Key Insights

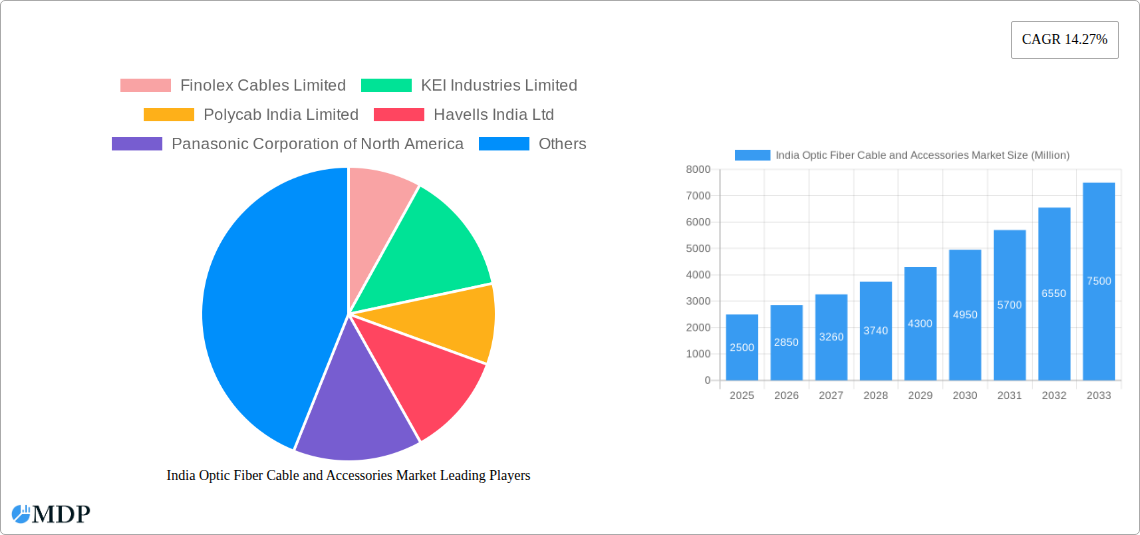

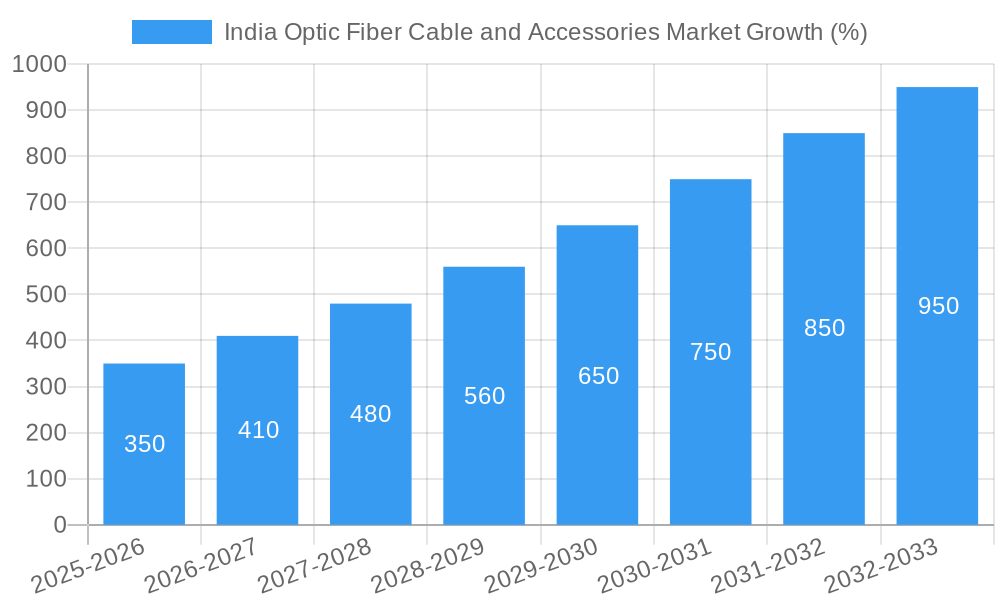

The India Optic Fiber Cable and Accessories Market is experiencing robust growth, fueled by the government's ambitious digital India initiative, expanding 5G network infrastructure, and rising broadband penetration. The market, valued at approximately ₹XX million in 2025 (assuming a reasonable market size based on global trends and the provided CAGR), is projected to witness a Compound Annual Growth Rate (CAGR) of 14.27% from 2025 to 2033. This expansion is driven by increasing demand for high-speed internet connectivity across residential, commercial, and industrial sectors. Furthermore, the growth of cloud computing and data centers necessitates extensive fiber optic cable infrastructure, contributing significantly to market expansion. Key players like Finolex Cables, KEI Industries, Polycab India, and Havells are strategically investing in capacity expansion and technological advancements to capitalize on this burgeoning market. Government initiatives promoting digitalization and infrastructure development further bolster the industry's positive outlook.

However, challenges remain. High initial investment costs for fiber optic infrastructure deployment and the potential for competition from alternative technologies could act as restraints. Nevertheless, the long-term prospects for the India Optic Fiber Cable and Accessories Market remain promising, driven by consistent growth in data consumption, the expansion of smart cities, and the government's continued focus on enhancing digital infrastructure. Market segmentation by type (single-mode, multi-mode), application (telecommunications, broadband, data centers), and region will reveal further insights into specific growth drivers and market dynamics. The increasing adoption of Fiber to the Home (FTTH) technology presents a significant opportunity for market expansion within the residential sector.

India Optic Fiber Cable and Accessories Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Optic Fiber Cable and Accessories Market, offering valuable insights for industry stakeholders, investors, and strategic planners. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and growth opportunities. The report covers market dynamics, leading players, technological advancements, and key challenges, providing a complete picture of this rapidly evolving sector. Expect detailed analysis of market segments, regional performance, and strategic recommendations for sustained success. Market values are expressed in Millions (USD).

India Optic Fiber Cable and Accessories Market Market Dynamics & Concentration

The Indian Optic Fiber Cable and Accessories market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is moderate, with a few major players holding significant market share, but a considerable number of smaller players also contributing significantly. Finolex Cables, KEI Industries, and Polycab India are among the key players, consistently investing in capacity expansion and technological innovation to maintain their competitive edge. The market is driven by technological advancements, particularly the adoption of high-density fiber optic cables like STL's 864F Micro Cable, which offer superior bandwidth and efficiency. Government initiatives like the BharatNet project are significant catalysts, driving substantial demand for fiber optic infrastructure. Regulatory frameworks play a vital role, shaping market access and competition. While the presence of substitute technologies is minimal, ongoing innovation continues to refine the existing technologies further. End-user trends demonstrate a strong preference for high-speed internet connectivity, pushing the demand for advanced fiber optic solutions. Furthermore, M&A activities have been relatively modest in recent years, with an estimated xx number of deals recorded between 2019 and 2024, representing a xx% change compared to the previous period. This indicates a market focused on organic growth rather than significant consolidation.

- Key Players: Finolex Cables Limited, KEI Industries Limited, Polycab India Limited, Havells India Ltd, Panasonic Corporation of North America, Sterlite Technologies Limited (STL Tech), Birla Cable Limited, Vindhya Telelinks Ltd, HFCL Limited, Aksh Optifibre Limited.

- Market Share: The top 5 players collectively hold an estimated xx% market share.

- M&A Activity: xx deals recorded between 2019 and 2024.

India Optic Fiber Cable and Accessories Market Industry Trends & Analysis

The Indian Optic Fiber Cable and Accessories market has experienced robust growth over the historical period (2019-2024), registering a Compound Annual Growth Rate (CAGR) of xx%. This growth trajectory is projected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace, with a projected CAGR of xx%. Several key factors propel this market expansion. The increasing penetration of high-speed internet and data consumption, driven by the expansion of 5G networks and rising smartphone usage, forms a crucial foundation for market expansion. The government’s push for digitalization and initiatives like BharatNet, aimed at providing nationwide broadband connectivity, significantly stimulate demand. Technological advancements leading to more efficient and cost-effective fiber optic cable production methods continue to support market growth. While competition remains intense, the market showcases a relatively high level of market penetration within urban areas, while rural penetration remains a significant growth opportunity. The evolving consumer preferences towards seamless connectivity and reliable internet access further reinforce the demand for advanced fiber optic solutions.

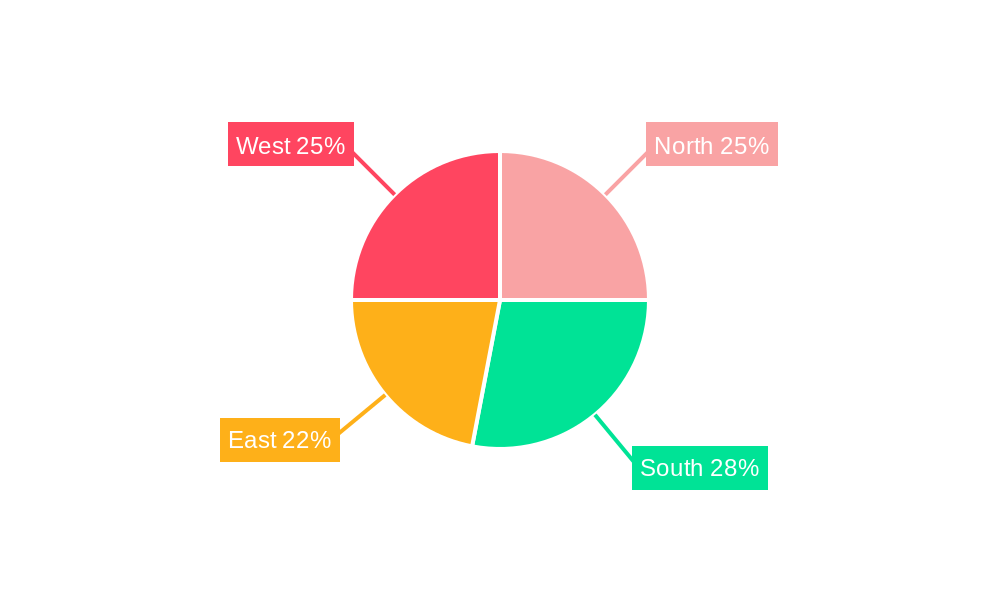

Leading Markets & Segments in India Optic Fiber Cable and Accessories Market

The Indian Optic Fiber Cable and Accessories market showcases significant regional disparities in growth and market share. Urban areas, especially in major metropolitan cities, dominate the market due to high population density, extensive network infrastructure, and increased digital adoption. Rural areas, though presenting significant untapped potential, lag due to infrastructure limitations and lower internet penetration. However, governmental initiatives aimed at bridging this digital divide promise significant future growth in rural markets.

- Key Drivers for Urban Dominance:

- Advanced infrastructure

- High internet penetration

- Concentrated population

- High disposable income

- Key Drivers for Rural Growth Potential:

- Government initiatives (BharatNet)

- Increasing mobile penetration

- Expanding telecom infrastructure

India Optic Fiber Cable and Accessories Market Product Developments

Recent product developments focus on enhancing cable density, improving transmission speed, and reducing costs. The introduction of high-density micro-cables, like STL's 864F, signifies a crucial step towards creating more efficient and compact fiber networks. This trend reflects the industry's ongoing focus on providing solutions that meet the increasing demand for higher bandwidth and faster data transmission. The market is also seeing the development of more robust and environmentally friendly materials, catering to the growing sustainability concerns. These advancements are crucial in expanding the reach and affordability of high-speed internet access across the country.

Key Drivers of India Optic Fiber Cable and Accessories Market Growth

The growth of the Indian Optic Fiber Cable and Accessories market is driven by a confluence of factors. Firstly, the government’s strong push for digital India and the BharatNet project is substantially increasing demand for optic fiber infrastructure. Secondly, the rapid expansion of 5G networks and the rising demand for high-speed internet access are key catalysts. Thirdly, the growth in data consumption and the increasing adoption of cloud-based services are further stimulating the market. Finally, continuous technological advancements resulting in improved cable performance and lower production costs are contributing to its expansion.

Challenges in the India Optic Fiber Cable and Accessories Market Market

The market faces challenges such as the complexities involved in laying fiber optic cables in diverse terrains, particularly in rural areas, which impacts project timelines and costs. The high initial investment required for infrastructure deployment presents a significant hurdle for smaller players and can potentially limit market expansion. Furthermore, competition amongst established players and the entry of new companies puts pressure on pricing and profit margins. Supply chain disruptions, especially concerning raw materials, can also impact production and delivery timelines.

Emerging Opportunities in India Optic Fiber Cable and Accessories Market

The market presents significant opportunities for growth fueled by the ongoing expansion of 5G networks and the increasing adoption of smart cities initiatives. Strategic partnerships between cable manufacturers and telecom providers can help to unlock new growth avenues. Moreover, the increasing emphasis on rural broadband penetration, particularly under the BharatNet project, creates substantial market potential for companies that can offer affordable and reliable solutions. Investing in research and development to enhance cable efficiency and durability will also be crucial in gaining a competitive edge.

Leading Players in the India Optic Fiber Cable and Accessories Market Sector

- Finolex Cables Limited

- KEI Industries Limited

- Polycab India Limited

- Havells India Ltd

- Panasonic Corporation of North America

- Sterlite Technologies Limited (STL Tech)

- Birla Cable Limited

- Vindhya Telelinks Ltd

- HFCL Limited

- Aksh Optifibre Limited

Key Milestones in India Optic Fiber Cable and Accessories Market Industry

- May 2024: Runaya aims to double its capacity and reach INR 500 crore (~USD 60 million) in revenue within 3-4 years, driven by 5G rollout, tower fiberization, home broadband, and BharatNet. Significant investment in FRP rod manufacturing since 2019.

- July 2024: STL launches its 864F Micro Cables, offering 1.5x the fiber capacity of standard micro-cables, enhancing connectivity for compact fiber networks.

Strategic Outlook for India Optic Fiber Cable and Accessories Market Market

The future of the Indian Optic Fiber Cable and Accessories market is bright, with substantial growth potential driven by ongoing digitalization efforts and the expansion of high-speed internet access. Companies that invest in innovative products, strategic partnerships, and efficient supply chains will be well-positioned to capitalize on this growth. Focusing on the underserved rural markets and expanding the reach of affordable broadband connectivity will be key to unlocking long-term value. The ongoing evolution of 5G technology and the increasing adoption of smart city solutions present significant opportunities for sustained market expansion.

India Optic Fiber Cable and Accessories Market Segmentation

-

1. Offering

- 1.1. Optical Fiber Cables

- 1.2. Optical Fiber Connectors

- 1.3. Optical Fiber Accessories

-

2. End-user Vertical

- 2.1. Industrial

- 2.2. Telecommunication

- 2.3. Energy and Utilities

- 2.4. Other End-user Verticals

India Optic Fiber Cable and Accessories Market Segmentation By Geography

- 1. India

India Optic Fiber Cable and Accessories Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.27% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT

- 3.3. Market Restrains

- 3.3.1. Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT

- 3.4. Market Trends

- 3.4.1. Rising Internet Penetration and 5G Deployment to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Optic Fiber Cable and Accessories Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Optical Fiber Cables

- 5.1.2. Optical Fiber Connectors

- 5.1.3. Optical Fiber Accessories

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Industrial

- 5.2.2. Telecommunication

- 5.2.3. Energy and Utilities

- 5.2.4. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Finolex Cables Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KEI Industries Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Polycab India Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Havells India Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic Corporation of North America

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sterlite Technologies Limited (STL Tech)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Birla Cable Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vindhya Telelinks Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 HFCL Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aksh Optifibre Limite

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Finolex Cables Limited

List of Figures

- Figure 1: India Optic Fiber Cable and Accessories Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Optic Fiber Cable and Accessories Market Share (%) by Company 2024

List of Tables

- Table 1: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 6: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 7: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Optic Fiber Cable and Accessories Market?

The projected CAGR is approximately 14.27%.

2. Which companies are prominent players in the India Optic Fiber Cable and Accessories Market?

Key companies in the market include Finolex Cables Limited, KEI Industries Limited, Polycab India Limited, Havells India Ltd, Panasonic Corporation of North America, Sterlite Technologies Limited (STL Tech), Birla Cable Limited, Vindhya Telelinks Ltd, HFCL Limited, Aksh Optifibre Limite.

3. What are the main segments of the India Optic Fiber Cable and Accessories Market?

The market segments include Offering , End-user Vertical .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT.

6. What are the notable trends driving market growth?

Rising Internet Penetration and 5G Deployment to Drive the Market.

7. Are there any restraints impacting market growth?

Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT.

8. Can you provide examples of recent developments in the market?

May 2024 - Runaya, a manufacturer of optical fiber cable components, aimed to double its capacity and scale its revenues to INR 500 crore (~USD 60 million) within the next 3-4 years. This ambition is driven by the accelerated rollout of 5G, the fiberization of towers, the push for home broadband connectivity, and the government's Bharatnet Project. Since 2019, the company has channeled a capital expenditure of INR 60 crore (~USD 7 million) into manufacturing FRP (fiber-reinforced polymer) rods, essential for optical fibers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Optic Fiber Cable and Accessories Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Optic Fiber Cable and Accessories Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Optic Fiber Cable and Accessories Market?

To stay informed about further developments, trends, and reports in the India Optic Fiber Cable and Accessories Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence