Key Insights

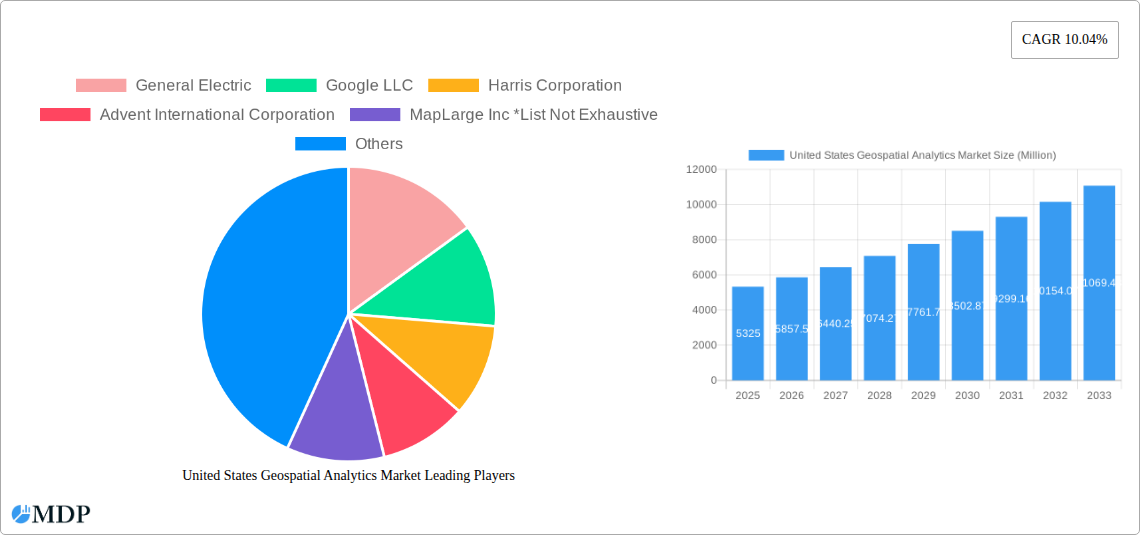

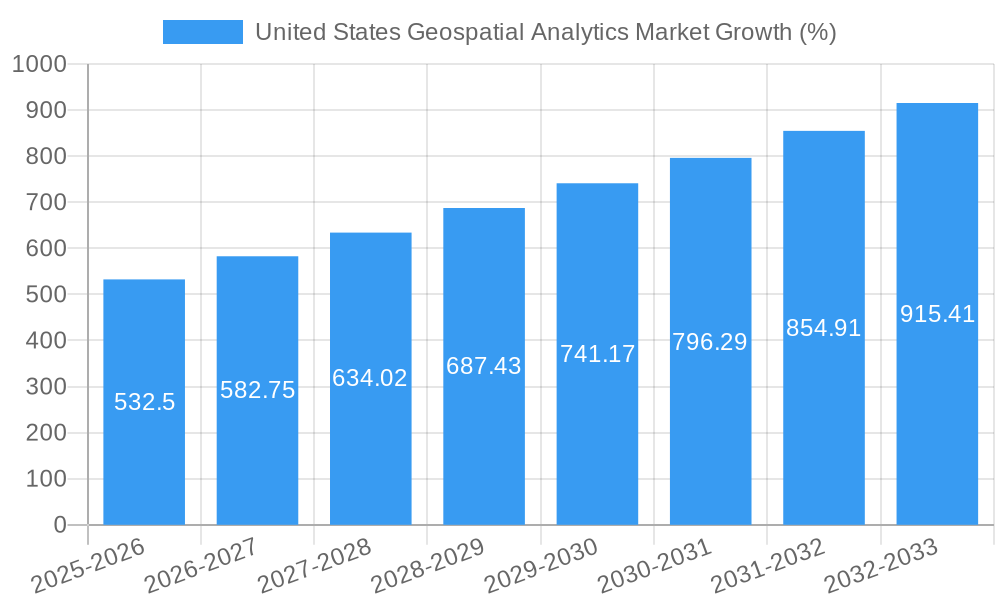

The United States geospatial analytics market, valued at approximately $5.325 billion in 2025 (assuming a proportional share of the global market size based on US economic strength and technological advancements), is projected to experience robust growth, driven by increasing adoption across diverse sectors. This expansion is fueled by several key factors. Firstly, the growing need for precise location intelligence across industries like agriculture (precision farming), utility and communication (network optimization), and defense and intelligence (surveillance and mapping) is a significant driver. Secondly, advancements in technologies such as AI, machine learning, and cloud computing are enhancing the capabilities of geospatial analytics, leading to more sophisticated applications and insights. Furthermore, government initiatives promoting data-driven decision-making and infrastructure development are further stimulating market growth. The market's segmentation reflects its versatility, with surface analysis, network analysis, and geovisualization representing key technological approaches. Leading players like Esri, Google, and Trimble are constantly innovating, developing advanced software and solutions that cater to the increasing demands for real-time data analysis and spatial modeling.

However, the market faces certain challenges. Data security and privacy concerns, particularly in sectors like defense and intelligence, represent a key restraint. Furthermore, the high cost of sophisticated software and the need for skilled professionals capable of interpreting and utilizing geospatial data can hinder wider adoption, especially for smaller companies. Despite these hurdles, the long-term outlook for the US geospatial analytics market remains exceptionally positive. Continued technological advancements, coupled with the increasing reliance on data-driven decision-making across diverse industries, promise substantial growth through 2033. The forecast suggests a consistent expansion, driven by the continued adoption of geospatial analytics across various sectors as businesses increasingly recognize its value for enhancing efficiency, optimizing operations, and gaining a competitive edge.

United States Geospatial Analytics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Geospatial Analytics market, covering market dynamics, industry trends, leading segments, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. Discover actionable insights and strategic recommendations to navigate this rapidly evolving market. The market is projected to reach xx Million by 2033.

United States Geospatial Analytics Market Market Dynamics & Concentration

The United States Geospatial Analytics market is characterized by a moderately concentrated landscape, with a handful of major players holding significant market share. However, the market exhibits robust innovation, driven by advancements in AI, machine learning, and cloud computing. Stringent data privacy regulations and cybersecurity concerns influence market dynamics, while the emergence of alternative technologies presents a degree of substitution. End-user trends indicate a growing preference for integrated solutions offering comprehensive data analysis and visualization capabilities.

- Market Concentration: The top 5 players collectively hold approximately xx% of the market share in 2025.

- Innovation Drivers: AI-powered analytics, cloud-based platforms, and improved data accessibility are key drivers of innovation.

- Regulatory Framework: Compliance with data privacy regulations (e.g., GDPR, CCPA) significantly impacts market operations.

- Product Substitutes: Traditional surveying methods and basic GIS software pose limited substitution threats.

- M&A Activity: The market witnessed xx M&A deals between 2019 and 2024, indicating consolidation and strategic expansion. This trend is expected to continue, with xx projected deals between 2025 and 2033.

- End-user Trends: Increasing demand for real-time data analysis and predictive modeling is shaping end-user preferences.

United States Geospatial Analytics Market Industry Trends & Analysis

The United States Geospatial Analytics market exhibits robust growth, driven by rising demand across diverse sectors. Technological disruptions, particularly the integration of AI and machine learning, are transforming data analysis capabilities. Consumer preferences are shifting towards solutions offering enhanced visualization, accessibility, and predictive capabilities. Competitive dynamics are characterized by innovation, strategic partnerships, and market consolidation.

The market is expected to register a CAGR of xx% during the forecast period (2025-2033). Market penetration in key sectors like government and defense remains high, while growth in sectors such as agriculture and healthcare is accelerating. This expansion is fueled by increased investment in digital infrastructure and a growing recognition of the value of geospatial data. The market penetration rate for geospatial analytics solutions within the US agriculture sector is projected to reach xx% by 2033.

Leading Markets & Segments in United States Geospatial Analytics Market

The report identifies the Government and Defense & Intelligence sectors as the leading end-user verticals, driven by robust government spending on infrastructure and national security. Within the "By Type" segment, Surface Analysis dominates due to its widespread applicability across various industries. Key regional markets include the East Coast and West Coast regions.

Key Drivers by Segment:

- Government: Increased government investment in infrastructure projects and smart city initiatives.

- Defense & Intelligence: Demand for advanced geospatial intelligence capabilities for national security.

- Agriculture: Precision farming techniques and improved yield optimization.

- Utility & Communication: Network optimization, asset management, and infrastructure planning.

- Surface Analysis: Wide range of applications across industries requiring terrain analysis.

- Network Analysis: Growth in logistics, transportation, and communication network planning.

- Geovisualization: Enhanced data interpretation and communication through 3D visualization.

Dominance Analysis: The Government sector's consistent investment in geospatial technology and infrastructure development solidifies its leading position. The large volume of data collected and analyzed within this sector drives the demand for advanced analytical tools.

United States Geospatial Analytics Market Product Developments

Recent product innovations focus on integrating AI and machine learning to automate data analysis, improve accuracy, and enhance predictive capabilities. Cloud-based platforms provide enhanced accessibility and scalability, while advancements in visualization tools enable more effective data communication. New applications are emerging in areas such as disaster response, environmental monitoring, and urban planning, highlighting the broad market fit of geospatial analytics solutions.

Key Drivers of United States Geospatial Analytics Market Growth

The market's growth is fueled by several key drivers. Technological advancements, particularly in AI and machine learning, significantly enhance analytical capabilities. Increased government investments in infrastructure and digital transformation initiatives boost demand across sectors. Regulatory mandates promoting data transparency and interoperability also contribute to market growth.

Challenges in the United States Geospatial Analytics Market Market

Data security concerns and the need for robust cybersecurity measures pose significant challenges. The complexity of integrating disparate data sources can hinder adoption. Competition among established players and the emergence of new entrants create pricing pressures and intensify the fight for market share. The market faces hurdles in managing diverse data formats and ensuring data quality across various sources.

Emerging Opportunities in United States Geospatial Analytics Market

The integration of IoT and 5G technologies promises to unlock new possibilities for real-time data acquisition and analysis. Strategic partnerships between technology providers and end-users are expected to drive market expansion. Further growth is projected from expansion into underserved markets and the development of specialized solutions tailored to niche sectors.

Leading Players in the United States Geospatial Analytics Market Sector

- General Electric

- Google LLC

- Harris Corporation

- Advent International Corporation

- MapLarge Inc

- ESRI Inc

- Alteryx Inc

- Intermap Technologies Inc

- Trimble Inc

- Bentley Systems Inc

Key Milestones in United States Geospatial Analytics Market Industry

- May 2023: CAPE Analytics extends its partnership with The Hanover Insurance Group, integrating geospatial analytics into underwriting procedures. This signifies the growing adoption of AI-powered geospatial intelligence in the insurance sector, boosting efficiency and improving risk assessment.

- March 2023: Carahsoft Technology Corp. partners with Orbital Insight to provide AI-powered geospatial data analytics to the public sector. This expands the accessibility of advanced geospatial tools within the government and public sector, facilitating more efficient resource management and service delivery.

Strategic Outlook for United States Geospatial Analytics Market Market

The United States Geospatial Analytics market exhibits strong growth potential, driven by continued technological innovation, increasing data availability, and rising demand across diverse sectors. Strategic partnerships, market expansion into new verticals, and the development of tailored solutions offer significant opportunities for players in this dynamic market. Focusing on addressing data security concerns and enhancing data integration capabilities will be crucial for sustained growth.

United States Geospatial Analytics Market Segmentation

-

1. Type

- 1.1. Surface Analysis

- 1.2. Network Analysis

- 1.3. Geovisualization

-

2. End-user Vertical

- 2.1. Agriculture

- 2.2. Utility and Communication

- 2.3. Defense and Intelligence

- 2.4. Government

- 2.5. Mining and Natural Resources

- 2.6. Automotive and Transportation

- 2.7. Healthcare

- 2.8. Real Estate and Construction

- 2.9. Other End-user Verticals

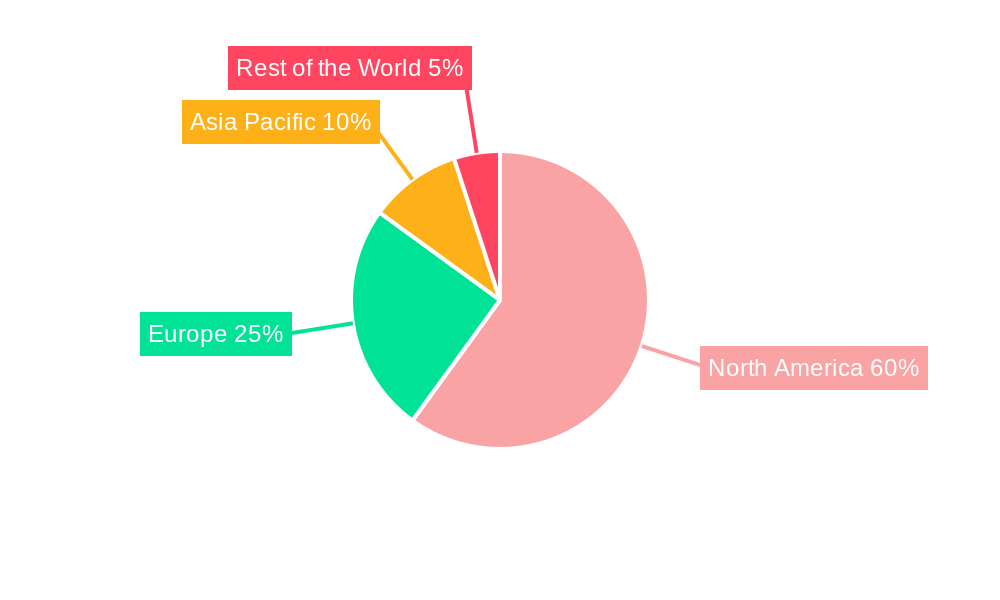

United States Geospatial Analytics Market Segmentation By Geography

- 1. United States

United States Geospatial Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing in Demand for Location Intelligence; Advancements of Big Data Analytics

- 3.3. Market Restrains

- 3.3.1. High Costs and Operational Concerns; Concerns related to Geoprivacy and Confidential Data

- 3.4. Market Trends

- 3.4.1. Network Analysis is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Analysis

- 5.1.2. Network Analysis

- 5.1.3. Geovisualization

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Agriculture

- 5.2.2. Utility and Communication

- 5.2.3. Defense and Intelligence

- 5.2.4. Government

- 5.2.5. Mining and Natural Resources

- 5.2.6. Automotive and Transportation

- 5.2.7. Healthcare

- 5.2.8. Real Estate and Construction

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America United States Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 7. Europe United States Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Germany

- 7.1.2 United Kingdom

- 7.1.3 France

- 7.1.4 Rest of Europe

- 8. Asia Pacific United States Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 Rest of Asia Pacific

- 9. Rest of the World United States Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 General Electric

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Google LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Harris Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Advent International Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 MapLarge Inc *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ESRI Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Alteryx Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Intermap Technologies Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Trimble Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bentley Systems Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 General Electric

List of Figures

- Figure 1: United States Geospatial Analytics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Geospatial Analytics Market Share (%) by Company 2024

List of Tables

- Table 1: United States Geospatial Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Geospatial Analytics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: United States Geospatial Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Geospatial Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States United States Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada United States Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Geospatial Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany United States Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom United States Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France United States Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe United States Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Geospatial Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China United States Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan United States Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India United States Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific United States Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States Geospatial Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United States Geospatial Analytics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 21: United States Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 22: United States Geospatial Analytics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Geospatial Analytics Market?

The projected CAGR is approximately 10.04%.

2. Which companies are prominent players in the United States Geospatial Analytics Market?

Key companies in the market include General Electric, Google LLC, Harris Corporation, Advent International Corporation, MapLarge Inc *List Not Exhaustive, ESRI Inc, Alteryx Inc, Intermap Technologies Inc, Trimble Inc, Bentley Systems Inc.

3. What are the main segments of the United States Geospatial Analytics Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing in Demand for Location Intelligence; Advancements of Big Data Analytics.

6. What are the notable trends driving market growth?

Network Analysis is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

High Costs and Operational Concerns; Concerns related to Geoprivacy and Confidential Data.

8. Can you provide examples of recent developments in the market?

May 2023 : CAPE Analytics, a player in AI-powered geospatial property intelligence, has extended its partnership with The Hanover Insurance Group, which provides independent agents with the best insurance coverage and prices. Integrating geospatial analytics and inspection and rating models into Hanover's underwriting procedure is the central component of the partnership expansion. The company's rating plans will benefit from this strategic move, which will improve workflows, new and renewal underwriting outcomes, and pricing segmentation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Geospatial Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Geospatial Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Geospatial Analytics Market?

To stay informed about further developments, trends, and reports in the United States Geospatial Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence