Key Insights

The Dublin data center market is experiencing robust growth, driven by increasing cloud adoption, the expansion of digital services, and Ireland's strategic location within the transatlantic cable network. A compound annual growth rate (CAGR) of 17.11% from 2019 to 2024 suggests a significant market expansion, and this trajectory is expected to continue. The market is segmented by colocation type (retail, wholesale, hyperscale), end-user (cloud and IT, telecom, etc.), data center size, and tier type, offering diverse investment opportunities. The presence of major global players like Equinix and Digital Realty, alongside regional operators, indicates a competitive yet dynamic landscape. Factors like government initiatives promoting digital infrastructure and the increasing demand for low-latency connectivity further fuel market expansion. While specific market size figures are not provided, considering the CAGR and the presence of major global players, we can reasonably assume a sizable market value, potentially exceeding several hundred million euros in 2025 and continuing its upward trajectory. The high concentration of hyperscale data centers within Dublin contributes to the growth by supplying demand from large cloud providers. Competition is fierce amongst providers, leading to ongoing investments in infrastructure and innovative service offerings to capture market share.

The limitations on available land and energy resources in Dublin pose potential constraints to future growth. However, ongoing investments in renewable energy infrastructure and smart city initiatives could mitigate these concerns. The absorption rate, which reflects the speed at which available data center space is being filled, acts as a critical indicator of market health. Sustained high absorption rates in Dublin support the outlook for continued strong market performance over the forecast period (2025-2033). Understanding the nuances across different segments, such as the varying growth rates of retail versus hyperscale colocation, will be crucial for informed strategic decision-making in this rapidly evolving market. Analyzing the geographical distribution of data centers within the Dublin region will highlight areas of potential expansion and competitive intensity.

Dublin Data Center Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Dublin data center market, covering market dynamics, industry trends, leading segments, key players, and future growth opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for investors, industry stakeholders, and strategic decision-makers. The report analyzes market trends and growth drivers, offering a clear understanding of the current landscape and future potential of the Dublin data center market. The detailed segmentation of the market across colocation types, end-users, data center sizes, and tier types provides a granular view of market dynamics. The report also features detailed profiles of leading players, including their market share, strategic initiatives, and competitive landscape. This essential resource facilitates informed business strategies and successful market navigation. The report features a detailed analysis of significant industry developments, including major investments and technological advancements.

Dublin Data Center Market Market Dynamics & Concentration

The Dublin data center market is experiencing robust growth driven by increasing digitalization, cloud adoption, and the expansion of multinational technology companies. Market concentration is moderate, with a few major players holding significant market share, while several smaller players compete in niche segments. Innovation is a key driver, with companies continuously investing in advanced technologies such as AI-powered solutions and sustainable cooling systems. The regulatory framework in Ireland is generally supportive of data center development, but environmental concerns are also leading to stricter regulations. Product substitution is limited due to the specialized nature of data centers. End-user trends indicate a strong preference for hyperscale facilities and colocation services.

- Market Share: Equinix Inc. and Digital Realty Trust Inc. (Interxion) hold a combined xx% market share in 2025.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, indicating consolidation within the market. The forecast period (2025-2033) is projected to see xx M&A deals, driven by expansion and consolidation strategies.

Dublin Data Center Market Industry Trends & Analysis

The Dublin data center market demonstrates a significant Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by the increasing demand for digital services, the expansion of cloud computing, and the strategic location of Dublin as a key European hub for data centers. Technological disruptions, such as the adoption of edge computing and AI, are further driving market expansion. Consumer preferences increasingly favor high-capacity, low-latency, and energy-efficient data center solutions. Competitive dynamics are marked by intense rivalry, with companies focusing on providing enhanced services, improved security, and competitive pricing. Market penetration of hyperscale facilities is expected to increase from xx% in 2025 to xx% by 2033.

Leading Markets & Segments in Dublin Data Center Market

The Dublin data center market is dominated by the Retail colocation type, accounting for xx Million USD in revenue in 2025. Within end-users, the Cloud and IT sector represents the largest segment, followed by the Telecom sector. The Large and Mega data center size segments are experiencing the highest growth rates. Tier III and Tier IV facilities dominate the market in terms of capacity. The Utilized absorption segment reflects the high demand for data center space in Dublin.

- Key Drivers for Dominant Segments:

- Retail Colocation: Growing demand for flexible and scalable solutions from SMEs and enterprises.

- Cloud and IT End-User: Expansion of cloud computing infrastructure and the increasing number of hyperscalers in Dublin.

- Large/Mega DC Size: Demand for high-capacity facilities to support large-scale data processing and storage.

- Tier III/IV: Emphasis on high availability, redundancy, and resilience.

- Utilized Absorption: Strong market demand and limited availability of suitable land and infrastructure.

Dublin Data Center Market Product Developments

Recent product innovations include advancements in cooling technologies, such as liquid cooling and AI-powered thermal management systems, designed to improve energy efficiency and reduce operating costs. Furthermore, there is increasing adoption of modular data center designs for scalability and faster deployment. These innovations enhance the efficiency, sustainability, and cost-effectiveness of data center operations. The market fit for these new products is exceptionally high, reflecting the continuous demand for improved data center infrastructure.

Key Drivers of Dublin Data Center Market Growth

The growth of the Dublin data center market is propelled by several key factors: Firstly, the significant increase in data generated by businesses and consumers fuels demand for robust data center infrastructure. Secondly, the strong government support for the technology sector, including favorable tax policies and investment incentives, contributes significantly. Finally, Dublin's strategic location as a major European digital hub, coupled with its robust connectivity and skilled workforce, enhances its attractiveness to both domestic and international data center operators.

Challenges in the Dublin Data Center Market Market

The Dublin data center market faces challenges like limited land availability for new data centers, increased energy costs, and escalating competition among established and emerging players. These factors impact the overall development and scalability of the market. Furthermore, environmental regulations pose challenges, requiring operators to implement sustainable solutions and manage power consumption efficiently. The competition intensifies the pressure on pricing and profitability within the market.

Emerging Opportunities in Dublin Data Center Market

The Dublin data center market presents substantial opportunities for growth in areas such as edge computing, AI-powered data center management, and the development of more sustainable data centers. Strategic partnerships between data center operators and technology providers will also drive innovation and market expansion. Furthermore, the increasing demand for colocation services and the continued growth of hyperscale data centers contribute to lucrative opportunities in the long term.

Leading Players in the Dublin Data Center Market Sector

- Eir evo

- Servecentric Ltd

- Equinix Inc

- BT Communications Limited (BT Group PLC)

- K2 STRATEGIC PTE LTD (Kuok Group)

- Web World Ireland

- Zenlayer Inc

- Viatel Ireland Limited

- Digital Realty Trust Inc (Interxion)

- Keppel DC REIT Management Pte Ltd

- Cyrus One Inc

- Sungard Availability Services LP

- EdgeConneX Inc (EQT Infrastructure)

Key Milestones in Dublin Data Center Market Industry

- June 2022: Vantage Data Centres Ltd. secures permission to construct two data centers totaling 40,580 sq. m in Profile Park, expanding the existing data center cluster. This signifies significant investment and growth within the market.

- July 2022: ST Engineering's introduction of data center pre-cooling technology offers a potential solution to reduce energy consumption and costs, impacting the operational efficiency and sustainability within the sector.

Strategic Outlook for Dublin Data Center Market Market

The Dublin data center market exhibits substantial potential for future growth, driven by sustained demand for digital infrastructure and favorable government policies. Strategic opportunities exist in developing sustainable data centers, leveraging edge computing technologies, and fostering strategic partnerships to enhance service offerings and expand market reach. The market's trajectory indicates continued expansion, presenting attractive prospects for investors and businesses.

Dublin Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud and IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media and Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-utilized

-

3.1. Utilized

Dublin Data Center Market Segmentation By Geography

- 1. Dublin

Dublin Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. Mega Size Data Centers are Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud and IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media and Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Dublin

- 5.1. Market Analysis, Insights and Forecast - by DC Size

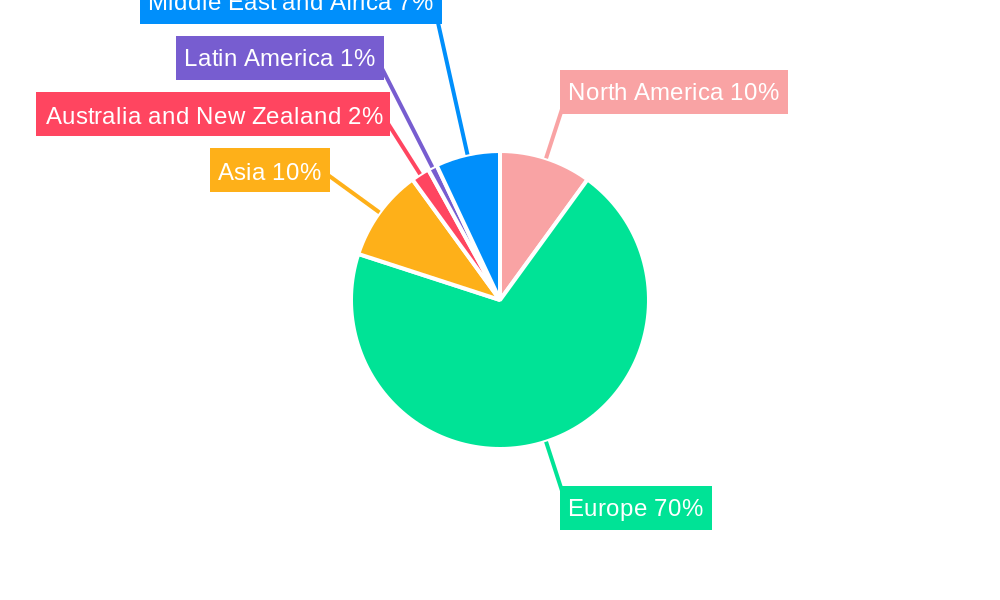

- 6. North America Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa Dublin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Eir evo

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Servecentric Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Equinix Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 BT Communications Limited (BT Group PLC)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 K2 STRATEGIC PTE LTD (Kuok Group)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Web World Ireland

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Zenlayer Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Viatel Ireland Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Digital Realty Trust Inc (Interxion)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Keppel DC REIT Management Pte Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Cyrus One Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Sungard Availability Services LP

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 EdgeConneX Inc (EQT Infrastructure)

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Eir evo

List of Figures

- Figure 1: Dublin Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Dublin Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Dublin Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Dublin Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Dublin Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Dublin Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Dublin Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Dublin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Dublin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Dublin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Dublin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Dublin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Dublin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Dublin Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: Dublin Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: Dublin Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: Dublin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dublin Data Center Market?

The projected CAGR is approximately 17.11%.

2. Which companies are prominent players in the Dublin Data Center Market?

Key companies in the market include Eir evo, Servecentric Ltd, Equinix Inc, BT Communications Limited (BT Group PLC), K2 STRATEGIC PTE LTD (Kuok Group), Web World Ireland, Zenlayer Inc, Viatel Ireland Limited, Digital Realty Trust Inc (Interxion), Keppel DC REIT Management Pte Ltd, Cyrus One Inc, Sungard Availability Services LP, EdgeConneX Inc (EQT Infrastructure).

3. What are the main segments of the Dublin Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

Mega Size Data Centers are Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

June 2022: Vantage Data Centres Ltd was granted permission to demolish an abandoned single-story residence and related outbuilding (206 sq. m) to make way for the construction of two data centers. The relevant 8.7-hectare site is located within Profile Park, regarded as "Ireland's Data Centre Cluster," in the townlands of Ballybane and Kilbride. The idea is to construct two two-story data centers with a plant on the roof of each facility and accompanying auxiliary development with a total floor space of 40,580 sq. m. Building 11, the first data center planned, will be built to the south of the property, while Building 12, the second data center, will be located north.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dublin Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dublin Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dublin Data Center Market?

To stay informed about further developments, trends, and reports in the Dublin Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence