Key Insights

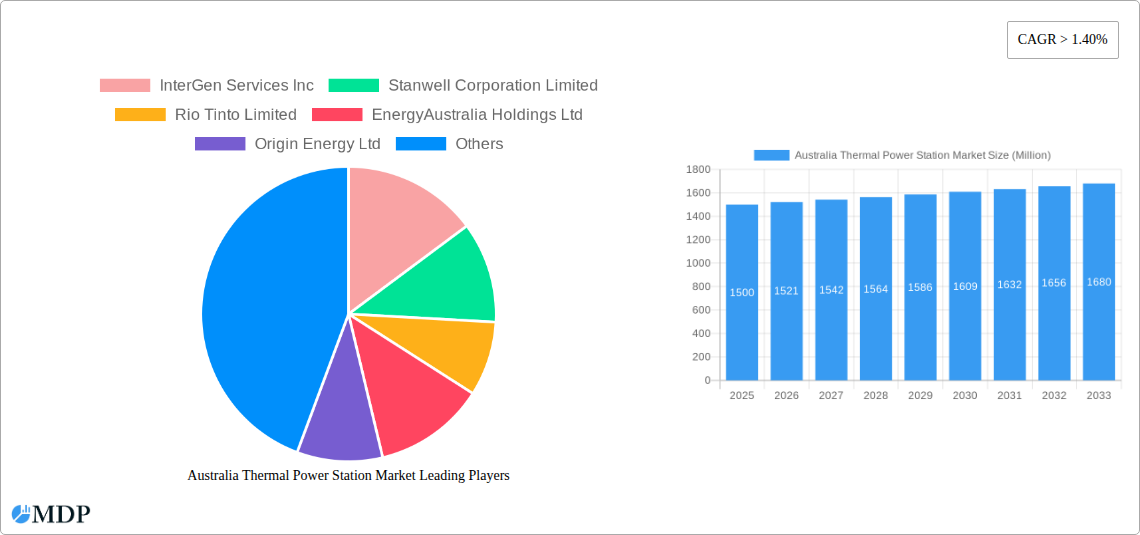

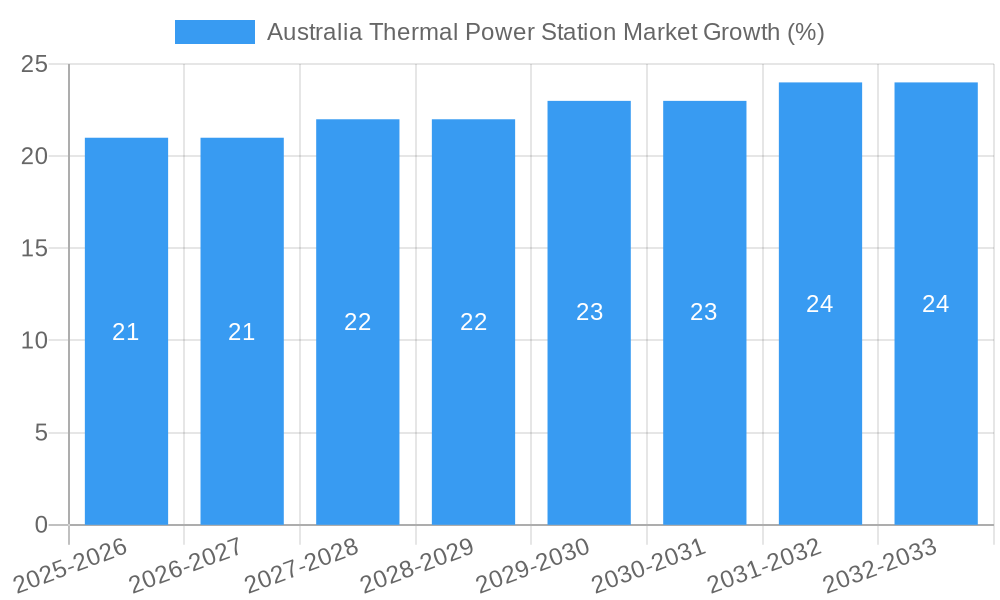

The Australian thermal power station market, valued at approximately $X million in 2025 (assuming a logical extrapolation from the provided CAGR and market size), is projected to experience robust growth, exceeding a 1.40% CAGR from 2025 to 2033. This growth is primarily driven by increasing energy demand fueled by a growing population and industrial expansion, particularly in resource-intensive sectors. While renewable energy sources are gaining traction, thermal power stations remain crucial for baseload power generation, ensuring grid stability and reliability. The market is segmented across three primary fuel sources: oil, natural gas, and coal. Coal, historically dominant, is expected to see a gradual decline due to environmental concerns and government policies promoting renewable energy transition. Conversely, natural gas is poised for growth, given its relatively lower carbon emissions compared to coal and its role as a transition fuel. Oil-based thermal power plants will maintain a smaller but stable market share, primarily serving niche applications. Key players, including InterGen Services Inc, Stanwell Corporation Limited, Rio Tinto Limited, EnergyAustralia Holdings Ltd, Origin Energy Ltd, Sumitomo Corporation, NRG Energy Inc, and AGL Energy Limited, are strategically adapting their portfolios to navigate this evolving landscape, investing in efficiency improvements and exploring diversification strategies. Market restraints include the rising costs of fuel, stringent environmental regulations aimed at reducing greenhouse gas emissions, and increasing competition from renewable energy sources such as solar and wind power.

The forecast period (2025-2033) will witness a continuous shift in the market dynamics. While the overall market expands, the relative contribution of different fuel sources will change significantly. Technological advancements in emission control and energy efficiency are likely to play a crucial role in shaping the market. Further, government incentives and policies directed toward renewable integration will impact the pace of transition away from coal-fired plants. Understanding the interplay of these factors is critical for stakeholders making strategic decisions within the Australian thermal power station market. Companies will need to focus on cost optimization, technological upgrades, and diversification to maintain competitiveness and profitability amidst this transformation.

Australia Thermal Power Station Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australian thermal power station market, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. This study meticulously examines market dynamics, leading players, technological advancements, and future growth potential, providing actionable intelligence to navigate the evolving landscape of Australia's thermal power generation sector. The market is segmented by fuel source: Oil, Natural Gas, and Coal.

Australia Thermal Power Station Market Market Dynamics & Concentration

The Australian thermal power station market is characterized by a moderate level of concentration, with a few major players holding significant market share. While precise market share data for each company fluctuates yearly, AGL Energy Limited, Origin Energy Ltd, and EnergyAustralia Holdings Ltd consistently rank among the top players, collectively accounting for an estimated xx% of the market in 2025. The market is influenced by several key dynamics:

- Innovation Drivers: Ongoing efforts to improve efficiency, reduce emissions, and incorporate advanced technologies such as carbon capture and storage (CCS) are driving innovation.

- Regulatory Frameworks: Stringent environmental regulations and policies aimed at reducing carbon emissions significantly impact investment decisions and operational strategies within the sector. The increasing focus on renewable energy sources also presents a challenge to the thermal power sector.

- Product Substitutes: The rise of renewable energy sources like solar and wind power presents a major challenge as a substitute for thermal power generation.

- End-User Trends: The increasing demand for reliable and affordable electricity across various sectors drives the need for a robust and diversified power generation mix.

- M&A Activities: The Australian thermal power market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, with approximately xx M&A deals recorded between 2019 and 2024. These activities primarily focused on consolidation and portfolio optimization.

Australia Thermal Power Station Market Industry Trends & Analysis

The Australian thermal power station market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by factors such as:

- Increasing Electricity Demand: Rising energy consumption across residential, commercial, and industrial sectors fuels the demand for reliable power generation. The projected increase in population and economic activity will further drive this demand.

- Technological Advancements: Investments in advanced technologies aiming to improve efficiency and reduce emissions are influencing market growth. The adoption of CCS and other emission reduction technologies is expected to increase gradually.

- Government Policies and Investments: While there's a shift towards renewable energy, government support for thermal power plants with improved emission controls remains a factor influencing the market's trajectory.

- Competitive Dynamics: Existing players are focusing on improving operational efficiency and adapting their strategies to comply with stringent environmental regulations. The increasing competition from renewable energy sources necessitates continuous innovation and cost optimization. Market penetration of thermal power generation remains significant, though declining slightly with increasing penetration of renewable sources.

Leading Markets & Segments in Australia Thermal Power Station Market

The Australian thermal power station market demonstrates regional variations in its structure and growth. While a comprehensive breakdown by specific regions is not available, it’s observed that the states with a higher concentration of industrial activity and population density generally have a higher concentration of thermal power plants.

Coal: The coal segment currently holds the largest market share due to existing infrastructure and established supply chains. However, its dominance is projected to decline due to increasing environmental concerns and government policies encouraging renewable energy sources.

Natural Gas: The natural gas segment is expected to witness moderate growth, driven by its relatively lower emission profile compared to coal. However, it still faces competition from renewable sources and the volatility of natural gas prices.

Oil: The oil segment holds a smaller market share, primarily used for peak demand and emergency backup power. Its future growth is constrained by its higher cost and environmental impact compared to other sources.

The dominance of each fuel source is influenced by factors such as:

- Economic Policies: Government incentives and regulations favoring particular fuel sources significantly impact market share.

- Infrastructure: Existing infrastructure for coal-fired power plants contributes to its continued dominance, although this is gradually changing.

- Fuel Prices: Fluctuations in fuel prices influence the economic viability of different fuel sources.

Australia Thermal Power Station Market Product Developments

Recent product developments in the Australian thermal power station market focus on enhancing efficiency, reducing emissions, and improving operational reliability. This includes the incorporation of advanced combustion technologies, improved steam cycle efficiency, and the exploration of CCS technologies to mitigate environmental impacts. These developments aim to extend the lifespan of existing plants and improve their competitiveness in a changing energy landscape.

Key Drivers of Australia Thermal Power Station Market Growth

The growth of the Australian thermal power station market is driven by several factors: the continued need for baseload power generation despite the rising adoption of renewable sources, investments in efficiency upgrades of existing plants, and the ongoing demand for electricity across various sectors. Government policies and regulatory frameworks, although pushing towards renewables, continue to influence the market through emission standards and supportive measures for certain thermal technologies.

Challenges in the Australia Thermal Power Station Market Market

The Australian thermal power station market faces considerable challenges. These include increasingly stringent environmental regulations leading to higher compliance costs, the rising cost of fossil fuels, and intense competition from renewable energy sources. Supply chain disruptions and skilled labor shortages also pose significant operational and investment risks. These factors collectively impact profitability and the long-term viability of thermal power generation in Australia. The market is experiencing a predicted xx% reduction in overall capacity by 2033 due to these challenges.

Emerging Opportunities in Australia Thermal Power Station Market

Despite the challenges, opportunities exist within the Australian thermal power sector. Focusing on efficiency improvements, carbon capture and storage technologies, and flexible operation to complement renewable energy sources, offer avenues for growth. Strategic partnerships between thermal power companies and renewable energy developers could lead to hybrid power generation models that optimize grid stability and reduce emissions. The focus on developing technologies that enable a smoother transition towards a greener energy mix creates opportunities for innovation and market expansion.

Leading Players in the Australia Thermal Power Station Market Sector

- InterGen Services Inc

- Stanwell Corporation Limited

- Rio Tinto Limited

- EnergyAustralia Holdings Ltd

- Origin Energy Ltd

- Sumitomo Corporation

- NRG Energy Inc

- AGL Energy Limited

Key Milestones in Australia Thermal Power Station Market Industry

- 2020: Increased focus on emission reduction targets by the Australian government.

- 2021: Several major thermal power plants announced upgrades to improve efficiency and reduce emissions.

- 2022: Significant investments in research and development of CCS technologies.

- 2023: Several M&A deals involving thermal power assets were finalized.

- 2024: Further policy changes emphasizing renewable energy integration but with continued recognition of the role of thermal power in grid stability.

Strategic Outlook for Australia Thermal Power Station Market Market

The Australian thermal power station market is undergoing a significant transformation. While the long-term outlook for coal-fired plants is uncertain due to environmental concerns, the market for gas-fired plants and those incorporating CCS technologies remains viable. Companies that effectively adapt to changing regulations, embrace technological innovation, and strategically integrate their operations with renewable energy sources are best positioned for success. The focus on improving efficiency, reducing emissions, and enhancing grid reliability will shape the future of this dynamic sector.

Australia Thermal Power Station Market Segmentation

-

1. Source

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Coal

Australia Thermal Power Station Market Segmentation By Geography

- 1. Australia

Australia Thermal Power Station Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Natural Gas-Based Power to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Thermal Power Station Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Coal

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 InterGen Services Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stanwell Corporation Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rio Tinto Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EnergyAustralia Holdings Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Origin Energy Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sumitomo Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NRG Energy Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AGL Energy Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 InterGen Services Inc

List of Figures

- Figure 1: Australia Thermal Power Station Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Thermal Power Station Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Thermal Power Station Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Thermal Power Station Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Australia Thermal Power Station Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Australia Thermal Power Station Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Australia Thermal Power Station Market Revenue Million Forecast, by Source 2019 & 2032

- Table 6: Australia Thermal Power Station Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Thermal Power Station Market?

The projected CAGR is approximately > 1.40%.

2. Which companies are prominent players in the Australia Thermal Power Station Market?

Key companies in the market include InterGen Services Inc, Stanwell Corporation Limited, Rio Tinto Limited, EnergyAustralia Holdings Ltd, Origin Energy Ltd, Sumitomo Corporation, NRG Energy Inc, AGL Energy Limited.

3. What are the main segments of the Australia Thermal Power Station Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Natural Gas-Based Power to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Thermal Power Station Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Thermal Power Station Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Thermal Power Station Market?

To stay informed about further developments, trends, and reports in the Australia Thermal Power Station Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence