Key Insights

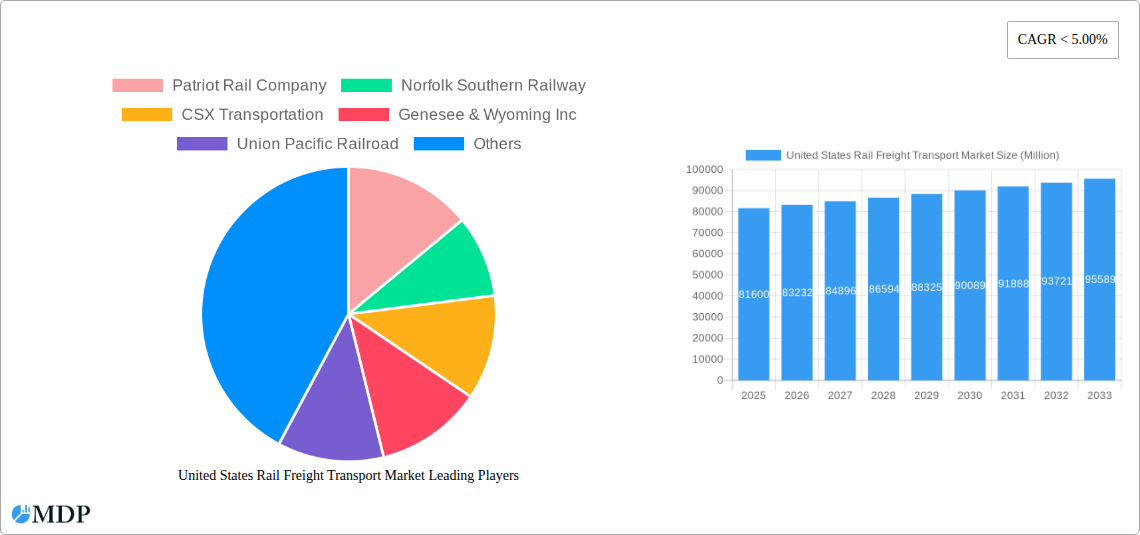

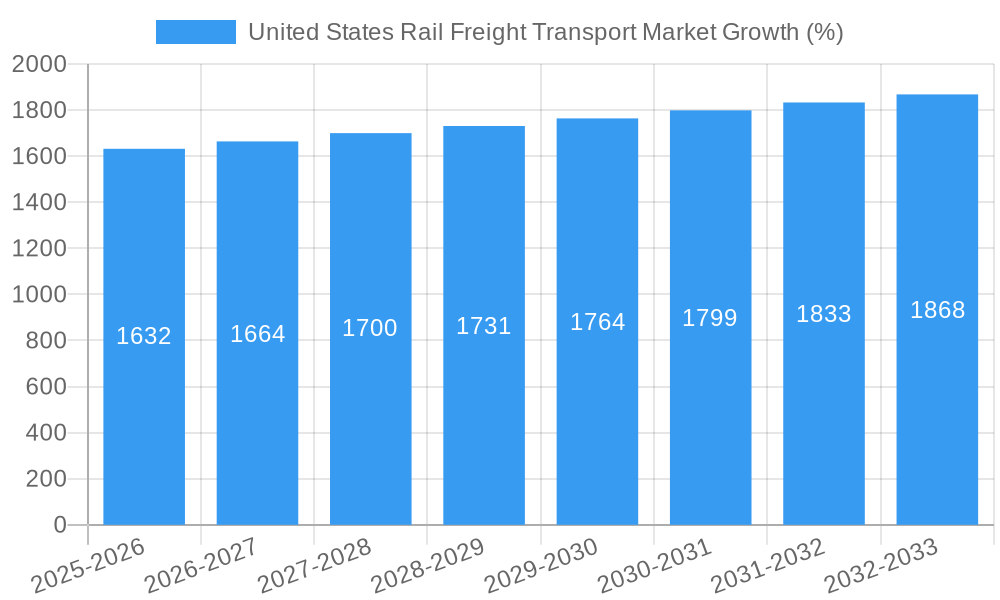

The United States rail freight transport market is a substantial component of the nation's logistics infrastructure, exhibiting steady growth driven by factors such as increasing freight volumes, infrastructure investments, and the inherent cost-effectiveness and environmental benefits compared to road transport. The market experienced significant growth between 2019 and 2024, influenced by a robust economy and increased demand for goods. While precise figures for market size are unavailable, we can infer substantial growth based on industry reports showing increased tonnage hauled and rail carloadings during this period. Assuming a conservative average annual growth rate (CAGR) of 2% during the historical period (2019-2024), and a market size of $80 billion in 2024, the market size in 2025 can be estimated at approximately $81.6 billion. This growth is projected to continue, albeit perhaps at a slightly moderated pace, throughout the forecast period (2025-2033), influenced by factors like ongoing infrastructure improvements, technological advancements in rail operations (such as improved tracking and efficiency), and government regulations promoting sustainable transportation. Challenges remain, including competition from trucking, fluctuations in fuel prices, and the need for continued investment in track maintenance and upgrades.

Looking ahead to 2033, assuming a slightly lower CAGR of 1.8% for the forecast period, reflecting potential economic slowdowns or shifts in transportation preferences, the market size could reach approximately $95 billion. This represents a significant expansion of the market, demonstrating its continued importance in the national economy. However, the actual figures will be contingent on various macroeconomic factors, government policies, and technological developments within the transportation sector. The market is segmented by cargo type (e.g., agricultural products, industrial goods, coal), rail operator size, and geographic region, each segment presenting unique growth trajectories and challenges. A comprehensive understanding of these segments is crucial for stakeholders seeking strategic advantage in this dynamic market.

United States Rail Freight Transport Market: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the United States Rail Freight Transport Market, covering the period 2019-2033. With a focus on key market segments, leading players, and emerging trends, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

United States Rail Freight Transport Market Dynamics & Concentration

The US rail freight transport market is characterized by a moderately concentrated structure, dominated by major players like Union Pacific Railroad, BNSF Railway Company, CSX Transportation, and Norfolk Southern Railway. These companies hold a significant market share, estimated at approximately xx% collectively in 2025. However, smaller players like Patriot Rail Company and Genesee & Wyoming Inc. contribute to the overall market dynamism.

Market concentration is influenced by several factors:

- High capital expenditure: The industry requires substantial investments in infrastructure, rolling stock, and technology, creating barriers to entry for new players.

- Extensive regulatory framework: Stringent safety and operational regulations govern the industry, impacting market entry and expansion strategies.

- Network effects: The efficiency of rail freight transport relies on extensive and interconnected networks, favoring established players with large-scale operations.

- Mergers & Acquisitions (M&A): Consolidation activity has been significant in recent years, with xx M&A deals recorded between 2019 and 2024, further shaping market concentration.

Innovation is driven by the need for improved efficiency, reduced environmental impact, and enhanced safety. Technological advancements, such as automation, predictive maintenance, and the adoption of electric locomotives, are reshaping the industry landscape. Product substitutes, including trucking and pipelines, exert competitive pressure, necessitating continuous innovation and operational optimization. End-user trends toward greater supply chain efficiency and sustainability also shape market dynamics.

United States Rail Freight Transport Market Industry Trends & Analysis

The US rail freight transport market is experiencing robust growth driven by several factors:

- Increased demand for freight transportation: Growth in e-commerce, industrial production, and consumer spending fuels demand for efficient and cost-effective freight movement.

- Government investments in infrastructure: Public initiatives aimed at improving rail infrastructure and capacity support market expansion.

- Technological advancements: Automation, data analytics, and electric locomotives are enhancing operational efficiency, reducing costs, and minimizing environmental impact.

- Focus on sustainability: Growing environmental concerns are driving the adoption of greener technologies and practices within the industry.

The market is witnessing significant technological disruptions, with the increasing adoption of precision scheduling, digital twins, and the Internet of Things (IoT) for real-time monitoring and optimization of rail operations. Consumer preferences are shifting towards more reliable, sustainable, and technologically advanced freight transportation solutions. Competitive dynamics are shaped by pricing strategies, service differentiation, and capacity expansion initiatives undertaken by key players.

Leading Markets & Segments in United States Rail Freight Transport Market

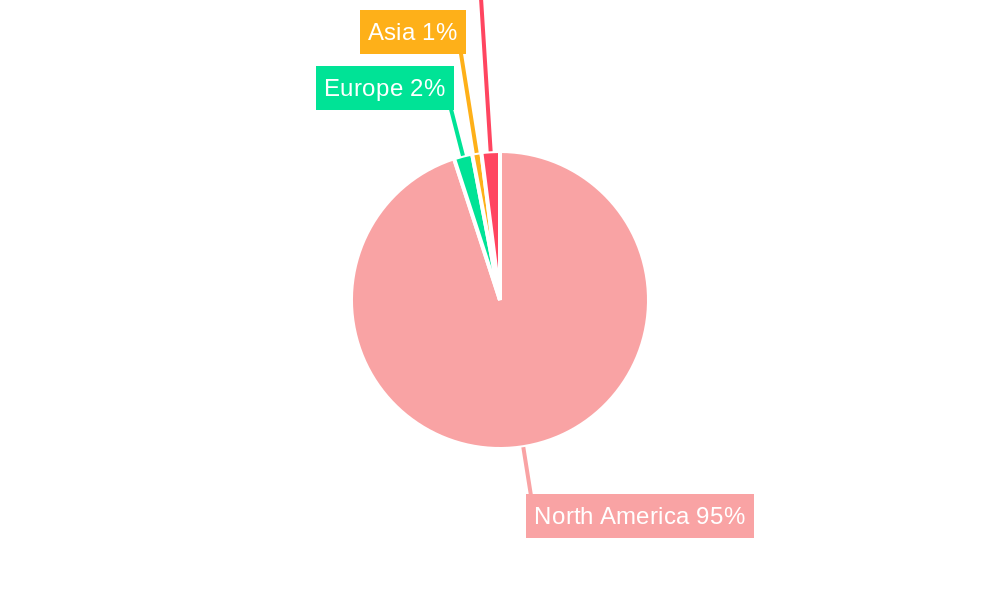

The domestic segment dominates the US rail freight transport market, accounting for approximately xx% of total revenue in 2025, primarily driven by the vastness of the US domestic market and the robust industrial sector. However, the international segment shows promising growth potential, driven by increased cross-border trade.

By Type of Cargo:

- Containerized (Includes Intermodal): This segment is experiencing the fastest growth, driven by the rise of intermodal transportation and increased efficiency. Key drivers include port infrastructure developments and the adoption of standardized containers.

- Non-containerized: This segment remains substantial, primarily catering to bulk commodities like coal, grain, and minerals. Growth is linked to the overall production and consumption of these commodities.

- Liquid Bulk: The liquid bulk segment experiences moderate growth, driven by the transportation of petroleum products and chemicals. Growth is correlated with industrial activity and energy demand.

By Service Type:

- Transportation: This forms the core of the market and experiences growth parallel to overall freight transportation demand.

- Services Allied to Transportation: This segment shows promising growth potential, driven by the need for efficient maintenance, switching, and storage of freight.

Key Drivers by Segment:

- Economic Policies: Favorable government policies promoting infrastructure development and trade are crucial growth drivers.

- Infrastructure: The availability of well-maintained and efficient rail networks plays a vital role in market growth.

- Technological Advancements: Automation and digitalization contribute to improved efficiency and cost-effectiveness.

United States Rail Freight Transport Market Product Developments

Recent product innovations focus on improving fuel efficiency, reducing emissions, and enhancing safety. The introduction of battery-electric locomotives, like the FLXdrive, signifies a move towards sustainable and environmentally friendly rail transport. These advancements offer competitive advantages through reduced operational costs, improved environmental performance, and enhanced brand image. The market fit for these innovations is strong, driven by increasing environmental regulations and growing consumer demand for sustainable transportation solutions.

Key Drivers of United States Rail Freight Transport Market Growth

Several factors contribute to the growth of the US rail freight transport market:

- Technological advancements: Automation, data analytics, and electric locomotives are improving efficiency and sustainability.

- Economic growth: Rising industrial production and consumer spending fuel demand for efficient freight movement.

- Government initiatives: Investments in infrastructure and regulatory reforms create a supportive environment for market expansion.

- Shifting consumer preferences: Growing demand for sustainable and reliable transportation solutions boosts market growth.

Challenges in the United States Rail Freight Transport Market

The US rail freight transport market faces several challenges:

- High capital expenditure: Significant investments are required for infrastructure upgrades and fleet modernization, limiting entry for new players and impacting smaller firms.

- Supply chain disruptions: External factors like labor shortages, geopolitical instability, and extreme weather events can cause delays and capacity constraints.

- Competitive pressures: Competition from trucking and other modes of transport necessitates continuous innovation and efficiency improvements.

- Regulatory hurdles: Stringent regulations on safety, security, and environmental compliance add complexity and costs.

Emerging Opportunities in United States Rail Freight Transport Market

Several opportunities exist for long-term growth:

- Technological breakthroughs: Continued advancements in automation, artificial intelligence, and sustainable technologies offer substantial growth potential.

- Strategic partnerships: Collaborations between rail operators, technology providers, and logistics companies can enhance efficiency and expand market reach.

- Market expansion: Growth in e-commerce and cross-border trade presents opportunities to expand services to new regions and markets. Expansion into underserved areas can be profitable.

Leading Players in the United States Rail Freight Transport Market Sector

- Patriot Rail Company

- Norfolk Southern Railway

- CSX Transportation

- Genesee & Wyoming Inc

- Union Pacific Railroad

- BNSF Railway Company

- Canadian National Railway

- Kansas City Southern

Key Milestones in United States Rail Freight Transport Market Industry

- January 2022: Wabtec Corporation receives an order for 10 FLXdrive battery-electric locomotives from Union Pacific Railroad, marking a significant step towards sustainable freight transportation. This signals a shift towards greener technologies and a potential boost in the electric locomotive segment.

- February 2022: BNSF Railway Company announces a USD 580 Million capital plan for efficiency and expansion initiatives, including double and triple-track additions, and intermodal facility expansions. This investment signals confidence in future market growth and a commitment to capacity expansion to meet increasing demand.

Strategic Outlook for United States Rail Freight Transport Market Market

The US rail freight transport market presents significant long-term growth potential. Continued investments in infrastructure, technological innovation, and strategic partnerships will be crucial for capturing market opportunities. The focus on sustainability and the adoption of advanced technologies will shape the future competitive landscape, offering opportunities for both established and emerging players. The market's growth trajectory is strongly tied to economic growth and global trade patterns.

United States Rail Freight Transport Market Segmentation

-

1. Type of Cargo

- 1.1. Containerized (Includes Intermodal)

- 1.2. Non-containerized

- 1.3. Liquid Bulk

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Service Type

- 3.1. Transportation

- 3.2. Services

United States Rail Freight Transport Market Segmentation By Geography

- 1. United States

United States Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need for Reliable Connections between Carriers and Shippers; Demand for Real-time Visibility of Shipments

- 3.3. Market Restrains

- 3.3.1. High Fragmentation of the Logistics Industry; Data Security Concerns

- 3.4. Market Trends

- 3.4.1. Demand on The US Freight Rail Network Increase

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 5.1.1. Containerized (Includes Intermodal)

- 5.1.2. Non-containerized

- 5.1.3. Liquid Bulk

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Service Type

- 5.3.1. Transportation

- 5.3.2. Services

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 6. North America United States Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. Europe United States Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Germany

- 7.1.2 United Kingdom

- 7.1.3 France

- 7.1.4 Russia

- 7.1.5 Spain

- 7.1.6 Rest of Europe

- 8. Asia Pacific United States Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 India

- 8.1.2 China

- 8.1.3 Japan

- 8.1.4 Rest of Asia Pacific

- 9. Latin America United States Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 Brazil

- 9.1.2 Argentina

- 9.1.3 Rest of Latin America

- 10. Middle East and Africa United States Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United Arab Emirates

- 10.1.2 Saudi Arabia

- 10.1.3 Qatar

- 10.1.4 Rest of Middle East and Africa

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Patriot Rail Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Norfolk Southern Railway

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CSX Transportation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Genesee & Wyoming Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Union Pacific Railroad

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BNSF Railway Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Canadian National Railway

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kansas City Southern**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Patriot Rail Company

List of Figures

- Figure 1: United States Rail Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Rail Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: United States Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Rail Freight Transport Market Revenue Million Forecast, by Type of Cargo 2019 & 2032

- Table 3: United States Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: United States Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 5: United States Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Russia United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United States Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: China United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United States Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Latin America United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United Arab Emirates United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Saudi Arabia United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Qatar United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Middle East and Africa United States Rail Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: United States Rail Freight Transport Market Revenue Million Forecast, by Type of Cargo 2019 & 2032

- Table 32: United States Rail Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 33: United States Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 34: United States Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Rail Freight Transport Market?

The projected CAGR is approximately < 5.00%.

2. Which companies are prominent players in the United States Rail Freight Transport Market?

Key companies in the market include Patriot Rail Company, Norfolk Southern Railway, CSX Transportation, Genesee & Wyoming Inc, Union Pacific Railroad, BNSF Railway Company, Canadian National Railway, Kansas City Southern**List Not Exhaustive.

3. What are the main segments of the United States Rail Freight Transport Market?

The market segments include Type of Cargo, Destination, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need for Reliable Connections between Carriers and Shippers; Demand for Real-time Visibility of Shipments.

6. What are the notable trends driving market growth?

Demand on The US Freight Rail Network Increase.

7. Are there any restraints impacting market growth?

High Fragmentation of the Logistics Industry; Data Security Concerns.

8. Can you provide examples of recent developments in the market?

January 2022 - Wabtec Corporation has received an order for 10 FLXdrive battery-electric locomotives from Union Pacific Railroad, a freight-hauling railroad in the US. The action will promote Union Pacific's efforts to lower greenhouse gas (GHG) emissions from operations while also upgrading the infrastructure of its train yards. Seven thousand battery cells will be used in each FLXdrive battery-electric locomotive. The US will be the exclusive producer of all the vehicles. The 10 battery-powered locomotives will be able to offset 4,000t of carbon emissions from Union Pacific's train yards each year when used together. Union Pacific is expected to receive the first units from Wabtec in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the United States Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence