Key Insights

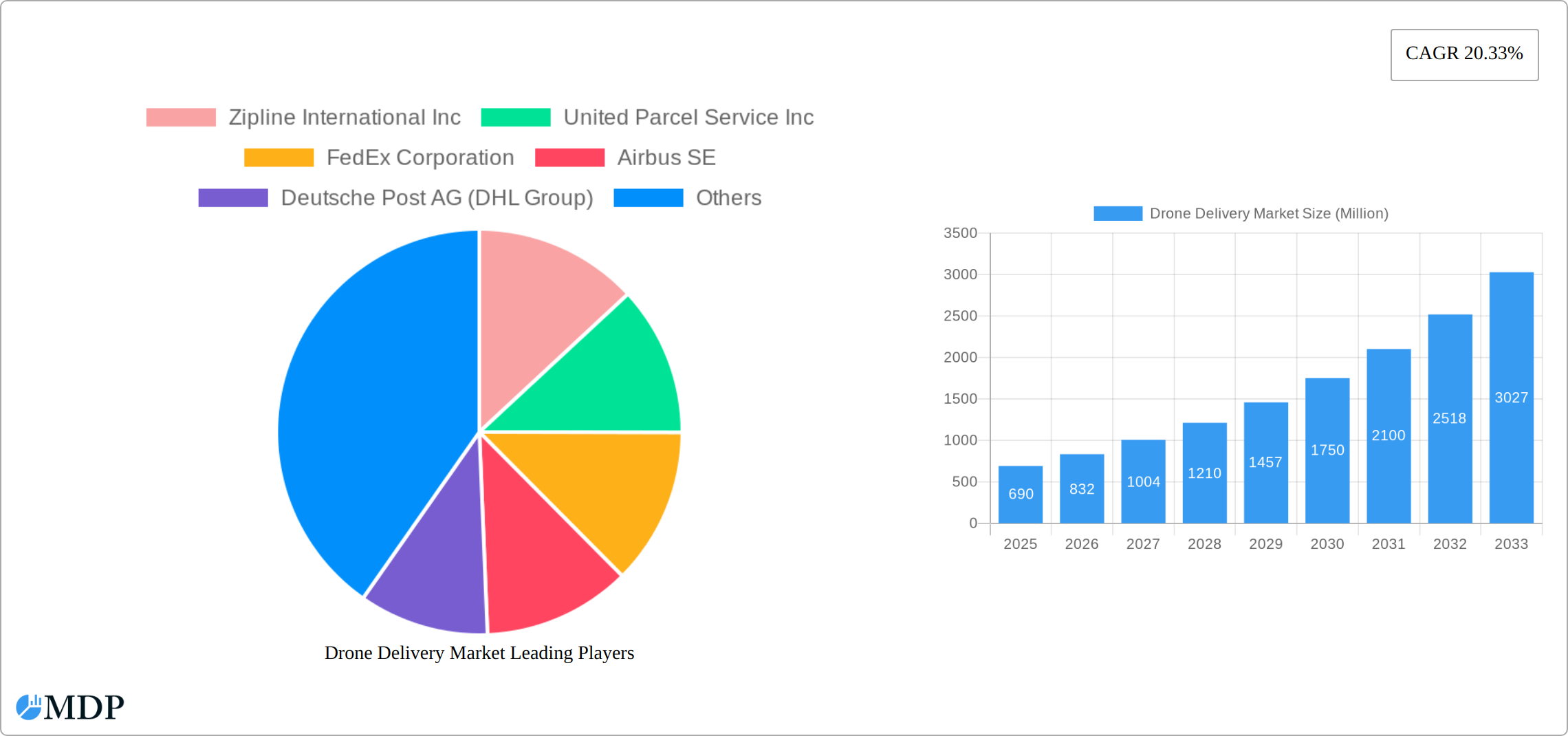

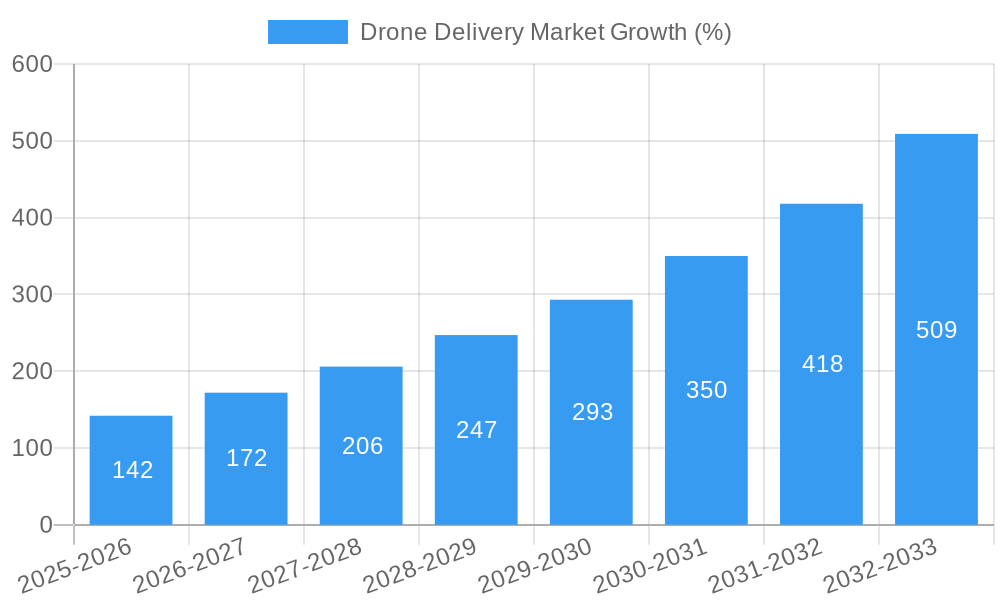

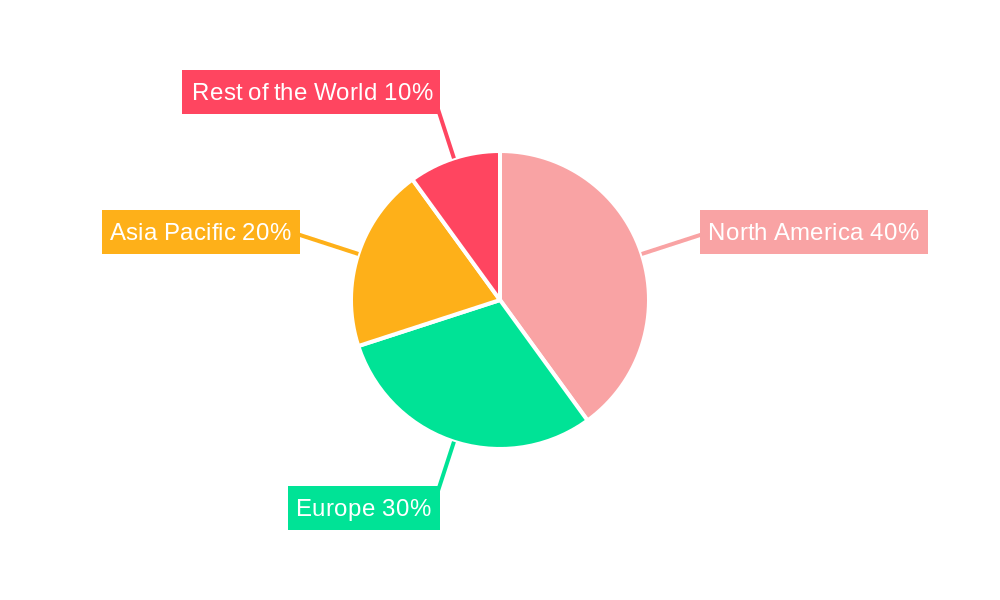

The drone delivery market is experiencing rapid growth, projected to reach a substantial size driven by the increasing demand for faster and more efficient delivery solutions across various sectors. The market's Compound Annual Growth Rate (CAGR) of 20.33% from 2019 to 2024 indicates significant expansion, and this momentum is expected to continue through 2033. Key drivers include the rising e-commerce sector, advancements in drone technology leading to improved range, payload capacity, and autonomous capabilities, and a growing need for last-mile delivery solutions in remote or densely populated areas. The market is segmented by drone type (rotary-wing and fixed-wing), payload capacity (less than and greater than 10kg), and end-user industry (food, healthcare, retail, and logistics). The dominance of certain segments, like the rotary-wing drones for smaller, localized deliveries and the larger fixed-wing drones for longer-range transportation, is likely to evolve as technology improves and regulations adapt. Competition is fierce, with established players like UPS, FedEx, and Amazon alongside innovative startups like Zipline and Flytrex vying for market share. Regulatory hurdles and safety concerns remain significant restraints, demanding continuous technological advancements and robust regulatory frameworks. Geographic distribution reflects the maturity of e-commerce and technological infrastructure; regions with strong e-commerce adoption and supportive regulations will likely witness faster growth. North America and Europe currently hold significant market shares, but the Asia-Pacific region is anticipated to witness significant growth due to its rapidly expanding e-commerce sector.

The continued expansion of the drone delivery market hinges on several factors. Firstly, continued technological advancements in battery technology, autonomous flight systems, and improved sensor technology will extend range, payload capacity, and improve safety features, driving wider adoption. Secondly, overcoming regulatory and safety concerns through standardized protocols and effective airspace management is crucial. Collaboration between drone manufacturers, logistics companies, and regulatory bodies is vital to foster trust and establish industry best practices. Finally, the growth hinges on consumer acceptance and the successful integration of drone delivery into existing logistics networks. This requires addressing consumer concerns about security, reliability, and environmental impact. The success of drone delivery also depends on efficient logistics infrastructure and the smooth integration of drones into the existing delivery ecosystems.

Drone Delivery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Drone Delivery Market, offering invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and growth opportunities. The report covers key market segments, leading players, and significant industry developments, enabling informed strategic decision-making. Expect detailed analysis of market dynamics, leading companies like Zipline, UPS, FedEx, and Amazon, and projections of a multi-billion dollar market.

Drone Delivery Market Market Dynamics & Concentration

The drone delivery market is experiencing explosive growth, driven by a confluence of factors: rapid technological advancements, evolving regulatory landscapes globally, and soaring demand across diverse sectors. While market concentration remains moderate, with several key players vying for leadership, significant consolidation through mergers and acquisitions (M&A) activity is anticipated in the coming years. The current market share is dispersed among major players such as Zipline International Inc., United Parcel Service Inc., FedEx Corporation, and Amazon.com Inc., alongside numerous smaller companies focusing on niche applications and geographic regions. This dynamic landscape presents both opportunities and challenges for market entrants.

- Innovation Drivers: Significant breakthroughs in drone technology are accelerating market expansion. These include longer flight ranges, substantially increased payload capacities, and increasingly sophisticated autonomous capabilities, including advanced obstacle avoidance and real-time weather adaptation.

- Regulatory Frameworks: Government regulations and policies exert a profound influence on market growth trajectory. The continuous evolution of drone regulations worldwide directly impacts market entry strategies, operational scalability, and overall market expansion. Harmonization of international regulations is a key factor in unlocking global market potential.

- Product Substitutes: Traditional delivery methods (trucks, airplanes, ships) remain strong competitors, especially for longer distances and bulk shipments. However, drone delivery offers compelling advantages in terms of speed, efficiency, reduced fuel consumption, and cost-effectiveness for last-mile delivery and specific logistical challenges, such as reaching remote or disaster-stricken areas.

- End-User Trends: The burgeoning demand from e-commerce, healthcare (medical supplies and organ transportation), and logistics sectors, particularly for rapid last-mile delivery, is a major catalyst for market growth. Consumer expectations for faster and more convenient delivery are fueling this demand.

- M&A Activities: The volume of M&A deals in the drone delivery market is projected to increase significantly, reaching an estimated [Insert Projected Number] by 2025. This surge is driven by the strategic imperative to acquire cutting-edge technology, expand geographical reach, and solidify market share dominance. The average deal size is anticipated to be approximately [Insert Projected Average Deal Size] million.

Drone Delivery Market Industry Trends & Analysis

The global drone delivery market exhibits a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is driven by factors such as the increasing adoption of e-commerce, advancements in drone technology enabling longer flight ranges and heavier payloads, and favorable government regulations in certain regions. The market penetration rate is projected to reach xx% by 2033, reflecting a significant shift towards drone-based delivery services. Consumer preferences are increasingly leaning towards faster and more convenient delivery options, further fueling market growth. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, leading to innovation and price competition.

Leading Markets & Segments in Drone Delivery Market

The North American region currently dominates the drone delivery market, driven by strong technological advancements, supportive regulatory frameworks, and high consumer demand. Within this region, the United States is the leading market. However, rapidly developing economies in Asia-Pacific are showing significant growth potential.

Type: The rotary-wing segment currently holds a larger market share due to its maneuverability and suitability for urban environments, though fixed-wing drones are gaining traction for longer distances and heavier payloads.

Capacity: The less than 10kg capacity segment dominates due to the current limitations in regulations and technology, but the greater than 10kg segment is expected to show significant growth driven by technological advancements.

End-User: The healthcare and food delivery sectors are currently major drivers, while the retail and logistics sectors are poised for significant expansion.

Key Drivers:

- North America: Strong e-commerce growth, advanced technological infrastructure, and supportive regulatory environment.

- Asia-Pacific: Rapid urbanization, increasing e-commerce adoption, and government initiatives promoting drone technology.

Drone Delivery Market Product Developments

Recent product innovations are focused on several key areas: extending flight range and endurance significantly, substantially increasing payload capacity to accommodate larger and heavier packages, refining autonomous navigation systems for enhanced safety and reliability, and incorporating advanced safety features to minimize risks. These improvements are driving wider market adoption and facilitating expansion into new applications, such as package delivery in urban environments, agricultural applications (crop monitoring and spraying), infrastructure inspection, search and rescue operations, and humanitarian aid delivery.

The integration of advanced sensors (LiDAR, radar, cameras), AI-powered flight control systems capable of learning and adapting to complex environments, and the development of longer-lasting, higher-capacity batteries are paramount to unlocking the full potential of drone delivery. These technological advancements are driving improvements in efficiency, cost savings, safety, and reliability, paving the way for widespread market acceptance.

Key Drivers of Drone Delivery Market Growth

The drone delivery market's growth is driven by several key factors:

- Technological Advancements: Improved battery technology, autonomous navigation systems, and enhanced payload capacities are expanding the operational capabilities of drones.

- Economic Factors: The rising demand for faster and more cost-effective delivery solutions, particularly in e-commerce, is a major catalyst for market growth.

- Favorable Regulations: Progressive regulatory frameworks in certain countries are facilitating drone operations and market expansion. The gradual easing of restrictions on beyond-visual-line-of-sight (BVLOS) flights, for instance, is a key factor.

Challenges in the Drone Delivery Market

Despite its growth potential, the drone delivery market faces several challenges:

- Regulatory Hurdles: Strict regulations regarding drone operations, airspace management, and safety standards present significant barriers to market entry and expansion.

- Supply Chain Issues: The availability and cost of drone components, skilled labor, and maintenance services can impact profitability and operational efficiency.

- Competitive Pressures: Intense competition from established delivery companies and emerging players puts pressure on prices and profit margins. The market share competition is projected to remain fierce in the coming years.

Emerging Opportunities in Drone Delivery Market

The future of the drone delivery market holds significant opportunities:

- Technological Breakthroughs: Advancements in battery technology, autonomous flight, and sensor integration will unlock new applications and enhance operational efficiency.

- Strategic Partnerships: Collaboration between drone manufacturers, logistics companies, and technology providers will accelerate market growth and adoption.

- Market Expansion: Expanding into new geographical regions and exploring new applications beyond last-mile delivery will drive significant market expansion.

Leading Players in the Drone Delivery Market Sector

- Zipline International Inc

- United Parcel Service Inc

- FedEx Corporation

- Airbus SE

- Deutsche Post AG (DHL Group)

- Flytrex Inc

- Drone Delivery Canada Corp

- TechEagle

- Alphabet Inc

- EHang Holdings Limited

- Wingcopter GmbH

- SZ DJI Technology Co Ltd

- Amazon com Inc

Key Milestones in Drone Delivery Market Industry

- March 2023: The FAA authorized UPS delivery drones using Matternet M2 for longer flights beyond visual line of sight (BVLOS), significantly expanding operational capabilities and paving the way for large-scale drone delivery operations.

- May 2023: Dronamics successfully tested its Black Swan cargo drone, showcasing a remarkable leap in payload capacity (770 pounds) and range (over 1,500 miles), potentially revolutionizing middle-mile transportation and opening up new possibilities for long-distance drone delivery.

- [Add more recent milestones here]

Strategic Outlook for Drone Delivery Market Market

The drone delivery market is poised for extraordinary growth in the coming years. Continuous technological innovation, expanding regulatory acceptance (including international harmonization efforts), and the steadily increasing demand across a widening range of sectors will be key drivers of market expansion. Strategic partnerships, substantial investments in research and development, and a focus on sustainable and environmentally responsible operations will be crucial for companies seeking to capitalize on this burgeoning market opportunity and secure a strong, long-term market position. The market is projected to reach [Insert Projected Market Value] Million by 2033, underscoring the significant potential for long-term growth and substantial returns on investment.

Drone Delivery Market Segmentation

-

1. Type

- 1.1. Rotary-wing

- 1.2. Fixed-wing

-

2. Capacity

- 2.1. Less than 10kg

- 2.2. Greater than 10kg

-

3. End-User

- 3.1. Food

- 3.2. Healthcare

- 3.3. Retail and Logistics

Drone Delivery Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Drone Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Retail and Logistics Segment Dominates the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Drone Delivery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Rotary-wing

- 5.1.2. Fixed-wing

- 5.2. Market Analysis, Insights and Forecast - by Capacity

- 5.2.1. Less than 10kg

- 5.2.2. Greater than 10kg

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Food

- 5.3.2. Healthcare

- 5.3.3. Retail and Logistics

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Drone Delivery Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Rotary-wing

- 6.1.2. Fixed-wing

- 6.2. Market Analysis, Insights and Forecast - by Capacity

- 6.2.1. Less than 10kg

- 6.2.2. Greater than 10kg

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Food

- 6.3.2. Healthcare

- 6.3.3. Retail and Logistics

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Drone Delivery Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Rotary-wing

- 7.1.2. Fixed-wing

- 7.2. Market Analysis, Insights and Forecast - by Capacity

- 7.2.1. Less than 10kg

- 7.2.2. Greater than 10kg

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Food

- 7.3.2. Healthcare

- 7.3.3. Retail and Logistics

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Drone Delivery Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Rotary-wing

- 8.1.2. Fixed-wing

- 8.2. Market Analysis, Insights and Forecast - by Capacity

- 8.2.1. Less than 10kg

- 8.2.2. Greater than 10kg

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Food

- 8.3.2. Healthcare

- 8.3.3. Retail and Logistics

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Drone Delivery Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Rotary-wing

- 9.1.2. Fixed-wing

- 9.2. Market Analysis, Insights and Forecast - by Capacity

- 9.2.1. Less than 10kg

- 9.2.2. Greater than 10kg

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Food

- 9.3.2. Healthcare

- 9.3.3. Retail and Logistics

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Drone Delivery Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Drone Delivery Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Drone Delivery Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Drone Delivery Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Zipline International Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 United Parcel Service Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 FedEx Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Airbus SE

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Deutsche Post AG (DHL Group)

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Flytrex Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Drone Delivery Canada Corp

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 TechEagle

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Alphabet Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 EHang Holdings Limited

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Wingcopter GmbH

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 SZ DJI Technology Co Ltd

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Amazon com Inc

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.1 Zipline International Inc

List of Figures

- Figure 1: Global Drone Delivery Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Drone Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Drone Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Drone Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Drone Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Drone Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Drone Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Drone Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Drone Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Drone Delivery Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Drone Delivery Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Drone Delivery Market Revenue (Million), by Capacity 2024 & 2032

- Figure 13: North America Drone Delivery Market Revenue Share (%), by Capacity 2024 & 2032

- Figure 14: North America Drone Delivery Market Revenue (Million), by End-User 2024 & 2032

- Figure 15: North America Drone Delivery Market Revenue Share (%), by End-User 2024 & 2032

- Figure 16: North America Drone Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Drone Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Drone Delivery Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Drone Delivery Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Drone Delivery Market Revenue (Million), by Capacity 2024 & 2032

- Figure 21: Europe Drone Delivery Market Revenue Share (%), by Capacity 2024 & 2032

- Figure 22: Europe Drone Delivery Market Revenue (Million), by End-User 2024 & 2032

- Figure 23: Europe Drone Delivery Market Revenue Share (%), by End-User 2024 & 2032

- Figure 24: Europe Drone Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Drone Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Drone Delivery Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Drone Delivery Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Drone Delivery Market Revenue (Million), by Capacity 2024 & 2032

- Figure 29: Asia Pacific Drone Delivery Market Revenue Share (%), by Capacity 2024 & 2032

- Figure 30: Asia Pacific Drone Delivery Market Revenue (Million), by End-User 2024 & 2032

- Figure 31: Asia Pacific Drone Delivery Market Revenue Share (%), by End-User 2024 & 2032

- Figure 32: Asia Pacific Drone Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Drone Delivery Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Drone Delivery Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Rest of the World Drone Delivery Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Rest of the World Drone Delivery Market Revenue (Million), by Capacity 2024 & 2032

- Figure 37: Rest of the World Drone Delivery Market Revenue Share (%), by Capacity 2024 & 2032

- Figure 38: Rest of the World Drone Delivery Market Revenue (Million), by End-User 2024 & 2032

- Figure 39: Rest of the World Drone Delivery Market Revenue Share (%), by End-User 2024 & 2032

- Figure 40: Rest of the World Drone Delivery Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Drone Delivery Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Drone Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Drone Delivery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Drone Delivery Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 4: Global Drone Delivery Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Global Drone Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Drone Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Drone Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Drone Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Drone Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Drone Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Drone Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Drone Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Drone Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Drone Delivery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Drone Delivery Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 16: Global Drone Delivery Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: Global Drone Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Drone Delivery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Drone Delivery Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 20: Global Drone Delivery Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 21: Global Drone Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Drone Delivery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Drone Delivery Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 24: Global Drone Delivery Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 25: Global Drone Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Drone Delivery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Drone Delivery Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 28: Global Drone Delivery Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 29: Global Drone Delivery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Drone Delivery Market?

The projected CAGR is approximately 20.33%.

2. Which companies are prominent players in the Drone Delivery Market?

Key companies in the market include Zipline International Inc, United Parcel Service Inc, FedEx Corporation, Airbus SE, Deutsche Post AG (DHL Group), Flytrex Inc, Drone Delivery Canada Corp, TechEagle, Alphabet Inc, EHang Holdings Limited, Wingcopter GmbH, SZ DJI Technology Co Ltd, Amazon com Inc.

3. What are the main segments of the Drone Delivery Market?

The market segments include Type, Capacity, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.69 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Retail and Logistics Segment Dominates the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: Dronamics, the Bulgarian drone cargo airline, successfully tested the first flight of its Black Swan cargo aircraft. This pioneering drone, with a payload capacity of 770 pounds and a range of over 1,500 miles, aims to revolutionize middle-mile transportation, offering the potential to halve costs, significantly reduce delivery times, and cut emissions by up to 60% in sectors such as e-commerce, healthcare, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Drone Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Drone Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Drone Delivery Market?

To stay informed about further developments, trends, and reports in the Drone Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence