Key Insights

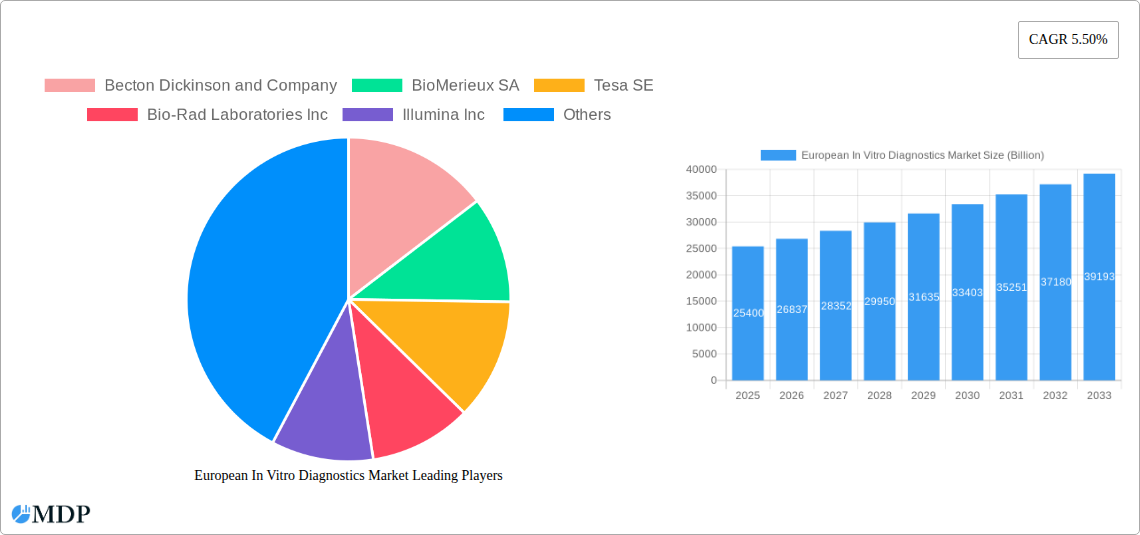

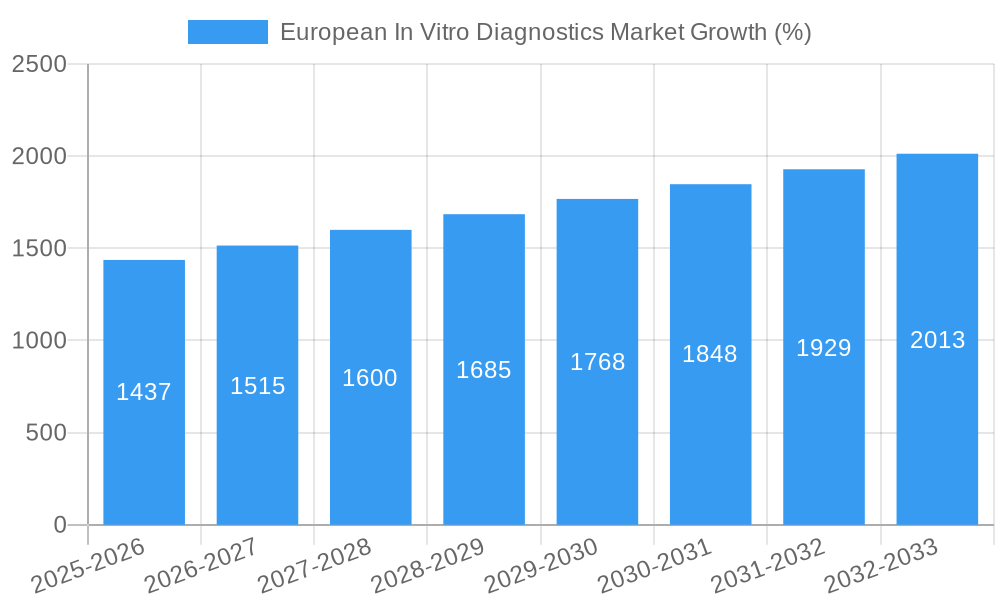

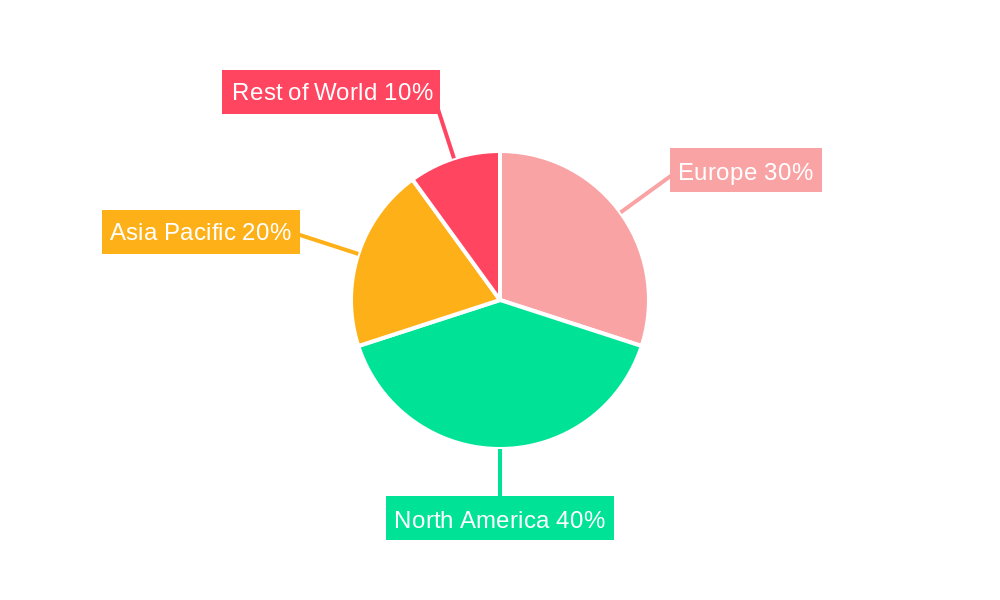

The European In Vitro Diagnostics (IVD) market, valued at €25.4 billion in 2025, is projected to experience robust growth, driven by several key factors. The rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular conditions fuels the demand for accurate and timely diagnostic testing. Technological advancements in molecular diagnostics, including next-generation sequencing and polymerase chain reaction (PCR) technologies, are enhancing diagnostic capabilities, leading to earlier disease detection and improved patient outcomes. Furthermore, the increasing adoption of point-of-care testing (POCT) devices allows for faster diagnosis and treatment initiation, particularly in remote areas or resource-limited settings. Government initiatives promoting preventative healthcare and improved healthcare infrastructure are also positively impacting market growth. The market is segmented by test type (clinical chemistry, molecular diagnostics, hematology, immunodiagnostics, etc.), product (instruments, reagents, consumables), usability (disposable/reusable devices), application (infectious diseases, oncology, cardiology, etc.), and end-user (diagnostic labs, hospitals, etc.). Germany, France, the UK, and Italy represent significant market shares within Europe, reflecting their advanced healthcare systems and higher healthcare expenditure.

However, the market faces certain challenges. Stringent regulatory approvals and reimbursement policies can hinder market penetration of new technologies. The high cost of advanced diagnostic equipment and reagents might limit accessibility in some regions. Furthermore, the increasing competition among established players and emerging companies necessitates continuous innovation and strategic partnerships to maintain market share. Despite these restraints, the long-term growth prospects remain positive, fueled by the aging population, increased healthcare awareness, and the continuous development of innovative diagnostic solutions. The market's CAGR of 5.50% suggests steady expansion throughout the forecast period (2025-2033), with notable growth anticipated in molecular diagnostics and POCT segments. The competitive landscape includes major players like Roche, Abbott, Siemens, and others, all vying for dominance through product innovation and strategic acquisitions.

European In Vitro Diagnostics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the European In Vitro Diagnostics (IVD) market, projecting a market valuation exceeding XX Billion by 2033. It covers the historical period (2019-2024), the base year (2025), and forecasts until 2033, offering invaluable insights for stakeholders across the IVD landscape. The report meticulously examines market dynamics, leading players, technological advancements, and future growth opportunities, empowering informed decision-making in this rapidly evolving sector. Key segments analyzed include Test Type, Product, Usability, Application, and End User, providing a granular understanding of market segmentation and growth potential.

European In Vitro Diagnostics Market Market Dynamics & Concentration

The European IVD market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. However, the market also presents opportunities for smaller companies specializing in niche areas or innovative technologies. The market's dynamism is driven by several factors including:

- Innovation: Continuous innovation in areas like molecular diagnostics, next-generation sequencing, and point-of-care testing is driving market growth. Companies are investing heavily in R&D to develop faster, more accurate, and cost-effective diagnostic solutions.

- Regulatory Frameworks: The stringent regulatory environment in Europe, primarily governed by the IVDR (In Vitro Diagnostic Regulation), significantly influences market dynamics. Compliance with these regulations is crucial for market entry and success.

- Product Substitutes: While IVD remains the primary method for diagnostics, alternative technologies are emerging, creating both opportunities and challenges. The impact of these substitutes on market share is currently estimated to be around xx%.

- End-User Trends: The increasing prevalence of chronic diseases, coupled with a rising demand for personalized medicine, drives market growth. Hospitals and diagnostic laboratories remain the largest end users, but the point-of-care segment is showing substantial growth.

- Mergers & Acquisitions (M&A): Consolidation is a notable trend within the European IVD sector, with a significant number of M&A deals recorded in recent years. The estimated number of M&A deals between 2019 and 2024 was xx, with an average deal value of xx Billion. This activity reflects companies' strategies for market expansion and technological integration. The market share of top 5 players in 2024 was approximately xx%.

European In Vitro Diagnostics Market Industry Trends & Analysis

The European IVD market exhibits a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key trends:

- Technological Disruptions: The integration of Artificial Intelligence (AI) and big data analytics is transforming diagnostic procedures, offering greater accuracy and efficiency. This, along with the rise of molecular diagnostics and next-generation sequencing, significantly boosts market growth.

- Consumer Preferences: Patients are increasingly demanding faster, more convenient, and personalized diagnostic services, which fuels innovation in point-of-care testing and home-based diagnostics.

- Competitive Dynamics: Intense competition among established players and emerging companies drives innovation and price optimization. This competitive landscape benefits consumers through better access to advanced diagnostic technologies.

- Market Penetration: The market penetration of advanced diagnostic technologies like molecular diagnostics is steadily increasing. The rate of market penetration for these technologies has been estimated to grow at xx% between 2025 and 2033.

Leading Markets & Segments in European In Vitro Diagnostics Market

While the entire European market presents significant opportunities, some segments and regions demonstrate stronger growth than others:

- Germany: Germany stands as a leading market within Europe, driven by its strong healthcare infrastructure, high healthcare expenditure, and advanced technological adoption. The large population and high prevalence of chronic diseases also contribute to market growth in this region.

- France and UK: France and the UK also hold significant market shares, reflecting substantial healthcare investments and the presence of major players in these countries.

- Dominant Segments:

- Test Type: Molecular Diagnostics is experiencing rapid growth due to its increasing application in personalized medicine and infectious disease diagnosis. Clinical Chemistry remains a significant segment due to its widespread use in routine diagnostics.

- Product: Reagents account for a substantial portion of the market, followed by instruments. The increasing adoption of automated systems is driving growth within the instrument segment.

- Usability: Disposable IVD devices hold the largest market share due to their convenience and hygiene benefits.

- Application: Infectious diseases remain a major driver of market growth, followed by oncology and cardiology.

- End User: Hospitals and diagnostic laboratories remain the largest end users, but the growth of point-of-care testing is expanding the other end user segment.

Key drivers for these dominant segments include favorable economic policies promoting healthcare investments, robust healthcare infrastructure, and increasing prevalence of chronic diseases. Strong regulatory frameworks ensure high quality and safety standards for IVD products.

European In Vitro Diagnostics Market Product Developments

The European IVD market showcases continuous innovation, with an emphasis on developing miniaturized, portable, and connected diagnostic devices. Recent advancements include point-of-care testing platforms that deliver rapid results, AI-powered diagnostic tools that enhance accuracy, and advanced molecular diagnostics that offer improved sensitivity and specificity. These developments respond directly to market demands for faster, more accurate, and efficient diagnostic solutions.

Key Drivers of European In Vitro Diagnostics Market Growth

Several factors fuel the growth of the European IVD market:

- Technological Advancements: Continuous innovation in molecular diagnostics, next-generation sequencing, and AI-powered diagnostics drives market expansion.

- Rising Prevalence of Chronic Diseases: The increasing incidence of chronic diseases like cancer, diabetes, and cardiovascular diseases necessitates advanced diagnostic solutions, thereby boosting market demand.

- Government Initiatives: Government initiatives aimed at improving healthcare access and quality stimulate market growth through funding and supportive regulations. Examples include the development and implementation of the IVDR within the European Union.

Challenges in the European In Vitro Diagnostics Market Market

The European IVD market faces several challenges:

- Regulatory Hurdles: The stringent regulatory environment, particularly under the IVDR, poses challenges for companies in terms of compliance and market access. The cost associated with meeting stringent regulatory standards can be significant.

- Supply Chain Disruptions: Global supply chain issues can disrupt the availability of raw materials and components, impacting production and potentially increasing costs.

- Pricing Pressure: Intense competition among players puts pressure on pricing, impacting profitability.

Emerging Opportunities in European In Vitro Diagnostics Market

The long-term growth of the European IVD market is driven by several emerging opportunities:

- Technological Breakthroughs: Further advancements in next-generation sequencing, AI-powered diagnostics, and liquid biopsy techniques promise to revolutionize diagnostic capabilities.

- Strategic Partnerships: Collaborations between IVD companies, pharmaceutical companies, and technology providers create synergies that lead to accelerated innovation and market expansion.

- Market Expansion: Growth in emerging markets within Europe offers significant expansion opportunities for IVD companies.

Leading Players in the European In Vitro Diagnostics Market Sector

- Becton Dickinson and Company

- BioMerieux SA

- Tesa SE

- Bio-Rad Laboratories Inc

- Illumina Inc

- Siemens Healthcare

- Hologic Inc

- Thermo Fisher Scientific Inc

- Abbott Laboratories

- Diasorin S p A

- Danaher Corporation (Beckman Coulter Inc)

- Sysmex Corporation

- QIAGEN

- Roche Diagnostics

Key Milestones in European In Vitro Diagnostics Market Industry

- September 2022: Noul Co., Ltd. received the CE-IVD mark for two next-generation diagnostic testing products, expanding its product line in in-vitro diagnostics systems.

- December 2022: BioMérieux SA received the CE mark for Vidas Kube automated immunoassay system.

- March 2023: MGI Tech Co., Ltd. received the CE mark for the DNBSeq-G99 sequencer.

Strategic Outlook for European In Vitro Diagnostics Market Market

The future of the European IVD market looks promising, driven by technological advancements, increasing prevalence of chronic diseases, and supportive regulatory frameworks. Companies that successfully leverage technological innovations, establish strategic partnerships, and adapt to evolving regulatory landscapes are poised to capitalize on the significant growth potential within this market. The focus on personalized medicine, point-of-care diagnostics, and digital health integration will continue shaping the market's trajectory in the coming years, leading to further expansion and market consolidation.

European In Vitro Diagnostics Market Segmentation

-

1. Test Type

- 1.1. Clinical Chemistry

- 1.2. Molecular Diagnostics

- 1.3. Hematology

- 1.4. Immuno Diagnostics

- 1.5. Other Test Types

-

2. Product

- 2.1. Instrument

- 2.2. Reagents

- 2.3. Other Products

-

3. Usability

- 3.1. Disposable IVD Devices

- 3.2. Reusable IVD Devices

-

4. Application

- 4.1. Infectious Disease

- 4.2. Diabetes

- 4.3. Cancer/Oncology

- 4.4. Cardiology

- 4.5. Autoimmune Disease

- 4.6. Nephrology

- 4.7. Other Applications

-

5. End User

- 5.1. Diagnostic Laboratories

- 5.2. Hospitals and Clinics

- 5.3. Other End Users

European In Vitro Diagnostics Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

European In Vitro Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Prevalence of Chronic Diseases; Increasing Demand for Point-of-care Diagnostics; Technological Advancements in In-Vitro Diagnostics Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations; Cumbersome Reimbursement Procedures

- 3.4. Market Trends

- 3.4.1. The Instrument Segment is Expected to Hold a Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Hematology

- 5.1.4. Immuno Diagnostics

- 5.1.5. Other Test Types

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instrument

- 5.2.2. Reagents

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Usability

- 5.3.1. Disposable IVD Devices

- 5.3.2. Reusable IVD Devices

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Infectious Disease

- 5.4.2. Diabetes

- 5.4.3. Cancer/Oncology

- 5.4.4. Cardiology

- 5.4.5. Autoimmune Disease

- 5.4.6. Nephrology

- 5.4.7. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by End User

- 5.5.1. Diagnostic Laboratories

- 5.5.2. Hospitals and Clinics

- 5.5.3. Other End Users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.6.2. United Kingdom

- 5.6.3. France

- 5.6.4. Italy

- 5.6.5. Spain

- 5.6.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. Germany European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Test Type

- 6.1.1. Clinical Chemistry

- 6.1.2. Molecular Diagnostics

- 6.1.3. Hematology

- 6.1.4. Immuno Diagnostics

- 6.1.5. Other Test Types

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Instrument

- 6.2.2. Reagents

- 6.2.3. Other Products

- 6.3. Market Analysis, Insights and Forecast - by Usability

- 6.3.1. Disposable IVD Devices

- 6.3.2. Reusable IVD Devices

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Infectious Disease

- 6.4.2. Diabetes

- 6.4.3. Cancer/Oncology

- 6.4.4. Cardiology

- 6.4.5. Autoimmune Disease

- 6.4.6. Nephrology

- 6.4.7. Other Applications

- 6.5. Market Analysis, Insights and Forecast - by End User

- 6.5.1. Diagnostic Laboratories

- 6.5.2. Hospitals and Clinics

- 6.5.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Test Type

- 7. United Kingdom European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Test Type

- 7.1.1. Clinical Chemistry

- 7.1.2. Molecular Diagnostics

- 7.1.3. Hematology

- 7.1.4. Immuno Diagnostics

- 7.1.5. Other Test Types

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Instrument

- 7.2.2. Reagents

- 7.2.3. Other Products

- 7.3. Market Analysis, Insights and Forecast - by Usability

- 7.3.1. Disposable IVD Devices

- 7.3.2. Reusable IVD Devices

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Infectious Disease

- 7.4.2. Diabetes

- 7.4.3. Cancer/Oncology

- 7.4.4. Cardiology

- 7.4.5. Autoimmune Disease

- 7.4.6. Nephrology

- 7.4.7. Other Applications

- 7.5. Market Analysis, Insights and Forecast - by End User

- 7.5.1. Diagnostic Laboratories

- 7.5.2. Hospitals and Clinics

- 7.5.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Test Type

- 8. France European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Test Type

- 8.1.1. Clinical Chemistry

- 8.1.2. Molecular Diagnostics

- 8.1.3. Hematology

- 8.1.4. Immuno Diagnostics

- 8.1.5. Other Test Types

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Instrument

- 8.2.2. Reagents

- 8.2.3. Other Products

- 8.3. Market Analysis, Insights and Forecast - by Usability

- 8.3.1. Disposable IVD Devices

- 8.3.2. Reusable IVD Devices

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Infectious Disease

- 8.4.2. Diabetes

- 8.4.3. Cancer/Oncology

- 8.4.4. Cardiology

- 8.4.5. Autoimmune Disease

- 8.4.6. Nephrology

- 8.4.7. Other Applications

- 8.5. Market Analysis, Insights and Forecast - by End User

- 8.5.1. Diagnostic Laboratories

- 8.5.2. Hospitals and Clinics

- 8.5.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Test Type

- 9. Italy European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Test Type

- 9.1.1. Clinical Chemistry

- 9.1.2. Molecular Diagnostics

- 9.1.3. Hematology

- 9.1.4. Immuno Diagnostics

- 9.1.5. Other Test Types

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Instrument

- 9.2.2. Reagents

- 9.2.3. Other Products

- 9.3. Market Analysis, Insights and Forecast - by Usability

- 9.3.1. Disposable IVD Devices

- 9.3.2. Reusable IVD Devices

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Infectious Disease

- 9.4.2. Diabetes

- 9.4.3. Cancer/Oncology

- 9.4.4. Cardiology

- 9.4.5. Autoimmune Disease

- 9.4.6. Nephrology

- 9.4.7. Other Applications

- 9.5. Market Analysis, Insights and Forecast - by End User

- 9.5.1. Diagnostic Laboratories

- 9.5.2. Hospitals and Clinics

- 9.5.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Test Type

- 10. Spain European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Test Type

- 10.1.1. Clinical Chemistry

- 10.1.2. Molecular Diagnostics

- 10.1.3. Hematology

- 10.1.4. Immuno Diagnostics

- 10.1.5. Other Test Types

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Instrument

- 10.2.2. Reagents

- 10.2.3. Other Products

- 10.3. Market Analysis, Insights and Forecast - by Usability

- 10.3.1. Disposable IVD Devices

- 10.3.2. Reusable IVD Devices

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Infectious Disease

- 10.4.2. Diabetes

- 10.4.3. Cancer/Oncology

- 10.4.4. Cardiology

- 10.4.5. Autoimmune Disease

- 10.4.6. Nephrology

- 10.4.7. Other Applications

- 10.5. Market Analysis, Insights and Forecast - by End User

- 10.5.1. Diagnostic Laboratories

- 10.5.2. Hospitals and Clinics

- 10.5.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Test Type

- 11. Rest of Europe European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Test Type

- 11.1.1. Clinical Chemistry

- 11.1.2. Molecular Diagnostics

- 11.1.3. Hematology

- 11.1.4. Immuno Diagnostics

- 11.1.5. Other Test Types

- 11.2. Market Analysis, Insights and Forecast - by Product

- 11.2.1. Instrument

- 11.2.2. Reagents

- 11.2.3. Other Products

- 11.3. Market Analysis, Insights and Forecast - by Usability

- 11.3.1. Disposable IVD Devices

- 11.3.2. Reusable IVD Devices

- 11.4. Market Analysis, Insights and Forecast - by Application

- 11.4.1. Infectious Disease

- 11.4.2. Diabetes

- 11.4.3. Cancer/Oncology

- 11.4.4. Cardiology

- 11.4.5. Autoimmune Disease

- 11.4.6. Nephrology

- 11.4.7. Other Applications

- 11.5. Market Analysis, Insights and Forecast - by End User

- 11.5.1. Diagnostic Laboratories

- 11.5.2. Hospitals and Clinics

- 11.5.3. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Test Type

- 12. Germany European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 13. France European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe European In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Becton Dickinson and Company

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 BioMerieux SA

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Tesa SE

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Bio-Rad Laboratories Inc

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Illumina Inc

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Siemens Healthcare

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Hologic Inc

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Thermo Fisher Scientific Inc

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Abbott Laboratories

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Diasorin S p A

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Danaher Corporation (Beckman Coulter Inc)

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 Sysmex Corporation

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.13 QIAGEN

- 19.2.13.1. Overview

- 19.2.13.2. Products

- 19.2.13.3. SWOT Analysis

- 19.2.13.4. Recent Developments

- 19.2.13.5. Financials (Based on Availability)

- 19.2.14 Roche Diagnostics

- 19.2.14.1. Overview

- 19.2.14.2. Products

- 19.2.14.3. SWOT Analysis

- 19.2.14.4. Recent Developments

- 19.2.14.5. Financials (Based on Availability)

- 19.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: European In Vitro Diagnostics Market Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: European In Vitro Diagnostics Market Share (%) by Company 2024

List of Tables

- Table 1: European In Vitro Diagnostics Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: European In Vitro Diagnostics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 4: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 5: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 6: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 7: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 8: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 9: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 10: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 11: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 12: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 13: European In Vitro Diagnostics Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 14: European In Vitro Diagnostics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 15: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 16: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Germany European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: Germany European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: France European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: France European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Italy European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 22: Italy European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: United Kingdom European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 24: United Kingdom European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Netherlands European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 26: Netherlands European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Sweden European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 28: Sweden European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe European In Vitro Diagnostics Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe European In Vitro Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 32: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 33: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 34: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 35: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 36: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 37: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 38: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 39: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 40: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 41: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 42: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 44: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 45: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 46: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 47: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 48: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 49: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 50: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 51: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 52: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 53: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 54: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 55: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 56: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 57: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 58: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 59: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 60: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 61: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 62: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 63: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 64: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 65: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 66: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 67: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 68: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 69: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 70: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 71: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 72: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 73: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 74: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 75: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 76: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 77: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 78: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 79: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 80: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 81: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 82: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 83: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 84: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 85: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 86: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 87: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 88: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 89: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 90: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 91: European In Vitro Diagnostics Market Revenue Billion Forecast, by Test Type 2019 & 2032

- Table 92: European In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 93: European In Vitro Diagnostics Market Revenue Billion Forecast, by Product 2019 & 2032

- Table 94: European In Vitro Diagnostics Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 95: European In Vitro Diagnostics Market Revenue Billion Forecast, by Usability 2019 & 2032

- Table 96: European In Vitro Diagnostics Market Volume K Unit Forecast, by Usability 2019 & 2032

- Table 97: European In Vitro Diagnostics Market Revenue Billion Forecast, by Application 2019 & 2032

- Table 98: European In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 99: European In Vitro Diagnostics Market Revenue Billion Forecast, by End User 2019 & 2032

- Table 100: European In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 101: European In Vitro Diagnostics Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 102: European In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European In Vitro Diagnostics Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the European In Vitro Diagnostics Market?

Key companies in the market include Becton Dickinson and Company, BioMerieux SA, Tesa SE, Bio-Rad Laboratories Inc, Illumina Inc , Siemens Healthcare, Hologic Inc, Thermo Fisher Scientific Inc, Abbott Laboratories, Diasorin S p A, Danaher Corporation (Beckman Coulter Inc), Sysmex Corporation, QIAGEN, Roche Diagnostics.

3. What are the main segments of the European In Vitro Diagnostics Market?

The market segments include Test Type, Product, Usability, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.4 Billion as of 2022.

5. What are some drivers contributing to market growth?

High Prevalence of Chronic Diseases; Increasing Demand for Point-of-care Diagnostics; Technological Advancements in In-Vitro Diagnostics Devices.

6. What are the notable trends driving market growth?

The Instrument Segment is Expected to Hold a Major Share in the Market.

7. Are there any restraints impacting market growth?

Stringent Regulations; Cumbersome Reimbursement Procedures.

8. Can you provide examples of recent developments in the market?

In March 2023, MGI Tech Co., Ltd. received the CE mark for the DNBSeq-G99 sequencer with an aim to precise sequencing of genetic substances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European In Vitro Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European In Vitro Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European In Vitro Diagnostics Market?

To stay informed about further developments, trends, and reports in the European In Vitro Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence