Key Insights

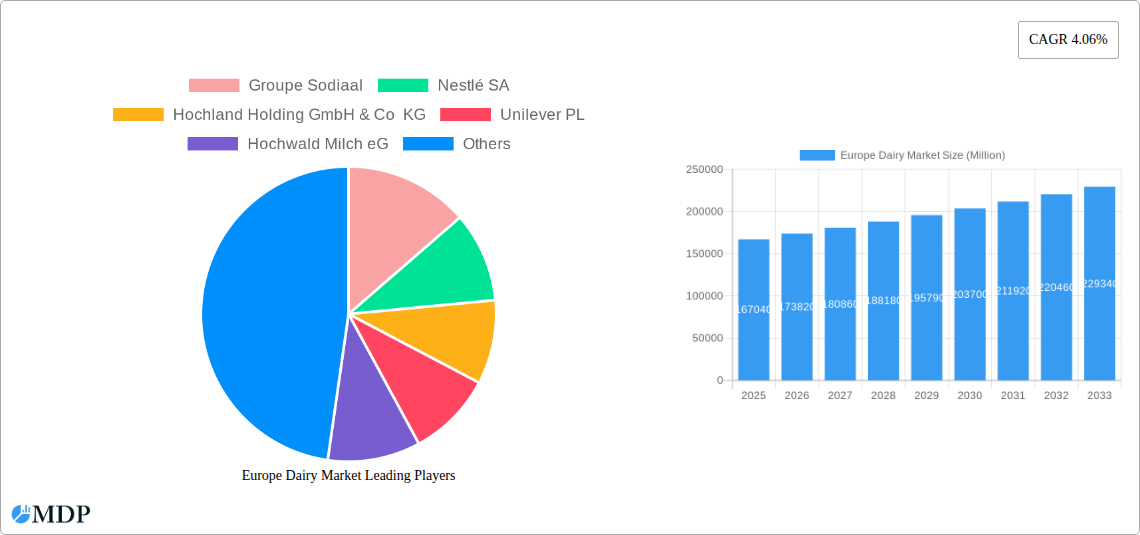

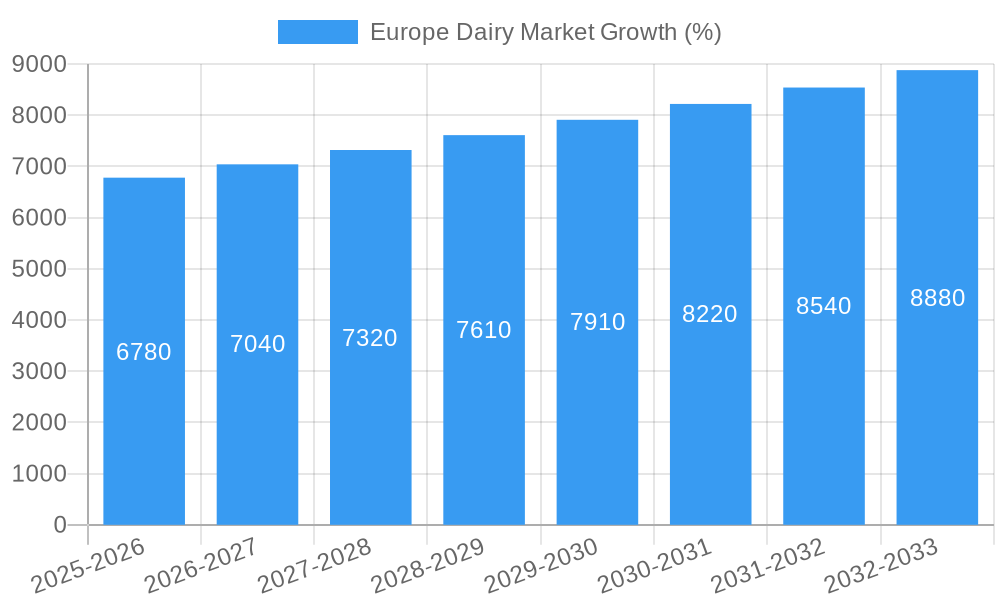

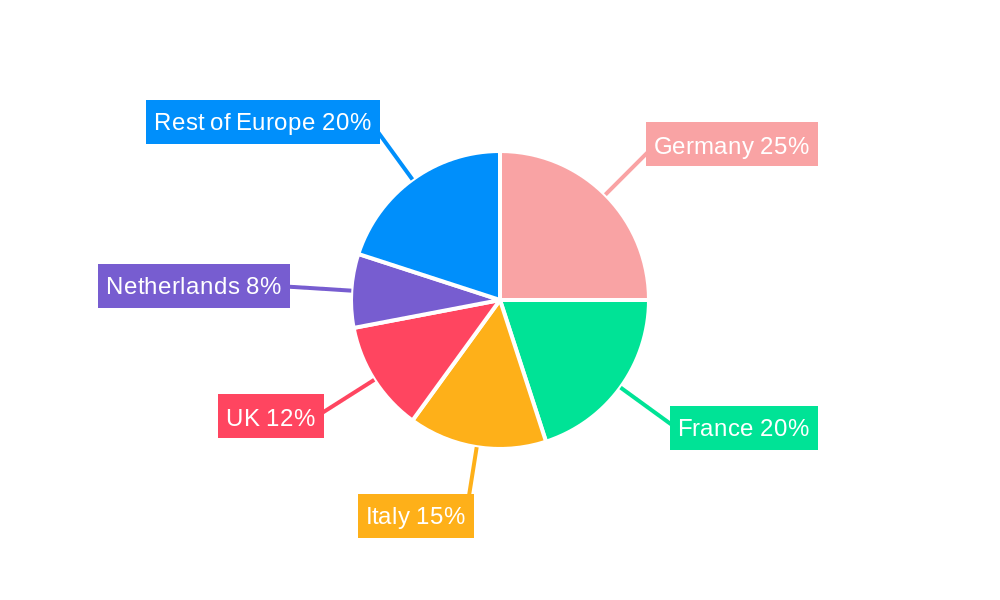

The European dairy market, valued at €167,040 million in 2025, is projected to experience steady growth, driven by increasing consumer demand for dairy products and a rising focus on health and wellness. This growth is expected to be fueled by several key factors. Firstly, the expanding middle class across major European economies is leading to increased disposable income, allowing consumers to spend more on premium dairy products. Secondly, the rising awareness of the nutritional benefits of dairy, particularly in relation to bone health and overall well-being, is driving consumption. Furthermore, innovation in product offerings, such as the development of organic, lactose-free, and plant-based dairy alternatives, is catering to evolving consumer preferences and expanding market reach. Key players like Groupe Sodiaal, Nestlé SA, and Unilever are heavily investing in research and development to maintain a competitive edge and cater to these trends. However, challenges such as fluctuating milk prices, stringent regulations regarding food safety and labeling, and increased competition from plant-based alternatives pose potential restraints on market expansion. The market segmentation reveals significant variation in consumption patterns across different countries and distribution channels, highlighting opportunities for targeted marketing and product diversification. Germany, France, Italy, and the UK are expected to remain dominant markets within the region, contributing significantly to overall market growth.

The off-trade channel, encompassing supermarkets and retail stores, is anticipated to maintain a substantial share of the market, although the on-trade segment, including restaurants and cafes, is projected to gradually increase its contribution driven by the revival of the hospitality industry post-pandemic. The butter category is a significant contributor to the overall market volume, reflecting sustained consumer preference for this essential dairy product. Nevertheless, the emergence of innovative product formats and flavor profiles, along with the growing popularity of specialty cheeses and yogurts, is expected to broaden the market landscape and enhance its dynamism. Geographic variations in consumer preferences and cultural habits will require tailored market strategies to maximize penetration and market share. The forecast period from 2025 to 2033 promises sustained growth for the European dairy industry, promising considerable opportunities for established players and new entrants alike.

Europe Dairy Market: A Comprehensive Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Dairy Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and opportunities across various segments and countries. Key players like Groupe Sodiaal, Nestlé SA, and Lactalis are analyzed, alongside market-shifting events and emerging opportunities. This report is essential for navigating the complexities of the European dairy landscape and capitalizing on future growth potential.

Europe Dairy Market Market Dynamics & Concentration

The European dairy market is a dynamic landscape characterized by varying degrees of concentration across different segments and countries. Market leaders, such as Nestlé SA and Lactalis, hold significant market share, while smaller regional players maintain a strong presence in their respective niches. Innovation plays a crucial role, driven by consumer demand for healthier and more sustainable products, prompting the development of novel dairy alternatives and processing techniques. Stringent regulatory frameworks concerning food safety, labeling, and environmental sustainability further shape market dynamics. The existence of product substitutes, including plant-based alternatives, poses a challenge to traditional dairy products. Consumer trends toward convenience, health consciousness, and ethical sourcing are transforming purchasing patterns. Mergers and acquisitions (M&A) activity contributes significantly to market consolidation and expansion, with an estimated xx M&A deals recorded between 2019 and 2024, resulting in a market concentration ratio (CR4) of approximately xx%.

- Market Share: Nestlé SA holds an estimated xx% market share, followed by Lactalis with xx%, and Groupe Sodiaal with xx%. Other major players collectively account for the remaining xx%.

- Innovation Drivers: Growing demand for organic, functional, and sustainable dairy products; advancements in dairy processing technologies.

- Regulatory Frameworks: EU regulations on food safety, labeling, and environmental sustainability significantly impact market operations.

- Product Substitutes: Plant-based alternatives, such as soy, almond, and oat milk, pose a growing competitive threat.

- End-User Trends: Increasing consumer demand for convenience, health & wellness, and ethically sourced dairy products.

- M&A Activity: The period 2019-2024 witnessed a significant number of M&A activities, leading to increased market consolidation.

Europe Dairy Market Industry Trends & Analysis

The Europe dairy market exhibits robust growth, driven by factors such as increasing consumption, evolving consumer preferences, and technological advancements. The market is experiencing a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration of organic dairy products continues to rise, driven by health concerns and environmental consciousness. Technological disruptions, such as precision farming and automated processing, improve efficiency and product quality. Consumer preferences shift toward healthier options, including low-fat, lactose-free, and fortified dairy products. Competitive dynamics are intense, with major players focusing on product innovation, brand building, and strategic acquisitions to maintain their market share. The market shows a high level of competition, but industry leaders, such as Nestlé and Danone, continue to maintain a dominant position. Factors like fluctuating milk prices and changing consumer demand continue to pose challenges and influence the dynamics of the market.

Leading Markets & Segments in Europe Dairy Market

Germany, France, and the United Kingdom represent the leading markets within the European dairy sector. The dominance of these nations stems from factors such as higher per capita consumption, established distribution networks, and favorable economic conditions. The Off-Trade distribution channel commands a larger market share compared to the On-Trade segment, owing to the increased popularity of retail sales through supermarkets and hypermarkets. The Butter category enjoys high demand, reflecting its versatility and use in various food applications. Key drivers for the leading markets and segments include:

- Germany: Strong domestic milk production, robust retail infrastructure, and high consumer spending.

- France: Extensive dairy farming, well-established processing industries, and a diverse product range.

- United Kingdom: High per capita dairy consumption, large retail market, and significant import/export activity.

- Off-Trade Channel: Convenience, wider product availability, and competitive pricing contribute to its dominance.

- Butter Category: Versatility, affordability, and traditional culinary usage maintain strong consumer demand.

Europe Dairy Market Product Developments

Recent product developments emphasize innovation in product formulation, packaging, and processing methods. There's a significant focus on creating healthier options, such as low-fat, lactose-free, and organic dairy products, to cater to evolving consumer preferences. Technological advancements like precision fermentation are enabling the creation of dairy alternatives, which are gaining popularity. The market reflects an increasing interest in sustainable and ethically sourced dairy products, aligning with consumer demand for environmentally friendly practices.

Key Drivers of Europe Dairy Market Growth

Several factors fuel the growth of the European dairy market. Technological advancements in dairy farming and processing enhance efficiency and product quality. Economic growth in several European countries increases consumer spending and dairy consumption. Favorable government policies and initiatives promoting sustainable dairy production provide incentives for growth.

Challenges in the Europe Dairy Market Market

The European dairy market faces several challenges. Fluctuating milk prices and input costs create volatility in the supply chain, impacting profitability. Stringent regulatory compliance requirements increase operational costs. Intense competition among major players forces companies to constantly innovate and seek new market opportunities.

Emerging Opportunities in Europe Dairy Market

Emerging opportunities in the European dairy market include the expanding demand for convenient and ready-to-consume dairy products. Innovation in dairy alternatives presents significant growth potential. Strategic partnerships between dairy companies and technology firms can lead to breakthroughs in dairy production and processing. Expansion into new markets and increased exports can drive long-term growth.

Leading Players in the Europe Dairy Market Sector

- Groupe Sodiaal

- Nestlé SA

- Hochland Holding GmbH & Co KG

- Unilever PL

- Hochwald Milch eG

- Glanbia PLC

- Danone SA

- Müller Group

- Arla Foods Amba

- Savencia Fromage & Dairy

- DMK Deutsches Milchkontor GmbH

- Groupe Lactalis

Key Milestones in Europe Dairy Market Industry

- June 2022: Hochwald Milch eG invested EUR 200 Million in a new dairy manufacturing facility in Germany, significantly increasing production capacity.

- June 2022: Hochwald opened its new plant in Mechernich, adding approximately 250 employees and processing 800 Million kg of milk annually into various products.

- March 2022: Lactalis Group acquired BMI's Fresh division, strengthening its position in the German market and furthering its partnership with southern German milk producers.

Strategic Outlook for Europe Dairy Market Market

The future of the European dairy market looks promising, with significant growth potential driven by innovation, sustainability initiatives, and evolving consumer preferences. Companies that adapt to changing consumer demands, embrace technological advancements, and focus on sustainable practices are best positioned to capture market share and drive future growth. The market will continue to evolve, with companies focusing on creating value-added products and strengthening their distribution networks to maintain competitiveness.

Europe Dairy Market Segmentation

-

1. Category

-

1.1. Butter

-

1.1.1. By Product Type

- 1.1.1.1. Cultured Butter

- 1.1.1.2. Uncultured Butter

-

1.1.1. By Product Type

-

1.2. Cheese

- 1.2.1. Natural Cheese

- 1.2.2. Processed Cheese

-

1.3. Cream

- 1.3.1. Double Cream

- 1.3.2. Single Cream

- 1.3.3. Whipping Cream

- 1.3.4. Others

-

1.4. Dairy Desserts

- 1.4.1. Cheesecakes

- 1.4.2. Frozen Desserts

- 1.4.3. Ice Cream

- 1.4.4. Mousses

-

1.5. Milk

- 1.5.1. Condensed milk

- 1.5.2. Flavored Milk

- 1.5.3. Fresh Milk

- 1.5.4. Powdered Milk

- 1.5.5. UHT Milk

- 1.6. Sour Milk Drinks

-

1.7. Yogurt

- 1.7.1. Flavored Yogurt

- 1.7.2. Unflavored Yogurt

-

1.1. Butter

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

Europe Dairy Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Dairy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for sports nutritional supplements

- 3.3. Market Restrains

- 3.3.1. Rising demand for plant-based protein

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Butter

- 5.1.1.1. By Product Type

- 5.1.1.1.1. Cultured Butter

- 5.1.1.1.2. Uncultured Butter

- 5.1.1.1. By Product Type

- 5.1.2. Cheese

- 5.1.2.1. Natural Cheese

- 5.1.2.2. Processed Cheese

- 5.1.3. Cream

- 5.1.3.1. Double Cream

- 5.1.3.2. Single Cream

- 5.1.3.3. Whipping Cream

- 5.1.3.4. Others

- 5.1.4. Dairy Desserts

- 5.1.4.1. Cheesecakes

- 5.1.4.2. Frozen Desserts

- 5.1.4.3. Ice Cream

- 5.1.4.4. Mousses

- 5.1.5. Milk

- 5.1.5.1. Condensed milk

- 5.1.5.2. Flavored Milk

- 5.1.5.3. Fresh Milk

- 5.1.5.4. Powdered Milk

- 5.1.5.5. UHT Milk

- 5.1.6. Sour Milk Drinks

- 5.1.7. Yogurt

- 5.1.7.1. Flavored Yogurt

- 5.1.7.2. Unflavored Yogurt

- 5.1.1. Butter

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Germany Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Dairy Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Groupe Sodiaal

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nestlé SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hochland Holding GmbH & Co KG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Unilever PL

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hochwald Milch eG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Glanbia PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Danone SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Müller Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Arla Foods Amba

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Savencia Fromage & Dairy

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 DMK Deutsches Milchkontor GmbH

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Groupe Lactalis

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Groupe Sodiaal

List of Figures

- Figure 1: Europe Dairy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Dairy Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Dairy Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Europe Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 4: Europe Dairy Market Volume K Tons Forecast, by Category 2019 & 2032

- Table 5: Europe Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Europe Dairy Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: Europe Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Dairy Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Europe Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Dairy Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: France Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Europe Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 26: Europe Dairy Market Volume K Tons Forecast, by Category 2019 & 2032

- Table 27: Europe Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Europe Dairy Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 29: Europe Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Dairy Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Germany Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: France Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Italy Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Spain Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Spain Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Netherlands Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Netherlands Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Belgium Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Belgium Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Sweden Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Sweden Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Norway Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Norway Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: Poland Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Poland Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Denmark Europe Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Denmark Europe Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Dairy Market?

The projected CAGR is approximately 4.06%.

2. Which companies are prominent players in the Europe Dairy Market?

Key companies in the market include Groupe Sodiaal, Nestlé SA, Hochland Holding GmbH & Co KG, Unilever PL, Hochwald Milch eG, Glanbia PLC, Danone SA, Müller Group, Arla Foods Amba, Savencia Fromage & Dairy, DMK Deutsches Milchkontor GmbH, Groupe Lactalis.

3. What are the main segments of the Europe Dairy Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 167040 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for sports nutritional supplements.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Rising demand for plant-based protein.

8. Can you provide examples of recent developments in the market?

June 2022: Hochwald Milch eG invested EUR 200 million to expand its business by opening a new dairy manufacturing facility in Germany. The new plant is located on a 21.5-hectare property and has 60,000 sq. m floor space.June 2022: Hochwald opened its new plant in Mechernich and invested EUR 200 million in the new location, where around 250 employees turn 800 million kg of milk per year into milk products, such as long-life milk, long-life cream, long-life milkshakes, and condensed milk.March 2022: Lactalis Group and Bayerische Milchindustrie eG (BMI) signed a contract for the sale of BMI’s Fresh division with the product groups: Fresh Milk, Yoghurt, and other products. Through this acquisition, Lactalis intends to build a close and long-term partnership with the southern German milk producers to further develop the market for regional products in food retail, national foodservice, and ethnic trade.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Dairy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Dairy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Dairy Market?

To stay informed about further developments, trends, and reports in the Europe Dairy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence