Key Insights

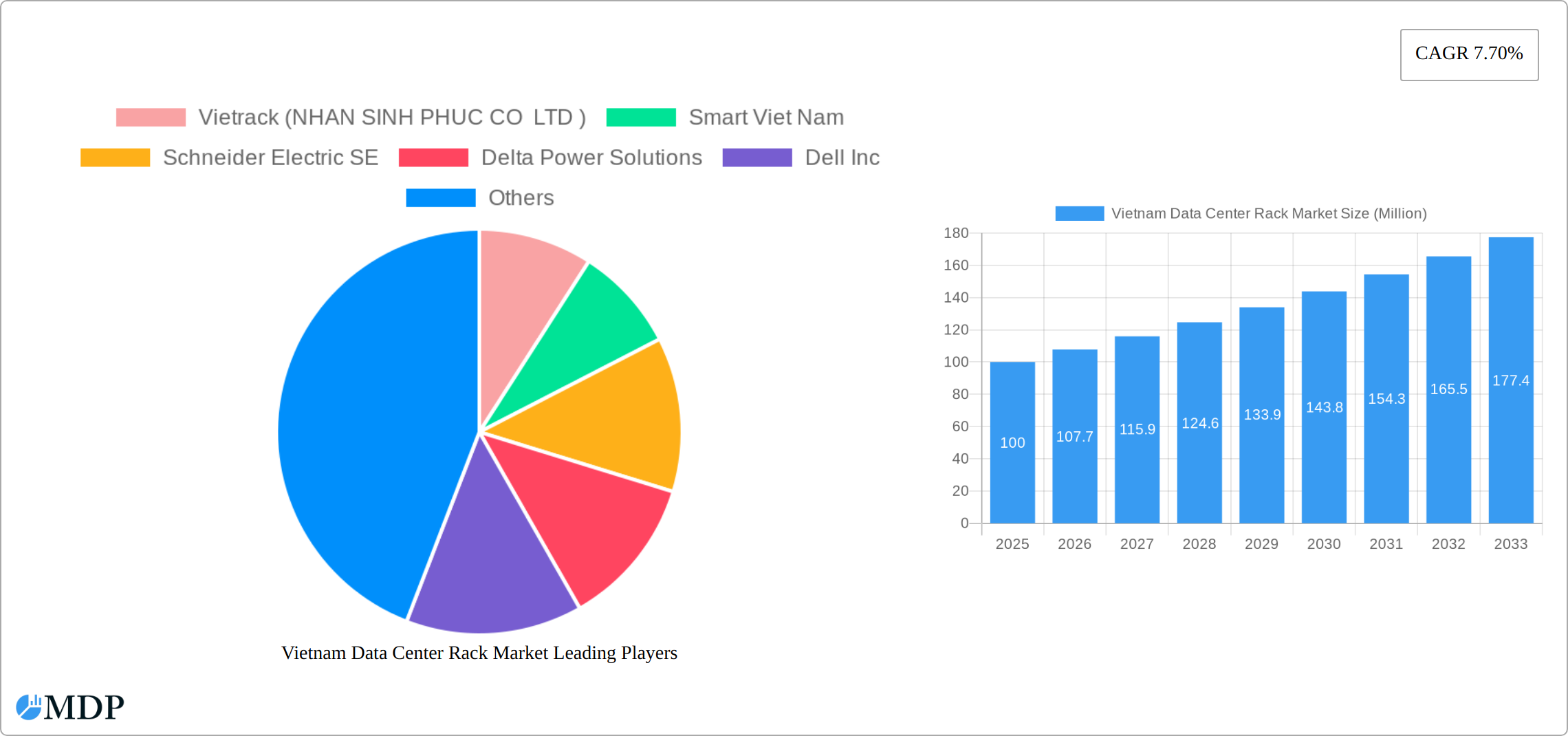

The Vietnam data center rack market is experiencing robust growth, projected to reach a substantial market size by 2033. A 7.70% CAGR from 2025 to 2033 indicates significant expansion driven by several key factors. The increasing adoption of cloud computing and digital transformation initiatives across various sectors, particularly IT & Telecommunication, BFSI (Banking, Financial Services, and Insurance), and the Government, fuels this demand. Furthermore, the burgeoning media and entertainment industry in Vietnam contributes significantly to the rising need for data center infrastructure, including racks. The market is segmented by rack size (quarter, half, and full racks), catering to diverse data center needs and scalability requirements. Key players like Vietrack, Smart Viet Nam, Schneider Electric, Delta Power Solutions, and Vertiv are actively shaping the market landscape through their product offerings and strategic partnerships. The growth is further facilitated by government initiatives promoting digital infrastructure development and attracting foreign investments in the technology sector.

However, the market faces certain challenges. Initial investment costs for data center infrastructure can be substantial, potentially acting as a restraint for smaller companies. Additionally, ensuring reliable power supply and robust cybersecurity measures are crucial for data center operations, which require significant attention and resources. Despite these restraints, the long-term outlook for the Vietnam data center rack market remains highly positive, fueled by consistent economic growth and the nation's ongoing digitalization efforts. The diverse range of end-users, coupled with the expanding adoption of advanced technologies, positions this market for substantial future expansion, attracting both domestic and international players. The preference for full racks is likely to increase as businesses scale operations and require greater capacity.

Vietnam Data Center Rack Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Vietnam data center rack market, encompassing market dynamics, industry trends, leading segments, key players, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for investors, businesses, and stakeholders seeking to understand and capitalize on the burgeoning opportunities within Vietnam's rapidly expanding data center infrastructure. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

Vietnam Data Center Rack Market Market Dynamics & Concentration

The Vietnam data center rack market is experiencing significant growth driven by increasing digitalization, government initiatives promoting digital transformation, and the expansion of cloud computing services. Market concentration is moderate, with several key players vying for market share. However, the market is witnessing increased consolidation through mergers and acquisitions (M&A), as larger companies seek to expand their reach and capabilities. Over the historical period (2019-2024), approximately xx M&A deals were recorded, resulting in a xx% increase in market concentration. Innovation is primarily driven by advancements in rack technology, energy efficiency, and data security. Regulatory frameworks are evolving to support data center development, but challenges remain regarding data privacy and cybersecurity. Product substitutes include alternative infrastructure solutions, but the demand for rack-based solutions remains strong due to their scalability and cost-effectiveness. End-user trends indicate a shift towards higher-density racks and customized solutions to meet specific business requirements.

- Market Share (2024): Vietrack (NHAN SINH PHUC CO LTD ): xx%; Smart Viet Nam: xx%; Schneider Electric SE: xx%; Others: xx%

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Increased energy efficiency, higher density racks, improved cooling technologies, enhanced security features.

- Regulatory Focus: Data privacy, cybersecurity, infrastructure development.

Vietnam Data Center Rack Market Industry Trends & Analysis

The Vietnam data center rack market is characterized by strong growth driven by several factors. The increasing adoption of cloud computing and digital services across various sectors fuels demand for robust data center infrastructure. Government initiatives promoting digital transformation and investments in telecommunications infrastructure further stimulate market growth. Technological disruptions, including the rise of edge computing and 5G networks, are creating new opportunities. Consumer preferences are shifting towards sustainable and energy-efficient data center solutions, prompting companies to invest in greener technologies. Competitive dynamics are intense, with both domestic and international players vying for market share through product innovation, strategic partnerships, and aggressive pricing strategies. The market is anticipated to experience substantial growth in the coming years, supported by favorable economic conditions and increasing government support for digital infrastructure development. The market penetration rate for data center racks in Vietnam is currently estimated at xx%, with projections of reaching xx% by 2033.

Leading Markets & Segments in Vietnam Data Center Rack Market

The Ho Chi Minh City region currently dominates the Vietnam data center rack market due to its advanced infrastructure, robust connectivity, and concentration of major businesses. The IT & Telecommunication sector accounts for the largest market share among end-users, followed by the BFSI (Banking, Financial Services, and Insurance) and Government sectors. Full-rack solutions command the highest demand, owing to their capacity and scalability.

- Dominant Region: Ho Chi Minh City

- Leading End-User Segment: IT & Telecommunication

- Largest Rack Size Segment: Full Rack

- Key Drivers for Ho Chi Minh City: Well-developed infrastructure, strong connectivity, business concentration.

- Key Drivers for IT & Telecommunication: Rapid digitalization, growing data volumes, increasing cloud adoption.

- Key Drivers for Full Rack: Scalability, capacity, suitability for large-scale deployments.

Vietnam Data Center Rack Market Product Developments

Recent product developments focus on enhancing energy efficiency, improving cooling systems, and increasing rack density. Innovations include advanced power distribution units (PDUs), intelligent cooling solutions, and modular rack designs. These advancements cater to the growing demand for sustainable and high-performance data center infrastructure, aligning with the industry’s focus on optimizing operational costs and minimizing environmental impact. The market is witnessing a trend toward specialized racks tailored to specific applications, such as high-performance computing and artificial intelligence.

Key Drivers of Vietnam Data Center Rack Market Growth

The Vietnam data center rack market's growth is propelled by several factors: Government initiatives promoting digitalization, a rising number of data centers, increasing cloud adoption across sectors (especially IT & Telecommunication and BFSI), and the expansion of 5G infrastructure. Strong economic growth and foreign direct investment further contribute to market expansion. Moreover, the improving energy infrastructure and supportive regulatory frameworks create a favorable environment for data center development. The increasing demand for edge computing further strengthens the market outlook.

Challenges in the Vietnam Data Center Rack Market Market

The Vietnam data center rack market faces challenges such as potential power shortages in certain regions, limited skilled labor, and the need for improved data center infrastructure in less developed areas. Supply chain disruptions can impact the availability and pricing of components. The competitive landscape is intense, with both domestic and international players competing for market share, potentially putting pressure on pricing and profitability for some companies. These factors can create a fluctuating market with varying supply and demand conditions that can be hard to predict.

Emerging Opportunities in Vietnam Data Center Rack Market

Significant opportunities exist in developing sustainable and energy-efficient data center solutions, expanding into underserved regions, and providing tailored solutions for specific industry verticals. Strategic partnerships between data center operators and technology providers can facilitate innovation and drive growth. The burgeoning edge computing market presents significant potential for growth, creating demand for localized data center infrastructure. The focus on data security and resilience creates opportunities for companies offering advanced security and disaster recovery solutions.

Leading Players in the Vietnam Data Center Rack Market Sector

- Vietrack (NHAN SINH PHUC CO LTD )

- Smart Viet Nam

- Schneider Electric SE

- Delta Power Solutions

- Dell Inc

- Norden Vietnam Pte Ltd

- Vertiv Group Corp

- Rittal GMBH & Co KG

- Eaton Corporation

Key Milestones in Vietnam Data Center Rack Market Industry

- May 2022: Australian Edge data center firm Edge Centres announced a new facility in Ho Chi Minh City, Vietnam, featuring 1 MW of solar infrastructure, 48 hours of battery and UPS backup, and 64 1 kW quarter rack capacity. This signifies the growing adoption of sustainable energy solutions in the data center sector.

- January 2023: Asia Direct Cable (ADC), a 9,600-kilometer submarine cable linking Hong Kong with mainland China, Japan, the Philippines, Singapore, Thailand, and Vietnam, landed its Hong Kong segment at SUNeVision's Cable Landing Station. This enhanced connectivity significantly boosts Vietnam's data center infrastructure capabilities and global reach.

Strategic Outlook for Vietnam Data Center Rack Market Market

The Vietnam data center rack market exhibits significant growth potential, driven by strong economic growth, digital transformation initiatives, and expanding telecommunications infrastructure. Strategic opportunities include investing in sustainable solutions, building strong partnerships, and focusing on niche market segments. Expansion into underserved regions and leveraging the growth of edge computing will be crucial for companies to capture market share. The focus on security and resilience presents opportunities for companies offering robust and secure data center solutions. The market is poised for substantial growth in the coming years, presenting lucrative opportunities for investors and businesses.

Vietnam Data Center Rack Market Segmentation

-

1. Rack Size

- 1.1. Quarter Rack

- 1.2. Half Rack

- 1.3. Full Rack

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

Vietnam Data Center Rack Market Segmentation By Geography

- 1. Vietnam

Vietnam Data Center Rack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Investments for the Expansion of 5G Network by Operators; Fiber Connectivity Network Expansion in the Country

- 3.3. Market Restrains

- 3.3.1. Increasing Cybersecurity Threats and Ransomware Attacks; Low Availability of Resources

- 3.4. Market Trends

- 3.4.1. IT & Telecom segment is expected to account for the highest market share among the end-user industries.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 5.1.1. Quarter Rack

- 5.1.2. Half Rack

- 5.1.3. Full Rack

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Vietrack (NHAN SINH PHUC CO LTD )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Smart Viet Nam

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schneider Electric SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Delta Power Solutions

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Norden Vietnam Pte Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vertiv Group Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rittal GMBH & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eaton Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Vietrack (NHAN SINH PHUC CO LTD )

List of Figures

- Figure 1: Vietnam Data Center Rack Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Data Center Rack Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 3: Vietnam Data Center Rack Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Vietnam Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Vietnam Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Vietnam Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 7: Vietnam Data Center Rack Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Vietnam Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Data Center Rack Market?

The projected CAGR is approximately 7.70%.

2. Which companies are prominent players in the Vietnam Data Center Rack Market?

Key companies in the market include Vietrack (NHAN SINH PHUC CO LTD ), Smart Viet Nam, Schneider Electric SE, Delta Power Solutions, Dell Inc, Norden Vietnam Pte Ltd, Vertiv Group Corp, Rittal GMBH & Co KG, Eaton Corporation.

3. What are the main segments of the Vietnam Data Center Rack Market?

The market segments include Rack Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Investments for the Expansion of 5G Network by Operators; Fiber Connectivity Network Expansion in the Country.

6. What are the notable trends driving market growth?

IT & Telecom segment is expected to account for the highest market share among the end-user industries..

7. Are there any restraints impacting market growth?

Increasing Cybersecurity Threats and Ransomware Attacks; Low Availability of Resources.

8. Can you provide examples of recent developments in the market?

January 2023: Asia Direct Cable (ADC) Lands the Hong Kong Segment at SUNeVision's Cable Landing Station. The ADC is a 9,600-kilometer submarine cable linking Hong Kong with mainland China, Japan, the Philippines, Singapore, Thailand, and Vietnam.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Data Center Rack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Data Center Rack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Data Center Rack Market?

To stay informed about further developments, trends, and reports in the Vietnam Data Center Rack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence