , Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

Government Regulations And Stricter Policies For Safety Roads.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa ADAS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa ADAS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa ADAS Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa ADAS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence