Key Insights

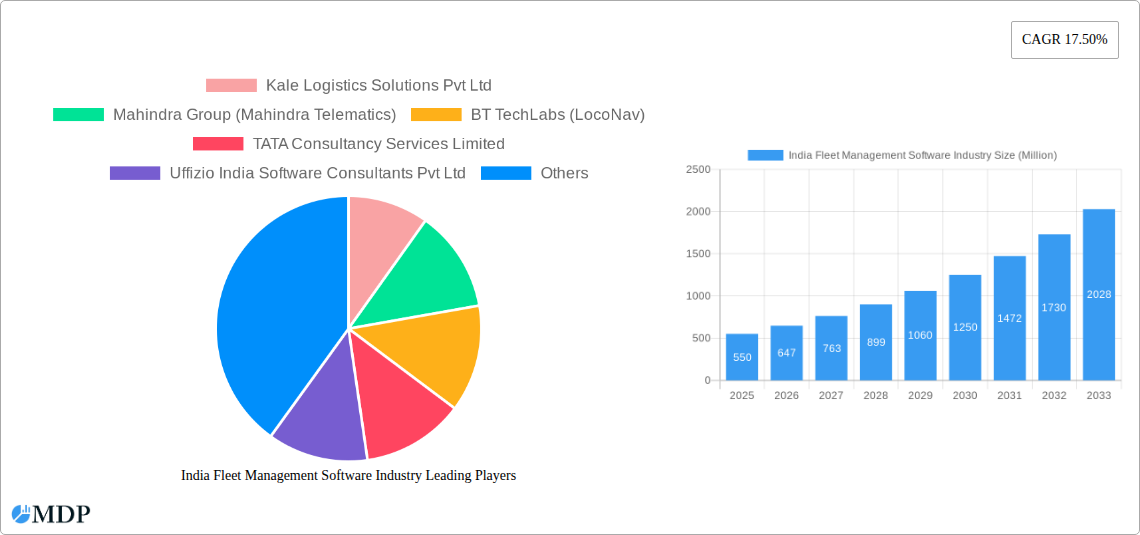

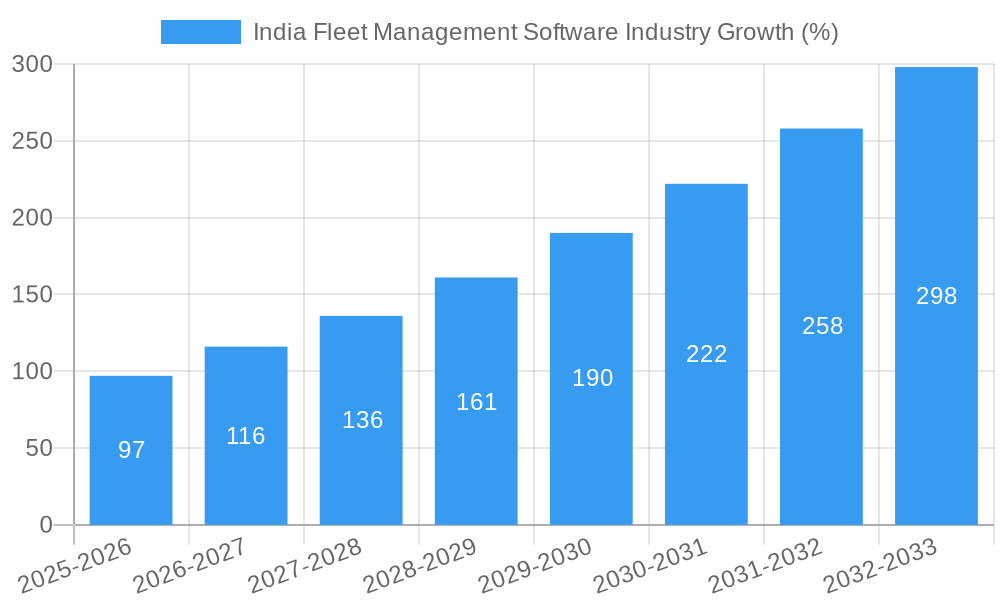

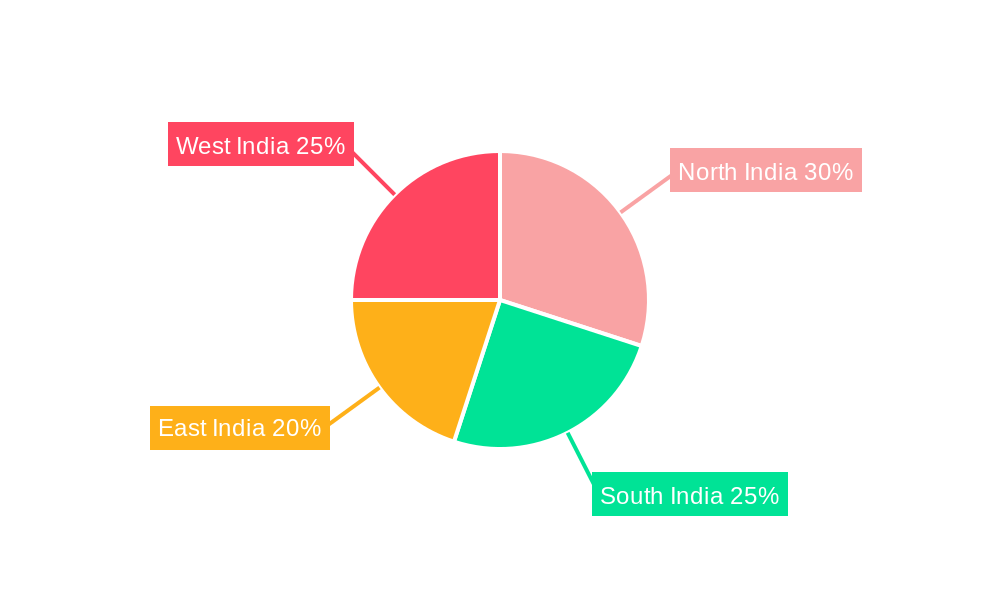

The Indian fleet management software market is experiencing robust growth, driven by increasing adoption of technology across logistics, manufacturing, and other sectors. The market's Compound Annual Growth Rate (CAGR) of 17.50% from 2019 to 2024 suggests a significant expansion, projected to continue through 2033. This growth is fueled by several key factors: the rising need for enhanced operational efficiency, improved fuel consumption monitoring, real-time vehicle tracking for security and safety, and stringent government regulations promoting digitalization in transportation. The shift towards cloud-based solutions offers scalability and cost-effectiveness, further accelerating market expansion. While initial investment costs and integration complexities can pose challenges, the long-term benefits of reduced operational expenses and improved fleet management outweigh these hurdles. The market is segmented by deployment (on-premise and cloud) and end-user (logistics, manufacturing, and others, including corporate and educational institutions). The dominance of the logistics sector in fleet management software adoption is expected to remain strong, while manufacturing and other sectors show promising growth potential. Key players like Kale Logistics Solutions, Mahindra Telematics, and LocoNav are driving innovation and competition within the market, contributing to its dynamic growth trajectory. Regional variations exist, with growth likely to be strongest in areas with high logistics activity and technological advancements, which could disproportionately favor specific regions, like North and West India.

Considering the provided CAGR of 17.50% from 2019-2024 and the base year of 2025, we can reasonably estimate the market size. Assuming a market size of approximately ₹500 million (or equivalent USD value) in 2024, the market size in 2025 would be slightly higher. The continued high CAGR suggests substantial future growth. Specific regional market shares within India can be extrapolated based on historical data of logistics and manufacturing concentrations and the expected rate of digital adoption in these regions, although further research would be needed for precise figures.

India Fleet Management Software Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India Fleet Management Software Industry, projecting robust growth from 2025 to 2033. It offers invaluable insights for stakeholders, investors, and industry professionals seeking to understand market dynamics, leading players, and future opportunities within this rapidly evolving sector. The report covers key market segments, technological advancements, and competitive landscapes, providing actionable intelligence for strategic decision-making. The total market value is expected to reach xx Million by 2033.

India Fleet Management Software Industry Market Dynamics & Concentration

The Indian fleet management software market is experiencing significant growth, driven by increasing adoption of digital technologies across various sectors. Market concentration is moderately high, with a few major players holding substantial market share, but numerous smaller companies also contribute significantly. The market is characterized by intense competition, fueled by continuous innovation and a focus on providing specialized solutions for diverse end-user needs.

Market Concentration: The top 5 players account for approximately xx% of the market share in 2025. This signifies a relatively concentrated market, although fragmentation remains significant.

Innovation Drivers: The key drivers of innovation include the integration of AI, IoT, and big data analytics to enhance fleet optimization, predictive maintenance, and fuel efficiency.

Regulatory Frameworks: Government regulations promoting digitalization and efficient logistics are stimulating market growth. However, data privacy regulations and cybersecurity concerns present challenges.

Product Substitutes: Traditional methods of fleet management, such as manual tracking and paper-based systems, remain in use in some segments, although their market share is gradually decreasing.

End-User Trends: The logistics and manufacturing sectors are the largest end-users, driving substantial demand for fleet management software. Increasing adoption across other sectors, such as corporate transportation and education, presents significant expansion opportunities.

M&A Activities: The industry has witnessed xx M&A deals between 2019 and 2024, indicating a trend towards consolidation and expansion. Larger players are acquiring smaller companies to enhance their product portfolios and market reach.

India Fleet Management Software Industry Industry Trends & Analysis

The Indian fleet management software market is projected to register a CAGR of xx% during the forecast period (2025-2033), driven by several key factors. The increasing adoption of cloud-based solutions is reducing upfront investment costs and improving accessibility. The integration of AI and machine learning is enhancing functionalities, such as predictive maintenance and route optimization. Government initiatives promoting digitalization and efficient logistics further stimulate market expansion. Consumer preferences are shifting towards user-friendly interfaces, real-time tracking capabilities, and integrated reporting functionalities. Competitive dynamics are characterized by strategic partnerships, product innovation, and price competition. Market penetration is estimated at xx% in 2025, projected to increase to xx% by 2033.

Leading Markets & Segments in India Fleet Management Software Industry

The cloud-based segment dominates the India Fleet Management Software Industry, owing to its scalability, cost-effectiveness, and enhanced accessibility. The logistics sector constitutes the largest end-user segment, fueled by the need for efficient supply chain management and cost optimization.

Key Drivers for Cloud Deployment:

- Reduced capital expenditure.

- Scalability and flexibility to meet fluctuating demand.

- Improved accessibility via remote access capabilities.

- Enhanced data security and backup features.

Key Drivers for Logistics Sector:

- Growing e-commerce industry and demand for timely deliveries.

- Stringent regulations regarding delivery timelines and efficiency.

- Need for real-time visibility and tracking of goods.

- Pressure to minimize operational costs and improve profitability.

The dominance of the cloud segment and logistics sector is expected to continue throughout the forecast period, driven by ongoing technological advancements and increasing industry demand. Other end-user segments such as manufacturing, corporate transportation, and education are demonstrating significant growth potential.

India Fleet Management Software Industry Product Developments

Recent product developments focus on AI-powered predictive maintenance, real-time location tracking with advanced mapping features, and integration with other business software. This trend enhances operational efficiency, reduces downtime, and improves overall fleet management. The market is seeing increased focus on user-friendly interfaces, tailored dashboards, and reporting capabilities for effective data analysis. These features align with market demands for increased transparency and control over fleet operations.

Key Drivers of India Fleet Management Software Industry Growth

The growth of the India Fleet Management Software Industry is driven by several factors:

- Technological advancements: AI, IoT, and big data analytics are enhancing fleet efficiency, optimization, and predictive maintenance.

- Government initiatives: Policies promoting digitalization and efficient logistics are incentivizing adoption of fleet management software.

- Economic growth: The expanding economy and increased industrial activity fuel demand for robust fleet management solutions.

- Rising fuel costs: The need for fuel efficiency and cost optimization is driving the adoption of software solutions to improve fuel management practices.

Challenges in the India Fleet Management Software Industry Market

The market faces challenges such as high initial implementation costs, data security and privacy concerns, resistance to technological change among some businesses, and the need for reliable internet connectivity, especially in remote areas. The lack of skilled workforce to implement and maintain these systems also poses a hurdle, affecting wider adoption, especially among smaller fleet operators. A conservative estimate indicates these challenges could impact the market by approximately xx Million annually.

Emerging Opportunities in India Fleet Management Software Industry

The emergence of 5G technology promises faster data transmission speeds, enabling real-time tracking and improved data analysis. Strategic partnerships between software providers and telecommunication companies are creating opportunities for enhanced connectivity and service delivery. The increasing focus on sustainability and green logistics drives the development of software solutions tailored for electric fleets and route optimization to minimize environmental impact. Expansion into new markets like the corporate transportation and education sectors offers significant growth potential.

Leading Players in the India Fleet Management Software Industry Sector

- Kale Logistics Solutions Pvt Ltd

- Mahindra Group (Mahindra Telematics)

- BT TechLabs (LocoNav)

- TATA Consultancy Services Limited

- Uffizio India Software Consultants Pvt Ltd

- iTriangle Infotech Pvt Ltd

- Zoho Corporation (WebNMS)

- Orange GPS Solutions Pvt Ltd (iTrack)

- Trimble Inc (Trimble Mobility Solutions India)

- Efkon India Private Limited

- fleetx Technologies Private Limited

Key Milestones in India Fleet Management Software Industry Industry

- October 2022: Shipsy launched a self-serve, plug-and-play international logistics management solution, expanding its reach to SMEs.

- January 2022: Vedanta Aluminium and GEAR India partnered to deploy an electric forklift fleet, highlighting the shift towards sustainable solutions.

- April 2023: Goldstone Technologies Ltd. partnered with Quantron AG to offer AI-enabled fleet management solutions, focusing on global markets including India.

Strategic Outlook for India Fleet Management Software Industry Market

The India Fleet Management Software Industry is poised for continued expansion, driven by technological advancements, increasing government support, and the growing adoption of digital solutions across various sectors. Strategic partnerships and investments in R&D are expected to further accelerate market growth. Focusing on niche segments, developing innovative solutions aligned with sustainability goals, and expanding into untapped markets will offer significant opportunities for existing and new players in this dynamic sector.

India Fleet Management Software Industry Segmentation

-

1. Deployment

- 1.1. On-Premise

- 1.2. Cloud

-

2. End User

- 2.1. Logistics

- 2.2. Manufacturing

- 2.3. Other End Users (Corporate, Education, etc.)

India Fleet Management Software Industry Segmentation By Geography

- 1. India

India Fleet Management Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Lowering Total Cost of Ownership Among Fleet Operators; Growing Demand for Mobility and Digital Transformation Trends

- 3.3. Market Restrains

- 3.3.1. Integration issues with traditional systems; Data quality and accuracy issues

- 3.4. Market Trends

- 3.4.1. IoT Deployment is expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Fleet Management Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-Premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Logistics

- 5.2.2. Manufacturing

- 5.2.3. Other End Users (Corporate, Education, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North India India Fleet Management Software Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Fleet Management Software Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Fleet Management Software Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Fleet Management Software Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Kale Logistics Solutions Pvt Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mahindra Group (Mahindra Telematics)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 BT TechLabs (LocoNav)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 TATA Consultancy Services Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Uffizio India Software Consultants Pvt Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 iTriangle Infotech Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Zoho Corporation (WebNMS)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Orange GPS Solutions Pvt Ltd (iTrack)*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Trimble Inc (Trimble Mobility Solutions India)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Efkon India Private Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 fleetx Technologies Private Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Kale Logistics Solutions Pvt Ltd

List of Figures

- Figure 1: India Fleet Management Software Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Fleet Management Software Industry Share (%) by Company 2024

List of Tables

- Table 1: India Fleet Management Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Fleet Management Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: India Fleet Management Software Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: India Fleet Management Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Fleet Management Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Fleet Management Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Fleet Management Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Fleet Management Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Fleet Management Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Fleet Management Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 11: India Fleet Management Software Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 12: India Fleet Management Software Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Fleet Management Software Industry?

The projected CAGR is approximately 17.50%.

2. Which companies are prominent players in the India Fleet Management Software Industry?

Key companies in the market include Kale Logistics Solutions Pvt Ltd, Mahindra Group (Mahindra Telematics), BT TechLabs (LocoNav), TATA Consultancy Services Limited, Uffizio India Software Consultants Pvt Ltd, iTriangle Infotech Pvt Ltd, Zoho Corporation (WebNMS), Orange GPS Solutions Pvt Ltd (iTrack)*List Not Exhaustive, Trimble Inc (Trimble Mobility Solutions India), Efkon India Private Limited, fleetx Technologies Private Limited.

3. What are the main segments of the India Fleet Management Software Industry?

The market segments include Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Lowering Total Cost of Ownership Among Fleet Operators; Growing Demand for Mobility and Digital Transformation Trends.

6. What are the notable trends driving market growth?

IoT Deployment is expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Integration issues with traditional systems; Data quality and accuracy issues.

8. Can you provide examples of recent developments in the market?

April 2023: In order to take advantage of the fleet management market, Goldstone Technologies Ltd., which is based in Hyderabad, announced a partnership with Quantron AG, one of Germany's largest e-mobility companies. Fleet management with AI-enabled solutions is a focus of the GTL and Quantron Joint Undertaking. In particular, it will be suited to demand in Europe, the United States, India, and the Middle East. In order to address efficiency and digitalization challenges, the Joint Undertaking aims to offer mobility-as-a-service (MaaS) solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Fleet Management Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Fleet Management Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Fleet Management Software Industry?

To stay informed about further developments, trends, and reports in the India Fleet Management Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence