Key Insights

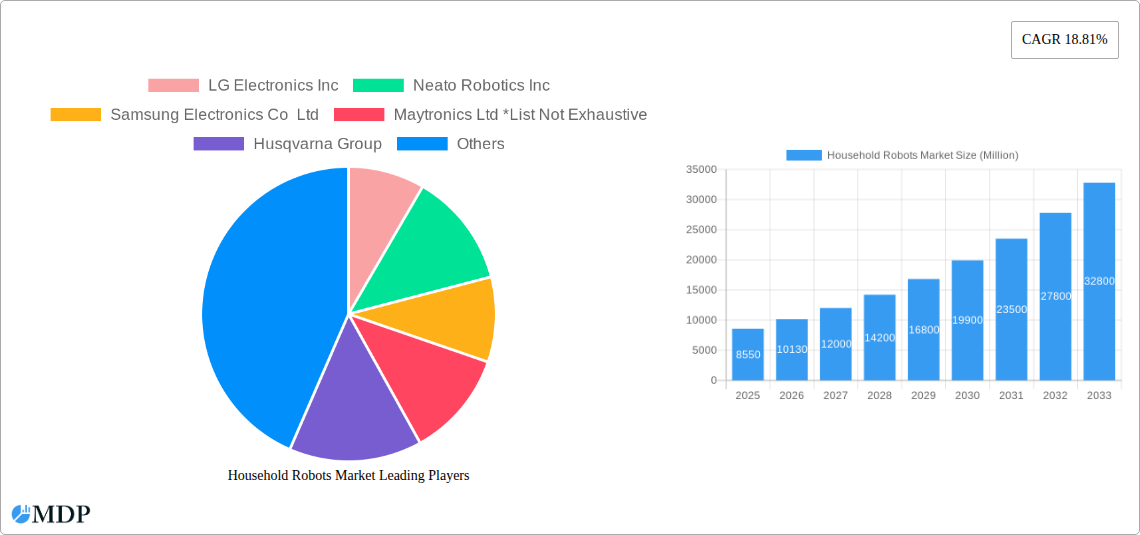

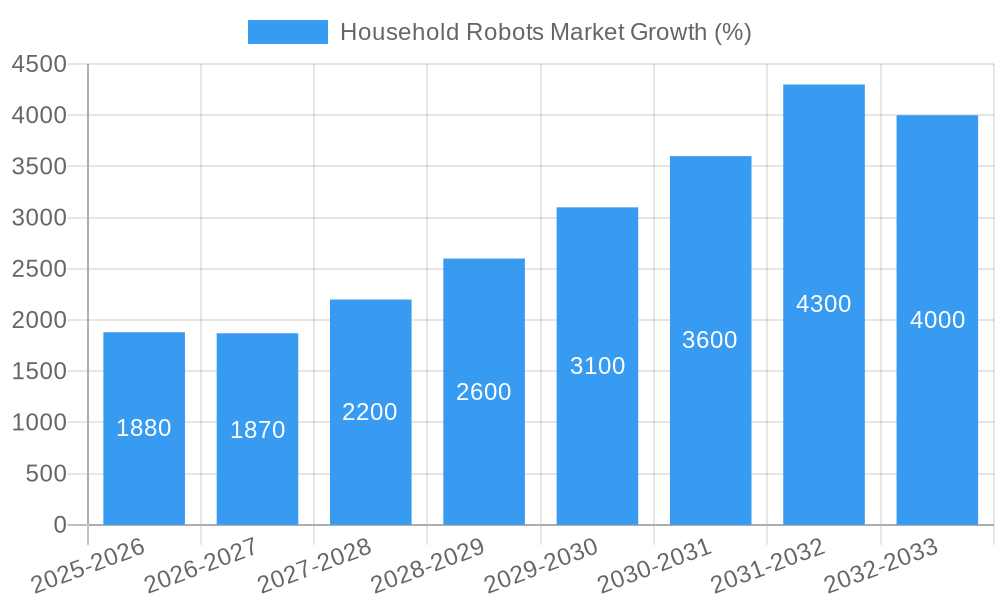

The global household robot market is experiencing robust growth, projected to reach \$8.55 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 18.81% from 2025 to 2033. This expansion is driven by several key factors. Increasing disposable incomes in developing economies are fueling demand for convenient and time-saving home automation solutions. Technological advancements, such as improved sensor technology, artificial intelligence (AI), and enhanced battery life, are making household robots more sophisticated, reliable, and user-friendly. The rising adoption of smart homes and the integration of household robots into these ecosystems further boost market growth. Consumer preferences are shifting towards automating household chores, freeing up time for leisure and other activities. Specific application segments like robotic vacuum cleaners and moppers are leading the charge, fueled by their practicality and affordability. However, high initial costs, concerns about data privacy and security associated with AI-powered robots, and potential job displacement in some sectors act as restraining factors.

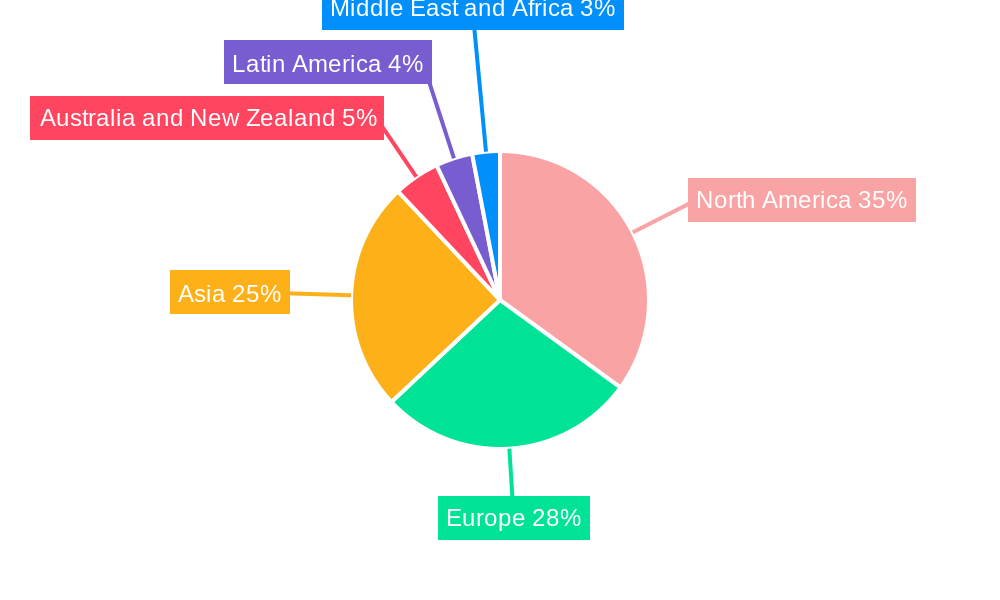

The market's segmentation reveals diverse growth opportunities. Robotic vacuum and mopping remain the dominant application, benefiting from technological advancements and increasing consumer awareness. Lawn mowing robots are gaining traction in developed regions due to their efficiency and convenience. Pool cleaning robots also show significant growth potential, particularly in areas with high rates of pool ownership. The companionship robot segment, although still nascent, is poised for expansion, driven by the increasing demand for elderly care and social interaction solutions. Geographically, North America and Europe currently hold substantial market share due to higher adoption rates and technological advancement, but the Asia-Pacific region is anticipated to witness faster growth in the coming years due to rising disposable income and increasing urbanization. Leading players like iRobot, Ecovacs, and Samsung are driving innovation and market competition, continuously improving product functionalities and expanding their product portfolios. This dynamic interplay of drivers, trends, and restraints will shape the future trajectory of the household robot market.

Household Robots Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Household Robots Market, covering the period 2019-2033. It delves into market dynamics, industry trends, leading players, and future growth opportunities, offering valuable insights for stakeholders across the robotics industry. The report utilizes data from the historical period (2019-2024), with the base year being 2025 and the forecast period extending to 2033. Market values are expressed in Millions of USD.

Household Robots Market Dynamics & Concentration

The Household Robots Market is experiencing significant growth, driven by technological advancements, increasing consumer disposable income, and a rising demand for convenience. Market concentration is moderate, with several key players holding substantial market share, but also featuring a number of smaller, specialized companies. Innovation is a key driver, with continuous improvements in robotic capabilities, such as navigation, cleaning efficiency, and AI integration.

Market Concentration Metrics (Estimated 2025):

- Top 5 players hold approximately xx% of the market share.

- The market exhibits a moderately fragmented landscape with several niche players.

Innovation Drivers:

- Advancements in AI and machine learning for improved navigation and task performance.

- Development of more efficient and quieter motors and sensors.

- Integration of smart home functionalities and voice control.

Regulatory Frameworks:

- Varying regulatory landscapes across different countries influence product safety standards and market access.

- Data privacy concerns related to connected robots are an emerging regulatory focus.

Product Substitutes:

- Traditional cleaning methods (e.g., manual cleaning) and other labor-saving appliances pose some level of competition.

End-User Trends:

- Growing preference for automated cleaning solutions, particularly among busy households and aging populations.

- Increasing demand for personalized cleaning experiences and customized features.

M&A Activities:

- The number of M&A deals in the sector averaged xx per year during 2019-2024. (Estimates indicate an upward trend for 2025-2033).

- Strategic acquisitions are driving market consolidation and expansion into new segments.

Household Robots Market Industry Trends & Analysis

The Household Robots Market is projected to experience robust growth throughout the forecast period, with a Compound Annual Growth Rate (CAGR) estimated at xx% from 2025 to 2033. This growth is fueled by several key factors. Technological disruptions, particularly in AI and sensor technology, are improving robot performance and reducing costs, driving market penetration. Consumer preferences increasingly favor convenience and automation, making household robots an attractive solution. The competitive landscape remains dynamic, with established players and new entrants vying for market share through product innovation and strategic partnerships. The market penetration rate is expected to reach xx% by 2033, up from xx% in 2025.

Leading Markets & Segments in Household Robots Market

The Robotic Vacuum and Mopping segment currently dominates the Household Robots Market, holding the largest market share. North America and Western Europe are leading regional markets due to high adoption rates and high disposable incomes. However, Asia-Pacific is expected to show substantial growth in the coming years.

Leading Segment: Robotic Vacuum and Mopping

- Key Drivers: High consumer demand for automated cleaning solutions, continuous product innovation (e.g., improved suction, advanced navigation systems), relatively lower entry price points compared to other household robots.

Other Significant Segments:

- Lawn Mowing: Growing popularity of robotic lawnmowers due to convenience and reduced labor costs. Market growth particularly strong in regions with large suburban areas and favorable climatic conditions.

- Pool Cleaning: Increasing demand for automated pool maintenance due to time constraints and the tedious nature of manual cleaning.

- Companionship and Other Applications: This segment is showing emerging growth potential, fueled by advancements in AI and robotics and increasing demand for assistive devices for elderly care.

Regional Dominance:

- North America: High adoption rates driven by higher disposable incomes and consumer awareness of smart home technology.

- Western Europe: Similar factors as North America contribute to strong growth. Stringent environmental regulations regarding lawn care are also influencing the adoption of robotic lawnmowers.

- Asia-Pacific: Rapidly expanding market fueled by increasing urbanization, rising disposable incomes, and a growing middle class.

Household Robots Market Product Developments

Recent product launches highlight significant technological advancements. The Roomba Combo Essential (iRobot) showcases affordable 2-in-1 functionality, while Ecovacs' DEEBOT X2 COMBO and WINBOT W2 OMNI demonstrate whole-home cleaning capabilities. These innovations focus on enhancing user experience and expanding the range of applications. This trend of integrating advanced features while reducing costs is shaping the competitive landscape.

Key Drivers of Household Robots Market Growth

Several factors are accelerating market growth:

- Technological Advancements: AI, improved navigation, advanced sensors, and quieter operation are enhancing product capabilities and consumer appeal.

- Economic Factors: Rising disposable incomes in developed and developing economies are enabling greater affordability.

- Regulatory Support: Government incentives and support for green technologies (e.g., reducing reliance on gas-powered lawnmowers) are promoting the adoption of certain types of household robots.

Challenges in the Household Robots Market Market

The Household Robots Market faces several challenges:

- High Initial Costs: The price point for advanced robots remains a barrier for many consumers.

- Maintenance and Repair: The cost and complexity of repairs and maintenance can deter some consumers.

- Supply Chain Issues: Disruptions in global supply chains can impact the availability and pricing of components.

- Intense Competition: The market is becoming increasingly crowded, leading to price wars and margin pressures.

Emerging Opportunities in Household Robots Market

The long-term outlook is positive, driven by:

- Technological Breakthroughs: Further advancements in AI, robotics, and sensor technology will enable more sophisticated and versatile robots.

- Strategic Partnerships: Collaborations between robotics companies and other technology firms can lead to product innovation and broader market reach.

- Market Expansion: Growth potential in emerging economies and new applications, such as elderly care and personal assistance, is expected.

Leading Players in the Household Robots Market Sector

- LG Electronics Inc

- Neato Robotics Inc

- Samsung Electronics Co Ltd

- Maytronics Ltd

- Husqvarna Group

- Roborock Technology Co Ltd

- bObsweep Inc

- Blue Frog Robotics Inc

- SharkNinja Operating LLC

- iRobot Corporation

- ILIFE Innovation Ltd

- Ecovacs Robotics Inc

- Panasonic Corporation

Key Milestones in Household Robots Market Industry

- April 2024: iRobot Corp launched the Roomba Combo Essential, a budget-friendly 2-in-1 robot vacuum and mop, and announced exceeding 50 Million robots sold globally. This signifies significant market penetration and consumer adoption.

- January 2024: ECOVACS unveiled its vision for whole-home robotics with the DEEBOT X2 COMBO and WINBOT W2 OMNI, showcasing advanced capabilities and driving innovation in automated cleaning.

Strategic Outlook for Household Robots Market Market

The Household Robots Market is poised for continued expansion, driven by technological innovation, growing consumer demand, and market penetration into new segments. Strategic partnerships, product diversification, and focus on cost optimization will be key success factors for market players. The future will see increased integration of robots into smart homes, creating a connected and automated living environment.

Household Robots Market Segmentation

-

1. Application

- 1.1. Robotic Vacuum and Mopping

- 1.2. Lawn Mowing

- 1.3. Pool Cleaning

- 1.4. Companionship and Other Applications

Household Robots Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Household Robots Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Research and Development Investments and Wide Range of Applications; Rapid Urbanization

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment

- 3.4. Market Trends

- 3.4.1. Robotic Vacuum and Mopping is Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Robotic Vacuum and Mopping

- 5.1.2. Lawn Mowing

- 5.1.3. Pool Cleaning

- 5.1.4. Companionship and Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Robotic Vacuum and Mopping

- 6.1.2. Lawn Mowing

- 6.1.3. Pool Cleaning

- 6.1.4. Companionship and Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Robotic Vacuum and Mopping

- 7.1.2. Lawn Mowing

- 7.1.3. Pool Cleaning

- 7.1.4. Companionship and Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Robotic Vacuum and Mopping

- 8.1.2. Lawn Mowing

- 8.1.3. Pool Cleaning

- 8.1.4. Companionship and Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Australia and New Zealand Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Robotic Vacuum and Mopping

- 9.1.2. Lawn Mowing

- 9.1.3. Pool Cleaning

- 9.1.4. Companionship and Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Latin America Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Robotic Vacuum and Mopping

- 10.1.2. Lawn Mowing

- 10.1.3. Pool Cleaning

- 10.1.4. Companionship and Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Middle East and Africa Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Robotic Vacuum and Mopping

- 11.1.2. Lawn Mowing

- 11.1.3. Pool Cleaning

- 11.1.4. Companionship and Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. North America Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Household Robots Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 LG Electronics Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Neato Robotics Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Samsung Electronics Co Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Maytronics Ltd *List Not Exhaustive

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Husqvarna Group

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Roborock Technology Co Ltd

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 bObsweep Inc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Blue Frog Robotics Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 SharkNinja Operating LLC

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 iRobot Corporation

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 ILIFE Innovation Ltd

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Ecovacs Robotics Inc

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Panasonic Corporation

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.1 LG Electronics Inc

List of Figures

- Figure 1: Global Household Robots Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Household Robots Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Household Robots Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Household Robots Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Household Robots Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Household Robots Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Asia Household Robots Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Asia Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Australia and New Zealand Household Robots Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Australia and New Zealand Household Robots Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Australia and New Zealand Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Australia and New Zealand Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Household Robots Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America Household Robots Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Latin America Household Robots Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East and Africa Household Robots Market Revenue (Million), by Application 2024 & 2032

- Figure 35: Middle East and Africa Household Robots Market Revenue Share (%), by Application 2024 & 2032

- Figure 36: Middle East and Africa Household Robots Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Middle East and Africa Household Robots Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Household Robots Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Household Robots Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Household Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Household Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Household Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Household Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Household Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Household Robots Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Household Robots Market Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Global Household Robots Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Household Robots Market?

The projected CAGR is approximately 18.81%.

2. Which companies are prominent players in the Household Robots Market?

Key companies in the market include LG Electronics Inc, Neato Robotics Inc, Samsung Electronics Co Ltd, Maytronics Ltd *List Not Exhaustive, Husqvarna Group, Roborock Technology Co Ltd, bObsweep Inc, Blue Frog Robotics Inc, SharkNinja Operating LLC, iRobot Corporation, ILIFE Innovation Ltd, Ecovacs Robotics Inc, Panasonic Corporation.

3. What are the main segments of the Household Robots Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Research and Development Investments and Wide Range of Applications; Rapid Urbanization.

6. What are the notable trends driving market growth?

Robotic Vacuum and Mopping is Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

High Cost of Equipment.

8. Can you provide examples of recent developments in the market?

April 2024 - iRobot Corp introduced the Roomba combo essential robot an affordable and easy-to use 2-in-1 robot vacuum and mop. At USD 275, the Roomba Combo Essential delivers the cleaning essentials customers loved about the best-selling1 Roomba 600 Series – but with better performance and an impressive set of features that make it even simpler to clean the way they want. The company also announced it has surpassed the milestone of selling more than 50 million robots worldwide

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Household Robots Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Household Robots Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Household Robots Market?

To stay informed about further developments, trends, and reports in the Household Robots Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence