Key Insights

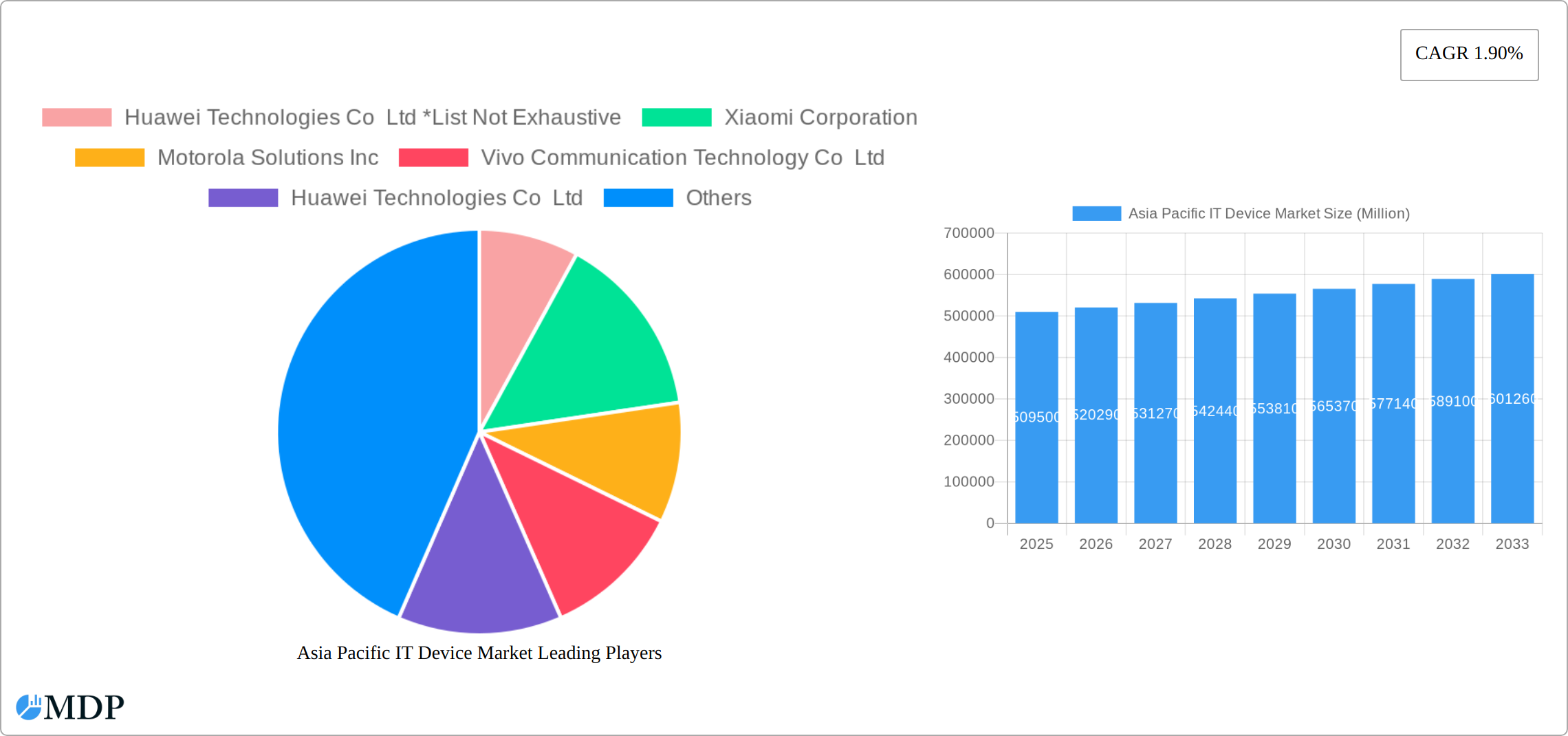

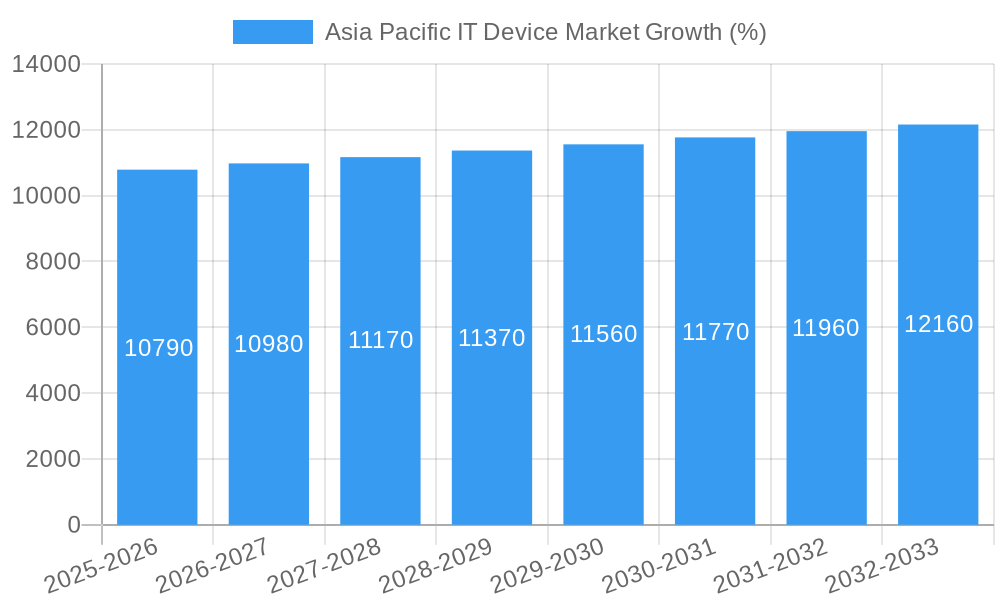

The Asia Pacific IT device market, encompassing PCs, tablets, and phones, is a dynamic and rapidly evolving sector. While precise market size data for 2025 is not provided, we can extrapolate based on the given CAGR of 1.90% and a presumably substantial existing market value. Assuming a 2024 market size in the range of $500 billion (a reasonable estimation for such a mature and large market), applying a 1.9% CAGR yields an estimated 2025 market value exceeding $509.5 billion. This significant value reflects the region's large and growing population, rising disposable incomes, increasing digital literacy, and the expanding adoption of technology across various sectors, from personal use to businesses and government. Key drivers include the ongoing demand for affordable and feature-rich smartphones, the increasing adoption of tablets for educational and entertainment purposes, and the sustained growth in demand for laptops for remote work and education. However, challenges remain, such as supply chain disruptions, fluctuating component costs, and intense competition among numerous domestic and international players. This competitive landscape, featuring major brands like Apple, Samsung, Huawei, and Xiaomi, alongside regional players, contributes to the market's dynamism.

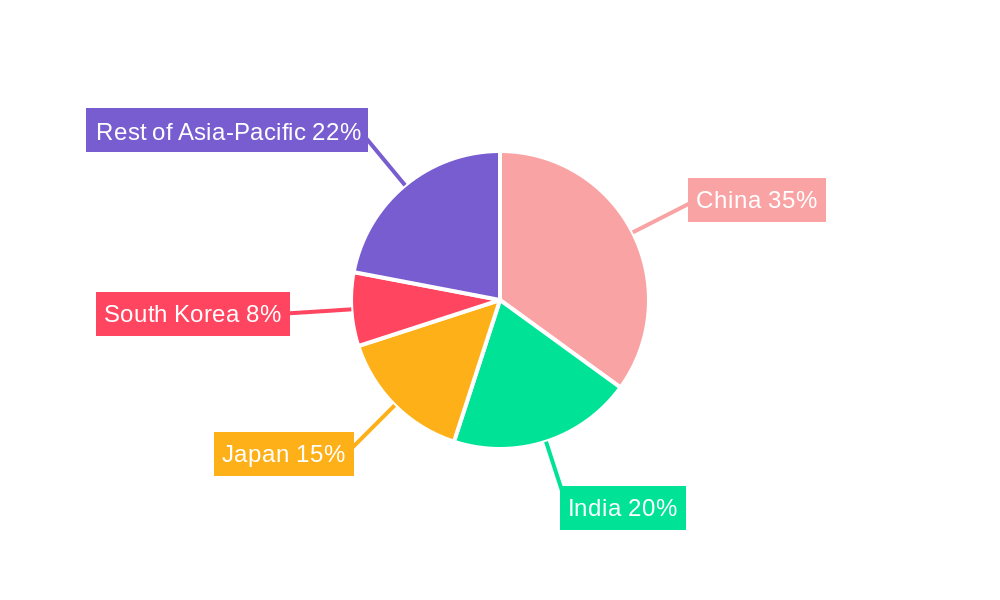

The market's segmentation reveals the dominance of smartphones, followed by PCs and tablets. While smartphone sales might show moderate growth driven by upgrades and feature enhancements, the PC segment might face slower growth due to market saturation in certain countries. The tablet segment is anticipated to exhibit steady but manageable growth driven by education and entertainment applications. Regional variations are expected, with China, India, and South Korea playing pivotal roles. The continued expansion of 5G networks and the growing popularity of innovative technologies such as AI and IoT will likely reshape the IT device landscape in the Asia Pacific region. This necessitates a keen understanding of evolving consumer preferences and technological advancements for sustained success within this highly competitive market. This growth is expected to continue through 2033, driven by ongoing technological innovation and increasing demand. However, careful consideration of economic fluctuations and potential geopolitical uncertainties are vital for accurate future forecasting.

Asia Pacific IT Device Market Report: 2019-2033

Dive deep into the dynamic Asia Pacific IT device market with this comprehensive report, offering actionable insights for strategic decision-making. This in-depth analysis covers the period from 2019 to 2033, with a focus on the estimated year 2025. The report provides a detailed overview of market dynamics, industry trends, leading players, and emerging opportunities, empowering businesses to navigate the complexities of this rapidly evolving landscape. Expect detailed analysis on PCs, Tablets, and Phones, across key markets and segments. Projected market value exceeds xx Million.

Asia Pacific IT Device Market Market Dynamics & Concentration

The Asia Pacific IT device market is characterized by intense competition among numerous global and regional players. Market concentration is moderate, with a few dominant players holding significant market share but facing pressure from numerous smaller, agile competitors. Innovation is a critical driver, with companies continually introducing new products and features to cater to evolving consumer preferences. Regulatory frameworks, varying across countries in the region, impact market access and product compliance. Product substitutes, like older models and refurbished devices, impact sales of newer products. End-user trends, shaped by factors like increasing smartphone penetration, digital literacy and growing demand for smart devices, are reshaping the market landscape. M&A activity has been moderate, with xx deals recorded between 2019-2024, primarily focused on expanding market reach and technological capabilities. Leading players are leveraging various strategies including strategic partnerships and acquisitions to maintain their competitiveness.

- Market Share: Samsung Electronics and Apple Inc hold a combined market share of approximately xx%, while Huawei Technologies Co Ltd, Xiaomi Corporation, and other players are vying for the remaining share.

- M&A Activity: The average deal size over the past 5 years (2019-2024) has been approximately xx Million, while the count reflects an increasing inclination of companies to focus on acquisition and mergers, rather than greenfield initiatives.

Asia Pacific IT Device Market Industry Trends & Analysis

The Asia Pacific IT device market exhibits robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated at xx%, reflecting consistent market expansion. Rising disposable incomes, particularly in developing economies, fuel increased demand for smartphones, tablets, and PCs. Technological disruptions, such as the advent of 5G and improved AI capabilities, are continuously reshaping the market. Consumer preferences are increasingly shifting towards feature-rich, affordable devices with advanced functionalities. Intense competition among established players and emerging brands leads to constant product innovation and price wars. Market penetration is high for mobile phones, with xx% of the population owning at least one device, whereas penetration for PCs and Tablets still lag.

Leading Markets & Segments in Asia Pacific IT Device Market

China remains the dominant market for IT devices in the Asia Pacific region, accounting for xx% of the total market value in 2024, followed by India and Japan. The smartphone segment accounts for the largest share of the market, driven by high demand for affordable and feature-rich devices.

Key Drivers for China's Dominance:

- Large and rapidly growing consumer base.

- Robust domestic manufacturing ecosystem.

- Government initiatives promoting technological advancement.

- High smartphone penetration rates.

Key Drivers for India's Growth:

- Increasing disposable incomes and smartphone affordability.

- Growing internet and mobile data penetration.

- Government initiatives to promote digital inclusion.

PC and Tablet segment analysis: This segment is growing steadily driven by increasing demand for work from home options and online educational platforms. However, the growth is slower compared to the smartphone segment. The market share of PC's vs Tablets is expected to be xx% and xx% respectively in 2025.

Asia Pacific IT Device Market Product Developments

Recent product innovations focus on enhanced processing power, improved camera technology, and advanced connectivity features. The integration of AI and 5G capabilities is transforming user experience. Companies are emphasizing designs that prioritize durability, user-friendliness and innovative features. This trend reflects the market's focus on meeting the diverse needs of consumers. Competition is driving manufacturers to offer unique value propositions like long lasting battery, faster processing power and innovative designs to garner market share.

Key Drivers of Asia Pacific IT Device Market Growth

The Asia Pacific IT device market's growth is fuelled by technological advancements (5G, AI), favorable economic conditions in several key markets, and supportive government policies promoting digitalization. The increasing penetration of mobile internet is boosting demand for smart devices across various demographics. Government initiatives to improve digital literacy and infrastructure are creating favorable conditions for market expansion.

Challenges in the Asia Pacific IT Device Market Market

Supply chain disruptions, especially those experienced post 2020, continue to impact the market, leading to price fluctuations. Regulatory hurdles and trade policies across different countries create complexities for manufacturers and distributors. Intense competition puts pressure on profit margins and necessitates continuous innovation to remain competitive. Counterfeit products pose a threat to the legitimate market.

Emerging Opportunities in Asia Pacific IT Device Market

The increasing adoption of IoT devices presents significant opportunities for market expansion. The growth of the cloud computing sector is driving demand for devices capable of seamless integration with cloud services. Strategic partnerships and investments in R&D are crucial for exploiting the market's long-term growth potential. The growing focus on sustainability and environmentally friendly manufacturing processes offers new opportunities for market differentiation.

Leading Players in the Asia Pacific IT Device Market Sector

- Huawei Technologies Co Ltd

- Xiaomi Corporation

- Motorola Solutions Inc

- Vivo Communication Technology Co Ltd

- Google LLC

- Lenovo Group Limited

- ASUSTek Computer Inc

- Acer Group

- Guangdong Oppo Mobile Telecommunications Corp Ltd

- Honor Technology Inc

- Haier Group Corporation

- Samsung Electronics Co Ltd

- Apple Inc

- Sony Corporation

- LG Corporation

- Microsoft Corporation

- Dell Technologies

- HP Inc

Key Milestones in Asia Pacific IT Device Market Industry

- July 2022: Samsung Electronics launched Samsung Newsroom Singapore, enhancing its communication and brand presence in Southeast Asia. This move aims to improve stakeholder communication and increase market reach.

- June 2022: Huawei unveiled groundbreaking technologies in AI, 5G, and user experience, including the "optical iris" and an adder neural network, impacting network efficiency and resource management. These developments contribute to cost-effectiveness and potentially faster 5G roll-outs.

Strategic Outlook for Asia Pacific IT Device Market Market

The Asia Pacific IT device market is poised for sustained growth, driven by continued technological advancements, expanding digital infrastructure, and rising consumer demand. Companies that prioritize innovation, strategic partnerships, and adaptable supply chains will be best positioned to capitalize on emerging opportunities. A focus on sustainability and customer experience will further drive market differentiation and success in the years to come.

Asia Pacific IT Device Market Segmentation

-

1. Type

-

1.1. PC's

- 1.1.1. Laptops

- 1.1.2. Desktop PCs

- 1.1.3. Tablets

-

1.2. Phones

- 1.2.1. Landline Phones

- 1.2.2. Smartphones

- 1.2.3. Feature Phones

-

1.1. PC's

-

2. Geography

- 2.1. Australia

- 2.2. China

- 2.3. India

- 2.4. Japan

- 2.5. Indonesia

- 2.6. Malaysia

- 2.7. Singapore

- 2.8. South Korea

- 2.9. Taiwan

- 2.10. Thailand

- 2.11. Rest of Asia-pacific

Asia Pacific IT Device Market Segmentation By Geography

- 1. Australia

- 2. China

- 3. India

- 4. Japan

- 5. Indonesia

- 6. Malaysia

- 7. Singapore

- 8. South Korea

- 9. Taiwan

- 10. Thailand

- 11. Rest of Asia pacific

Asia Pacific IT Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand of 5G Enabled Smartphones; Robust Technological Presence in China

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption Owing to COVID-19

- 3.4. Market Trends

- 3.4.1. Robust Demand for Smart Phones

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. PC's

- 5.1.1.1. Laptops

- 5.1.1.2. Desktop PCs

- 5.1.1.3. Tablets

- 5.1.2. Phones

- 5.1.2.1. Landline Phones

- 5.1.2.2. Smartphones

- 5.1.2.3. Feature Phones

- 5.1.1. PC's

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Australia

- 5.2.2. China

- 5.2.3. India

- 5.2.4. Japan

- 5.2.5. Indonesia

- 5.2.6. Malaysia

- 5.2.7. Singapore

- 5.2.8. South Korea

- 5.2.9. Taiwan

- 5.2.10. Thailand

- 5.2.11. Rest of Asia-pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.3.2. China

- 5.3.3. India

- 5.3.4. Japan

- 5.3.5. Indonesia

- 5.3.6. Malaysia

- 5.3.7. Singapore

- 5.3.8. South Korea

- 5.3.9. Taiwan

- 5.3.10. Thailand

- 5.3.11. Rest of Asia pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Australia Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. PC's

- 6.1.1.1. Laptops

- 6.1.1.2. Desktop PCs

- 6.1.1.3. Tablets

- 6.1.2. Phones

- 6.1.2.1. Landline Phones

- 6.1.2.2. Smartphones

- 6.1.2.3. Feature Phones

- 6.1.1. PC's

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Australia

- 6.2.2. China

- 6.2.3. India

- 6.2.4. Japan

- 6.2.5. Indonesia

- 6.2.6. Malaysia

- 6.2.7. Singapore

- 6.2.8. South Korea

- 6.2.9. Taiwan

- 6.2.10. Thailand

- 6.2.11. Rest of Asia-pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. China Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. PC's

- 7.1.1.1. Laptops

- 7.1.1.2. Desktop PCs

- 7.1.1.3. Tablets

- 7.1.2. Phones

- 7.1.2.1. Landline Phones

- 7.1.2.2. Smartphones

- 7.1.2.3. Feature Phones

- 7.1.1. PC's

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Australia

- 7.2.2. China

- 7.2.3. India

- 7.2.4. Japan

- 7.2.5. Indonesia

- 7.2.6. Malaysia

- 7.2.7. Singapore

- 7.2.8. South Korea

- 7.2.9. Taiwan

- 7.2.10. Thailand

- 7.2.11. Rest of Asia-pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. India Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. PC's

- 8.1.1.1. Laptops

- 8.1.1.2. Desktop PCs

- 8.1.1.3. Tablets

- 8.1.2. Phones

- 8.1.2.1. Landline Phones

- 8.1.2.2. Smartphones

- 8.1.2.3. Feature Phones

- 8.1.1. PC's

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Australia

- 8.2.2. China

- 8.2.3. India

- 8.2.4. Japan

- 8.2.5. Indonesia

- 8.2.6. Malaysia

- 8.2.7. Singapore

- 8.2.8. South Korea

- 8.2.9. Taiwan

- 8.2.10. Thailand

- 8.2.11. Rest of Asia-pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Japan Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. PC's

- 9.1.1.1. Laptops

- 9.1.1.2. Desktop PCs

- 9.1.1.3. Tablets

- 9.1.2. Phones

- 9.1.2.1. Landline Phones

- 9.1.2.2. Smartphones

- 9.1.2.3. Feature Phones

- 9.1.1. PC's

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Australia

- 9.2.2. China

- 9.2.3. India

- 9.2.4. Japan

- 9.2.5. Indonesia

- 9.2.6. Malaysia

- 9.2.7. Singapore

- 9.2.8. South Korea

- 9.2.9. Taiwan

- 9.2.10. Thailand

- 9.2.11. Rest of Asia-pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Indonesia Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. PC's

- 10.1.1.1. Laptops

- 10.1.1.2. Desktop PCs

- 10.1.1.3. Tablets

- 10.1.2. Phones

- 10.1.2.1. Landline Phones

- 10.1.2.2. Smartphones

- 10.1.2.3. Feature Phones

- 10.1.1. PC's

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Australia

- 10.2.2. China

- 10.2.3. India

- 10.2.4. Japan

- 10.2.5. Indonesia

- 10.2.6. Malaysia

- 10.2.7. Singapore

- 10.2.8. South Korea

- 10.2.9. Taiwan

- 10.2.10. Thailand

- 10.2.11. Rest of Asia-pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Malaysia Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. PC's

- 11.1.1.1. Laptops

- 11.1.1.2. Desktop PCs

- 11.1.1.3. Tablets

- 11.1.2. Phones

- 11.1.2.1. Landline Phones

- 11.1.2.2. Smartphones

- 11.1.2.3. Feature Phones

- 11.1.1. PC's

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Australia

- 11.2.2. China

- 11.2.3. India

- 11.2.4. Japan

- 11.2.5. Indonesia

- 11.2.6. Malaysia

- 11.2.7. Singapore

- 11.2.8. South Korea

- 11.2.9. Taiwan

- 11.2.10. Thailand

- 11.2.11. Rest of Asia-pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Singapore Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. PC's

- 12.1.1.1. Laptops

- 12.1.1.2. Desktop PCs

- 12.1.1.3. Tablets

- 12.1.2. Phones

- 12.1.2.1. Landline Phones

- 12.1.2.2. Smartphones

- 12.1.2.3. Feature Phones

- 12.1.1. PC's

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. Australia

- 12.2.2. China

- 12.2.3. India

- 12.2.4. Japan

- 12.2.5. Indonesia

- 12.2.6. Malaysia

- 12.2.7. Singapore

- 12.2.8. South Korea

- 12.2.9. Taiwan

- 12.2.10. Thailand

- 12.2.11. Rest of Asia-pacific

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. South Korea Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. PC's

- 13.1.1.1. Laptops

- 13.1.1.2. Desktop PCs

- 13.1.1.3. Tablets

- 13.1.2. Phones

- 13.1.2.1. Landline Phones

- 13.1.2.2. Smartphones

- 13.1.2.3. Feature Phones

- 13.1.1. PC's

- 13.2. Market Analysis, Insights and Forecast - by Geography

- 13.2.1. Australia

- 13.2.2. China

- 13.2.3. India

- 13.2.4. Japan

- 13.2.5. Indonesia

- 13.2.6. Malaysia

- 13.2.7. Singapore

- 13.2.8. South Korea

- 13.2.9. Taiwan

- 13.2.10. Thailand

- 13.2.11. Rest of Asia-pacific

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. Taiwan Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - by Type

- 14.1.1. PC's

- 14.1.1.1. Laptops

- 14.1.1.2. Desktop PCs

- 14.1.1.3. Tablets

- 14.1.2. Phones

- 14.1.2.1. Landline Phones

- 14.1.2.2. Smartphones

- 14.1.2.3. Feature Phones

- 14.1.1. PC's

- 14.2. Market Analysis, Insights and Forecast - by Geography

- 14.2.1. Australia

- 14.2.2. China

- 14.2.3. India

- 14.2.4. Japan

- 14.2.5. Indonesia

- 14.2.6. Malaysia

- 14.2.7. Singapore

- 14.2.8. South Korea

- 14.2.9. Taiwan

- 14.2.10. Thailand

- 14.2.11. Rest of Asia-pacific

- 14.1. Market Analysis, Insights and Forecast - by Type

- 15. Thailand Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - by Type

- 15.1.1. PC's

- 15.1.1.1. Laptops

- 15.1.1.2. Desktop PCs

- 15.1.1.3. Tablets

- 15.1.2. Phones

- 15.1.2.1. Landline Phones

- 15.1.2.2. Smartphones

- 15.1.2.3. Feature Phones

- 15.1.1. PC's

- 15.2. Market Analysis, Insights and Forecast - by Geography

- 15.2.1. Australia

- 15.2.2. China

- 15.2.3. India

- 15.2.4. Japan

- 15.2.5. Indonesia

- 15.2.6. Malaysia

- 15.2.7. Singapore

- 15.2.8. South Korea

- 15.2.9. Taiwan

- 15.2.10. Thailand

- 15.2.11. Rest of Asia-pacific

- 15.1. Market Analysis, Insights and Forecast - by Type

- 16. Rest of Asia pacific Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - by Type

- 16.1.1. PC's

- 16.1.1.1. Laptops

- 16.1.1.2. Desktop PCs

- 16.1.1.3. Tablets

- 16.1.2. Phones

- 16.1.2.1. Landline Phones

- 16.1.2.2. Smartphones

- 16.1.2.3. Feature Phones

- 16.1.1. PC's

- 16.2. Market Analysis, Insights and Forecast - by Geography

- 16.2.1. Australia

- 16.2.2. China

- 16.2.3. India

- 16.2.4. Japan

- 16.2.5. Indonesia

- 16.2.6. Malaysia

- 16.2.7. Singapore

- 16.2.8. South Korea

- 16.2.9. Taiwan

- 16.2.10. Thailand

- 16.2.11. Rest of Asia-pacific

- 16.1. Market Analysis, Insights and Forecast - by Type

- 17. China Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 18. Japan Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 19. India Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 20. South Korea Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 21. Taiwan Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 22. Australia Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 23. Rest of Asia-Pacific Asia Pacific IT Device Market Analysis, Insights and Forecast, 2019-2031

- 24. Competitive Analysis

- 24.1. Market Share Analysis 2024

- 24.2. Company Profiles

- 24.2.1 Huawei Technologies Co Ltd *List Not Exhaustive

- 24.2.1.1. Overview

- 24.2.1.2. Products

- 24.2.1.3. SWOT Analysis

- 24.2.1.4. Recent Developments

- 24.2.1.5. Financials (Based on Availability)

- 24.2.2 Xiaomi Corporation

- 24.2.2.1. Overview

- 24.2.2.2. Products

- 24.2.2.3. SWOT Analysis

- 24.2.2.4. Recent Developments

- 24.2.2.5. Financials (Based on Availability)

- 24.2.3 Motorola Solutions Inc

- 24.2.3.1. Overview

- 24.2.3.2. Products

- 24.2.3.3. SWOT Analysis

- 24.2.3.4. Recent Developments

- 24.2.3.5. Financials (Based on Availability)

- 24.2.4 Vivo Communication Technology Co Ltd

- 24.2.4.1. Overview

- 24.2.4.2. Products

- 24.2.4.3. SWOT Analysis

- 24.2.4.4. Recent Developments

- 24.2.4.5. Financials (Based on Availability)

- 24.2.5 Huawei Technologies Co Ltd

- 24.2.5.1. Overview

- 24.2.5.2. Products

- 24.2.5.3. SWOT Analysis

- 24.2.5.4. Recent Developments

- 24.2.5.5. Financials (Based on Availability)

- 24.2.6 Google LLC

- 24.2.6.1. Overview

- 24.2.6.2. Products

- 24.2.6.3. SWOT Analysis

- 24.2.6.4. Recent Developments

- 24.2.6.5. Financials (Based on Availability)

- 24.2.7 Lenovo Group Limited

- 24.2.7.1. Overview

- 24.2.7.2. Products

- 24.2.7.3. SWOT Analysis

- 24.2.7.4. Recent Developments

- 24.2.7.5. Financials (Based on Availability)

- 24.2.8 ASUSTek Computer Inc

- 24.2.8.1. Overview

- 24.2.8.2. Products

- 24.2.8.3. SWOT Analysis

- 24.2.8.4. Recent Developments

- 24.2.8.5. Financials (Based on Availability)

- 24.2.9 Acer Group

- 24.2.9.1. Overview

- 24.2.9.2. Products

- 24.2.9.3. SWOT Analysis

- 24.2.9.4. Recent Developments

- 24.2.9.5. Financials (Based on Availability)

- 24.2.10 Guangdong Oppo Mobile Telecommunications Corp Ltd

- 24.2.10.1. Overview

- 24.2.10.2. Products

- 24.2.10.3. SWOT Analysis

- 24.2.10.4. Recent Developments

- 24.2.10.5. Financials (Based on Availability)

- 24.2.11 Honor Technology Inc

- 24.2.11.1. Overview

- 24.2.11.2. Products

- 24.2.11.3. SWOT Analysis

- 24.2.11.4. Recent Developments

- 24.2.11.5. Financials (Based on Availability)

- 24.2.12 Haier Group Corporation

- 24.2.12.1. Overview

- 24.2.12.2. Products

- 24.2.12.3. SWOT Analysis

- 24.2.12.4. Recent Developments

- 24.2.12.5. Financials (Based on Availability)

- 24.2.13 Samsung Electronics Co Ltd

- 24.2.13.1. Overview

- 24.2.13.2. Products

- 24.2.13.3. SWOT Analysis

- 24.2.13.4. Recent Developments

- 24.2.13.5. Financials (Based on Availability)

- 24.2.14 Apple Inc

- 24.2.14.1. Overview

- 24.2.14.2. Products

- 24.2.14.3. SWOT Analysis

- 24.2.14.4. Recent Developments

- 24.2.14.5. Financials (Based on Availability)

- 24.2.15 Sony Corporation

- 24.2.15.1. Overview

- 24.2.15.2. Products

- 24.2.15.3. SWOT Analysis

- 24.2.15.4. Recent Developments

- 24.2.15.5. Financials (Based on Availability)

- 24.2.16 LG Corporation

- 24.2.16.1. Overview

- 24.2.16.2. Products

- 24.2.16.3. SWOT Analysis

- 24.2.16.4. Recent Developments

- 24.2.16.5. Financials (Based on Availability)

- 24.2.17 Microsoft Corporation

- 24.2.17.1. Overview

- 24.2.17.2. Products

- 24.2.17.3. SWOT Analysis

- 24.2.17.4. Recent Developments

- 24.2.17.5. Financials (Based on Availability)

- 24.2.18 Dell Technologies

- 24.2.18.1. Overview

- 24.2.18.2. Products

- 24.2.18.3. SWOT Analysis

- 24.2.18.4. Recent Developments

- 24.2.18.5. Financials (Based on Availability)

- 24.2.19 HP Inc

- 24.2.19.1. Overview

- 24.2.19.2. Products

- 24.2.19.3. SWOT Analysis

- 24.2.19.4. Recent Developments

- 24.2.19.5. Financials (Based on Availability)

- 24.2.1 Huawei Technologies Co Ltd *List Not Exhaustive

List of Figures

- Figure 1: Asia Pacific IT Device Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific IT Device Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia Pacific IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia Pacific IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Asia Pacific IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia Pacific IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Asia Pacific IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Asia Pacific IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Asia Pacific IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Asia Pacific IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Asia Pacific IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia Pacific IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia Pacific IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Asia Pacific IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia Pacific IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Asia Pacific IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Asia Pacific IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 27: Asia Pacific IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Asia Pacific IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Asia Pacific IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Asia Pacific IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Asia Pacific IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Asia Pacific IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia Pacific IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia Pacific IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Asia Pacific IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 36: Asia Pacific IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Asia Pacific IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Asia Pacific IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 39: Asia Pacific IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Asia Pacific IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 41: Asia Pacific IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: Asia Pacific IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Asia Pacific IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Asia Pacific IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 45: Asia Pacific IT Device Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific IT Device Market?

The projected CAGR is approximately 1.90%.

2. Which companies are prominent players in the Asia Pacific IT Device Market?

Key companies in the market include Huawei Technologies Co Ltd *List Not Exhaustive, Xiaomi Corporation, Motorola Solutions Inc, Vivo Communication Technology Co Ltd, Huawei Technologies Co Ltd, Google LLC, Lenovo Group Limited, ASUSTek Computer Inc, Acer Group, Guangdong Oppo Mobile Telecommunications Corp Ltd, Honor Technology Inc, Haier Group Corporation, Samsung Electronics Co Ltd, Apple Inc, Sony Corporation, LG Corporation, Microsoft Corporation, Dell Technologies, HP Inc.

3. What are the main segments of the Asia Pacific IT Device Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand of 5G Enabled Smartphones; Robust Technological Presence in China.

6. What are the notable trends driving market growth?

Robust Demand for Smart Phones.

7. Are there any restraints impacting market growth?

Supply Chain Disruption Owing to COVID-19.

8. Can you provide examples of recent developments in the market?

July 2022: Samsung Electronics, the leading telephone brand in the world, announced the launch of Samsung Newsroom Singapore. The Samsung Newsroom in Southeast Asia, located in Singapore, would offer various information, including press releases, live broadcasts of local and international Samsung events, and high-quality photos and videos.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific IT Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific IT Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific IT Device Market?

To stay informed about further developments, trends, and reports in the Asia Pacific IT Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence