Key Insights

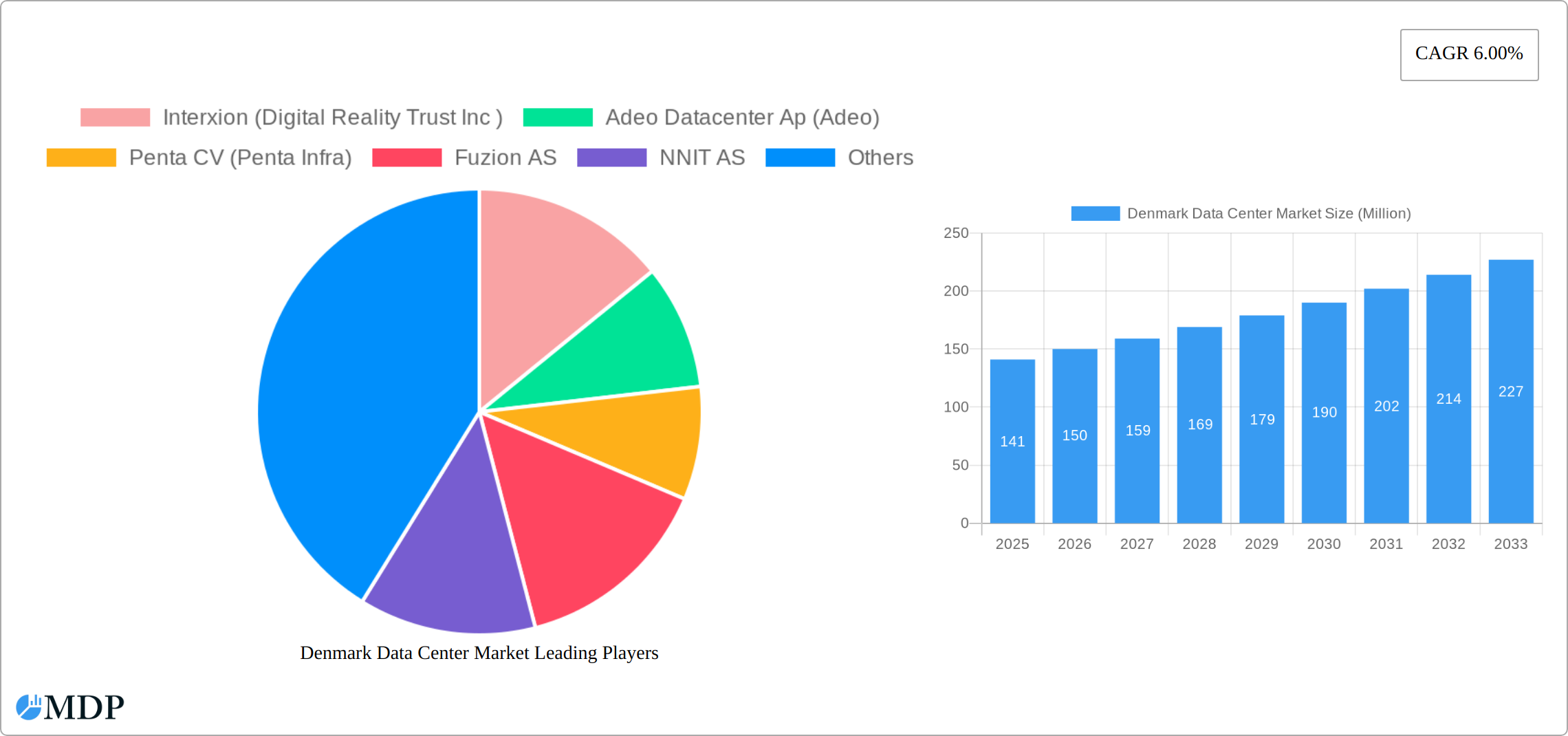

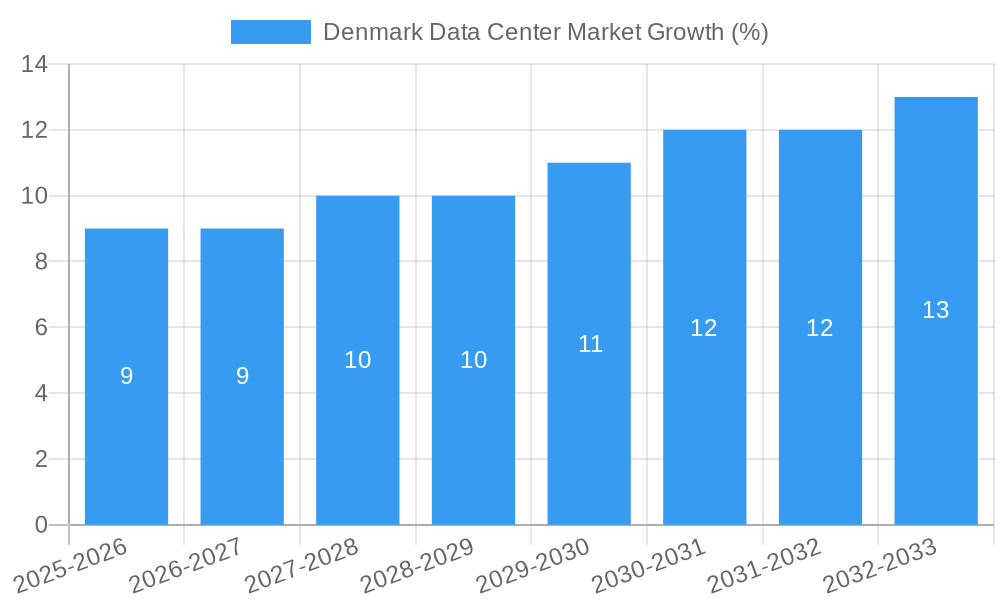

The Denmark data center market, valued at approximately €[Estimate based on XX million and CAGR – needs a starting value to calculate this. Let's assume a 2019 value of €100 million for illustrative purposes. This would result in a 2025 value of approximately €141 million. Adjust this initial value as needed based on your actual XX value.] million in 2025, is experiencing robust growth, projected to maintain a compound annual growth rate (CAGR) of 6.00% through 2033. This expansion is driven primarily by the increasing adoption of cloud computing services, the burgeoning digital economy, and the government's initiatives promoting digital infrastructure development within Denmark. The high concentration of multinational corporations and a strong focus on data security contribute significantly to market demand. Major trends include a shift towards hyperscale data centers, increased investment in renewable energy sources to power facilities, and a growing emphasis on edge computing to reduce latency. However, the market faces constraints such as limited land availability for large-scale projects and the high costs associated with establishing and maintaining data center infrastructure in a densely populated region like Copenhagen. The market is segmented by data center size (large, massive, medium, mega, small), tier type (Tier 1, Tier 2, Tier 3, Tier 4), absorption (utilized, non-utilized), end-users (other end-users), and hotspot location (Copenhagen, Rest of Denmark).

The competitive landscape is characterized by a mix of established international players like Interxion (Digital Realty Trust Inc.), Colt Technology Services, and Stack Infrastructure, alongside regional providers such as Adeo Datacenter Ap, Penta CV, and Fuzion AS. These companies are strategically investing in expanding their capacity and service offerings to cater to the growing demand. The market's future trajectory hinges on the continued growth of the Danish digital economy, government policies supportive of data center development, and the ability of providers to overcome infrastructural challenges and secure sufficient energy resources. Successful navigation of these factors will determine the extent to which the market reaches its projected growth potential over the forecast period. A focus on sustainability and resilience will be crucial for attracting investment and meeting increasingly stringent environmental regulations.

Denmark Data Center Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Denmark data center market, covering market dynamics, industry trends, leading segments, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for industry stakeholders, investors, and anyone seeking a comprehensive understanding of this rapidly evolving market. It leverages extensive research to provide actionable insights and forecasts, empowering informed decision-making.

Key Highlights:

- Market Size & Growth: Detailed analysis of market size (in Millions) across different segments, including CAGR projections from 2025-2033.

- Competitive Landscape: In-depth profiling of leading players such as Interxion (Digital Realty Trust Inc), Adeo Datacenter Ap (Adeo), Penta CV (Penta Infra), and more, examining market share and competitive strategies.

- Technological Advancements: Exploration of emerging technologies like immersed cooling and their impact on market dynamics and energy efficiency.

- Regional Analysis: Focus on key hotspots like Copenhagen and the rest of Denmark, identifying regional growth drivers and challenges.

- Investment Opportunities: Identification of promising investment opportunities based on market trends and future growth potential.

Denmark Data Center Market Market Dynamics & Concentration

The Denmark data center market is experiencing significant growth, driven by increasing digitalization, cloud adoption, and government initiatives promoting digital infrastructure. Market concentration is moderate, with several large players and numerous smaller providers vying for market share. The market is characterized by a mix of hyperscalers, colocation providers, and enterprises operating their own data centers.

Key Dynamics:

- Market Concentration: The market share is currently distributed among several players, with xx% held by the top 5 players. This indicates a competitive yet evolving landscape.

- Innovation Drivers: The push for energy efficiency, improved cooling technologies (like the immersed cooling adopted by GlobalConnect), and the demand for higher capacity and uptime are key innovation drivers.

- Regulatory Frameworks: Favorable government policies supporting digital infrastructure development and renewable energy sources are creating a conducive environment for growth. However, data privacy regulations present challenges and opportunities for compliance-focused innovation.

- Product Substitutes: While traditional on-premise data centers remain dominant, cloud services pose a competitive threat, especially for smaller businesses.

- End-User Trends: Increasing adoption of cloud computing and big data analytics is fuelling demand for data center services across various industries (finance, healthcare, etc.).

- M&A Activities: The recent acquisition of Sentia Denmark by Penta Infra highlights increased M&A activity, indicating consolidation within the market. An estimated xx M&A deals were closed in the historical period (2019-2024).

Denmark Data Center Market Industry Trends & Analysis

The Denmark data center market exhibits a robust growth trajectory, fueled by several key trends. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). Market penetration of data center services across various sectors continues to increase.

This growth is driven by:

- Rising Demand for Cloud Services: The increasing adoption of cloud computing across all sectors fuels demand for reliable and scalable data center infrastructure.

- Growth of Big Data and Analytics: The exponential growth of data necessitates advanced data center capabilities to manage and process information effectively.

- Government Support for Digitalization: Denmark's focus on becoming a leading digital nation creates a favourable regulatory environment for data center investments.

- Investment in Renewable Energy: The emphasis on sustainable energy solutions within data centers enhances their appeal to environmentally conscious clients.

- Technological Advancements: Innovations such as immersed cooling improve energy efficiency and reduce operational costs, driving further market growth.

- Competitive Dynamics: The influx of global players and local providers fosters competition, resulting in improved services and pricing strategies. This also spurs innovation and adoption of new technologies.

Leading Markets & Segments in Denmark Data Center Market

The Copenhagen area is the dominant hotspot for data center activity in Denmark. This is due to its superior connectivity, skilled workforce, and established digital infrastructure. The rest of Denmark has significant, but comparatively less developed, data center markets. Within the segments, the Large and Mega data center sizes hold significant market share. The demand for Tier III and Tier IV facilities is increasing due to enterprise need for high uptime and reliability.

Key Drivers:

- Copenhagen:

- Excellent connectivity (both terrestrial and subsea cable landing stations)

- Highly skilled workforce

- Strong government support

- Presence of major cloud providers and colocation facilities

- Rest of Denmark:

- Growing demand from regional businesses

- Expanding digital infrastructure

- Government incentives to attract investment

Dominant Segments:

- Data Center Size: Large and Mega data centers dominate, reflecting the demand for high capacity and scalable solutions from large enterprises and hyperscalers.

- Tier Type: Tier III and Tier IV facilities are becoming increasingly prevalent, driven by high availability requirements.

- Absorption: Utilized capacity demonstrates the growing demand for data center space. Data on non-utilized capacity highlights potential expansion opportunities.

- End Users: While various end users exist, the finance and technology sectors show particularly high demand.

Denmark Data Center Market Product Developments

Recent product innovations focus on energy efficiency and sustainability. GlobalConnect's adoption of immersed cooling technology demonstrates a commitment to reducing power consumption and environmental impact. This technology, along with advancements in power management and cooling systems, is enhancing the operational efficiency and sustainability of data centers. These innovations directly address market demand for cost-effective, environmentally friendly data center solutions.

Key Drivers of Denmark Data Center Market Growth

Several factors drive the growth of the Denmark data center market. These include:

- Technological advancements: Immersed cooling and other efficiency improvements make data centers more attractive and cost-effective.

- Strong government support: Policies promoting digitalization and renewable energy encourage investments.

- Robust digital infrastructure: Existing network infrastructure and connectivity support high-demand applications.

- Growing demand for cloud services: Increased cloud adoption across all sectors drives demand.

Challenges in the Denmark Data Center Market Market

Despite favorable conditions, the market faces certain challenges:

- Energy costs: While renewable energy is increasing, overall energy costs can impact operational expenditure.

- Land availability: Suitable land for large-scale data centers might be limited in prime locations.

- Competition: Intense competition from established and emerging players necessitates ongoing innovation.

Emerging Opportunities in Denmark Data Center Market

Long-term growth is fueled by:

- Expansion into edge computing: Supporting low-latency applications necessitates deploying data centers closer to end-users.

- 5G and IoT deployments: Growth in these technologies will drive demand for higher capacity and lower latency data centers.

- Strategic partnerships: Collaborations between data center providers and technology companies will spur further innovation and expansion.

Leading Players in the Denmark Data Center Market Sector

- Interxion (Digital Reality Trust Inc)

- Adeo Datacenter Ap (Adeo)

- Penta CV (Penta Infra)

- Fuzion AS

- NNIT AS

- Cibicom AS

- Bulk Infrastructure Group AS

- CenterServ

- Stack Infrastructure Inc

- Colt Technology Services

- WNB Hosting AS

- GlobalConnect AB

Key Milestones in Denmark Data Center Market Industry

- February 2023: GlobalConnect deploys immersed cooling technology in Copenhagen, significantly reducing power consumption. This highlights innovation in energy efficiency and sustainability.

- June 2021: Penta Infra acquires Sentia Denmark's data center, marking its entry into the Nordic market. This signifies increased M&A activity and market consolidation.

- February 2021: STACK Infrastructure secures land and permits for a new large-scale data center campus, indicating significant investment in Denmark's data center capacity. This demonstrates the confidence investors have in the Danish market’s long-term growth potential.

Strategic Outlook for Denmark Data Center Market Market

The Denmark data center market holds significant growth potential. Future growth will be driven by increasing cloud adoption, the expansion of 5G and IoT, and ongoing investments in sustainable infrastructure. Strategic partnerships and expansion into new technologies will be crucial for success in this dynamic market. The focus on energy efficiency and sustainability will continue to influence future developments and attract both investors and clients.

Denmark Data Center Market Segmentation

-

1. Hotspot

- 1.1. Copenhagen

- 1.2. Rest of Denmark

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End Users

Denmark Data Center Market Segmentation By Geography

- 1. Denmark

Denmark Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Copenhagen

- 5.1.2. Rest of Denmark

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End Users

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Interxion (Digital Reality Trust Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adeo Datacenter Ap (Adeo)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Penta CV (Penta Infra)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fuzion AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NNIT AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cibicom AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bulk Infrastructure Group AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CenterServ

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stack Infrastructure Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Colt Technology Services

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 WNB Hosting AS5

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GlobalConnect AB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Interxion (Digital Reality Trust Inc )

List of Figures

- Figure 1: Denmark Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Denmark Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Denmark Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Denmark Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Denmark Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 4: Denmark Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 5: Denmark Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 6: Denmark Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 7: Denmark Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 8: Denmark Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 9: Denmark Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 10: Denmark Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 11: Denmark Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 12: Denmark Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 13: Denmark Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Denmark Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 15: Denmark Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 16: Denmark Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 17: Denmark Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Denmark Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Denmark Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 20: Denmark Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 21: Denmark Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 22: Denmark Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 23: Denmark Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 24: Denmark Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 25: Denmark Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Denmark Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 27: Denmark Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 28: Denmark Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 29: Denmark Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Denmark Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 31: Denmark Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Denmark Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Data Center Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Denmark Data Center Market?

Key companies in the market include Interxion (Digital Reality Trust Inc ), Adeo Datacenter Ap (Adeo), Penta CV (Penta Infra), Fuzion AS, NNIT AS, Cibicom AS, Bulk Infrastructure Group AS, CenterServ, Stack Infrastructure Inc, Colt Technology Services, WNB Hosting AS5 , GlobalConnect AB.

3. What are the main segments of the Denmark Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

February 2023: GlobalConnect is the first colocation operator in Europe to offer its clients immersed cooling technique that can reduce data center cooling power consumption by up to 90%. The next-generation cooling technology was deployed in GlobalConnect's data center in Copenhagen and will be rolled out to all remaining data centers based on customer demand.June 2021: Sentia Denmark’s data center in Glostrup is accquired by European data center provider Penta Infra. The acquisition of Sentia Danmark's data centers is Penta Infra's first step toward entering the Nordic market. Penta Infra currently manages a number of data centers in the Netherlands and Germany.February 2021: The digital infrastructure provider, STACK Infrastructure ("STACK"), has purchased a 110,000 m2 plot of land, secured enough renewable energy to support the development, and onsite water, planning and building permissions to erect five data centers for a significant new campus site in Denmark. The campus masterplan provides for five 6MW IT load data centers and an office building.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Data Center Market?

To stay informed about further developments, trends, and reports in the Denmark Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence