Key Insights

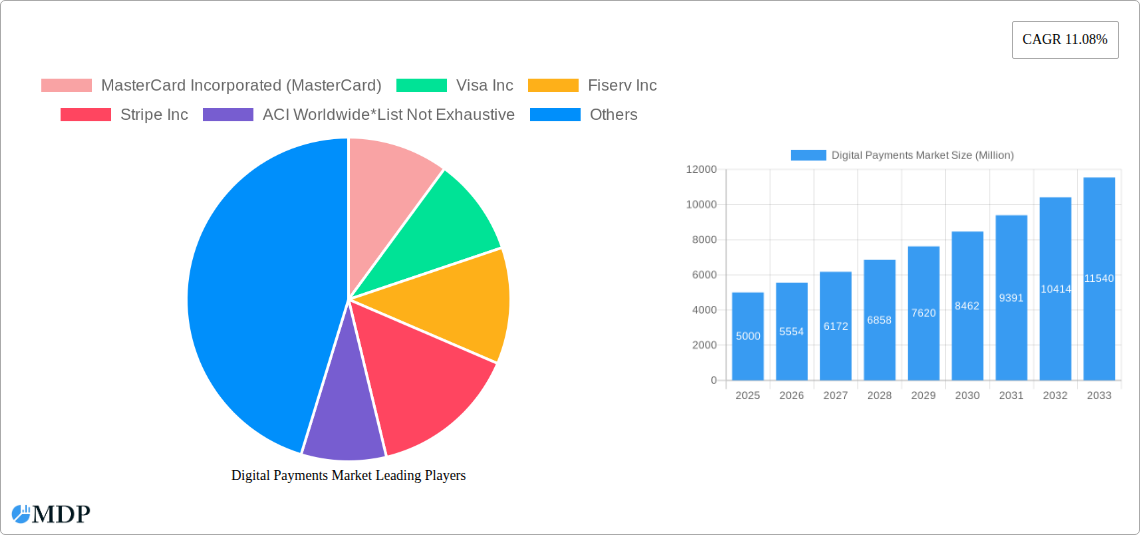

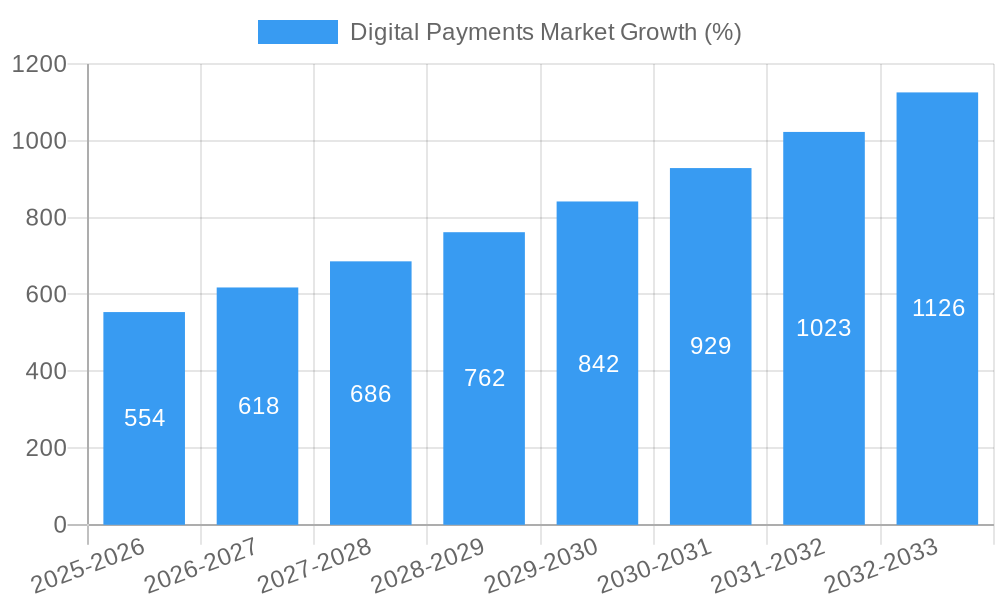

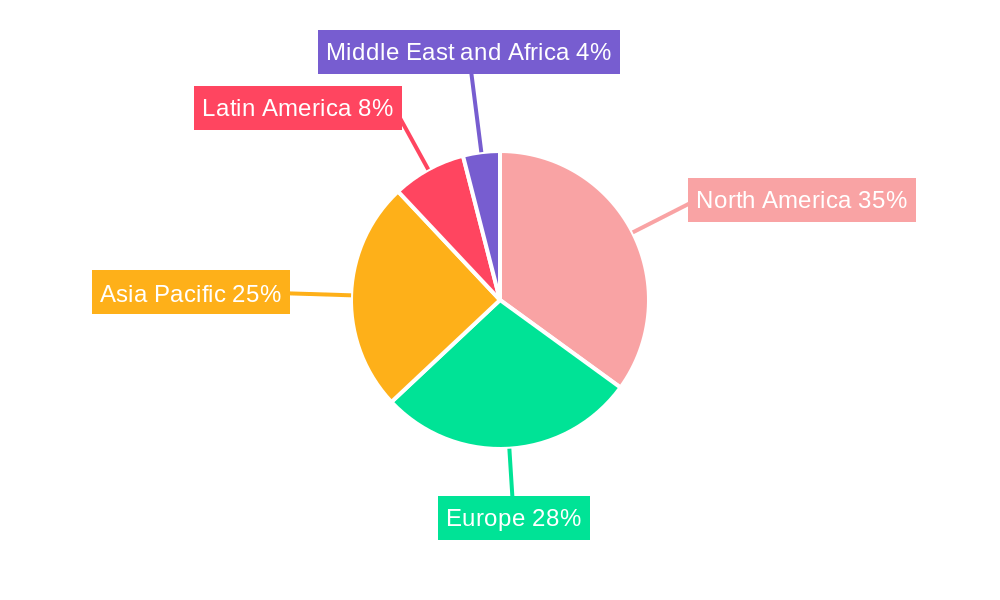

The global digital payments market is experiencing robust growth, projected to reach a substantial size within the forecast period (2025-2033). A compound annual growth rate (CAGR) of 11.08% signifies significant expansion driven by several key factors. The increasing adoption of smartphones and internet penetration, particularly in emerging economies, fuels the shift towards cashless transactions. Furthermore, the rising popularity of e-commerce and online shopping platforms creates a surge in demand for secure and convenient digital payment solutions. Government initiatives promoting financial inclusion and digitalization further accelerate market growth. The market is segmented by payment mode (Point of Sale and Online Sale) and end-user industry (Retail, Entertainment, Healthcare, Hospitality, and Others). The dominance of major players like Mastercard, Visa, and PayPal highlights the competitive landscape, although innovative fintech startups and established tech giants like Amazon and Apple are also making significant inroads. The market is geographically diverse, with North America and Europe currently holding substantial shares, but the Asia-Pacific region is predicted to witness the most rapid growth, fuelled by increasing digital literacy and a burgeoning middle class. Challenges include security concerns regarding data breaches and fraud, as well as the need for robust infrastructure and regulatory frameworks to support widespread adoption in less developed regions.

The forecast period of 2025-2033 anticipates continued expansion, with the market size progressively increasing year-on-year. While precise figures for each year require further detailed market research, the sustained CAGR indicates a trajectory of significant growth. Key market segments, such as online sales and the Asia-Pacific region, are poised to outperform others due to the factors mentioned above. Competitive dynamics will remain intense, with established players investing heavily in technology and innovation to maintain market share and emerging players leveraging disruptive technologies to gain traction. Strategic partnerships and mergers and acquisitions are expected to reshape the competitive landscape. The continued focus on enhancing security measures and addressing regulatory challenges will be crucial for sustainable market expansion.

Digital Payments Market Report: 2019-2033

Dive into the comprehensive analysis of the Digital Payments Market, revealing key trends, opportunities, and challenges shaping the future of financial transactions. This in-depth report provides a detailed examination of the market's evolution from 2019 to 2033, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic landscape. The report covers a study period of 2019-2033, with 2025 as the base and estimated year, and a forecast period spanning 2025-2033. The historical period covered is 2019-2024.

Digital Payments Market Dynamics & Concentration

The global digital payments market is characterized by intense competition and significant consolidation, driven by technological innovation and evolving regulatory landscapes. Market concentration is high, with a few major players controlling a substantial share. The market share of the top five players (MasterCard, Visa, PayPal, Stripe, and Fiserv) is estimated at xx%. Mergers and acquisitions (M&A) activity has been substantial, with an estimated xx M&A deals in the past five years, reflecting the strategic efforts of companies to expand their market presence and product offerings.

- Innovation Drivers: The rapid advancement of technologies like mobile wallets, contactless payments, and biometric authentication are key innovation drivers, constantly pushing market evolution.

- Regulatory Frameworks: Government regulations regarding data privacy, security, and cross-border payments significantly influence market dynamics.

- Product Substitutes: While digital payments are gaining dominance, traditional methods still exist, presenting a level of competitive pressure.

- End-User Trends: The growing preference for seamless, secure, and convenient payment options among consumers shapes market growth.

- M&A Activities: Strategic acquisitions and mergers are frequently used to gain market share, expand product portfolios, and access new technologies.

Digital Payments Market Industry Trends & Analysis

The digital payments market exhibits robust growth, driven by increasing smartphone penetration, expanding internet access, and rising e-commerce adoption globally. The market is witnessing a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of blockchain technology and the integration of AI, are transforming the industry landscape. Consumer preferences are shifting towards contactless payments and mobile wallets, further fueling market expansion. Competitive dynamics remain intense, with established players constantly innovating to retain their market share and new entrants disrupting the space with innovative solutions. Market penetration in developed economies is high, while emerging markets present substantial growth opportunities.

Leading Markets & Segments in Digital Payments Market

By Mode of Payment:

- Point of Sale (POS): The POS segment is a dominant force, driven by increasing adoption of contactless payments and mobile POS systems. Key drivers include the convenience for merchants and growing consumer preference for speed and efficiency.

- Online Sale: The online sales segment continues to witness significant growth, fueled by the expanding e-commerce industry and the preference for online shopping. Factors like robust internet infrastructure and secure online payment gateways contribute to this segment's success.

By End-user Industry:

- Retail: The retail sector is a major driver of growth, as digital payments are now the norm across many businesses. The industry's focus on streamlined processes and improved customer experience is pivotal here.

- Entertainment: The entertainment industry has rapidly adopted digital payments, facilitating seamless ticket purchasing and in-app transactions.

- Healthcare: The healthcare industry is increasingly embracing digital payments to improve billing and payment processes. Factors such as increased transparency and regulatory compliance support this trend.

- Hospitality: The hospitality sector has embraced digital payments across multiple services, ranging from hotel bookings to in-room purchases.

- Other End-user Industries: A wide array of other industries contribute to market growth, making digital payments a diverse and extensive ecosystem.

Digital Payments Market Product Developments

The market is witnessing continuous product innovation, with new payment methods and technologies constantly emerging. These include advancements in mobile wallets, biometric authentication, and blockchain-based payment solutions. The focus is on enhanced security, convenience, and user experience, catering to evolving consumer preferences and demand. Competitors are constantly vying for market share through product differentiation, strategic partnerships, and aggressive marketing efforts.

Key Drivers of Digital Payments Market Growth

Several factors fuel the growth of the digital payments market. Technological advancements like mobile wallets and contactless payments significantly contribute to convenience and wider adoption. Favorable economic conditions, especially in emerging markets, drive increased spending and the need for efficient payment systems. Supportive government regulations and initiatives further stimulate market expansion.

Challenges in the Digital Payments Market Market

The digital payments market faces several challenges. Regulatory hurdles, including data privacy and security regulations, can hinder growth. Supply chain disruptions can affect the availability of payment terminals and other infrastructure. The intense competitive landscape and security concerns contribute to these ongoing challenges. The cost of implementation and maintenance of digital payment systems also presents a barrier to entry for smaller businesses.

Emerging Opportunities in Digital Payments Market

Long-term growth will be driven by technological breakthroughs such as advancements in AI and blockchain, leading to more secure and innovative payment solutions. Strategic partnerships between financial institutions and tech companies will foster market expansion. The increasing adoption of digital payments in underserved markets offers significant untapped potential.

Leading Players in the Digital Payments Market Sector

- MasterCard Incorporated (MasterCard)

- Visa Inc

- Fiserv Inc

- Stripe Inc

- ACI Worldwide

- Mobiamo Inc

- PayPal Holdings Inc

- Wordplay Inc (Fidelity National Information Services)

- Amazon Payments Inc (Amazon com Inc)

- Alphabet Inc

- Paytm (One97 Communications Limited)

- Alipay com Co Ltd

- Apple Inc

Key Milestones in Digital Payments Market Industry

- June 2023: PayPal Holdings, Inc. and KKR announced a USD 3.37 billion loan commitment to purchase up to USD 44.87 billion of BNPL loan receivables, significantly impacting the BNPL market segment.

- February 2023: HDFC Bank launched a pilot program for offline digital payments, showcasing innovation in emerging markets.

- November 2022: Mastercard's partnership with Arab African International Bank accelerates Egypt's digital transformation, highlighting the strategic importance of partnerships in market penetration.

Strategic Outlook for Digital Payments Market Market

The future of the digital payments market is bright, with continued growth driven by technological innovation, expanding digital literacy, and a favorable regulatory environment. Strategic partnerships, expansion into emerging markets, and the development of innovative payment solutions will shape the future success of companies in this highly competitive sector. Focus on security, enhanced user experience, and compliance will be critical success factors.

Digital Payments Market Segmentation

-

1. Mode of Payment

- 1.1. Point of Sale

- 1.2. Online Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

Digital Payments Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Digital Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.08% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Proliferation of Smartphones and Digital Initiatives; Favorable Changes in Regulatory Frameworks Across the World

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulations in the Payments Industry

- 3.4. Market Trends

- 3.4.1. Retail End User Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.2. Online Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. North America Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6.1.1. Point of Sale

- 6.1.2. Online Sale

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Retail

- 6.2.2. Entertainment

- 6.2.3. Healthcare

- 6.2.4. Hospitality

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7. Europe Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 7.1.1. Point of Sale

- 7.1.2. Online Sale

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Retail

- 7.2.2. Entertainment

- 7.2.3. Healthcare

- 7.2.4. Hospitality

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8. Asia Pacific Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 8.1.1. Point of Sale

- 8.1.2. Online Sale

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Retail

- 8.2.2. Entertainment

- 8.2.3. Healthcare

- 8.2.4. Hospitality

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9. Latin America Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 9.1.1. Point of Sale

- 9.1.2. Online Sale

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Retail

- 9.2.2. Entertainment

- 9.2.3. Healthcare

- 9.2.4. Hospitality

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10. Middle East and Africa Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 10.1.1. Point of Sale

- 10.1.2. Online Sale

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Retail

- 10.2.2. Entertainment

- 10.2.3. Healthcare

- 10.2.4. Hospitality

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 11. North America Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Digital Payments Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 MasterCard Incorporated (MasterCard)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Visa Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Fiserv Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Stripe Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 ACI Worldwide*List Not Exhaustive

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Mobiamo Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 PayPal Holdings Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Wordplay Inc (Fidelity National Information Services)

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Amazon Payments Inc (Amazon com Inc )

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Alphabet Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Paytm (One97 Communications Limited)

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Alipay com Co Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Apple Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 MasterCard Incorporated (MasterCard)

List of Figures

- Figure 1: Global Digital Payments Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Digital Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 13: North America Digital Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 14: North America Digital Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Digital Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Digital Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 19: Europe Digital Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 20: Europe Digital Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Digital Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Digital Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 25: Asia Pacific Digital Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 26: Asia Pacific Digital Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Digital Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Digital Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 31: Latin America Digital Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 32: Latin America Digital Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Digital Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Digital Payments Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Digital Payments Market Revenue (Million), by Mode of Payment 2024 & 2032

- Figure 37: Middle East and Africa Digital Payments Market Revenue Share (%), by Mode of Payment 2024 & 2032

- Figure 38: Middle East and Africa Digital Payments Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa Digital Payments Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa Digital Payments Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Digital Payments Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital Payments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 3: Global Digital Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Digital Payments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Digital Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Digital Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Digital Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Digital Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Digital Payments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Digital Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 16: Global Digital Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Digital Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 19: Global Digital Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Digital Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 22: Global Digital Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Digital Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 25: Global Digital Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Digital Payments Market Revenue Million Forecast, by Mode of Payment 2019 & 2032

- Table 28: Global Digital Payments Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Digital Payments Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Payments Market?

The projected CAGR is approximately 11.08%.

2. Which companies are prominent players in the Digital Payments Market?

Key companies in the market include MasterCard Incorporated (MasterCard), Visa Inc, Fiserv Inc, Stripe Inc, ACI Worldwide*List Not Exhaustive, Mobiamo Inc, PayPal Holdings Inc, Wordplay Inc (Fidelity National Information Services), Amazon Payments Inc (Amazon com Inc ), Alphabet Inc, Paytm (One97 Communications Limited), Alipay com Co Ltd, Apple Inc.

3. What are the main segments of the Digital Payments Market?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Proliferation of Smartphones and Digital Initiatives; Favorable Changes in Regulatory Frameworks Across the World.

6. What are the notable trends driving market growth?

Retail End User Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

; Stringent Regulations in the Payments Industry.

8. Can you provide examples of recent developments in the market?

June 2023: PayPal Holdings, Inc. and KKR, one of the leading global investment firms, announced the signing of an exclusive multi-year agreement for a EUR 3 billion (USD 3.37 billion) replenishing loan commitment under which private credit funds and accounts managed by KKR will purchase up to EUR 40 billion (USD 44.87 billion) of buy now, pay later (BNPL) loan receivables originated by PayPal in Italy, France, United Kingdom, Spain, and Germany.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Payments Market?

To stay informed about further developments, trends, and reports in the Digital Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence