Key Insights

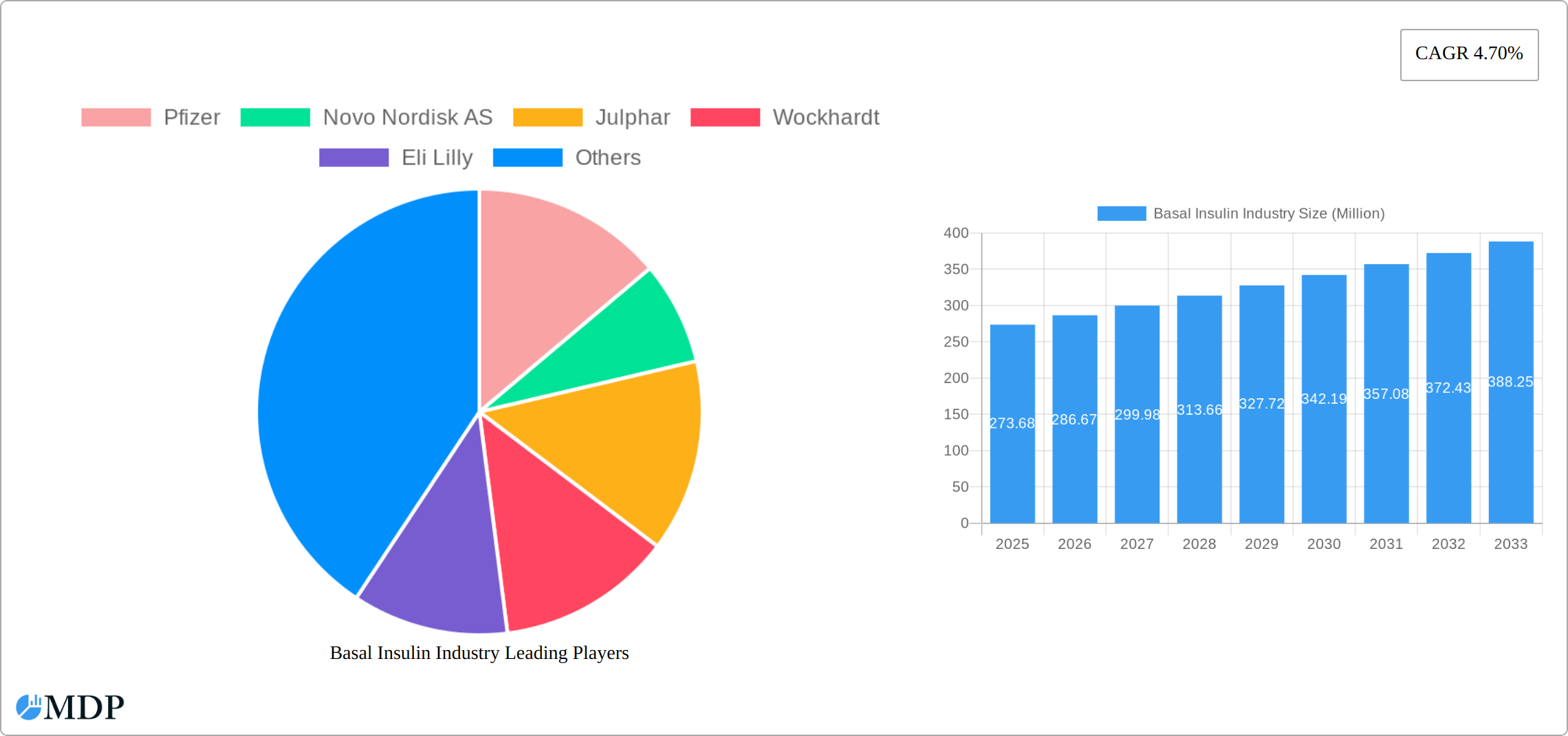

The global basal insulin market, valued at $273.68 million in 2025, is projected to experience robust growth, driven by a rising prevalence of type 1 and type 2 diabetes, an aging global population, and increasing healthcare expenditure. The market's Compound Annual Growth Rate (CAGR) of 4.70% from 2019 to 2024 suggests sustained expansion through 2033. Key growth drivers include the increasing adoption of insulin analogs over human insulin due to their superior efficacy and safety profiles. Furthermore, advancements in insulin delivery systems, such as insulin pens and pumps, are enhancing patient convenience and compliance, further stimulating market growth. However, factors such as high treatment costs, the potential for hypoglycemia, and the emergence of alternative diabetes treatments, like GLP-1 receptor agonists, could act as market restraints. Competition among major players like Novo Nordisk, Sanofi, Eli Lilly, and Pfizer is intense, with ongoing innovation in formulations and delivery technologies shaping market dynamics. Geographic distribution shows significant market concentration in North America and Europe, reflecting higher diabetes prevalence and better healthcare infrastructure in these regions; however, emerging markets in Asia-Pacific and South America represent considerable growth potential as awareness and access to treatment improve.

The segment analysis reveals Lantus, Levemir, Toujeo, Tresiba, and Basaglar as leading basal insulin products. Their market share is influenced by factors including brand recognition, efficacy, safety profiles, and pricing strategies. The continued research and development efforts by pharmaceutical companies to improve basal insulin therapies and develop novel formulations with enhanced efficacy and reduced side effects will likely shape future market trends. The forecast period (2025-2033) presents ample opportunities for market expansion, especially with the growing focus on personalized medicine and the development of sophisticated algorithms for diabetes management. The market's continued success will hinge upon successful strategies to address the market restraints outlined above. Addressing cost-related barriers to access and effectively mitigating risks like hypoglycemia will be crucial for sustained growth.

Basal Insulin Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Basal Insulin industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth potential. Expect detailed analysis of key players like Novo Nordisk AS, Eli Lilly, Sanofi Aventis, and Pfizer, alongside exploration of leading products such as Lantus, Levemir, Toujeo, Tresiba, and Basaglar. Discover actionable strategies for navigating this dynamic market and capitalize on emerging opportunities.

Basal Insulin Industry Market Dynamics & Concentration

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the basal insulin industry. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024.

Market Concentration: The basal insulin market is moderately concentrated, with a few major players holding significant market share. Novo Nordisk AS and Eli Lilly currently command a substantial portion of the global market, estimated at xx% and xx%, respectively, in 2025. Other key players such as Sanofi Aventis and Pfizer contribute significantly but with smaller market shares. The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, indicating a moderately concentrated market.

Innovation Drivers: Continuous R&D efforts focused on improving insulin delivery systems (e.g., once-weekly injections), enhanced efficacy, and reduced side effects drive market innovation. Biosimilar development also contributes significantly to market dynamics.

Regulatory Frameworks: Stringent regulatory approvals and pricing pressures from government agencies in various countries significantly impact market growth. The regulatory landscape varies across regions, influencing market entry strategies and product lifecycle management.

Product Substitutes: While no perfect substitutes exist, alternative diabetes management therapies, including oral medications and GLP-1 receptor agonists, exert competitive pressure on the basal insulin market.

End-User Trends: The increasing prevalence of diabetes globally fuels market growth. The growing adoption of insulin therapy among type 1 and type 2 diabetes patients, coupled with improved patient awareness and access, further boosts demand.

M&A Activities: The basal insulin market has witnessed several M&A activities in recent years, primarily focused on expanding product portfolios and strengthening market presence. An estimated xx M&A deals occurred between 2019 and 2024, with a projected xx deals for 2025-2033.

Basal Insulin Industry Industry Trends & Analysis

This section delves into the market growth drivers, technological disruptions, consumer preferences, and competitive dynamics within the basal insulin industry from 2019 to 2033.

The global basal insulin market is experiencing substantial growth, driven by several factors. The rising prevalence of diabetes, particularly type 2 diabetes, is a primary driver, leading to an increased demand for insulin therapies. Technological advancements in insulin delivery systems, such as the development of once-weekly insulin analogs, are improving treatment convenience and adherence, contributing to higher market penetration. Furthermore, increasing awareness and better diagnosis of diabetes among the global population propel market expansion. The market exhibited a CAGR of xx% during 2019-2024 and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Consumer preferences shift towards more convenient delivery systems and improved efficacy profiles, influencing product development and market competition. The competitive landscape is characterized by intense rivalry among established pharmaceutical giants and emerging biosimilar manufacturers, leading to continuous price pressure and innovation.

Leading Markets & Segments in Basal Insulin Industry

This section identifies the dominant regions, countries, and product segments within the basal insulin market. The analysis focuses on the performance of key products: Lantus, Levemir, Toujeo, Tresiba, and Basaglar.

Dominant Regions: North America currently holds the largest market share, driven by high diabetes prevalence and strong healthcare infrastructure. However, rapidly growing economies in Asia-Pacific and emerging markets in Latin America are exhibiting significant growth potential.

Country-Specific Analysis: The United States remains the leading national market due to its large diabetic population and advanced healthcare infrastructure. Within Europe, Germany and the UK are substantial markets, influenced by strong healthcare systems and regulatory frameworks. High growth rates are observed in India and China due to an expanding diabetic population and increasing healthcare expenditure.

Product Segment Analysis: Lantus and Levemir (both long-acting basal insulins) hold significant market shares owing to their established presence and wide acceptance among healthcare providers. Newer products such as Tresiba and Toujeo are gaining traction with their improved pharmacokinetic profiles, but face price competition from biosimilars. Basaglar, a biosimilar to Lantus, is witnessing growing market adoption as a cost-effective alternative.

Key Drivers: Several factors contribute to the dominance of specific regions and segments. These include economic policies supporting healthcare access, robust healthcare infrastructure, favorable regulatory environments, and consumer preferences for specific product characteristics.

Basal Insulin Industry Product Developments

The basal insulin market witnesses continuous innovation in insulin delivery systems and formulations. Recent developments include the introduction of once-weekly insulin analogs, offering improved patient convenience and potentially enhancing treatment adherence. Furthermore, research focuses on developing insulin formulations with enhanced efficacy and reduced side effects. These advancements cater to unmet medical needs and create competitive advantages in a dynamic market.

Key Drivers of Basal Insulin Industry Growth

Several factors fuel the growth of the basal insulin market. The escalating prevalence of diabetes globally is a key driver, along with technological innovations such as once-weekly insulin analogs that improve patient compliance. Favorable regulatory frameworks supporting new product launches in key markets and increasing healthcare expenditure also contribute significantly.

Challenges in the Basal Insulin Industry Market

The basal insulin industry faces several challenges, including stringent regulatory hurdles for new product approvals, which can delay market entry and increase costs. Supply chain disruptions and price pressures from biosimilars impact profitability. The intense competition among established players and emerging biosimilar manufacturers also poses significant challenges.

Emerging Opportunities in Basal Insulin Industry

The basal insulin market presents significant long-term growth opportunities. Further technological breakthroughs, including advanced delivery systems and novel insulin analogs, will continue to drive market expansion. Strategic partnerships, collaborations, and market expansion into emerging economies offer substantial growth potential. Furthermore, developing personalized insulin therapies tailored to individual patient needs represents a significant future opportunity.

Leading Players in the Basal Insulin Industry Sector

- Pfizer

- Novo Nordisk AS

- Julphar

- Wockhardt

- Eli Lilly

- Sanofi Aventis

- Biocon

- Eli Lill

Key Milestones in Basal Insulin Industry Industry

March 2023: Novo Nordisk announced price reductions of 75% for NovoLog and other insulin brands, and 65% for some other brands, effective January 1, 2024, in the United States. This significantly impacts market pricing and competition.

October 2022: Novo Nordisk released positive results from the ONWARDS 5 trial for once-weekly insulin icodec, potentially revolutionizing insulin therapy and creating a new market segment. This development has significant implications for future product pipelines and market share dynamics.

Strategic Outlook for Basal Insulin Industry Market

The basal insulin market is poised for continued growth, driven by technological innovations, expanding diabetes prevalence, and increasing healthcare expenditure globally. Companies with robust R&D pipelines, strategic partnerships, and effective market penetration strategies are well-positioned to capitalize on emerging opportunities. Focusing on personalized medicine and advanced delivery systems will be key to securing future market leadership.

Basal Insulin Industry Segmentation

-

1. Products

- 1.1. Lantus

- 1.2. Levemir

- 1.3. Toujeo

- 1.4. Tresiba

- 1.5. Basaglar

-

2. Application

- 2.1. Type 1 Diabetes

- 2.2. Type 2 Diabetes

Basal Insulin Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. Spain

- 2.3. Italy

- 2.4. France

- 2.5. United Kingdom

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. Japan

- 3.2. China

- 3.3. Australia

- 3.4. India

- 3.5. South Korea

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. Thailand

- 3.9. Philippines

- 3.10. Vietnam

- 3.11. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Oman

- 5.4. Egypt

- 5.5. Iran

- 5.6. Rest of Middle East and Africa

Basal Insulin Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Increasing diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Basal Insulin Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Lantus

- 5.1.2. Levemir

- 5.1.3. Toujeo

- 5.1.4. Tresiba

- 5.1.5. Basaglar

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Type 1 Diabetes

- 5.2.2. Type 2 Diabetes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. North America Basal Insulin Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Products

- 6.1.1. Lantus

- 6.1.2. Levemir

- 6.1.3. Toujeo

- 6.1.4. Tresiba

- 6.1.5. Basaglar

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Type 1 Diabetes

- 6.2.2. Type 2 Diabetes

- 6.1. Market Analysis, Insights and Forecast - by Products

- 7. Europe Basal Insulin Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Products

- 7.1.1. Lantus

- 7.1.2. Levemir

- 7.1.3. Toujeo

- 7.1.4. Tresiba

- 7.1.5. Basaglar

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Type 1 Diabetes

- 7.2.2. Type 2 Diabetes

- 7.1. Market Analysis, Insights and Forecast - by Products

- 8. Asia Pacific Basal Insulin Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Products

- 8.1.1. Lantus

- 8.1.2. Levemir

- 8.1.3. Toujeo

- 8.1.4. Tresiba

- 8.1.5. Basaglar

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Type 1 Diabetes

- 8.2.2. Type 2 Diabetes

- 8.1. Market Analysis, Insights and Forecast - by Products

- 9. Latin America Basal Insulin Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Products

- 9.1.1. Lantus

- 9.1.2. Levemir

- 9.1.3. Toujeo

- 9.1.4. Tresiba

- 9.1.5. Basaglar

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Type 1 Diabetes

- 9.2.2. Type 2 Diabetes

- 9.1. Market Analysis, Insights and Forecast - by Products

- 10. Middle East and Africa Basal Insulin Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Products

- 10.1.1. Lantus

- 10.1.2. Levemir

- 10.1.3. Toujeo

- 10.1.4. Tresiba

- 10.1.5. Basaglar

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Type 1 Diabetes

- 10.2.2. Type 2 Diabetes

- 10.1. Market Analysis, Insights and Forecast - by Products

- 11. North America Basal Insulin Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Basal Insulin Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Basal Insulin Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Basal Insulin Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Basal Insulin Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Basal Insulin Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Pfizer

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Novo Nordisk AS

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Julphar

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Wockhardt

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Eli Lilly

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Sanofi Aventis

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Biocon

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Eli Lill

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.1 Pfizer

List of Figures

- Figure 1: Global Basal Insulin Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Basal Insulin Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Basal Insulin Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Basal Insulin Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Basal Insulin Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Basal Insulin Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Basal Insulin Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Basal Insulin Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Basal Insulin Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Basal Insulin Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Basal Insulin Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Basal Insulin Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Basal Insulin Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Basal Insulin Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Basal Insulin Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: South America Basal Insulin Industry Volume (K Unit), by Country 2024 & 2032

- Figure 17: South America Basal Insulin Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Basal Insulin Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: North America Basal Insulin Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: North America Basal Insulin Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: North America Basal Insulin Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America Basal Insulin Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: MEA Basal Insulin Industry Revenue (Million), by Country 2024 & 2032

- Figure 24: MEA Basal Insulin Industry Volume (K Unit), by Country 2024 & 2032

- Figure 25: MEA Basal Insulin Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: MEA Basal Insulin Industry Volume Share (%), by Country 2024 & 2032

- Figure 27: North America Basal Insulin Industry Revenue (Million), by Products 2024 & 2032

- Figure 28: North America Basal Insulin Industry Volume (K Unit), by Products 2024 & 2032

- Figure 29: North America Basal Insulin Industry Revenue Share (%), by Products 2024 & 2032

- Figure 30: North America Basal Insulin Industry Volume Share (%), by Products 2024 & 2032

- Figure 31: North America Basal Insulin Industry Revenue (Million), by Application 2024 & 2032

- Figure 32: North America Basal Insulin Industry Volume (K Unit), by Application 2024 & 2032

- Figure 33: North America Basal Insulin Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: North America Basal Insulin Industry Volume Share (%), by Application 2024 & 2032

- Figure 35: North America Basal Insulin Industry Revenue (Million), by Country 2024 & 2032

- Figure 36: North America Basal Insulin Industry Volume (K Unit), by Country 2024 & 2032

- Figure 37: North America Basal Insulin Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: North America Basal Insulin Industry Volume Share (%), by Country 2024 & 2032

- Figure 39: Europe Basal Insulin Industry Revenue (Million), by Products 2024 & 2032

- Figure 40: Europe Basal Insulin Industry Volume (K Unit), by Products 2024 & 2032

- Figure 41: Europe Basal Insulin Industry Revenue Share (%), by Products 2024 & 2032

- Figure 42: Europe Basal Insulin Industry Volume Share (%), by Products 2024 & 2032

- Figure 43: Europe Basal Insulin Industry Revenue (Million), by Application 2024 & 2032

- Figure 44: Europe Basal Insulin Industry Volume (K Unit), by Application 2024 & 2032

- Figure 45: Europe Basal Insulin Industry Revenue Share (%), by Application 2024 & 2032

- Figure 46: Europe Basal Insulin Industry Volume Share (%), by Application 2024 & 2032

- Figure 47: Europe Basal Insulin Industry Revenue (Million), by Country 2024 & 2032

- Figure 48: Europe Basal Insulin Industry Volume (K Unit), by Country 2024 & 2032

- Figure 49: Europe Basal Insulin Industry Revenue Share (%), by Country 2024 & 2032

- Figure 50: Europe Basal Insulin Industry Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Basal Insulin Industry Revenue (Million), by Products 2024 & 2032

- Figure 52: Asia Pacific Basal Insulin Industry Volume (K Unit), by Products 2024 & 2032

- Figure 53: Asia Pacific Basal Insulin Industry Revenue Share (%), by Products 2024 & 2032

- Figure 54: Asia Pacific Basal Insulin Industry Volume Share (%), by Products 2024 & 2032

- Figure 55: Asia Pacific Basal Insulin Industry Revenue (Million), by Application 2024 & 2032

- Figure 56: Asia Pacific Basal Insulin Industry Volume (K Unit), by Application 2024 & 2032

- Figure 57: Asia Pacific Basal Insulin Industry Revenue Share (%), by Application 2024 & 2032

- Figure 58: Asia Pacific Basal Insulin Industry Volume Share (%), by Application 2024 & 2032

- Figure 59: Asia Pacific Basal Insulin Industry Revenue (Million), by Country 2024 & 2032

- Figure 60: Asia Pacific Basal Insulin Industry Volume (K Unit), by Country 2024 & 2032

- Figure 61: Asia Pacific Basal Insulin Industry Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Basal Insulin Industry Volume Share (%), by Country 2024 & 2032

- Figure 63: Latin America Basal Insulin Industry Revenue (Million), by Products 2024 & 2032

- Figure 64: Latin America Basal Insulin Industry Volume (K Unit), by Products 2024 & 2032

- Figure 65: Latin America Basal Insulin Industry Revenue Share (%), by Products 2024 & 2032

- Figure 66: Latin America Basal Insulin Industry Volume Share (%), by Products 2024 & 2032

- Figure 67: Latin America Basal Insulin Industry Revenue (Million), by Application 2024 & 2032

- Figure 68: Latin America Basal Insulin Industry Volume (K Unit), by Application 2024 & 2032

- Figure 69: Latin America Basal Insulin Industry Revenue Share (%), by Application 2024 & 2032

- Figure 70: Latin America Basal Insulin Industry Volume Share (%), by Application 2024 & 2032

- Figure 71: Latin America Basal Insulin Industry Revenue (Million), by Country 2024 & 2032

- Figure 72: Latin America Basal Insulin Industry Volume (K Unit), by Country 2024 & 2032

- Figure 73: Latin America Basal Insulin Industry Revenue Share (%), by Country 2024 & 2032

- Figure 74: Latin America Basal Insulin Industry Volume Share (%), by Country 2024 & 2032

- Figure 75: Middle East and Africa Basal Insulin Industry Revenue (Million), by Products 2024 & 2032

- Figure 76: Middle East and Africa Basal Insulin Industry Volume (K Unit), by Products 2024 & 2032

- Figure 77: Middle East and Africa Basal Insulin Industry Revenue Share (%), by Products 2024 & 2032

- Figure 78: Middle East and Africa Basal Insulin Industry Volume Share (%), by Products 2024 & 2032

- Figure 79: Middle East and Africa Basal Insulin Industry Revenue (Million), by Application 2024 & 2032

- Figure 80: Middle East and Africa Basal Insulin Industry Volume (K Unit), by Application 2024 & 2032

- Figure 81: Middle East and Africa Basal Insulin Industry Revenue Share (%), by Application 2024 & 2032

- Figure 82: Middle East and Africa Basal Insulin Industry Volume Share (%), by Application 2024 & 2032

- Figure 83: Middle East and Africa Basal Insulin Industry Revenue (Million), by Country 2024 & 2032

- Figure 84: Middle East and Africa Basal Insulin Industry Volume (K Unit), by Country 2024 & 2032

- Figure 85: Middle East and Africa Basal Insulin Industry Revenue Share (%), by Country 2024 & 2032

- Figure 86: Middle East and Africa Basal Insulin Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Basal Insulin Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Basal Insulin Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Basal Insulin Industry Revenue Million Forecast, by Products 2019 & 2032

- Table 4: Global Basal Insulin Industry Volume K Unit Forecast, by Products 2019 & 2032

- Table 5: Global Basal Insulin Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Basal Insulin Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Global Basal Insulin Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Basal Insulin Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global Basal Insulin Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Global Basal Insulin Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Germany Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Germany Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Kingdom Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: France Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Spain Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Italy Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Spain Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Belgium Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Belgium Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Netherland Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Netherland Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Nordics Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Global Basal Insulin Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: China Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: China Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Japan Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: India Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: South Korea Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Southeast Asia Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Southeast Asia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Australia Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Indonesia Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Indonesia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Phillipes Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Phillipes Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Singapore Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Singapore Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Thailandc Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Thailandc Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: Rest of Asia Pacific Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Asia Pacific Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 63: Global Basal Insulin Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 65: Brazil Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Brazil Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: Argentina Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Argentina Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: Peru Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Peru Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: Chile Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Chile Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: Colombia Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Colombia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Ecuador Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Ecuador Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 77: Venezuela Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Venezuela Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 79: Rest of South America Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Rest of South America Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 81: Global Basal Insulin Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 83: United States Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: United States Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: Canada Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Canada Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Mexico Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Mexico Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Global Basal Insulin Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 90: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 91: United Arab Emirates Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: United Arab Emirates Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 93: Saudi Arabia Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Saudi Arabia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 95: South Africa Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: South Africa Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 97: Rest of Middle East and Africa Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Rest of Middle East and Africa Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 99: Global Basal Insulin Industry Revenue Million Forecast, by Products 2019 & 2032

- Table 100: Global Basal Insulin Industry Volume K Unit Forecast, by Products 2019 & 2032

- Table 101: Global Basal Insulin Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 102: Global Basal Insulin Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 103: Global Basal Insulin Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 104: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 105: United States Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 106: United States Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 107: Canada Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 108: Canada Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 109: Rest of North America Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 110: Rest of North America Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 111: Global Basal Insulin Industry Revenue Million Forecast, by Products 2019 & 2032

- Table 112: Global Basal Insulin Industry Volume K Unit Forecast, by Products 2019 & 2032

- Table 113: Global Basal Insulin Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 114: Global Basal Insulin Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 115: Global Basal Insulin Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 116: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 117: Germany Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 118: Germany Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 119: Spain Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 120: Spain Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 121: Italy Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 122: Italy Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 123: France Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 124: France Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 125: United Kingdom Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 126: United Kingdom Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 127: Russia Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 128: Russia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 129: Rest of Europe Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 130: Rest of Europe Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 131: Global Basal Insulin Industry Revenue Million Forecast, by Products 2019 & 2032

- Table 132: Global Basal Insulin Industry Volume K Unit Forecast, by Products 2019 & 2032

- Table 133: Global Basal Insulin Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 134: Global Basal Insulin Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 135: Global Basal Insulin Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 136: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 137: Japan Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 138: Japan Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 139: China Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 140: China Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 141: Australia Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 142: Australia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 143: India Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 144: India Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 145: South Korea Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 146: South Korea Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 147: Malaysia Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 148: Malaysia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 149: Indonesia Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 150: Indonesia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 151: Thailand Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 152: Thailand Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 153: Philippines Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 154: Philippines Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 155: Vietnam Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 156: Vietnam Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 157: Rest of Asia Pacific Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 158: Rest of Asia Pacific Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 159: Global Basal Insulin Industry Revenue Million Forecast, by Products 2019 & 2032

- Table 160: Global Basal Insulin Industry Volume K Unit Forecast, by Products 2019 & 2032

- Table 161: Global Basal Insulin Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 162: Global Basal Insulin Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 163: Global Basal Insulin Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 164: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 165: Brazil Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 166: Brazil Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 167: Mexico Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 168: Mexico Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 169: Rest of Latin America Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 170: Rest of Latin America Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 171: Global Basal Insulin Industry Revenue Million Forecast, by Products 2019 & 2032

- Table 172: Global Basal Insulin Industry Volume K Unit Forecast, by Products 2019 & 2032

- Table 173: Global Basal Insulin Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 174: Global Basal Insulin Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 175: Global Basal Insulin Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 176: Global Basal Insulin Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 177: South Africa Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 178: South Africa Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 179: Saudi Arabia Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 180: Saudi Arabia Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 181: Oman Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 182: Oman Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 183: Egypt Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 184: Egypt Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 185: Iran Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 186: Iran Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 187: Rest of Middle East and Africa Basal Insulin Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 188: Rest of Middle East and Africa Basal Insulin Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Basal Insulin Industry?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Basal Insulin Industry?

Key companies in the market include Pfizer, Novo Nordisk AS, Julphar, Wockhardt, Eli Lilly, Sanofi Aventis, Biocon, Eli Lill.

3. What are the main segments of the Basal Insulin Industry?

The market segments include Products, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 273.68 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Increasing diabetes prevalence.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

March 2023: Novo Nordisk announced that the company will drop prices for vials and pens of NovoLog and other insulin brands by 75 percent beginning January 1, 2024, in the United States. The price for some other Novo Nordisk insulin brands will be lowered by 65 percent.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Basal Insulin Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Basal Insulin Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Basal Insulin Industry?

To stay informed about further developments, trends, and reports in the Basal Insulin Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence