Key Insights

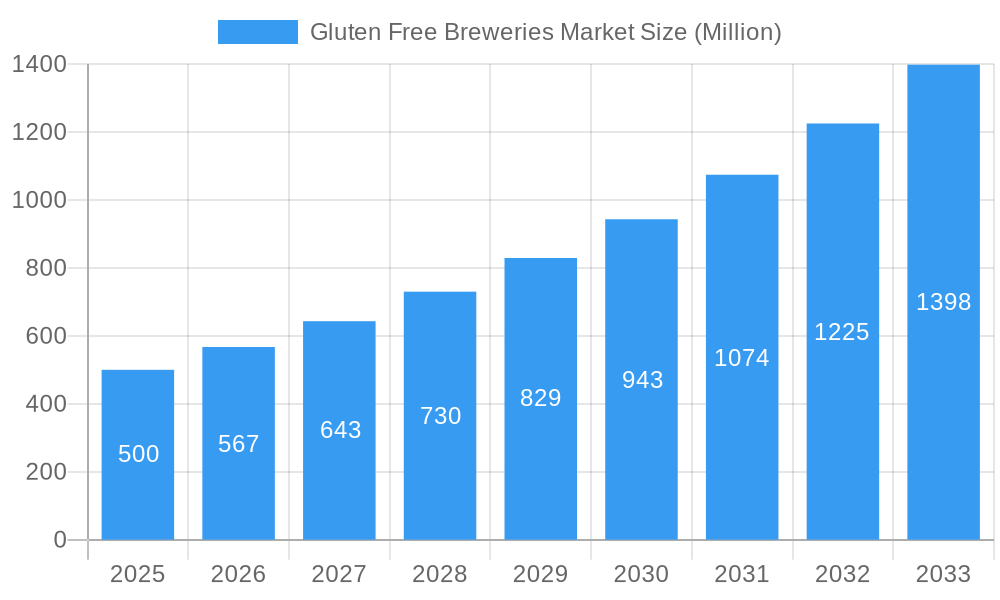

The global gluten-free breweries market is experiencing robust growth, fueled by the rising prevalence of celiac disease and gluten intolerance, coupled with increasing consumer demand for healthier and specialized food and beverage options. The market, valued at approximately $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 13.72% from 2025 to 2033, reaching an estimated $YY million by 2033 (Note: $YY is a calculated projection based on the provided CAGR and 2025 market value; the exact figure requires the missing 2025 market value). Key drivers include the expanding health-conscious population, increased awareness of gluten-related disorders, and the innovative development of palatable gluten-free beers that closely mimic the taste and texture of traditional beers. Market segmentation reveals a diverse landscape, with corn, sorghum, and millet emerging as popular ingredient types, while ale and lager beer styles dominate the product types. Distribution channels are largely split between on-trade (restaurants, bars) and off-trade (grocery stores, retail outlets) segments. Major players such as New Planet Beer Company, Holidaily Brewing Company, and Anheuser-Busch are actively shaping market dynamics through product innovation and expansion strategies.

Gluten Free Breweries Market Market Size (In Million)

Regional variations are anticipated, with North America and Europe likely maintaining significant market shares due to higher awareness levels and established gluten-free product markets. However, Asia-Pacific is poised for considerable growth, driven by rising disposable incomes and changing consumer preferences. Despite these positive trends, market growth may be somewhat constrained by the relatively higher production costs associated with gluten-free brewing and the potential for limited availability in certain regions. The long-term outlook remains highly positive, with continuous research and development in gluten-free brewing technologies and increased consumer acceptance expected to drive market expansion throughout the forecast period. Strategic partnerships, mergers and acquisitions, and the introduction of new gluten-free beer varieties will be crucial factors in determining market leadership and shaping future growth trajectories.

Gluten Free Breweries Market Company Market Share

Gluten-Free Breweries Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Gluten-Free Breweries Market, offering invaluable insights for industry stakeholders, investors, and market entrants. Projected to reach xx Million by 2033, this burgeoning market presents significant opportunities amidst evolving consumer preferences and technological advancements. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033, and utilizes 2025 as the base and estimated year.

Gluten Free Breweries Market Market Dynamics & Concentration

The Gluten-Free Breweries market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is currently [insert market concentration metric, e.g., moderately fragmented], with several key players vying for market share. Innovation is a crucial driver, with companies continuously developing new gluten-free beer formulations using diverse ingredients like corn, sorghum, and millet. Stringent regulatory frameworks concerning gluten labeling and production standards play a significant role, ensuring consumer safety and product quality. The market experiences competition from gluten-containing beers and other alcoholic beverages, while mergers and acquisitions (M&A) activity contributes to market consolidation.

- Market Share: [Insert estimated market share data for top players, e.g., New Planet Beer Company holds an estimated X% market share].

- M&A Activity: [Insert number] M&A deals were recorded between [Start Year] and [End Year], indicating a growing trend of consolidation within the market. A notable example is Sierra Nevada's acquisition of Sufferfest Beer Company in 2019, highlighting the strategic importance of entering the gluten-free beer segment.

- Innovation Drivers: Continuous research and development in ingredient sourcing, brewing techniques, and flavor profiles are driving market innovation.

- Regulatory Landscape: Stringent regulations regarding gluten content labeling and brewing processes influence market dynamics and promote consumer confidence.

- Product Substitutes: The availability of other alcoholic beverages and gluten-free alternatives presents competition for gluten-free breweries.

- End-User Trends: Growing awareness of celiac disease and increasing demand for healthier lifestyle choices fuels market growth.

Gluten Free Breweries Market Industry Trends & Analysis

The Gluten-Free Breweries market exhibits robust growth, driven by several key factors. The increasing prevalence of celiac disease and gluten intolerance globally is a primary driver, boosting demand for gluten-free alternatives. Technological advancements in brewing processes and ingredient sourcing have improved the taste and quality of gluten-free beers, attracting a broader consumer base beyond those with dietary restrictions. Consumer preferences are shifting towards healthier and specialized beverages, creating a niche market for gluten-free beers. However, the competitive landscape remains dynamic, with both established brewers and new entrants vying for market share. This competition fosters innovation and product diversification. The market is projected to experience a Compound Annual Growth Rate (CAGR) of [Insert CAGR] during the forecast period (2025-2033), with a market penetration rate of [Insert Market Penetration Percentage] by 2033.

Leading Markets & Segments in Gluten Free Breweries Market

[Insert dominant region/country analysis, e.g., North America currently dominates the gluten-free breweries market, driven by high celiac disease prevalence and strong consumer demand for healthier alternatives.] Within the market segments:

By Ingredient Type: Sorghum and corn currently hold the largest market shares, owing to their cost-effectiveness and ability to produce a desirable taste profile in gluten-free beers. Millet and other ingredients represent niche markets.

By Type: Ale beer holds a significant market share, followed by lager beer. Other beer types occupy smaller niche markets.

By Distribution Channel: Off-Trade stores (e.g., supermarkets, liquor stores) currently hold a larger share of the distribution channel compared to On-Trade stores (e.g., restaurants, bars). However, the growth of the On-Trade segment is expected to accelerate as more restaurants and bars embrace gluten-free options.

Key Drivers:

- High Celiac Disease Prevalence: A substantial portion of the population suffers from celiac disease, directly driving the demand for gluten-free products.

- Health-Conscious Consumers: Increasing consumer awareness about health and wellness fuels the demand for gluten-free alternatives.

- Government Regulations: Regulations promoting gluten-free labeling and production standards enhance consumer trust and market growth.

- Economic Factors: The disposable income levels across various regions influence the market growth within that particular region.

Gluten Free Breweries Market Product Developments

The gluten-free breweries market witnesses continuous innovation in product development. Companies are focusing on enhancing the taste and quality of gluten-free beers to broaden their appeal. Technological advancements in brewing processes are allowing for the creation of a more diverse range of beer types, mirroring the options available in the traditional beer market. This focus on product development and improvement is crucial in attracting and retaining a growing customer base and ensuring market competitiveness.

Key Drivers of Gluten Free Breweries Market Growth

Several key factors drive the growth of the Gluten-Free Breweries Market:

- Rising Prevalence of Celiac Disease: The increasing number of people diagnosed with celiac disease and gluten intolerance significantly boosts demand.

- Growing Health-Consciousness: Consumers increasingly prioritize health and wellness, making gluten-free options more appealing.

- Technological Advancements: Improved brewing techniques and ingredient sourcing enhance the quality and taste of gluten-free beer.

- Favorable Regulatory Environment: Government regulations supporting the production and labeling of gluten-free products create a conducive market environment.

Challenges in the Gluten Free Breweries Market Market

The Gluten-Free Breweries Market faces several challenges:

- Higher Production Costs: Gluten-free brewing can be more expensive than traditional brewing methods.

- Supply Chain Issues: Sourcing high-quality gluten-free ingredients can be challenging.

- Competition from Traditional Brewers: Traditional brewers are increasingly entering the gluten-free market, intensifying competition.

- Consumer Perception: Some consumers still perceive gluten-free beer as inferior in taste to traditional beer.

Emerging Opportunities in Gluten Free Breweries Market

Several opportunities exist for long-term growth:

- Expansion into New Markets: Untapped markets in developing countries offer significant potential for expansion.

- Strategic Partnerships: Collaborations with food retailers and restaurants can enhance distribution and brand awareness.

- Product Diversification: Developing new product varieties (e.g., gluten-free craft beers, flavored gluten-free beers) can attract a broader customer base.

- Technological Innovation: Investing in research and development can lead to improvements in taste, texture, and shelf life.

Leading Players in the Gluten Free Breweries Market Sector

- New Planet Beer Company

- Holidaily Brewing Company

- Coors Brewing Company

- Anheuser-Busch

- Ipswich Ale Brewery

- Greenview Brewing (ALT Brew)

- Bard's Brewing LLC

- BURNING BROTHERS BREWING LLC

- Brasseurs Sans Gluten

- Epic Brewing Company

Key Milestones in Gluten Free Breweries Market Industry

- September 2021: TWØBAYS launched its gluten-free beer brand, GFB, endorsed by Coeliac Australia. This launch showcases the growing acceptance and demand for quality gluten-free beers.

- November 2020: New Planet Beer Company, a pioneer in gluten-free beer, unveiled a new package design and updated website, demonstrating continued innovation and commitment to the market.

- February 2019: Sierra Nevada's acquisition of Sufferfest Beer Company signifies the significant market entry of a major player into the gluten-free beer sector.

Strategic Outlook for Gluten Free Breweries Market Market

The Gluten-Free Breweries Market holds immense future potential, driven by continuous innovation, expanding consumer base, and strategic partnerships. Companies that focus on product quality, efficient distribution networks, and targeted marketing strategies are expected to thrive. The market's future growth hinges on addressing challenges like production costs and consumer perception while capitalizing on emerging opportunities in global markets. The market's growth trajectory looks optimistic, underpinned by the consistent rise in demand for gluten-free products and further advancements in brewing technology.

Gluten Free Breweries Market Segmentation

-

1. Ingredient Type

- 1.1. Corn

- 1.2. Sorghum

- 1.3. Millet

- 1.4. Others

-

2. Type

- 2.1. Ale Beer

- 2.2. Lager Beer

- 2.3. Others

-

3. Distribution Channel

- 3.1. On-Trade Store

-

3.2. Off-Trade Store

- 3.2.1. Bars & Resturant

- 3.2.2. Liquor Stores

- 3.2.3. Supermarkets

- 3.2.4. Others

Gluten Free Breweries Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. South Africa

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East and Africa

Gluten Free Breweries Market Regional Market Share

Geographic Coverage of Gluten Free Breweries Market

Gluten Free Breweries Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and E-commerce Penetration

- 3.3. Market Restrains

- 3.3.1. Detrimental Health Impact of Caffeine Intake

- 3.4. Market Trends

- 3.4.1. Inclination Towards Gluten-free Craft Beer

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gluten Free Breweries Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.1.1. Corn

- 5.1.2. Sorghum

- 5.1.3. Millet

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Ale Beer

- 5.2.2. Lager Beer

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. On-Trade Store

- 5.3.2. Off-Trade Store

- 5.3.2.1. Bars & Resturant

- 5.3.2.2. Liquor Stores

- 5.3.2.3. Supermarkets

- 5.3.2.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6. North America Gluten Free Breweries Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6.1.1. Corn

- 6.1.2. Sorghum

- 6.1.3. Millet

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Ale Beer

- 6.2.2. Lager Beer

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. On-Trade Store

- 6.3.2. Off-Trade Store

- 6.3.2.1. Bars & Resturant

- 6.3.2.2. Liquor Stores

- 6.3.2.3. Supermarkets

- 6.3.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7. Europe Gluten Free Breweries Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7.1.1. Corn

- 7.1.2. Sorghum

- 7.1.3. Millet

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Ale Beer

- 7.2.2. Lager Beer

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. On-Trade Store

- 7.3.2. Off-Trade Store

- 7.3.2.1. Bars & Resturant

- 7.3.2.2. Liquor Stores

- 7.3.2.3. Supermarkets

- 7.3.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8. Asia Pacific Gluten Free Breweries Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8.1.1. Corn

- 8.1.2. Sorghum

- 8.1.3. Millet

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Ale Beer

- 8.2.2. Lager Beer

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. On-Trade Store

- 8.3.2. Off-Trade Store

- 8.3.2.1. Bars & Resturant

- 8.3.2.2. Liquor Stores

- 8.3.2.3. Supermarkets

- 8.3.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9. South America Gluten Free Breweries Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9.1.1. Corn

- 9.1.2. Sorghum

- 9.1.3. Millet

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Ale Beer

- 9.2.2. Lager Beer

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. On-Trade Store

- 9.3.2. Off-Trade Store

- 9.3.2.1. Bars & Resturant

- 9.3.2.2. Liquor Stores

- 9.3.2.3. Supermarkets

- 9.3.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10. Middle East Gluten Free Breweries Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10.1.1. Corn

- 10.1.2. Sorghum

- 10.1.3. Millet

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Ale Beer

- 10.2.2. Lager Beer

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. On-Trade Store

- 10.3.2. Off-Trade Store

- 10.3.2.1. Bars & Resturant

- 10.3.2.2. Liquor Stores

- 10.3.2.3. Supermarkets

- 10.3.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 11. South Africa Gluten Free Breweries Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 11.1.1. Corn

- 11.1.2. Sorghum

- 11.1.3. Millet

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Ale Beer

- 11.2.2. Lager Beer

- 11.2.3. Others

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. On-Trade Store

- 11.3.2. Off-Trade Store

- 11.3.2.1. Bars & Resturant

- 11.3.2.2. Liquor Stores

- 11.3.2.3. Supermarkets

- 11.3.2.4. Others

- 11.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 New Planet Beer Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Holidaily Brewing Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Coors Brewing Company*List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Anaheuser-Busch

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 IIpswich Ale Brewery

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Greenview Brewing (ALT Brew)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Bard's Brewing LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 BURNING BROTHERS BREWING LLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Brasseurs Sans Gluten

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Epic Brewing Company

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 New Planet Beer Company

List of Figures

- Figure 1: Global Gluten Free Breweries Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Gluten Free Breweries Market Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 3: North America Gluten Free Breweries Market Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 4: North America Gluten Free Breweries Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Gluten Free Breweries Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Gluten Free Breweries Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Gluten Free Breweries Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Gluten Free Breweries Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Gluten Free Breweries Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Gluten Free Breweries Market Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 11: Europe Gluten Free Breweries Market Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 12: Europe Gluten Free Breweries Market Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Gluten Free Breweries Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Gluten Free Breweries Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Gluten Free Breweries Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Gluten Free Breweries Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Gluten Free Breweries Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Gluten Free Breweries Market Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 19: Asia Pacific Gluten Free Breweries Market Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 20: Asia Pacific Gluten Free Breweries Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Gluten Free Breweries Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Gluten Free Breweries Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Gluten Free Breweries Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Gluten Free Breweries Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Gluten Free Breweries Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Gluten Free Breweries Market Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 27: South America Gluten Free Breweries Market Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 28: South America Gluten Free Breweries Market Revenue (Million), by Type 2025 & 2033

- Figure 29: South America Gluten Free Breweries Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Gluten Free Breweries Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Gluten Free Breweries Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Gluten Free Breweries Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Gluten Free Breweries Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Gluten Free Breweries Market Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 35: Middle East Gluten Free Breweries Market Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 36: Middle East Gluten Free Breweries Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East Gluten Free Breweries Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East Gluten Free Breweries Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East Gluten Free Breweries Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East Gluten Free Breweries Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Gluten Free Breweries Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South Africa Gluten Free Breweries Market Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 43: South Africa Gluten Free Breweries Market Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 44: South Africa Gluten Free Breweries Market Revenue (Million), by Type 2025 & 2033

- Figure 45: South Africa Gluten Free Breweries Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: South Africa Gluten Free Breweries Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 47: South Africa Gluten Free Breweries Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: South Africa Gluten Free Breweries Market Revenue (Million), by Country 2025 & 2033

- Figure 49: South Africa Gluten Free Breweries Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gluten Free Breweries Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 2: Global Gluten Free Breweries Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Gluten Free Breweries Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Gluten Free Breweries Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Gluten Free Breweries Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 6: Global Gluten Free Breweries Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Gluten Free Breweries Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Gluten Free Breweries Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Gluten Free Breweries Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 14: Global Gluten Free Breweries Market Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Gluten Free Breweries Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Gluten Free Breweries Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Germany Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Gluten Free Breweries Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 25: Global Gluten Free Breweries Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Gluten Free Breweries Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Gluten Free Breweries Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: China Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: India Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Japan Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Australia Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Gluten Free Breweries Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 34: Global Gluten Free Breweries Market Revenue Million Forecast, by Type 2020 & 2033

- Table 35: Global Gluten Free Breweries Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Gluten Free Breweries Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Gluten Free Breweries Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 41: Global Gluten Free Breweries Market Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Global Gluten Free Breweries Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Gluten Free Breweries Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Gluten Free Breweries Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 45: Global Gluten Free Breweries Market Revenue Million Forecast, by Type 2020 & 2033

- Table 46: Global Gluten Free Breweries Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 47: Global Gluten Free Breweries Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Saudi Arabia Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East and Africa Gluten Free Breweries Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gluten Free Breweries Market?

The projected CAGR is approximately 13.72%.

2. Which companies are prominent players in the Gluten Free Breweries Market?

Key companies in the market include New Planet Beer Company, Holidaily Brewing Company, Coors Brewing Company*List Not Exhaustive, Anaheuser-Busch, IIpswich Ale Brewery, Greenview Brewing (ALT Brew), Bard's Brewing LLC, BURNING BROTHERS BREWING LLC, Brasseurs Sans Gluten, Epic Brewing Company.

3. What are the main segments of the Gluten Free Breweries Market?

The market segments include Ingredient Type, Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and E-commerce Penetration.

6. What are the notable trends driving market growth?

Inclination Towards Gluten-free Craft Beer.

7. Are there any restraints impacting market growth?

Detrimental Health Impact of Caffeine Intake.

8. Can you provide examples of recent developments in the market?

In September 2021, TWØBAYS launched a new brand- GFB. The first beer in the GFB range is a full-strength Draught. Draught beer is lightly hopped with a simple malt base and was endorsed by Coeliac Australia. GFB uses sorghum and rice malts to create that easy-drinking flavor profile. It is also available in 375ml-can six-packs and 24-can slabs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gluten Free Breweries Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gluten Free Breweries Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gluten Free Breweries Market?

To stay informed about further developments, trends, and reports in the Gluten Free Breweries Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence