Key Insights

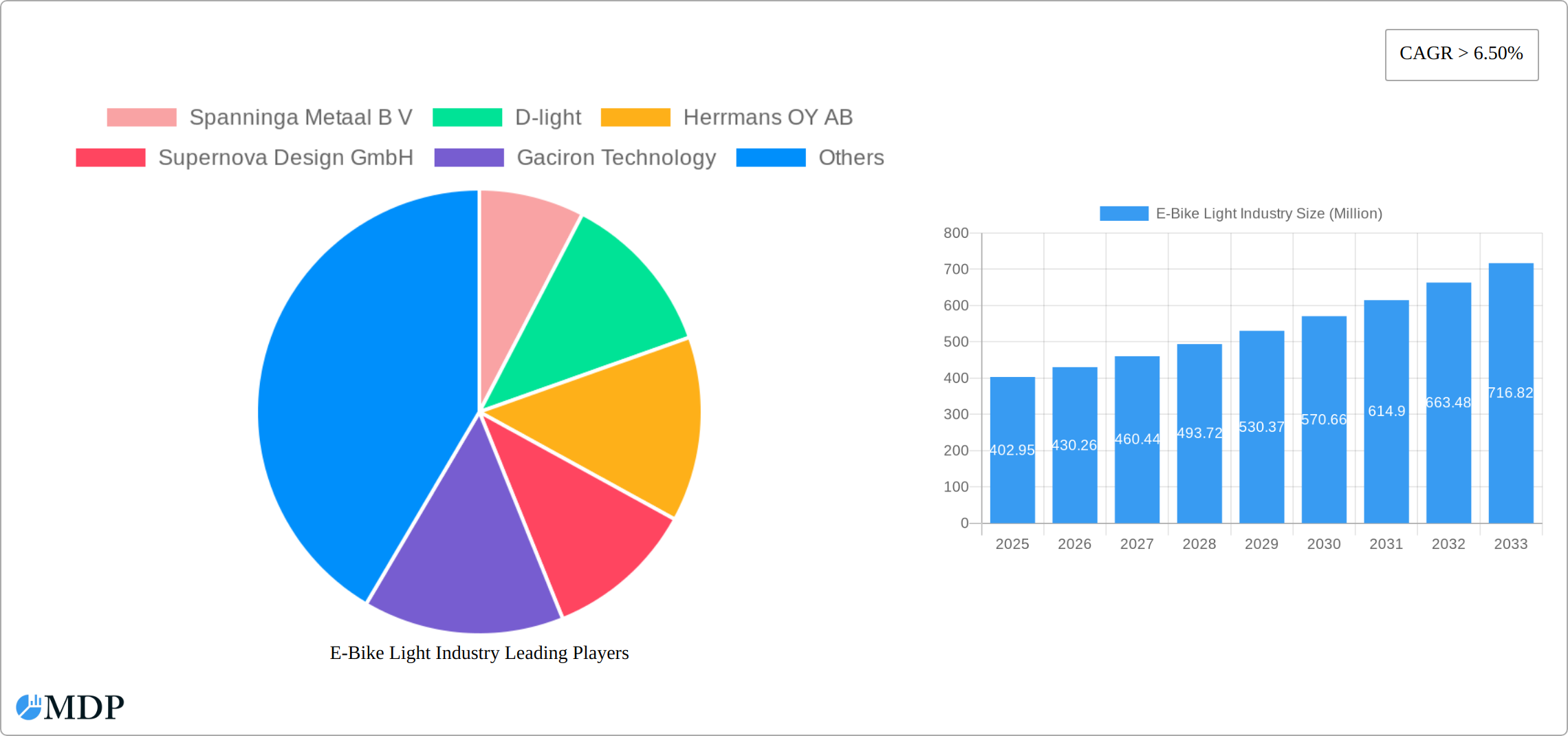

The e-bike light industry is experiencing robust growth, projected to reach a market size of $402.95 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 6.50% from 2025 to 2033. This expansion is fueled by several key factors. The increasing popularity of e-bikes globally, driven by environmental concerns and the need for sustainable transportation solutions, is a primary driver. Furthermore, stringent safety regulations mandating lighting systems on e-bikes in many regions are significantly boosting demand. Technological advancements, such as the integration of smart features and improved brightness and durability in e-bike lights, are also contributing to market growth. The market is segmented by light mounting (headlight, rear safety light), sales channel (offline stores, online stores), and end-user (aftermarket, stock fitting). The aftermarket segment is expected to show particularly strong growth due to the increasing number of e-bike owners seeking to upgrade or replace their existing lighting systems. North America and Europe currently hold significant market shares, but the Asia-Pacific region is poised for substantial expansion driven by rising e-bike adoption and increasing disposable incomes. Competition within the industry is relatively high, with established players like Spanninga Metaal B.V., D-light, and Herrmans OY AB competing alongside newer entrants focusing on innovation and technological advancements.

The continued growth of the e-bike light market is predicated on several factors. Firstly, government initiatives promoting cycling and micromobility are further incentivizing e-bike adoption. Secondly, the integration of e-bike lights with other smart features, such as GPS tracking and connectivity, is enhancing their appeal to consumers. Thirdly, a rising awareness of safety, particularly in low-light conditions, will propel demand for higher-quality, more visible lighting systems. While potential restraints such as fluctuating raw material prices and economic downturns exist, the overall positive market outlook is expected to remain strong, driven by the fundamental drivers mentioned above. The industry is witnessing a shift towards more sophisticated lighting technologies, focusing on energy efficiency, improved light output, and enhanced safety features. This trend will continue to shape the competitive landscape and drive innovation within the e-bike light sector.

E-Bike Light Industry Market Report: 2019-2033

Dive into the dynamic world of e-bike lighting with this comprehensive market report, projecting a market value exceeding $XX Million by 2033. This in-depth analysis covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), providing actionable insights for stakeholders across the e-bike light value chain. From understanding market concentration and leading players like Spanninga Metaal B V and Supernova Design GmbH to identifying lucrative segments and emerging opportunities, this report is your essential guide to navigating this rapidly evolving market.

E-Bike Light Industry Market Dynamics & Concentration

The global e-bike light market, valued at $XX Million in 2024, is experiencing significant growth fueled by the rising popularity of e-bikes and stringent safety regulations. Market concentration is moderately high, with a few key players holding substantial market share. Spanninga Metaal B V, Supernova Design GmbH, and Herrmans OY AB are amongst the leading players, exhibiting a combined market share of approximately xx%. However, the entry of new players, particularly from Asia, is increasing competition. Innovation is driven by the demand for brighter, more energy-efficient, and integrated lighting solutions. Regulatory frameworks, particularly those concerning safety standards (like StVZO in Europe), significantly impact product design and market access. Product substitutes, such as traditional bicycle lights, are gradually losing market share due to the superior performance and features of e-bike-specific lights. End-user trends show a preference for integrated lighting systems and smart features. M&A activity in the sector has been relatively low in recent years, with only xx deals reported between 2019 and 2024.

- Market Concentration: Moderately high, with top 3 players holding xx% market share.

- Innovation Drivers: Energy efficiency, brighter output, smart features, and integration with e-bike systems.

- Regulatory Frameworks: Stringent safety standards driving product innovation and market access.

- Product Substitutes: Traditional bicycle lights facing declining market share.

- End-User Trends: Increasing demand for integrated and smart lighting solutions.

- M&A Activity: Relatively low, with xx deals recorded from 2019-2024.

E-Bike Light Industry Trends & Analysis

The e-bike light market is experiencing robust growth, with a projected CAGR of xx% from 2025 to 2033. This growth is driven by several factors, including the expanding e-bike market, increasing consumer awareness of safety, and technological advancements leading to superior lighting solutions. The market penetration of e-bike lights is increasing, particularly in developed regions with well-established cycling infrastructure and high e-bike adoption rates. Technological disruptions are evident in the shift towards LED technology, improved battery life, and the integration of smart features such as Bluetooth connectivity and automatic brightness adjustments. Consumer preferences are leaning towards brighter, more durable, and aesthetically pleasing lights, often integrated seamlessly into the e-bike design. Competitive dynamics are marked by increasing competition, with both established players and new entrants vying for market share through innovation and pricing strategies.

Leading Markets & Segments in E-Bike Light Industry

The European market currently dominates the e-bike light industry, driven by high e-bike adoption rates, stringent safety regulations, and well-developed cycling infrastructure. Within Europe, Germany and the Netherlands are particularly strong markets.

- By Light Mounting: Headlights hold the largest market share, followed by rear safety lights. The demand for integrated lighting systems is growing.

- By Sales Channel: Online stores are witnessing faster growth compared to offline stores, fueled by the convenience of e-commerce.

- By End-User: The aftermarket segment currently dominates, offering opportunities for both established and new players. However, the stock fitting segment is also exhibiting significant growth.

Key Drivers:

- High E-bike Adoption: Europe and North America are leading adopters.

- Stringent Safety Regulations: Mandating e-bike lights in several regions.

- Developed Cycling Infrastructure: Encouraging cycling as a mode of transportation.

E-Bike Light Industry Product Developments

Recent product innovations focus on enhanced brightness, improved energy efficiency, and smaller form factors. The integration of smart features, such as automatic brightness adjustment based on ambient light conditions and Bluetooth connectivity for customization, is a significant trend. These advancements offer competitive advantages by improving safety, convenience, and user experience, contributing to increased market penetration and consumer preference. Furthermore, the use of durable and weather-resistant materials is increasingly common to enhance product lifespan and reliability.

Key Drivers of E-Bike Light Industry Growth

The e-bike light market is driven by the convergence of technological advancements, economic factors, and regulatory frameworks. Technological progress, such as the development of highly efficient LEDs and improved battery technology, has significantly enhanced the performance and appeal of e-bike lights. The growing affordability of e-bikes and increasing consumer disposable income fuel market demand. Stringent safety regulations mandating the use of lights on e-bikes in many regions provide a further boost to market growth.

Challenges in the E-Bike Light Industry Market

The industry faces challenges including intense competition, fluctuating raw material costs affecting production expenses, and the potential for regulatory changes impacting product design and compliance. Supply chain disruptions, particularly concerning electronic components, can lead to production delays and increased costs. Moreover, the increasing prevalence of counterfeit products poses a threat to both brand reputation and market integrity.

Emerging Opportunities in E-Bike Light Industry

Significant opportunities exist in the development of innovative lighting solutions integrating smart features like connectivity and advanced safety systems. Strategic partnerships between e-bike manufacturers and lighting suppliers can foster product integration and market expansion. Expansion into emerging markets with growing e-bike adoption rates presents further growth potential. The development of sustainable and eco-friendly lighting solutions also offers a significant opportunity.

Leading Players in the E-Bike Light Industry Sector

- Spanninga Metaal B V

- D-light

- Herrmans OY AB

- Supernova Design GmbH

- Gaciron Technology

- Magicshine

- Limeforge Ltd

- Lezyne

- Lord Benex

Key Milestones in E-Bike Light Industry Industry

- December 2022: Magicshine launched the ME StVZO 100LUX E-BIKE LIGHT in India, signifying expansion into new markets and product diversification.

- March 2023: Upway's US launch indicates the growing demand for refurbished e-bikes and potential downstream effects on the e-bike light market (increased demand for replacement parts and upgrades).

Strategic Outlook for E-Bike Light Industry Market

The e-bike light market is poised for continued growth, driven by technological advancements, increasing e-bike adoption, and supportive regulatory environments. Strategic opportunities lie in product innovation, targeted market expansion, and strategic partnerships. Focus on sustainability and integration with broader smart city initiatives will further enhance market potential. The long-term outlook remains positive, with substantial growth expected in both developed and emerging markets.

E-Bike Light Industry Segmentation

-

1. Light Mounting

- 1.1. Headlight

- 1.2. Rear Safety Light

-

2. Sales Channel

- 2.1. Offline Stores

- 2.2. Online Stores

-

3. End-User

- 3.1. Aftermarket

- 3.2. Stock Fitting

E-Bike Light Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

E-Bike Light Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Sales of E-bikes

- 3.3. Market Restrains

- 3.3.1. High Cost of EV Solid-State Battery May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Growing Demand for E-bikes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Light Mounting

- 5.1.1. Headlight

- 5.1.2. Rear Safety Light

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. Offline Stores

- 5.2.2. Online Stores

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Aftermarket

- 5.3.2. Stock Fitting

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Light Mounting

- 6. North America E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Light Mounting

- 6.1.1. Headlight

- 6.1.2. Rear Safety Light

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. Offline Stores

- 6.2.2. Online Stores

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Aftermarket

- 6.3.2. Stock Fitting

- 6.1. Market Analysis, Insights and Forecast - by Light Mounting

- 7. Europe E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Light Mounting

- 7.1.1. Headlight

- 7.1.2. Rear Safety Light

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. Offline Stores

- 7.2.2. Online Stores

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Aftermarket

- 7.3.2. Stock Fitting

- 7.1. Market Analysis, Insights and Forecast - by Light Mounting

- 8. Asia Pacific E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Light Mounting

- 8.1.1. Headlight

- 8.1.2. Rear Safety Light

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. Offline Stores

- 8.2.2. Online Stores

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Aftermarket

- 8.3.2. Stock Fitting

- 8.1. Market Analysis, Insights and Forecast - by Light Mounting

- 9. Rest of the World E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Light Mounting

- 9.1.1. Headlight

- 9.1.2. Rear Safety Light

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel

- 9.2.1. Offline Stores

- 9.2.2. Online Stores

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Aftermarket

- 9.3.2. Stock Fitting

- 9.1. Market Analysis, Insights and Forecast - by Light Mounting

- 10. North America E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Russia

- 11.1.5 Spain

- 11.1.6 Rest of Europe

- 12. Asia Pacific E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World E-Bike Light Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Spanninga Metaal B V

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 D-light

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Herrmans OY AB

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Supernova Design GmbH

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Gaciron Technology

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Magicshin

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Limeforge Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Lezyne

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Lord Benex

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.1 Spanninga Metaal B V

List of Figures

- Figure 1: Global E-Bike Light Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America E-Bike Light Industry Revenue (Million), by Light Mounting 2024 & 2032

- Figure 11: North America E-Bike Light Industry Revenue Share (%), by Light Mounting 2024 & 2032

- Figure 12: North America E-Bike Light Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 13: North America E-Bike Light Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 14: North America E-Bike Light Industry Revenue (Million), by End-User 2024 & 2032

- Figure 15: North America E-Bike Light Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 16: North America E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe E-Bike Light Industry Revenue (Million), by Light Mounting 2024 & 2032

- Figure 19: Europe E-Bike Light Industry Revenue Share (%), by Light Mounting 2024 & 2032

- Figure 20: Europe E-Bike Light Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 21: Europe E-Bike Light Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 22: Europe E-Bike Light Industry Revenue (Million), by End-User 2024 & 2032

- Figure 23: Europe E-Bike Light Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 24: Europe E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific E-Bike Light Industry Revenue (Million), by Light Mounting 2024 & 2032

- Figure 27: Asia Pacific E-Bike Light Industry Revenue Share (%), by Light Mounting 2024 & 2032

- Figure 28: Asia Pacific E-Bike Light Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 29: Asia Pacific E-Bike Light Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 30: Asia Pacific E-Bike Light Industry Revenue (Million), by End-User 2024 & 2032

- Figure 31: Asia Pacific E-Bike Light Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 32: Asia Pacific E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World E-Bike Light Industry Revenue (Million), by Light Mounting 2024 & 2032

- Figure 35: Rest of the World E-Bike Light Industry Revenue Share (%), by Light Mounting 2024 & 2032

- Figure 36: Rest of the World E-Bike Light Industry Revenue (Million), by Sales Channel 2024 & 2032

- Figure 37: Rest of the World E-Bike Light Industry Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 38: Rest of the World E-Bike Light Industry Revenue (Million), by End-User 2024 & 2032

- Figure 39: Rest of the World E-Bike Light Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 40: Rest of the World E-Bike Light Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World E-Bike Light Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global E-Bike Light Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global E-Bike Light Industry Revenue Million Forecast, by Light Mounting 2019 & 2032

- Table 3: Global E-Bike Light Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 4: Global E-Bike Light Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Global E-Bike Light Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Russia E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: China E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: South America E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Middle East and Africa E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global E-Bike Light Industry Revenue Million Forecast, by Light Mounting 2019 & 2032

- Table 27: Global E-Bike Light Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 28: Global E-Bike Light Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 29: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of North America E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global E-Bike Light Industry Revenue Million Forecast, by Light Mounting 2019 & 2032

- Table 34: Global E-Bike Light Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 35: Global E-Bike Light Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 36: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Russia E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global E-Bike Light Industry Revenue Million Forecast, by Light Mounting 2019 & 2032

- Table 44: Global E-Bike Light Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 45: Global E-Bike Light Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 46: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: India E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: China E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global E-Bike Light Industry Revenue Million Forecast, by Light Mounting 2019 & 2032

- Table 53: Global E-Bike Light Industry Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 54: Global E-Bike Light Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 55: Global E-Bike Light Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: South America E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Middle East and Africa E-Bike Light Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-Bike Light Industry?

The projected CAGR is approximately > 6.50%.

2. Which companies are prominent players in the E-Bike Light Industry?

Key companies in the market include Spanninga Metaal B V, D-light, Herrmans OY AB, Supernova Design GmbH, Gaciron Technology, Magicshin, Limeforge Ltd, Lezyne, Lord Benex.

3. What are the main segments of the E-Bike Light Industry?

The market segments include Light Mounting, Sales Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 402.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Sales of E-bikes.

6. What are the notable trends driving market growth?

Growing Demand for E-bikes.

7. Are there any restraints impacting market growth?

High Cost of EV Solid-State Battery May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

March 2023: Upway, the French refurbisher and reseller of electric bikes across various brands, launched in the United States. The company will focus its efforts on the Northeast region of the country. Still, its bikes will be available for shipping across the continental U.S. Upway already collaborates with major European e-bike brands such as VanMoof, Riese & Müller, and Gazelle. Still, it plans to extend its roster to include American bike brands such as Specialised, Cannondale, and Rad Power Bikes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-Bike Light Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-Bike Light Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-Bike Light Industry?

To stay informed about further developments, trends, and reports in the E-Bike Light Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence