Key Insights

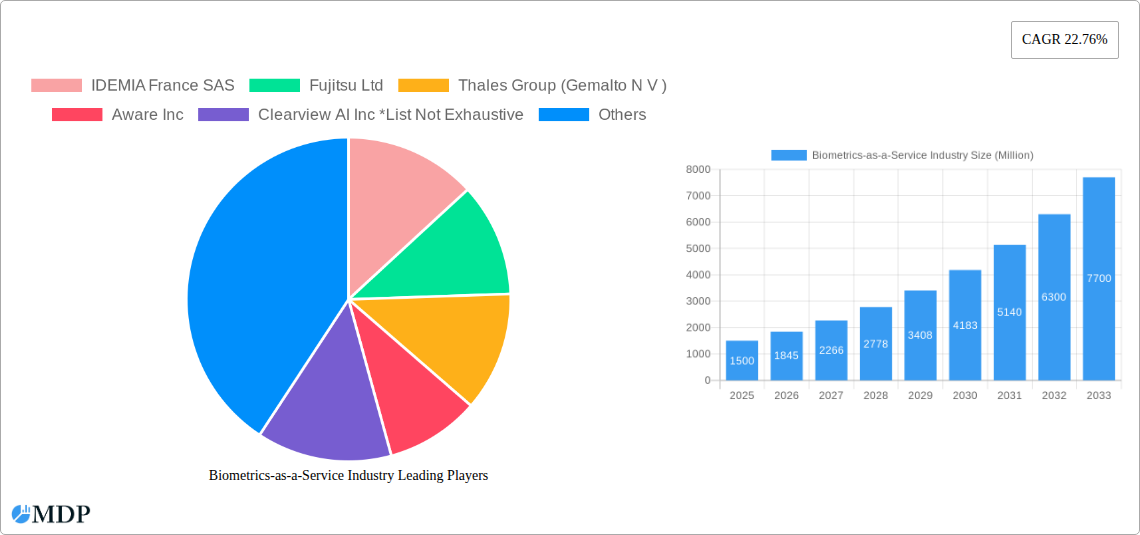

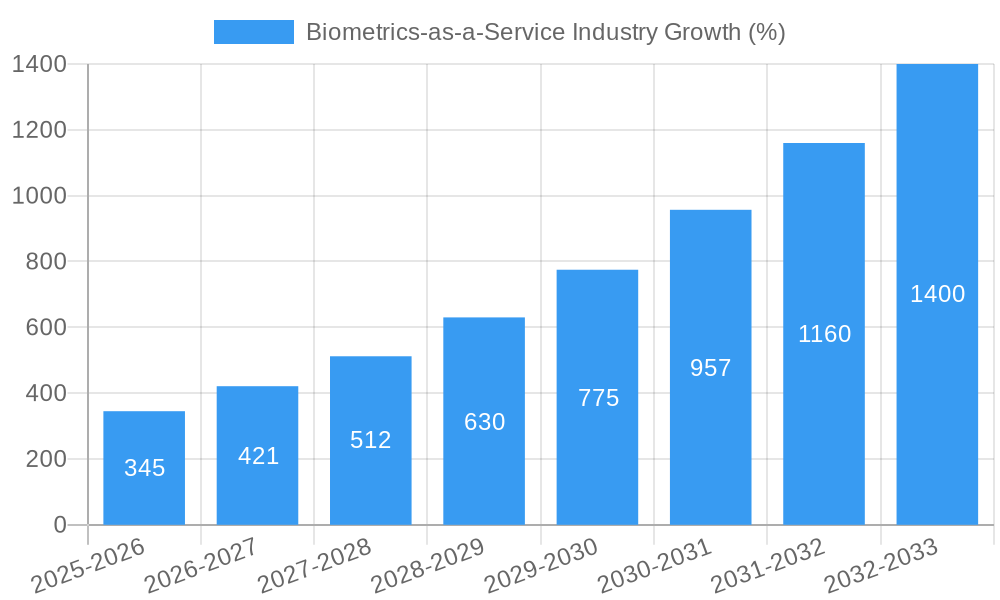

The Biometrics-as-a-Service (BaaS) market is experiencing rapid growth, driven by increasing demand for secure and convenient authentication solutions across various sectors. The market, currently valued at approximately $XX million in 2025 (assuming a reasonable value based on industry reports and the provided CAGR), is projected to expand at a Compound Annual Growth Rate (CAGR) of 22.76% from 2025 to 2033. This robust growth is fueled by several key factors. The rising adoption of cloud-based services and the increasing need for robust security measures in government, BFSI (Banking, Financial Services, and Insurance), healthcare, and retail sectors are major contributors. Furthermore, advancements in biometric technologies, such as facial and iris recognition, are making authentication more accurate and user-friendly. The emergence of mobile biometric applications and the integration of biometrics into various workplace systems further accelerate market expansion. The shift towards remote work and the increasing importance of digital identity verification are also significant drivers.

Despite the positive outlook, certain restraints exist. Concerns around data privacy and security, along with the cost of implementing and maintaining BaaS infrastructure, can hinder widespread adoption. Regulatory challenges concerning data protection and the potential for biometric data breaches pose significant hurdles for market growth. However, the ongoing innovation in biometric technologies, combined with robust security protocols and increasing awareness of data privacy concerns, is expected to mitigate these challenges. The market segmentation, encompassing various end-user industries, applications, and scanner types, offers diverse opportunities for growth. The increasing sophistication of biometric technologies and their integration into various applications will continue to drive market expansion over the forecast period. The strong presence of key players like IDEMIA, Fujitsu, and Thales, alongside emerging innovative companies, further indicates the vibrant and competitive nature of this market.

Biometrics-as-a-Service (BaaS) Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Biometrics-as-a-Service (BaaS) industry, projecting robust growth from 2025 to 2033. The report leverages data from 2019-2024, establishing a solid foundation for forecasting the market's trajectory. Key players like IDEMIA, Fujitsu, Thales, and Aware are profiled, alongside emerging companies, providing a holistic view of the competitive landscape. This report is essential for investors, industry professionals, and strategists seeking a detailed understanding of this rapidly evolving sector. The projected market value reaches xx Million by 2033.

Biometrics-as-a-Service Industry Market Dynamics & Concentration

The BaaS market exhibits a moderately concentrated structure, with a few major players holding significant market share. IDEMIA, Fujitsu, and Thales collectively account for an estimated xx% of the global market in 2025. However, the market is witnessing increased competition from smaller, agile companies specializing in niche applications.

Innovation Drivers:

- Advancements in AI and machine learning are enhancing biometric accuracy and speed.

- Miniaturization of biometric sensors is expanding application possibilities in mobile and wearable devices.

- Cloud-based BaaS platforms are driving scalability and cost-effectiveness.

Regulatory Frameworks:

- Growing concerns around data privacy and security are leading to stricter regulations (e.g., GDPR, CCPA).

- Government initiatives promoting digital identity verification are stimulating BaaS adoption.

Product Substitutes:

- Traditional authentication methods (passwords, PINs) still hold a significant market share, but their security limitations are driving adoption of BaaS.

End-User Trends:

- Increased demand for secure and frictionless user experiences is pushing the adoption of BaaS across various sectors.

M&A Activities:

- The number of M&A deals in the BaaS industry increased by xx% between 2021 and 2024, signifying consolidation and expansion strategies among industry players. Approximately xx M&A deals were recorded in 2024.

Biometrics-as-a-Service Industry Industry Trends & Analysis

The BaaS market is experiencing significant growth, driven by increasing demand for secure authentication across various sectors. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is fueled by several key factors.

Technological advancements such as improved accuracy, miniaturization of sensors, and integration with AI are creating more efficient and reliable solutions. The increasing adoption of mobile devices and the growth of the internet of things (IoT) are expanding potential applications for biometric authentication. Consumer preference is shifting towards convenient and secure authentication methods, further boosting BaaS adoption. The competitive landscape is dynamic, with both established players and startups innovating and vying for market share. Market penetration across key sectors like government and BFSI is expected to increase significantly.

Leading Markets & Segments in Biometrics-as-a-Service Industry

The Government sector is currently the leading end-user industry for BaaS, accounting for an estimated xx% of the market share in 2025. This is driven by the need for robust security systems and efficient citizen identity management. The BFSI sector follows closely, with significant investments in fraud prevention and secure transactions.

By End-user Industry:

- Government: Strong government initiatives for digital identity programs and national security.

- BFSI: High demand for secure financial transactions and fraud prevention.

- Retail: Growing adoption for seamless customer checkout experiences.

- Healthcare: Increasing use in patient identification and access control.

By Application:

- Site Access Control: High demand for secure building access across various sectors.

- Mobile Applications: Increased adoption for secure mobile banking and other applications.

By Scanner Type:

- Fingerprint Recognition: Currently the most prevalent scanner type due to maturity and cost-effectiveness.

- Facial Recognition: Rapidly growing adoption driven by ease of use and integration with mobile devices.

Biometrics-as-a-Service Industry Product Developments

Recent product innovations include multi-modal biometric systems integrating multiple biometric traits for enhanced security and improved accuracy. Cloud-based platforms are gaining popularity due to their scalability, flexibility, and cost-effectiveness. New applications are constantly emerging, with a focus on seamless user experiences and enhanced security protocols. The market is witnessing strong competition among companies offering differentiated products with unique competitive advantages, driving innovation.

Key Drivers of Biometrics-as-a-Service Industry Growth

The BaaS market is experiencing rapid growth due to a confluence of factors. Technological advancements, including improved sensor technology and AI-powered algorithms, have increased the accuracy and reliability of biometric authentication. Government regulations pushing for digital identity initiatives and stringent security measures in various sectors are driving adoption. The rising need for secure and seamless user experiences in various applications fuels further growth.

Challenges in the Biometrics-as-a-Service Industry Market

The BaaS industry faces various challenges, including stringent data privacy regulations which increase compliance costs. Supply chain disruptions impacting the availability of key components can hinder production and expansion. Intense competition from established players and new entrants creates pressure on pricing and profitability. Concerns around data breaches and security vulnerabilities pose a significant threat to market growth.

Emerging Opportunities in Biometrics-as-a-Service Industry

The BaaS market presents significant long-term growth opportunities. Advancements in behavioral biometrics and the development of advanced algorithms will create new and more secure solutions. Strategic partnerships between technology providers and industry verticals will accelerate BaaS adoption and market expansion. The growing adoption of IoT and the increasing need for secure access control in smart homes and cities will drive further growth.

Leading Players in the Biometrics-as-a-Service Industry Sector

- IDEMIA France SAS

- Fujitsu Ltd

- Thales Group (Gemalto N V)

- Aware Inc

- Clearview AI Inc

- ImageWare Systems Inc

- NEC Corporation

- Leidos Holdings Inc

- Mobbeel Solutions S L L

- BioEngagable Technologies Pvt Ltd

- M2SYS Technology - KernellÓ Inc

Key Milestones in Biometrics-as-a-Service Industry Industry

- 2020: Increased adoption of facial recognition technology for contactless access control systems.

- 2021: Launch of several cloud-based BaaS platforms, enhancing scalability and accessibility.

- 2022: Significant investments in R&D for improving biometric accuracy and security.

- 2023: Several major M&A deals shaping the industry landscape.

- 2024: Growing adoption of multi-modal biometric systems for enhanced security.

Strategic Outlook for Biometrics-as-a-Service Industry Market

The BaaS market is poised for significant growth driven by technological advancements, increasing demand for secure authentication, and supportive government regulations. Companies adopting a strategic approach focused on innovation, partnerships, and market expansion will be well-positioned to capture significant market share. The market’s future success hinges on addressing security concerns and navigating evolving privacy regulations.

Biometrics-as-a-Service Industry Segmentation

-

1. Application

- 1.1. Site Access Control

- 1.2. Time Recording

- 1.3. Mobile Application

- 1.4. Web and Workplace

-

2. Scanner Type

- 2.1. Fingerprint Recognition

- 2.2. Iris Recognition

- 2.3. Palm Recognition

- 2.4. Facial Recognition

- 2.5. Voice Recognition

- 2.6. Other Scanner Types

-

3. End-user Industry

- 3.1. Government

- 3.2. Retail

- 3.3. IT and Telecom

- 3.4. BFSI

- 3.5. Healthcare

- 3.6. Other End-user Industries

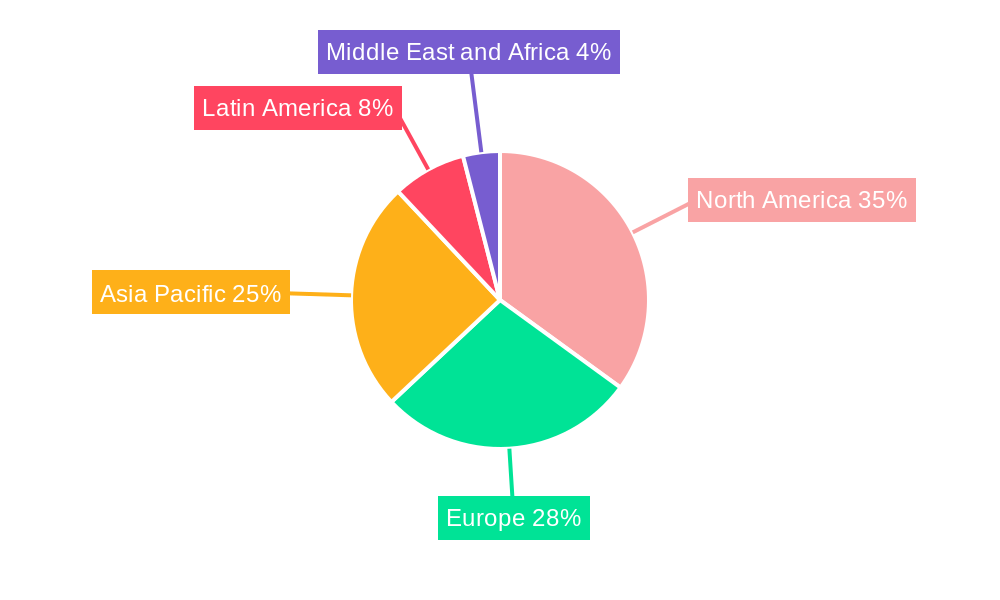

Biometrics-as-a-Service Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Biometrics-as-a-Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 22.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Need to Secure Increasing Online Transaction; Increased Sophistication of Security Threat; Governments Adopting Technology to Secure Citizens

- 3.3. Market Restrains

- 3.3.1. Regulatory and Policy Constraints; Technical Complexity and Expertise

- 3.4. Market Trends

- 3.4.1. Retail is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biometrics-as-a-Service Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Site Access Control

- 5.1.2. Time Recording

- 5.1.3. Mobile Application

- 5.1.4. Web and Workplace

- 5.2. Market Analysis, Insights and Forecast - by Scanner Type

- 5.2.1. Fingerprint Recognition

- 5.2.2. Iris Recognition

- 5.2.3. Palm Recognition

- 5.2.4. Facial Recognition

- 5.2.5. Voice Recognition

- 5.2.6. Other Scanner Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Government

- 5.3.2. Retail

- 5.3.3. IT and Telecom

- 5.3.4. BFSI

- 5.3.5. Healthcare

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Biometrics-as-a-Service Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Site Access Control

- 6.1.2. Time Recording

- 6.1.3. Mobile Application

- 6.1.4. Web and Workplace

- 6.2. Market Analysis, Insights and Forecast - by Scanner Type

- 6.2.1. Fingerprint Recognition

- 6.2.2. Iris Recognition

- 6.2.3. Palm Recognition

- 6.2.4. Facial Recognition

- 6.2.5. Voice Recognition

- 6.2.6. Other Scanner Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Government

- 6.3.2. Retail

- 6.3.3. IT and Telecom

- 6.3.4. BFSI

- 6.3.5. Healthcare

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Biometrics-as-a-Service Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Site Access Control

- 7.1.2. Time Recording

- 7.1.3. Mobile Application

- 7.1.4. Web and Workplace

- 7.2. Market Analysis, Insights and Forecast - by Scanner Type

- 7.2.1. Fingerprint Recognition

- 7.2.2. Iris Recognition

- 7.2.3. Palm Recognition

- 7.2.4. Facial Recognition

- 7.2.5. Voice Recognition

- 7.2.6. Other Scanner Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Government

- 7.3.2. Retail

- 7.3.3. IT and Telecom

- 7.3.4. BFSI

- 7.3.5. Healthcare

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Biometrics-as-a-Service Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Site Access Control

- 8.1.2. Time Recording

- 8.1.3. Mobile Application

- 8.1.4. Web and Workplace

- 8.2. Market Analysis, Insights and Forecast - by Scanner Type

- 8.2.1. Fingerprint Recognition

- 8.2.2. Iris Recognition

- 8.2.3. Palm Recognition

- 8.2.4. Facial Recognition

- 8.2.5. Voice Recognition

- 8.2.6. Other Scanner Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Government

- 8.3.2. Retail

- 8.3.3. IT and Telecom

- 8.3.4. BFSI

- 8.3.5. Healthcare

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Biometrics-as-a-Service Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Site Access Control

- 9.1.2. Time Recording

- 9.1.3. Mobile Application

- 9.1.4. Web and Workplace

- 9.2. Market Analysis, Insights and Forecast - by Scanner Type

- 9.2.1. Fingerprint Recognition

- 9.2.2. Iris Recognition

- 9.2.3. Palm Recognition

- 9.2.4. Facial Recognition

- 9.2.5. Voice Recognition

- 9.2.6. Other Scanner Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Government

- 9.3.2. Retail

- 9.3.3. IT and Telecom

- 9.3.4. BFSI

- 9.3.5. Healthcare

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Biometrics-as-a-Service Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Site Access Control

- 10.1.2. Time Recording

- 10.1.3. Mobile Application

- 10.1.4. Web and Workplace

- 10.2. Market Analysis, Insights and Forecast - by Scanner Type

- 10.2.1. Fingerprint Recognition

- 10.2.2. Iris Recognition

- 10.2.3. Palm Recognition

- 10.2.4. Facial Recognition

- 10.2.5. Voice Recognition

- 10.2.6. Other Scanner Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Government

- 10.3.2. Retail

- 10.3.3. IT and Telecom

- 10.3.4. BFSI

- 10.3.5. Healthcare

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Biometrics-as-a-Service Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Biometrics-as-a-Service Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Biometrics-as-a-Service Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Biometrics-as-a-Service Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Biometrics-as-a-Service Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 IDEMIA France SAS

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Fujitsu Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Thales Group (Gemalto N V )

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Aware Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Clearview AI Inc *List Not Exhaustive

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 ImageWare Systems Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 NEC Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Leidos Holdings Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Mobbeel Solutions S L L

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 BioEngagable Technologies Pvt Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 M2SYS Technology - KernellÓ Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 IDEMIA France SAS

List of Figures

- Figure 1: Global Biometrics-as-a-Service Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Biometrics-as-a-Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Biometrics-as-a-Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Biometrics-as-a-Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Biometrics-as-a-Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Biometrics-as-a-Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Biometrics-as-a-Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Biometrics-as-a-Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Biometrics-as-a-Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Biometrics-as-a-Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Biometrics-as-a-Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Biometrics-as-a-Service Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Biometrics-as-a-Service Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Biometrics-as-a-Service Industry Revenue (Million), by Scanner Type 2024 & 2032

- Figure 15: North America Biometrics-as-a-Service Industry Revenue Share (%), by Scanner Type 2024 & 2032

- Figure 16: North America Biometrics-as-a-Service Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America Biometrics-as-a-Service Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America Biometrics-as-a-Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Biometrics-as-a-Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Biometrics-as-a-Service Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Biometrics-as-a-Service Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Biometrics-as-a-Service Industry Revenue (Million), by Scanner Type 2024 & 2032

- Figure 23: Europe Biometrics-as-a-Service Industry Revenue Share (%), by Scanner Type 2024 & 2032

- Figure 24: Europe Biometrics-as-a-Service Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Europe Biometrics-as-a-Service Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Europe Biometrics-as-a-Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Biometrics-as-a-Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Biometrics-as-a-Service Industry Revenue (Million), by Application 2024 & 2032

- Figure 29: Asia Pacific Biometrics-as-a-Service Industry Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Biometrics-as-a-Service Industry Revenue (Million), by Scanner Type 2024 & 2032

- Figure 31: Asia Pacific Biometrics-as-a-Service Industry Revenue Share (%), by Scanner Type 2024 & 2032

- Figure 32: Asia Pacific Biometrics-as-a-Service Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Asia Pacific Biometrics-as-a-Service Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Asia Pacific Biometrics-as-a-Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Biometrics-as-a-Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Biometrics-as-a-Service Industry Revenue (Million), by Application 2024 & 2032

- Figure 37: Latin America Biometrics-as-a-Service Industry Revenue Share (%), by Application 2024 & 2032

- Figure 38: Latin America Biometrics-as-a-Service Industry Revenue (Million), by Scanner Type 2024 & 2032

- Figure 39: Latin America Biometrics-as-a-Service Industry Revenue Share (%), by Scanner Type 2024 & 2032

- Figure 40: Latin America Biometrics-as-a-Service Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Latin America Biometrics-as-a-Service Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Latin America Biometrics-as-a-Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Biometrics-as-a-Service Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Biometrics-as-a-Service Industry Revenue (Million), by Application 2024 & 2032

- Figure 45: Middle East and Africa Biometrics-as-a-Service Industry Revenue Share (%), by Application 2024 & 2032

- Figure 46: Middle East and Africa Biometrics-as-a-Service Industry Revenue (Million), by Scanner Type 2024 & 2032

- Figure 47: Middle East and Africa Biometrics-as-a-Service Industry Revenue Share (%), by Scanner Type 2024 & 2032

- Figure 48: Middle East and Africa Biometrics-as-a-Service Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 49: Middle East and Africa Biometrics-as-a-Service Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 50: Middle East and Africa Biometrics-as-a-Service Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Biometrics-as-a-Service Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Scanner Type 2019 & 2032

- Table 4: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Biometrics-as-a-Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Biometrics-as-a-Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Biometrics-as-a-Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Biometrics-as-a-Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Biometrics-as-a-Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Scanner Type 2019 & 2032

- Table 18: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 19: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Scanner Type 2019 & 2032

- Table 22: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Scanner Type 2019 & 2032

- Table 26: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 27: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Scanner Type 2019 & 2032

- Table 30: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 31: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Scanner Type 2019 & 2032

- Table 34: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 35: Global Biometrics-as-a-Service Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biometrics-as-a-Service Industry?

The projected CAGR is approximately 22.76%.

2. Which companies are prominent players in the Biometrics-as-a-Service Industry?

Key companies in the market include IDEMIA France SAS, Fujitsu Ltd, Thales Group (Gemalto N V ), Aware Inc, Clearview AI Inc *List Not Exhaustive, ImageWare Systems Inc, NEC Corporation, Leidos Holdings Inc, Mobbeel Solutions S L L, BioEngagable Technologies Pvt Ltd, M2SYS Technology - KernellÓ Inc.

3. What are the main segments of the Biometrics-as-a-Service Industry?

The market segments include Application, Scanner Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Need to Secure Increasing Online Transaction; Increased Sophistication of Security Threat; Governments Adopting Technology to Secure Citizens.

6. What are the notable trends driving market growth?

Retail is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Regulatory and Policy Constraints; Technical Complexity and Expertise.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biometrics-as-a-Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biometrics-as-a-Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biometrics-as-a-Service Industry?

To stay informed about further developments, trends, and reports in the Biometrics-as-a-Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence