Key Insights

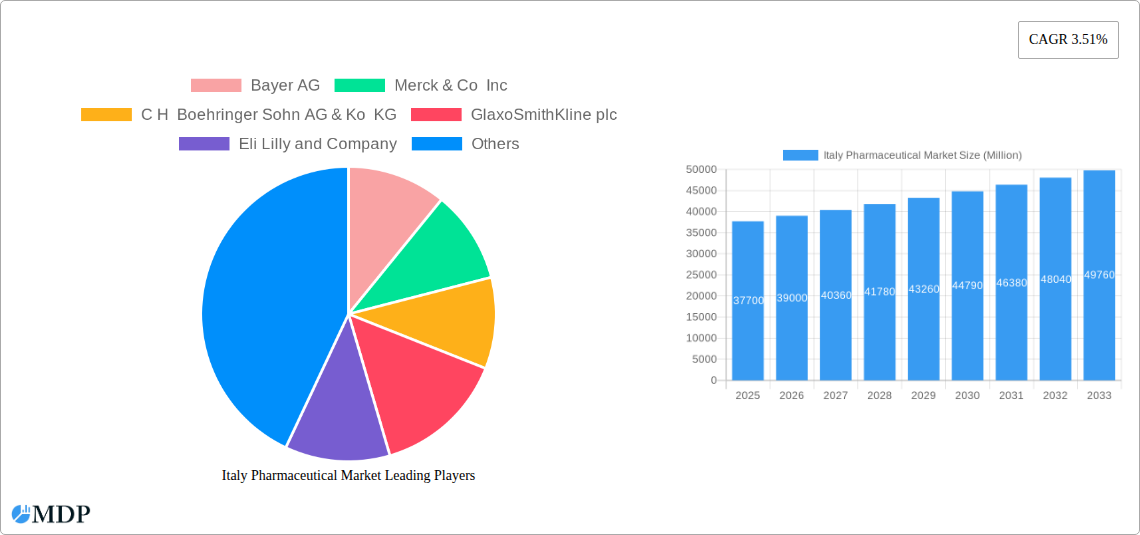

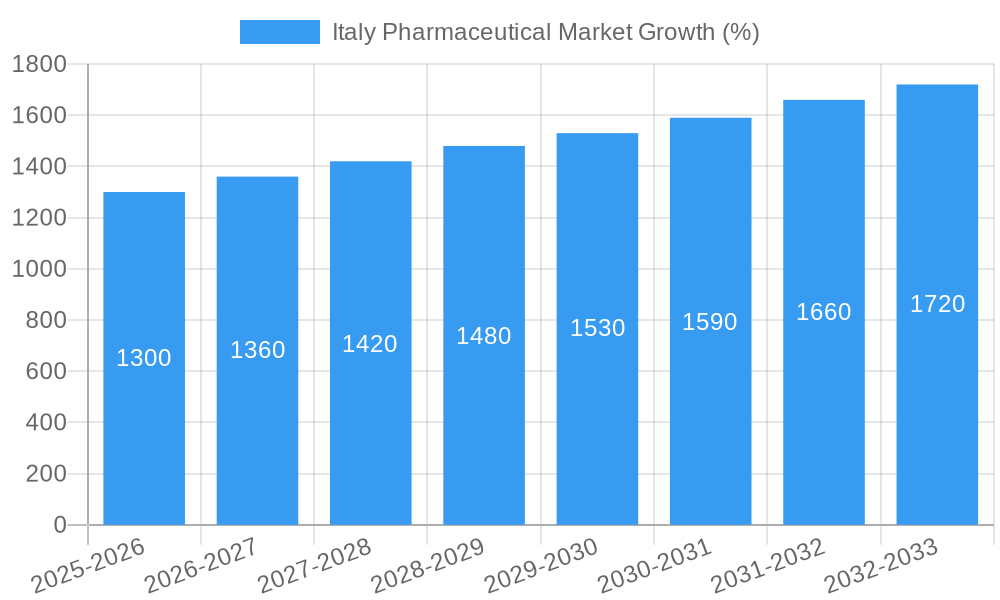

The Italian pharmaceutical market, valued at €37.70 billion in 2025, is projected to experience steady growth, driven by factors such as an aging population, increasing prevalence of chronic diseases (like cardiovascular diseases and diabetes), and rising healthcare expenditure. The market's Compound Annual Growth Rate (CAGR) of 3.51% from 2019 to 2024 suggests a continued upward trajectory through 2033. Significant market segments include cardiovascular, neurological, and gastrointestinal drugs, with both branded and generic medications playing crucial roles. The strong presence of major pharmaceutical companies like Bayer, Merck, and Roche indicates a competitive yet established market. Growth is expected to be further fueled by technological advancements in drug delivery and personalized medicine, leading to the development of innovative therapies. However, challenges remain, including stringent regulatory approvals, pricing pressures from generic competition, and the increasing focus on cost-effectiveness within the Italian healthcare system. These factors will likely influence the pace of market expansion in the coming years.

The segmentation within the Italian pharmaceutical market reveals several key dynamics. The prescription drug segment dominates, reflecting the reliance on physician-led treatment for chronic conditions. However, the over-the-counter (OTC) segment is likely to show growth, driven by self-medication trends and increasing consumer awareness. Furthermore, the ongoing shift towards generic drugs is expected to continue, impacting the market share of branded pharmaceuticals. Regional variations within Italy itself might also influence market dynamics, with larger urban areas potentially showcasing higher consumption rates compared to rural regions. The consistent presence of major global players suggests a highly competitive landscape, with companies continually striving for innovation and market share. Future growth will depend on successful navigation of regulatory hurdles, management of pricing pressures, and adapting to evolving patient needs.

Italy Pharmaceutical Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Italy pharmaceutical market, covering market dynamics, industry trends, leading segments, key players, and future outlook. The report utilizes data from 2019-2024 (historical period), with the base year being 2025 and a forecast period extending to 2033. This report is crucial for pharmaceutical companies, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market size is estimated at xx Million in 2025.

Italy Pharmaceutical Market Market Dynamics & Concentration

The Italian pharmaceutical market is characterized by a moderate level of concentration, with a handful of multinational corporations holding significant market share. Market share data for 2025 suggests that the top five players (Bayer AG, Merck & Co Inc, C H Boehringer Sohn AG & Ko KG, GlaxoSmithKline plc, and Eli Lilly and Company) collectively account for approximately xx% of the total market. Innovation is a key driver, fueled by increasing R&D investment and a focus on developing novel therapies for chronic diseases prevalent in the aging Italian population. The regulatory framework, governed by AIFA (Agenzia Italiana del Farmaco), plays a crucial role in shaping market access and pricing strategies. Generic substitution is a growing force, impacting branded drug sales and driving price competition. End-user trends show an increasing preference for convenient drug delivery systems and personalized medicine. M&A activity remains steady, with approximately xx deals recorded between 2019 and 2024, reflecting consolidation within the industry and a pursuit of strategic expansion.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation Drivers: R&D investment in novel therapies, personalized medicine.

- Regulatory Framework: AIFA's influence on market access and pricing.

- Product Substitutes: Increasing presence of generic drugs.

- End-User Trends: Demand for convenient drug delivery and personalized treatments.

- M&A Activity: Approximately xx deals between 2019 and 2024.

Italy Pharmaceutical Market Industry Trends & Analysis

The Italy pharmaceutical market is projected to witness a CAGR of xx% during the forecast period (2025-2033). Growth is primarily driven by an aging population, increasing prevalence of chronic diseases such as cardiovascular diseases and diabetes, rising healthcare expenditure, and government initiatives to improve healthcare access. Technological disruptions, such as the adoption of telemedicine and digital health solutions, are transforming how healthcare is delivered, creating new market opportunities. Consumer preferences are shifting towards personalized medicine and convenient drug delivery options. The competitive landscape is highly dynamic, with both domestic and multinational players vying for market share. Market penetration of innovative therapies remains relatively high due to favorable regulatory environment and strong patient demand.

Leading Markets & Segments in Italy Pharmaceutical Market

The Italian pharmaceutical market is geographically concentrated, with the northern regions exhibiting higher consumption due to factors like higher income levels and better healthcare infrastructure.

- By ATC/Therapeutic Class: The Cardiovascular System segment dominates, driven by high prevalence of heart disease. The Nervous System and Respiratory System segments also show strong growth due to aging population and prevalence of respiratory illnesses.

- By Drug Type: Branded drugs continue to hold a larger market share than generics, although the generic segment is experiencing substantial growth, fuelled by price advantages and increasing regulatory support.

- By Prescription Type: Prescription drugs (Rx) represent the majority of the market, reflecting the high prevalence of chronic diseases requiring ongoing medication. The OTC segment shows consistent growth driven by self-medication trends.

Key Drivers:

- Economic Policies: Government healthcare spending, pricing regulations.

- Infrastructure: Availability of advanced healthcare facilities.

- Demographics: Aging population, prevalence of chronic diseases.

Italy Pharmaceutical Market Product Developments

Recent product developments focus on targeted therapies, personalized medicine approaches, and improved drug delivery systems. Companies are increasingly investing in innovative technologies like biosimilars and gene therapies to address unmet medical needs. These developments aim to enhance treatment efficacy, improve patient compliance, and establish a competitive advantage in the market. The focus is on addressing prevalent conditions such as cancer, diabetes, and cardiovascular diseases.

Key Drivers of Italy Pharmaceutical Market Growth

Several factors are fueling growth in the Italy pharmaceutical market: the aging population increasing the demand for chronic disease treatments; rising healthcare expenditure reflecting greater investment in healthcare infrastructure and services; technological advancements offering innovative therapies; and supportive regulatory environment fostering innovation and market access.

Challenges in the Italy Pharmaceutical Market Market

The market faces challenges including stringent regulatory approvals creating hurdles for new drug launches; supply chain complexities increasing production and distribution costs; and intense competition among pharmaceutical companies. These factors can impact market entry, pricing strategies, and overall profitability. Price controls imposed by the government can also limit profitability.

Emerging Opportunities in Italy Pharmaceutical Market

Strategic partnerships between pharmaceutical companies and technology providers are emerging as significant opportunities. Advancements in digital health and telemedicine offer opportunities for improved patient access, monitoring, and treatment outcomes. Expansion into niche therapeutic areas and focusing on personalized medicine are also significant growth opportunities.

Leading Players in the Italy Pharmaceutical Market Sector

- Bayer AG

- Merck & Co Inc

- C H Boehringer Sohn AG & Ko KG

- GlaxoSmithKline plc

- Eli Lilly and Company

- F Hoffmann-La Roche AG

- AstraZeneca plc

- AbbVie Inc

- Bristol Myers Squibb Company

- Sanofi S A

Key Milestones in Italy Pharmaceutical Market Industry

- August 2021: Cadila Healthcare partners with CHEMI SpA to launch a generic drug for Deep Vein Thrombosis in the US market (indirect impact on the Italian market through potential future collaborations).

- April 2020: Primex Pharmaceuticals launches OZASED in Italy through TheSi Farma, expanding access to pediatric anesthesia medications.

Strategic Outlook for Italy Pharmaceutical Market Market

The Italy pharmaceutical market holds significant long-term growth potential driven by an aging population, increasing healthcare spending, and a favorable regulatory landscape. Strategic investments in innovation, digital health, and strategic partnerships are essential for success in this competitive market. Focusing on personalized medicine and addressing unmet medical needs will be key differentiators for market leaders.

Italy Pharmaceutical Market Segmentation

-

1. ATC/Therapeutic Class

- 1.1. Blood and Hematopoietic Organs

- 1.2. Cardiovascular System

- 1.3. Dermatological

- 1.4. Gastrointestinal System and Metabolism

- 1.5. Nervous System

- 1.6. Respiratory System

- 1.7. Others

-

2. Drug Type

- 2.1. Branded

- 2.2. Generic

-

3. Prescription Type

- 3.1. Prescription Drugs (Rx)

- 3.2. OTC Drugs

Italy Pharmaceutical Market Segmentation By Geography

- 1. Italy

Italy Pharmaceutical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising R&D Expenditure; Rising Incidence of Chronic Disease

- 3.3. Market Restrains

- 3.3.1. High Cost of Drugs

- 3.4. Market Trends

- 3.4.1. Prescription Drugs segment Holds the Largest Share and Expected to do Same in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Pharmaceutical Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 5.1.1. Blood and Hematopoietic Organs

- 5.1.2. Cardiovascular System

- 5.1.3. Dermatological

- 5.1.4. Gastrointestinal System and Metabolism

- 5.1.5. Nervous System

- 5.1.6. Respiratory System

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. Branded

- 5.2.2. Generic

- 5.3. Market Analysis, Insights and Forecast - by Prescription Type

- 5.3.1. Prescription Drugs (Rx)

- 5.3.2. OTC Drugs

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bayer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Merck & Co Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 C H Boehringer Sohn AG & Ko KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GlaxoSmithKline plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly and Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 F Hoffmann-La Roche AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AstraZeneca plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AbbVie Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bristol Myers Squibb Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sanofi S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bayer AG

List of Figures

- Figure 1: Italy Pharmaceutical Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Pharmaceutical Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Pharmaceutical Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Pharmaceutical Market Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 3: Italy Pharmaceutical Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 4: Italy Pharmaceutical Market Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 5: Italy Pharmaceutical Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Italy Pharmaceutical Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Italy Pharmaceutical Market Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 8: Italy Pharmaceutical Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 9: Italy Pharmaceutical Market Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 10: Italy Pharmaceutical Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Pharmaceutical Market?

The projected CAGR is approximately 3.51%.

2. Which companies are prominent players in the Italy Pharmaceutical Market?

Key companies in the market include Bayer AG, Merck & Co Inc, C H Boehringer Sohn AG & Ko KG, GlaxoSmithKline plc, Eli Lilly and Company, F Hoffmann-La Roche AG, AstraZeneca plc, AbbVie Inc, Bristol Myers Squibb Company, Sanofi S A.

3. What are the main segments of the Italy Pharmaceutical Market?

The market segments include ATC/Therapeutic Class, Drug Type, Prescription Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising R&D Expenditure; Rising Incidence of Chronic Disease.

6. What are the notable trends driving market growth?

Prescription Drugs segment Holds the Largest Share and Expected to do Same in the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Drugs.

8. Can you provide examples of recent developments in the market?

In August 2021, Cadila Healthcare entered into a partnership with Italian firm CHEMI SpA to launch a generic drug used in the treatment of Deep Vein Thrombosis, in the United States market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Pharmaceutical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Pharmaceutical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Pharmaceutical Market?

To stay informed about further developments, trends, and reports in the Italy Pharmaceutical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence