Key Insights

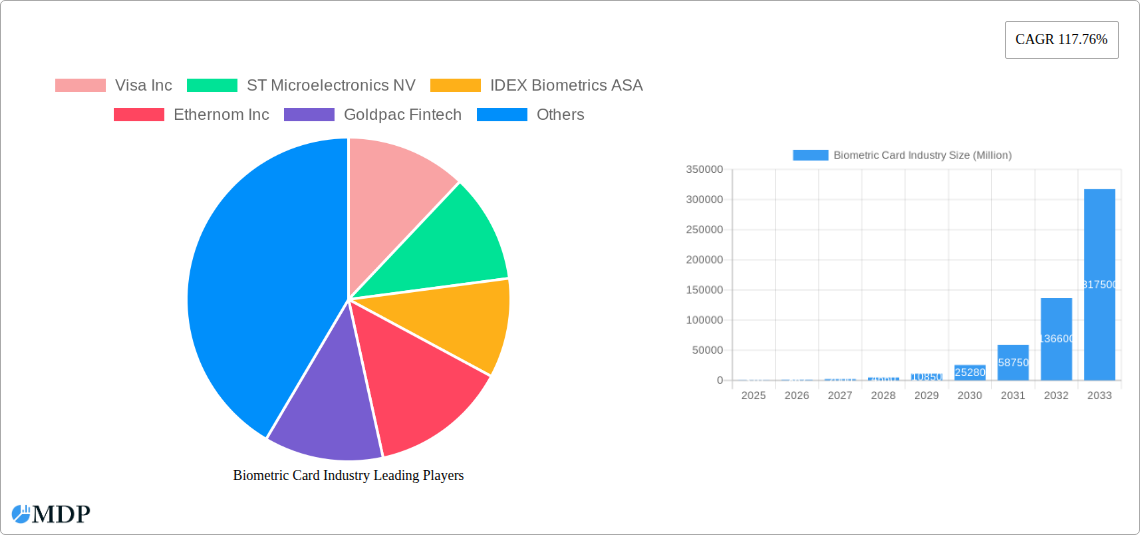

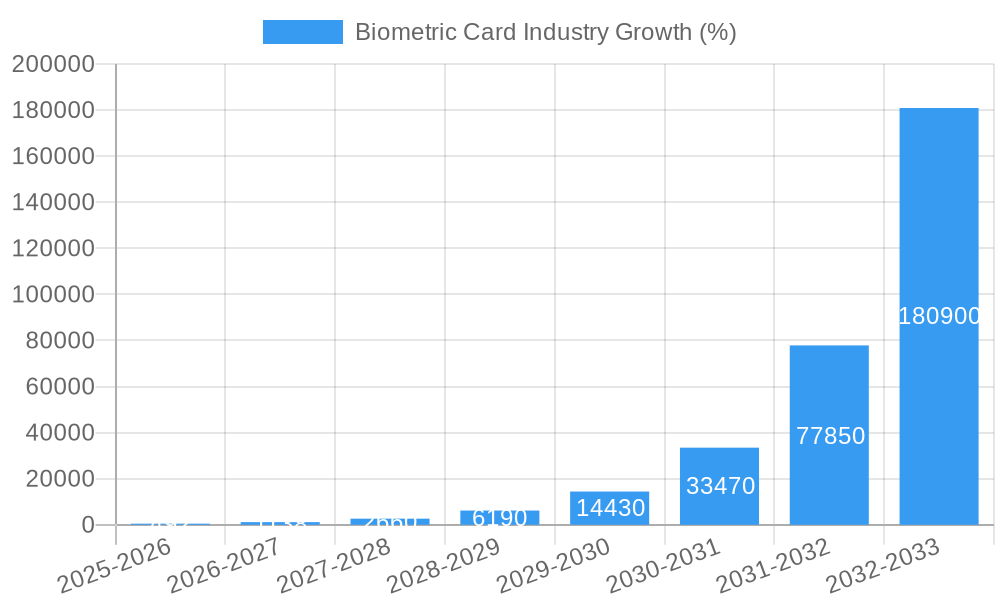

The biometric card market, valued at $0.37 billion in 2025, is experiencing explosive growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 117.76% from 2025 to 2033. This remarkable expansion is driven by several key factors. Firstly, the increasing demand for enhanced security features in payment transactions and access control systems is fueling adoption across various sectors. Secondly, government initiatives promoting digital identity and financial inclusion are significantly boosting market growth, especially in emerging economies. The rising adoption of contactless payment solutions and the growing concerns regarding data breaches are further propelling the market forward. Furthermore, technological advancements in biometric sensor technology, leading to more accurate, reliable, and user-friendly solutions, are contributing to wider acceptance. Segmentation reveals significant opportunities within the payments application segment and across end-user verticals like BFSI (Banking, Financial Services, and Insurance) and government. The substantial presence of key players like Visa, Mastercard, and Thales Group underscores the market's maturity and potential for further consolidation. Competition is expected to intensify as smaller players strive for market share, potentially leading to innovation and price optimization.

While the market presents significant opportunities, challenges remain. High initial investment costs for infrastructure and implementation can be a barrier for adoption, particularly among smaller businesses and in regions with limited technological infrastructure. Data privacy and security concerns also pose significant hurdles, necessitating robust regulatory frameworks and ethical considerations. However, these challenges are likely to be mitigated as technology advances and consumer trust grows, paving the way for continued market expansion. The market's growth trajectory reflects a clear shift toward secure, convenient, and user-friendly authentication solutions. The forecast period indicates the market will likely see substantial consolidation and further technological innovation, driven by ongoing research and development efforts among leading players. This dynamic market will continue attracting investment and shaping the future of secure transactions and identification processes globally.

Biometric Card Industry Market Report: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Biometric Card Industry, projecting a market value exceeding $XX Million by 2033. It offers crucial insights for industry stakeholders, investors, and businesses seeking to navigate this rapidly evolving landscape. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. Key players like Visa Inc., Mastercard Incorporated, and Thales Group are analyzed alongside emerging companies driving innovation.

Biometric Card Industry Market Dynamics & Concentration

The Biometric Card Industry is experiencing robust growth, driven by increasing demand for secure authentication and enhanced user experience. Market concentration is moderate, with several key players holding significant market share, but a competitive landscape fostering innovation. Visa Inc. and Mastercard Incorporated hold a substantial portion, estimated at xx% combined in 2025, while companies like Thales Group, IDEMIA Group, and ST Microelectronics NV contribute significantly. The industry’s growth is fueled by:

- Innovation Drivers: Advancements in biometric technologies, such as improved fingerprint sensors and facial recognition, are driving market expansion.

- Regulatory Frameworks: Government regulations promoting digital security and financial inclusion are creating a favorable environment for biometric card adoption.

- Product Substitutes: While alternatives exist, biometric cards offer superior security and convenience, limiting the impact of substitutes.

- End-User Trends: The increasing preference for contactless payments and secure access solutions fuels demand for biometric cards.

- M&A Activities: The number of M&A deals in the sector has increased in recent years (xx deals in 2024), leading to consolidation and the emergence of larger players. The value of these deals totalled approximately $XX Million in 2024.

Biometric Card Industry Industry Trends & Analysis

The Biometric Card Industry is poised for significant growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key trends:

- Market Growth Drivers: Rising concerns about security breaches and fraud are driving adoption of biometric authentication. The increasing penetration of smartphones and other smart devices further fuels market growth. Government initiatives promoting digitalization and financial inclusion in developing economies are also significant drivers.

- Technological Disruptions: Emerging technologies such as Artificial Intelligence (AI) and Machine Learning (ML) are enhancing biometric authentication accuracy and security. The introduction of new biometric modalities, like behavioral biometrics, offers additional opportunities.

- Consumer Preferences: Consumers are increasingly demanding convenient and secure payment and access solutions, further driving the adoption of biometric cards. The shift towards contactless transactions is significantly impacting market growth.

- Competitive Dynamics: Intense competition among established players and emerging companies is leading to innovation and price optimization, creating a dynamic market landscape. Market penetration for biometric cards in the BFSI sector is projected to reach xx% by 2033.

Leading Markets & Segments in Biometric Card Industry

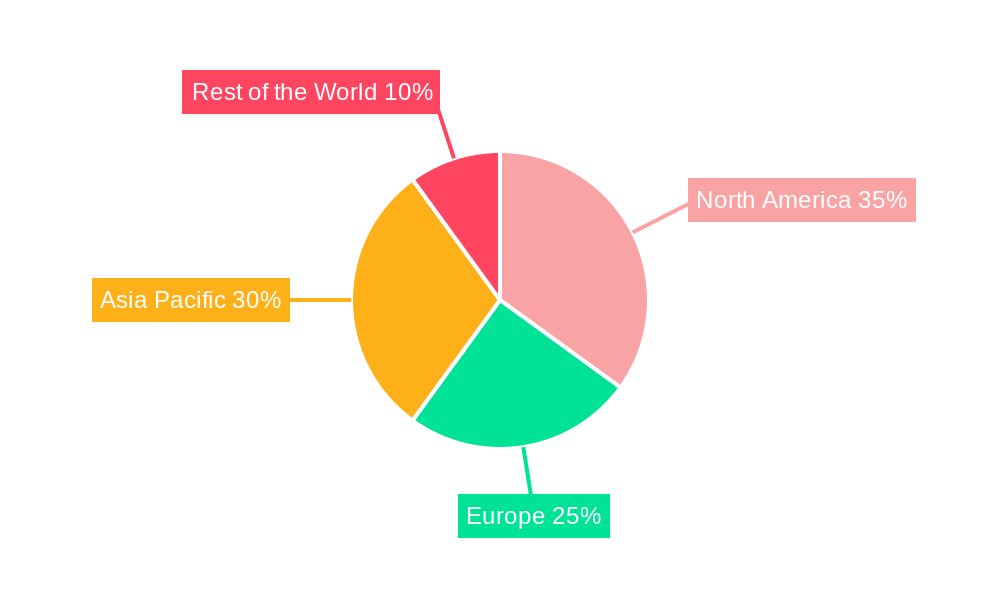

The Asia-Pacific region is currently the leading market for biometric cards, followed by North America and Europe. Key segments driving market growth include:

By Application:

- Payments: The payments segment is the largest and fastest-growing segment, driven by the increasing preference for contactless payments.

- Access Control: This segment is experiencing strong growth due to the need for secure access to buildings, facilities, and data.

- Government ID and Financial Inclusion: Government initiatives promoting digital identity and financial inclusion are creating significant opportunities in this segment. India and several African countries are showing particularly rapid growth.

By End-User Vertical:

- BFSI: The BFSI sector is a major driver of market growth, with banks and financial institutions adopting biometric cards to enhance security and improve customer experience.

- Government: Government adoption of biometric cards for national ID programs and citizen services is driving segment growth.

- Other End-user Verticals: Healthcare, retail, and commercial entities are gradually adopting biometric cards for improved security and efficiency. The growth in the retail sector is linked to the demand for secure and convenient payment solutions.

Key Drivers:

- Economic policies: Government investments in digital infrastructure and initiatives promoting financial inclusion are key drivers of market growth.

- Infrastructure: The availability of reliable internet infrastructure is essential for the widespread adoption of biometric cards.

- Technological advancements: Continued innovation in biometric sensor technology and improved data security are pivotal for the industry’s growth.

Biometric Card Industry Product Developments

Recent product developments focus on miniaturization of sensors, enhanced security features, and the integration of multiple biometric modalities. This includes the incorporation of advanced encryption techniques and improved usability features. The market is seeing a move towards multi-functional biometric cards that integrate payment, access control, and identity verification functionalities, enhancing their market fit.

Key Drivers of Biometric Card Industry Growth

The Biometric Card Industry is fueled by several key factors:

- Technological advancements: Improvements in sensor technology, algorithms, and data security are driving adoption.

- Economic factors: Rising disposable incomes and increasing digitalization are creating a favorable environment for growth.

- Regulatory support: Government regulations promoting digital identity and financial inclusion are crucial for market expansion.

Challenges in the Biometric Card Industry Market

The industry faces several challenges:

- Regulatory hurdles: Varying regulations across different countries can complicate market entry and adoption. Compliance costs can be significant.

- Supply chain issues: Disruptions in the supply chain of components can affect production and availability.

- Competitive pressures: Intense competition among players can lead to price wars and margin compression.

Emerging Opportunities in Biometric Card Industry

The Biometric Card Industry presents several emerging opportunities:

- Technological breakthroughs: The development of more accurate, reliable, and secure biometric technologies will further drive market expansion.

- Strategic partnerships: Collaborations between technology providers, financial institutions, and government agencies can accelerate adoption.

- Market expansion: Expanding into emerging markets with high growth potential offers significant opportunities for players.

Leading Players in the Biometric Card Industry Sector

- Visa Inc.

- ST Microelectronics NV

- IDEX Biometrics ASA

- Ethernom Inc

- Goldpac Fintech

- Thales Group

- Shanghai Fudan Microelectronics Group Co Ltd

- Fingerprint Cards AB

- Samsung's System LSI Business

- Mastercard Incorporated

- IDEMIA Group

- Seshaasai Business Forms (P) Ltd

- Zwipe AS

Key Milestones in Biometric Card Industry Industry

- 2020: Increased adoption of contactless payments due to the COVID-19 pandemic accelerated biometric card usage.

- 2021: Several key partnerships formed between technology providers and financial institutions to develop next-generation biometric cards.

- 2022: Significant investments in research and development of advanced biometric authentication technologies.

- 2023: Launch of several new biometric card products with enhanced security features and improved user experience.

- 2024: Several mergers and acquisitions aimed at consolidating the market.

Strategic Outlook for Biometric Card Industry Market

The Biometric Card Industry is poised for continued robust growth, driven by technological advancements, increasing security concerns, and the expansion of digital economies. Strategic partnerships and investments in research and development will play a key role in shaping the future of the industry. The market's potential for expansion into emerging markets remains substantial, offering exciting opportunities for players that adapt to evolving consumer preferences and regulatory landscapes.

Biometric Card Industry Segmentation

-

1. Application

- 1.1. Payments

- 1.2. Access Control

- 1.3. Government ID and Financial Inclusion

- 1.4. Other Applications

-

2. End-User Vertical

- 2.1. BFSI

- 2.2. Retail

- 2.3. Government

- 2.4. Healthcare

- 2.5. Commercial Entities

- 2.6. Other End-user Verticals

Biometric Card Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Biometric Card Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 117.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Financial Inclusion-based Initiatives in Emerging Countries; Move Toward Multi-factor Authentication Bodes Well for Market Growth

- 3.3. Market Restrains

- 3.3.1. Costs Involved With Installation by Utility Providers and Security and Integration Challenges

- 3.4. Market Trends

- 3.4.1. Payments Segment to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biometric Card Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Payments

- 5.1.2. Access Control

- 5.1.3. Government ID and Financial Inclusion

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.2.1. BFSI

- 5.2.2. Retail

- 5.2.3. Government

- 5.2.4. Healthcare

- 5.2.5. Commercial Entities

- 5.2.6. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Biometric Card Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Payments

- 6.1.2. Access Control

- 6.1.3. Government ID and Financial Inclusion

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 6.2.1. BFSI

- 6.2.2. Retail

- 6.2.3. Government

- 6.2.4. Healthcare

- 6.2.5. Commercial Entities

- 6.2.6. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Biometric Card Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Payments

- 7.1.2. Access Control

- 7.1.3. Government ID and Financial Inclusion

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 7.2.1. BFSI

- 7.2.2. Retail

- 7.2.3. Government

- 7.2.4. Healthcare

- 7.2.5. Commercial Entities

- 7.2.6. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Biometric Card Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Payments

- 8.1.2. Access Control

- 8.1.3. Government ID and Financial Inclusion

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 8.2.1. BFSI

- 8.2.2. Retail

- 8.2.3. Government

- 8.2.4. Healthcare

- 8.2.5. Commercial Entities

- 8.2.6. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Biometric Card Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Payments

- 9.1.2. Access Control

- 9.1.3. Government ID and Financial Inclusion

- 9.1.4. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 9.2.1. BFSI

- 9.2.2. Retail

- 9.2.3. Government

- 9.2.4. Healthcare

- 9.2.5. Commercial Entities

- 9.2.6. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. North America Biometric Card Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Biometric Card Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Biometric Card Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Biometric Card Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Visa Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 ST Microelectronics NV

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 IDEX Biometrics ASA

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Ethernom Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Goldpac Fintech

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Thales Group

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Shanghai Fudan Microelectronics Group Co Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Fingerprint Cards AB

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Samsung's System LSI Business

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Mastercard Incorporated

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 IDEMIA Group

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Seshaasai Business Forms (P) Ltd

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Zwipe AS

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.1 Visa Inc

List of Figures

- Figure 1: Global Biometric Card Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Biometric Card Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Biometric Card Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Biometric Card Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Biometric Card Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Biometric Card Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Biometric Card Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Biometric Card Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Biometric Card Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Biometric Card Industry Revenue (Million), by Application 2024 & 2032

- Figure 11: North America Biometric Card Industry Revenue Share (%), by Application 2024 & 2032

- Figure 12: North America Biometric Card Industry Revenue (Million), by End-User Vertical 2024 & 2032

- Figure 13: North America Biometric Card Industry Revenue Share (%), by End-User Vertical 2024 & 2032

- Figure 14: North America Biometric Card Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Biometric Card Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Biometric Card Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: Europe Biometric Card Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Biometric Card Industry Revenue (Million), by End-User Vertical 2024 & 2032

- Figure 19: Europe Biometric Card Industry Revenue Share (%), by End-User Vertical 2024 & 2032

- Figure 20: Europe Biometric Card Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Biometric Card Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Biometric Card Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Asia Pacific Biometric Card Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Asia Pacific Biometric Card Industry Revenue (Million), by End-User Vertical 2024 & 2032

- Figure 25: Asia Pacific Biometric Card Industry Revenue Share (%), by End-User Vertical 2024 & 2032

- Figure 26: Asia Pacific Biometric Card Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Biometric Card Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Biometric Card Industry Revenue (Million), by Application 2024 & 2032

- Figure 29: Rest of the World Biometric Card Industry Revenue Share (%), by Application 2024 & 2032

- Figure 30: Rest of the World Biometric Card Industry Revenue (Million), by End-User Vertical 2024 & 2032

- Figure 31: Rest of the World Biometric Card Industry Revenue Share (%), by End-User Vertical 2024 & 2032

- Figure 32: Rest of the World Biometric Card Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Biometric Card Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Biometric Card Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Biometric Card Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Biometric Card Industry Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 4: Global Biometric Card Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Biometric Card Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Biometric Card Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Biometric Card Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Biometric Card Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Biometric Card Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Biometric Card Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Biometric Card Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Biometric Card Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Biometric Card Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Global Biometric Card Industry Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 15: Global Biometric Card Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Biometric Card Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Biometric Card Industry Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 18: Global Biometric Card Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Biometric Card Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Biometric Card Industry Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 21: Global Biometric Card Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Biometric Card Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Global Biometric Card Industry Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 24: Global Biometric Card Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biometric Card Industry?

The projected CAGR is approximately 117.76%.

2. Which companies are prominent players in the Biometric Card Industry?

Key companies in the market include Visa Inc, ST Microelectronics NV, IDEX Biometrics ASA, Ethernom Inc, Goldpac Fintech, Thales Group, Shanghai Fudan Microelectronics Group Co Ltd, Fingerprint Cards AB, Samsung's System LSI Business, Mastercard Incorporated, IDEMIA Group, Seshaasai Business Forms (P) Ltd, Zwipe AS.

3. What are the main segments of the Biometric Card Industry?

The market segments include Application, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Financial Inclusion-based Initiatives in Emerging Countries; Move Toward Multi-factor Authentication Bodes Well for Market Growth.

6. What are the notable trends driving market growth?

Payments Segment to Show Significant Growth.

7. Are there any restraints impacting market growth?

Costs Involved With Installation by Utility Providers and Security and Integration Challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biometric Card Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biometric Card Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biometric Card Industry?

To stay informed about further developments, trends, and reports in the Biometric Card Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence