Key Insights

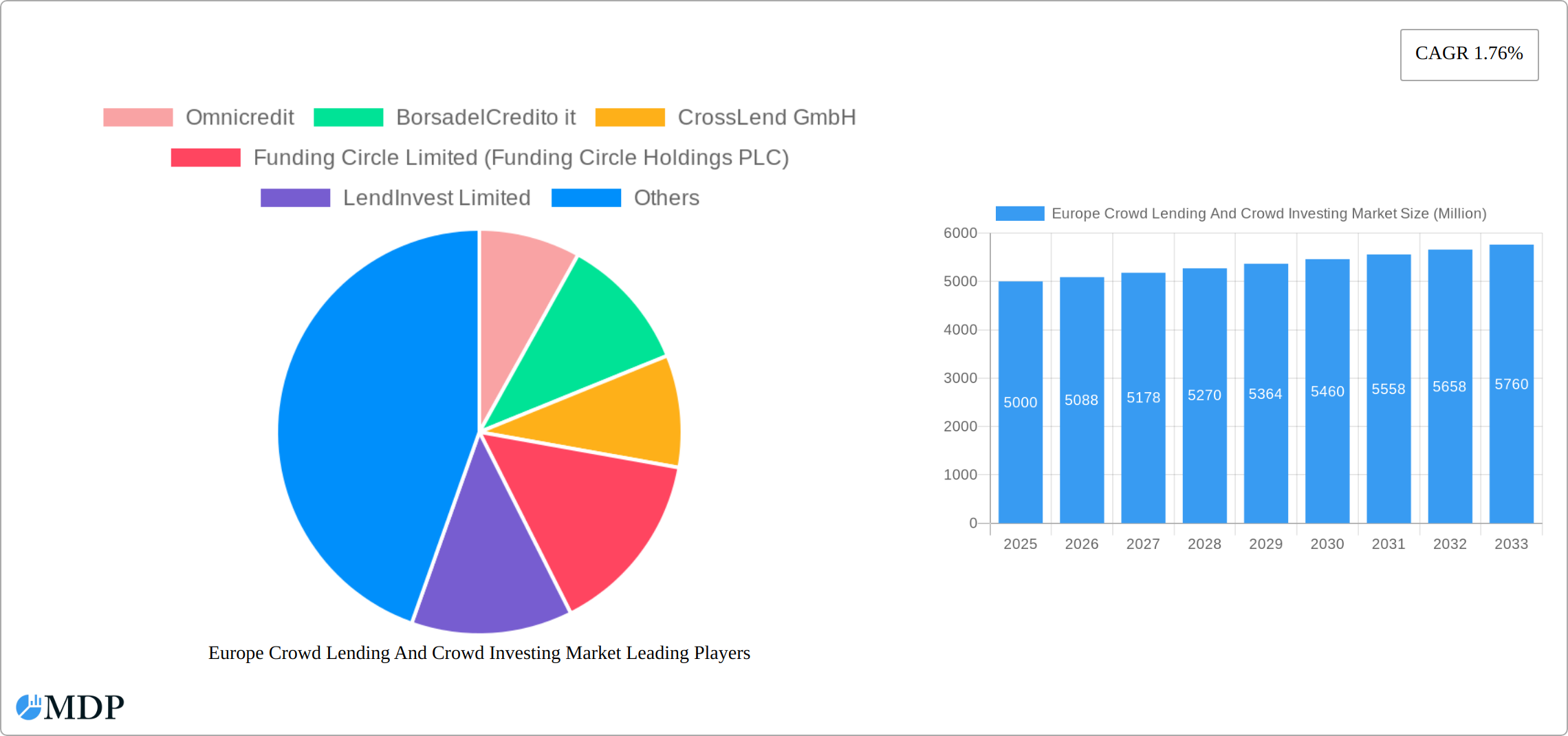

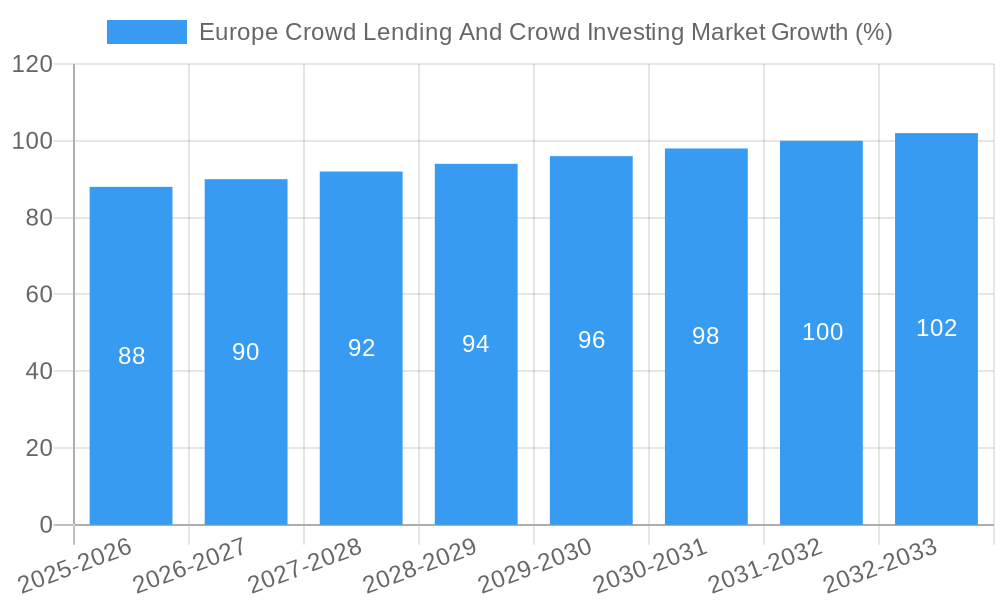

The European crowd lending and crowd investing market, exhibiting a Compound Annual Growth Rate (CAGR) of 1.76%, presents a compelling investment landscape. While the precise market size in 2025 is unavailable, projecting from a reasonable base year assumption of €5 Billion in 2025 (considering the presence of major players and significant market activity), the market is poised for steady growth. The market's expansion is driven by several factors. Increasingly sophisticated online platforms are democratizing access to finance for both borrowers and lenders, fostering transparency and efficiency. Growing awareness of alternative investment options among retail and institutional investors, coupled with the lower risk perception associated with diversified portfolios incorporating crowd lending, contributes to this upward trajectory. Furthermore, supportive regulatory frameworks across key European nations are gradually evolving, creating a more favorable environment for market growth. However, the market also faces certain challenges. Economic downturns and macroeconomic uncertainty can impact both lender confidence and borrower demand. Stringent regulatory compliance and the risk of loan defaults remain crucial considerations for market participants. The segment breakdown shows significant involvement from both business and consumer lending, with business lending potentially possessing a larger market share due to higher individual loan amounts.

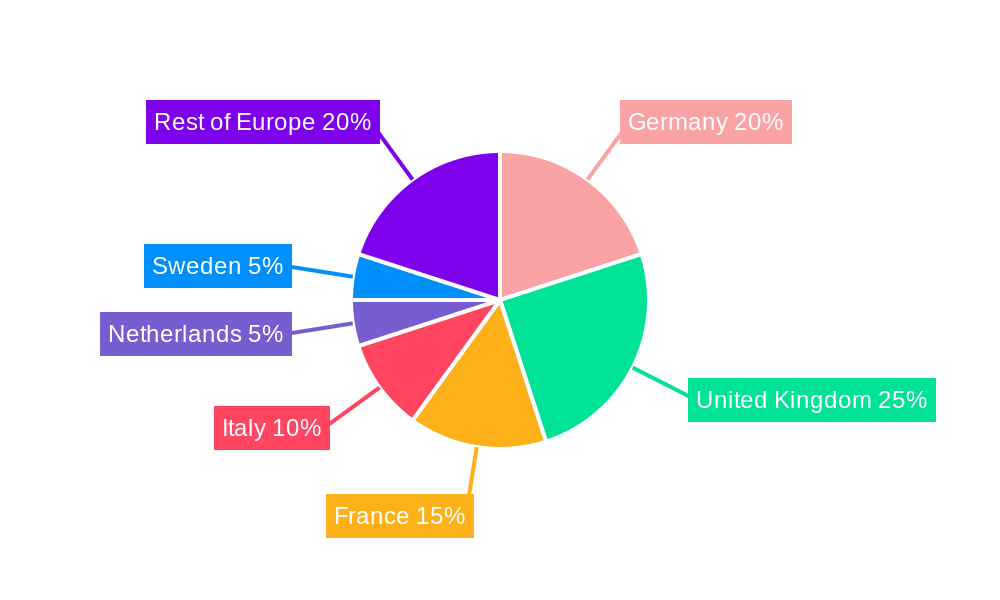

The major players in the market, including Omnicredit, BorsadelCredito.it, CrossLend GmbH, Funding Circle, LendInvest, and Mintos, contribute to a highly competitive yet dynamic market. Regional distribution favors established financial hubs like the United Kingdom, Germany, and France, but growing interest is observed across Sweden, the Netherlands, and other European nations. This decentralized structure, coupled with ongoing technological improvements and strategic partnerships, suggests that the European crowd lending and crowd investing market will experience continued, albeit moderate, expansion throughout the forecast period of 2025-2033. The continued diversification of investment options within this space, catering to a broader range of risk tolerances and investment goals, remains a key factor in its ongoing evolution.

Europe Crowd Lending and Crowd Investing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Crowd Lending and Crowd Investing Market, offering invaluable insights for investors, businesses, and industry stakeholders. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report projects market growth from 2025 to 2033, building upon historical data from 2019 to 2024. Expect detailed analysis of market dynamics, leading players, emerging trends, and key milestones shaping this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe Crowd Lending And Crowd Investing Market Market Dynamics & Concentration

The European crowd lending and crowd investing market is characterized by a dynamic interplay of factors impacting its concentration and future trajectory. Market concentration is currently moderate, with several key players holding significant shares but not achieving dominance. The market share of the top 5 players is estimated at xx%, indicating opportunities for both established firms and new entrants. Innovation is a significant driver, fueled by technological advancements in fintech, improved risk assessment models, and evolving investor preferences towards alternative investment options. Regulatory frameworks across Europe vary, creating both challenges and opportunities, with some countries fostering a more conducive environment for growth than others. The existence of traditional lending institutions and investment platforms acts as a substitute, posing a competitive challenge. However, the increasing popularity of crowd lending and investing, driven by lower barriers to entry and greater transparency, is steadily increasing market penetration. Mergers and acquisitions (M&A) activity is significant, as evidenced by recent deals like the Republic acquisition of Seedrs, indicating consolidation and a shift toward larger, more diversified platforms. In the past five years, there were approximately xx M&A deals in this sector.

- Market Concentration: Moderate, with top 5 players holding xx% market share.

- Innovation Drivers: Fintech advancements, improved risk assessment, evolving investor preferences.

- Regulatory Frameworks: Varied across Europe, impacting market growth.

- Product Substitutes: Traditional lending and investment platforms.

- End-User Trends: Increasing preference for alternative investments, higher transparency.

- M&A Activity: Significant, with approximately xx deals in the last 5 years.

Europe Crowd Lending And Crowd Investing Market Industry Trends & Analysis

The European crowd lending and crowd investing market demonstrates strong growth potential, driven by several key trends. Increasing digitalization and financial inclusion are broadening access to investment opportunities, while favorable economic conditions in certain regions have stimulated investment activity. The market has witnessed considerable technological disruption, with the adoption of blockchain technology, AI-powered risk assessment tools, and enhanced online platforms improving efficiency and transparency. Consumer preferences are shifting towards more accessible and diversified investment portfolios, contributing to market expansion. The competitive landscape is marked by both established players and innovative startups, resulting in intense competition, driving innovation and pricing pressures. The market is segmented by type (Business and Consumer), with business lending currently accounting for a larger share of the market, at approximately xx%. The CAGR for the overall market during the forecast period is estimated at xx%, with market penetration expected to reach xx% by 2033.

Leading Markets & Segments in Europe Crowd Lending And Crowd Investing Market

The UK and Germany currently represent the leading markets in Europe for crowd lending and crowd investing. This dominance is attributable to several key factors:

- UK: Established regulatory framework, strong entrepreneurial ecosystem, and a mature fintech sector.

- Germany: Large and affluent population, robust SME sector, and growing investor interest in alternative investments.

By Type:

- Business Lending: This segment dominates the market, driven by the financing needs of SMEs and startups, which often face difficulties accessing traditional funding. The increasing number of businesses embracing crowdfunding for expansion and capital raises contributes to this segment's growth.

- Consumer Lending: While smaller than business lending, the consumer lending segment is also experiencing growth, driven by the increasing popularity of peer-to-peer lending platforms offering attractive interest rates for both borrowers and lenders.

The following factors contribute to the dominance of these markets and segments:

- Economic Policies: Supportive regulations and tax incentives promoting alternative financing options.

- Infrastructure: Robust digital infrastructure facilitating seamless online transactions.

- Investor Sophistication: A growing pool of sophisticated investors seeking diversified investment opportunities.

Europe Crowd Lending And Crowd Investing Market Product Developments

Recent product innovations have focused on enhancing user experience, improving risk management, and expanding investment options. New platforms are incorporating AI-powered algorithms for automated loan assessment and risk scoring, resulting in faster processing times and reduced operational costs. The integration of blockchain technology promises greater transparency and security in transactions. A trend toward niche platforms specializing in specific sectors, such as renewable energy or social impact investing, is also emerging. These developments are driving increased market penetration and attracting a wider range of investors and borrowers.

Key Drivers of Europe Crowd Lending And Crowd Investing Market Growth

Several factors contribute to the robust growth of the European crowd lending and crowd investing market:

- Technological advancements: Fintech innovations such as AI and blockchain are enhancing efficiency and transparency.

- Economic conditions: Favorable economic climate in certain regions fuels investment activity.

- Regulatory support: Supportive government policies and regulations are encouraging market expansion in various European countries. For example, the UK's supportive regulatory environment has fostered a thriving crowdfunding ecosystem.

Challenges in the Europe Crowd Lending And Crowd Investing Market Market

The market faces several challenges, including:

- Regulatory uncertainty: Inconsistencies across European nations create complexities for cross-border operations.

- Credit risk management: Accurate risk assessment remains crucial to mitigate potential losses for lenders.

- Competition: The intense competition from established financial institutions and new entrants requires constant innovation. This competition has resulted in decreased average lending interest rates for lenders.

Emerging Opportunities in Europe Crowd Lending And Crowd Investing Market

The long-term growth potential of the market is significant, fueled by:

- Technological breakthroughs: Further advancements in AI and blockchain could revolutionize risk assessment and transaction processing.

- Strategic partnerships: Collaborations between established financial institutions and crowdfunding platforms can expand market reach and credibility.

- Market expansion: Untapped potential exists in underserved markets across Europe, particularly in Southern and Eastern Europe.

Leading Players in the Europe Crowd Lending And Crowd Investing Market Sector

- Omnicredit

- BorsadelCredito it

- CrossLend GmbH

- Funding Circle Limited (Funding Circle Holdings PLC)

- LendInvest Limited

- Mintos Marketplace AS

- Companist

- International Personal Finance PLC (IPF)

- Lidya

- OurCrowd

- CreamFinance

- Zopa Limited

- Crowdcube

- Monevo Inc

- Crowdestor

Key Milestones in Europe Crowd Lending And Crowd Investing Market Industry

- September 2022: Republic acquires Seedrs, expanding its European footprint and significantly impacting the market consolidation trend.

- November 2022: Oneplanetcrowd merges with Invesdor, demonstrating the growing trend of consolidation within the European crowdfunding landscape and increased focus on sustainable investments. This merger also signals the increasing popularity of social impact investing.

Strategic Outlook for Europe Crowd Lending And Crowd Investing Market Market

The future of the European crowd lending and crowd investing market looks bright. Continued technological innovation, strategic partnerships, and increasing regulatory clarity will drive market expansion. Untapped potential remains in underserved markets, offering significant opportunities for growth. The focus on sustainable and socially responsible investments will likely shape future market trends, attracting both investors and businesses seeking to align their activities with environmental and social goals. The market is poised for significant growth in the coming years, with the potential for further consolidation among key players and the emergence of new, specialized platforms catering to niche market segments.

Europe Crowd Lending And Crowd Investing Market Segmentation

-

1. Type

- 1.1. Business

- 1.2. Consumer

Europe Crowd Lending And Crowd Investing Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Crowd Lending And Crowd Investing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Shift Towards Digital Transformation Opens up New Growth Opportunities; High Proliferation of Smartphones Combined with Vendor Efforts to Appeal to the Younger Population

- 3.3. Market Restrains

- 3.3.1. ; Privacy Concerns towards the Authentication Vendor and High Costs of Token

- 3.4. Market Trends

- 3.4.1. High Proliferation of Smartphones Combined with Vendor Efforts to Appeal to the Younger Population will Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Business

- 5.1.2. Consumer

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Omnicredit

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 BorsadelCredito it

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 CrossLend GmbH

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Funding Circle Limited (Funding Circle Holdings PLC)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 LendInvest Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Mintos Marketplace AS

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Companist

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 International Personal Finance PLC (IPF)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Lidya

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 OurCrowd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 CreamFinance

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Zopa Limited

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Crowdcube

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Monevo Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Crowdestor

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 Omnicredit

List of Figures

- Figure 1: Europe Crowd Lending And Crowd Investing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Crowd Lending And Crowd Investing Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Crowd Lending And Crowd Investing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Crowd Lending And Crowd Investing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Crowd Lending And Crowd Investing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Crowd Lending And Crowd Investing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Crowd Lending And Crowd Investing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Europe Crowd Lending And Crowd Investing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Crowd Lending And Crowd Investing Market?

The projected CAGR is approximately 1.76%.

2. Which companies are prominent players in the Europe Crowd Lending And Crowd Investing Market?

Key companies in the market include Omnicredit, BorsadelCredito it, CrossLend GmbH, Funding Circle Limited (Funding Circle Holdings PLC), LendInvest Limited, Mintos Marketplace AS, Companist, International Personal Finance PLC (IPF), Lidya, OurCrowd, CreamFinance, Zopa Limited, Crowdcube, Monevo Inc, Crowdestor.

3. What are the main segments of the Europe Crowd Lending And Crowd Investing Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Shift Towards Digital Transformation Opens up New Growth Opportunities; High Proliferation of Smartphones Combined with Vendor Efforts to Appeal to the Younger Population.

6. What are the notable trends driving market growth?

High Proliferation of Smartphones Combined with Vendor Efforts to Appeal to the Younger Population will Drive the Market.

7. Are there any restraints impacting market growth?

; Privacy Concerns towards the Authentication Vendor and High Costs of Token.

8. Can you provide examples of recent developments in the market?

November 2022: Oneplanetcrowd, a Netherlands-based operating firm, merged into Invesdor, a Finland-based larger European securities crowdfunding platform. Oneplanetcrowd platform enables early-stage firms, including sustainable energy projects, to raise capital from individuals interested in social impact investing. Oneplanetcrowd reports over 43,000 investors having completed 300 funding rounds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Crowd Lending And Crowd Investing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Crowd Lending And Crowd Investing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Crowd Lending And Crowd Investing Market?

To stay informed about further developments, trends, and reports in the Europe Crowd Lending And Crowd Investing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence