Key Insights

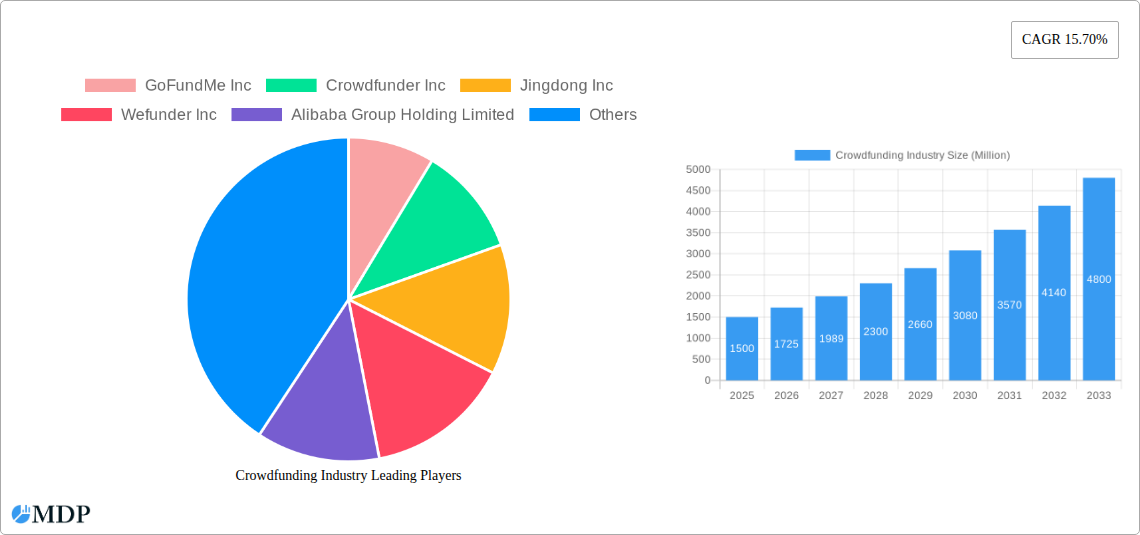

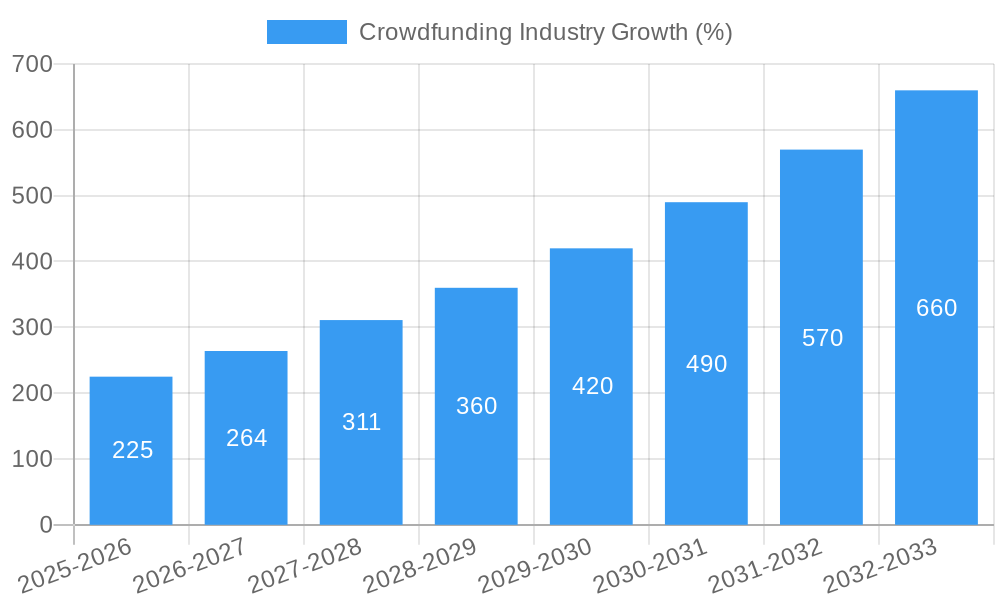

The crowdfunding industry, valued at $1.5 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.70% from 2025 to 2033. This expansion is driven by several key factors. Increased internet and mobile penetration globally has broadened access to crowdfunding platforms, enabling individuals and businesses to connect with a wider investor base. The rising popularity of social media facilitates campaign promotion and community building around projects, significantly impacting funding success. Furthermore, a growing preference for alternative financing options, especially among small and medium-sized enterprises (SMEs) and startups struggling to secure traditional bank loans, fuels the market's growth. The diverse range of crowdfunding models, including reward-based, equity, and donation-based platforms, caters to various project needs and investor preferences, further contributing to the industry's expansion. Technological advancements, such as improved payment gateways and enhanced platform security measures, are also bolstering investor confidence and platform adoption.

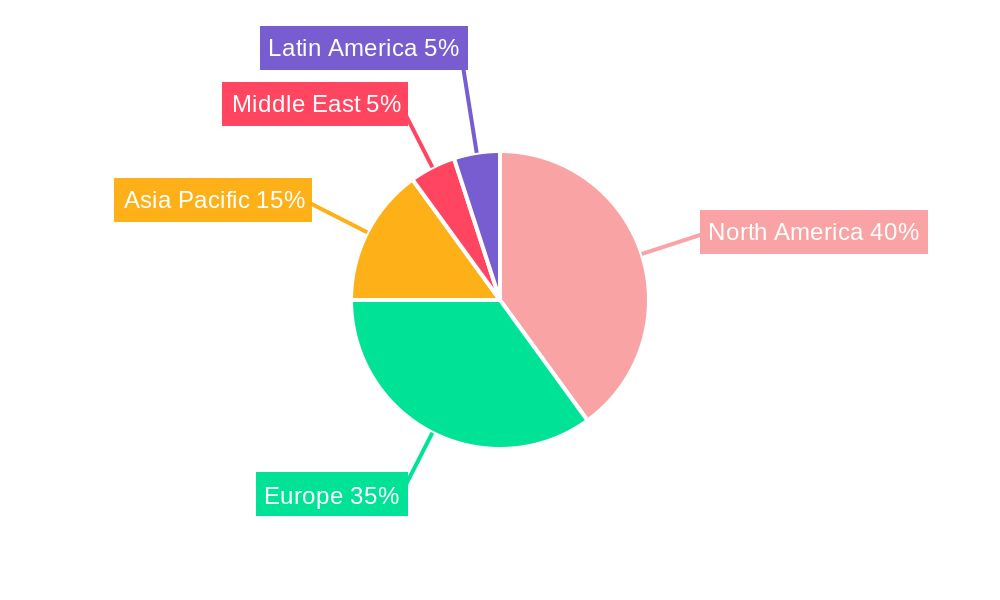

However, challenges persist. Regulatory uncertainties across different jurisdictions create complexities for both platform operators and users. Concerns about fraud and project legitimacy remain a significant hurdle to overcome, requiring robust verification processes and transparency mechanisms. Competition among numerous platforms necessitates continuous innovation and improvement in user experience to maintain a competitive edge. Finally, economic downturns or shifts in investor sentiment can impact funding levels, highlighting the cyclical nature of this market. The segment breakdown reveals that while reward-based crowdfunding remains prominent, equity crowdfunding is experiencing accelerated growth, driven by the increasing number of startups seeking funding beyond seed rounds. Geographically, North America and Europe currently hold the largest market shares, but the Asia-Pacific region is poised for significant expansion due to its burgeoning entrepreneurial landscape and increasing digital adoption.

Crowdfunding Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global crowdfunding industry, projecting a market value exceeding $XX Million by 2033. Leveraging data from 2019-2024, with a base year of 2025 and forecast period of 2025-2033, this report is an indispensable resource for investors, entrepreneurs, and industry stakeholders seeking to navigate this rapidly evolving landscape. The study covers key players like GoFundMe, Kickstarter, and Alibaba, analyzing market segments, growth drivers, and challenges to offer actionable insights for strategic decision-making.

Crowdfunding Industry Market Dynamics & Concentration

The global crowdfunding market exhibits a moderately concentrated landscape, with a few major players holding significant market share. GoFundMe, Kickstarter, and Indiegogo command a combined xx% of the market in 2025, reflecting their established brand recognition and platform functionalities. However, the market is dynamic, with smaller players and new entrants continually emerging, particularly in niche segments. Innovation in areas like blockchain-based crowdfunding and decentralized autonomous organizations (DAOs) is driving further disruption. Regulatory frameworks, varying significantly across countries, influence market access and operations. While reward-based crowdfunding remains dominant, the equity crowdfunding segment is experiencing substantial growth driven by evolving investor preferences and regulatory changes. Mergers and acquisitions (M&A) activity is anticipated to increase, with approximately xx deals projected annually throughout the forecast period, further shaping market consolidation. Substitutes for crowdfunding, such as angel investors and venture capital, continue to exist but crowdfunding offers unique advantages for startups and small businesses, especially in accessing a wider pool of investors. End-user trends indicate a growing preference for platforms offering transparency, robust security features, and diverse investment opportunities.

Crowdfunding Industry Industry Trends & Analysis

The crowdfunding industry is projected to experience a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by several key factors. Increased internet and mobile penetration in developing economies is expanding the pool of both funders and project creators. Technological advancements, such as improved payment gateways, enhanced security protocols, and sophisticated analytics dashboards, are improving user experience and platform efficiency. Changing consumer preferences towards supporting socially responsible projects and ethical businesses are fueling growth in donation-based and impact investing platforms. Intense competitive dynamics are fostering innovation and driving down platform fees, making crowdfunding more accessible. Market penetration remains relatively low in many regions, signifying significant untapped potential for growth. This growth will be fueled by increasing awareness and trust in crowdfunding, and the growing demand for alternative financing solutions. The integration of artificial intelligence (AI) and machine learning (ML) into crowdfunding platforms is improving project selection, risk assessment, and fraud detection.

Leading Markets & Segments in Crowdfunding Industry

The North American market is currently the largest contributor to the global crowdfunding market, with strong participation from both individual investors and businesses. However, significant growth opportunities exist in Asia-Pacific and Europe, fueled by rising disposable incomes, increased entrepreneurial activity, and supportive government policies.

By Product Type:

- Reward-based crowdfunding: Remains the largest segment, driven by its accessibility and ease of use.

- Equity crowdfunding: Exhibits the highest growth rate, propelled by regulatory changes and increasing investor interest.

- Donation-based crowdfunding: Continues to attract substantial funding, particularly for social causes and charitable initiatives.

By End-User Application:

- Technology: Dominates funding volume due to high investor interest in innovative technologies and startups.

- Product: Experiences steady growth, with crowdfunding providing a viable route to market for innovative consumer goods.

- Cultural Sector: Attracts significant funding for creative projects, demonstrating the power of crowdfunding to support the arts.

Key Drivers:

- Favorable Regulatory Environment: Governments in many countries are enacting policies to support the growth of crowdfunding.

- Robust Technological Infrastructure: High-speed internet access and mobile penetration enable widespread platform adoption.

- Growing Entrepreneurial Ecosystem: A surge in startups and SMEs fuels demand for alternative financing solutions.

Crowdfunding Industry Product Developments

Recent product developments in the crowdfunding industry have focused on enhancing platform functionality, security, and user experience. Innovations include integrated payment systems, advanced analytics tools, and enhanced investor communication features. The integration of blockchain technology promises to enhance transparency and security, while the use of artificial intelligence is improving fraud detection and risk assessment. These advancements are aimed at improving market fit by attracting a wider range of users, from individual investors to institutional players.

Key Drivers of Crowdfunding Industry Growth

The crowdfunding industry's growth is fueled by technological advancements, favorable economic conditions, and supportive regulatory environments. The proliferation of smartphones and high-speed internet access expands market reach. Government initiatives promoting entrepreneurship and access to finance further stimulate growth. Technological innovation continues to refine platforms, attracting more users and improving operational efficiency.

Challenges in the Crowdfunding Industry Market

The crowdfunding industry faces challenges such as regulatory uncertainty across different jurisdictions, potentially leading to compliance costs and market fragmentation. Supply chain disruptions can affect project delivery and impact investor confidence. High competition and low barriers to entry create pressure on pricing and platform profitability. The risk of fraud and scams needs to be mitigated through robust security measures, impacting operational efficiency.

Emerging Opportunities in Crowdfunding Industry

The long-term growth of the crowdfunding industry is propelled by the increasing adoption of blockchain technology, fostering trust and transparency. Strategic partnerships between crowdfunding platforms and traditional financial institutions can expand access to capital. Market expansion into emerging economies with high growth potential offers significant opportunities.

Leading Players in the Crowdfunding Industry Sector

- GoFundMe Inc

- Crowdfunder Inc

- Jingdong Inc

- Wefunder Inc

- Alibaba Group Holding Limited

- Owners Circle

- Crowdcube Limited

- Fundable LLC

- Indiegogo Inc

- Realcrowd Inc

- GoGetFunding

- Fundly

- Suning com Co Ltd

- Kickstarter PBC

Key Milestones in Crowdfunding Industry Industry

- 2012: Kickstarter surpasses $1 Billion in funding.

- 2015: Equity crowdfunding regulations are relaxed in several countries, boosting market growth.

- 2018: Increased adoption of blockchain technology in crowdfunding platforms.

- 2020: The pandemic accelerates the shift towards online fundraising and accelerates digital adoption.

- 2022: Significant M&A activity among crowdfunding platforms consolidates market share.

Strategic Outlook for Crowdfunding Industry Market

The crowdfunding industry holds immense future potential, driven by technological advancements and increasing investor interest in alternative investment opportunities. Strategic partnerships, innovative product offerings, and expansion into new markets will be key growth accelerators. The focus on ethical and sustainable projects will attract more conscious investors, further driving market expansion.

Crowdfunding Industry Segmentation

-

1. Product Type

- 1.1. Reward-based Crowdfunding

- 1.2. Equity Crowdfunding

- 1.3. Donation and Other Product Types

-

2. End-User Application

- 2.1. Cultural Sector

- 2.2. Technology

- 2.3. Product

- 2.4. Healthcare

- 2.5. Other End-User Applications

Crowdfunding Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia pacific

- 4. Middle East

- 5. Latin America

Crowdfunding Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Use of Social Media as a Free of Cost Promotion Source; Increasing Investor Forward looking Strategic Behaviour and Social Interactions among Investors

- 3.3. Market Restrains

- 3.3.1. Time Consuming Process and Stringent Regulatory Compliance

- 3.4. Market Trends

- 3.4.1. Reward-Based Crowdfunding is Anticipated to Augment the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Reward-based Crowdfunding

- 5.1.2. Equity Crowdfunding

- 5.1.3. Donation and Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Application

- 5.2.1. Cultural Sector

- 5.2.2. Technology

- 5.2.3. Product

- 5.2.4. Healthcare

- 5.2.5. Other End-User Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia pacific

- 5.3.4. Middle East

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Reward-based Crowdfunding

- 6.1.2. Equity Crowdfunding

- 6.1.3. Donation and Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-User Application

- 6.2.1. Cultural Sector

- 6.2.2. Technology

- 6.2.3. Product

- 6.2.4. Healthcare

- 6.2.5. Other End-User Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Reward-based Crowdfunding

- 7.1.2. Equity Crowdfunding

- 7.1.3. Donation and Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-User Application

- 7.2.1. Cultural Sector

- 7.2.2. Technology

- 7.2.3. Product

- 7.2.4. Healthcare

- 7.2.5. Other End-User Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia pacific Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Reward-based Crowdfunding

- 8.1.2. Equity Crowdfunding

- 8.1.3. Donation and Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-User Application

- 8.2.1. Cultural Sector

- 8.2.2. Technology

- 8.2.3. Product

- 8.2.4. Healthcare

- 8.2.5. Other End-User Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Reward-based Crowdfunding

- 9.1.2. Equity Crowdfunding

- 9.1.3. Donation and Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-User Application

- 9.2.1. Cultural Sector

- 9.2.2. Technology

- 9.2.3. Product

- 9.2.4. Healthcare

- 9.2.5. Other End-User Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Reward-based Crowdfunding

- 10.1.2. Equity Crowdfunding

- 10.1.3. Donation and Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-User Application

- 10.2.1. Cultural Sector

- 10.2.2. Technology

- 10.2.3. Product

- 10.2.4. Healthcare

- 10.2.5. Other End-User Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia pacific Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Middle East Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 GoFundMe Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Crowdfunder Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Jingdong Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Wefunder Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Alibaba Group Holding Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Owners Circle

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Crowdcube Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Fundable LLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Indiegogo Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Realcrowd Inc *List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 GoGetFunding

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Fundly

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Suning com Co Ltd

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Kickstarter PBC

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 GoFundMe Inc

List of Figures

- Figure 1: Global Crowdfunding Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia pacific Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia pacific Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Crowdfunding Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Crowdfunding Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Crowdfunding Industry Revenue (Million), by End-User Application 2024 & 2032

- Figure 15: North America Crowdfunding Industry Revenue Share (%), by End-User Application 2024 & 2032

- Figure 16: North America Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Crowdfunding Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe Crowdfunding Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Crowdfunding Industry Revenue (Million), by End-User Application 2024 & 2032

- Figure 21: Europe Crowdfunding Industry Revenue Share (%), by End-User Application 2024 & 2032

- Figure 22: Europe Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia pacific Crowdfunding Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia pacific Crowdfunding Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia pacific Crowdfunding Industry Revenue (Million), by End-User Application 2024 & 2032

- Figure 27: Asia pacific Crowdfunding Industry Revenue Share (%), by End-User Application 2024 & 2032

- Figure 28: Asia pacific Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia pacific Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East Crowdfunding Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Middle East Crowdfunding Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Middle East Crowdfunding Industry Revenue (Million), by End-User Application 2024 & 2032

- Figure 33: Middle East Crowdfunding Industry Revenue Share (%), by End-User Application 2024 & 2032

- Figure 34: Middle East Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Crowdfunding Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Latin America Crowdfunding Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Latin America Crowdfunding Industry Revenue (Million), by End-User Application 2024 & 2032

- Figure 39: Latin America Crowdfunding Industry Revenue Share (%), by End-User Application 2024 & 2032

- Figure 40: Latin America Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Latin America Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Crowdfunding Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2019 & 2032

- Table 4: Global Crowdfunding Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Crowdfunding Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Crowdfunding Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Crowdfunding Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Crowdfunding Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Crowdfunding Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2019 & 2032

- Table 17: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2019 & 2032

- Table 20: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2019 & 2032

- Table 23: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2019 & 2032

- Table 26: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2019 & 2032

- Table 29: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crowdfunding Industry?

The projected CAGR is approximately 15.70%.

2. Which companies are prominent players in the Crowdfunding Industry?

Key companies in the market include GoFundMe Inc, Crowdfunder Inc, Jingdong Inc, Wefunder Inc, Alibaba Group Holding Limited, Owners Circle, Crowdcube Limited, Fundable LLC, Indiegogo Inc, Realcrowd Inc *List Not Exhaustive, GoGetFunding, Fundly, Suning com Co Ltd, Kickstarter PBC.

3. What are the main segments of the Crowdfunding Industry?

The market segments include Product Type, End-User Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Use of Social Media as a Free of Cost Promotion Source; Increasing Investor Forward looking Strategic Behaviour and Social Interactions among Investors.

6. What are the notable trends driving market growth?

Reward-Based Crowdfunding is Anticipated to Augment the Growth of the Market.

7. Are there any restraints impacting market growth?

Time Consuming Process and Stringent Regulatory Compliance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Crowdfunding Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Crowdfunding Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Crowdfunding Industry?

To stay informed about further developments, trends, and reports in the Crowdfunding Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence