Key Insights

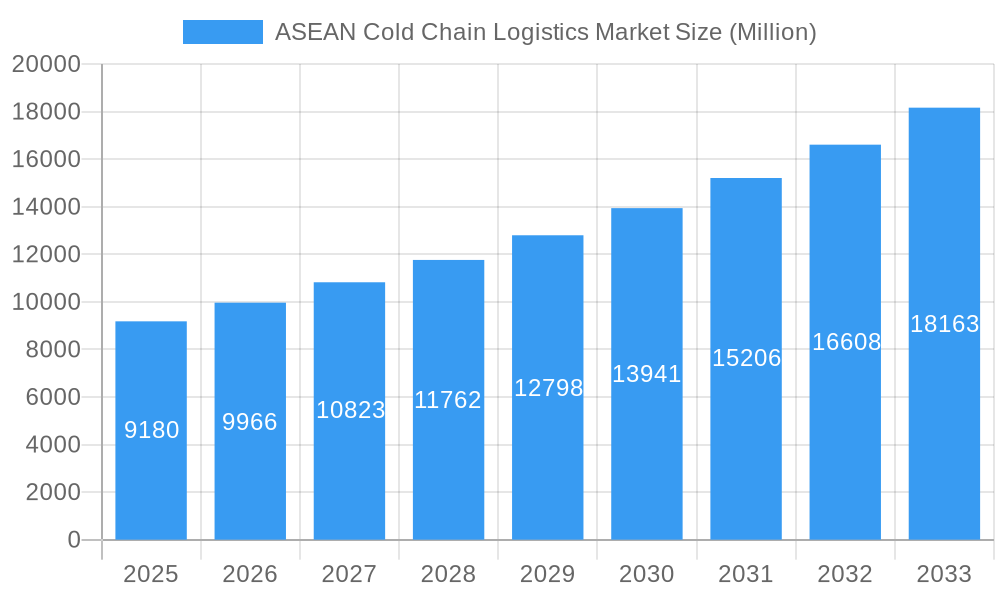

The ASEAN cold chain logistics market, valued at $9.18 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.80% from 2025 to 2033. This surge is driven by several key factors. The rising demand for fresh produce, processed foods, pharmaceuticals, and other temperature-sensitive goods across the region fuels the need for efficient and reliable cold chain solutions. Increased consumer disposable incomes, coupled with a shift towards healthier diets and a growing middle class, are significantly bolstering demand for perishable goods, thereby driving market expansion. Furthermore, advancements in cold chain technologies, such as improved refrigeration systems, temperature monitoring devices, and specialized transportation vehicles, are enhancing efficiency and reducing spoilage, contributing to market growth. Government initiatives promoting food safety and infrastructure development in the region further support the industry's expansion. However, challenges remain, including the need for further infrastructure improvements, particularly in less developed areas, along with the need for skilled workforce development to maintain consistent service quality and minimize product loss across the supply chain. The fragmented nature of the market in certain countries presents an obstacle to consolidation and economies of scale. Despite these challenges, the long-term outlook for the ASEAN cold chain logistics market remains highly positive, fueled by sustained economic growth and evolving consumer preferences.

ASEAN Cold Chain Logistics Market Market Size (In Billion)

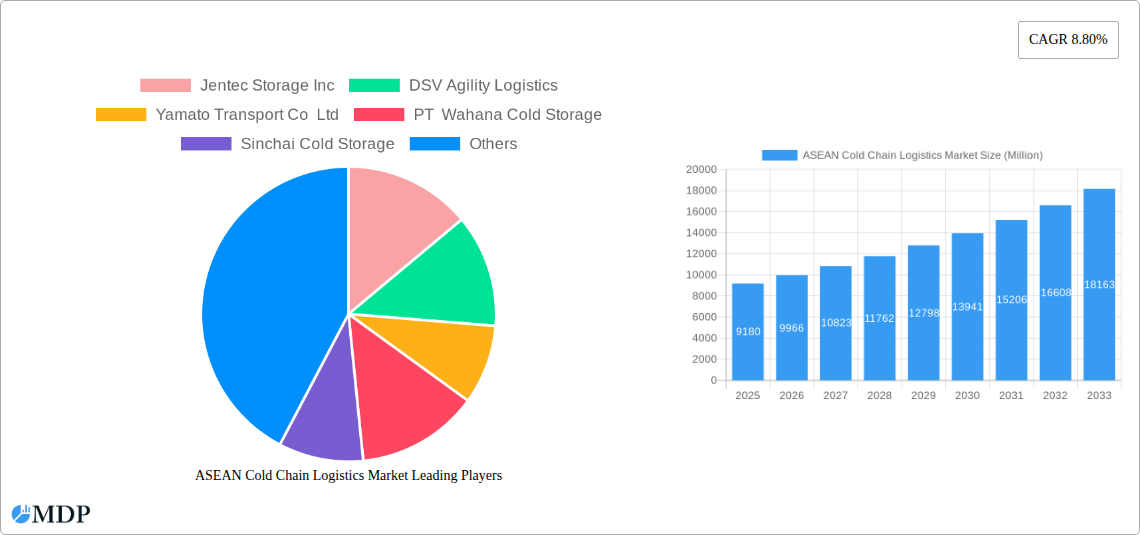

The market is segmented by service (storage, transportation, value-added services like blast freezing and inventory management), temperature (ambient, chilled, frozen), and application (horticulture, dairy, meat and fish, processed food, pharmaceuticals, life sciences, chemicals, and others). Major players like Jentec Storage Inc, DSV Agility Logistics, and Yamato Transport Co Ltd are actively shaping the market landscape through strategic investments, expansion initiatives, and technological advancements. Regional variations exist, with countries like Singapore and Thailand exhibiting relatively advanced cold chain infrastructure compared to others in the ASEAN region. The continued growth will depend on factors such as improving infrastructure in less developed areas, addressing regulatory hurdles, and fostering collaboration across the supply chain. Investment in technology and skilled workforce development will be crucial for sustained market expansion.

ASEAN Cold Chain Logistics Market Company Market Share

ASEAN Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the ASEAN cold chain logistics market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research to deliver actionable intelligence and precise forecasts. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

High-traffic keywords: ASEAN cold chain logistics, cold chain market ASEAN, cold chain logistics market size, ASEAN cold chain industry, cold chain transportation ASEAN, cold chain storage ASEAN, cold chain logistics companies ASEAN, ASEAN food cold chain, pharmaceutical cold chain ASEAN.

ASEAN Cold Chain Logistics Market Dynamics & Concentration

The ASEAN cold chain logistics market is experiencing dynamic growth, driven by factors such as rising disposable incomes, changing consumer preferences for fresh and processed food, and the burgeoning e-commerce sector. Market concentration is moderate, with several large multinational players competing alongside regional players. The market share of the top 5 players is estimated to be around xx%. Several key trends are shaping the market landscape:

- Innovation Drivers: Technological advancements in temperature-controlled transportation, sophisticated warehousing solutions (e.g., automated storage and retrieval systems), and advanced tracking and monitoring systems are boosting efficiency and reducing spoilage.

- Regulatory Frameworks: Government initiatives to improve infrastructure and implement stricter food safety regulations are creating both opportunities and challenges. Harmonization of regulations across ASEAN countries is crucial for smooth cross-border logistics.

- Product Substitutes: While direct substitutes are limited, pressure exists from alternative preservation methods for some products.

- End-User Trends: Growing demand for fresh, high-quality food products, especially in urban areas, is fueling growth. Increasing health consciousness is driving demand for temperature-sensitive pharmaceuticals and healthcare products.

- M&A Activities: The market has witnessed a moderate number of mergers and acquisitions (M&A) in recent years, approximately xx deals in the historical period (2019-2024), indicating consolidation and expansion efforts by key players.

ASEAN Cold Chain Logistics Market Industry Trends & Analysis

The ASEAN cold chain logistics market is characterized by significant growth, primarily driven by factors such as rising per capita income, rapid urbanization, and the expanding middle class. The market is experiencing a shift towards technologically advanced solutions, including IoT-enabled tracking and monitoring, predictive maintenance, and automation in warehouses. E-commerce growth and its associated demand for last-mile delivery of perishable goods are also major catalysts. The increasing awareness of food safety and hygiene standards is further propelling the adoption of advanced cold chain solutions. Competitive dynamics are intense, with both multinational and regional players vying for market share. Strategies include investments in infrastructure, technological upgrades, and strategic partnerships. The market penetration of advanced cold chain technologies is steadily increasing, with estimates suggesting a xx% penetration rate in 2025.

Leading Markets & Segments in ASEAN Cold Chain Logistics Market

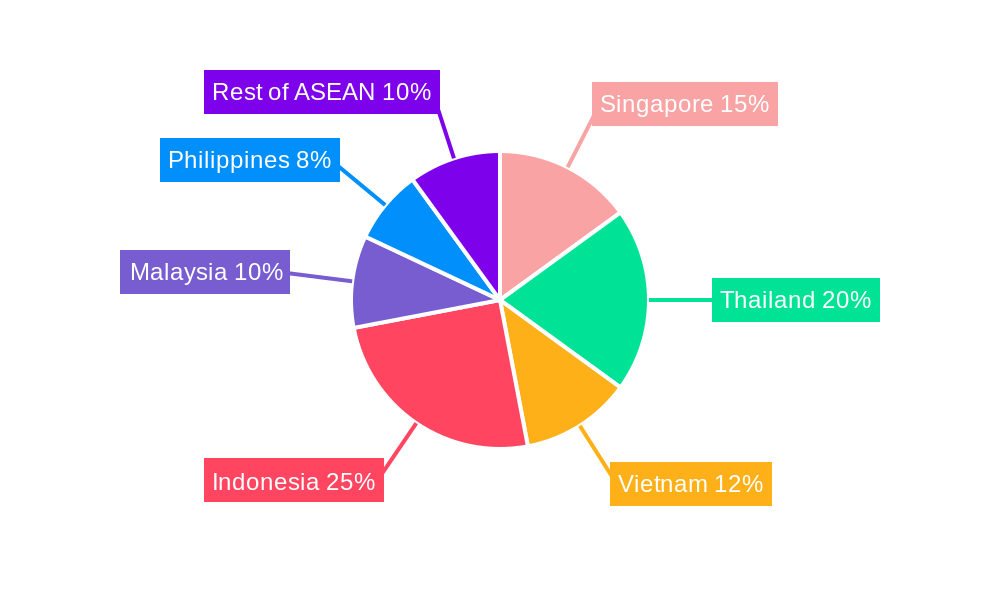

The ASEAN cold chain logistics market demonstrates significant variations across different regions, countries, and segments. While specific market share data for each segment isn't readily available, we can infer dominance based on existing market forces and country-specific consumption patterns.

Dominant Regions: Singapore, Thailand, and Malaysia are expected to lead the market due to their advanced infrastructure and strong economies. Indonesia, with its massive population and developing economy, shows significant growth potential.

By Service: Transportation is currently the largest segment, driven by the need to move perishable goods across vast distances. Storage is experiencing rapid growth due to increasing demands for specialized warehousing solutions. Value-added services are gaining traction, offering solutions like blast freezing, labeling, and inventory management.

By Temperature: The frozen segment dominates, followed by chilled, with ambient being the smallest. This reflects the significant demand for frozen food products and pharmaceuticals.

By Application: Horticulture, followed by dairy and meat products, are major segments. Pharmaceuticals and life sciences show high growth potential, spurred by increasing healthcare spending and the need for temperature-sensitive drug delivery. Specific driver examples include government investments in infrastructure for each country (xx for Thailand, xx for Vietnam, etc.) and economic policies promoting agricultural exports (xx initiatives in Malaysia).

ASEAN Cold Chain Logistics Market Product Developments

Recent product innovations include the use of IoT sensors for real-time monitoring of temperature and humidity, automated guided vehicles (AGVs) for efficient warehouse operations, and the development of specialized packaging materials to maintain product integrity. These advancements enhance efficiency, improve product quality, and reduce waste. These innovations are aligning with the increasing demand for traceability and stringent quality standards, especially in the pharmaceutical and food sectors.

Key Drivers of ASEAN Cold Chain Logistics Market Growth

Several factors contribute to the robust growth of the ASEAN cold chain logistics market:

- Technological Advancements: IoT, AI, and automation are enhancing efficiency and reducing costs.

- Economic Growth: Rising disposable incomes and increasing urbanization fuel demand for fresh and processed food.

- Regulatory Support: Government initiatives promoting food safety and infrastructure development create favorable conditions.

Challenges in the ASEAN Cold Chain Logistics Market Market

Several challenges hinder market growth:

- Inadequate Infrastructure: Lack of modern cold storage facilities and efficient transportation networks in some regions creates bottlenecks. The estimated impact of this is a xx% reduction in efficiency compared to more developed regions.

- Regulatory Inconsistencies: Differences in food safety regulations across ASEAN countries complicate cross-border trade.

- Competition: Intense competition amongst existing players puts pressure on margins.

Emerging Opportunities in ASEAN Cold Chain Logistics Market

The market offers several attractive opportunities:

- Technological Disruption: The adoption of blockchain technology and advanced analytics offers enhanced traceability and visibility throughout the supply chain.

- Strategic Partnerships: Collaborations between cold chain logistics providers and e-commerce platforms can unlock significant growth opportunities.

- Market Expansion: Untapped potential exists in less developed regions of ASEAN, offering significant growth potential for early entrants.

Leading Players in the ASEAN Cold Chain Logistics Market Sector

- Jentec Storage Inc

- DSV Agility Logistics

- Yamato Transport Co Ltd

- PT Wahana Cold Storage

- Sinchai Cold Storage

- KOSPA

- Nippon Express

- MGM Bosco

- Thai Max Co Ltd

- JWD Logistics

- NYK (Yusen Logitics & TASCO)

- United Parcel Service of America

- Tiong Nam Logistics

- PT Pluit Cold Storage

- Havi Logistics

- Royal Cargo

- Deutsche Post DHL

Key Milestones in ASEAN Cold Chain Logistics Market Industry

- November 2023: The YCH Group's strategic alliances with Shanghai Shine-link International Logistics and New Land-Sea Corridor Operation Co., Ltd. enhance access for Chinese companies entering the ASEAN market, potentially boosting cross-border trade volumes.

- September 2023: DP World's expansion into enhanced logistics and supply chain expertise in Southeast Asia signals increased investment and capacity building in the region, potentially improving efficiency and reducing logistical bottlenecks.

Strategic Outlook for ASEAN Cold Chain Logistics Market Market

The ASEAN cold chain logistics market presents significant growth potential, driven by sustained economic growth, rising consumer demand, and technological advancements. Strategic opportunities abound for companies that can leverage technological innovations, develop robust supply chain capabilities, and effectively navigate the regulatory landscape. Focusing on sustainable practices and building strong partnerships will be crucial for long-term success in this dynamic market.

ASEAN Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Ambient

- 2.2. Chilled

- 2.3. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats and Fish

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other Applications

-

4. Geography

- 4.1. Singapore

- 4.2. Thailand

- 4.3. Vietnam

- 4.4. Indonesia

- 4.5. Malaysia

- 4.6. Philippines

- 4.7. Rest of ASEAN

ASEAN Cold Chain Logistics Market Segmentation By Geography

- 1. Singapore

- 2. Thailand

- 3. Vietnam

- 4. Indonesia

- 5. Malaysia

- 6. Philippines

- 7. Rest of ASEAN

ASEAN Cold Chain Logistics Market Regional Market Share

Geographic Coverage of ASEAN Cold Chain Logistics Market

ASEAN Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for cold chain logistics4.; Expansion of international trade in the region

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of proper infrastructure and facilities4.; High cost associated to cold chain logistics

- 3.4. Market Trends

- 3.4.1. Hallal Food is offering traction to the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Ambient

- 5.2.2. Chilled

- 5.2.3. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats and Fish

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Singapore

- 5.4.2. Thailand

- 5.4.3. Vietnam

- 5.4.4. Indonesia

- 5.4.5. Malaysia

- 5.4.6. Philippines

- 5.4.7. Rest of ASEAN

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Singapore

- 5.5.2. Thailand

- 5.5.3. Vietnam

- 5.5.4. Indonesia

- 5.5.5. Malaysia

- 5.5.6. Philippines

- 5.5.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Singapore ASEAN Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Storage

- 6.1.2. Transportation

- 6.1.3. Value-ad

- 6.2. Market Analysis, Insights and Forecast - by Temperature

- 6.2.1. Ambient

- 6.2.2. Chilled

- 6.2.3. Frozen

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Horticulture (Fresh Fruits and Vegetables)

- 6.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 6.3.3. Meats and Fish

- 6.3.4. Processed Food Products

- 6.3.5. Pharma, Life Sciences, and Chemicals

- 6.3.6. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Singapore

- 6.4.2. Thailand

- 6.4.3. Vietnam

- 6.4.4. Indonesia

- 6.4.5. Malaysia

- 6.4.6. Philippines

- 6.4.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Thailand ASEAN Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Storage

- 7.1.2. Transportation

- 7.1.3. Value-ad

- 7.2. Market Analysis, Insights and Forecast - by Temperature

- 7.2.1. Ambient

- 7.2.2. Chilled

- 7.2.3. Frozen

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Horticulture (Fresh Fruits and Vegetables)

- 7.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 7.3.3. Meats and Fish

- 7.3.4. Processed Food Products

- 7.3.5. Pharma, Life Sciences, and Chemicals

- 7.3.6. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Singapore

- 7.4.2. Thailand

- 7.4.3. Vietnam

- 7.4.4. Indonesia

- 7.4.5. Malaysia

- 7.4.6. Philippines

- 7.4.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Vietnam ASEAN Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Storage

- 8.1.2. Transportation

- 8.1.3. Value-ad

- 8.2. Market Analysis, Insights and Forecast - by Temperature

- 8.2.1. Ambient

- 8.2.2. Chilled

- 8.2.3. Frozen

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Horticulture (Fresh Fruits and Vegetables)

- 8.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 8.3.3. Meats and Fish

- 8.3.4. Processed Food Products

- 8.3.5. Pharma, Life Sciences, and Chemicals

- 8.3.6. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Singapore

- 8.4.2. Thailand

- 8.4.3. Vietnam

- 8.4.4. Indonesia

- 8.4.5. Malaysia

- 8.4.6. Philippines

- 8.4.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Indonesia ASEAN Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Storage

- 9.1.2. Transportation

- 9.1.3. Value-ad

- 9.2. Market Analysis, Insights and Forecast - by Temperature

- 9.2.1. Ambient

- 9.2.2. Chilled

- 9.2.3. Frozen

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Horticulture (Fresh Fruits and Vegetables)

- 9.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 9.3.3. Meats and Fish

- 9.3.4. Processed Food Products

- 9.3.5. Pharma, Life Sciences, and Chemicals

- 9.3.6. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Singapore

- 9.4.2. Thailand

- 9.4.3. Vietnam

- 9.4.4. Indonesia

- 9.4.5. Malaysia

- 9.4.6. Philippines

- 9.4.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Malaysia ASEAN Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Storage

- 10.1.2. Transportation

- 10.1.3. Value-ad

- 10.2. Market Analysis, Insights and Forecast - by Temperature

- 10.2.1. Ambient

- 10.2.2. Chilled

- 10.2.3. Frozen

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Horticulture (Fresh Fruits and Vegetables)

- 10.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 10.3.3. Meats and Fish

- 10.3.4. Processed Food Products

- 10.3.5. Pharma, Life Sciences, and Chemicals

- 10.3.6. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Singapore

- 10.4.2. Thailand

- 10.4.3. Vietnam

- 10.4.4. Indonesia

- 10.4.5. Malaysia

- 10.4.6. Philippines

- 10.4.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Philippines ASEAN Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Storage

- 11.1.2. Transportation

- 11.1.3. Value-ad

- 11.2. Market Analysis, Insights and Forecast - by Temperature

- 11.2.1. Ambient

- 11.2.2. Chilled

- 11.2.3. Frozen

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Horticulture (Fresh Fruits and Vegetables)

- 11.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 11.3.3. Meats and Fish

- 11.3.4. Processed Food Products

- 11.3.5. Pharma, Life Sciences, and Chemicals

- 11.3.6. Other Applications

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Singapore

- 11.4.2. Thailand

- 11.4.3. Vietnam

- 11.4.4. Indonesia

- 11.4.5. Malaysia

- 11.4.6. Philippines

- 11.4.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Rest of ASEAN ASEAN Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Service

- 12.1.1. Storage

- 12.1.2. Transportation

- 12.1.3. Value-ad

- 12.2. Market Analysis, Insights and Forecast - by Temperature

- 12.2.1. Ambient

- 12.2.2. Chilled

- 12.2.3. Frozen

- 12.3. Market Analysis, Insights and Forecast - by Application

- 12.3.1. Horticulture (Fresh Fruits and Vegetables)

- 12.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 12.3.3. Meats and Fish

- 12.3.4. Processed Food Products

- 12.3.5. Pharma, Life Sciences, and Chemicals

- 12.3.6. Other Applications

- 12.4. Market Analysis, Insights and Forecast - by Geography

- 12.4.1. Singapore

- 12.4.2. Thailand

- 12.4.3. Vietnam

- 12.4.4. Indonesia

- 12.4.5. Malaysia

- 12.4.6. Philippines

- 12.4.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Service

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Jentec Storage Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 DSV Agility Logistics

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Yamato Transport Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 PT Wahana Cold Storage

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Sinchai Cold Storage

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 KOSPA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Nippon Express

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 MGM Bosco**List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Thai Max Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 JWD Logistics

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 NYK (Yusen Logitics & TASCO)

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 United Parcel Service of America

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Tiong Nam Logistics

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 PT Pluit Cold Storage

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Havi Logistics

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Royal Cargo

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Deutsche Post DHL

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.1 Jentec Storage Inc

List of Figures

- Figure 1: Global ASEAN Cold Chain Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Singapore ASEAN Cold Chain Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 3: Singapore ASEAN Cold Chain Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: Singapore ASEAN Cold Chain Logistics Market Revenue (Million), by Temperature 2025 & 2033

- Figure 5: Singapore ASEAN Cold Chain Logistics Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 6: Singapore ASEAN Cold Chain Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 7: Singapore ASEAN Cold Chain Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Singapore ASEAN Cold Chain Logistics Market Revenue (Million), by Geography 2025 & 2033

- Figure 9: Singapore ASEAN Cold Chain Logistics Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Singapore ASEAN Cold Chain Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 11: Singapore ASEAN Cold Chain Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Thailand ASEAN Cold Chain Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 13: Thailand ASEAN Cold Chain Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 14: Thailand ASEAN Cold Chain Logistics Market Revenue (Million), by Temperature 2025 & 2033

- Figure 15: Thailand ASEAN Cold Chain Logistics Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 16: Thailand ASEAN Cold Chain Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Thailand ASEAN Cold Chain Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Thailand ASEAN Cold Chain Logistics Market Revenue (Million), by Geography 2025 & 2033

- Figure 19: Thailand ASEAN Cold Chain Logistics Market Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Thailand ASEAN Cold Chain Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Thailand ASEAN Cold Chain Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Vietnam ASEAN Cold Chain Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 23: Vietnam ASEAN Cold Chain Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 24: Vietnam ASEAN Cold Chain Logistics Market Revenue (Million), by Temperature 2025 & 2033

- Figure 25: Vietnam ASEAN Cold Chain Logistics Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 26: Vietnam ASEAN Cold Chain Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 27: Vietnam ASEAN Cold Chain Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Vietnam ASEAN Cold Chain Logistics Market Revenue (Million), by Geography 2025 & 2033

- Figure 29: Vietnam ASEAN Cold Chain Logistics Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Vietnam ASEAN Cold Chain Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Vietnam ASEAN Cold Chain Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Indonesia ASEAN Cold Chain Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 33: Indonesia ASEAN Cold Chain Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 34: Indonesia ASEAN Cold Chain Logistics Market Revenue (Million), by Temperature 2025 & 2033

- Figure 35: Indonesia ASEAN Cold Chain Logistics Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 36: Indonesia ASEAN Cold Chain Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Indonesia ASEAN Cold Chain Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Indonesia ASEAN Cold Chain Logistics Market Revenue (Million), by Geography 2025 & 2033

- Figure 39: Indonesia ASEAN Cold Chain Logistics Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Indonesia ASEAN Cold Chain Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Indonesia ASEAN Cold Chain Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Malaysia ASEAN Cold Chain Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 43: Malaysia ASEAN Cold Chain Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 44: Malaysia ASEAN Cold Chain Logistics Market Revenue (Million), by Temperature 2025 & 2033

- Figure 45: Malaysia ASEAN Cold Chain Logistics Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 46: Malaysia ASEAN Cold Chain Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 47: Malaysia ASEAN Cold Chain Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 48: Malaysia ASEAN Cold Chain Logistics Market Revenue (Million), by Geography 2025 & 2033

- Figure 49: Malaysia ASEAN Cold Chain Logistics Market Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Malaysia ASEAN Cold Chain Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Malaysia ASEAN Cold Chain Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 52: Philippines ASEAN Cold Chain Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 53: Philippines ASEAN Cold Chain Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 54: Philippines ASEAN Cold Chain Logistics Market Revenue (Million), by Temperature 2025 & 2033

- Figure 55: Philippines ASEAN Cold Chain Logistics Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 56: Philippines ASEAN Cold Chain Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 57: Philippines ASEAN Cold Chain Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Philippines ASEAN Cold Chain Logistics Market Revenue (Million), by Geography 2025 & 2033

- Figure 59: Philippines ASEAN Cold Chain Logistics Market Revenue Share (%), by Geography 2025 & 2033

- Figure 60: Philippines ASEAN Cold Chain Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Philippines ASEAN Cold Chain Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Rest of ASEAN ASEAN Cold Chain Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 63: Rest of ASEAN ASEAN Cold Chain Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 64: Rest of ASEAN ASEAN Cold Chain Logistics Market Revenue (Million), by Temperature 2025 & 2033

- Figure 65: Rest of ASEAN ASEAN Cold Chain Logistics Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 66: Rest of ASEAN ASEAN Cold Chain Logistics Market Revenue (Million), by Application 2025 & 2033

- Figure 67: Rest of ASEAN ASEAN Cold Chain Logistics Market Revenue Share (%), by Application 2025 & 2033

- Figure 68: Rest of ASEAN ASEAN Cold Chain Logistics Market Revenue (Million), by Geography 2025 & 2033

- Figure 69: Rest of ASEAN ASEAN Cold Chain Logistics Market Revenue Share (%), by Geography 2025 & 2033

- Figure 70: Rest of ASEAN ASEAN Cold Chain Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 71: Rest of ASEAN ASEAN Cold Chain Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 8: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 13: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 17: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 18: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 22: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 23: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 27: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 28: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 29: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 32: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 33: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 35: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 37: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 38: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 40: Global ASEAN Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Cold Chain Logistics Market?

The projected CAGR is approximately 8.80%.

2. Which companies are prominent players in the ASEAN Cold Chain Logistics Market?

Key companies in the market include Jentec Storage Inc, DSV Agility Logistics, Yamato Transport Co Ltd, PT Wahana Cold Storage, Sinchai Cold Storage, KOSPA, Nippon Express, MGM Bosco**List Not Exhaustive, Thai Max Co Ltd, JWD Logistics, NYK (Yusen Logitics & TASCO), United Parcel Service of America, Tiong Nam Logistics, PT Pluit Cold Storage, Havi Logistics, Royal Cargo, Deutsche Post DHL.

3. What are the main segments of the ASEAN Cold Chain Logistics Market?

The market segments include Service, Temperature, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.18 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for cold chain logistics4.; Expansion of international trade in the region.

6. What are the notable trends driving market growth?

Hallal Food is offering traction to the market.

7. Are there any restraints impacting market growth?

4.; Lack of proper infrastructure and facilities4.; High cost associated to cold chain logistics.

8. Can you provide examples of recent developments in the market?

November 2023: The YCH Group disclosed strategic alliances with Shanghai Shine-link International Logistics and New Land-Sea Corridor Operation Co., Ltd, providing advantages for Chinese companies seeking expansion into the ASEAN market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the ASEAN Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence