Key Insights

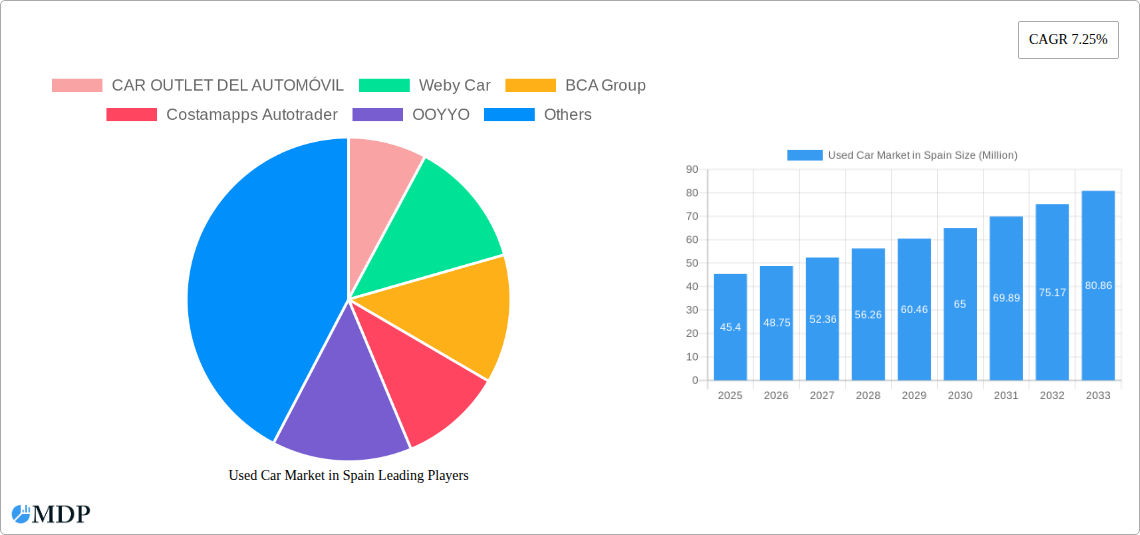

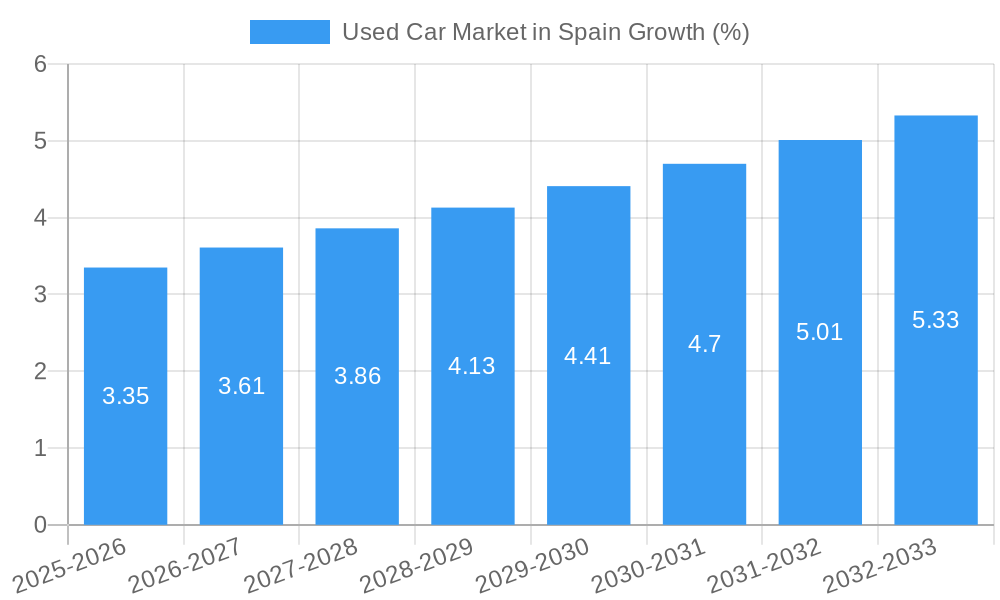

The Spanish used car market, valued at €45.40 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.25% from 2025 to 2033. This expansion is fueled by several key factors. Increasing consumer preference for cost-effective mobility solutions, coupled with the rising popularity of online car buying platforms, significantly contributes to market growth. The diverse range of vehicle body styles available – Hatchbacks, Sedans, SUVs, and MPVs – caters to varied consumer needs, further boosting market penetration. Furthermore, the market is segmented by vendor type (organized vs. unorganized) and fuel type (petrol, diesel, electric, and others), reflecting evolving consumer preferences and technological advancements in the automotive sector. While challenges exist, such as fluctuating fuel prices and economic uncertainty, the overall market outlook remains positive, driven by a young, digitally savvy population embracing online marketplaces and the pre-owned vehicle sector.

The competitive landscape is dynamic, with both established players like AUTO1 Group and emerging online platforms like Weby Car vying for market share. The organized sector is expected to witness faster growth compared to the unorganized sector due to increased transparency and consumer trust. Factors such as government regulations aimed at promoting sustainable mobility (favoring electric vehicles) and improved financing options are expected to positively influence market expansion. The consistent growth in Spain's tourism industry could also indirectly contribute to the used car market due to increased vehicle demand from rental and tourism-related businesses. While data on specific market segments is limited, a reasonable estimation based on market trends suggests that SUVs and online booking channels will likely dominate the market due to their popularity and convenience respectively.

Used Car Market in Spain: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the used car market in Spain, covering market dynamics, industry trends, leading segments, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This in-depth analysis is crucial for industry stakeholders, investors, and businesses seeking to navigate this dynamic market. The report leverages extensive data and insights to offer actionable strategies and predictions.

Used Car Market in Spain Market Dynamics & Concentration

The Spanish used car market, valued at xx Million in 2024, is characterized by a moderately concentrated landscape. While a few large players like AUTO1 com GmbH and Clicars Spain SL hold significant market share (estimated at xx% and xx% respectively in 2024), a large number of smaller, independent dealers also contribute significantly. Market concentration is expected to increase slightly by 2033 due to ongoing consolidation and the rise of online platforms.

Innovation is driven by technological advancements, particularly in online platforms offering streamlined buying processes and increased transparency. The regulatory framework, including emissions standards and vehicle safety regulations, plays a crucial role in shaping market dynamics. Substitutes, such as public transportation and ride-hailing services, exert moderate pressure, particularly in urban areas. End-user trends favor SUVs and electric vehicles, while M&A activity is expected to remain steady, with an estimated xx deals projected for 2025–2033.

- Market Share (2024): AUTO1 com GmbH (xx%), Clicars Spain SL (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx

- Projected M&A Deal Count (2025-2033): xx

Used Car Market in Spain Industry Trends & Analysis

The Spanish used car market exhibits a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. Key growth drivers include rising disposable incomes, increasing vehicle ownership, and government initiatives promoting vehicle renewal. Technological disruptions, including online marketplaces and digital financing options, are transforming the consumer experience and enhancing market efficiency. Consumer preferences are shifting toward fuel-efficient and environmentally friendly vehicles, fueling demand for electric and hybrid used cars. The market is increasingly competitive, with both online and offline players vying for market share. Market penetration of online platforms is estimated at xx% in 2024 and is expected to reach xx% by 2033.

Leading Markets & Segments in Used Car Market in Spain

The Spanish used car market is geographically diverse, with strong performance across major urban centers and coastal regions. However, specific regional dominance is difficult to ascertain without further detailed data.

- By Vehicle Body Style: SUVs and Hatchbacks are the leading segments, driven by consumer preferences for practicality and fuel efficiency.

- By Vendor Type: The organized sector (dealerships, online platforms) holds a larger market share compared to the unorganized sector (private sellers).

- By Booking Type: Online bookings are growing rapidly, fueled by convenience and increased transparency. However, offline channels still maintain significant market share.

- By Fuel Type: Petrol and Diesel vehicles remain dominant, but the electric vehicle segment is growing at a faster rate due to government incentives and increasing environmental awareness.

Key drivers for segment dominance include:

- Economic policies: Government incentives for used electric vehicles are boosting sales in that segment.

- Infrastructure: The growing network of charging stations supports the adoption of electric vehicles.

Used Car Market in Spain Product Developments

Recent product developments in the Spanish used car market center on enhancing the online buying experience. Features such as virtual inspections, detailed vehicle history reports, and online financing options are becoming increasingly common. The integration of AI and machine learning for vehicle valuation and risk assessment is also gaining traction, improving efficiency and transparency in the market. This technological advancement increases convenience, builds trust, and improves the overall market fit.

Key Drivers of Used Car Market in Spain Growth

The growth of the Spanish used car market is fueled by several factors:

- Increasing affordability: Used cars offer a more affordable alternative to new cars.

- Government incentives: Programs like Moves III stimulate demand for used electric vehicles.

- Technological advancements: Online platforms are improving market transparency and access.

- Economic recovery: Improved economic conditions contribute to increased consumer spending.

Challenges in the Used Car Market in Spain Market

The used car market in Spain faces several challenges:

- Supply chain disruptions: Global supply chain issues can impact used car availability.

- Economic downturns: Economic uncertainty can reduce consumer demand.

- Regulatory changes: Evolving emission regulations can affect the value of certain vehicles.

- Fraudulent activities: The risk of buying fraudulent or damaged vehicles poses a significant barrier.

Emerging Opportunities in Used Car Market in Spain

Opportunities abound in the Spanish used car market, particularly for businesses leveraging technology to improve the buying experience. The expansion into less penetrated regions and offering value-added services such as extended warranties and financing options are key areas.

Leading Players in the Used Car Market in Spain Sector

- CAR OUTLET DEL AUTOMÓVIL

- Weby Car

- BCA Group

- Costamapps Autotrader

- OOYYO

- Auto Fes

- VIVA AUTOS COSTA BLANCA SL

- Clicars Spain SL

- OcasionPlus

- Impormop Venta De Maquinaria SL

- AUTO1 com GmbH

- YAMOVIL

Key Milestones in Used Car Market in Spain Industry

- January 2024: Norbolsa launched a plan for a digital used car platform, partnering with eight dealers and Arval (BNP Paribas subsidiary). This initiative aims to digitize the market and improve efficiency.

- January 2024: The Spanish government expanded the Moves III electric vehicle subsidy program to include pre-owned vehicles (less than one year old) and broadened eligibility for fleet operators. This boosts demand for used electric vehicles.

- January 2024: CaixaBank's plan to increase consumer credit growth by offering pre-approved loans to low-risk customers will positively influence purchasing power and demand for used cars.

Strategic Outlook for Used Car Market in Spain Market

The Spanish used car market presents substantial growth potential, driven by sustained consumer demand, technological innovations, and supportive government policies. Strategic opportunities exist in expanding online platforms, catering to the growing demand for electric vehicles, and enhancing customer service through value-added offerings. Focusing on transparency, trust, and efficient processes will be critical for success in this evolving market.

Used Car Market in Spain Segmentation

-

1. Vehicle Body Style

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Booking Type

- 3.1. Online

- 3.2. Offline

-

4. Fuel Type

- 4.1. Petrol

- 4.2. Diesel

- 4.3. Electric

- 4.4. Others

Used Car Market in Spain Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Used Car Market in Spain REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Buyers Inclination Toward Affordable Used Cars to Fuel the Market Growth

- 3.3. Market Restrains

- 3.3.1 Technology Advances

- 3.3.2 Older Used Cars May Lack the Latest Features

- 3.4. Market Trends

- 3.4.1. The Sport Utility Vehicles (SUVs) and Multi-Purpose Vehicles (MPVs) Segment Holds a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Market in Spain Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Booking Type

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Fuel Type

- 5.4.1. Petrol

- 5.4.2. Diesel

- 5.4.3. Electric

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 6. North America Used Car Market in Spain Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 6.1.1. Hatchbacks

- 6.1.2. Sedans

- 6.1.3. Sports U

- 6.2. Market Analysis, Insights and Forecast - by Vendor Type

- 6.2.1. Organized

- 6.2.2. Unorganized

- 6.3. Market Analysis, Insights and Forecast - by Booking Type

- 6.3.1. Online

- 6.3.2. Offline

- 6.4. Market Analysis, Insights and Forecast - by Fuel Type

- 6.4.1. Petrol

- 6.4.2. Diesel

- 6.4.3. Electric

- 6.4.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 7. South America Used Car Market in Spain Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 7.1.1. Hatchbacks

- 7.1.2. Sedans

- 7.1.3. Sports U

- 7.2. Market Analysis, Insights and Forecast - by Vendor Type

- 7.2.1. Organized

- 7.2.2. Unorganized

- 7.3. Market Analysis, Insights and Forecast - by Booking Type

- 7.3.1. Online

- 7.3.2. Offline

- 7.4. Market Analysis, Insights and Forecast - by Fuel Type

- 7.4.1. Petrol

- 7.4.2. Diesel

- 7.4.3. Electric

- 7.4.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 8. Europe Used Car Market in Spain Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 8.1.1. Hatchbacks

- 8.1.2. Sedans

- 8.1.3. Sports U

- 8.2. Market Analysis, Insights and Forecast - by Vendor Type

- 8.2.1. Organized

- 8.2.2. Unorganized

- 8.3. Market Analysis, Insights and Forecast - by Booking Type

- 8.3.1. Online

- 8.3.2. Offline

- 8.4. Market Analysis, Insights and Forecast - by Fuel Type

- 8.4.1. Petrol

- 8.4.2. Diesel

- 8.4.3. Electric

- 8.4.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 9. Middle East & Africa Used Car Market in Spain Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 9.1.1. Hatchbacks

- 9.1.2. Sedans

- 9.1.3. Sports U

- 9.2. Market Analysis, Insights and Forecast - by Vendor Type

- 9.2.1. Organized

- 9.2.2. Unorganized

- 9.3. Market Analysis, Insights and Forecast - by Booking Type

- 9.3.1. Online

- 9.3.2. Offline

- 9.4. Market Analysis, Insights and Forecast - by Fuel Type

- 9.4.1. Petrol

- 9.4.2. Diesel

- 9.4.3. Electric

- 9.4.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 10. Asia Pacific Used Car Market in Spain Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 10.1.1. Hatchbacks

- 10.1.2. Sedans

- 10.1.3. Sports U

- 10.2. Market Analysis, Insights and Forecast - by Vendor Type

- 10.2.1. Organized

- 10.2.2. Unorganized

- 10.3. Market Analysis, Insights and Forecast - by Booking Type

- 10.3.1. Online

- 10.3.2. Offline

- 10.4. Market Analysis, Insights and Forecast - by Fuel Type

- 10.4.1. Petrol

- 10.4.2. Diesel

- 10.4.3. Electric

- 10.4.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 CAR OUTLET DEL AUTOMÓVIL

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Weby Car

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BCA Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Costamapps Autotrader

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 OOYYO

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Auto Fes

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 VIVA AUTOS COSTA BLANCA SL

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clicars Spain SL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 OcasionPlus

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Impormop Venta De Maquinaria SL

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AUTO1 com GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 YAMOVIL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 CAR OUTLET DEL AUTOMÓVIL

List of Figures

- Figure 1: Global Used Car Market in Spain Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Spain Used Car Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 3: Spain Used Car Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Used Car Market in Spain Revenue (Million), by Vehicle Body Style 2024 & 2032

- Figure 5: North America Used Car Market in Spain Revenue Share (%), by Vehicle Body Style 2024 & 2032

- Figure 6: North America Used Car Market in Spain Revenue (Million), by Vendor Type 2024 & 2032

- Figure 7: North America Used Car Market in Spain Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 8: North America Used Car Market in Spain Revenue (Million), by Booking Type 2024 & 2032

- Figure 9: North America Used Car Market in Spain Revenue Share (%), by Booking Type 2024 & 2032

- Figure 10: North America Used Car Market in Spain Revenue (Million), by Fuel Type 2024 & 2032

- Figure 11: North America Used Car Market in Spain Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 12: North America Used Car Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Used Car Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Used Car Market in Spain Revenue (Million), by Vehicle Body Style 2024 & 2032

- Figure 15: South America Used Car Market in Spain Revenue Share (%), by Vehicle Body Style 2024 & 2032

- Figure 16: South America Used Car Market in Spain Revenue (Million), by Vendor Type 2024 & 2032

- Figure 17: South America Used Car Market in Spain Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 18: South America Used Car Market in Spain Revenue (Million), by Booking Type 2024 & 2032

- Figure 19: South America Used Car Market in Spain Revenue Share (%), by Booking Type 2024 & 2032

- Figure 20: South America Used Car Market in Spain Revenue (Million), by Fuel Type 2024 & 2032

- Figure 21: South America Used Car Market in Spain Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 22: South America Used Car Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 23: South America Used Car Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Used Car Market in Spain Revenue (Million), by Vehicle Body Style 2024 & 2032

- Figure 25: Europe Used Car Market in Spain Revenue Share (%), by Vehicle Body Style 2024 & 2032

- Figure 26: Europe Used Car Market in Spain Revenue (Million), by Vendor Type 2024 & 2032

- Figure 27: Europe Used Car Market in Spain Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 28: Europe Used Car Market in Spain Revenue (Million), by Booking Type 2024 & 2032

- Figure 29: Europe Used Car Market in Spain Revenue Share (%), by Booking Type 2024 & 2032

- Figure 30: Europe Used Car Market in Spain Revenue (Million), by Fuel Type 2024 & 2032

- Figure 31: Europe Used Car Market in Spain Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 32: Europe Used Car Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Used Car Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa Used Car Market in Spain Revenue (Million), by Vehicle Body Style 2024 & 2032

- Figure 35: Middle East & Africa Used Car Market in Spain Revenue Share (%), by Vehicle Body Style 2024 & 2032

- Figure 36: Middle East & Africa Used Car Market in Spain Revenue (Million), by Vendor Type 2024 & 2032

- Figure 37: Middle East & Africa Used Car Market in Spain Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 38: Middle East & Africa Used Car Market in Spain Revenue (Million), by Booking Type 2024 & 2032

- Figure 39: Middle East & Africa Used Car Market in Spain Revenue Share (%), by Booking Type 2024 & 2032

- Figure 40: Middle East & Africa Used Car Market in Spain Revenue (Million), by Fuel Type 2024 & 2032

- Figure 41: Middle East & Africa Used Car Market in Spain Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 42: Middle East & Africa Used Car Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Used Car Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Used Car Market in Spain Revenue (Million), by Vehicle Body Style 2024 & 2032

- Figure 45: Asia Pacific Used Car Market in Spain Revenue Share (%), by Vehicle Body Style 2024 & 2032

- Figure 46: Asia Pacific Used Car Market in Spain Revenue (Million), by Vendor Type 2024 & 2032

- Figure 47: Asia Pacific Used Car Market in Spain Revenue Share (%), by Vendor Type 2024 & 2032

- Figure 48: Asia Pacific Used Car Market in Spain Revenue (Million), by Booking Type 2024 & 2032

- Figure 49: Asia Pacific Used Car Market in Spain Revenue Share (%), by Booking Type 2024 & 2032

- Figure 50: Asia Pacific Used Car Market in Spain Revenue (Million), by Fuel Type 2024 & 2032

- Figure 51: Asia Pacific Used Car Market in Spain Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 52: Asia Pacific Used Car Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 53: Asia Pacific Used Car Market in Spain Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Used Car Market in Spain Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Used Car Market in Spain Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 3: Global Used Car Market in Spain Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Global Used Car Market in Spain Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 5: Global Used Car Market in Spain Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 6: Global Used Car Market in Spain Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Used Car Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Used Car Market in Spain Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 9: Global Used Car Market in Spain Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 10: Global Used Car Market in Spain Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 11: Global Used Car Market in Spain Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 12: Global Used Car Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Used Car Market in Spain Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 17: Global Used Car Market in Spain Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 18: Global Used Car Market in Spain Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 19: Global Used Car Market in Spain Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 20: Global Used Car Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Used Car Market in Spain Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 25: Global Used Car Market in Spain Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 26: Global Used Car Market in Spain Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 27: Global Used Car Market in Spain Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 28: Global Used Car Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Spain Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Benelux Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Used Car Market in Spain Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 39: Global Used Car Market in Spain Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 40: Global Used Car Market in Spain Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 41: Global Used Car Market in Spain Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 42: Global Used Car Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Used Car Market in Spain Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 50: Global Used Car Market in Spain Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 51: Global Used Car Market in Spain Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 52: Global Used Car Market in Spain Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 53: Global Used Car Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 54: China Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: ASEAN Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Oceania Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Used Car Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Market in Spain?

The projected CAGR is approximately 7.25%.

2. Which companies are prominent players in the Used Car Market in Spain?

Key companies in the market include CAR OUTLET DEL AUTOMÓVIL, Weby Car, BCA Group, Costamapps Autotrader, OOYYO, Auto Fes, VIVA AUTOS COSTA BLANCA SL, Clicars Spain SL, OcasionPlus, Impormop Venta De Maquinaria SL, AUTO1 com GmbH, YAMOVIL.

3. What are the main segments of the Used Car Market in Spain?

The market segments include Vehicle Body Style, Vendor Type, Booking Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Buyers Inclination Toward Affordable Used Cars to Fuel the Market Growth.

6. What are the notable trends driving market growth?

The Sport Utility Vehicles (SUVs) and Multi-Purpose Vehicles (MPVs) Segment Holds a Significant Market Share.

7. Are there any restraints impacting market growth?

Technology Advances. Older Used Cars May Lack the Latest Features.

8. Can you provide examples of recent developments in the market?

January 2024: Norbolsa planned a digital platform for selling used cars in Spain with eight dealers and Arval, a BNP Paribas subsidiary. CaixaBank aims to boost consumer credit growth, offering pre-approved loans to low-risk customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Market in Spain," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Market in Spain report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Market in Spain?

To stay informed about further developments, trends, and reports in the Used Car Market in Spain, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence