Key Insights

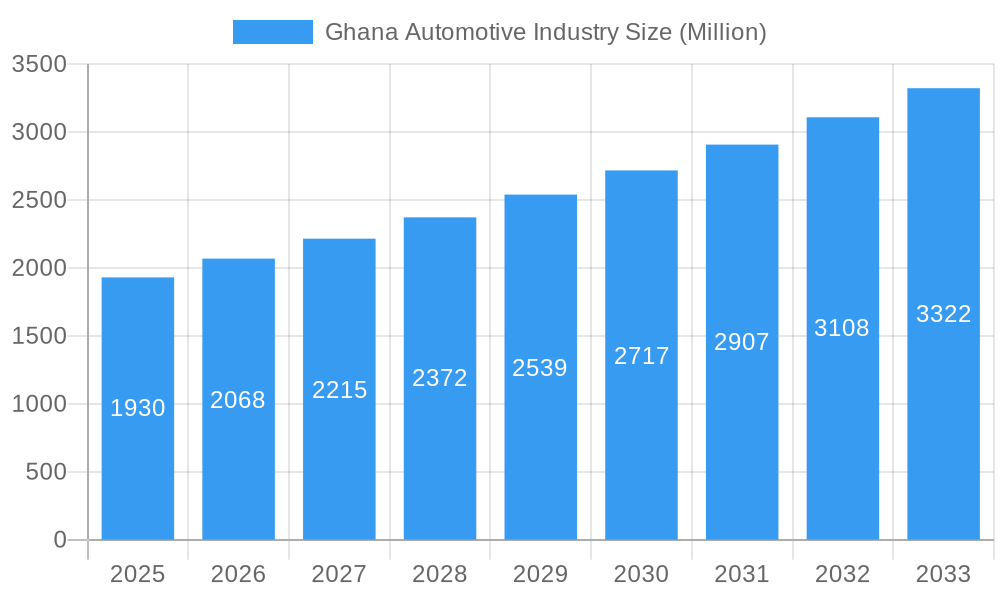

The Ghana automotive industry, valued at $1.93 billion in 2025, is poised for significant growth over the next decade. The period from 2019 to 2024 represents a crucial historical period showing foundational development within the sector. While precise figures for previous years are unavailable, the industry's expansion is likely driven by factors including increasing vehicle ownership spurred by a growing middle class and expanding infrastructure projects requiring transportation solutions. Government initiatives to improve road networks and stimulate economic activity also contribute significantly to market expansion. Furthermore, the influx of used vehicles, while impacting the new vehicle market, has fostered a robust aftermarket for parts and servicing, further fueling industry growth. We estimate a Compound Annual Growth Rate (CAGR) of approximately 7% for the forecast period (2025-2033), reflecting a blend of steady economic progress and continued infrastructure development. This growth, however, is projected to be somewhat moderated by global economic uncertainties and potential fluctuations in commodity prices impacting vehicle production costs.

Ghana Automotive Industry Market Size (In Billion)

The projected CAGR suggests a market size exceeding $3.5 billion by 2033. This growth necessitates a focus on sustainable practices within the automotive sector. Addressing challenges such as improving vehicle maintenance standards, enhancing the supply chain’s efficiency and promoting environmentally friendly vehicle options are crucial for realizing the industry's full potential. This balanced approach—combining sustained growth with responsible development—will ensure long-term profitability and sustainability for the Ghanaian automotive market. Further research into specific sub-segments, such as commercial vehicles, passenger cars, and the aftermarket, will reveal a more granular understanding of growth opportunities and potential challenges within each area.

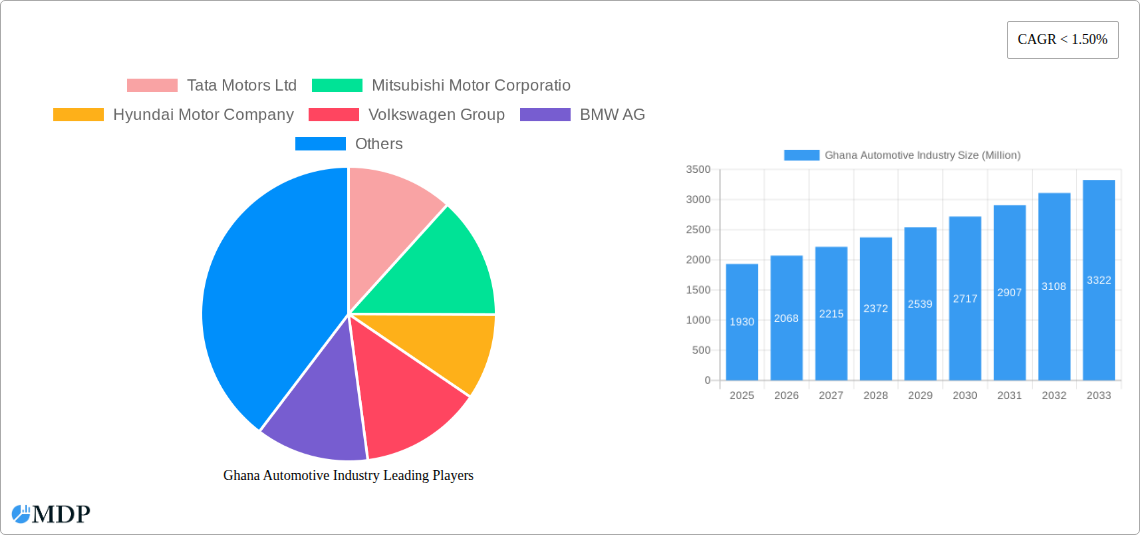

Ghana Automotive Industry Company Market Share

Ghana Automotive Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Ghana automotive industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future opportunities within the Ghanaian automotive landscape. The report leverages extensive data analysis and incorporates recent key developments to paint a vivid picture of the current state and future trajectory of this dynamic sector. Expect in-depth coverage of key segments including passenger cars, commercial vehicles, two-wheelers, and three-wheelers, along with a focus on both internal combustion engine (ICE) vehicles and the burgeoning electric vehicle (EV) market.

Ghana Automotive Industry Market Dynamics & Concentration

The Ghanaian automotive market exhibits a moderately concentrated landscape, with a few multinational players holding significant market share. Market concentration is influenced by factors such as import tariffs, distribution networks, and brand loyalty. Innovation is driven by the increasing demand for fuel-efficient and technologically advanced vehicles, alongside government initiatives to promote sustainable transportation. The regulatory framework, while evolving, plays a crucial role in shaping market dynamics. Product substitutes, primarily used vehicles, present a considerable challenge to new vehicle sales. End-user trends show a growing preference for SUVs and multi-purpose vehicles, reflecting changing lifestyle preferences and evolving family needs. M&A activity remains relatively low, with xx major deals recorded between 2019 and 2024. This suggests limited consolidation in the market.

- Market Share: Toyota and other established brands hold approximately 60% of the market. The remaining 40% is shared among other players including local assemblers.

- M&A Deal Count (2019-2024): xx

- Innovation Drivers: Government incentives for EVs, rising fuel prices, and consumer demand for technologically advanced features.

- Regulatory Framework: Import duties and regulations influencing vehicle pricing and availability.

Ghana Automotive Industry Industry Trends & Analysis

The Ghanaian automotive industry is experiencing robust growth, driven by a burgeoning middle class, rising urbanization, and improved infrastructure. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 is estimated at xx%. Technological disruptions, particularly the introduction of EVs, are reshaping the competitive landscape. Consumer preferences are shifting towards fuel-efficient and technologically advanced vehicles, impacting sales of conventional ICE vehicles. The market is characterized by intense competition, with established international brands vying for market share alongside local assemblers. Market penetration of EVs remains low (xx%), but is projected to increase significantly in the forecast period.

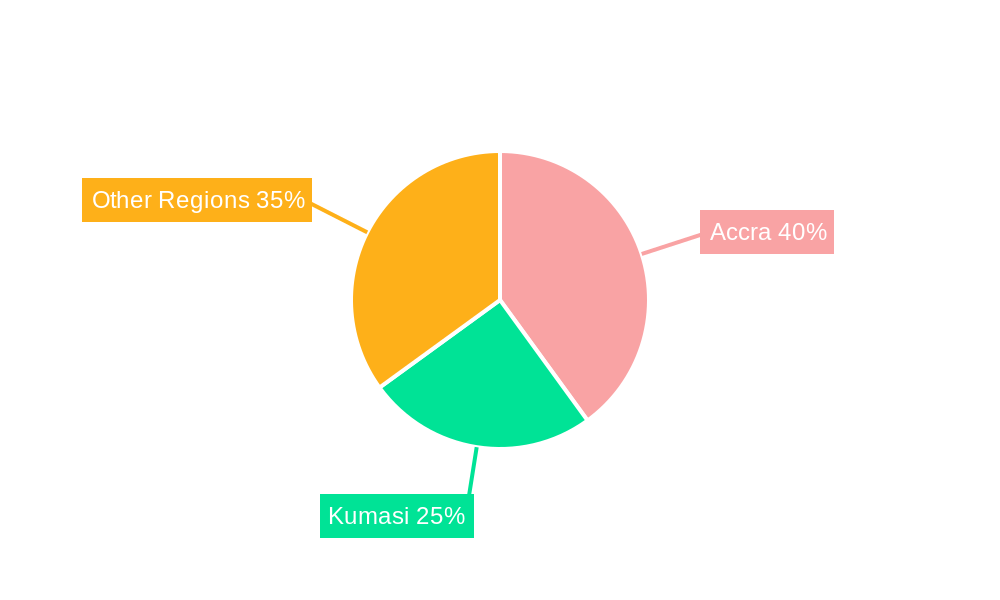

Leading Markets & Segments in Ghana Automotive Industry

The passenger car segment dominates the Ghanaian automotive market, accounting for approximately 70% of total sales. Within this segment, new vehicles represent a larger portion of the market, driven by financing options and consumer preferences for new models. The commercial vehicle segment continues to show steady growth, fueled by infrastructure development and a growing logistics sector. While the two-wheeler and three-wheeler segments are less prominent, their growth potential is significant, with increasing demand from urban areas.

Key Drivers for Passenger Car Dominance: Growing middle class, increased disposable income, and preference for personal transportation.

Key Drivers for Commercial Vehicle Growth: Infrastructure development projects, expanding logistics sector, and government initiatives.

Key Drivers for Two and Three-Wheeler Growth: Affordable transportation solutions for urban areas and last-mile delivery needs.

Regional Dominance: Accra and its surrounding regions constitute the largest market segment.

Ghana Automotive Industry Product Developments

Recent years have witnessed a surge in the introduction of new vehicle models, particularly in the passenger car segment. Technological advancements, such as improved fuel efficiency and safety features, are driving product innovation. Electric vehicles (EVs) are entering the market, although their penetration remains low, This is further fueled by companies such as SolarTaxi introducing ride-hailing services using electric vehicles. Competition is intensifying as companies compete to offer superior features, quality, and affordability to customers.

Key Drivers of Ghana Automotive Industry Growth

Several factors contribute to the growth of the Ghanaian automotive industry. Economic growth, expanding infrastructure, and government initiatives supporting the sector all play significant roles. Technological advancements in areas such as fuel efficiency and connectivity contribute significantly to the industry's development. Further growth is expected through investment in local assembly plants and increased access to financing options.

Challenges in the Ghana Automotive Industry Market

The industry faces several challenges, including high import duties, inadequate infrastructure, and limited access to financing for vehicle purchases. Fluctuations in currency exchange rates impact vehicle pricing, making them less affordable for some customers. Supply chain disruptions, particularly related to global events, have also had a negative impact on industry growth.

Emerging Opportunities in Ghana Automotive Industry

The Ghanaian automotive market presents considerable opportunities for growth. The expansion of the EV segment, the development of local assembly plants, and the potential for increased government support all present promising avenues for future development. Strategic partnerships, particularly with international players, are emerging as key to success. Further investment in infrastructure and skills development will facilitate this growth.

Leading Players in the Ghana Automotive Industry Sector

- Tata Motors Ltd

- Mitsubishi Motor Corporation

- Hyundai Motor Company

- Volkswagen Group

- BMW AG

- Mercedes-Benz Group AG

- Nissan Motor Co Ltd

- Toyota Motor Corporation

- Honda Motor Company Ltd

- Bajaj Motors

- Kantaka Group

- Volvo Group

- Ford Motor Company

Key Milestones in Ghana Automotive Industry Industry

- March 2023: TVS Motor Company launches the TVS King Series three-wheelers, expanding its African market presence.

- March 2023: Toyota Manufacturing Ghana Co. Limited commissions its first locally assembled Suzuki Swift, signaling increased local production.

- October 2022: SIXAI and Musashi Seimitsu announce plans to produce and lease millions of electric motorcycles, with potential for local assembly.

- March 2022: SolarTaxi launches Africa's first electric car on a ride-hailing app, introducing a greener transportation option.

Strategic Outlook for Ghana Automotive Industry Market

The future of the Ghanaian automotive market is bright, with substantial growth potential driven by economic expansion, infrastructural development, and increased consumer demand. Strategic partnerships between local and international players, coupled with investments in sustainable transportation solutions, will be crucial for future success. The focus on developing local assembly capabilities and promoting the adoption of electric vehicles will further shape the industry's trajectory.

Ghana Automotive Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

- 1.3. Two-wheelers

- 1.4. Three-wheelers

-

2. Propulsion

- 2.1. Internal Combustion Engine

- 2.2. Electric Vehicles

-

3. Type

- 3.1. New Vehicles

- 3.2. Used Vehicles

Ghana Automotive Industry Segmentation By Geography

- 1. Ghana

Ghana Automotive Industry Regional Market Share

Geographic Coverage of Ghana Automotive Industry

Ghana Automotive Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of < 1.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding the Presence of Automobile Assembly Plants in Ghana to Drive Demand in Target Market

- 3.3. Market Restrains

- 3.3.1. High Import Tariffs and Taxes on Vehicles May Stymie Industry Expansion

- 3.4. Market Trends

- 3.4.1. Passenger Car Segment to Hold Majority of the Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ghana Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.1.3. Two-wheelers

- 5.1.4. Three-wheelers

- 5.2. Market Analysis, Insights and Forecast - by Propulsion

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. New Vehicles

- 5.3.2. Used Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Ghana

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tata Motors Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Motor Corporatio

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Motor Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volkswagen Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BMW AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mercedes-Benz Group AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nissan Motor Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyota Motor Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honda Motor Company Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bajaj Motors

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kantaka Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Volvo Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Ford Motor Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Tata Motors Ltd

List of Figures

- Figure 1: Ghana Automotive Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Ghana Automotive Industry Share (%) by Company 2025

List of Tables

- Table 1: Ghana Automotive Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Ghana Automotive Industry Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 3: Ghana Automotive Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Ghana Automotive Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Ghana Automotive Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Ghana Automotive Industry Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 7: Ghana Automotive Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Ghana Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ghana Automotive Industry?

The projected CAGR is approximately < 1.50%.

2. Which companies are prominent players in the Ghana Automotive Industry?

Key companies in the market include Tata Motors Ltd, Mitsubishi Motor Corporatio, Hyundai Motor Company, Volkswagen Group, BMW AG, Mercedes-Benz Group AG, Nissan Motor Co Ltd, Toyota Motor Corporation, Honda Motor Company Ltd, Bajaj Motors, Kantaka Group, Volvo Group, Ford Motor Company.

3. What are the main segments of the Ghana Automotive Industry?

The market segments include Vehicle Type, Propulsion, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding the Presence of Automobile Assembly Plants in Ghana to Drive Demand in Target Market.

6. What are the notable trends driving market growth?

Passenger Car Segment to Hold Majority of the Market Share.

7. Are there any restraints impacting market growth?

High Import Tariffs and Taxes on Vehicles May Stymie Industry Expansion.

8. Can you provide examples of recent developments in the market?

March 2023: TVS Motor Company announced the launch of new three-wheeler products in Ghana, the TVS King Series. The launch aims to expand the company’s reach and develop new avenues for growth in the African market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ghana Automotive Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ghana Automotive Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ghana Automotive Industry?

To stay informed about further developments, trends, and reports in the Ghana Automotive Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence