Key Insights

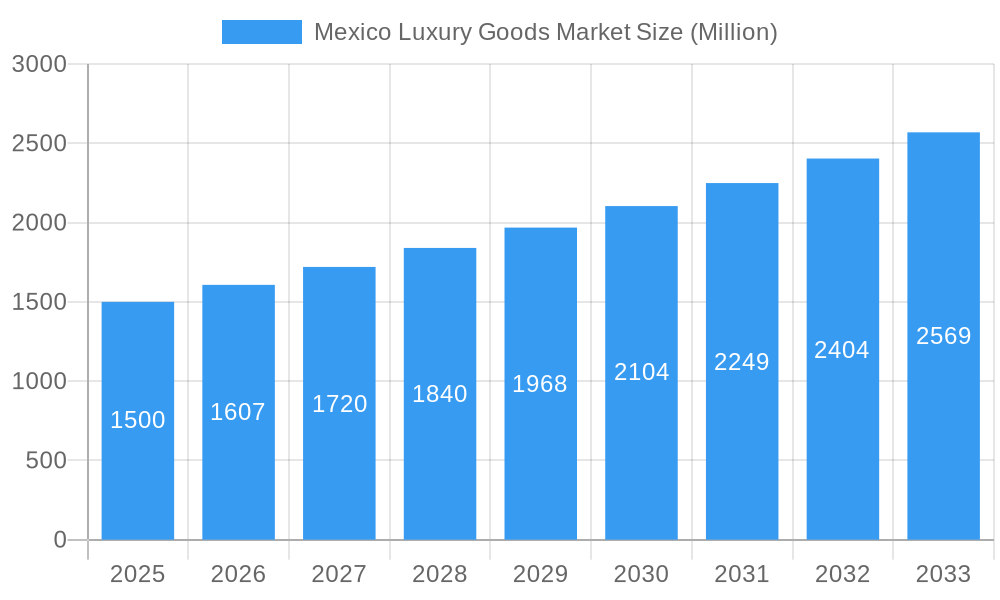

Mexico's luxury goods market demonstrates substantial growth potential, projected to achieve a Compound Annual Growth Rate (CAGR) of 4.32%. This expansion is driven by an increasing affluent demographic with rising disposable income and a strong preference for premium brands. Key growth drivers include the escalating adoption of e-commerce for luxury purchases, heightened demand for personalized brand experiences, and a growing consumer inclination towards sustainable and ethically produced goods. Apparel and accessories are leading segments, with single-brand stores dominating distribution, though online channels are rapidly gaining traction. The market's dynamism is further supported by the presence of major international luxury houses and the emerging appeal of artisanal Mexican luxury products. Potential economic volatility and currency fluctuations necessitate agile pricing and targeted marketing strategies tailored to the Mexican consumer. The market size is estimated at 3.61 billion in the base year 2025.

Mexico Luxury Goods Market Market Size (In Billion)

The competitive environment is characterized by a blend of established global brands and burgeoning local luxury players. Success hinges on cultivating a robust brand identity and articulating unique value propositions to a discerning consumer base. Market penetration strategies must incorporate Mexican cultural nuances, emphasizing trust-building and personalized customer service. Exclusive experiences, sophisticated digital marketing, and collaborations with local influencers are key avenues for growth. Understanding the distinct needs of various consumer segments, from emerging luxury buyers to established high-net-worth individuals, is vital for market share optimization and sustained expansion. The outlook for Mexico's luxury goods sector is positive, requiring strategic acumen to effectively navigate market complexities.

Mexico Luxury Goods Market Company Market Share

Mexico Luxury Goods Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico luxury goods market, covering market dynamics, industry trends, leading segments, key players, and future growth prospects. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this lucrative market. Expect detailed insights, supported by robust data and analysis, to inform your strategic decisions.

Mexico Luxury Goods Market Market Dynamics & Concentration

The Mexico luxury goods market is characterized by a dynamic interplay of factors influencing its concentration and growth trajectory. Market concentration is currently moderate, with a few key players holding significant market share, but a considerable number of smaller, niche brands also contributing. Innovation plays a vital role, driven by the constant demand for unique designs, high-quality materials, and technological advancements enhancing the luxury experience. The regulatory framework, while largely supportive of economic growth, faces ongoing evolution impacting market access and taxation. Product substitutes, mainly from the premium segment, present a competitive challenge, requiring luxury brands to continuously differentiate their offerings. End-user trends reveal a growing preference for personalized experiences, sustainability, and ethical sourcing – further shaping product development strategies. The number of M&A activities within the last 5 years has averaged xx per year, indicating a consolidation trend within the market. Key players are exploring strategic alliances to broaden their reach and consolidate their position.

- Market Share: LVMH Moet Hennessy Louis Vuitton holds an estimated xx% market share, followed by xx% for Kering and xx% for Richemont.

- M&A Activity: xx deals concluded between 2019 and 2024.

- Innovation Drivers: Technological advancements in materials, manufacturing, and personalized experiences.

- Regulatory Framework: Focus on import/export regulations and taxation policies.

- Product Substitutes: Premium brands offering comparable quality at lower price points.

Mexico Luxury Goods Market Industry Trends & Analysis

The Mexico luxury goods market is witnessing robust growth, projected to reach xx Million by 2033. This expansion is fueled by several key factors. Rising disposable incomes among the affluent population and the burgeoning middle class are driving increased demand. A growing preference for luxury goods as status symbols and a desire for higher-quality products contribute significantly. Technological disruptions are seen in the form of e-commerce expansion and personalized marketing strategies. Consumer preferences are shifting toward sustainable and ethically sourced products, compelling luxury brands to adapt their supply chains. Competitive dynamics are intense, with established brands facing competition from both emerging domestic and international players.

- CAGR (2025-2033): xx%

- Market Penetration: xx% of the affluent population are currently luxury goods consumers.

- Growth Drivers: Rising disposable incomes, increasing demand for luxury, and e-commerce adoption.

- Competitive Dynamics: Intense competition among both established and emerging brands.

Leading Markets & Segments in Mexico Luxury Goods Market

Within the Mexico luxury goods market, the largest segment by type is currently Clothing and Apparel, followed by Watches and Jewelry. These segments benefit from high demand from affluent consumers. The dominance of these segments is attributed to several factors. Strong local fashion traditions contribute to high demand for apparel, while the appreciation for sophisticated timepieces and exquisite jewelry drives sales in these categories. By distribution channel, Single-Brand Stores currently hold the largest share, with their premium positioning enhancing the brand experience. However, Multi-Brand Stores and Online Stores are gaining traction, indicating a trend towards diversification among consumers and increasing accessibility.

- Dominant Segment (By Type): Clothing and Apparel

- Dominant Segment (By Distribution Channel): Single-Brand Stores

- Key Drivers (Economic Policies): Favorable taxation policies, supportive government initiatives for foreign investment.

- Key Drivers (Infrastructure): Development of upscale shopping malls and retail spaces.

Mexico Luxury Goods Market Product Developments

Recent product innovations focus on incorporating sustainable materials, leveraging technology for personalized experiences (e.g., customized jewelry), and integrating digital elements to enhance brand engagement. Brands are also focusing on enhancing customer experiences both online and offline to differentiate and attract more discerning consumers. New product lines are emphasizing versatility and affordability to tap into broader consumer groups, while maintaining the luxury brand's prestigious image.

Key Drivers of Mexico Luxury Goods Market Growth

Several factors are propelling the growth of the Mexico luxury goods market. Rising disposable incomes among the affluent population are a primary driver, fueling increased spending on premium goods. Favorable government policies, including incentives for foreign investment, are creating a supportive environment for luxury brands. The expansion of e-commerce platforms is increasing the accessibility of luxury goods to a wider customer base. The growing influence of social media and celebrity endorsements further enhances the desirability of these products. The emergence of the middle class also contributes to expansion in this market sector.

Challenges in the Mexico Luxury Goods Market Market

The Mexico luxury goods market faces several challenges, including economic volatility which can influence consumer spending. Counterfeit goods represent a significant threat, eroding brand value and market share. Supply chain disruptions, particularly given the global nature of the industry, can lead to delays and increased costs. The competitive landscape, marked by both established and emerging players, creates intense rivalry for market share. Finally, fluctuations in currency exchange rates also impact profitability and pricing strategies.

Emerging Opportunities in Mexico Luxury Goods Market

Significant opportunities exist for long-term growth in the Mexico luxury goods market. The increasing popularity of e-commerce provides a vast opportunity to reach a wider audience and personalize brand experiences. Strategic partnerships with local designers and artisans can create unique and culturally relevant products. Expansion into niche segments, focusing on sustainability or ethical sourcing, taps into growing consumer preferences. Investments in advanced technologies, such as AI-powered customer service, can further enhance the luxury experience.

Leading Players in the Mexico Luxury Goods Market Sector

Key Milestones in Mexico Luxury Goods Market Industry

- October 2020: Hermès launched its first beauty line, Rouge Hermès.

- November 2021: Chanel opened a new store in Malaysia dedicated to shoes (Note: This is outside of Mexico, but included in the provided data).

- February 2022: TOUS launched a new concept store in Kuala Lumpur, Malaysia (Note: This is outside of Mexico, but included in the provided data).

Strategic Outlook for Mexico Luxury Goods Market Market

The Mexico luxury goods market presents substantial long-term growth potential. Continued economic growth, coupled with evolving consumer preferences and technological advancements, will shape the market's future trajectory. Strategic opportunities lie in adapting to the shift towards sustainable and ethical products, personalizing customer experiences, and leveraging digital technologies for increased reach and engagement. Brands that can successfully navigate these trends are poised to capture significant market share and enjoy sustained growth in this lucrative market.

Mexico Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Watches

- 1.5. Jewelry

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-Brand Stores

- 2.2. Multi-Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Mexico Luxury Goods Market Segmentation By Geography

- 1. Mexico

Mexico Luxury Goods Market Regional Market Share

Geographic Coverage of Mexico Luxury Goods Market

Mexico Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sunglasses As A Fashion Statement; Advertisement and Promotional Activities

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Preference for E-commerce Platform to Purchase Luxury Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Watches

- 5.1.5. Jewelry

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-Brand Stores

- 5.2.2. Multi-Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Giorgio Armani S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compagnie Financière Richemont SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hermès

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Swatch Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Patek Philippe SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PRADA S P A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kering

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rolex SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 H & M Hennes & Mauritz AB (H&M)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Estee Lauder Companies

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: Mexico Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Mexico Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: Mexico Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Mexico Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: Mexico Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Luxury Goods Market?

The projected CAGR is approximately 4.32%.

2. Which companies are prominent players in the Mexico Luxury Goods Market?

Key companies in the market include Giorgio Armani S p A, Compagnie Financière Richemont SA, Hermès, The Swatch Group, Patek Philippe SA, PRADA S P A, LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive, Kering, Rolex SA, H & M Hennes & Mauritz AB (H&M), The Estee Lauder Companies.

3. What are the main segments of the Mexico Luxury Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Sunglasses As A Fashion Statement; Advertisement and Promotional Activities.

6. What are the notable trends driving market growth?

Increasing Preference for E-commerce Platform to Purchase Luxury Goods.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In February 2022, TOUS, the Spanish luxury brand launched a new concept store in Kuala Lumpur, Malaysia. The new boutique features a large assortment of key categories including bags, jewelry, gemstones, and perfumes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Mexico Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence