Key Insights

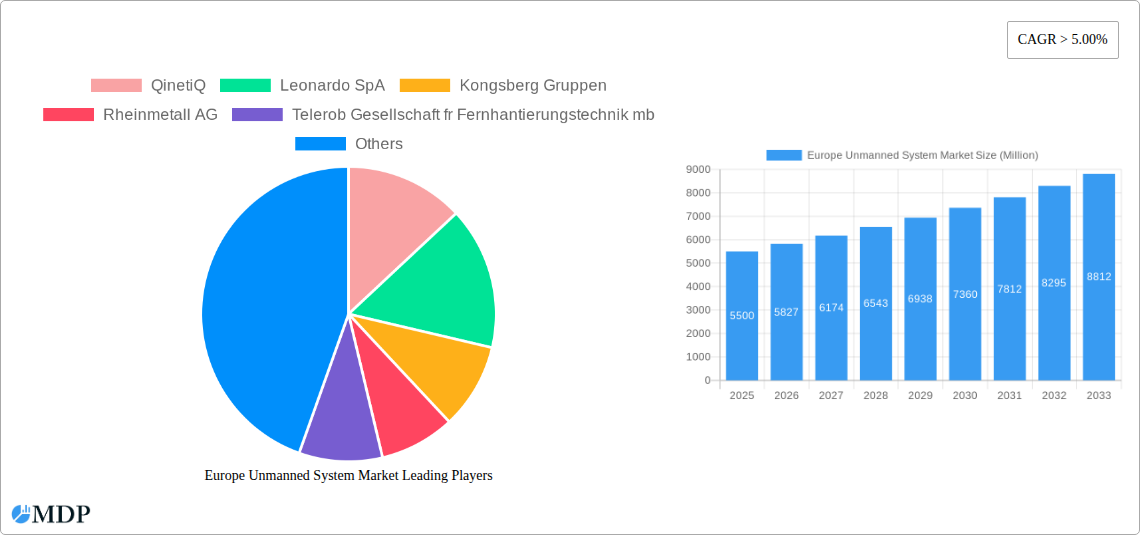

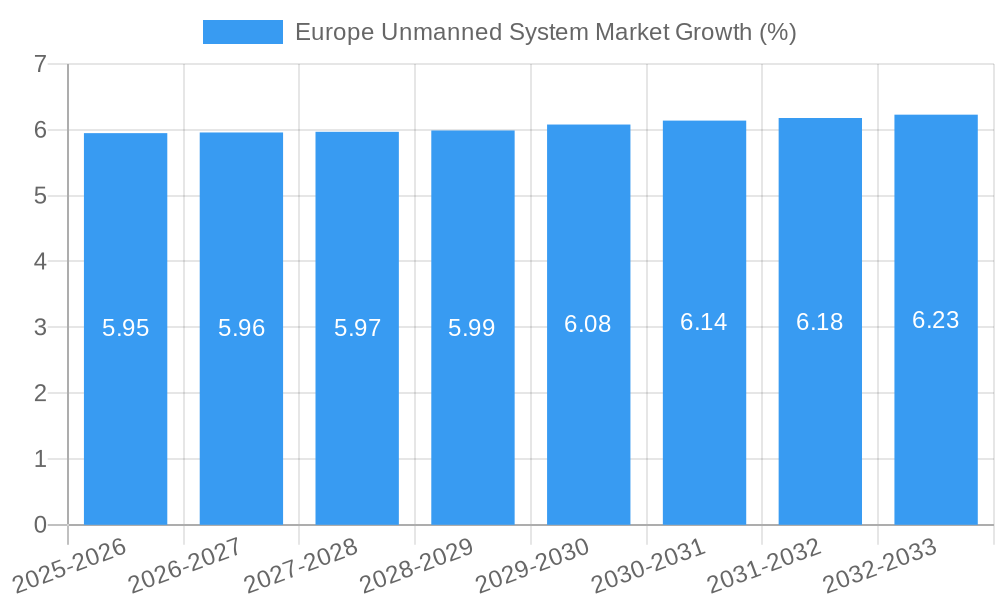

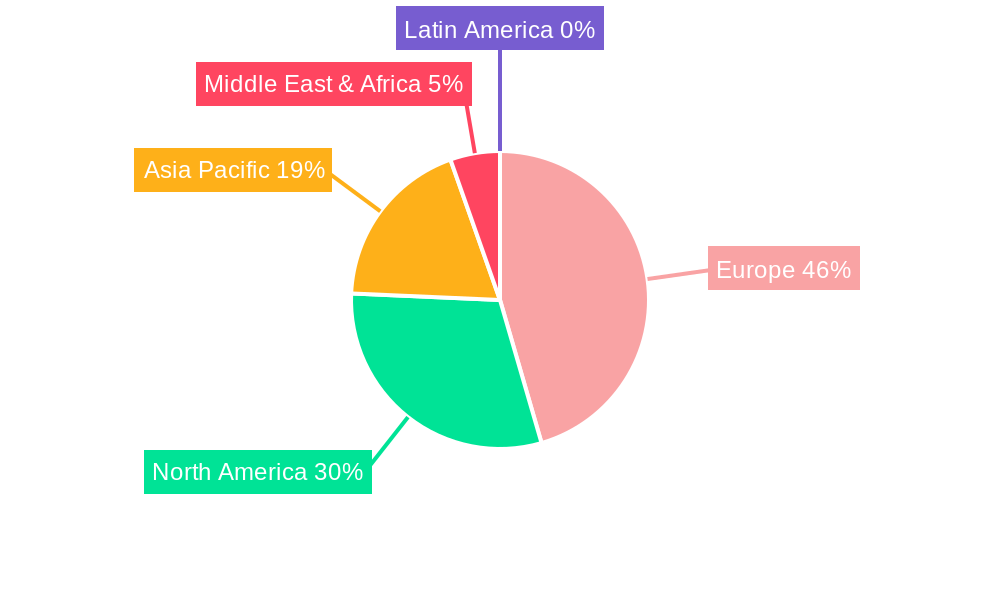

The European Unmanned System Market is poised for substantial expansion, projected to reach a market size of USD XX Million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 5.00% through 2033. This significant growth is propelled by a confluence of critical drivers, including escalating defense budgets across European nations, a burgeoning demand for enhanced surveillance and reconnaissance capabilities, and the increasing integration of unmanned systems in both military and civilian sectors for applications like logistics, disaster management, and infrastructure inspection. Key trends fueling this market surge include the rapid advancement in artificial intelligence and sensor technology, leading to more autonomous and sophisticated unmanned platforms, as well as a growing emphasis on modular and interoperable systems to cater to diverse operational needs. The market's trajectory is also being shaped by a concerted effort towards domestic production and technological sovereignty within Europe, aiming to reduce reliance on external suppliers and foster innovation.

Despite the promising outlook, the market faces certain restraints. The stringent regulatory frameworks surrounding the deployment and operation of unmanned systems, particularly in civilian airspace, can pose a hurdle to widespread adoption. Furthermore, the high initial investment costs associated with acquiring advanced unmanned systems and the ongoing need for skilled personnel for their operation and maintenance present economic challenges. However, the persistent drive for efficiency, cost-effectiveness in operations, and the undeniable strategic advantages offered by unmanned technologies are expected to outweigh these limitations. The market is segmented across production, consumption, import/export, and pricing dynamics, with significant activity expected in the production and consumption of advanced aerial and maritime unmanned systems. Leading companies like QinetiQ, Leonardo SpA, Kongsberg Gruppen, and Thales Group are at the forefront of innovation, developing cutting-edge solutions that will continue to shape the market landscape across key European regions such as the United Kingdom, Germany, and France.

Unlock unparalleled insights into the burgeoning Europe Unmanned System Market with this in-depth industry report. Covering the crucial period from 2019 to 2033, with a detailed base and estimated year of 2025, this report delivers actionable intelligence for manufacturers, suppliers, investors, and stakeholders. Explore the evolving landscape of drones, UAVs, and autonomous vehicles across various applications, from defense and security to commercial and civil operations.

Europe Unmanned System Market Market Dynamics & Concentration

The Europe Unmanned System Market exhibits a dynamic and moderately concentrated landscape. Innovation drivers are primarily fueled by advancements in AI, sensor technology, and miniaturization, leading to increasingly sophisticated and versatile unmanned systems. Regulatory frameworks, such as EASA regulations for drones, are maturing, providing clearer guidelines but also posing challenges for widespread adoption. Product substitutes, while limited for highly specialized military applications, exist in the form of manned systems or less advanced unmanned alternatives in commercial sectors. End-user trends lean towards increased automation, remote operation, and data-driven decision-making, driving demand for integrated unmanned solutions. Merger and acquisition (M&A) activities are prevalent as larger defense and technology firms seek to consolidate capabilities and expand their portfolios. For instance, the market saw approximately 15 significant M&A deals between 2019 and 2024, with estimated market share concentration among the top 5 players at around 60%. Key areas of focus for M&A include acquiring expertise in software development, AI integration, and specialized payload technologies.

- Innovation Drivers: AI-powered autonomy, advanced sensor fusion, improved battery life, swarm capabilities, secure communication protocols.

- Regulatory Frameworks: EASA regulations, national drone laws, airspace management policies, data privacy concerns.

- End-User Trends: Increased adoption in defense, surveillance, logistics, inspection, agriculture, and emergency services. Demand for hybrid systems and integrated solutions.

- M&A Activities: Strategic acquisitions to gain technological expertise, market access, and expand product offerings. Consolidation of niche players by larger corporations.

Europe Unmanned System Market Industry Trends & Analysis

The Europe Unmanned System Market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period (2025-2033). This expansion is significantly driven by escalating defense spending across European nations, coupled with the growing adoption of unmanned systems in civil and commercial applications such as infrastructure inspection, logistics, and precision agriculture. Technological disruptions are continuously reshaping the market, with advancements in artificial intelligence enabling greater autonomy, enhanced navigation capabilities, and sophisticated data processing for real-time decision-making. The integration of advanced sensors, including LiDAR and hyperspectral imaging, is further broadening the application spectrum and data accuracy. Consumer preferences are shifting towards systems that offer higher endurance, increased payload capacity, and robust communication links, particularly for beyond visual line of sight (BVLOS) operations. Competitive dynamics are intensifying, with both established aerospace and defense giants and agile technology startups vying for market share. The market penetration of small and medium-sized drones in commercial sectors is rapidly increasing, signifying a democratization of unmanned technology. The total market value is estimated to reach over $XX Billion by 2033.

- Market Growth Drivers: Increased defense budgets, growing demand for surveillance and reconnaissance, expansion of drone applications in logistics and delivery, advancements in AI and sensor technology.

- Technological Disruptions: Development of autonomous navigation systems, AI-driven data analysis, swarming capabilities, advanced sensor integration, and improved communication technologies.

- Consumer Preferences: Demand for longer flight times, higher payload capacities, enhanced security features, and user-friendly interfaces. Growing interest in eco-friendly and sustainable unmanned solutions.

- Competitive Dynamics: Intense competition between established players and emerging startups, strategic collaborations and partnerships, and a focus on developing specialized unmanned systems for niche applications.

Leading Markets & Segments in Europe Unmanned System Market

The Europe Unmanned System Market is characterized by significant regional variations in dominance and segment performance. In terms of Production Analysis, Germany and France are emerging as key manufacturing hubs due to their strong industrial bases and government investments in defense R&D. The Consumption Analysis reveals a strong demand in the United Kingdom and Germany, driven by substantial defense modernization programs and the expanding commercial drone sector. The Import Market Analysis (Value & Volume) indicates that the UK, France, and the Netherlands are significant importers of specialized unmanned aerial vehicles (UAVs) and unmanned ground vehicles (UGVs), particularly for defense and security applications. Estimated import value in 2025 is projected to be around $X.XX Billion with XX,XXX units. The Export Market Analysis (Value & Volume) shows that countries like Sweden and Israel, though not within Europe, are major players influencing the European market through their advanced technology exports. Within Europe, Germany and France are also significant exporters of components and integrated systems. Estimated export value in 2025 is projected to be around $X.XX Billion with XX,XXX units. The Price Trend Analysis shows a general decline in the cost of smaller, commercially oriented drones due to mass production, while sophisticated military-grade systems continue to command premium prices due to their advanced capabilities and R&D investments.

- Dominant Regions/Countries:

- United Kingdom: High consumption for defense, increasing commercial adoption.

- Germany: Strong manufacturing capabilities, significant defense and industrial demand.

- France: Robust defense industry, focus on advanced unmanned systems.

- Key Drivers for Dominance:

- Economic Policies: Government incentives for R&D, defense procurement strategies, trade agreements.

- Infrastructure: Advanced research facilities, skilled workforce, supportive industrial ecosystem.

- Regulatory Environment: Clearer regulations fostering innovation and market entry.

- Leading Segments by Value:

- Military Drones (UAVs): Surveillance, reconnaissance, combat roles.

- Commercial Drones: Inspection, mapping, delivery, agriculture.

- Unmanned Ground Vehicles (UGVs): Bomb disposal, reconnaissance, logistics.

Europe Unmanned System Market Product Developments

Recent product developments in the Europe Unmanned System Market are characterized by increased autonomy, enhanced sensor integration, and multi-domain capabilities. Companies are focusing on developing advanced AI algorithms for sophisticated threat detection and target identification in defense applications. In the commercial sector, innovations include longer-endurance drones for remote inspections, robust VTOL (Vertical Take-Off and Landing) capabilities for difficult terrain, and AI-powered analytics for automated data processing in agriculture and infrastructure monitoring. The trend towards modular payloads and swarming technologies is also gaining momentum, allowing for flexible mission configurations and collaborative operations. These advancements are driven by a need for greater efficiency, reduced human risk, and more comprehensive data acquisition.

Key Drivers of Europe Unmanned System Market Growth

The Europe Unmanned System Market is propelled by several key drivers. The escalating geopolitical tensions and the need for advanced defense capabilities are significantly boosting military drone procurement. Rapid technological advancements in AI, sensor technology, and battery life are making unmanned systems more capable and cost-effective. The growing adoption of drones for commercial applications like logistics, inspection, and precision agriculture, driven by demands for efficiency and cost reduction, is a major growth catalyst. Furthermore, supportive government initiatives and regulatory frameworks aimed at fostering innovation and safe integration of unmanned systems are creating a favorable market environment.

Challenges in the Europe Unmanned System Market Market

Despite its growth, the Europe Unmanned System Market faces several challenges. Stringent and evolving regulatory frameworks, particularly concerning airspace integration and data privacy, can hinder rapid deployment and innovation. Supply chain disruptions and the reliance on specific components can impact production and lead times. Intense competition among a growing number of players, coupled with high R&D costs for advanced technologies, creates pressure on profit margins. Public perception and concerns regarding safety, security, and privacy can also pose a significant barrier to widespread adoption in certain sectors.

Emerging Opportunities in Europe Unmanned System Market

The Europe Unmanned System Market is ripe with emerging opportunities. The increasing demand for unmanned systems in maritime surveillance and offshore operations presents a significant avenue for growth. The development of drone-in-a-box solutions for autonomous operations in remote locations, such as for infrastructure monitoring or emergency response, is a key trend. Strategic partnerships between technology developers and end-users are crucial for co-creating solutions tailored to specific industry needs. Furthermore, the expansion of urban air mobility (UAM) concepts, which heavily rely on advanced unmanned system technology, offers a long-term growth trajectory.

Leading Players in the Europe Unmanned System Market Sector

- QinetiQ

- Leonardo SpA

- Kongsberg Gruppen

- Rheinmetall AG

- Telerob Gesellschaft fr Fernhantierungstechnik mb

- Maritime Robotics AS

- DJI

- Thales Group

- Parrot Drone SAS

- Nexter Group

- Milrem Robotics

- UAS Europe AB

- BAE Systems plc

- Saab AB

- Flyability SA

Key Milestones in Europe Unmanned System Market Industry

- 2019: Introduction of new EASA regulations for drone operations, standardizing safety across Europe.

- 2020: Significant increase in drone usage for surveillance and logistics due to the COVID-19 pandemic.

- 2021: Launch of advanced AI-powered unmanned systems with enhanced autonomy by key players.

- 2022: Increased investment in drone technology for defense modernization programs by several European nations.

- 2023: Milrem Robotics secures major contracts for its unmanned ground systems, highlighting UGV market growth.

- 2024: Growing emphasis on BVLOS (Beyond Visual Line of Sight) operations and regulatory approvals for commercial use.

Strategic Outlook for Europe Unmanned System Market Market

- 2019: Introduction of new EASA regulations for drone operations, standardizing safety across Europe.

- 2020: Significant increase in drone usage for surveillance and logistics due to the COVID-19 pandemic.

- 2021: Launch of advanced AI-powered unmanned systems with enhanced autonomy by key players.

- 2022: Increased investment in drone technology for defense modernization programs by several European nations.

- 2023: Milrem Robotics secures major contracts for its unmanned ground systems, highlighting UGV market growth.

- 2024: Growing emphasis on BVLOS (Beyond Visual Line of Sight) operations and regulatory approvals for commercial use.

Strategic Outlook for Europe Unmanned System Market Market

The strategic outlook for the Europe Unmanned System Market is exceptionally strong, driven by continuous technological innovation and expanding application areas. Key growth accelerators include further integration of AI for enhanced decision-making, development of robust counter-drone technologies, and the expansion of drone-as-a-service (DaaS) models. Strategic partnerships and collaborations will be crucial for overcoming regulatory hurdles and fostering broader market acceptance. The increasing focus on sustainability and eco-friendly propulsion systems will also shape future product development. Investors and industry players should focus on niche markets, advanced software solutions, and integrated system offerings to capitalize on the market's substantial future potential.

Europe Unmanned System Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Unmanned System Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Unmanned System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Military Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 QinetiQ

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Leonardo SpA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Kongsberg Gruppen

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Rheinmetall AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Telerob Gesellschaft fr Fernhantierungstechnik mb

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Maritime Robotics AS

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 DJI

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Thales Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Parrot Drone SAS

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nexter Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Milrem Robotics

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 UAS Europe AB

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 BAE Systems plc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Saab AB

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Flyability SA

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 QinetiQ

List of Figures

- Figure 1: Europe Unmanned System Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Unmanned System Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Unmanned System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Unmanned System Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Europe Unmanned System Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Europe Unmanned System Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Europe Unmanned System Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Europe Unmanned System Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Europe Unmanned System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Unmanned System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Europe Unmanned System Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Europe Unmanned System Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Europe Unmanned System Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Europe Unmanned System Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Europe Unmanned System Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Europe Unmanned System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Norway Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Poland Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Unmanned System Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Europe Unmanned System Market?

Key companies in the market include QinetiQ, Leonardo SpA, Kongsberg Gruppen, Rheinmetall AG, Telerob Gesellschaft fr Fernhantierungstechnik mb, Maritime Robotics AS, DJI, Thales Group, Parrot Drone SAS, Nexter Group, Milrem Robotics, UAS Europe AB, BAE Systems plc, Saab AB, Flyability SA.

3. What are the main segments of the Europe Unmanned System Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Military Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Unmanned System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Unmanned System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Unmanned System Market?

To stay informed about further developments, trends, and reports in the Europe Unmanned System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence