Key Insights

The United Kingdom car rental market, a significant segment of the broader European car rental landscape, is experiencing robust growth, fueled by several key factors. The market's expansion is driven by increasing tourism, particularly from international visitors, and a growing preference for flexible travel arrangements among domestic travelers. The rise of online booking platforms has streamlined the rental process, boosting accessibility and driving market expansion. Business travel, while impacted by remote work trends in recent years, continues to contribute significantly to demand, especially in major UK cities like London, Manchester, and Birmingham. The segment encompassing premium and luxury vehicles shows particularly strong growth, indicating a rising demand for higher-end travel experiences. Conversely, while budget-friendly options remain popular, their growth rate may be slightly slower compared to the premium segment. The long-term rental segment is benefiting from the increasing popularity of car subscription services, offering an alternative to traditional car ownership. Competition remains fierce, with established players like Europcar, Hertz, Enterprise, and Sixt competing alongside ride-hailing services like Uber, which offer a supplementary transport option.

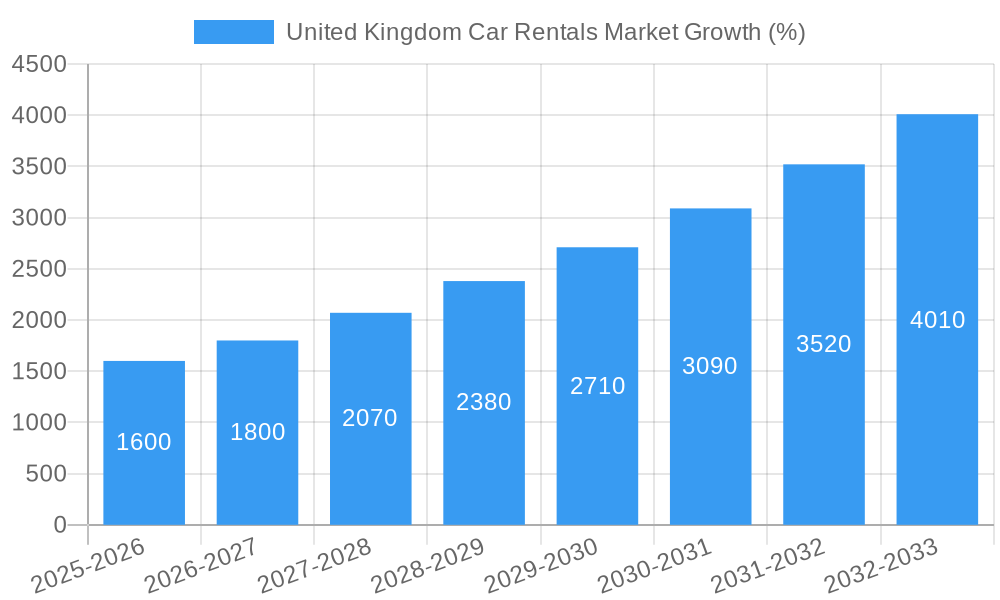

Considering a CAGR of 13.70% and a global market size of XX million (which we will assume is approximately €100 billion for illustrative purposes and to provide realistic scale to our estimation - it is therefore important to replace this value with the correct one when available ), and taking into account the UK's significant contribution to the European market, a reasonable estimation can be made for the UK car rental market size. Assuming the UK market represents around 10-15% of the European market, the UK market size could be placed between £10 billion and £15 billion in 2025. With a 13.70% CAGR, this suggests a substantial increase in the coming years. However, external factors like fuel prices, economic fluctuations, and evolving travel patterns could influence this growth. The market is likely to see further consolidation amongst major players, alongside continued innovation in areas like technology integration (e.g., mobile apps, contactless rentals), sustainability initiatives (e.g., electric vehicle fleets), and enhanced customer service strategies. The long-term outlook remains positive, driven by projected growth in tourism and increasing reliance on flexible transportation options.

United Kingdom Car Rentals Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United Kingdom car rentals market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to understand this dynamic sector. The study covers the period 2019-2033, with a focus on the estimated year 2025, and includes historical data (2019-2024) and future forecasts (2025-2033). The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX%.

United Kingdom Car Rentals Market Dynamics & Concentration

The UK car rental market is characterized by a moderately concentrated landscape, with key players such as Europcar International, The Hertz Corporation, Enterprise Holdings Inc, SIXT SE, Uber Technologies Inc, and Avis Budget Group Inc holding significant market share. The combined market share of the top five players is estimated to be around XX% in 2025. Innovation in areas like electric vehicle fleets, mobile booking apps, and subscription services are driving market growth. Stringent regulatory frameworks concerning emissions, safety, and licensing influence market operations. Substitute modes of transportation such as ride-hailing services and public transport exert competitive pressure, impacting market penetration. End-user preferences are shifting towards convenience, technology integration, and sustainable options. M&A activity in the sector has been moderate in recent years, with approximately XX deals recorded between 2019 and 2024. Further consolidation is anticipated as companies seek to expand their market reach and diversify their offerings.

- Market Concentration: XX% held by top 5 players in 2025.

- M&A Activity: Approximately XX deals between 2019-2024.

- Innovation Drivers: Electric vehicle adoption, mobile booking apps, subscription models.

- Regulatory Framework: Emission standards, safety regulations, licensing requirements.

- End-User Trends: Preference for convenience, technology, and sustainability.

United Kingdom Car Rentals Market Industry Trends & Analysis

The UK car rental market is experiencing robust growth, propelled by several factors. The burgeoning tourism sector and increasing business travel contribute significantly to demand. Technological advancements, such as the integration of AI and machine learning in reservation systems and customer service, enhance efficiency and customer experience. Consumer preferences are shifting towards online booking platforms, emphasizing convenience and price transparency. However, the market faces competitive challenges from ride-sharing services and public transportation. The rise of subscription models and peer-to-peer car-sharing platforms is also impacting traditional rental models. The market penetration of online booking is expected to exceed XX% by 2033.

Leading Markets & Segments in United Kingdom Car Rentals Market

The short-term rental segment dominates the UK car rental market, accounting for approximately XX% of total revenue in 2025. Online booking is the preferred method, surpassing offline bookings with a market share exceeding XX%. The leisure/tourism application segment outpaces the business segment, although both show considerable growth. Budget/economy vehicles comprise the largest vehicle type segment, catering to price-sensitive customers. London and other major metropolitan areas represent the most lucrative regional markets due to high tourist traffic and business activity.

- Rental Duration: Short-term rentals dominate (XX% market share in 2025).

- Booking Type: Online booking leads with over XX% market share in 2025.

- Application Type: Leisure/tourism is the largest segment.

- Vehicle Type: Budget/economy vehicles hold the largest market share.

- Key Drivers: Strong tourism industry, business travel growth, convenient online booking options, and competitive pricing.

United Kingdom Car Rentals Market Product Developments

Recent product innovations include the introduction of electric and hybrid vehicle fleets, reflecting the growing emphasis on sustainability. Companies are integrating advanced technology features into their vehicles, such as in-car Wi-Fi and advanced driver-assistance systems. The focus is on enhancing customer convenience through seamless mobile apps and personalized services. This aligns with consumer preferences for technology integration and superior customer service.

Key Drivers of United Kingdom Car Rentals Market Growth

Several factors are driving the growth of the UK car rental market. The expanding tourism industry and business travel contribute significantly. Technological advancements, such as improved mobile booking platforms and AI-driven customer service, boost efficiency and satisfaction. Government initiatives promoting sustainable transportation are also playing a role, encouraging the adoption of electric and hybrid vehicles. Favorable economic conditions further stimulate demand for car rental services.

Challenges in the United Kingdom Car Rentals Market Market

The UK car rental market faces several challenges, including increased competition from ride-hailing services and public transportation, impacting market share. Fluctuations in fuel prices and the rising cost of vehicle maintenance affect profitability. Stringent regulations regarding emissions and safety standards impose operational costs. Supply chain disruptions can impact vehicle availability, potentially leading to increased prices.

Emerging Opportunities in United Kingdom Car Rentals Market

The growing adoption of electric vehicles presents significant opportunities. Strategic partnerships with hotels, airlines, and other travel businesses can expand market reach and customer base. Expanding into underserved regions and offering specialized rental services (e.g., campervans, luxury vehicles) can unlock new revenue streams. Technological innovations, such as autonomous driving technology, hold immense long-term potential.

Leading Players in the United Kingdom Car Rentals Market Sector

- Europcar International

- The Hertz Corporation

- Enterprise Holdings Inc

- SIXT SE

- Uber Technologies Inc

- Avis Budget Group Inc

Key Milestones in United Kingdom Car Rentals Market Industry

- 2020: Increased focus on hygiene and sanitation protocols following the COVID-19 pandemic.

- 2021: Expansion of electric vehicle fleets by major rental companies.

- 2022: Launch of several new mobile booking apps with enhanced features.

- 2023: Introduction of subscription-based car rental services by some players.

- 2024: Increased investment in technology for improved customer service and operational efficiency.

Strategic Outlook for United Kingdom Car Rentals Market Market

The UK car rental market is poised for continued growth, driven by technological advancements, a thriving tourism sector, and increasing business travel. Strategic partnerships and expansion into new market segments will be key to success. The integration of sustainable vehicles and advanced technologies will be crucial for maintaining competitiveness and meeting evolving consumer preferences. The market presents substantial opportunities for companies that can adapt to changing trends and leverage innovation to enhance their offerings.

United Kingdom Car Rentals Market Segmentation

-

1. Rental Duration

- 1.1. Short Term

- 1.2. Long Term

-

2. Booking Type

- 2.1. Online

- 2.2. Offline

-

3. Application Type

- 3.1. Leisure/Tourism

- 3.2. Business

-

4. Vehicle Type

- 4.1. Budget/Economy

- 4.2. Premium/Luxury

United Kingdom Car Rentals Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Car Rentals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for ADAS likely Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lower efficiency in bad weather conditions

- 3.4. Market Trends

- 3.4.1. Growing Demand for Tour and Travel Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Car Rentals Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Rental Duration

- 5.1.1. Short Term

- 5.1.2. Long Term

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Leisure/Tourism

- 5.3.2. Business

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Budget/Economy

- 5.4.2. Premium/Luxury

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Rental Duration

- 6. Germany United Kingdom Car Rentals Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. United Kingdom United Kingdom Car Rentals Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Italy United Kingdom Car Rentals Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Spain United Kingdom Car Rentals Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Rest of Europe United Kingdom Car Rentals Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Europcar International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Hertz Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Enterprise Holdings Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SIXT SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Uber Technologies Inc *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Avis Budget Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Europcar International

List of Figures

- Figure 1: United Kingdom Car Rentals Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Car Rentals Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Car Rentals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Car Rentals Market Revenue Million Forecast, by Rental Duration 2019 & 2032

- Table 3: United Kingdom Car Rentals Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 4: United Kingdom Car Rentals Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 5: United Kingdom Car Rentals Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 6: United Kingdom Car Rentals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: United Kingdom Car Rentals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Car Rentals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Car Rentals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Car Rentals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Car Rentals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Kingdom Car Rentals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Car Rentals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Car Rentals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Car Rentals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Car Rentals Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Car Rentals Market Revenue Million Forecast, by Rental Duration 2019 & 2032

- Table 18: United Kingdom Car Rentals Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 19: United Kingdom Car Rentals Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 20: United Kingdom Car Rentals Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 21: United Kingdom Car Rentals Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Car Rentals Market?

The projected CAGR is approximately 13.70%.

2. Which companies are prominent players in the United Kingdom Car Rentals Market?

Key companies in the market include Europcar International, The Hertz Corporation, Enterprise Holdings Inc, SIXT SE, Uber Technologies Inc *List Not Exhaustive, Avis Budget Group Inc.

3. What are the main segments of the United Kingdom Car Rentals Market?

The market segments include Rental Duration, Booking Type, Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for ADAS likely Drive the Market.

6. What are the notable trends driving market growth?

Growing Demand for Tour and Travel Activities.

7. Are there any restraints impacting market growth?

Lower efficiency in bad weather conditions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Car Rentals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Car Rentals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Car Rentals Market?

To stay informed about further developments, trends, and reports in the United Kingdom Car Rentals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence