Key Insights

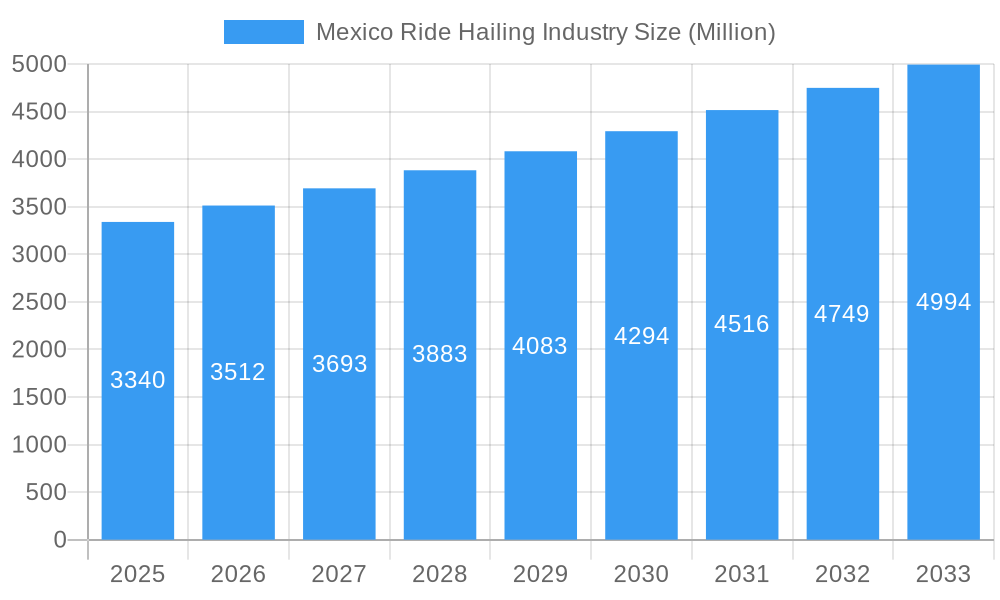

The Mexico ride-hailing market, valued at $3.34 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.02% from 2025 to 2033. This expansion is driven by several factors. Increasing urbanization and traffic congestion in major Mexican cities like Mexico City, Guadalajara, and Monterrey fuel the demand for convenient and efficient transportation alternatives. The rising adoption of smartphones and mobile internet penetration has significantly contributed to the growth of online booking platforms, further accelerating market expansion. Furthermore, the increasing disposable income among the young, tech-savvy population fuels the demand for ride-hailing services, especially among younger demographics who increasingly prioritize convenience and cost-effectiveness over personal vehicle ownership. The market segmentation reveals a dominance of e-hailing services, with a significant contribution from online booking channels. Passenger cars constitute the largest vehicle type segment. However, the growth of two-wheeler ride-hailing, particularly in densely populated urban areas, represents a significant future opportunity. Competitive pressures from established players like Uber and Didi, alongside local companies like Cabify and Beat, continue to shape the market landscape. Regulatory frameworks and infrastructure development also play a crucial role in shaping the industry's future trajectory.

Mexico Ride Hailing Industry Market Size (In Billion)

Regulatory hurdles, such as licensing requirements and safety regulations, coupled with fluctuating fuel prices, pose challenges to the industry's sustainable growth. The increasing competition among ride-hailing companies also leads to price wars, impacting overall profitability. Infrastructure limitations, including insufficient road networks and parking spaces, especially in smaller cities, also hinder market penetration. However, the ongoing investments in public transportation infrastructure and the government's initiatives to promote digitalization are expected to mitigate some of these challenges. Furthermore, the emergence of innovative service models, such as ride-pooling and subscription-based services, is expected to provide further diversification and growth opportunities within the Mexican ride-hailing market. The increasing focus on safety and security features within the apps, coupled with the expansion of service areas to encompass smaller cities, will also be important determinants of future market expansion.

Mexico Ride Hailing Industry Company Market Share

Mexico Ride Hailing Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico ride-hailing industry, covering market dynamics, trends, leading players, and future growth prospects from 2019 to 2033. The report leverages extensive data analysis to offer actionable insights for industry stakeholders, including investors, operators, and policymakers. With a focus on key segments (E-hailing, Car Sharing, Car Rental, etc.) and leading companies like Uber, Didi, and BlaBlaCar, this report is an essential resource for navigating this dynamic market. The study period spans 2019-2033, with 2025 serving as the base and estimated year.

Mexico Ride Hailing Industry Market Dynamics & Concentration

The Mexican ride-hailing market, valued at xx Million USD in 2025, exhibits a dynamic interplay of factors influencing its growth and concentration. Market share is largely dominated by a few key players, with Uber and Didi holding significant portions, while smaller players like Beat and Cabify compete for market share. The market concentration is expected to remain moderately high in the coming years, though the entry of innovative players and the growth of niche services could impact this over time.

Innovation Drivers: The industry is driven by technological innovation, particularly in areas like app development, payment systems, and fleet management. The introduction of electric vehicle fleets, as exemplified by Beat Zero's launch, reflects a significant push towards sustainability.

Regulatory Frameworks: Government regulations regarding ride-hailing operations, licensing, and pricing significantly affect market dynamics. Variations in regulations across different states in Mexico create unique challenges and opportunities for different players.

Product Substitutes: Public transportation systems, personal vehicle ownership, and alternative transportation services (e.g., bike-sharing) act as substitutes, impacting the market penetration of ride-hailing services.

End-User Trends: Increasing urbanization, growing smartphone penetration, and a preference for convenient and affordable transportation fuels the demand for ride-hailing services.

M&A Activities: The number of M&A deals in the Mexican ride-hailing market has been xx in the historical period. Consolidation among smaller players is expected to continue as larger players seek to expand their market reach. Further research will reveal specific deal values and the market share change due to mergers and acquisitions.

Mexico Ride Hailing Industry Industry Trends & Analysis

The Mexican ride-hailing industry is experiencing robust growth, with a CAGR of xx% projected from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes are leading to increased spending on transportation services, particularly among younger demographics. Urbanization continues to drive demand for efficient urban transportation solutions. Technological advancements are improving the efficiency and convenience of ride-hailing services, while also increasing competition amongst industry leaders. The market penetration of ride-hailing services within Mexico is projected to reach xx% by 2033, driven largely by increasing smartphone usage and the accessibility of the internet. Consumer preferences are shifting toward convenient and cost-effective transport options. Competitive dynamics are intense, with incumbent players constantly innovating to retain market share and attract new customers, as well as to mitigate challenges from new entrants.

Leading Markets & Segments in Mexico Ride Hailing Industry

By Service Type: E-hailing dominates the market, driven by convenience and affordability. Car sharing and car rental services are experiencing moderate growth, with the potential for expansion as awareness increases.

By Booking Channel: Online bookings account for the significant majority of transactions, reflecting the increasing digital adoption rate in Mexico.

By Vehicle Type: Passenger cars form the bulk of the market, although the use of two-wheelers may increase in certain urban areas, depending on regulatory frameworks.

Dominance Analysis: Mexico City and other major metropolitan areas demonstrate the highest demand for ride-hailing services due to factors like high population density, traffic congestion, and limited public transportation options. The growth in these metropolitan areas is significantly higher than the growth in other areas of Mexico.

Key Drivers:

- Economic Policies: Government policies promoting inclusive growth and technological development support the ride-hailing industry.

- Infrastructure: Improvements to road infrastructure and digital connectivity are critical for the industry's expansion.

- Technological Advancements: The continuous improvement of ride-hailing apps and payment systems contributes to better user experience and efficiency.

Mexico Ride Hailing Industry Product Developments

Recent product innovations focus on enhanced safety features, improved user interfaces, and the integration of various payment options. The introduction of electric vehicle fleets (Beat Zero) illustrates a move towards sustainable transportation solutions. This development aligns with increasing consumer preferences for environmentally friendly choices and government incentives. The successful integration of these innovations into the broader ride-hailing ecosystem provides a distinct competitive advantage.

Key Drivers of Mexico Ride Hailing Industry Growth

The Mexican ride-hailing market's growth is fueled by several key factors:

- Technological advancements: App-based booking systems, real-time tracking, and mobile payment options enhance convenience and accessibility.

- Economic factors: Rising disposable incomes and increasing urbanization contribute to higher demand for transportation services.

- Regulatory environment: While regulatory hurdles exist, progressive policies regarding digital services and transportation are supporting industry expansion.

Challenges in the Mexico Ride Hailing Industry Market

The industry faces significant challenges, including stringent regulations, intense competition among existing players and new entrants, and safety concerns. Supply chain disruptions can affect the availability of vehicles and drivers. Furthermore, fluctuating fuel prices contribute to operational cost volatility. The combined effect of these factors causes a reduction in profit margins for players in the market and may discourage new entrants from the market.

Emerging Opportunities in Mexico Ride Hailing Industry

The Mexican ride-hailing industry presents several promising opportunities for growth. The expansion of services into smaller cities and towns, strategic partnerships with local businesses, and the integration of innovative technologies (like autonomous vehicles) are key potential catalysts for long-term growth. Government incentives for sustainable transportation solutions open up additional opportunities.

Leading Players in the Mexico Ride Hailing Industry Sector

- BlaBlaCar

- Didi Chuxing Technology Co

- Uber Technologies Inc

- Lyft Inc

- Cabify Spain SLU

- BEAT

Key Milestones in Mexico Ride Hailing Industry Industry

- February 2024: inDrive partners with R2 to offer driver loans. This initiative enhances driver financial access and stability.

- July 2023: Hoop Carpool secures USD 1.3 Million in funding, boosting the carpool segment's growth.

- June 2022: IFC invests USD 15 Million in BlaBlaCar, strengthening its market position.

- February 2022: Beat launches Beat Zero, introducing electric vehicles and improving the overall customer experience.

Strategic Outlook for Mexico Ride Hailing Industry Market

The Mexican ride-hailing industry's future is bright, with significant potential for growth driven by continued urbanization, technological innovation, and evolving consumer preferences. Strategic partnerships, expansion into underserved markets, and a focus on sustainability will be crucial for companies seeking to thrive in this competitive landscape. The increasing adoption of technology and the improvement in the infrastructure of Mexico will lead to the improvement of the existing services in the market and increase profitability.

Mexico Ride Hailing Industry Segmentation

-

1. Service Type

- 1.1. E-hailing

- 1.2. Car Sharing

- 1.3. Car Rental

- 1.4. Other Service Types

-

2. Type

- 2.1. Peer-to-peer Sharing

- 2.2. Business Sharing

-

3. Booking Channel

- 3.1. Online

- 3.2. Offline

-

4. Vehicle Type

- 4.1. Two Wheelers

- 4.2. Passenger Cars

-

5. Distance

- 5.1. Intercity

- 5.2. Intracity

Mexico Ride Hailing Industry Segmentation By Geography

- 1. Mexico

Mexico Ride Hailing Industry Regional Market Share

Geographic Coverage of Mexico Ride Hailing Industry

Mexico Ride Hailing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism Industry in Australia

- 3.3. Market Restrains

- 3.3.1. Varying Government Regulations on Taxi Services

- 3.4. Market Trends

- 3.4.1. Online Booking Channel is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Ride Hailing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. E-hailing

- 5.1.2. Car Sharing

- 5.1.3. Car Rental

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Peer-to-peer Sharing

- 5.2.2. Business Sharing

- 5.3. Market Analysis, Insights and Forecast - by Booking Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Two Wheelers

- 5.4.2. Passenger Cars

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Intercity

- 5.5.2. Intracity

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BlaBlaCar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Didi Chuxing Technology Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Uber Technologies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lyft Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cabify Spain SLU

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BEAT

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 BlaBlaCar

List of Figures

- Figure 1: Mexico Ride Hailing Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Ride Hailing Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Ride Hailing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Mexico Ride Hailing Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Mexico Ride Hailing Industry Revenue Million Forecast, by Booking Channel 2020 & 2033

- Table 4: Mexico Ride Hailing Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Mexico Ride Hailing Industry Revenue Million Forecast, by Distance 2020 & 2033

- Table 6: Mexico Ride Hailing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Mexico Ride Hailing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Mexico Ride Hailing Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Mexico Ride Hailing Industry Revenue Million Forecast, by Booking Channel 2020 & 2033

- Table 10: Mexico Ride Hailing Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Mexico Ride Hailing Industry Revenue Million Forecast, by Distance 2020 & 2033

- Table 12: Mexico Ride Hailing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Ride Hailing Industry?

The projected CAGR is approximately 5.02%.

2. Which companies are prominent players in the Mexico Ride Hailing Industry?

Key companies in the market include BlaBlaCar, Didi Chuxing Technology Co, Uber Technologies Inc, Lyft Inc, Cabify Spain SLU, BEAT.

3. What are the main segments of the Mexico Ride Hailing Industry?

The market segments include Service Type, Type, Booking Channel, Vehicle Type, Distance.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism Industry in Australia.

6. What are the notable trends driving market growth?

Online Booking Channel is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Varying Government Regulations on Taxi Services.

8. Can you provide examples of recent developments in the market?

February 2024: The ride-share platform inDrive collaborated with the financial technology firm R2 to offer loans to its drivers in Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Ride Hailing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Ride Hailing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Ride Hailing Industry?

To stay informed about further developments, trends, and reports in the Mexico Ride Hailing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence