Key Insights

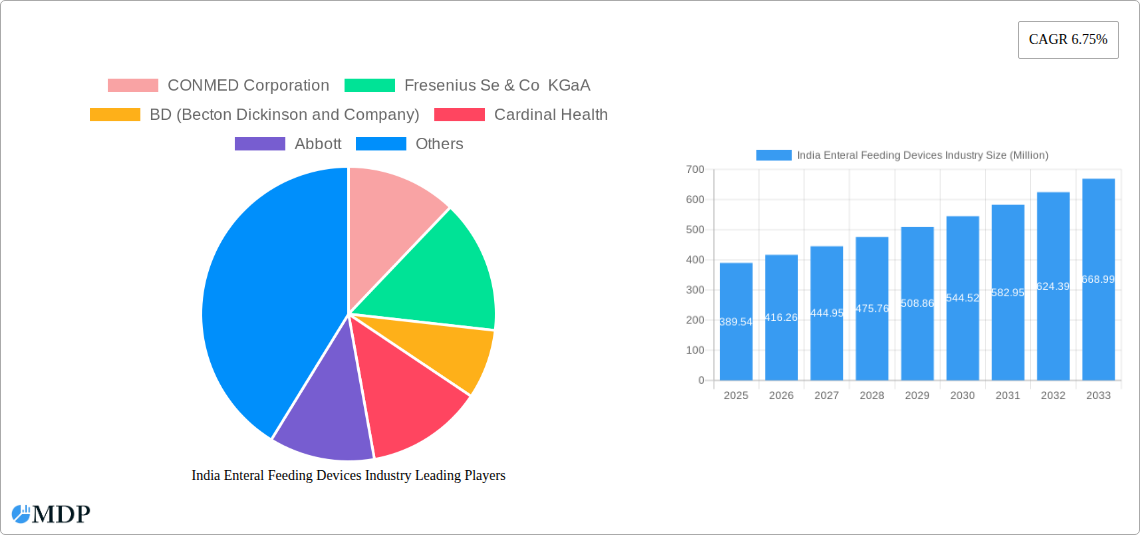

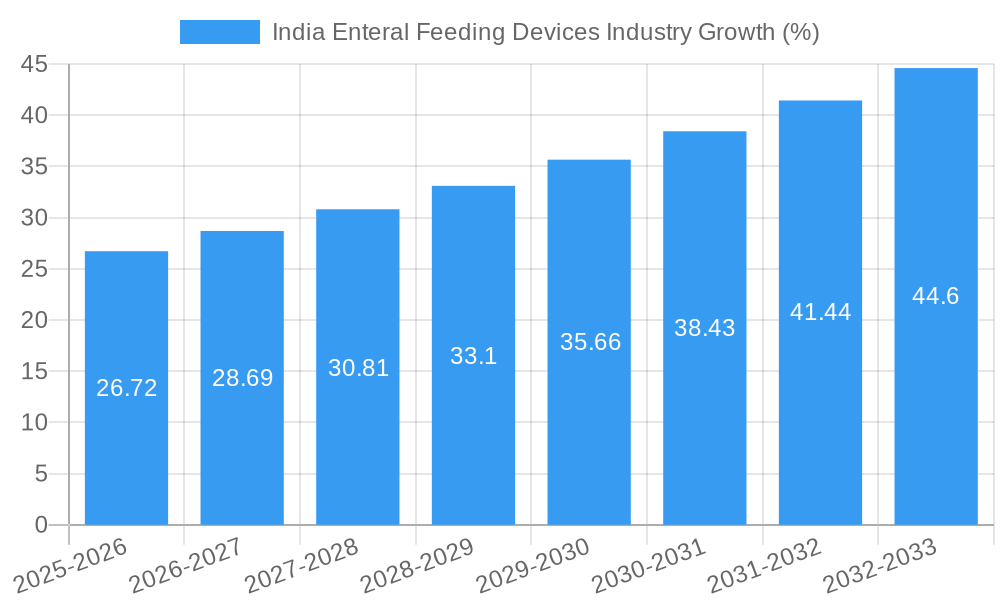

The India enteral feeding devices market, valued at $389.54 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.75% from 2025 to 2033. This expansion is driven by several key factors. Rising prevalence of chronic diseases like diabetes, neurological disorders, and cancer, necessitating long-term nutritional support, significantly fuels market demand. An aging population and increasing awareness regarding the benefits of enteral nutrition among healthcare professionals and patients contribute to market growth. Furthermore, technological advancements in enteral feeding devices, leading to more efficient and user-friendly products, are also boosting market adoption. The market is segmented by product type (enteral feeding pumps, tubes, and other devices), age group (adult and pediatric), end-user (hospitals, ambulatory care services, and others), and application (oncology, gastroenterology, diabetes, neurological disorders, and others). The growth is expected to be relatively higher in the hospital segment due to the increasing number of hospital admissions for chronic diseases. Geographic variations exist, with potential for stronger growth in regions experiencing rapid urbanization and healthcare infrastructure development.

While the market enjoys significant growth potential, certain challenges persist. High costs associated with advanced enteral feeding devices might limit accessibility, particularly in rural areas with limited healthcare resources. Furthermore, the market faces potential regulatory hurdles and the need for consistent improvements in healthcare infrastructure to fully realize its growth potential. However, ongoing investments in healthcare infrastructure and increasing government initiatives aimed at improving healthcare access are expected to mitigate these restraints. The competitive landscape includes both domestic and international players vying for market share, focusing on innovation and strategic partnerships to enhance their position. Future growth is expected to be influenced by the success of new product launches, technological innovations, and the expansion of healthcare services across India's diverse regions.

India Enteral Feeding Devices Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the India Enteral Feeding Devices market, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report projects robust growth driven by increasing prevalence of chronic diseases and technological advancements. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

India Enteral Feeding Devices Industry Market Dynamics & Concentration

The India Enteral Feeding Devices market is characterized by a moderately concentrated landscape, with key players like CONMED Corporation, Fresenius Se & Co KGaA, BD (Becton Dickinson and Company), Cardinal Health, Abbott, Cook Medical Incorporated, Boston Scientific Corporation, Nestlé, B Braun SE, and others competing for market share. Innovation in areas like minimally invasive devices and smart pumps is a key driver. Stringent regulatory frameworks, including those related to medical device approvals, significantly influence market dynamics. The market also experiences competition from alternative feeding methods. Recent years have witnessed several mergers and acquisitions (M&A) activities, with xx deals recorded between 2019 and 2024, leading to increased market consolidation. The market share of the top 5 players is estimated to be xx% in 2025. End-user trends, such as the increasing preference for home healthcare, are shaping market growth.

India Enteral Feeding Devices Industry Industry Trends & Analysis

The Indian enteral feeding devices market is experiencing significant growth, propelled by several key factors. The rising prevalence of chronic diseases like diabetes, cancer, and neurological disorders is a primary driver, increasing the demand for enteral feeding solutions. Technological advancements, such as the development of sophisticated enteral feeding pumps with advanced features like medication delivery and data monitoring, are further enhancing market expansion. Changing consumer preferences towards convenient and effective feeding methods are also contributing to market growth. The market is witnessing increased adoption of enteral feeding in ambulatory care settings, driven by a growing preference for home-based care. Competitive dynamics are shaping the market with companies investing in research and development, strategic partnerships, and product diversification. The market penetration of enteral feeding devices is projected to increase from xx% in 2024 to xx% by 2033.

Leading Markets & Segments in India Enteral Feeding Devices Industry

By Product: The Enteral Feeding Tube segment holds the largest market share, driven by its widespread use across various applications and affordability. Enteral Feeding Pumps are exhibiting high growth due to the increasing preference for advanced features.

By Age Group: The adult segment dominates, reflecting the higher prevalence of chronic diseases in this demographic. The pediatric segment shows promising growth potential, driven by the rising awareness of nutritional needs in children with special healthcare requirements.

By End User: Hospitals account for a substantial share, followed by ambulatory care services, reflecting the increasing adoption of home-based healthcare.

By Application: Oncology and gastroenterology are the leading applications, with increasing demand from neurological disorders and diabetes management. The growth in these segments is being influenced by factors like rising incidence of these diseases, increasing awareness of enteral nutrition, and government initiatives aimed at improving healthcare infrastructure. These are further enhanced by economic policies that favor the expansion of private hospitals and healthcare facilities. The robust growth of the private sector healthcare industry is improving access to medical devices and increasing demand for premium products. Investment in infrastructure, particularly in areas with limited access to healthcare, also contribute positively to market expansion.

India Enteral Feeding Devices Industry Product Developments

Recent product innovations focus on user-friendly designs, advanced features like automated medication delivery and data logging, and improved safety mechanisms. These advancements cater to growing demand for convenient and effective feeding solutions, addressing the challenges of traditional methods. Miniaturized and less invasive feeding tubes are gaining traction, improving patient comfort and reducing the risk of complications. The integration of smart technologies and telehealth capabilities is opening new avenues for remote patient monitoring and data-driven clinical decision-making, resulting in enhanced patient care.

Key Drivers of India Enteral Feeding Devices Industry Growth

Several factors contribute to the growth of the India Enteral Feeding Devices market. The rising prevalence of chronic diseases necessitating enteral nutrition is a major driver. Technological advancements in devices such as smart pumps are improving efficiency and patient outcomes. Government initiatives to improve healthcare infrastructure and access are also contributing. Furthermore, increasing awareness among healthcare professionals and patients about the benefits of enteral feeding is fuelling market expansion.

Challenges in the India Enteral Feeding Devices Industry Market

The market faces challenges such as stringent regulatory approvals, leading to longer product launch timelines. Supply chain disruptions and high import costs can impact pricing and availability. High initial investment costs for advanced devices may limit their adoption in certain settings. Intense competition among established players and new entrants is also creating price pressures. These factors collectively impact market growth and profitability.

Emerging Opportunities in India Enteral Feeding Devices Industry

The market presents significant opportunities, especially in the area of technological innovation. Advancements in material science and device miniaturization can lead to more comfortable and effective products. Strategic partnerships between device manufacturers and healthcare providers can improve market access and distribution. Expansion into rural and underserved markets offers untapped potential, driven by increasing healthcare awareness and government initiatives.

Leading Players in the India Enteral Feeding Devices Industry Sector

- CONMED Corporation

- Fresenius Se & Co KGaA

- BD (Becton Dickinson and Company)

- Cardinal Health

- Abbott

- Cook Medical Incorporated

- Boston Scientific Corporation

- Nestlé

- B Braun SE

Key Milestones in India Enteral Feeding Devices Industry Industry

April 2022: Fresenius Kabi launched a new enteral nutrition product app, enhancing product information accessibility and comparison. This improved access to information positively influenced market adoption.

February 2022: Nestlé Health Science supported Feeding Tube Awareness Week, promoting positive perceptions of enteral feeding and potentially increasing market demand.

Strategic Outlook for India Enteral Feeding Devices Industry Market

The India Enteral Feeding Devices market is poised for significant growth, driven by ongoing technological advancements, increasing disease prevalence, and expanding healthcare infrastructure. Strategic partnerships, focused product development, and market expansion into underserved areas will be crucial for companies seeking to capitalize on this market’s potential. The focus on innovation, coupled with favorable regulatory environments, will pave the way for sustained growth in the coming years.

India Enteral Feeding Devices Industry Segmentation

-

1. Product

- 1.1. Enteral Feeding Pump

- 1.2. Enteral Feeding Tube

- 1.3. Other Devices

-

2. Age Group

- 2.1. Adult

- 2.2. Pediatric

-

3. End User

- 3.1. Hospital

- 3.2. Ambulatory Care Service

- 3.3. Other End Users

-

4. Application

- 4.1. Oncology

- 4.2. Gastroenterology

- 4.3. Diabetes

- 4.4. Neurological Disorder

- 4.5. Hypermetabolism

- 4.6. Other Applications

India Enteral Feeding Devices Industry Segmentation By Geography

- 1. India

India Enteral Feeding Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Geriatric Population and High Prevalence of Chronic Diseases; Increasing Premature Birth Rate

- 3.3. Market Restrains

- 3.3.1. Complications Associated with Enteral Feeding Tubes

- 3.4. Market Trends

- 3.4.1. Oncology Segment Expected to Grow Faster During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Enteral Feeding Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Enteral Feeding Pump

- 5.1.2. Enteral Feeding Tube

- 5.1.3. Other Devices

- 5.2. Market Analysis, Insights and Forecast - by Age Group

- 5.2.1. Adult

- 5.2.2. Pediatric

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospital

- 5.3.2. Ambulatory Care Service

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Oncology

- 5.4.2. Gastroenterology

- 5.4.3. Diabetes

- 5.4.4. Neurological Disorder

- 5.4.5. Hypermetabolism

- 5.4.6. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product

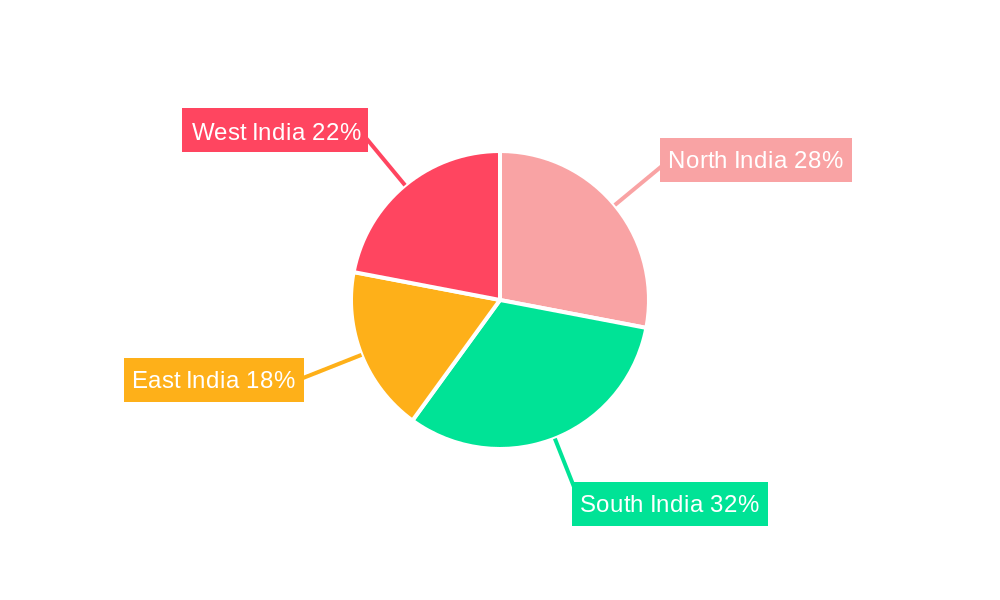

- 6. North India India Enteral Feeding Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Enteral Feeding Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Enteral Feeding Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Enteral Feeding Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 CONMED Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Fresenius Se & Co KGaA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 BD (Becton Dickinson and Company)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cardinal Health

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Abbott

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cook Medical Incorporated

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Boston Scientific Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nestlé*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 B Braun SE

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 CONMED Corporation

List of Figures

- Figure 1: India Enteral Feeding Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Enteral Feeding Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: India Enteral Feeding Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Enteral Feeding Devices Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: India Enteral Feeding Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: India Enteral Feeding Devices Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 5: India Enteral Feeding Devices Industry Revenue Million Forecast, by Age Group 2019 & 2032

- Table 6: India Enteral Feeding Devices Industry Volume K Units Forecast, by Age Group 2019 & 2032

- Table 7: India Enteral Feeding Devices Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 8: India Enteral Feeding Devices Industry Volume K Units Forecast, by End User 2019 & 2032

- Table 9: India Enteral Feeding Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 10: India Enteral Feeding Devices Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 11: India Enteral Feeding Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 12: India Enteral Feeding Devices Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 13: India Enteral Feeding Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Enteral Feeding Devices Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 15: North India India Enteral Feeding Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: North India India Enteral Feeding Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: South India India Enteral Feeding Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South India India Enteral Feeding Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: East India India Enteral Feeding Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: East India India Enteral Feeding Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: West India India Enteral Feeding Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: West India India Enteral Feeding Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: India Enteral Feeding Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 24: India Enteral Feeding Devices Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 25: India Enteral Feeding Devices Industry Revenue Million Forecast, by Age Group 2019 & 2032

- Table 26: India Enteral Feeding Devices Industry Volume K Units Forecast, by Age Group 2019 & 2032

- Table 27: India Enteral Feeding Devices Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 28: India Enteral Feeding Devices Industry Volume K Units Forecast, by End User 2019 & 2032

- Table 29: India Enteral Feeding Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 30: India Enteral Feeding Devices Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 31: India Enteral Feeding Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: India Enteral Feeding Devices Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Enteral Feeding Devices Industry?

The projected CAGR is approximately 6.75%.

2. Which companies are prominent players in the India Enteral Feeding Devices Industry?

Key companies in the market include CONMED Corporation, Fresenius Se & Co KGaA, BD (Becton Dickinson and Company), Cardinal Health, Abbott, Cook Medical Incorporated, Boston Scientific Corporation, Nestlé*List Not Exhaustive, B Braun SE.

3. What are the main segments of the India Enteral Feeding Devices Industry?

The market segments include Product, Age Group, End User, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 389.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Geriatric Population and High Prevalence of Chronic Diseases; Increasing Premature Birth Rate.

6. What are the notable trends driving market growth?

Oncology Segment Expected to Grow Faster During the Forecast Period.

7. Are there any restraints impacting market growth?

Complications Associated with Enteral Feeding Tubes.

8. Can you provide examples of recent developments in the market?

April 2022: Fresenius Kabi launched a new enteral nutrition product app. The enteral nutrition product app makes it easier to access detailed product information and includes a quick comparison tool to compare nutritional values against reference nutrient intakes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Enteral Feeding Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Enteral Feeding Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Enteral Feeding Devices Industry?

To stay informed about further developments, trends, and reports in the India Enteral Feeding Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence