Key Insights

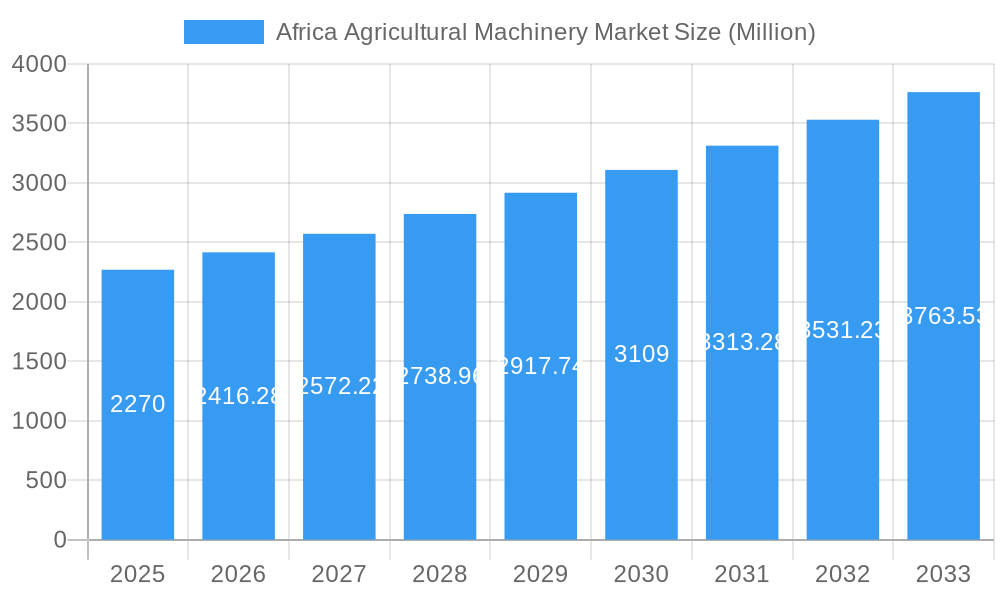

The Africa Agricultural Machinery Market is poised for significant growth, projected to reach a market size of $2.27 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 6.40% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing government initiatives across many African nations focused on agricultural modernization and food security are fueling demand for advanced machinery. Secondly, the rising adoption of improved farming techniques and precision agriculture, coupled with favorable climate conditions in certain regions, is boosting productivity and, consequently, the need for efficient agricultural equipment. Thirdly, a growing young and entrepreneurial farming population is embracing mechanization to enhance efficiency and profitability. Finally, access to financing and leasing options for agricultural machinery is improving, making it more affordable for farmers. However, challenges remain. High initial investment costs, inadequate infrastructure in some areas hindering the timely delivery and maintenance of equipment, and a lack of skilled operators pose constraints to market growth. Furthermore, reliance on rainfall in several regions makes agricultural production susceptible to climatic variations, impacting demand fluctuations.

Africa Agricultural Machinery Market Market Size (In Billion)

Despite these constraints, the market segmentation reveals significant potential. Tractors, planting and fertilizing machinery, and harvesting machinery segments are expected to lead the growth, driven by increasing demand for improved crop yields and efficiency across various agricultural sectors. Key players such as Deere & Company, AGCO Corporation, and Mahindra & Mahindra Ltd. are strategically investing in the region, focusing on developing robust distribution networks and offering tailored solutions to address the unique needs of African farmers. The expansion within specific countries like South Africa, Kenya, and Tanzania presents lucrative opportunities, while the "Rest of Africa" segment holds considerable untapped potential, albeit with its own set of unique challenges. Future growth will depend on overcoming infrastructure limitations, enhancing farmer training programs, and developing financing mechanisms to support widespread adoption of agricultural machinery.

Africa Agricultural Machinery Market Company Market Share

Africa Agricultural Machinery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Africa Agricultural Machinery Market, offering valuable insights for industry stakeholders, investors, and policymakers. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033 and a base year of 2025. The market is segmented by product type, encompassing tractors, plowing and cultivating machinery, planting and fertilizing machinery, harvesting machinery, haying and forage machinery, irrigation machinery, and other product types. Key players shaping the market landscape include Kuhn Group, Deere & Company, Kverneland AS, AGCO Corporation, CNH Industrial NV, Mahindra & Mahindra Ltd, Tractors and Farm Equipment Limited (TAFE), Claas KGaA mbH, Kubota Agricultural Machinery, Lindsay Corporation, Escorts Group, and J C Bamford Excavators Limited. The report projects a market value exceeding xx Million by 2033.

Africa Agricultural Machinery Market Market Dynamics & Concentration

The Africa Agricultural Machinery Market is characterized by a dynamic interplay of factors influencing its concentration and growth trajectory. While xx% market share is currently held by the top 5 players, increasing investments and government initiatives are fostering the entry of new players and enhancing competition.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players and several smaller regional players. Market share data reveals a concentration ratio of xx for the top 5 players in 2024, indicating the presence of both established and emerging players.

- Innovation Drivers: Technological advancements in precision farming, automation, and data analytics are driving innovation within the sector, leading to the development of more efficient and productive machinery.

- Regulatory Frameworks: Government policies promoting agricultural modernization, mechanization, and investment in rural infrastructure play a significant role in market expansion. However, inconsistent regulatory environments across different African countries can create challenges for businesses.

- Product Substitutes: While technologically advanced machinery is gaining popularity, traditional methods still prevail in many regions, creating a dynamic market landscape. The availability and affordability of substitutes influence adoption rates and market segmentation.

- End-User Trends: Growing demand for high-yield crops and increased pressure to enhance agricultural productivity are driving end-user preferences towards technologically advanced and efficient machinery.

- M&A Activities: The number of mergers and acquisitions in the sector during 2019–2024 stood at xx, reflecting industry consolidation efforts and expansion strategies by larger players.

Africa Agricultural Machinery Market Industry Trends & Analysis

The African agricultural machinery market is experiencing substantial growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) from 2019–2024 was xx%, indicating robust market expansion. This growth is further fueled by increasing government support for agricultural mechanization, rising agricultural production, and a growing awareness of the need for efficient farming practices. Technological advancements like precision farming technologies and GPS-guided equipment have significantly improved efficiency and productivity, driving market penetration. However, challenges like limited access to finance, infrastructure gaps, and uneven technological adoption across different regions influence market dynamics. Consumer preferences are shifting towards cost-effective, fuel-efficient, and easy-to-maintain machinery. Competitive dynamics are marked by a mix of global and local players, creating both opportunities and challenges for market participants. Market penetration of advanced machinery is currently estimated at xx%, expected to increase to xx% by 2033, indicating significant growth potential.

Leading Markets & Segments in Africa Agricultural Machinery Market

The leading market within Africa varies by product type and region. South Africa remains a dominant player, accounting for xx% of the market in 2024. Other key markets include Nigeria, Kenya, Egypt, and Ethiopia, but regional disparities remain significant.

- Tractors: The tractor segment dominates the market, driven by the need for land preparation and primary tillage operations. Growth is fueled by increasing farm sizes and the adoption of large-scale farming practices.

- Plowing & Cultivating Machinery: Demand for plowing and cultivating machinery is strong, especially in regions with larger farms and suitable land conditions.

- Planting & Fertilizing Machinery: Improved efficiency and accuracy of planting and fertilizing is driving adoption.

- Harvesting Machinery: This sector is experiencing increasing demand due to the need for post-harvest handling and efficient harvesting techniques.

- Haying & Forage Machinery: The demand for haying and forage machinery is influenced by the livestock farming sector and the need for animal feed.

- Irrigation Machineries: Growing awareness of water conservation and efficient irrigation techniques is driving increased adoption.

- Other Product Types: This includes a variety of specialized equipment depending on the specific agricultural needs of a region.

Key Drivers:

- Economic Policies: Government initiatives supporting agricultural modernization and investment in rural infrastructure are key growth catalysts.

- Infrastructure Development: Improved transportation networks, energy access, and communication infrastructure facilitate market penetration.

- Agricultural Production Increase: The growing demand for food and agricultural products is driving market expansion.

- Climate Change Mitigation: The use of advanced technology is enhancing adaptability to changing climate patterns.

Africa Agricultural Machinery Market Product Developments

Recent product developments focus on enhancing efficiency, precision, and fuel efficiency. Manufacturers are incorporating advanced technologies like GPS guidance, automation, and data analytics to improve operational efficiency and reduce labor costs. The integration of smart sensors and data management systems further enhances decision-making capabilities. These innovations are tailored to address specific challenges faced by African farmers, like limited resources and varying terrain conditions. The market fit is improving, as these products enhance yields, reduce input costs, and increase overall farm profitability.

Key Drivers of Africa Agricultural Machinery Market Growth

Several key factors are driving growth in the African agricultural machinery market:

- Technological Advancements: Precision farming technologies, automation, and data analytics improve efficiency and productivity.

- Government Support: Government initiatives and subsidies promote agricultural mechanization and investment in rural infrastructure (e.g., the South African government's support for the cotton industry).

- Economic Growth: Rising incomes and urbanization fuel demand for food and agricultural products.

- Rising Food Demand: Population growth and dietary shifts are creating a need for increased agricultural output.

Challenges in the Africa Agricultural Machinery Market Market

Despite substantial growth potential, the market faces several challenges:

- High Initial Investment Costs: The high cost of machinery can deter smaller farmers from adopting advanced technology.

- Limited Access to Finance: Farmers often lack access to credit and financing options to acquire machinery.

- Inadequate Infrastructure: Poor transportation networks, limited electricity access, and inadequate maintenance facilities hinder market penetration.

- Skills Gap: The lack of trained personnel to operate and maintain advanced machinery creates a significant barrier.

- Supply Chain Disruptions: Global supply chain disruptions affect the availability and cost of machinery.

Emerging Opportunities in Africa Agricultural Machinery Market

Long-term growth is driven by several emerging opportunities:

- Technological Breakthroughs: Continued advancements in precision farming, automation, and AI-driven solutions will improve efficiency and productivity.

- Strategic Partnerships: Collaboration between machinery manufacturers, financial institutions, and agricultural extension services can improve access to technology and finance for farmers.

- Market Expansion: Untapped potential in several African countries creates significant opportunities for growth.

- Government Initiatives: Continued government support for agricultural development and mechanization will accelerate adoption.

Leading Players in the Africa Agricultural Machinery Market Sector

- Kuhn Group

- Deere & Company

- Kverneland AS

- AGCO Corporation

- CNH Industrial NV

- Mahindra & Mahindra Ltd

- Tractors and Farm Equipment Limited (TAFE)

- Claas KGaA mbH

- Kubota Agricultural Machinery

- Lindsay Corporation

- Escorts Group

- J C Bamford Excavators Limited

Key Milestones in Africa Agricultural Machinery Market Industry

- May 2022: AGCO introduced new Fendt One tractor models and the Fendt Ideal Combine 10T at NAMPO, showcasing technological advancements in efficiency and reduced maintenance. This signifies a push towards higher-end technology in the market.

- May 2022: Bridgestone's entry into the South African agricultural market with specialized tires expanded the supply chain and provided farmers with improved tire options for tractors and combine harvesters, improving overall operational capabilities.

- August 2022: The South African Department of Science and Innovation's provision of cotton baler machines to farmers demonstrates government support for technological advancements in specific agricultural sectors, improving efficiency in the cotton industry.

Strategic Outlook for Africa Agricultural Machinery Market Market

The African agricultural machinery market holds significant long-term growth potential. Continued technological innovation, strategic partnerships, and supportive government policies will accelerate market expansion. Focus on affordable and durable machinery tailored to the specific needs of African farmers will be critical for sustained growth. Expanding access to finance and developing skilled labor will further enhance market penetration and adoption rates. The market's future hinges on addressing existing challenges and capitalizing on the considerable opportunities for sustainable agricultural development.

Africa Agricultural Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Agricultural Machinery Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Agricultural Machinery Market Regional Market Share

Geographic Coverage of Africa Agricultural Machinery Market

Africa Agricultural Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis

- 3.3. Market Restrains

- 3.3.1. Lack of Data on Dosages and Results; Lack of Access to Financial Assistance

- 3.4. Market Trends

- 3.4.1. Increasing Focus on Sustainable Mechanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Agricultural Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kuhn Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deere & Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kverneland AS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AGCO Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CNH Industrial NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mahindra & Mahindra Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tractors and Farm Equipment Limited (TAFE)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Claas KGaA mbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kubota Agricultural Machinery

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lindsay Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Escorts Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 J C Bamford Excavators Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Kuhn Group

List of Figures

- Figure 1: Africa Agricultural Machinery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Agricultural Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Agricultural Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Africa Agricultural Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Africa Agricultural Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Africa Agricultural Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Africa Agricultural Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Africa Agricultural Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Africa Agricultural Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Africa Agricultural Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Africa Agricultural Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Africa Agricultural Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Africa Agricultural Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Africa Agricultural Machinery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Africa Agricultural Machinery Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: Nigeria Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nigeria Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 27: South Africa Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Africa Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 29: Egypt Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Egypt Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 31: Kenya Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Kenya Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 33: Ethiopia Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Ethiopia Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 35: Morocco Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Morocco Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 37: Ghana Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Ghana Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 39: Algeria Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Algeria Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 41: Tanzania Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Tanzania Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 43: Ivory Coast Africa Agricultural Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Ivory Coast Africa Agricultural Machinery Market Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Agricultural Machinery Market?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the Africa Agricultural Machinery Market?

Key companies in the market include Kuhn Group, Deere & Company, Kverneland AS, AGCO Corporation, CNH Industrial NV, Mahindra & Mahindra Ltd, Tractors and Farm Equipment Limited (TAFE), Claas KGaA mbH, Kubota Agricultural Machinery, Lindsay Corporatio, Escorts Group, J C Bamford Excavators Limited.

3. What are the main segments of the Africa Agricultural Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis.

6. What are the notable trends driving market growth?

Increasing Focus on Sustainable Mechanization.

7. Are there any restraints impacting market growth?

Lack of Data on Dosages and Results; Lack of Access to Financial Assistance.

8. Can you provide examples of recent developments in the market?

August 2022: As part of plans to support and boost the cotton industry in South Africa, the Department of Science and Innovation (DSI) and its entity, the Technology Innovation Agency(TIA), have together supplied farmers with two cotton baler machines to put an end to manual cotton baling.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Agricultural Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Agricultural Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Agricultural Machinery Market?

To stay informed about further developments, trends, and reports in the Africa Agricultural Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence