Key Insights

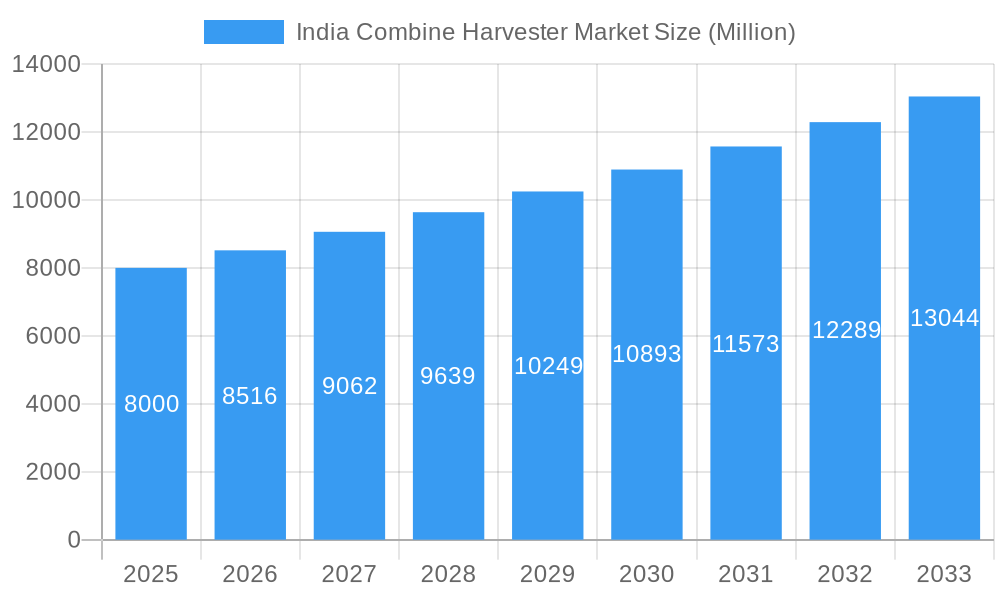

The Indian combine harvester market is poised for significant growth, projected to reach $275.4 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.7% from 2025 to 2033. This expansion is propelled by increased agricultural mechanization, especially in Northern and Western India, and the escalating need for efficient harvesting solutions to support a growing population's food demands. Government initiatives fostering agricultural modernization and accessible farmer financing are key growth drivers. The market is segmented by type, including self-propelled, track, and tractor-powered combine harvesters, with self-propelled models showing higher demand due to superior efficiency and operational ease. Leading players like Kubota, TAFE, Mahindra Tractors, and John Deere are instrumental in market development through innovation and strategic growth. Key challenges include high upfront investment, limited credit access for smallholders, and regional technological literacy gaps.

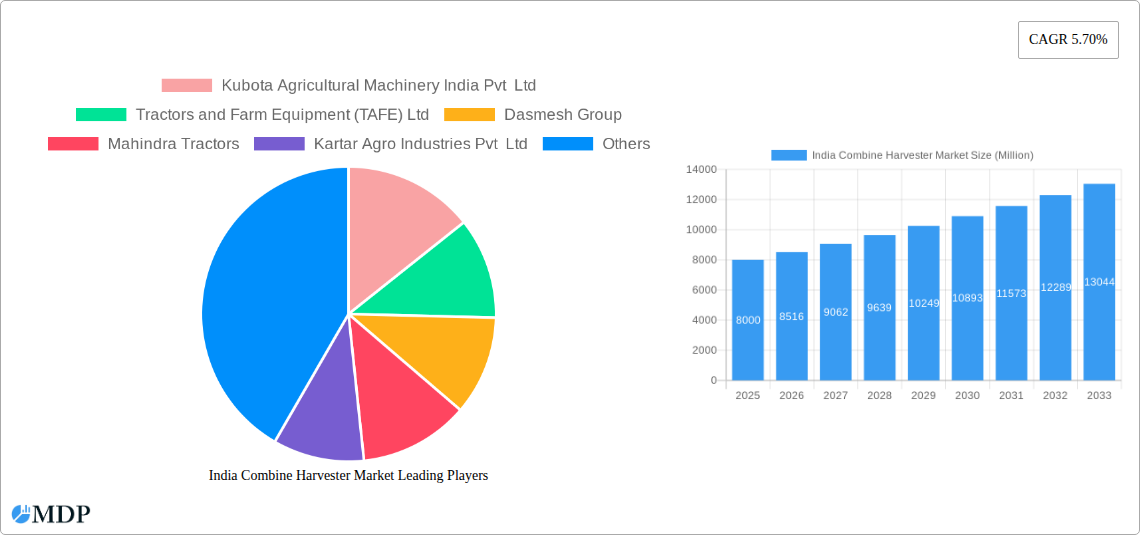

India Combine Harvester Market Market Size (In Million)

Despite these challenges, the long-term market outlook is robust. Growing awareness of advanced farming methods and accessible financing are expected to alleviate existing restraints. Furthermore, a heightened focus on reducing post-harvest losses and boosting crop yields will drive demand for advanced combine harvesters offering features like enhanced grain separation and improved fuel efficiency. India's expanding agricultural sector, supported by government mechanization initiatives, will sustain market growth throughout the forecast period. Regional adoption will vary, with Northern and Western India leading due to higher engagement with advanced agricultural technologies.

India Combine Harvester Market Company Market Share

India Combine Harvester Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Combine Harvester Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamics, trends, and future potential. The report covers key players like Kubota, TAFE, Mahindra & Mahindra, and more, analyzing market segments including self-propelled, track, and tractor-powered combine harvesters. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

India Combine Harvester Market Market Dynamics & Concentration

The Indian combine harvester market is characterized by a moderately concentrated landscape, with key players holding significant market share. However, the entry of new players and technological advancements are fostering increased competition. Innovation is a key driver, with manufacturers focusing on fuel efficiency, automation, and improved harvesting capabilities. Government regulations regarding agricultural mechanization and emission norms significantly influence market dynamics. Tractor-powered combine harvesters remain a dominant segment, although self-propelled models are gaining traction due to increased efficiency. Substitutes include manual harvesting, but the growing need for faster and more efficient harvesting is driving the adoption of combine harvesters. Recent M&A activities have been relatively low, with a reported xx M&A deals in the past five years. This suggests a market focused on organic growth and technological advancements. The market share distribution is as follows (estimated 2025):

- Mahindra & Mahindra: xx%

- TAFE: xx%

- Kubota: xx%

- John Deere: xx%

- Others: xx%

India Combine Harvester Market Industry Trends & Analysis

The Indian combine harvester market is experiencing robust growth, driven by several factors. The increasing adoption of mechanization in agriculture, rising labor costs, and the need for efficient harvesting contribute significantly to market expansion. Technological disruptions, including advancements in automation, GPS technology, and improved engine efficiency, are shaping the industry landscape. Consumer preferences are shifting towards fuel-efficient, high-capacity machines with improved ergonomics. The competitive landscape is intensifying, with established players and new entrants vying for market share through product innovation and strategic partnerships. The market is projected to witness a CAGR of xx% from 2025 to 2033, driven by expanding acreage under cultivation and government initiatives promoting agricultural mechanization. The market penetration of combine harvesters is steadily increasing, currently estimated at xx% of total harvested acreage.

Leading Markets & Segments in India Combine Harvester Market

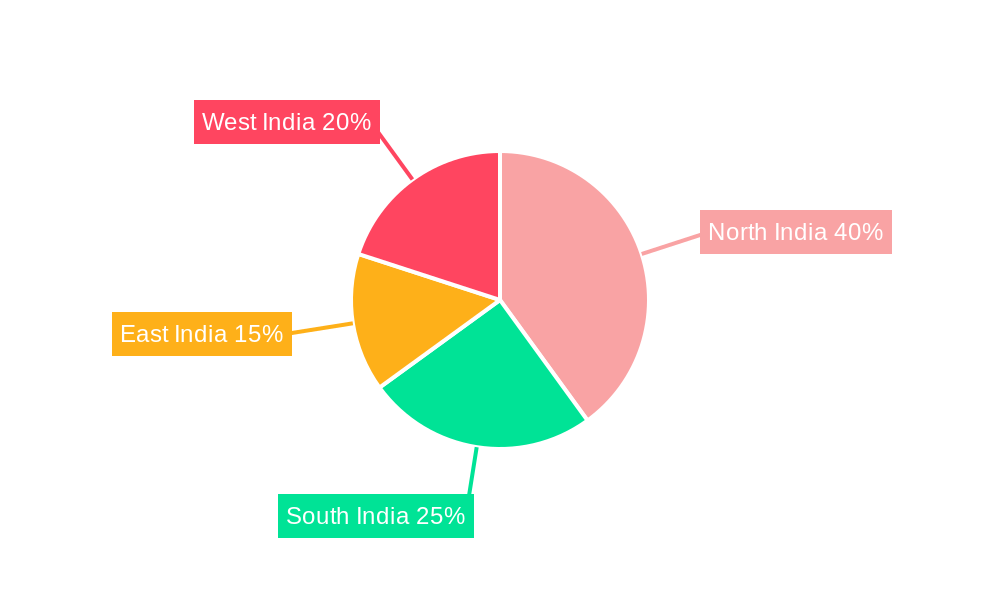

The Northern and Western regions of India dominate the combine harvester market due to extensive wheat and rice cultivation. Punjab, Haryana, and Uttar Pradesh are major contributors to market demand. Among the segments, tractor-powered combine harvesters maintain the largest market share, driven by their lower initial investment cost. However, self-propelled combine harvesters are witnessing faster growth rates due to higher efficiency and versatility. Key drivers for the dominance of these regions and segments include:

- Economic Policies: Government subsidies and support schemes for agricultural mechanization.

- Infrastructure: Well-developed road networks enabling efficient transportation of machinery.

- Favorable Climate: Suitable climate conditions for cultivating major crops like wheat and rice.

- Technological Advancements: Availability of advanced combine harvesters suited to local farming practices.

Detailed Dominance Analysis: The dominance of the tractor-powered segment stems from its affordability, making it accessible to a wider range of farmers. Self-propelled harvesters, while more expensive, are becoming increasingly popular among larger farms due to their superior efficiency and operational flexibility. The regional dominance underscores the importance of localized sales and marketing strategies for manufacturers.

India Combine Harvester Market Product Developments

Recent product innovations in the Indian combine harvester market include improved threshing mechanisms, enhanced grain cleaning systems, and the incorporation of GPS technology for precision farming. These advancements aim to maximize harvesting efficiency, minimize grain loss, and improve operational precision. Manufacturers are also focusing on developing fuel-efficient models with reduced emissions to address environmental concerns. The focus on developing harvesters suited to specific crop types and regional conditions is crucial for market success. The integration of advanced technology enhances the overall value proposition of combine harvesters in a competitive market.

Key Drivers of India Combine Harvester Market Growth

Several factors are fueling the growth of the India Combine Harvester Market. Firstly, rising labor costs are pushing farmers toward mechanization. Secondly, government initiatives promoting agricultural modernization and subsidies for farm equipment are significantly boosting adoption rates. Thirdly, technological advancements resulting in more efficient, versatile, and user-friendly combine harvesters are creating greater demand. Finally, the increasing acreage under cultivation for major crops like wheat and rice is driving the need for efficient harvesting solutions.

Challenges in the India Combine Harvester Market Market

The Indian combine harvester market faces challenges, including the high initial investment cost for advanced models, hindering affordability for small and marginal farmers. Supply chain disruptions, especially concerning imported components, can impact production and availability. Intense competition among existing players and the emergence of new entrants create pressure on profit margins. Moreover, navigating regulatory compliance and addressing concerns about fuel efficiency and environmental impact present ongoing challenges for manufacturers.

Emerging Opportunities in India Combine Harvester Market

The long-term growth of the Indian combine harvester market hinges on several opportunities. Technological advancements, such as AI-powered automation and precision farming technologies, will transform harvesting practices. Strategic partnerships between manufacturers and agricultural service providers can enhance market access and improve customer service. Expanding into new regions with high agricultural potential and focusing on specialized combine harvesters for diverse crops will unlock significant growth prospects.

Leading Players in the India Combine Harvester Market Sector

- Kubota Agricultural Machinery India Pvt Ltd

- Tractors and Farm Equipment (TAFE) Ltd

- Dasmesh Group

- Mahindra Tractors

- Kartar Agro Industries Pvt Ltd

- CLAAS India

- Balkar Combines

- John Deere India Pvt Ltd

- PREET Group

- Sonalika Group

- *List Not Exhaustive

Key Milestones in India Combine Harvester Market Industry

- August 2023: Mahindra & Mahindra Ltd launched the Swaraj 8200 Wheel Harvester, enhancing harvesting efficiency and grain quality.

- November 2022: Mahindra & Mahindra inaugurated a new farm machinery plant in Pithampur, Madhya Pradesh, significantly boosting production capacity.

- June 2022: The Andhra Pradesh government distributed combine harvesters under the YSR Yantra Seva Pathakam Scheme, boosting market demand.

Strategic Outlook for India Combine Harvester Market Market

The Indian combine harvester market holds immense potential for future growth. Continued technological innovation, government support for agricultural mechanization, and rising farmer incomes will drive demand. Strategic partnerships, expansion into new markets, and the development of customized solutions for diverse farming needs are crucial for maximizing long-term growth and market share. The focus on sustainability and environmentally friendly technologies will play a vital role in shaping the future landscape of the industry.

India Combine Harvester Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Combine Harvester Market Segmentation By Geography

- 1. India

India Combine Harvester Market Regional Market Share

Geographic Coverage of India Combine Harvester Market

India Combine Harvester Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Cost of Farm Labors; Increasing Consumption of Grain Crops

- 3.3. Market Restrains

- 3.3.1. High Cost of Combine Harvesters; Small and Fragmented Land Holdings

- 3.4. Market Trends

- 3.4.1. High Cost of Farm Labor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Combine Harvester Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kubota Agricultural Machinery India Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tractors and Farm Equipment (TAFE) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dasmesh Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mahindra Tractors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kartar Agro Industries Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CLAAS India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Balkar Combines

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 John Deere India Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PREET Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sonalika Group*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kubota Agricultural Machinery India Pvt Ltd

List of Figures

- Figure 1: India Combine Harvester Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Combine Harvester Market Share (%) by Company 2025

List of Tables

- Table 1: India Combine Harvester Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: India Combine Harvester Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Combine Harvester Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Combine Harvester Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Combine Harvester Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Combine Harvester Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: India Combine Harvester Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: India Combine Harvester Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Combine Harvester Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Combine Harvester Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Combine Harvester Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Combine Harvester Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Combine Harvester Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the India Combine Harvester Market?

Key companies in the market include Kubota Agricultural Machinery India Pvt Ltd, Tractors and Farm Equipment (TAFE) Ltd, Dasmesh Group, Mahindra Tractors, Kartar Agro Industries Pvt Ltd, CLAAS India, Balkar Combines, John Deere India Pvt Ltd, PREET Group, Sonalika Group*List Not Exhaustive.

3. What are the main segments of the India Combine Harvester Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 275.4 million as of 2022.

5. What are some drivers contributing to market growth?

High Cost of Farm Labors; Increasing Consumption of Grain Crops.

6. What are the notable trends driving market growth?

High Cost of Farm Labor.

7. Are there any restraints impacting market growth?

High Cost of Combine Harvesters; Small and Fragmented Land Holdings.

8. Can you provide examples of recent developments in the market?

August 2023: Mahindra & Mahindra Ltd (M&M Ltd) launched a new wheel harvester under the Swaraj brand in the domestic market. Swaraj 8200 Wheel Harvester provides maximum harvesting acreage in a year with best-in-class grain quality and maximum profit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Combine Harvester Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Combine Harvester Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Combine Harvester Market?

To stay informed about further developments, trends, and reports in the India Combine Harvester Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence