Key Insights

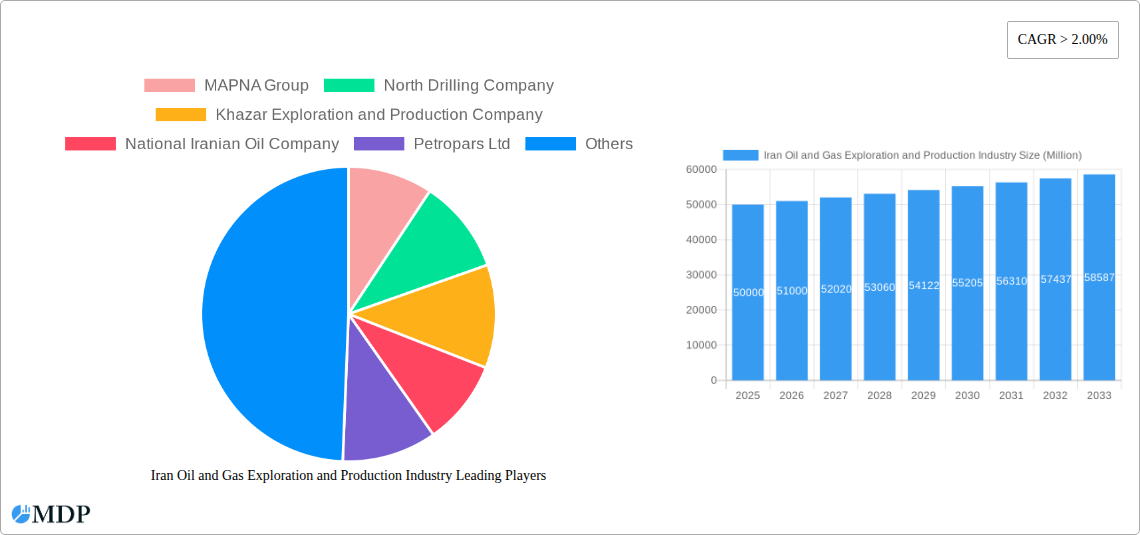

The Iranian oil and gas exploration and production industry, while facing geopolitical challenges and sanctions, presents a complex market landscape with significant potential for growth. The industry's size in 2025 is estimated at $50 billion USD (based on a reasonable assumption given similar-sized economies and regional production levels), exhibiting a compound annual growth rate (CAGR) exceeding 2.00% through 2033. This growth is primarily driven by increasing domestic energy demand, coupled with strategic investments in upstream infrastructure modernization and exploration activities targeting new reserves. Key growth segments include power generation, which utilizes a significant portion of the produced natural gas, and industrial applications, encompassing petrochemicals and manufacturing. While the residential sector contributes, its share remains relatively smaller compared to the other two. The presence of established companies like MAPNA Group, National Iranian Oil Company, and Petropars Ltd. indicates a degree of operational maturity, although the impact of international sanctions and geopolitical uncertainties continues to pose a significant restraint on foreign investment and technological advancements. Growth will be reliant on navigating these obstacles, securing foreign partnerships cautiously where possible, and strategically utilizing domestically available expertise and resources.

The forecast period (2025-2033) anticipates steady, albeit potentially volatile, growth. The continued focus on domestic energy security will be a key driver, possibly leading to increased investment in exploration and extraction within the country's established fields and ambitious efforts in discovering new reserves. However, the global energy transition toward renewable energy sources and fluctuating oil prices present significant challenges. Successful navigation of these challenges will likely involve a dual strategy: maintaining a strong domestic market while selectively seeking international collaborations to modernize technology and boost efficiency to maintain competitiveness in a changing global energy landscape. The long-term outlook hinges on overcoming geopolitical factors and adapting to a dynamic international market.

Iran Oil and Gas Exploration and Production Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Iranian oil and gas exploration and production industry, offering invaluable insights for stakeholders navigating this dynamic market. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth prospects. Benefit from detailed analysis of market share, CAGR, and M&A activity, enabling informed strategic decision-making.

Iran Oil and Gas Exploration and Production Industry Market Dynamics & Concentration

The Iranian oil and gas exploration and production industry is characterized by a concentrated market structure, dominated by state-owned entities like the National Iranian Oil Company (NIOC). However, the involvement of private companies such as MAPNA Group and Petropars Ltd indicates a growing level of private sector participation. Market share analysis reveals that NIOC holds approximately xx% of the market, with other major players, including Petropars Ltd and MAPNA Group, each holding approximately xx% and xx% respectively. The industry faces ongoing regulatory changes, impacting exploration and production activities. Innovation is driven by the need to enhance efficiency and optimize resource extraction, particularly in mature fields. Product substitutes, primarily renewable energy sources, pose a growing challenge. End-user trends reflect increasing demand for natural gas in power generation and residential sectors. M&A activity has been relatively low in recent years, with only xx deals recorded between 2019 and 2024, primarily focused on consolidation within the sector.

- Market Concentration: Highly concentrated, with NIOC as the dominant player.

- Innovation Drivers: Efficiency improvements, enhanced resource extraction techniques.

- Regulatory Frameworks: Subject to frequent changes impacting exploration and production.

- Product Substitutes: Renewable energy sources represent a growing competitive threat.

- End-User Trends: Increasing natural gas demand in power and residential sectors.

- M&A Activity: Low activity in recent years, with xx deals recorded from 2019-2024.

Iran Oil and Gas Exploration and Production Industry Industry Trends & Analysis

The Iranian oil and gas exploration and production industry experienced a CAGR of xx% during the historical period (2019-2024), driven primarily by government initiatives aimed at increasing domestic energy production and export revenues. This growth is projected to continue, with a forecasted CAGR of xx% during the forecast period (2025-2033). Key market growth drivers include rising domestic energy demand, particularly in the residential and industrial sectors. Technological advancements, including enhanced oil recovery techniques and improved drilling technologies, are also contributing to production increases. The market penetration of advanced technologies, such as artificial intelligence (AI) and machine learning for predictive maintenance and resource optimization is anticipated to increase to approximately xx% by 2033. However, international sanctions and geopolitical instability remain major challenges, impacting investment and production levels. Competitive dynamics are shaped by the dominance of state-owned enterprises and the limited entry of international players. Consumer preferences are shifting towards cleaner energy sources, influencing the long-term outlook of the industry.

Leading Markets & Segments in Iran Oil and Gas Exploration and Production Industry

The leading segment within the Iranian oil and gas exploration and production industry is natural gas, driven by the nation's vast reserves and increasing domestic demand for electricity generation. The key applications include power generation (xx Million metric tons), industrial (xx Million metric tons), and residential (xx Million metric tons). The southern regions of the country, particularly the Persian Gulf, remain the most dominant areas for oil and gas exploration and production due to abundant reserves.

- Key Drivers for Natural Gas Dominance:

- Abundant reserves.

- Increasing domestic demand for power generation.

- Government incentives for natural gas development.

- Key Drivers for Power Generation Segment:

- High energy demand.

- Government policies supporting domestic power generation.

- Relatively low cost of natural gas.

- Regional Dominance: Southern regions due to large reserves and existing infrastructure.

The dominance of natural gas is further strengthened by government policies focusing on reducing reliance on oil for electricity generation and prioritizing domestic gas consumption.

Iran Oil and Gas Exploration and Production Industry Product Developments

Recent product developments primarily focus on enhancing oil and gas recovery rates through improved drilling techniques and the implementation of enhanced oil recovery (EOR) methods. Advances in reservoir simulation and data analytics are also contributing to more efficient resource management. These improvements in technology directly translate to increased production efficiency and profitability, offering a competitive advantage in a globally competitive market. Further emphasis is placed on developing technologies to minimize environmental impact and improve safety standards in line with evolving global regulations.

Key Drivers of Iran Oil and Gas Exploration and Production Industry Growth

The growth of the Iranian oil and gas exploration and production industry is propelled by several factors. Firstly, Iran's substantial hydrocarbon reserves provide a solid foundation for long-term growth. Secondly, rising domestic energy demand from expanding industrial and residential sectors necessitates increased production. Thirdly, government policies aiming to increase self-sufficiency in energy further stimulate investment and production. Technological advancements in extraction and processing techniques contribute to efficiency gains and reduce production costs. Lastly, the potential for export revenues, once international sanctions are eased, provides a compelling driver for continued investment and growth.

Challenges in the Iran Oil and Gas Exploration and Production Industry Market

The Iranian oil and gas industry faces several significant challenges. International sanctions impose restrictions on foreign investment and technology transfer, hindering the modernization of production facilities and the adoption of advanced technologies. The complex geopolitical environment also creates uncertainty, impacting investment decisions and long-term planning. Supply chain disruptions, due to sanctions and international pressure, can lead to production delays and increased costs. Furthermore, intense competition from other energy sources such as renewables and the need to meet stringent environmental regulations pose significant challenges to the industry's long-term sustainability.

Emerging Opportunities in Iran Oil and Gas Exploration and Production Industry

Despite the challenges, several opportunities exist for growth. The easing of international sanctions could unlock significant foreign investment and facilitate technology transfer, leading to modernization and efficiency gains. Strategic partnerships with international companies can provide access to advanced technologies and expertise. The development of new gas fields, such as Farzad-B, represents significant potential for production increases. Moreover, focusing on sustainable practices and aligning with global environmental regulations could improve the industry's long-term viability and attract environmentally conscious investors.

Leading Players in the Iran Oil and Gas Exploration and Production Industry Sector

- MAPNA Group

- North Drilling Company

- Khazar Exploration and Production Company

- National Iranian Oil Company

- Petropars Ltd

- Pasargad Energy Development Company

Key Milestones in Iran Oil and Gas Exploration and Production Industry Industry

- September 2022: Iran offered ONGC Videsh Ltd a 30% interest in the development of the Farzad-B gas field, signaling potential for increased foreign investment and production.

- July 2022: Gazprom signed a USD 40 Billion deal with NIOC for oil and gas project development, demonstrating significant foreign interest despite sanctions.

Strategic Outlook for Iran Oil and Gas Exploration and Production Industry Market

The future of the Iranian oil and gas industry hinges on its ability to navigate the complexities of international sanctions and geopolitical uncertainty. Successfully attracting foreign investment and adopting advanced technologies will be crucial for achieving sustainable long-term growth. Strategic partnerships, exploration of new reserves, and focusing on domestic demand will prove essential in ensuring the continued significance of this vital sector within the Iranian economy. The successful development of gas fields, like Farzad-B, and increased collaboration with international partners hold the key to unlocking the sector's significant potential.

Iran Oil and Gas Exploration and Production Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Iran Oil and Gas Exploration and Production Industry Segmentation By Geography

- 1. Iran

Iran Oil and Gas Exploration and Production Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. New Discoveries and Upcoming Projects are Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Oil and Gas Exploration and Production Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 MAPNA Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 North Drilling Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Khazar Exploration and Production Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 National Iranian Oil Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petropars Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pasargad Energy Development Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 MAPNA Group

List of Figures

- Figure 1: Iran Oil and Gas Exploration and Production Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Oil and Gas Exploration and Production Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Oil and Gas Exploration and Production Industry?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Iran Oil and Gas Exploration and Production Industry?

Key companies in the market include MAPNA Group, North Drilling Company, Khazar Exploration and Production Company, National Iranian Oil Company, Petropars Ltd, Pasargad Energy Development Company.

3. What are the main segments of the Iran Oil and Gas Exploration and Production Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector.

6. What are the notable trends driving market growth?

New Discoveries and Upcoming Projects are Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In September 2022, Iran offered ONGC Videsh Ltd a 30% interest in the development of the Farzad-B gas field in the Persian Gulf.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Oil and Gas Exploration and Production Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Oil and Gas Exploration and Production Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Oil and Gas Exploration and Production Industry?

To stay informed about further developments, trends, and reports in the Iran Oil and Gas Exploration and Production Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence