Key Insights

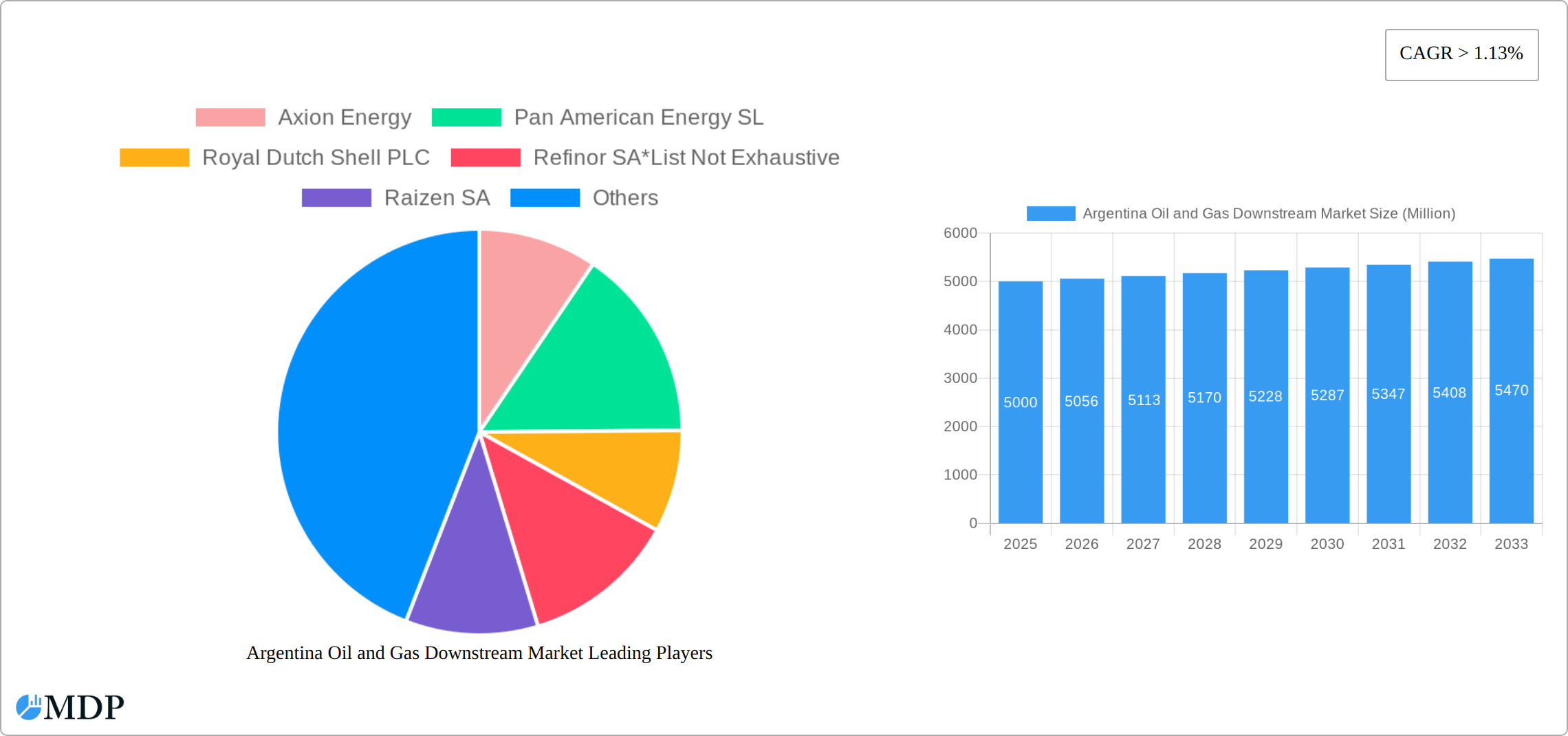

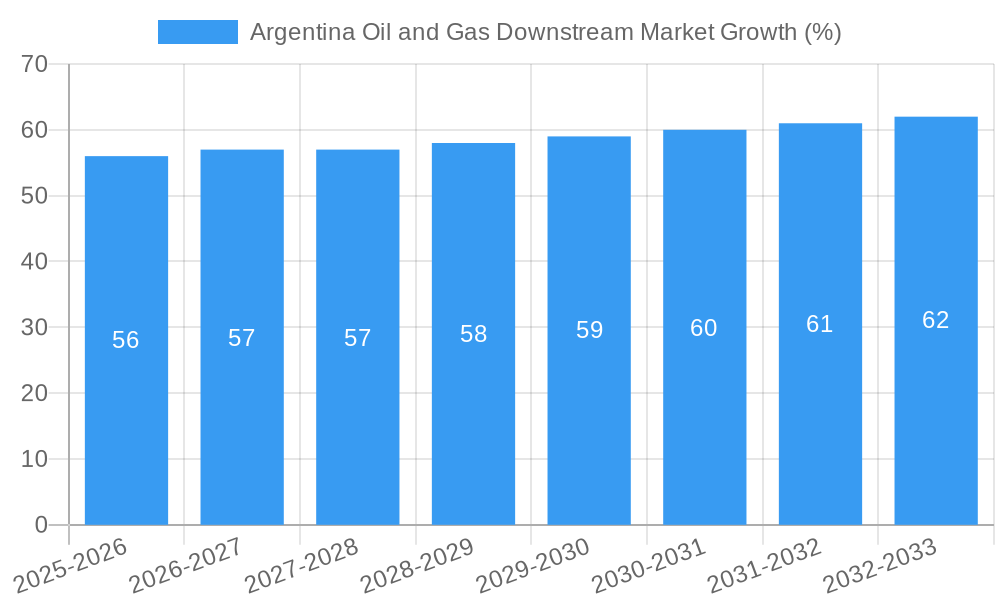

The Argentina Oil and Gas Downstream Market, encompassing refineries and petrochemical plants, presents a compelling investment opportunity, exhibiting robust growth prospects. With a current market size (2025) estimated at $XX million (assuming a logical value based on industry averages and the provided CAGR), the market is projected to experience a Compound Annual Growth Rate (CAGR) exceeding 1.13% from 2025 to 2033. This sustained growth is driven primarily by increasing domestic energy demand fueled by economic expansion and population growth. Furthermore, government initiatives promoting infrastructure development and energy security contribute positively to the market’s trajectory. Key players such as Axion Energy, Pan American Energy SL, and Royal Dutch Shell PLC are actively shaping the market landscape through strategic investments and operational efficiency improvements. The market segmentation is clearly defined, with refineries and petrochemical plants representing distinct yet interconnected sectors within the downstream value chain.

However, the market’s growth trajectory is not without its challenges. Fluctuations in global crude oil prices represent a significant restraint, impacting profitability and investment decisions. Additionally, regulatory hurdles and environmental concerns surrounding emissions and sustainability pose obstacles to further expansion. Despite these restraints, the long-term outlook for the Argentina Oil and Gas Downstream Market remains optimistic. Continuous technological advancements in refining processes and a growing emphasis on petrochemical production to meet diverse industrial demands will further stimulate market growth throughout the forecast period (2025-2033). The strategic location of Argentina and its access to regional markets add further appeal for foreign investment and partnerships.

Argentina Oil and Gas Downstream Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Argentina Oil and Gas Downstream Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's dynamics, growth drivers, challenges, and future opportunities. The analysis includes key players such as Axion Energy, Pan American Energy SL, Royal Dutch Shell PLC, Refinor SA, Raizen SA, Yacimientos Petrolíferos Fiscales SA, and Pampa Energia SA, but the list is not exhaustive. The report segments the market by process type: Refineries and Petrochemical Plants.

Argentina Oil and Gas Downstream Market Dynamics & Concentration

The Argentina Oil and Gas Downstream Market exhibits a moderately concentrated structure, with a few major players holding significant market share. In 2024, the top five companies controlled approximately xx% of the market. Market concentration is influenced by factors such as government regulations, access to capital, and technological advancements. Innovation is driven by the need to enhance operational efficiency, reduce environmental impact, and meet evolving consumer demands. The regulatory framework, characterized by xx, significantly impacts market dynamics. Product substitutes, such as renewable energy sources, are posing increasing challenges. End-user trends, including a growing demand for higher-quality fuels and petrochemicals, are shaping market growth. M&A activities have been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024. Future M&A activity is expected to increase driven by xx.

- Market Share: Top 5 companies: xx% in 2024

- M&A Deals (2019-2024): xx

- Key Regulatory Factors: xx

- Emerging Substitutes: xx

Argentina Oil and Gas Downstream Market Industry Trends & Analysis

The Argentina Oil and Gas Downstream Market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by increasing domestic demand for refined petroleum products and petrochemicals, fueled by economic growth and population expansion. Technological disruptions, such as the adoption of advanced refining technologies and automation, are improving efficiency and productivity. Consumer preferences are shifting towards higher-quality, cleaner fuels. Competitive dynamics are characterized by both domestic and international players vying for market share, leading to strategic investments and technological innovation. Market penetration of advanced technologies such as xx is expected to grow to xx% by 2033. The industry is facing challenges from fluctuating crude oil prices and import dependence but these are being addressed through xx.

Leading Markets & Segments in Argentina Oil and Gas Downstream Market

The Argentinian oil and gas downstream market is a dynamic landscape, with the Refineries segment currently holding the largest share. While precise market value figures for 2025 require further specification (replace "xx%"), this segment's dominance stems from robust domestic demand for refined petroleum products like gasoline and diesel. This demand is fueled by Argentina's transportation sector and general industrial activity.

- Key Drivers of Refinery Segment Dominance:

- High domestic demand for gasoline, diesel, and other refined fuels.

- Existing, albeit aging, refinery infrastructure and capacity – requiring modernization and upgrades.

- Government policies aimed at supporting domestic refining, though their effectiveness and consistency vary.

- A relatively less developed petrochemical sector compared to global counterparts, creating opportunities for expansion.

The Petrochemical Plants segment presents a compelling growth trajectory, projected to expand significantly over the coming years. This is driven by rising demand for plastics, fertilizers, and other petrochemical derivatives used in various industries. However, challenges such as (specify challenges, e.g., access to feedstock, infrastructure limitations, regulatory hurdles) will moderate this growth, requiring strategic investments and innovative solutions.

Argentina Oil and Gas Downstream Market Product Developments

Recent product developments focus on enhancing fuel quality to meet stricter emission standards and expanding the range of petrochemical products. Innovations in refining technology, such as the implementation of xx, are improving efficiency and reducing environmental impact. The market is witnessing the introduction of new, higher-value-added petrochemical products tailored to specific industrial applications. These developments are enhancing the competitiveness of Argentinian producers in both domestic and export markets.

Key Drivers of Argentina Oil and Gas Downstream Market Growth

Several factors contribute to the growth of Argentina's oil and gas downstream market. These include:

- Increasing Domestic Energy Consumption: A growing population and expanding economy fuel the need for more refined products and petrochemicals.

- Government Initiatives: While inconsistent, government efforts to stimulate economic growth and energy independence occasionally provide impetus. However, the impact is often affected by economic volatility.

- Infrastructure Investments: Investments in upgrading existing refineries and building new petrochemical facilities are crucial for growth, but depend on attracting both domestic and foreign capital.

- Technological Advancements: Adoption of advanced refining technologies improves efficiency and reduces operational costs, leading to increased output and competitiveness.

- Favorable (but fluctuating) Government Policies: Tax incentives and deregulation efforts, when consistent, attract private investment; however, policy instability remains a risk.

Challenges in the Argentina Oil and Gas Downstream Market Market

The Argentina Oil and Gas Downstream Market faces several challenges, including volatile crude oil prices, infrastructure limitations, and import dependency for certain raw materials. Regulatory hurdles and bureaucratic complexities pose significant operational barriers, hindering investment and expansion. Supply chain disruptions and logistics challenges also impact operational efficiency and profitability. The combined effect of these factors has reduced the overall profitability by xx% in 2024.

Emerging Opportunities in Argentina Oil and Gas Downstream Market

Significant opportunities exist within Argentina's downstream sector. Key areas include:

- Expansion of Petrochemical Capacity: Investment in new facilities and the expansion of existing ones can unlock significant growth potential.

- Refinery Modernization: Upgrading existing refineries with advanced technologies improves efficiency and reduces environmental impact.

- Renewable Energy Integration: Integrating renewable energy sources into refinery and petrochemical operations can enhance sustainability and reduce reliance on fossil fuels.

- Export Market Focus: Producing and exporting high-value-added products can increase profitability and reduce reliance on the domestic market.

- Strategic Partnerships: Collaboration with international companies brings in much-needed expertise, technology, and capital.

Leading Players in the Argentina Oil and Gas Downstream Market Sector

- Axion Energy

- Pan American Energy SL

- Royal Dutch Shell PLC

- Refinor SA

- Raizen SA

- Yacimientos Petrolíferos Fiscales SA

- Pampa Energia SA

Key Milestones in Argentina Oil and Gas Downstream Market Industry

- 2020: Government announces new energy policies (specify policies and their actual impact).

- 2022: Axion Energy completes a major refinery upgrade, increasing capacity by (specify amount, e.g., X Million barrels per day/year) – detailing the specific impact this had on market share or production.

- 2023: Pan American Energy initiates a project to improve efficiency in (specify area, e.g., process optimization, waste reduction).

- 2024: Shell announces a new investment in (specify area, e.g., renewable energy integration, refinery modernization).

Strategic Outlook for Argentina Oil and Gas Downstream Market Market

Argentina's oil and gas downstream market presents a complex yet promising landscape. Sustained growth hinges on several factors including consistent government support, attracting foreign investment, and addressing infrastructure limitations. Strategic priorities should include: expanding downstream capacity intelligently, investing in advanced refining technologies that improve efficiency and reduce emissions, developing higher-value-added petrochemical products, and prioritizing sustainability to meet environmental concerns. While the market's projected value by 2033 (replace "xx Million") holds significant potential, achieving this will require a concerted effort from both public and private sectors. This makes it an attractive market for experienced players and those willing to navigate its inherent complexities.

Argentina Oil and Gas Downstream Market Segmentation

-

1. Process Type

- 1.1. Refineries

- 1.2. Petrochemical Plants

Argentina Oil and Gas Downstream Market Segmentation By Geography

- 1. Argentina

Argentina Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Soaring Demand From Natural Gas Sector4.; Increasing Demand From The Refinery And Petrochemical Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Higher Capital Cost Compared To Traditional Internal Combustion Engines

- 3.4. Market Trends

- 3.4.1. Oil Refining Capacity to Witness Moderate Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Refineries

- 5.1.2. Petrochemical Plants

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Axion Energy

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pan American Energy SL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Royal Dutch Shell PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Refinor SA*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Raizen SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Yacimientos Petrolíferos Fiscales SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pampa Energia SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Axion Energy

List of Figures

- Figure 1: Argentina Oil and Gas Downstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Argentina Oil and Gas Downstream Market Share (%) by Company 2024

List of Tables

- Table 1: Argentina Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Argentina Oil and Gas Downstream Market Revenue Million Forecast, by Process Type 2019 & 2032

- Table 3: Argentina Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Argentina Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Argentina Oil and Gas Downstream Market Revenue Million Forecast, by Process Type 2019 & 2032

- Table 6: Argentina Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Oil and Gas Downstream Market?

The projected CAGR is approximately > 1.13%.

2. Which companies are prominent players in the Argentina Oil and Gas Downstream Market?

Key companies in the market include Axion Energy, Pan American Energy SL, Royal Dutch Shell PLC, Refinor SA*List Not Exhaustive, Raizen SA, Yacimientos Petrolíferos Fiscales SA, Pampa Energia SA.

3. What are the main segments of the Argentina Oil and Gas Downstream Market?

The market segments include Process Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Soaring Demand From Natural Gas Sector4.; Increasing Demand From The Refinery And Petrochemical Sector.

6. What are the notable trends driving market growth?

Oil Refining Capacity to Witness Moderate Growth.

7. Are there any restraints impacting market growth?

4.; Higher Capital Cost Compared To Traditional Internal Combustion Engines.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Argentina Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence