Key Insights

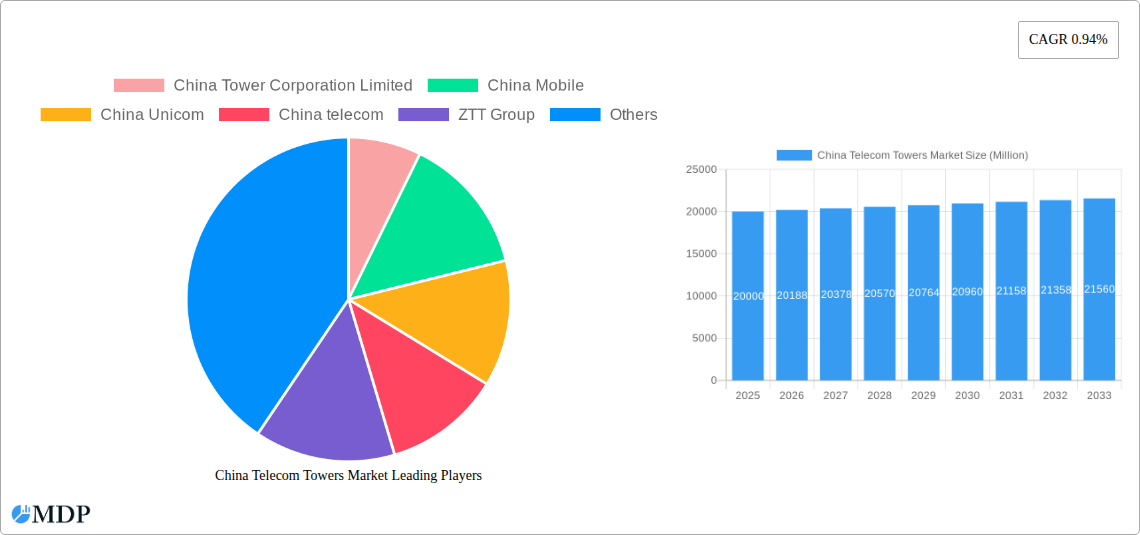

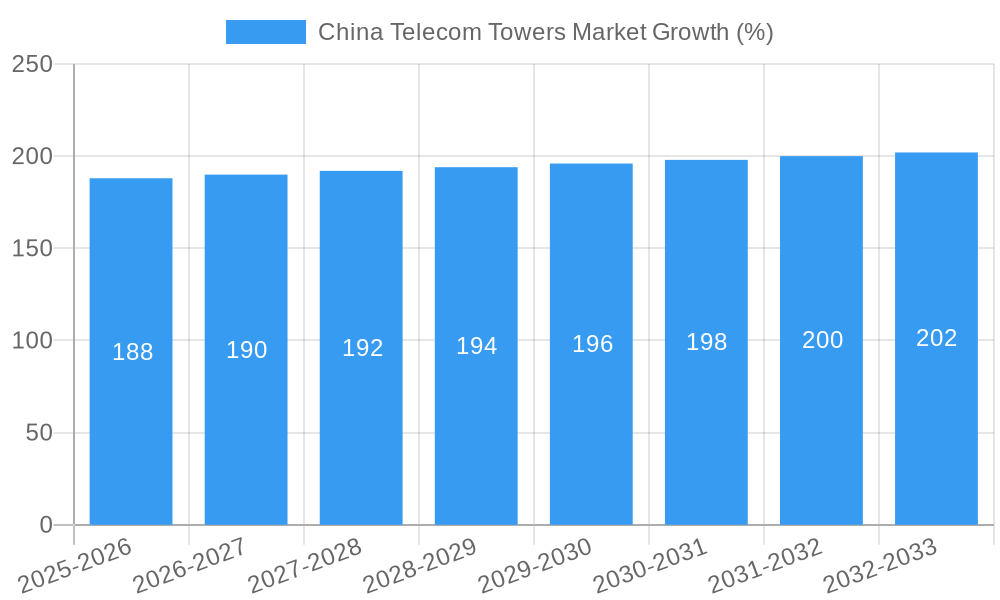

The China telecom towers market, while exhibiting a relatively modest Compound Annual Growth Rate (CAGR) of 0.94%, presents a significant opportunity due to its substantial size (estimated at approximately $XX million in 2025 based on the provided study period and CAGR, though the exact figure requires further data for precision). This growth is fueled by the increasing demand for enhanced mobile broadband services, the expansion of 5G networks across the country, and the continuous upgrading of existing infrastructure to support higher data throughput. Key drivers include government initiatives promoting digital infrastructure development, rising smartphone penetration and data consumption amongst the Chinese population, and the ongoing expansion of the Internet of Things (IoT) applications. However, the market faces certain restraints, such as the high initial investment required for tower construction and maintenance, potential regulatory hurdles, and intense competition among established players like China Tower Corporation Limited, China Mobile, China Unicom, China Telecom, and other significant technology companies. The market is segmented by technology (e.g., 4G, 5G), tower type (e.g., macrocell, small cell), and geographic location, offering opportunities for specialized service providers and technology solutions.

The strategic alliances and mergers and acquisitions within the sector reflect the competitive landscape. Major players are focusing on optimizing their tower infrastructure, exploring innovative cost-saving solutions, and expanding their service offerings to cater to the growing demand. The forecast period (2025-2033) suggests a steady but gradual market expansion, mirroring the anticipated growth of the broader telecommunications sector in China. Though precise regional breakdowns are missing, it's likely that urban and densely populated areas will experience higher growth rates compared to more rural regions. Continued investment in infrastructure, coupled with technological advancements and strategic partnerships, will be pivotal in shaping the future trajectory of the China telecom towers market.

This in-depth report provides a comprehensive analysis of the China Telecom Towers Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report delves into market dynamics, trends, leading players, and future growth prospects. Uncover key opportunities and challenges shaping this dynamic sector.

China Telecom Towers Market Market Dynamics & Concentration

The China Telecom Towers market exhibits a high degree of concentration, primarily driven by the dominance of state-owned enterprises. China Tower Corporation Limited holds a significant market share, estimated at xx%, followed by China Mobile and China Unicom, each possessing substantial market influence. The market is characterized by intense competition, with ongoing mergers and acquisitions (M&A) activity shaping the competitive landscape. Over the historical period (2019-2024), approximately xx M&A deals were recorded, indicating a dynamic consolidation process.

- Market Concentration: High, with xx% market share held by the top three players.

- Innovation Drivers: 5G rollout, increasing demand for data, and the adoption of innovative tower technologies (e.g., FRP).

- Regulatory Frameworks: Government policies supporting infrastructure development and digital transformation significantly influence market growth.

- Product Substitutes: Limited direct substitutes exist, although alternative deployment strategies for telecom infrastructure may indirectly impact market demand.

- End-User Trends: Growing mobile penetration and data consumption drive demand for robust telecom infrastructure.

- M&A Activities: Significant M&A activity, with xx deals recorded between 2019 and 2024, indicating consolidation and strategic expansion.

China Telecom Towers Market Industry Trends & Analysis

The China Telecom Towers market is experiencing robust growth, driven by the rapid expansion of 5G networks, increasing smartphone penetration, and rising data consumption. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%. Market penetration of 5G technology is rapidly increasing, exceeding xx% in major urban areas by 2025. Technological advancements, such as the introduction of Fiber Reinforced Plastic (FRP) towers, are improving efficiency and sustainability. However, competitive pressures and potential regulatory changes present challenges.

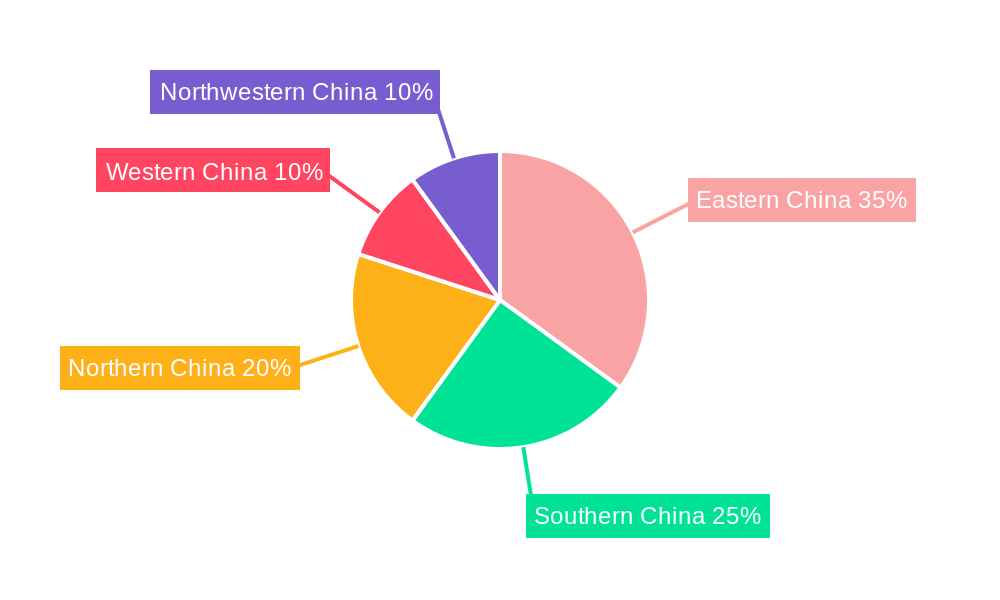

Leading Markets & Segments in China Telecom Towers Market

The eastern coastal regions of China dominate the telecom towers market, fueled by high population density, advanced infrastructure, and significant economic activity. The key drivers include:

- Economic Policies: Government initiatives promoting digitalization and infrastructure development.

- Infrastructure: Well-developed transportation and energy networks facilitate tower construction and deployment.

- Population Density: High population concentration in coastal areas necessitates a robust telecom infrastructure.

The dominance of these regions is expected to continue, although strategic investments in less developed areas may contribute to a more geographically diversified market in the coming years.

China Telecom Towers Market Product Developments

Recent innovations focus on enhancing efficiency, reducing environmental impact, and improving network capacity. The introduction of FRP towers by Huawei and Edotco represents a significant advancement, offering lighter, more sustainable, and cost-effective solutions. This trend towards eco-friendly and efficient tower technologies is expected to accelerate in the coming years, driven by increasing environmental awareness and government regulations.

Key Drivers of China Telecom Towers Market Growth

The market's growth is propelled by several factors:

- 5G Network Rollout: The extensive deployment of 5G networks requires a significant expansion of telecom towers.

- Rising Data Consumption: Increasing mobile penetration and data usage necessitate robust infrastructure.

- Government Support: Favorable government policies and investments in digital infrastructure fuel market expansion.

Challenges in the China Telecom Towers Market Market

Several challenges hinder market growth:

- Regulatory Hurdles: Navigating complex regulatory requirements can delay project implementation and increase costs.

- Supply Chain Issues: Disruptions in the global supply chain can impact the availability of materials and components.

- Competitive Pressures: Intense competition among major players can limit profitability margins.

Emerging Opportunities in China Telecom Towers Market

Long-term growth is fueled by several opportunities:

- Technological Advancements: Continued innovation in tower technology, such as the adoption of smart towers and AI-powered solutions, offers significant potential.

- Strategic Partnerships: Collaboration between telecom operators and tower infrastructure providers facilitates efficient network expansion.

- Market Expansion: Investing in less developed regions presents significant growth opportunities.

Leading Players in the China Telecom Towers Market Sector

- China Tower Corporation Limited

- China Mobile

- China Unicom

- China Telecom

- ZTT Group

- FiberHome Telecommunication Technologies Co Ltd

- BYD Company Limited

- Datang Telecom Technology Co Ltd

- ZTE Corporation

- Huawei Technologies Co Ltd

Key Milestones in China Telecom Towers Market Industry

- April 2024: China Mobile launches the world's first commercial 5G-Advanced network, aiming for 300+ cities by year-end and 20 Million 5G-A users.

- March 2024: Huawei and Edotco introduce the first fiberglass tower solution in Bangladesh, promising 44% weight reduction and 75% faster construction.

Strategic Outlook for China Telecom Towers Market Market

The China Telecom Towers market is poised for continued expansion, driven by ongoing 5G deployment, rising data demand, and technological innovation. Strategic partnerships and investments in sustainable and efficient tower solutions will be crucial for long-term success. The market presents significant opportunities for companies that can adapt to evolving technological trends and regulatory changes, offering both short-term and long-term value.

China Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

China Telecom Towers Market Segmentation By Geography

- 1. China

China Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.94% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Telecom Towers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 China Tower Corporation Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Mobile

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Unicom

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China telecom

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ZTT Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FiberHome Telecommunication Technologies Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BYD Compny Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Datang Telecom Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ZTE Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huawei Technologies Co Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China Tower Corporation Limited

List of Figures

- Figure 1: China Telecom Towers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Telecom Towers Market Share (%) by Company 2024

List of Tables

- Table 1: China Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 3: China Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 4: China Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: China Telecom Towers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: China Telecom Towers Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 7: China Telecom Towers Market Revenue Million Forecast, by Installation 2019 & 2032

- Table 8: China Telecom Towers Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 9: China Telecom Towers Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Telecom Towers Market?

The projected CAGR is approximately 0.94%.

2. Which companies are prominent players in the China Telecom Towers Market?

Key companies in the market include China Tower Corporation Limited, China Mobile, China Unicom, China telecom, ZTT Group, FiberHome Telecommunication Technologies Co Ltd, BYD Compny Limited, Datang Telecom Technology Co Ltd, ZTE Corporation, Huawei Technologies Co Lt.

3. What are the main segments of the China Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment.

7. Are there any restraints impacting market growth?

Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

April 2024: China Mobile, in collaboration with Ericsson, unveiled the world's inaugural commercial 5G-Advanced network before the standard's anticipated completion later this year. As per an announcement from Ericsson on Wednesday, China Mobile rolled out its 5G-A network in 100 cities across China, with plans to broaden its reach to over 300 cities by the end of 2024. Furthering its commitment, China Mobile plans to introduce more than 20 devices compatible with 5G-A technology later this year, setting a target of onboarding at least 20 million users for these devices in 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Telecom Towers Market?

To stay informed about further developments, trends, and reports in the China Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence