Key Insights

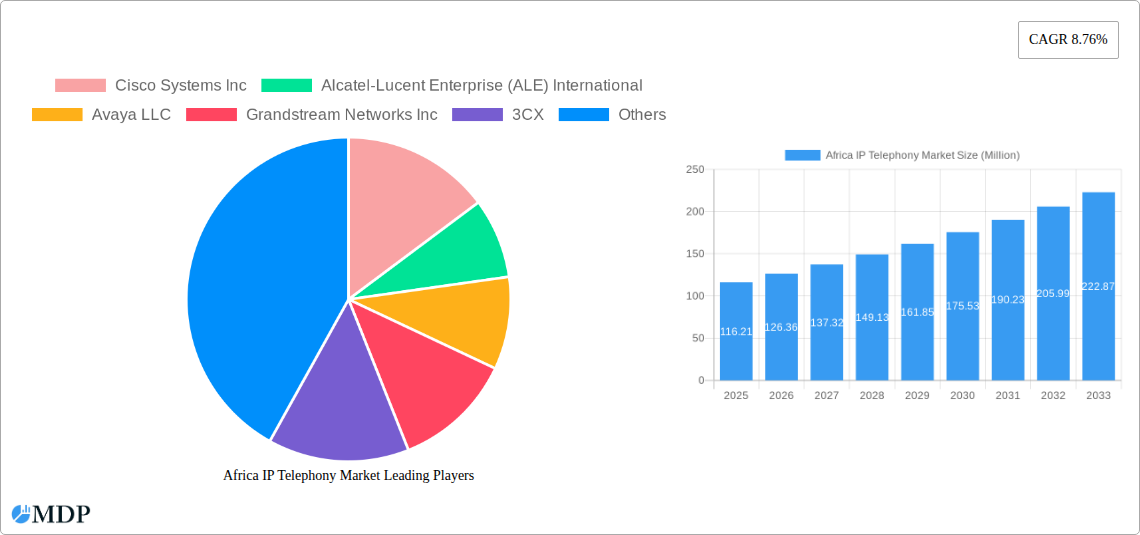

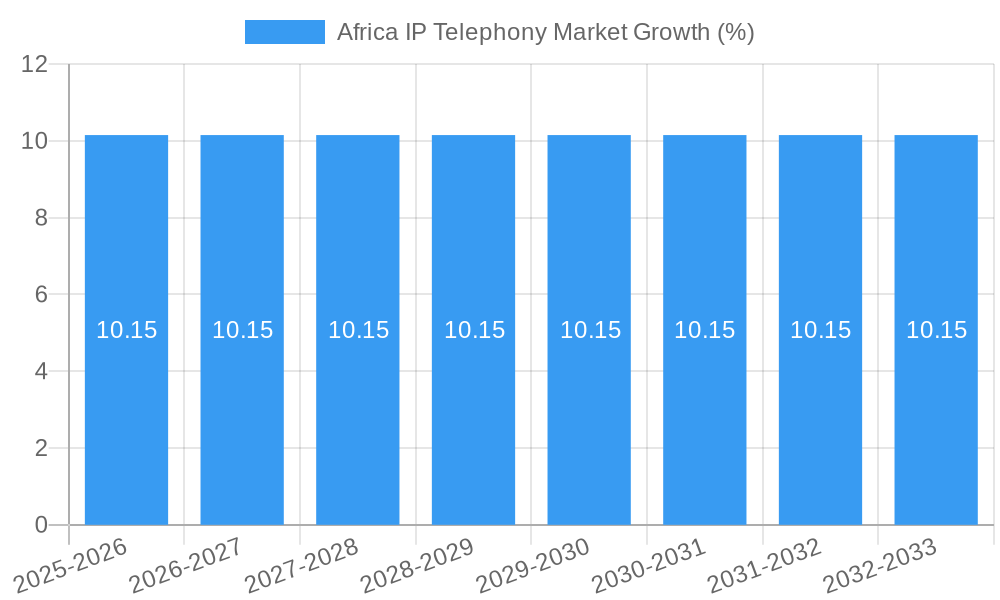

The Africa IP Telephony market is experiencing robust growth, projected to reach a market size of $116.21 million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 8.76% from 2019 to 2033. This expansion is driven by several key factors. Increased internet penetration and mobile network infrastructure improvements across the continent are creating a conducive environment for the adoption of IP telephony systems. Businesses, particularly in rapidly developing urban centers, are increasingly seeking cost-effective and feature-rich communication solutions, making IP telephony a compelling alternative to traditional PBX systems. The rising demand for enhanced communication features such as video conferencing, unified communications, and improved call management capabilities further fuels market growth. Moreover, government initiatives promoting digital transformation and technological advancements are encouraging the uptake of IP telephony solutions across various sectors, including healthcare, education, and finance. The competitive landscape is dynamic, with established players like Cisco Systems, Alcatel-Lucent Enterprise, and Avaya competing alongside emerging vendors like Grandstream and 3CX. This competition fosters innovation and drives down costs, making IP telephony more accessible to a broader range of businesses and organizations.

The market's growth trajectory is expected to remain positive throughout the forecast period (2025-2033). However, challenges remain. Limited digital literacy in certain regions and the high upfront investment costs associated with implementing IP telephony systems could hinder adoption in some areas. Furthermore, ensuring reliable power supply and internet connectivity across the diverse geographical landscape of Africa poses a significant operational hurdle. Despite these challenges, the long-term outlook for the African IP telephony market is optimistic. Continued investments in infrastructure, growing digitalization efforts, and increasing demand for advanced communication solutions will propel market expansion in the coming years. The segmentations within the market (not provided in initial data) likely include various system types (cloud-based, on-premise), industry verticals served, and types of users (small businesses, enterprises). Further research into these aspects would provide more detailed market insights.

Africa IP Telephony Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Africa IP Telephony Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, industry trends, leading players, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Africa IP Telephony Market Market Dynamics & Concentration

This section delves into the competitive landscape of the African IP telephony market, analyzing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and merger and acquisition (M&A) activities. The market is characterized by a moderate level of concentration, with a few major players holding significant market share. However, the presence of numerous smaller, specialized vendors contributes to a dynamic and competitive environment.

Market Concentration: The top 5 players account for approximately xx% of the market share in 2025. This indicates a moderately concentrated market with opportunities for both established players and new entrants. The market share of each leading player is expected to fluctuate in response to technological advancements and market demand.

Innovation Drivers: Ongoing advancements in VoIP technology, the increasing adoption of cloud-based solutions, and the growing demand for unified communications are key innovation drivers. The integration of AI and machine learning capabilities within IP telephony systems is further pushing innovation and value creation.

Regulatory Frameworks: Varying regulatory environments across African nations pose both challenges and opportunities. Harmonization of regulations and policies relating to licensing, data privacy and cybersecurity will significantly influence market growth.

Product Substitutes: The market faces competition from alternative communication technologies, including mobile messaging applications and social media platforms. These substitutes present challenges, however, the need for secure and reliable business communications for both individual and commercial purposes continues to drive demand for IP telephony solutions.

End-User Trends: The increasing adoption of IP telephony across various sectors, including BFSI (Banking, Financial Services and Insurance), healthcare, government, and education, is a major growth catalyst. The demand is growing from both large enterprises and SMEs in several key African nations. Moreover, the shift towards remote working and the need for improved connectivity fuels the market expansion.

M&A Activities: The number of M&A deals in the African IP telephony market has witnessed a steady increase during the historical period (2019-2024) with xx deals recorded. These activities reflect the consolidation and expansion strategies of leading players.

Africa IP Telephony Market Industry Trends & Analysis

This section provides a detailed analysis of the factors driving market growth, technological disruptions, evolving consumer preferences, and competitive dynamics within the African IP telephony market. Market expansion is propelled by factors such as increasing internet penetration, rising smartphone adoption, and the growing demand for advanced communication solutions.

The market is experiencing significant technological disruptions driven by the rise of cloud-based IP telephony services, the integration of artificial intelligence (AI), the deployment of 5G networks and the growing adoption of Unified Communications as a Service (UCaaS). Consumer preferences are shifting towards flexible, scalable, and cost-effective solutions with enhanced features such as video conferencing and mobile integration. The competitive landscape is characterized by both established players and emerging technology companies competing for market share.

The market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033. Market penetration remains relatively low in many parts of Africa, presenting significant opportunities for expansion. However, factors such as infrastructural limitations and affordability concerns are acting as constraints.

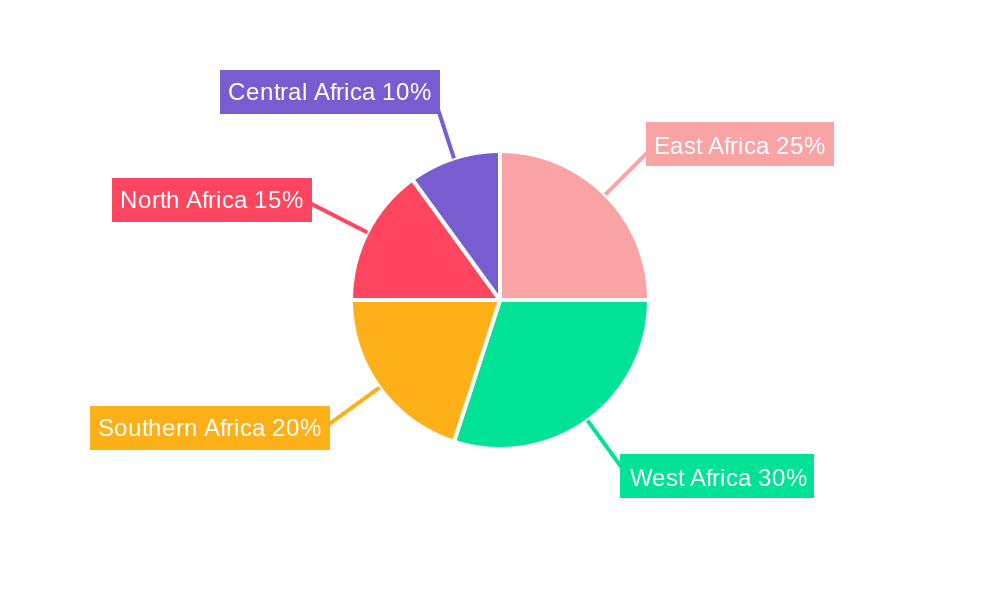

Leading Markets & Segments in Africa IP Telephony Market

This section identifies the dominant regions, countries, and segments within the African IP telephony market. The detailed analysis highlights key factors driving growth in each region and segment.

- Dominant Regions: South Africa, Nigeria, Kenya, and Egypt are the leading markets for IP telephony in Africa, driven by strong economic growth, expanding telecommunications infrastructure, and a growing adoption of advanced communication technologies.

- Key Drivers:

- Economic Growth: Robust economic growth in several African nations fuels demand for advanced communication solutions.

- Government Initiatives: Government initiatives supporting ICT infrastructure development and digital transformation play a pivotal role in propelling the adoption of IP telephony.

- Expanding Infrastructure: The expansion of mobile networks and broadband connectivity is crucial for IP telephony deployment.

- Increased Smartphone Penetration: Increased smartphone penetration enhances the accessibility and usage of IP telephony.

- Favorable Regulatory Environment: Supportive regulations create a favorable environment for investment and market growth.

Detailed dominance analysis of each of the key markets is presented in the full report.

Africa IP Telephony Market Product Developments

Significant advancements in IP telephony technology include the development of cloud-based solutions, enhanced integration with mobile devices, and the incorporation of AI-powered features such as voice recognition and automated call routing. These product innovations enable businesses and individuals to communicate more effectively and efficiently, aligning with evolving market demands for seamless and integrated communication solutions.

Key Drivers of Africa IP Telephony Market Growth

Several key factors fuel the growth of the African IP telephony market. These include:

- Technological Advancements: The continuous development of sophisticated IP telephony solutions, including cloud-based services and integration with mobile devices, is a primary driver.

- Economic Growth: The increasing economic activity in various sectors of the African economy creates demand for reliable and efficient communication technologies.

- Government Initiatives: Government initiatives promoting ICT development and digital transformation foster the adoption of IP telephony.

- Rising Internet and Mobile Penetration: Widespread adoption of mobile phones and internet access is a crucial enabler for IP telephony growth.

Challenges in the Africa IP Telephony Market Market

Several factors hinder the growth of the African IP telephony market:

- Infrastructure Gaps: Inadequate telecommunications infrastructure in some parts of Africa presents a challenge to seamless IP telephony implementation.

- Affordability Concerns: The high cost of IP telephony services and equipment remains a barrier for adoption among many users.

- Cybersecurity Risks: The threat of cyberattacks and data breaches presents security challenges that need addressing.

- Regulatory Hurdles: Complex and inconsistent regulatory frameworks across different African countries create uncertainty and hinder investment.

Emerging Opportunities in Africa IP Telephony Market

Significant opportunities exist in the African IP telephony market. These include:

- Expansion of 5G Networks: The widespread adoption of 5G networks will facilitate increased bandwidth and improved reliability, paving the way for advanced IP telephony applications.

- Growth of Cloud-Based Solutions: Cloud-based IP telephony solutions are becoming increasingly popular, offering scalability and cost-effectiveness.

- Increased Adoption of Unified Communications: The convergence of various communication channels into unified platforms creates significant opportunities for market growth.

- Strategic Partnerships: Partnerships between technology providers and local telecommunication companies drive market penetration.

Leading Players in the Africa IP Telephony Market Sector

- Cisco Systems Inc

- Alcatel-Lucent Enterprise (ALE) International

- Avaya LLC

- Grandstream Networks Inc

- 3CX

- Google Inc

- Logitech South Africa

- Yealink SA

- Comms Partner (Pty) Ltd

- AVICOM

- Unify (Mitel)

- List Not Exhaustive

Key Milestones in Africa IP Telephony Market Industry

- April 2024: MTN Group and Huawei unveil the Technology Innovation Lab, focusing on 5G, AI, and cloud computing, enhancing Africa's digital infrastructure.

- May 2024: The Next-Gen Infrastructure Company (NGIC) joint venture, involving Ascend Digital, K-NET, Radisys, Nokia, Tech Mahindra, the Ghanaian government, and MNOs, secures a 5G license for nationwide rollout by the end of 2024, with plans for regional expansion.

Strategic Outlook for Africa IP Telephony Market Market

The African IP telephony market presents substantial growth potential driven by technological advancements, economic expansion, and rising internet penetration. Strategic partnerships, investments in infrastructure, and the adoption of innovative business models are key accelerators for future market growth. The focus on affordable and accessible solutions tailored to the diverse needs of the African market will be crucial for maximizing the market's potential.

Africa IP Telephony Market Segmentation

-

1. Enterprise Size

- 1.1. Small an

- 1.2. Large Enterprises (more than 500 employees)

Africa IP Telephony Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa IP Telephony Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for audio and video conferencing solutions; Changing workforce dynamics leading to the emergence of advanced devices of enterprise collaboration

- 3.3. Market Restrains

- 3.3.1. Rising demand for audio and video conferencing solutions; Changing workforce dynamics leading to the emergence of advanced devices of enterprise collaboration

- 3.4. Market Trends

- 3.4.1. Rising Demand for Audio and Video Conferencing Solutions is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa IP Telephony Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.1.1. Small an

- 5.1.2. Large Enterprises (more than 500 employees)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cisco Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alcatel-Lucent Enterprise (ALE) International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Avaya LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Grandstream Networks Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3CX

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Google Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Logitech South Africa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yealink SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Comms Partner (Pty) Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AVICOM

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Unify (Mitel)*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cisco Systems Inc

List of Figures

- Figure 1: Africa IP Telephony Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa IP Telephony Market Share (%) by Company 2024

List of Tables

- Table 1: Africa IP Telephony Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa IP Telephony Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Africa IP Telephony Market Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 4: Africa IP Telephony Market Volume Million Forecast, by Enterprise Size 2019 & 2032

- Table 5: Africa IP Telephony Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa IP Telephony Market Volume Million Forecast, by Region 2019 & 2032

- Table 7: Africa IP Telephony Market Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 8: Africa IP Telephony Market Volume Million Forecast, by Enterprise Size 2019 & 2032

- Table 9: Africa IP Telephony Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Africa IP Telephony Market Volume Million Forecast, by Country 2019 & 2032

- Table 11: Nigeria Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Nigeria Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 13: South Africa Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: Egypt Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Egypt Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: Kenya Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kenya Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: Ethiopia Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Ethiopia Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: Morocco Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Morocco Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Ghana Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ghana Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Algeria Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Algeria Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: Tanzania Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Tanzania Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 29: Ivory Coast Africa IP Telephony Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Ivory Coast Africa IP Telephony Market Volume (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa IP Telephony Market?

The projected CAGR is approximately 8.76%.

2. Which companies are prominent players in the Africa IP Telephony Market?

Key companies in the market include Cisco Systems Inc, Alcatel-Lucent Enterprise (ALE) International, Avaya LLC, Grandstream Networks Inc, 3CX, Google Inc, Logitech South Africa, Yealink SA, Comms Partner (Pty) Ltd, AVICOM, Unify (Mitel)*List Not Exhaustive.

3. What are the main segments of the Africa IP Telephony Market?

The market segments include Enterprise Size .

4. Can you provide details about the market size?

The market size is estimated to be USD 116.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for audio and video conferencing solutions; Changing workforce dynamics leading to the emergence of advanced devices of enterprise collaboration.

6. What are the notable trends driving market growth?

Rising Demand for Audio and Video Conferencing Solutions is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Rising demand for audio and video conferencing solutions; Changing workforce dynamics leading to the emergence of advanced devices of enterprise collaboration.

8. Can you provide examples of recent developments in the market?

May 2024: Ascend Digital, K-NET, Radisys, Nokia, and Tech Mahindra, in collaboration with the Government of Ghana and MNOs (mobile network operators) AT Ghana and Telecel Ghana, unveiled their joint venture, the Next-Gen Infrastructure Company (NGIC). This strategic partnership aims to democratize 5G mobile broadband services in Ghana. NGIC secured its 5G license and is slated to roll out 5G services nationwide in Ghana by the end of 2024, with plans for subsequent expansion into other African regions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa IP Telephony Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa IP Telephony Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa IP Telephony Market?

To stay informed about further developments, trends, and reports in the Africa IP Telephony Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence