Key Insights

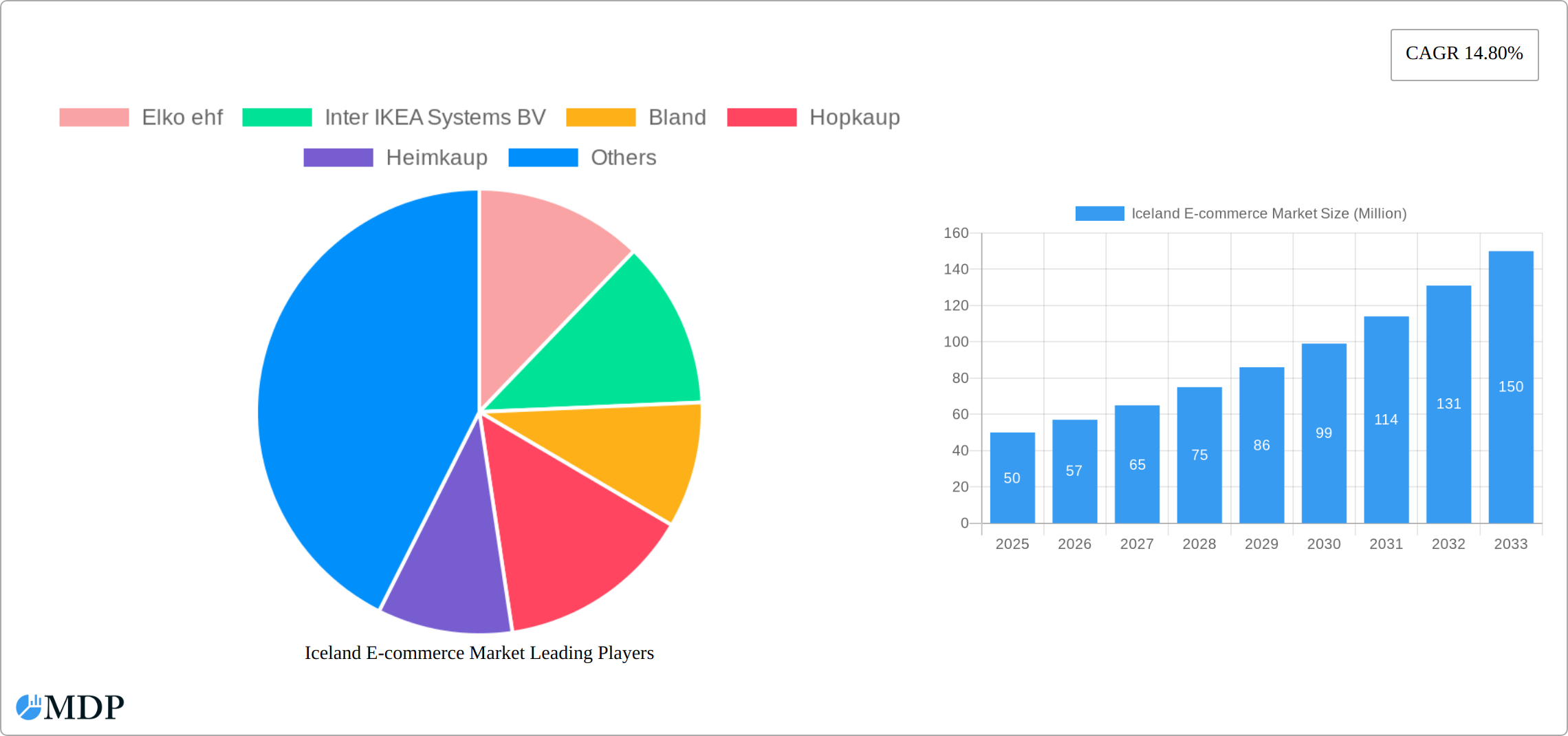

The Iceland e-commerce market, currently experiencing robust growth, is projected to maintain a significant upward trajectory. With a Compound Annual Growth Rate (CAGR) of 14.80% from 2019-2033, the market demonstrates considerable potential. While precise market size figures for 2025 are unavailable, considering the provided CAGR and a likely substantial base in 2019 (even assuming a relatively small initial size for a country like Iceland), we can infer a considerable market value by 2025 – perhaps in the tens of millions of USD (extrapolation required, not presented as fact). Key drivers fueling this expansion include rising internet penetration, increasing smartphone usage, growing consumer preference for convenience, and the expansion of logistics infrastructure to support efficient e-commerce operations within Iceland's geographical constraints. Emerging trends such as mobile commerce, social commerce, and the increasing adoption of omnichannel strategies by businesses are further accelerating market growth. However, challenges remain, including potential limitations in logistics and delivery infrastructure reaching remote areas, and the relatively small domestic market size compared to larger economies. The presence of both international giants (Amazon, ASOS, AliExpress) and local players (Elko ehf, Inter IKEA Systems BV, Bland, Hopkaup, Heimkaup, EPAL) highlights a competitive landscape with a blend of global reach and localized expertise. The focus on specific application segments within the e-commerce market (details on which are lacking in provided data) will be crucial for future growth and profitability.

The competitive landscape within the Icelandic e-commerce sector is characterized by a dynamic interplay between international and domestic players. Established international companies leverage their brand recognition and global supply chains to compete effectively. Simultaneously, local businesses possess an understanding of the unique aspects of the Icelandic market, including consumer preferences and logistical challenges. This competition is likely driving innovation and efficiency improvements throughout the sector. Future growth will depend upon factors such as continued investment in logistics and technology, further advancements in digital infrastructure, and successful adaptation to evolving consumer expectations. The market segmentation by application (data missing) will play a key role in understanding which segments are driving growth and attracting the most investment. Effective strategies will involve targeting specific consumer needs within these segments, as well as navigating the competitive pressures from both international and domestic players. Sustaining the current growth rate will require innovation in areas like delivery optimization, personalized customer experiences, and addressing any regulatory hurdles.

Iceland E-commerce Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Iceland e-commerce market, covering its dynamics, trends, leading players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for businesses, investors, and policymakers seeking to understand and navigate this rapidly evolving market. The report leverages extensive data analysis to provide actionable intelligence on market size (reaching xx Million by 2033), growth trajectory, and key market segments. Discover how technological advancements, evolving consumer preferences, and strategic M&A activities are shaping the future of e-commerce in Iceland.

Iceland E-commerce Market Market Dynamics & Concentration

The Icelandic e-commerce market, while smaller than its European counterparts, demonstrates significant growth potential. Market concentration is relatively moderate, with several key players vying for market share. The estimated market size in 2025 is xx Million, expected to reach xx Million by 2033, exhibiting a CAGR of xx%.

- Market Concentration: While precise market share data for each player is limited, Amazon com Ltd, Inter IKEA Systems BV, and local players like Elko ehf, Bland, Hopkaup, and Heimkaup are key players. The market is characterized by a mix of international giants and established local businesses.

- Innovation Drivers: The adoption of mobile commerce, improved logistics infrastructure, and increasing internet penetration are driving innovation. Investment in fintech solutions also plays a significant role.

- Regulatory Frameworks: Iceland’s relatively stable regulatory environment fosters a favorable climate for e-commerce growth. However, specific regulations concerning data privacy and consumer protection are continually evolving.

- Product Substitutes: Traditional brick-and-mortar retail remains a significant competitor. However, the convenience and wider selection offered by online retailers are gradually shifting consumer preference.

- End-User Trends: A growing young and tech-savvy population is driving demand for online shopping. Increasing disposable income and a preference for convenience are further accelerating market growth.

- M&A Activities: The recent acquisition of Valitor by Rapyd in July 2021 (USD 100 Million deal) highlights the increasing interest in the Icelandic payments sector, indirectly impacting the e-commerce landscape. The number of M&A deals in the sector over the historical period (2019-2024) was xx.

Iceland E-commerce Market Industry Trends & Analysis

The Icelandic e-commerce market is experiencing robust growth, fueled by a number of key factors. The market's CAGR during the historical period (2019-2024) was xx%, reflecting a significant expansion. Market penetration, while still lower compared to many Western European countries, is steadily increasing, expected to reach xx% by 2033. Technological disruptions, notably the increasing adoption of mobile commerce and the rise of social commerce platforms, are transforming the customer experience. Consumer preferences are shifting towards ease of use, secure payment options, and fast delivery. This competitive landscape is driving innovation and efficiency improvements across the industry. Key growth drivers include rising internet and smartphone penetration, increasing urbanization, and a growing middle class. Furthermore, government initiatives to promote digitalization are facilitating growth. The competitive landscape is marked by both local and international players, fostering innovation and competition.

Leading Markets & Segments in Iceland E-commerce Market

While detailed regional breakdown data is unavailable, it is likely that the Reykjavik metropolitan area constitutes the dominant market segment due to higher population density and greater internet penetration. This region benefits from superior infrastructure including reliable internet access and efficient delivery networks.

- Key Drivers for Reykjavik's Dominance:

- Higher Population Density: Concentrated population translates to a larger potential customer base.

- Advanced Infrastructure: Superior internet connectivity and logistics networks facilitate efficient e-commerce operations.

- Higher Disposable Income: Relatively higher disposable income in this region translates to stronger purchasing power.

- Greater Technological Literacy: Higher internet penetration and technological familiarity amongst the population drive adoption of e-commerce.

Iceland E-commerce Market Product Developments

Recent product innovations focus on enhancing the customer experience through improved user interfaces, personalized recommendations, and seamless payment gateways. The integration of augmented reality and virtual reality technologies is also emerging, offering immersive shopping experiences. This focus on technological advancements directly contributes to the market's growth and competitive advantage.

Key Drivers of Iceland E-commerce Market Growth

Several factors are driving the growth of Iceland's e-commerce market:

- Rising Internet and Smartphone Penetration: Increasing access to the internet and mobile devices empowers more consumers to engage in online shopping.

- Government Initiatives: Government support for digital infrastructure and digitalization strategies are positively influencing market growth.

- Improved Logistics Infrastructure: Enhanced delivery networks and improved logistics capabilities enable faster and more reliable delivery services, boosting consumer confidence.

Challenges in the Iceland E-commerce Market Market

The Icelandic e-commerce market faces several challenges:

- High Shipping Costs: The geographical isolation of Iceland leads to higher shipping costs compared to other countries, impacting pricing competitiveness.

- Relatively Small Domestic Market: The limited size of the Icelandic market restricts the potential scale of operations compared to larger markets.

- Dependence on Import: A significant portion of goods sold online are imported. Currency fluctuations and import duties can significantly impact profitability and prices.

Emerging Opportunities in Iceland E-commerce Market

Despite the challenges, the Icelandic e-commerce market presents significant opportunities for growth. Expanding into niche markets, focusing on sustainable and ethically sourced products, leveraging the growing popularity of mobile payments, and developing strategic partnerships with local businesses are examples of promising approaches. Furthermore, investment in advanced logistics solutions such as drone delivery could significantly improve delivery times and reduce costs.

Leading Players in the Iceland E-commerce Market Sector

- Elko ehf

- Inter IKEA Systems BV

- Bland

- Hopkaup

- Heimkaup

- Amazon com Ltd

- ASOS com Ltd

- AliExpress (Alibaba Group)

- EPAL

- eBay Inc

- Lin Design

Key Milestones in Iceland E-commerce Market Industry

- July 2021: Rapyd's acquisition of Valitor for USD 100 Million significantly improved payment processing capabilities within the Icelandic e-commerce sector, streamlining online transactions.

Strategic Outlook for Iceland E-commerce Market Market

The Iceland e-commerce market is poised for continued growth, driven by increasing internet penetration, a young and tech-savvy population, and ongoing government support. Companies focusing on enhancing customer experience, optimizing logistics, and adapting to evolving consumer preferences are well-positioned to capitalize on the market's potential. Strategic partnerships and investments in innovative technologies will be crucial for achieving long-term success.

Iceland E-commerce Market Segmentation

-

1. Type

- 1.1. B2C

- 1.2. B2B

Iceland E-commerce Market Segmentation By Geography

- 1. Iceland

Iceland E-commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Number of E-shoppers is Expected to Boost the E-commerce Market; Strong Internet Penetration to Boost the E-commerce Market

- 3.3. Market Restrains

- 3.3.1. Privacy and security concerns

- 3.4. Market Trends

- 3.4.1. Growing Number of E-shoppers is Expected to Boost the E-commerce Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iceland E-commerce Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. B2C

- 5.1.2. B2B

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Iceland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Elko ehf

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Inter IKEA Systems BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bland

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hopkaup

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Heimkaup

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amazon com Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ASOS com Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AliExpress (Alibaba Group)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 EPAL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 eBay Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lin Design

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Elko ehf

List of Figures

- Figure 1: Iceland E-commerce Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iceland E-commerce Market Share (%) by Company 2024

List of Tables

- Table 1: Iceland E-commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iceland E-commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Iceland E-commerce Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Iceland E-commerce Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Iceland E-commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Iceland E-commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Iceland E-commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Iceland E-commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Iceland E-commerce Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Iceland E-commerce Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 11: Iceland E-commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Iceland E-commerce Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iceland E-commerce Market?

The projected CAGR is approximately 14.80%.

2. Which companies are prominent players in the Iceland E-commerce Market?

Key companies in the market include Elko ehf, Inter IKEA Systems BV, Bland, Hopkaup, Heimkaup, Amazon com Ltd, ASOS com Ltd, AliExpress (Alibaba Group), EPAL, eBay Inc, Lin Design.

3. What are the main segments of the Iceland E-commerce Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Number of E-shoppers is Expected to Boost the E-commerce Market; Strong Internet Penetration to Boost the E-commerce Market.

6. What are the notable trends driving market growth?

Growing Number of E-shoppers is Expected to Boost the E-commerce Market.

7. Are there any restraints impacting market growth?

Privacy and security concerns.

8. Can you provide examples of recent developments in the market?

July 2021- Rapyd, a global fintech-as-a-service company, has entered into a definitive agreement with Arion Banki to acquire Valitor, an Icelandic payments solutions company, for USD 100 million. The acquisition of Valitor will complement Rapyd's existing payment capabilities throughout Europe and enhance its issuing portfolio. Valitor provides in-store and online payment acceptance solutions and card issuing to SMB merchants in Iceland, the United Kingdom, Ireland, and Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iceland E-commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iceland E-commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iceland E-commerce Market?

To stay informed about further developments, trends, and reports in the Iceland E-commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence