Key Insights

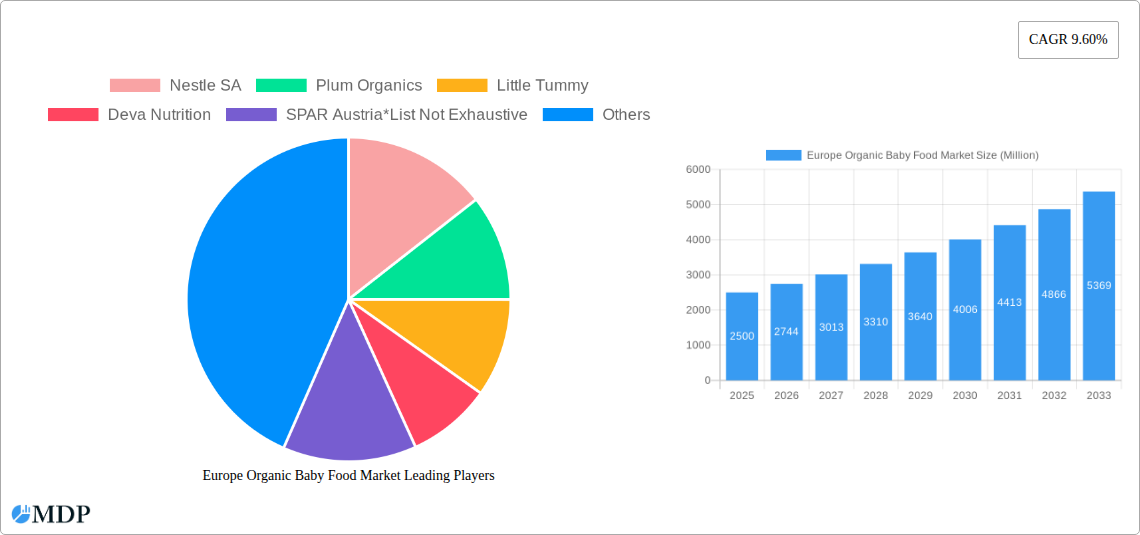

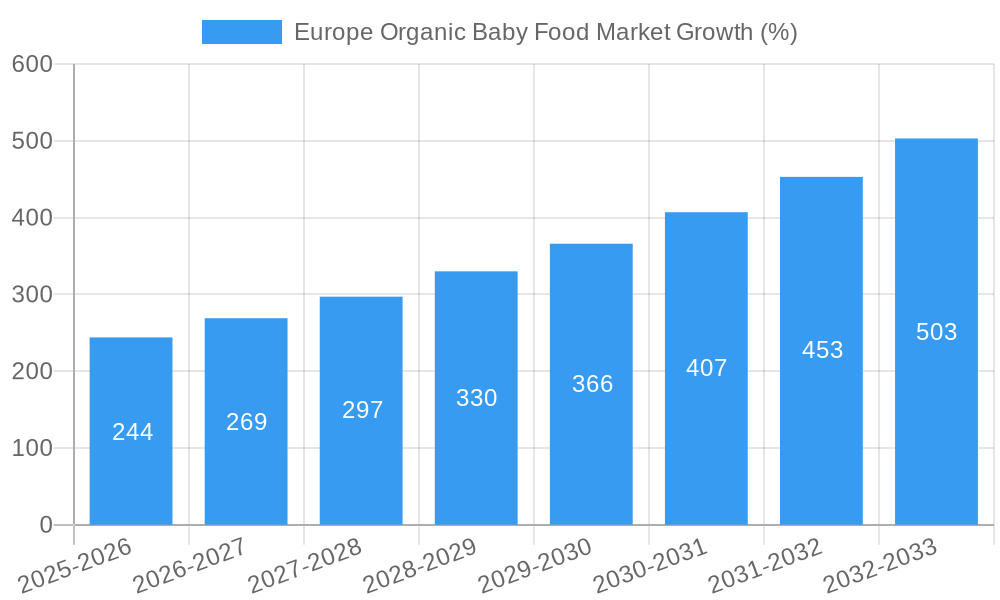

The European organic baby food market, valued at approximately €X million in 2025 (assuming a logical extrapolation based on the provided CAGR of 9.60% and a market size "XX" at an unspecified year), is projected to experience robust growth throughout the forecast period (2025-2033). This expansion is driven by several key factors. Increasing parental awareness of the health benefits associated with organic food, including reduced exposure to pesticides and improved nutritional content, is a major catalyst. Furthermore, rising disposable incomes in several European countries and a growing preference for premium and natural products are contributing to higher demand. The market's segmentation by product type (milk formula, prepared baby food, dried baby food) and distribution channel (supermarkets, online retail, specialty stores) reveals diverse growth opportunities. Online retail channels, in particular, are expected to witness significant expansion fueled by increasing e-commerce penetration and consumer convenience. While the market faces restraints such as price sensitivity among some consumer segments and potential supply chain challenges related to organic ingredient sourcing, the overall growth trajectory remains positive.

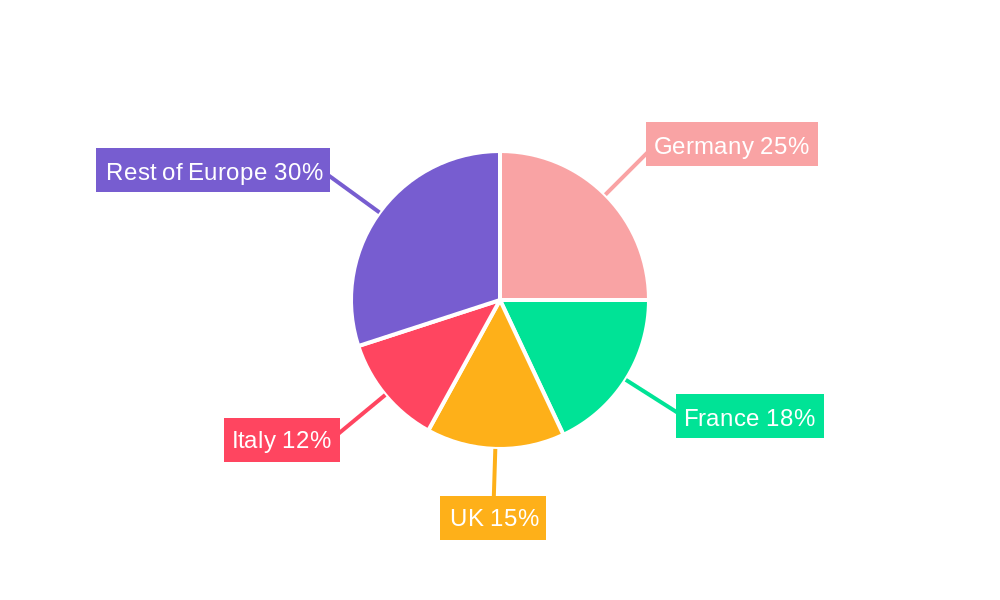

The competitive landscape is characterized by a mix of established multinational corporations like Nestlé SA and Danone SA, alongside smaller, specialized organic baby food brands such as Holle baby food AG and Plum Organics. These companies are employing various strategies, including product innovation (e.g., introducing new organic formulations and convenient packaging options), brand building, and strategic partnerships, to gain market share. Geographic variations exist within Europe, with countries like Germany, France, and the UK anticipated to remain key markets due to their relatively higher adoption rates of organic products and established consumer preferences. The market's future growth will be significantly shaped by regulatory changes related to organic certification standards, evolving consumer preferences, and advancements in food technology that enhance the nutritional value and shelf life of organic baby food products.

Europe Organic Baby Food Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe organic baby food market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a comprehensive understanding of past performance, current market dynamics, and future growth projections. The market size is expected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Europe Organic Baby Food Market Market Dynamics & Concentration

The European organic baby food market is characterized by a moderate level of concentration, with key players like Nestlé SA, Danone SA, and HiPP UK Ltd holding significant market share. However, smaller, specialized brands are also gaining traction, driven by increasing consumer demand for niche products and higher quality ingredients. Market concentration is further influenced by mergers and acquisitions (M&A) activity, with xx M&A deals recorded between 2019 and 2024. This activity reflects the industry's consolidation trend and the pursuit of economies of scale. Innovation is a key driver, with companies continually developing new products catering to specific dietary needs and preferences. Stringent regulatory frameworks governing organic certification and food safety significantly impact market dynamics. The market also faces competition from conventional baby food products, but the growing awareness of health benefits associated with organic food is gradually shifting consumer preferences.

- Market Concentration: Moderately concentrated, with top players holding xx% market share (2024).

- Innovation Drivers: Demand for specialized formulas, novel ingredients, and convenient packaging.

- Regulatory Frameworks: Stringent organic certifications and food safety regulations.

- Product Substitutes: Conventional baby food products.

- End-user Trends: Increasing preference for organic, ethically sourced, and sustainable products.

- M&A Activity: xx M&A deals between 2019 and 2024.

Europe Organic Baby Food Market Industry Trends & Analysis

The Europe organic baby food market is experiencing significant growth, fueled by several key trends. Rising consumer disposable incomes, coupled with increasing awareness regarding health and wellness, are driving demand for organic baby food products. Technological advancements in food processing and packaging are enhancing product quality and shelf life. Consumer preferences are shifting towards natural and minimally processed foods, further fueling market growth. Competitive dynamics are characterized by both fierce competition among established players and the emergence of smaller, niche brands. This competitive landscape fosters innovation and encourages companies to differentiate their products through unique formulations and marketing strategies. The market exhibits a substantial growth trajectory, projected to achieve xx Million by 2033, registering a CAGR of xx%. Market penetration of organic baby food products continues to rise, currently estimated at xx% and projected to increase to xx% by 2033.

Leading Markets & Segments in Europe Organic Baby Food Market

Germany and the UK are the leading markets in Europe for organic baby food, driven by high consumer awareness of health benefits and relatively higher disposable incomes. Prepared baby food constitutes the largest segment by product type, followed by dried baby food and milk formula. Supermarkets and hypermarkets command the largest share of distribution channels, providing wide reach and convenient access for consumers.

- Key Drivers for Germany & UK: High consumer awareness of health benefits, strong disposable incomes, and robust retail infrastructure.

- By Product Type:

- Prepared Baby Food: Largest segment, driven by convenience and variety.

- Dried Baby Food: Growing segment due to longer shelf life and ease of storage.

- Milk Formula: Significant segment, with a focus on organic and specialized formulations.

- By Distribution Channel:

- Supermarkets & Hypermarkets: Dominant channel due to extensive reach and consumer accessibility.

- Online Retail Channels: Growing segment, providing convenient access and wider product choice.

- Specialty Stores: Niche channel catering to specific consumer needs and preferences.

Europe Organic Baby Food Market Product Developments

Recent product innovations focus on organic, sustainable sourcing, and specialized formulations catering to dietary needs like allergies and intolerances. Manufacturers are emphasizing convenient packaging options, such as single-serving pouches and recyclable materials, aligning with consumer preferences for sustainability. Competitive advantages are built upon product quality, unique formulations, branding, and marketing strategies that effectively resonate with health-conscious parents. Technological advancements in processing and preservation techniques are enhancing product quality and shelf life.

Key Drivers of Europe Organic Baby Food Market Growth

Several key factors drive the growth of the European organic baby food market: Rising disposable incomes enable parents to opt for premium, organic products. Increasing awareness regarding the long-term health benefits of organic food is a significant driver. Stringent regulations promoting organic farming practices and ensuring food safety enhance consumer trust and market credibility. The growing demand for convenient, easy-to-prepare products further supports market growth.

Challenges in the Europe Organic Baby Food Market Market

The market faces challenges including the higher cost of organic ingredients compared to conventional ones, leading to higher prices that may hinder affordability for some consumers. Supply chain disruptions and fluctuations in raw material costs can impact profitability and product availability. Intense competition from both established players and new entrants necessitates continuous innovation and strategic marketing to maintain a competitive edge. Meeting stringent regulatory requirements adds to production costs and complexity.

Emerging Opportunities in Europe Organic Baby Food Market

Expansion into niche markets, such as organic baby food tailored to specific dietary requirements (e.g., allergies), presents significant opportunities for growth. Strategic partnerships and collaborations with retailers and distributors can improve market reach and distribution efficiency. Leveraging technological advancements in processing, packaging, and traceability enhance product quality and consumer trust, opening further avenues for market penetration. Exploration of emerging markets within Europe, particularly those with growing middle classes, offers a strong potential for future market expansion.

Leading Players in the Europe Organic Baby Food Market Sector

- Nestle SA

- Plum Organics

- Little Tummy

- Deva Nutrition

- SPAR Austria

- Abbott Laboratories

- Danone SA

- Lebenswert

- HiPP UK Ltd

- Hero Group

- Holle baby food AG

Key Milestones in Europe Organic Baby Food Market Industry

- July 2022: Organix launches 29 new products and two new ranges (Baby Meals and Organix Kids) in Asda and its online shop.

- June 2021: SPAR Austria launches a new range of organic baby food for infants aged 5-12 months.

- January 2021: Hero Group acquires Baby Gourmet, a Canadian organic baby food brand.

Strategic Outlook for Europe Organic Baby Food Market Market

The future of the Europe organic baby food market appears promising. Continued growth is anticipated, driven by increasing health consciousness, growing disposable incomes, and the increasing demand for convenience and specialized products. Companies that successfully adapt to changing consumer preferences, embrace innovation, and effectively manage supply chain challenges will be best positioned to capitalize on market opportunities. Further expansion into e-commerce channels and targeted marketing strategies are essential to achieving sustainable growth in the years ahead.

Europe Organic Baby Food Market Segmentation

-

1. product Type

- 1.1. Milk Formula

- 1.2. Prepared Baby Food

- 1.3. Dried Baby Food

-

2. Distibution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Channels

- 2.5. Other Distribution Channels

Europe Organic Baby Food Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Organic Baby Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Preference For Breastfeeding Alternatives

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by product Type

- 5.1.1. Milk Formula

- 5.1.2. Prepared Baby Food

- 5.1.3. Dried Baby Food

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Channels

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by product Type

- 6. Germany Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Nestle SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Plum Organics

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Little Tummy

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Deva Nutrition

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 SPAR Austria*List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Abbott Laboratories

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Danone SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Lebenswert

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 HiPP UK Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Hero Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Holle baby food AG

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Nestle SA

List of Figures

- Figure 1: Europe Organic Baby Food Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Organic Baby Food Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Organic Baby Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Organic Baby Food Market Revenue Million Forecast, by product Type 2019 & 2032

- Table 3: Europe Organic Baby Food Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 4: Europe Organic Baby Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Organic Baby Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Organic Baby Food Market Revenue Million Forecast, by product Type 2019 & 2032

- Table 14: Europe Organic Baby Food Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 15: Europe Organic Baby Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Organic Baby Food Market?

The projected CAGR is approximately 9.60%.

2. Which companies are prominent players in the Europe Organic Baby Food Market?

Key companies in the market include Nestle SA, Plum Organics, Little Tummy, Deva Nutrition, SPAR Austria*List Not Exhaustive, Abbott Laboratories, Danone SA, Lebenswert, HiPP UK Ltd, Hero Group, Holle baby food AG.

3. What are the main segments of the Europe Organic Baby Food Market?

The market segments include product Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Increasing Preference For Breastfeeding Alternatives.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In July 2022, The United Kingdom-based organic baby and toddler food brand, Organix unveiled 29 new products and two new ranges namely Baby Meals and Organix Kids and announced that these will be introduced initially in Asda and the Organix Online Shop. It also announced that it will bring further additions to its current finger food and snack ranges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Organic Baby Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Organic Baby Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Organic Baby Food Market?

To stay informed about further developments, trends, and reports in the Europe Organic Baby Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence