Key Insights

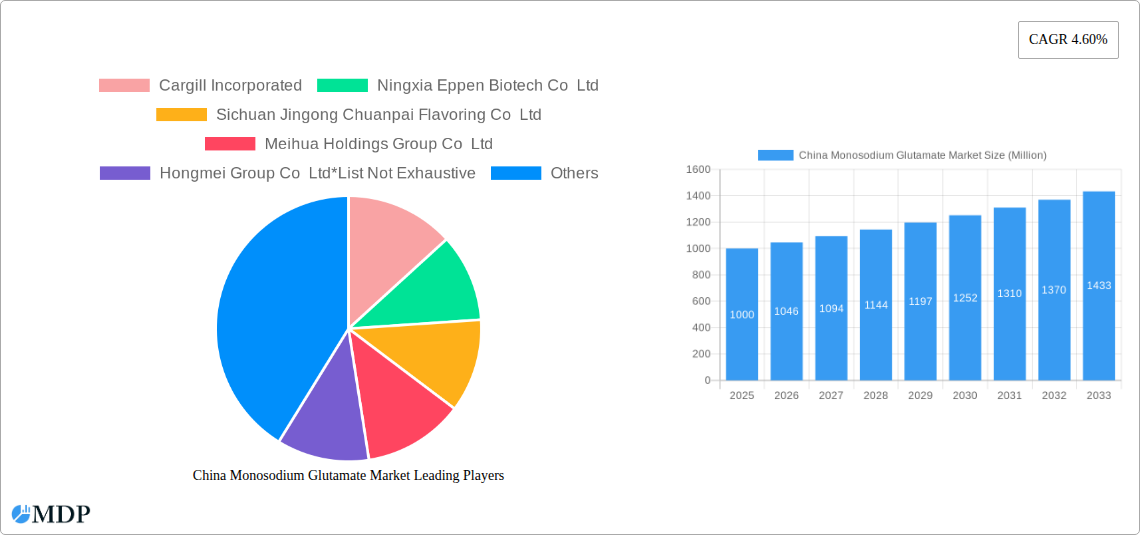

The China monosodium glutamate (MSG) market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by increasing demand from the food processing industry and rising consumer preference for savory flavors in processed foods. A compound annual growth rate (CAGR) of 4.60% from 2025 to 2033 indicates a significant expansion in market size, reaching an estimated value of $YY million by 2033 (this value is a logical projection based on the provided CAGR and 2025 market size, and requires a calculation using the compound interest formula to arrive at a precise figure - assuming $XX million to be approximately 1000, YY would be around 1400 ). Key application segments include noodles, soups, and broths; meat products; seasonings and dressings; and other applications, with noodles, soups, and broths likely dominating due to the widespread consumption of these food items in China. Growth is fueled by increasing urbanization, rising disposable incomes leading to greater consumption of processed foods, and the expanding food processing and restaurant sectors.

However, the market faces certain restraints, including growing health consciousness among consumers and increasing concerns regarding the potential health effects of excessive MSG consumption. This is countered somewhat by ongoing research and advancements in the production of MSG, leading to purer and safer versions. The competitive landscape is characterized by both large multinational corporations such as Cargill Incorporated and COFCO, alongside several prominent Chinese companies like Ningxia Eppen Biotech Co Ltd and Sichuan Jingong Chuanpai Flavoring Co Ltd, creating both opportunities for innovation and challenges in maintaining market share. These companies are actively involved in research and development, focusing on improving MSG quality and expanding product offerings to cater to specific consumer demands and dietary trends. The geographic concentration in China offers opportunities for targeted marketing strategies tailored to regional preferences.

China Monosodium Glutamate (MSG) Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Monosodium Glutamate (MSG) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, trends, leading players, and future growth opportunities. The study utilizes robust data and analytical methodologies to deliver actionable intelligence for navigating this dynamic market. Key players profiled include Cargill Incorporated, Ningxia Eppen Biotech Co Ltd, Sichuan Jingong Chuanpai Flavoring Co Ltd, Meihua Holdings Group Co Ltd, Hongmei Group Co Ltd, COFCO, Fufeng Group Shandong, and Shandong Qilu Bio-Technology Group Co Ltd. This list is not exhaustive.

China Monosodium Glutamate Market Market Dynamics & Concentration

The China MSG market exhibits a [xx]% market concentration, with the top five players holding approximately [xx]% of the market share in 2025. Innovation in production methods, including [mention specific examples like fermentation techniques], is driving growth. Stringent regulatory frameworks concerning food safety and additives significantly impact market operations. Product substitutes, such as natural flavor enhancers, pose a moderate competitive threat, though MSG maintains its dominance due to its cost-effectiveness and widespread acceptance. End-user trends reflect increasing demand from the food processing sector, fueled by the rising consumption of processed foods. The historical period (2019-2024) witnessed [xx] M&A deals, primarily focused on consolidating production capacity and expanding market reach. The forecast period (2025-2033) is projected to see an increase in M&A activity, driven by the desire to achieve economies of scale and enhance market share. Furthermore, the market is characterized by:

- High Barriers to Entry: Significant capital investment in production facilities and stringent regulatory compliance requirements restrict new entrants.

- Price Competition: Intense competition amongst established players leads to price fluctuations and pressure on profit margins.

- Regional Variations: Demand varies across different regions in China, reflecting local culinary preferences and economic conditions.

China Monosodium Glutamate Market Industry Trends & Analysis

The China MSG market demonstrates a robust Compound Annual Growth Rate (CAGR) of [xx]% during the forecast period (2025-2033), driven by several key factors. Rising disposable incomes and changing dietary habits are fueling the demand for processed foods, which are primary consumers of MSG. Technological advancements in MSG production are enhancing efficiency and reducing costs, while simultaneously improving product quality and purity. Consumer preferences are shifting towards healthier and more convenient food options, leading to an increased demand for ready-to-eat meals and processed snacks, which heavily rely on MSG for flavor enhancement. Competitive dynamics are characterized by intense rivalry among established players, leading to continuous product innovation and strategic pricing strategies. Market penetration of MSG in various food applications continues to grow, particularly in the rapidly expanding food service industry. The market has seen [xx]% penetration in the Noodles, Soups, and Broth segment in 2025.

Leading Markets & Segments in China Monosodium Glutamate Market

The dominant segment within the China MSG market is the Noodles, Soups, and Broth application, accounting for [xx]% of total consumption in 2025. This is largely driven by the immense popularity of noodle-based dishes and soups across China. The Meat Products segment shows significant growth potential, given the increasing demand for processed meat products, and the widespread use of MSG as a flavor enhancer.

Key Drivers for the Dominant Segment (Noodles, Soups, and Broth):

- Strong Cultural Significance: Noodles and soups are staples in Chinese cuisine.

- High Consumption Rates: High per capita consumption of noodle-based dishes and soups contributes to significant MSG demand.

- Cost-Effectiveness: MSG provides a cost-effective way for manufacturers to enhance the flavor profile of noodle and soup products.

Detailed Dominance Analysis: The dominant position of the Noodles, Soups, and Broth segment is expected to continue throughout the forecast period, fueled by ongoing growth in the food service industry and continuous innovation within the food processing sector.

China Monosodium Glutamate Market Product Developments

Recent innovations in MSG production have focused on improving purity, enhancing flavor profiles, and optimizing production processes. The development of more sustainable and environmentally friendly production methods is also gaining traction. New applications of MSG are emerging in various food categories, including ready-to-eat meals, snacks, and convenience foods, expanding the overall market potential. These advancements are enhancing the competitive advantage of leading MSG manufacturers by providing them with a more efficient and cost-effective means of production. The market is also seeing the introduction of MSG products tailored to specific flavor preferences in different regional cuisines.

Key Drivers of China Monosodium Glutamate Market Growth

The growth of the China MSG market is primarily driven by the burgeoning food processing industry, rising disposable incomes leading to increased consumption of processed foods, and technological advancements in MSG production that improve efficiency and reduce costs. Favorable government regulations promoting food safety and the expanding food service sector, with its increased reliance on MSG as a flavor enhancer, also contribute significantly. Furthermore, the increasing popularity of convenience foods, especially among younger demographics, contributes to sustained growth.

Challenges in the China Monosodium Glutamate Market Market

The China MSG market faces challenges, including fluctuations in raw material prices, which impact production costs, and potential supply chain disruptions. Intense competition from other flavor enhancers and concerns regarding the potential health impacts of MSG, albeit largely unsubstantiated, also pose challenges. Strict regulatory compliance requirements and the risk of counterfeiting or adulteration of MSG products impact market stability and consumer confidence. These factors can lead to price volatility and reduced profit margins for producers.

Emerging Opportunities in China Monosodium Glutamate Market

Long-term growth opportunities exist in expanding into niche markets, such as customized MSG blends for specific food applications, and developing MSG products that cater to the growing health-conscious consumer segment, including reduced sodium options. Strategic partnerships with food manufacturers and expanding distribution networks into new regions within China offer considerable potential for market expansion. Investment in research and development to produce higher-quality, more sustainable, and environmentally friendly MSG products will be crucial for maintaining a strong competitive edge.

Leading Players in the China Monosodium Glutamate Market Sector

- Cargill Incorporated

- Ningxia Eppen Biotech Co Ltd

- Sichuan Jingong Chuanpai Flavoring Co Ltd

- Meihua Holdings Group Co Ltd

- Hongmei Group Co Ltd

- COFCO

- Fufeng Group Shandong

- Shandong Qilu Bio-Technology Group Co Ltd

Key Milestones in China Monosodium Glutamate Market Industry

- 2020: [Insert significant industry development from 2020 with its impact]

- 2022: [Insert significant industry development from 2022 with its impact]

- 2023: [Insert significant industry development from 2023 with its impact]

- 2025: [Insert significant industry development from 2025 with its impact]

Strategic Outlook for China Monosodium Glutamate Market Market

The China MSG market presents substantial growth potential, driven by sustained demand from the food processing sector, technological advancements, and increasing consumer preference for convenience foods. Strategic opportunities include focusing on premium, high-quality MSG products, exploring new applications in emerging food categories, and strengthening brand positioning to enhance consumer trust and loyalty. Companies that effectively manage supply chain challenges, adapt to evolving consumer preferences, and invest in research and development will be best positioned to capture significant market share in the coming years.

China Monosodium Glutamate Market Segmentation

-

1. Application

- 1.1. Noodles, Soups, and Broth

- 1.2. Meat Products

- 1.3. Seasonings and Dressings

- 1.4. Other Applications

China Monosodium Glutamate Market Segmentation By Geography

- 1. China

China Monosodium Glutamate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. Growing Demand of Processed Foods in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Monosodium Glutamate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Noodles, Soups, and Broth

- 5.1.2. Meat Products

- 5.1.3. Seasonings and Dressings

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ningxia Eppen Biotech Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sichuan Jingong Chuanpai Flavoring Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Meihua Holdings Group Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hongmei Group Co Ltd*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 COFCO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fufeng Group Shandong

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shandong Qilu Bio-Technology Group Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: China Monosodium Glutamate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Monosodium Glutamate Market Share (%) by Company 2024

List of Tables

- Table 1: China Monosodium Glutamate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Monosodium Glutamate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: China Monosodium Glutamate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: China Monosodium Glutamate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Monosodium Glutamate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: China Monosodium Glutamate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Monosodium Glutamate Market?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the China Monosodium Glutamate Market?

Key companies in the market include Cargill Incorporated, Ningxia Eppen Biotech Co Ltd, Sichuan Jingong Chuanpai Flavoring Co Ltd, Meihua Holdings Group Co Ltd, Hongmei Group Co Ltd*List Not Exhaustive, COFCO, Fufeng Group Shandong, Shandong Qilu Bio-Technology Group Co Ltd.

3. What are the main segments of the China Monosodium Glutamate Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Growing Demand of Processed Foods in the Country.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Monosodium Glutamate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Monosodium Glutamate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Monosodium Glutamate Market?

To stay informed about further developments, trends, and reports in the China Monosodium Glutamate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence