Key Insights

The Asia-Pacific Automotive Advanced Driver Assistance Systems (ADAS) market is projected for substantial expansion, propelled by increasing vehicle production, heightened consumer demand for safety technologies, and supportive governmental initiatives for road safety. This market is forecast to reach a size of 38.91 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 12.3%. Key growth drivers include the increasing affordability of ADAS, advancements in sensor technology (RADAR, LiDAR, Camera), and the rising adoption of connected vehicle features. Market segmentation spans diverse ADAS types, vehicle categories (Passenger Cars, Commercial Vehicles), and technological implementations. China, India, Japan, and South Korea are pivotal contributors, reflecting their robust automotive sectors and growing middle-class purchasing power. Challenges include the initial cost of ADAS integration, data privacy and cybersecurity concerns, and the need for advanced infrastructure. The competitive landscape features key players like Hyundai Mobis, Bosch, Continental, and Denso, driving innovation and strategic alliances. Future market trajectory relies on continuous technological progress, favorable regulatory frameworks, and growing consumer awareness of ADAS benefits.

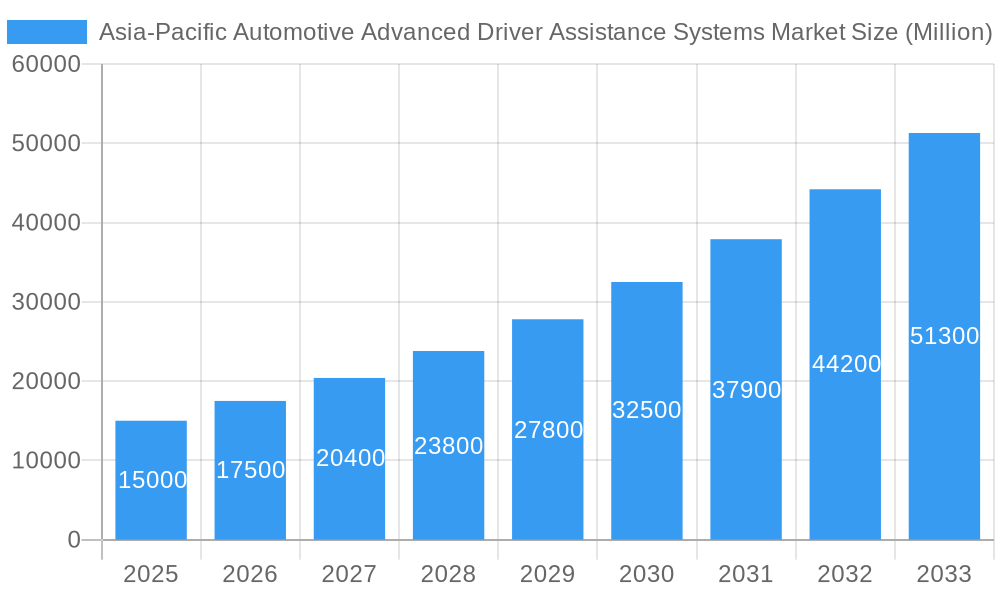

Asia-Pacific Automotive Advanced Driver Assistance Systems Market Market Size (In Billion)

Projected growth in the Asia-Pacific ADAS market is underpinned by several critical factors. The expanding middle class in economies such as China and India is a primary driver, fueling demand for advanced automotive safety features. Furthermore, increasingly stringent government regulations mandating specific ADAS functionalities are accelerating adoption rates. Ongoing technological innovations are also contributing by reducing ADAS component costs, thereby enhancing accessibility for vehicle manufacturers and consumers alike. While infrastructure development remains a consideration for fully realizing certain ADAS capabilities, the overall market outlook is exceptionally positive. Projections indicate sustained significant growth throughout the forecast period, with segments like Advanced Automatic Emergency Braking and Adaptive Cruise Control anticipated to experience particularly strong expansion. Success for leading companies will depend on their capacity for innovation, adaptability to technological shifts, and their ability to meet the varied demands of the Asia-Pacific automotive sector.

Asia-Pacific Automotive Advanced Driver Assistance Systems Market Company Market Share

Asia-Pacific Automotive Advanced Driver Assistance Systems (ADAS) Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific Automotive Advanced Driver Assistance Systems (ADAS) market, offering invaluable insights for stakeholders across the automotive value chain. From market dynamics and leading players to emerging trends and future opportunities, this report equips you with the knowledge to navigate this rapidly evolving landscape. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by Type, Vehicle Type, Technology Type, and Country. The total market size is expected to reach xx Million by 2033.

Asia-Pacific Automotive Advanced Driver Assistance Systems Market Dynamics & Concentration

The Asia-Pacific ADAS market is characterized by high growth potential, driven by increasing vehicle production, rising consumer demand for safety features, and supportive government regulations. Market concentration is moderate, with several key players dominating specific segments. However, the market also witnesses significant participation from several smaller players, fostering innovation and competition.

Market Concentration: The market share of the top five players is estimated at approximately 60% in 2025. The remaining share is dispersed amongst numerous smaller players, indicating a moderately consolidated market.

Innovation Drivers: Stringent safety regulations, technological advancements in sensor technologies (RADAR, LiDAR, Camera), and the increasing integration of Artificial Intelligence (AI) are driving innovation within the ADAS sector.

Regulatory Frameworks: Governments across the Asia-Pacific region are actively implementing stricter safety regulations, mandating the adoption of ADAS features in new vehicles. This is a significant factor pushing market growth.

Product Substitutes: While no direct substitutes exist for core ADAS functionalities, the competitive landscape includes various levels of feature sophistication and pricing, offering substitutes within the market itself.

End-User Trends: Consumer preference is shifting toward vehicles equipped with advanced safety and driver-assistance features, boosting demand for ADAS.

M&A Activities: The number of mergers and acquisitions in the ADAS sector has been steadily increasing over the past few years, with xx major deals recorded between 2020 and 2024, indicating consolidation within the industry.

Asia-Pacific Automotive Advanced Driver Assistance Systems Market Industry Trends & Analysis

The Asia-Pacific ADAS market is experiencing robust growth, projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by several factors: the increasing affordability of ADAS technologies, rising disposable incomes in developing economies, and the burgeoning adoption of connected car technologies. Technological advancements, particularly in sensor technology, AI and machine learning are revolutionizing the capabilities of ADAS, leading to more sophisticated and effective systems. Consumer preferences are shifting towards vehicles offering enhanced safety and convenience features, further stimulating market expansion. The competitive landscape is dynamic, with both established automotive giants and emerging technology companies vying for market share, driving innovation and price competitiveness. Market penetration of ADAS features is steadily increasing, particularly in premium vehicle segments. However, the penetration is still relatively low in budget-friendly vehicle categories, presenting opportunities for companies offering cost-effective ADAS solutions.

Leading Markets & Segments in Asia-Pacific Automotive Advanced Driver Assistance Systems Market

China remains the dominant market in the Asia-Pacific region, followed by Japan and South Korea. Within the segment breakdown:

Dominant Segments:

- By Type: Adaptive Cruise Control (ACC) and Advanced Automatic Emergency Braking (AEB) systems currently hold the largest market share, owing to their widespread adoption and relatively high cost-effectiveness.

- By Vehicle Type: Passenger cars currently dominate the ADAS market due to higher demand and production volumes. Commercial vehicles are experiencing moderate growth, with adoption of safety features increasing for commercial fleet applications.

- By Technology Type: Camera-based systems currently hold a significant share, while LiDAR and RADAR technologies are experiencing substantial growth due to their capabilities in advanced autonomous driving features.

- By Country:

- China: Strong government support for technological advancements, a massive automotive manufacturing base, and increasing consumer demand drive its dominance.

- Japan: Established automotive industry with a strong focus on technology and safety features.

- South Korea: High technological capabilities, significant investment in automotive R&D, and the presence of major global automotive companies contribute to its high market share.

- India: Rapid economic growth, increasing vehicle sales, and a growing middle class are driving the growth of the ADAS market, though it lags behind the leading countries in market maturity.

Key Drivers for Leading Markets:

- China: Government initiatives promoting technological advancements in the automotive sector, supportive infrastructure, and a large consumer base are key drivers.

- Japan: Established technological leadership in the automotive sector, advanced R&D capabilities, and strong brand reputation drive its prominence.

- South Korea: High level of technological expertise, government incentives for automotive innovation, and the presence of global automotive manufacturers contribute to the high market share.

Asia-Pacific Automotive Advanced Driver Assistance Systems Market Product Developments

Recent product innovations focus on enhanced sensor fusion, improved AI algorithms for better object recognition and decision-making, and increased integration with vehicle connectivity features. The development of more compact and cost-effective sensors is driving greater adoption across various vehicle segments. Competition is primarily centered on improving system accuracy, reliability, and cost-effectiveness, enhancing the overall value proposition for consumers and vehicle manufacturers.

Key Drivers of Asia-Pacific Automotive Advanced Driver Assistance Systems Market Growth

Technological advancements, particularly in sensor technology (LiDAR, RADAR, Camera) and AI, are driving significant improvements in ADAS capabilities. Stringent government regulations mandating ADAS features in new vehicles are compelling manufacturers to integrate these technologies. Rising consumer awareness of safety benefits and increasing disposable incomes fuel demand for vehicles equipped with advanced safety features. Furthermore, the development of cost-effective ADAS solutions is expanding market penetration into more affordable vehicle segments.

Challenges in the Asia-Pacific Automotive Advanced Driver Assistance Systems Market

High initial investment costs for ADAS technology can be a barrier to entry for smaller manufacturers. Supply chain disruptions and component shortages can hinder production and impact market growth. Data privacy and cybersecurity concerns surrounding connected ADAS systems are significant considerations. Variations in infrastructure and regulatory frameworks across different countries in the Asia-Pacific region pose challenges for standardized implementation.

Emerging Opportunities in Asia-Pacific Automotive Advanced Driver Assistance Systems Market

The integration of ADAS with autonomous driving technologies presents significant opportunities for future growth. Strategic partnerships between automotive manufacturers and technology companies are enabling the development of innovative ADAS solutions. Expansion into developing economies with a growing middle class and increasing vehicle sales presents untapped market potential. The growing demand for connected car services and their integration with ADAS features offers substantial growth opportunities.

Leading Players in the Asia-Pacific Automotive Advanced Driver Assistance Systems Market Sector

Key Milestones in Asia-Pacific Automotive Advanced Driver Assistance Systems Market Industry

- June 2022: ZF Group inaugurates a new tech center in Hyderabad, India, focusing on e-mobility and ADAS development. This significantly enhances ZF's capabilities in the Asia-Pacific market.

- September 2021: Continental AG forms a joint venture with Horizon Robotics to develop integrated ADAS and autonomous driving solutions for the Chinese market, enhancing their regional presence and technological capabilities.

- April 2021: Denso Corporation announces the development of LiDAR, Locator Telescope Camera, and SIS ECU, which have been adopted in Lexus LS and Toyota Mirai vehicles. This underscores the ongoing technological advancements in ADAS sensor technologies.

Strategic Outlook for Asia-Pacific Automotive Advanced Driver Assistance Systems Market

The Asia-Pacific ADAS market exhibits substantial growth potential driven by technological advancements, increasing safety regulations, and rising consumer demand. Strategic opportunities exist in developing cost-effective ADAS solutions for mass-market vehicles, expanding into underserved markets, and fostering collaborations to integrate ADAS with autonomous driving capabilities. Focusing on advanced sensor fusion and AI-powered functionalities is pivotal for staying ahead in this competitive landscape. The market’s future success hinges on the ability of companies to adapt to rapid technological change, meet stringent regulatory requirements, and offer compelling value propositions to customers in diverse market segments.

Asia-Pacific Automotive Advanced Driver Assistance Systems Market Segmentation

-

1. Type

- 1.1. Parking Assist System

- 1.2. Adaptive Front-lighting

- 1.3. Night Vision System

- 1.4. Blind Spot Detection

- 1.5. Advanced Automatic Emergency Braking System

- 1.6. Collision Warning

- 1.7. Driver Drowsiness Alert

- 1.8. Traffic Sign Recognition

- 1.9. Lane Departure Warning

- 1.10. Adaptive Cruise Control

-

2. Vehicle Type

- 2.1. Passenger Car

- 2.2. Commercial Vehicles

-

3. Technology Type

- 3.1. RADAR

- 3.2. LiDAR

- 3.3. Camera

Asia-Pacific Automotive Advanced Driver Assistance Systems Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Automotive Advanced Driver Assistance Systems Market Regional Market Share

Geographic Coverage of Asia-Pacific Automotive Advanced Driver Assistance Systems Market

Asia-Pacific Automotive Advanced Driver Assistance Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. Growing Demand For ADAS Features In Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Automotive Advanced Driver Assistance Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Parking Assist System

- 5.1.2. Adaptive Front-lighting

- 5.1.3. Night Vision System

- 5.1.4. Blind Spot Detection

- 5.1.5. Advanced Automatic Emergency Braking System

- 5.1.6. Collision Warning

- 5.1.7. Driver Drowsiness Alert

- 5.1.8. Traffic Sign Recognition

- 5.1.9. Lane Departure Warning

- 5.1.10. Adaptive Cruise Control

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Car

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Technology Type

- 5.3.1. RADAR

- 5.3.2. LiDAR

- 5.3.3. Camera

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hyundai Mobis Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infineon Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aisin Seiki Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Continental AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Robert Bosch GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hella KGAA Hueck & Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Magna International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Valeo SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Autoliv Inc *List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DENSO Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ZF Friedrichshafen AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Aptiv PLC (Delphi Automotive PLC)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Hyundai Mobis Co Ltd

List of Figures

- Figure 1: Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Automotive Advanced Driver Assistance Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 4: Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 8: Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Automotive Advanced Driver Assistance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Automotive Advanced Driver Assistance Systems Market?

The projected CAGR is approximately 12.3%.

2. Which companies are prominent players in the Asia-Pacific Automotive Advanced Driver Assistance Systems Market?

Key companies in the market include Hyundai Mobis Co Ltd, Infineon Technologies, Aisin Seiki Co Ltd, Continental AG, Robert Bosch GmbH, Hella KGAA Hueck & Co, Magna International, Valeo SA, Autoliv Inc *List Not Exhaustive, DENSO Corporation, ZF Friedrichshafen AG, Aptiv PLC (Delphi Automotive PLC).

3. What are the main segments of the Asia-Pacific Automotive Advanced Driver Assistance Systems Market?

The market segments include Type, Vehicle Type, Technology Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.91 billion as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Growing Demand For ADAS Features In Vehicles.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

In June 2022, In India, ZF Group inaugurated its new Tech center facility in Hyderabad. The Tech Center India is critical for ZF Group's global development in the technology domains of e-mobility, ADAS, integrated safety, vehicle motion control, as well as digitalization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Automotive Advanced Driver Assistance Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Automotive Advanced Driver Assistance Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Automotive Advanced Driver Assistance Systems Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Automotive Advanced Driver Assistance Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence